Sourcery (1/23-1/27)

The Great Repricing ~ QuickNode, Dayforward, Vartana, Zurp, Architect, Tranch, Sandbar, Suppli, Coverdash, SetPoint Medical, Pearl Health, Elaborate, Journey Clinical, Nourish, RapidDeploy, Strata

Yesterday’s price is not today’s price

Deal announcements are appearing to increase in activity, but these announcements do not necessarily indicate the current state of deal activity. Many deals take place several months prior to the announcement, often for various strategic reasons such as signaling market strength to raise funds, hire talent, or attract customers. However, these announcements can be deceiving and may not accurately reflect the actual health of the deals, especially in the Series A and above. Behind the scenes, there may be layoffs, restructuring, changes in deal structures, pivoting, down rounds, flat rounds, secondary sales, fire sales, or acquisitions occurring. As a founder, it's important to keep in mind that you likely still have the most equity at the table and it is in your best interest to navigate your company towards the most successful path. Whatever that may be.

In a much more eloquent explanation, I laid this out in a May ‘22 Sourcery on the Kentucky Derby winner Rich Strike. The ultimate underdog story.

Readings

Thinning The Herd, Kyle Harrison

In the words of Bill Gurley, "forget those prices happened."

Unicorn startups lost almost $100 billion this year, The Future Party

Microsoft as a Mirror - What We Can Expect for SaaS in 2023, Tomasz Tunguz

Microsoft’s Ability to Cross-Sell its Suite is Driving Dominance in Many Categories

GitHub is now home to 100 million developers.

Atlassian has 10m active users compared to 90m actives at Github.

Power Automate has more than 45,000 customers – from AT&T to Rabobank – up over 50 percent year-over-year.

UIPath, the leader in RPA reported 10,650 customers in October 2022.

Teams surpassed 280 million monthly active users this quarter… And we continue to take share across every category, from collaboration, to chat, to meetings, to calling.

About 70% of commercial Office subscribers use Teams.

Over the past 12 months, our security business surpassed $20 billion in revenue, as we help customers protect their digital estate across clouds and endpoint platforms. This is about 12% of the global information security market according to Gartner.

. . .

Last Week (1/23-1/27):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include QuickNode, Dayforward, Vartana, Calimero Network, Senken, Zurp, Architect, Tranch, Asset Reality, Sandbar, Grazzy, Suppli, Coverdash, SetPoint Medical, Pearl Health, Elaborate, Journey Clinical, Nourish, Parable, Pasqal, Zift, Osmo, CYGNVS, Forward Networks, Crowdbotics, RapidDeploy, Strata, Inscribe, Snyk, Memfault, DevZero, PortPro, Kittl, Accord, Spatial Labs, Supernormal, SYKY, Scenario, StoryCo, Skillit, Grilla, Floodbase, Senken; Strava/Fatmap, Dell/Cloudify

Final numbers on Pitch Deck Interactions Q1, GenAI Deal Flow, and Tiktok Shows No Signs of Slowing at the bottom.

Deals

Fintech:

- QuickNode, a Miami-based development platform for Web3 builders, raised $60 million in Series B funding. 10T Holdings led the round and was joined by Tiger Global, Seven Seven Six, Protocol Labs, QED, and others.

- Dayforward, a New York-based life insurance startup, raised $25m. AXA Ventures led, and was joined by insiders Juxtapose, HCSM Ventures and Munich Ventures. www.dayforward.com

- Mad Mobile, a Tampa, Fla.-based POS modernization platform for retail and restaurants, raised $20m from Eastward Capital Partners. www.madmobile.com

- PayEm, a San Francisco-based spend and procurement management platform, raised $20 million in funding. MUFG and Collaborative Fund co-led the round and were joined by Glilot, Pitango, and NFX.

- Vartana, a San Francisco-based sales closing and financing platform, raised $12 million in Series A funding. Mayfield led the round and was joined by Xerox Ventures, Flex Capital, and Audacious Ventures.

- Calimero Network, a London-based blockchain infrastructure startup, raised $8.5m in seed funding from Khosla Ventures, Lyrik Ventures, Near Foundation, GSR, FJ Labs and Warburg Serres. https://axios.link/3J8YTeD

- Foro, a Charlotte-based commercial lending company, raised $8 million in Series A funding. TTV Capital led the round and was joined by Fin Capital, Correlation Ventures, AME Cloud Ventures, US Bank’s investment arm, and others.

- Senken, a Berlin- and Cape Town-based climate finance trading platform, raised $7.5 million in funding. Obvious Ventures led the round and was joined by Offline Ventures, Inflection, Kraken Ventures, and Climate Capital.

- Twinco Capital, a Madrid-based supply chain finance solution, raised $9 million in funding. Quona Capital led the round and was joined by Working Capital, Mundi Ventures, and Finch Capital.

- Zurp, a New York-based fintech platform connecting fans with creators, raised $5 million in pre-seed funding. New Form, MAGIC Fund, Launchpad VC, OVO Fund, Darling Ventures, Animal Capital, and other angels invested in the round.

- Architect, a provider of crypto trading infrastructure led by ex-FTX US president Brett Harrison, raised $5m from Coinbase Ventures, Circle Ventures, SV Angel, SALT Fund, P2P, Third King Venture Capital, Anthony Scaramucci, Shari Glazer and Motivate Venture Capital. https://axios.link/3XNo9uU

- Tranch, a London-based BNPL platform for SaaS companies, raised $5m in seed funding. Soma Capital led, and was joined by FoundersX and insiders GFC and YC. The company also secured $95m in debt from Clear Haven Capital Management. https://axios.link/3HprgnA

- Asset Reality, a London-based digital asset recovery solutions provider, raised $4.91 million in seed funding. Framework Ventures led the round and was joined by investors including TechStars, The Fund, SGH Capital, and other angels.

- Sandbar, a New York-based anti-money laundering, fraud, and counter-terrorism risk detection software provider, raised $4.8 million in seed funding. Lachy Groom and Abstract Ventures co-led the round and were joined by BoxGroup and other angels.

- Grazzy, an Austin-based employee payments platform, raised $4.25 million in seed funding from Next Coast Ventures and Tuesday Capital.

- Suppli, an Austin, Texas-based digital accounts receivable platform for the construction market, raised $3.1m in seed funding. Equal Ventures led, and was joined by Audacious Ventures and Dash Fund. www.gosuppli.com

- Coverdash, a New York-based insurance solutions provider to businesses, raised $2.5 million in seed funding. Bling Capital led the round and was joined by AXIS Digital Ventures, Tokio Marine Future Fund, Expansion VC, and Cameron Ventures.

. . .

Care:

- SetPoint Medical, a Valencia, Calif.-based clinical-stage health care company for patients with chronic autoimmune diseases, raised $80 million in funding co-led by new investors Norwest Venture Partners and Viking Global Investors.

- Pearl Health, a New York-based startup helping independent physician practices participate in value-based care models, raised $75m in Series B funding. Andreessen Horowitz and Viking Global Investors co-led, and were joined by AlleyCorp and SV Angel. https://axios.link/3H74X4N

- Angle Health, a San Francisco-based health insurance provider, raised $58 million in Series A funding. Portage led the round and was joined by PruVen Capital, Wing Venture Capital, SixThirty Ventures, Mighty Capital, Wormhole Capital, Mindset Ventures, Crew Capital, Aloft VC, Pilot founder Waseem Daher, and others.

- Precision Neuroscience, a New York-based brain implant developer for neurological disorders, raised $41 million in Series B funding. Forepont Capital Partners led the round and was joined by Mubadala Capital, Draper Associates, Alumni Ventures, re.Mind Capital, Steadview Capital, and B Capital Group.

- Atomic AI, a San Francisco-based RNA drug discovery platform, raised $35 million in Series A funding. Playground Global led the round and was joined by 8VC, Factory HQ, Greylock, NotBoring, AME Cloud Ventures, and other angels.

- Elaborate, a New York-based lab result delivery platform for patients, raised $10 million in seed funding. Tusk Venture Partners led the round and was joined by Founder Collective, Company Ventures, Bling Ventures, Arkitekt Ventures, and other angels.

- Journey Clinical, a New York-based psychedelic therapy company, raised $8.5 million in funding. Union Square Ventures led the round and was joined by AlleyCorp, Fifty Years, Able Partners, Gaingels, Palo Santo, PsyMed Ventures, Coalition Operators, Mystic Ventures, Colibri, Satori Capital, and other angels.

- Nourish, an SF-based telehealth platform for nutrition, raised $8m in seed funding. Thrive Capital led, and was joined by Susa Ventures, Operator Partners, Box Group and YC. https://axios.link/3QZjST6

- Mighty Health, an Oakland-based developer of coaching and exercise programs for seniors, raised $7.6m in new seed funding, per Axios Pro. Co-led, and were joined by Will Ventures and GFT Ventures co-led, and were joined by the AARP, Mercury CEO Immad Akhund, Hyper, Baselayer Ventures and Z Venture Capital. https://axios.link/3XY3AMt

- Oneleaf, a Paris-based self-hypnosis wellness company, raised $5.1 million in pre-seed funding. VC Frst led the round and was joined by Kima Ventures and Raise Ventures.

- Kinspire, a Denver-based pediatric occupational therapy platform, raised $3.6 million in seed funding. Corazon Capital and Looking Glass Capital co-led the round and were joined by Bradley Tusk, Difference Partners, Great Oaks VC, Service Provider Capital, The Fund, and Copper Wire Ventures

- Crescendo Health, an SF-based health data startup focused on aiding clinical trials, raised $3.4m in seed funding led by Define Ventures. https://axios.link/3ZZVqFl

- Parable, an Atlanta-based brain care company, raised $2.75 million in seed funding co-led by M13 and Break Trail Ventures.

- Free From Market, a Kansas City-based digital health startup focused on personalized food access and selection for lower-income users, raised $2.1m in seed funding. Bluestein Ventures led, and was joined by Acumen America, Beta Boom, KCRise Fund, 1st Course Capital and Asset Blue Ventures. www.freefrommarket.com

. . .

Enterprise & Consumer:

- Pasqal, a Paris-based quantum computing startup, raised $100m in Series B funding. Temasek led, and was joined by the EIC Fund, Wa’ed Ventures, Bpifrance and insiders Quantonation, Defense Innovation Fund, Daphni and Eni Next. https://axios.link/3QZlUTf

- Zift, a Cary, N.C.-based provider of partner relationship management and through-channel marketing automation software, raised over $70m. Investcorp Technology Partners led, and was joined by insiders Arrowroot, Oxx, SSM, and AshGrove Capital. www.ziftsolutions.com

- Osmo, a Cambridge, Mass.-based A.I. company mapping human smell, raised $60 million in Series A funding. Lux Capital and GV co-led the round and were joined by Arena Holdings, the Bill & Melinda Gates Foundation, Moore Strategic Ventures, Exor Ventures, Two Sigma Ventures, Amazon Alexa Fund, and other angels.

- CYGNVS, a Los Altos, Calif.-based guided cyber crisis response platform, raised $55 million in Series A funding. Andreessen Horowitz led the round and was joined by Stone Point Ventures and EOS Venture Partners.

- Forward Networks, a Santa Clara, Calif.-based network security and reliability platform, raised $50 million in Series D funding. MSD Partners led the round and was joined by Section 32, Omega Venture Partners, Goldman Sachs Asset Management, Threshold Ventures, A. Capital, and Andreessen Horowitz.

- Crux, a San Francisco-based data integration, transformation, and observability solution, raised an additional $50 million in funding co-led by Two Sigma and Goldman Sachs Asset Management.

- Crowdbotics, a Berkeley, Calif.-based software development platform, raised $40 million in Series B funding. NEA led the round and was joined by Homebrew, JSV, Harrison Metal, and Cooley.

- RapidDeploy, an Austin-based 911 mapping and analytics solutions for public safety, raised $34 million in funding. Edison Partners led the round and was joined by GreatPoint Ventures, Morpheus Ventures, GM Ventures, Ericsson Ventures, Tao Capital Partners, Clearvision Ventures, Tau Ventures, NedBank CIB, and others.

- Strata, a Boulder, Colo.-based identity orchestration company, raised $26 million in Series B funding. Telstra Ventures led the round and was joined by Menlo Ventures, Forgepoint Capital, and Innovating Capital.

- Inscribe, a San Francisco-based fraud detection and document automation platform, raised $25 million in Series B funding. Threshold Ventures led the round and was joined by Crosslink Capital, Foundry, and Uncork Capital.

- Snyk, a Boston-based security company for software development, raised an additional $25 million in Series G funding from ServiceNow.

- Memfault, a San Francisco-based Internet of Things reliability platform provider, raised $24 million in Series B funding. Stripes led the round and was joined by the 5G Open Innovation Lab, Partech Partners, and Uncork Capital.

- DevZero, a Seattle-based cloud-based coding platform for developers, raised $21 million in Series A funding. Anthos Capital led the round and was joined by Fika Ventures, Foundation Capital, and Madrona Venture Group.

- Gemba, a London-based virtual reality workforce learning platform, raised $18 million in Series A funding led by Parkway Venture Capital.

- PortPro, a Kearny, N.J.-based developer of tech solutions for drayage carriers, raised $12m led by Avenue Growth Partners. www.portpro.io

- Kittl, a Berlin-based graphic design platform, raised €10.8m in Series A funding. Left Lane Capital led, and was joined by Speedinvest. https://axios.link/3HvLQCO

- Accord, a San Francisco-based collaboration platform for B2B sales, raised $10 million in Series A funding. Matrix Partners, Nat Friedman, and Y Combinator invested in the round.

- Emperia, a London and New York-based virtual spaces developer for the retail industry, raised $10 million in Series A funding. Base10 Partners led the round and was joined by Dastore, Sony Ventures, Background Capital, Stanford Capital Partners, and Concept Ventures.

- Spatial Labs, a Los Angeles-based Web3 hardware/software infrastructure company, raised $10 million in seed funding. Blockchain Capital led the round and was joined by Marcy Venture Partners.

- Supernormal, a Stockholm-based note-taking platform, raised $10 million in seed funding. Balderton Capital led the round and was joined by EQT Ventures, Acequia Capital, and byFounders.

- SYKY, a web3 fashion platform, raised $9.5m in Series A funding. Seven Seven Six led, and was joined by Brevan Howard Digital, Leadout Capital, First Light Capital Group and Polygon Ventures. https://axios.link/3kGsi5O

- Scenario, a Paris and San Francisco-based game asset development company, raised $6 million in seed funding. Play Ventures led the round and was joined by Anorak Ventures, Founders, Inc., Heracles Capital, Venture Reality Fund, and other angels.

- StoryCo, a Los Angeles-based storytelling media platform, raised $6 million in seed funding. Collab + Currency and Patron co-led the round and were joined by Floodgate Ventures, Blockchange Ventures, Sfermion, Flamingo DAO, and other angels.

- Skillit, a New York-based recruiting platform for construction labor, raised $5.1 million in seed funding. Building Ventures led the round and was joined by MetaProp, HOLT Ventures, Great North Ventures, 1Sharpe Ventures, and Takeoff Capital.

- Share Creators, a Burlingame, Calif.-based collaboration and digital file management company, raised $5 million in Series A funding. 5Y Capital led the round and was joined by Foxit.

- Traction Complete, a Port Moody, Canada-based data management solutions provider, raised $5 million in funding co-led by Pender Ventures and Thomvest Ventures.

- Tribes, a San Francisco-based Web3 messaging app, raised $3.3 million in pre-seed funding co-led by Kindred Ventures, South Park Commons, and Script Capital.

- Grilla, a Miami-based skill-based games platform, raised $3 million in funding from Tusk Venture Partners.

- Argilla, a Madrid-based open-source platform for natural language processing, raised $1.6 million in seed funding co-led by Zetta Venture Partners and Caixa Capital Risc.

- Peerlist, a professional networking startup, raised $1.1m in seed funding led by HubSpot co-founder Dharmesh Shah. https://axios.link/3j1q5RV

. . .

Sustainability:

- Scythe Robotics, a Boulder, Colo.-based autonomous solutions development company for the landscape industry, raised $42 million in Series B funding. Energy Impact Partners led the round and was joined by ArcTern Ventures, Alumni Ventures, Alexa Fund, True Ventures, Inspired Capital, and others.

- Rumin8, a Perth, Australia-based climate technology company, raised $12 million in seed funding. Breakthrough Energy Ventures led the round and was joined by Harvest Road Group.

- Floodbase, a Menlo Park, Calif.-based flood monitoring startup, raised $12m in Series A funding. Lowercarbon Capital led, and was joined by Collaborative Fund, Floating Point, and Vidavo. https://axios.link/3kMyRnq

- Senken, an online marketplace for on-chain carbon credits, raised $7.5m in seed funding, per Axios Pro. Obvious Ventures led, and was joined by Offline Ventures, Inflection, Kraken Ventures and Climate Capital. https://axios.link/3Jkhchb

Acquisitions & PE:

- OpenWeb acquired Jeeng, a New York-based audience management platform, for $100 million.

- Doodles, a Canadian collectibles NFT platform that’s raised $54m in VC funding, acquired animation studio Golden Wolf. https://axios.link/3J8Xzs5

- Strava, the fitness tracking app valued by VCs in late 2020 at $1.76b, acquired Fatmap, a London-based 3D mapping app that raised around $28m from backers like Strava, InMotion Ventures, 83North, Azimut Libera Impresa, ACF Investors and Tornig. https://axios.link/3WsR5Yc

- Floor, a New York-based NFT price tracking startup that last year raised $10m led by 6th Man Ventures, acquired NFT analytics firm WGMI.io. https://axios.link/3XylFRx

- Dell (NYSE: DELL) agreed to buy Cloudify, an Israeli cloud orchestration and infrastructure automation company, for upwards of $100m. Cloudify raised around $8m from firms like KPN Ventures and Claridge. https://axios.link/3WBTgIV

. . .

IPOs:

Nothing to see here…

. . .

SPACs:

Nothing to see here…

Funds:

- Cowboy Ventures raised $140m for its fourth flagship fund, plus $120m for its first opportunities fund. https://axios.link/3XUiWSg

- Thrive Capital, the New York-based VC firm led by Joshua Kushner, sold a passive minority ownership stake to an investor group that includes Henry Kravis, Bob Iger, Jorge Paulo Lemann, Xavier Niel and Mukesh Ambani. https://axios.link/3Ht4bAv

- WestView Capital Partners, a Boston-based growth equity firm, raised $1b for its fifth fund. www.wvcapital.com

- Kearny Jackson, a VC firm led by Sriram Krishnan (ex-Spotify, Tinder) and Sunil Chhaya (Menlo Ventures), raised $14m for its second fund. https://axios.link/3XQVBRg

- FJ Labs, a New York-based VC firm, raised a total of $260m for a new pre-seed fund and an opportunity fund. https://axios.link/3RaAwit

- Sapphire Ventures raised $181m for its second Sapphire Sport fund, which focuses on early-stage startups “at the nexus of tech and culture.” www.sapphireventures.com

- WSJ report that Joshua Kushner's firm sold a 3.5% stake in itself for $175 million to a group of individual investors that included Henry Kravis and Bob Iger. Valuing Thrive at $5.3 billion, on $15 billion in assets under management.

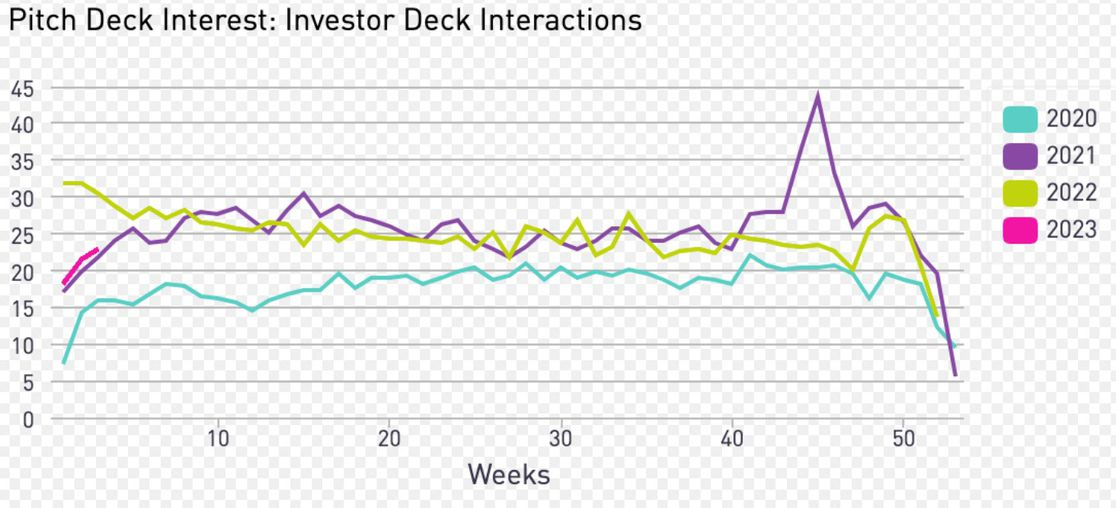

Pitch Deck Interactions

Source: DocSend

Last week Dan Primack tweeted that VC deal activity seems unexpectedly high for January. The actual phrase used was "kinda nuts."

Got pushback from folks suggesting a lot of these announcements are Q4 deals with delayed PR, plus someone from Carta saying that last month was the slowest December fundraising for Carta companies since 2018.

Then was sent the above chart from DocSend, which tracks pitch deck interactions, suggesting that there is indeed a very strong start to 2023. Not last year's level, but just above 2021 and well above pre-pandemic 2020.

Takeaway is that we'll need to wait until the end of Q1 for legit clarity on VC deal activity.

GenAI Deal Flow

Data: PitchBook; Note: 2022 data includes the first 16 days of 2023; Chart: Axios Visuals

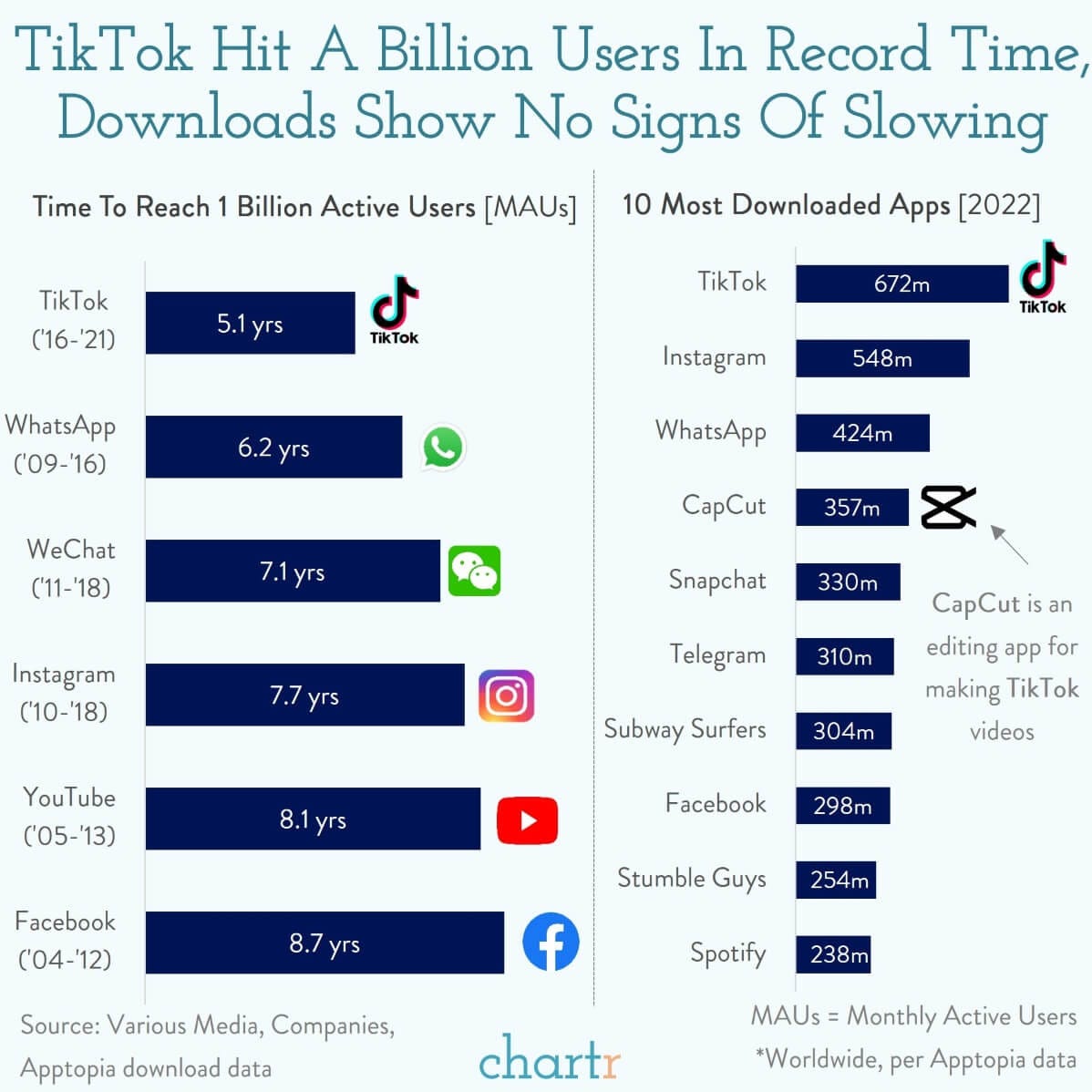

TikTok is Still Growing Strong

In the dock

In devastating news for lip-syncers and procrastinators, TikTok looks to be edging closer to a potential ban in the US as a House panel gears up to vote on the motion next month. Shou Zi Chew, the CEO of the Chinese-owned video platform, will testify before Congress in March to defend the app’s alleged CCP affiliation, data security practices, and the impact it's having on American children.

Still on top

To say that TikTok, a shortform video app owned by the Beijing-based tech firm ByteDance, burst onto the social media scene is a serious understatement.

Its addictive algorithm, stylized as its For You page, saw TikTok become the quickest social platform to hit 1 billion active users in history, reaching the milestone in just over 5 years. That’s ~2.6 years quicker than Instagram and ~3.6 quicker than Facebook too.

Since then, it hasn't slowed down. The company has been breaking revenue records in remarkable time, has become teens' social media of choice and was (once again) the most downloaded app of last year according to data from Apptopia.

Despite its rapid rise, TikTok's ties to the CCP have long been touted as a security risk. Successive US governments have made various attempts to regulate the app, with president Trump going the furthest via an executive order in 2020 that sought to sell the US operations of TikTok to an American company. With US-China relations already strained, a ban on China's most famous tech company would be poorly received, although there's a strong precedent in the other direction, with American platforms like YouTube, Facebook, Twitter and others all banned in China.

. . .

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.