Sourcery (1/25-1/29)

Nubank, Melio, Fast, Rhino, Pilot, Bolt, Yotta, Lyra, Sidecar Health, SWORD, Calibrate, Concert Health, GoodTrust, OwnBackup, Booksy, Shipmonk, Splashtop, Literati...

Last Week (1/25-1/29):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech,Care, Future of Work, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Nubank, Melio, Fast, Rhino, Pilot, Bolt, Yotta, Lyra, Sidecar Health, SWORD, Calibrate, Concert Health, GoodTrust, OwnBackup, Booksy, Shipmonk, Splashtop, Literati, Ocient, Airspace, SetSail, Lynk, Darwin Homes, BlackCart, Stacker, Loanpal, Starship. Confide. Flywire, Qualtrics, Squarespace, Roblox, Coinbase. WeWork, Taboola, Wheels Up, 23&me, Faraday Future, Nerdy.

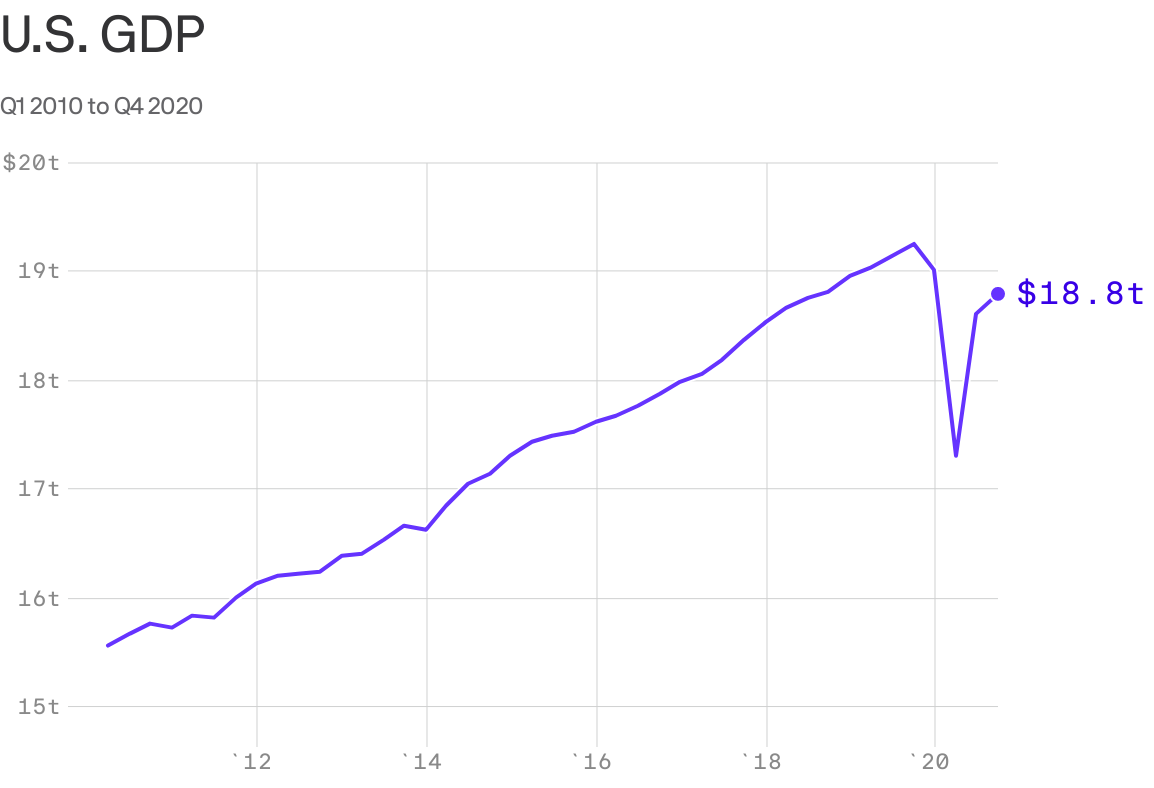

Final numbers on 2020 US GDP and Ultra-High Volume Stocks at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Nubank, a Brazilian neobank, raised $400 million in Series G funding, valuing it at $25 billion. GIC, Whale Rock, and Invesco led the round.

- Melio, a New York-based maker of software for small businesses digitally managing their supplier payments, raised $110 million. Coatue led the round that values the company at $1.3 billion.

- Fast, a San Francisco-based online checkout company, raised $102 million in Series B funding. Stripe and Addition led and were joined by investors including Index Ventures.

- Albert, a Walnut, Calif.-based financial software company, raised $100 million in Series C funding. General Atlantic led the round and was joined by investors including CapitalG.

- Rhino, a New York City-based insurtech focused on rent, raised $95 million in funding. Tiger Global Management led the round. The deal values the firm at about $500 million.

- Pilot, a San Francisco-based provider of back office services, raised $60 million in Series C funding. Sequoia Capital led the round and was joined by investors including Index Ventures and Stripe.

- Bolt, a San Francisco-based payments and checkout company, raised $75 million. General Atlantic and WestCap led the round and were joined by investors including Activant Capital and Tribe Capital.

- Alma, a French buy now, pay later lender, raised €49 million ($60 million) in Series B funding. Cathay Innovation led the round and was joined by investors including Idinvest, Bpifrance, Seaya Ventures, and Picus Capital.

- Check, a New York-based payroll infrastructure startup, raised $35 million in Series B funding from Stripe and Thrive Capital. http://axios.link/masd

- Roostify, a San Francisco-based maker of home lending technology, raised $32 million in Series C funding. Ten Coves Capital led the round and was joined by investors including principals at Stone Point Capital, Cota Capital, Mouro Capital, Colchis Capital, Point72 Ventures, and JPMorgan Chase.

- Yotta, a New York-based savings app maker, raised $13.2 million in Series A funding. Base10 Partners led the round and was joined by investors including Y Combinator, Core Innovation Capital, and Slow Ventures.

- Apiture, a Wilmington, N.C.-based provider of digital transformation solutions for financial institutions, raised $10 million from Bankers Healthcare Group. http://axios.link/GlcX

- dYdX, a San Francisco-based maker of a decentralized exchange, raised $10 million in Series B funding. Three Arrows Capital and DeFiance Capital led the round and were joined by investors including Wintermute, Hashed, GSR, SCP, Scalar Capital, Spartan Group, RockTree Capital, a16z, Polychain Capital, Kindred Ventures, 1confirmation, Elad Gil, and Fred Ehrsam.

- Goalsetter, a Brooklyn, New York-based kids and family finance app, raised $3.9 million in seed funding. Astia led the round and was joined by investors including PNC Bank, Mastercard, US Bank, Northwestern Mutual Future Ventures, Elevate Capital, Portfolia Rising America, and Pipeline Angels.

- Joshu, a Menlo Park, Calif.-based insurtech for carriers to launch online, raised $3.7 million. Blumberg Capital led the round and was joined by investors including Engineering Capital, Correlation Ventures, Innovation Endeavors, and Sure Ventures.

- Doorvest, a San Francisco-based real estate investing platform, raised $2.5 million in seed funding. Mucker Capital led the round.

. . .

Care:

- LyraHealth, a Burlingame, Calif.-based provider of mental health care benefits for employers, raised $187 million in Series E funding at a $2.3 billion post-money valuation. Addition led, and was joined by Durable Capital Partners, Fidelity and Baillie Gifford. www.lyrahealth.com

- Sidecar Health, a Los Angeles-based health insurance startup, raised $125 million in funding. Investors included Drive Capital, BOND, Tiger Global, and Menlo Ventures. Read more.

- SWORD Health, a New York-based virtual physical therapy care provider, raised $25 million. Todd Cozzens of Transformation Capital led the round and was joined by investors including Khosla Ventures, Founders Fund, Green Innovations, Vesalius Biocapital, and Faber.

- Calibrate, a New York-based telemedicine metabolic health platform, raised $22.5 million in Series A funding. Emily Melton at Threshold Partners led the round and was joined by existing investors including Forerunner Ventures and Redesign Health.

- Concert Health, a San Diego, Calif.-based behavioral health medical group, raised $14 million in Series A funding. Vertical Venture Partners led the round and was joined by investors including Town Hall Ventures, Silicon Valley Bank, Healthy Ventures, and Clearvision Equity.

- Vessel, a San Diego, Calif.-based maker of a wellness tracker, raised $8 million in funding. Monogram Capital Partners led the round and was joined by investors including Able, BFG, Cove, and Sidekick.

- Hurdle, a Washington, D.C.-based mental health startup, raised $5 million in seed funding. 406 Ventures and Seae Ventures co-led the round and were joined by F-Prime.

- Talent Hack, a New York-based B2C platform for fitness instructors and studios, raised $4.7 million in seed funding led by Global Founders Capital. http://axios.link/NqAt

- Kevala, a Seattle-based maker of workforce management software for care facilities, raised $4 million in seed funding. Vulcan Capital led the round and was joined by investors including Costanoa Ventures, High Alpha, and PSL Ventures.

- Cutback Coach, a San Francisco-based company aimed at moderating alcohol consumption, raised $3.1 million in seed funding. Stephanie Palmeri of Uncork Capital led the round and was joined by investors including Nico Wittenborn of Adjacent Venture Capital.

- GoodTrust, a Palo Alto, Calif.-based startup focused on wills and social media accounts of the deceased, raised $2.3 million in seed funding. Investors included Bling Capital, Synetro Ventures, Azure Capital Partners,Nikesh Arora, Bobby Lo, and Christian Wiklund.

. . .

Future of Work:

- DriveNets, an Israel-based networking software company, raised $208 million in Series B funding, valuing it at over $1 billion. D1 Capital Partners led the round and was joined by investors including Bessemer Venture Partners, Pitango, and Atreides Management.

- OwnBackup, an Englewood Cliffs, N.J.-based cloud data protection platform, raised $168 million in Series D funding. Insight Partners, Salesforce Ventures and Sapphire Ventures co-led, and were joined by Innovation Endeavors, Vertex Ventures and Oryzn Capital. www.ownbackup.com

- Booksy, a U.K.-based maker of a beauty and wellness appointment booking app, raised $70 million in a Series C funding. Cat Rock Capital led the round and was joined by investors including Sprints Capital.

- ShipMonk, a Fort Lauderdale, Fla.-based provider of e-commerce fulfillment solutions, raised $65 million from Periphas Capital. www.shipmonk.com

- Splashtop, a San Jose, Calif.-based remote support company, raised $50 million, valuing it at over $1 billion. Sapphire Ventures led the round and was joined by investors including NEA, DFJ DragonFund, and Storm Ventures.

- Sitetracker, a Palo Alto, Calif.-based infrastructure tech company, raised $42 million in additional funding. H.I.G. Growth Partners led the round and was joined by investors including Energize Ventures, New Enterprise Associates, National Grid Partners, Wells Fargo Strategic Capital, and Salesforce Ventures.

- Literati, an Austin, Texas-based book club subscription service, raised $40 million in Series B funding. Felicis Ventures led, and was joined by 01 Advisors, Founders Fund, General Catalyst, Shasta Ventures, Silverton Partners, Springdale Venture and Stephen Curry. www.literati.com

- Ocient, a Chicago, Ill.-based data analytics company, raised $40 million in Series B funding. OCA Ventures and Greycroft led the round and were joined by investors including Valor Equity Partners, PSP Partners, Hyde Park Angels, Pritzker Group Venture Capital, Gaingels, and the MIT and Northwestern University chapters of Alumni Venture Group.

- Airspace, a Carlsbad, Calif.-based time-critical shopping startup, raised $38 million in Series C funding. Telstra Ventures and HarbourVest Partners co-led, and were joined by Qualcomm Ventures, Prologis Ventures, Defy Partners and Scale Venture Partners. www.airspace.com

- IMVU, a Redwood City, Calif.-based maker of a virtual social network, raised $35 million. Investors included Structural Capital and NetEase.

- ClassDojo, a San Francisco-based pre-K–8 communications app, raised $30 million led by Josh Buckley. http://axios.link/R4VZ

- Run:AI, a Tel Aviv, Israel-based maker of orchestration and virtualization software for artificial intelligence, raised $30 million in Series B funding. Insight Partners led the round and was joined by investors including TLV Partners and S-Capital.

- SetSail, a San Mateo, Calif.-based sales comp platform, raised $26 million in Series A funding. Insight Partners led, and was joined by insiders Wing VC, Team8 and Operator Collective. http://axios.link/4XFQ

- Playvox, a Sunnyvale, Calif.-based leading contact center provider, raised $25 million. Five Elms Capital led the round.

- Lynk, a Hong Kong-based "knowledge-as-a-service" platform, raised $24 million. Brewer Lane Ventures and MassMutual Ventures co-led, and were joined by Alibaba Entrepreneurs Fund. http://axios.link/KGFF

- LoveCrafts, a London-based online crafting marketplace, raised $22 million in equity and debt funding from Scottish Equity Partners, Highland Europe, Balderton Capital and TriplePoint Capital. It also acquired WEBS, a U.S. online yarn retailer. http://axios.link/G0js

-Mediafly, a Chicago-based sales enablement and content management firm, raised $25 million in equity and debt funding from Boathouse Capital and Sterling National Bank. www.mediafly.com

- Flowhaven, a Los Angeles-based software for media licensing, raised $16 million. Sapphire Sport led the round and was joined by investors including Global Founders Capital and Icebreaker.vc. Read more.

- Vectorized, a San Francisco-based streaming data tool, raised $15.5 million in seed and Series A funding. Lightspeed Venture Partners led, and was joined by GV. http://axios.link/WhSF

- Darwin Homes, an Austin-based real estate startup, raised $15 million in Series A funding. Canvas Ventures led the round and was joined by investors including Camber Creek, Khosla Ventures, Wave Capital, Pear Ventures, and Silicon Valley Bank.

- Usermind, a Seattle-based journey orchestration platform, raised $14 million. WestRiver Group led, and was joined by return backers Andreessen Horowitz and Menlo Ventures.http://axios.link/JG4I

- Sounding Board, a Foster City, Calif.-based maker of a coaching platform, raised $13.1 million in Series A funding. Canaan Partners led the round and was joined by investors including Correlation Ventures, Bloomberg Beta, and Precursor Ventures.

- Raydiant, a San Diego-based digital signage company, raised $13 Million in Series A funding. 8VC and Atomic co-led the round and were joined by Mark Wahlberg, Delta Zulu, Gaingels, and BN Capital by Lerer Hippeau.

- Appdetex, a Boise, Id.-based scam detection company focused on brand protection, raised $12.2 million in Series C funding. Baird Capital led the round and was joined by investors including First Analysis, Origin Ventures, and EPIC Ventures.

- Oncue, an Oakland, Calif.-based maker of booking software for the moving industry, raised $10 million in Series A funding. Rethink Impact led the round and was joined by investors including Crosslink Capital and Bowery Capital.

- SamCart, an Austin-based maker of an e-commerce platform, raised $10 million in Series A funding. TTV Capital led the round and was joined by investors including Fin VC and George Kaiser Foundation.

- Pinecone, a San Mateo, Calif.-based startup for building machine learning applications, raised $10 million in seed funding Wing Venture Capital led the round. Read more.

- LottieFiles, a San Francisco and Kuala Lumpur-based company for animations, raised $9 million in Series A funding. M12 led the round and was joined by investors including 500 Startups. Read more.

- BlackCart, a Toronto-based e-commerce software company with a “try before you buy” program for merchants, raised $8.8 million in Series A funding. Origin Ventures and Hyde Park Venture Partners co-led the round and were joined by Citi Ventures, 500 Startups, and Struck Capital.

- Yac Inc., a Kissimmee, Fla.-based online voice message software maker remote teams, raised $7.5 million. GGV Capital and the Slack Fund co-led the round.

- Mealco, a new restaurant launch platform for chefs, raised $7 million in seed funding. Rucker Park Capital led, and was joined by FJLabs, Reshape, 2048.vc, Oceans Ventures and WLP. http://axios.link/VW6P

- Opal, a startup for blocking distractions, raised $4.3 million in seed funding. Nicolas Wittenborn at Adjacent led the round. Read more.

- ARMO, a Tel Aviv-based cybersecurity company, raised $4.5 million in seed funding from Pitango First.

- Ctrl IQ, a Berkeley, Calif.-based company focused on cloud computing, raised $4 million in Series A funding. OpenDrives and IAG Capital Partners invested.

- Gowalla, the resurrected Foursquare rival that’s now a social AR app, raised $4 million in seed funding co-led by GV and Spark Capital. http://axios.link/tBUs

- Catalytic, a Chicago-based no-code company, raised an undisclosed amount of funding from In-Q-Tel.

- Club Feast, a San Francisco-based subscription-based restaurant delivery service, raised $3.5 million in seed funding. General Catalyst led the round.

- Sturish, a Menlo Park, Calif.-based e-commerce platform, raised $3.2 million in seed funding. Neo led the round and was joined by investors including Act One Ventures and Fika Ventures.

- Loupe Tech, a Miami-based maker of a sports card app, raised $3 million in funding. Upfront Ventures led the round.

- S’More, a New York-based maker of a dating app, raised $2.1 million. Benson Oak Ventures led the round and was joined by investors including Workplay Ventures (Mark Pincus), Gaingels, Loud Capital/Pride Fund, Kenny Harris (Plusgrade), Justen Stepka (Enterprise Fund), and Rafael Vivas (AppLovin).

- Stacker, a maker of software for companies to create tools and apps for their businesses, raised $1.7 million in funding. Initialized Capital led the round and was joined by investors including Y Combinator, Pioneer Fund, and Makerpad.

. . .

Sustainability:

- Loanpal, a point-of-sale payment platform for solar and other home efficiency solutions, raised more than $800 million. NEA and WestCap Group co-led, and were joined by Brookfield Asset Management and Riverstone Holdings. www.loanpal.com

- Aspiration, a California-based sustainable financial firm, raised $50 million. Investors included Deep Field Asset Management and AGO Partners.

- FreeWire Technologies, a San Leandro, Calif.-based electric vehicle charging company, raised $50 million in Series C funding. Riverstone Holdings led the round and was joined by investors including bp ventures, Energy Innovation Capital, TRIREC, and Alumni Ventures Group.

- Span, a San Francisco-based maker of an electrical panel, raised $20 million. Munich Re Ventures’ HSB Fund led the round and was joined by investors including Alexa Fund.

- Starship Technologies, a San Francisco-based autonomous delivery service, raised an additional $17 million. Investors include TDK Ventures and Goodyear Ventures.

- Phospholutions, a State College, Penn.-based sustainable fertilizer startup, raised $10.3 million in Series A funding. Continental Grain Company led the round and was joined by investors including Tekfen Ventures, Maumee Ventures, Ag Ventures Alliance Cooperative, and 1855 Capital.

- Kate Farms, a Santa Barbara, Calif.-based maker of plant-based, raised an additional $9 million in Series B funding. Main Street Advisors invested.

Acquisitions:

- IAC (Nasdaq: IAC) acquired Confide, a New York-based encrypted mobile messaging app that had seed seeded by firms like WGI Group, GV and Lerer Hippeau. http://axios.link/0XWe

- Workday (NASDAQ:WDAY) acquired Peakon, a Denmark-based employee feedback and insights platform, for about $700 million.

- Xerox (NYSE: XRX) acquired CareAR, an augmented reality support platform. Financial terms weren't disclosed.

. . .

IPOs:

- Flywire, a Boston-based vertical payments company, hired Goldman Sachs and JPMorgan for an IPO that could value the company at around $3 billion, per Reuters. It raised $263 million from firms like GS, Spark Capital, Bain Capital Ventures, F-Prime Capital, Tiger Global and Adage Capital Management. http://axios.link/OHrE

-Grab, the Southeast Asia ride-hail giant, picked Morgan Stanley and J.P. Morgan for a U.S. IPO that could raise at least $2 billion, as its merger talks with rival Gojek have stalled, per Bloomberg. http://axios.link/3kGd

-Qualtrics, the Utah-based experience management company being spun out of SAP (NYSE: SAP), upped its IPO terms to 50.4 million shares at $27-$29. It previously planned to offer 49.2 million shares at $22-$26. http://axios.link/gs8N

- The Bountiful Co. (f.k.a. Nature’s Bounty), a Ronkonkoma, N.Y.-based nutritional supplements maker owned by KKR, is in talks with banks about an upcoming IPO that would value the company at north of $6 billion, per Bloomberg. http://axios.link/9ECG

-Cole Haan, a Greenland, N.H.-based shoemaker owned by Apax Partners, withdrew its IPO registration. It originally filed for a $200 million listing in February 2020, but soon postponed because of the pandemic. http://axios.link/YlDh

- Vimeo, a video company backed by IAC (NASDAQ: IAC), raised $300 million from T. Rowe Price and Oberndorf Enterprises valuing it at over $5 billion. IAC is planning to spin Vimeo off into its own separately traded company.

- Squarespace, the New York-based website hosting company, filed confidentially for an IPO. Read more.

– Shoals Technologies Group, a Portland, Tenn.-based provider of products for solar projects, raised $1.9 billion in a sale of 77 million shares (88% from existing shareholders) priced at $25 apiece. Oaktree backs the firm. Read more.

- loanDepot, a Foothill Ranch, Calif.-based mortgage and loan provider, plans to raise $300 million in an offering of 15 million shares (37% sold by existing shareholders) priced between $19 to $21. Parthenon Capital backs the firm. Read more.

- Agrify, a Burlington, Mass.-based provider of indoor faring software, raised $54 million in its IPO. It priced at $10 per share (high end of range) and will list on the Nasdaq (AGFY). Last year it raised $4.5 million from LDA Capital, Phyto Partners and Arcadian Capital. www.agrify.com

- Roblox Corp, a San Mateo, Calif.-based game company, has postponed plans to go public due to scrutiny from the U.S. Securities and Exchange Commission over its accounting, per Reuters. Read more.

- Coinbase, a San Francisco-based cryptocurrency trading platform, says it plans to go public via direct listing.

. . .

SPACs:

- WeWork, the SoftBank-backed co-working space giant, is in talks to go public via a reverse merger with a SPAC affiliated with Bow Capital Management, per the WSJ. http://axios.link/y7Yr

- Alight Solutions, a Lincolnshire, Ill.-based benefits services provider, agreed to go public via merger with Foley Trasimene Acquisition, a SPAC. A deal could value the firm at $7.3 billion. Blackstone backs the firm.

- Taboola, a New York-based content management company, plans to go public via merger with ION Acquisition Corp. 1. (NYSE: IACA), a SPAC, valuing the company at $2.6 billion.

- Sunlight Financial, a Charlotte-based residential solar financing platform, plans to go public via merger with Spartan Acquisition Corp. II (NYSE: SPRQ), a SPAC backed by Apollo Global Management, valuing it at $1.3 billion. Sunlight’s existing investors include Tiger Infrastructure Partners, FTV Capital, and founder Hudson Sustainable Group.

- RedBall Acquisition (NYSE: RBAC), a SPAC formed by longtime baseball executive Billy Beane and private equity investor Gerry Cardinale, has ended talks to buy a minority stake in Fenway Sports Group, parent company of the Boston Red Sox and Liverpool F.C., as Axios reported yesterday. Expectations now are that Cardinale's private equity firm, RedBird Capital Partners, will work to structure a more traditional private equity investment in FSG.

-Wheels Up, the private jet subscription service, is in talks to go public via reverse merger with an LVMH-affiliated SPAC, as first reported by Reuters and confirmed by Axios. http://axios.link/ygyd

- Playstudios, a Las Vegas-based social casino games company, is in talks to go public via Acies Acquisition (Nasdaq: ACAC), a SPAC chaired by ex-MGM Resorts CEO Jim Murren, per Bloomberg. Playstudios has raised over $30 million, from firms like Icon Ventures, MGM Resorts and Incendium Capital. http://axios.link/OJc9

- Sharecare, an Atlanta-based health and wellness engagement platform, is in talks to go public via reverse merger with Falcon Capital Acquisition (Nasdaq: FCAC), a SPAC led by veteran investment banker (and famous brother) Alan Mnuchin. Sharecare has raised nearly $400 million, plus got a PPP loan. Backers include Galen Partners, Tivity Health, New Evolution Ventures, Claritas Capital

- 23andMe, a Sunnyvale, Calif.-based gene testing company, is in talks to go public via merger with Richard Branson’s VG Acquisition Corp. in a $4 billion deal, per Bloomberg. Read more.

- Faraday Future, a Los Angeles-based electric car maker, agreed to merge with Property Solutions Acquisition Corp., a SPAC. The deal values the business at $3.4 billion.

- Nerdy, the parent company of online learning platform Varsity Tutors, is in talks to be acquired by a SPAC affiliated with private equity giant TPG, per Axios. Nerdy has raised over $100 million from TCV, Learn Capital and the Chan Zuckerberg Initiative. http://axios.link/99KD

-Stryve Foods, a Plano, Texas-based healthy snackmaker , agreed to go public via a reverse merger with Andina Acquisition Corp. III (Nasdaq: ANDA) at an initial value of $170 million. Stryve had raised VC funding from firms like Murano Group, Meaningful Partners and Pendyne Capital. http://axios.link/PEVa

- MoneyLion, a New York-based fintech, is in talks to go public via merger with Fusion Acquisition Corp., a SPAC, per Bloomberg. Read more.

- L Catterton, the private equity firm co-founded by LVMH, has filed confidentially for a $250 million SPAC focused on Asia, per Bloomberg. Read more.

Funds:

- Bank of America, the Charlotte, N.C.-based bank, plans to invest $150 million into 40 funds focused on minority entrepreneurs. Read more.

- Thrive Capital, the New York-based venture firm backed by Joshua Kushner, plans to raise about $2 billion for a new early-stage fund and a growth vehicle, per the Wall Street Journal. Read more.

- TCV, a Menlo Park, Calif.-based venture capital firm, raised $4 billion for TCV XI.

- Bracket Capital, a Los Angeles-based investment firm focused on venture capital secondaries, raised $450 million across its second fund ($150 million) and co-investment vehicles ($300 million). Read more.

- Union Square Ventures, a New York-based venture firm, raised $250 million for its 2021 Core Fund.

- Bond Capital, the growth equity spinout from Kleiner Perkins, is raising $1.5 billion for its second fund, per the WSJ. http://axios.link/xm3R

- Prime Movers Lab, a Jackson, Wyo.-based an investor in scientific startups, raised $245 million for its second early-stage investment fund.

- ServiceNow (NYSE: NOW), a Santa Clara, Calif.-based digital workflow company, launched a $100 million ServiceNow Racial Equity Fund.

- NextView Ventures, a Boston-based seed and pre-seed firm, raised $100 million for its fourth fund. www.nextviewventures.com

- GGV Capital, a venture firm investing in primarily both China and the U.S., raised $2.5 billion across four new funds. Read more.

Final Numbers

Source: FRED; Chart: Axios Visuals

The U.S. economy grew at a 4% annualized pace in the last quarter of 2020, meaning the economy shrank by 3.5% for the full year, the government said on Thursday. Go deeper.

Data: Bloomberg; Chart: Sara Wise and Andrew Witherspoon/Axios. Note: Stocks limited to companies with a market capitalization of more than $150 million.