Sourcery (1/30-2/3)

Ozempic, GenAI, & VC Markets ~ Stripe, Moov, Treasury Prime, Hnry, Method, Sovereign Labs, Paradigm, AnswersNow, Doctify, Anthropic, Portside, JOKR, Exploration Co, Craft, Sentra, Triple Whale

What do Ozempic, Generative AI, and the current state of VC markets have in common?

(ChatGPT did not have an answer for this)

It’s tempting to think one can take a pill and have a quick solution to the hard work of consistent fitness or eating better but like most things in life - it’s the deep motivation, daily journey, and hard work that can produce the best results.*

Shortcuts in venture capital are no different. Last week on the All-In Podcast, Chamath pointed to research he conducted which concluded that most successful investors, defined by having distributed over $1B+ to their investors, were traditionally trained in finance. These weren’t the momentum driven powerpoint ninjas at flashy rocket ship startups - where the narrative of newer careers has been about access to “hot” talent and getting in on competitive deals.

Chamath’s lesson was that true financial success in investing often came from individuals with a grounding in financial analysis, possessing market research & insights and who truly understood risk management.

The basic premise of working from a model, sticking to foundational principles of a market you have deep expertise in and avoiding the FOMO of the latest trends has more consistently produced superior results. This takes muscle memory and methodology, but most importantly discipline.

Investors have been nervously changing their PFPs on Twitter from their favorite NFT to their favorite Generative AI photo of themselves. But isn’t that the point? Changing from the last big funding theme to the next without any staying power? There is no doubt that Generative AI will produce some major outsized returns but there is also little doubt that it will attract the same over-capitalization as Web3 did.

All the while, as Generative AI is the talk of the town right now and has seemingly infinite applications - the reality is offshoots like ChatGPT are not yet quite ready to be completely relied on. Although it is fun to use, fast, and powerful, it still has early limitations like character count restrictions, difficulties with abstract questions (such as this), and the potential to produce incorrect responses.

The need for checks and balances remains. The work continues.

*Of course Ozempic is useful for many who are prescribed it medically. But, when you’re hearing about it at Erewhon, tech confs, family dinners, etc. maybe this possible “quick-fix” is going too far.

Thank you to Mark Suster for edits, and who inspired this convo with his tweet (below) on the All-In Podcast.

Readings

Issue No. 218: The Obesity Cure, Fitt Insider

No, Ozempic isn’t going to cure-all.

Cause for concern. Still new and lacking long-term studies, the side effects are not fully understood. Gastrointestinal issues, nausea, and dehydration are common. Increased risk of thyroid cancer has also been flagged.

A troubling trend, multiple studies show that semaglutide users regain weight when treatment is stopped — meaning, absent lasting behavior change, the drug must be continued for life.

Expensive and not covered by insurance, once-weekly injections can cost upwards of $1,500/month. Inaccessible for those most in need, the drugs are popular among celebrities and individuals seeking aesthetic enhancement.

GenAI

Generative vs. Genuine: Why Today’s Generative AI Isn’t Tuned for B2B, Emergence

Racing to Catch Up With ChatGPT, Google Plans Release of Its Own Chatbot, NYT

Mark-et Analysis - Current State of VC

. . .

Last Week (1/30-2/3):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Stripe, Moov, Treasury Prime, Hnry, Method, Sovereign Labs, Paradigm, AnswersNow, Doctify, Teal Health, TBD Health, Anthropic, Portside, JOKR, Freeform, Exploration Co, Craft, Sentra, Q-CTRL, Triple Whale, AtomicJar, Nobl9, Select Star, Lavender, Beek, Samooha, PortPro, Nexus, Jetpack.io, Hypernative, TrueBiz, Superlayer, Our Next Energy, Boston Metal, Gradient; Marqeta/Power Finance, KnowBe4, QAD/Redzone, Aesop, Cvent, Standard AI/Skip

Final numbers on GenerativeAI Deal Value, Global M&A YoY, and Startups Cutting Costs at the bottom.

Deals

Fintech:

- Stripe, the payments infrastructure giant, is in talks to raise around $2.5b led by Thrive Capital at between a $55b-$60b valuation, as first reported by the NY Times. The down-round would be aimed at funding employee liquidity and related tax liabilities.

- Moov, a Cedar Falls, Iowa-based embedded payments processing startup, raised $45m in Series B funding. Commerce Ventures led, and was joined by Andreessen Horowitz, Bain Capital Ventures, Visa, and Sorenson Ventures. www.moov.io

- Treasury Prime, a banking-as-a-service provider, raised a $40 million Series C and grew revenues by close to 400%. BAM Elevate led, and was joined by Banc Funds, Invicta and insiders Deciens, QED and SaaStr. https://axios.link/3YaZTTO

- Hnry, a Sydney, Australia- and Wellington, New Zealand-based accountancy fintech platform, raised $35 million in Series B funding. AirTree Ventures, Athletic Ventures, and Left Lane Capital invested in the round.

- Lulalend, a Cape Town, South Africa-based digital lender for small- to medium-sized businesses, raised $35 million in Series B funding. Lightrock led the round and was joined by DEG, Triodos Investment Management, Women's World Banking, The International Finance Corporation, and Quona Capital.

- Method, an Austin-based debt repayment API, raised $16 million in Series A funding. Andreessen Horowitz led the round and was joined by Truist Ventures, Y Combinator, Abstract Ventures, SV Angel, and others.

- Passthrough, a New York-based fund workflow automation platform for investors, fund managers, and other fintechs, raised $10 million in Series A funding. Positive Sum led the round and was joined by Motley Fool Ventures, Broadhaven Ventures, Company Ventures, and Great Oaks VC.

- Guardz, a Dallas-based cyber insurance startup focused on attack-as-a-service breaches, raised $10m in seed funding. Hanaco Ventures led, and was joined by with iAngels, GKFF Ventures and Cyverse Capital. https://axios.link/40dt6iK

- Sovereign Labs, a blockchain scaling company, raised $7.4 million in seed funding. Haun Ventures led the round and was joined by Maven 11, 1KX, Robot Ventures, and Plaintext Capital.

- Archimedes, a DeFi lending and borrowing marketplace, raised $7.3m. Hack VC led, and was joined by Uncorrelated Venture, Psalion, Truffle Ventures, Cogitent Ventures, Haven VC and Palsar. www.archimedesdefi.com

- TigerBeetle, a financial accounting infrastructure startup, raised $6.4m from Amplify Partners and Coil. www.tigerbeetle.com

- Dasseti, formerly Diligend, a New York-based due diligence software company, raised $6 million in Series A funding led by Nasdaq Ventures.

- Baobab, a Berlin-based cyber insurance startup, raised €3m from Augmentum. https://axios.link/3JtMyll

. . .

Care:

- Paradigm, a New York-based clinical research access platform for patients, raised $203 million in Series A funding. ARCH Venture Partners and General Catalyst co-led the round and were joined by F-Prime Capital, GV, LUX Capital, Mubadala Capital, Magnetic Ventures, and the American Cancer Society’s BrightEdge fund.

- Colossal Biosciences, a Dallas-based biosciences and genetic engineering company, raised $150 million in Series B funding. United States Innovative Technology Fund led the round and was joined by Breyer Capital, Bob Nelsen, Animal Capital, Victor Vescovo, In-Q-Tel, Animoca Brands, Peak 6, BOLD Capital, Jazz Ventures, and others.

- Spark Advisors, a retirement benefits navigation software startup, raised $15m in Series A funding, per Axios Pro. American Family Ventures led, and was joined by Primary Ventures, Torch Capital and Vine Ventures. https://axios.link/3RlTrXN

- Dimension Inx, a Chicago-based biomaterials design platform, raised $12 million in Series A funding. Prime Movers Lab led the round and was joined by KdT Ventures, Revolution’s Rise of the Rest Seed Fund, Solas BioVentures, Portal Innovation Ventures, and Alumni Ventures.

- AnswersNow, a Richmond, Va.-based digital applied behavior analysis therapy company, raised $11 million in Series A funding. Left Lane Capital led the round and was joined by American Family Institute for Social Impact, Blue Heron Capital, Difference Partners, and former Kadiant CEO Lani Fritts.

- Doctify, a London-based patient reviews platform, raised $10 million in funding. Beringea led the round and was joined by Keen Venture Partners, Amadeus Capital Partners, and Guinness Ventures.

- Teal Health, an SF-based provider of virtual health screenings for women, raised $8.8m in seed funding, per Axios Pro. Backers include Emerson Collective, Serena Ventures, Metrodora Ventures and Felicis Ventures. https://axios.link/3HJfmoT

- TBD Health, a New York-based sexual health care provider, raised $4.4 million in seed funding. Tusk Venture Partners led the round and was joined by Springdale Ventures, Human Ventures, Expansion VC, Starbloom Capital, Hyphen Capital, and The Community Fund, and other angels.

- Starling Medical, a Houston-based maker of urine testing devices, raised $3.4m in seed funding led by Rebel Fund. https://axios.link/3Jm8FKy

- Frontrow Health, an Austin-based digital health company, raised $3 million in seed funding co-led by Next Coast Ventures and NextGen Venture Partners.

- Gotcare, a Toronto-based home health platform, raised CAD $2.6 million ($1.96 million) in bridge funding. TELUS Pollinator Fund for Good led the round and was joined by Sandpiper Ventures.

. . .

Enterprise & Consumer:

- Anthropic, an SF-based generative AI company, is in the process of raising around $300m at around a $5b valuation, per the NY Times. Last year it raised $580m in a Series B round led by Sam Bankman-Fried, whose investment could get clawed back via the FTX bankruptcy. https://axios.link/3HJoGZT

- Fever, a New York, NY-based live entertainment discovery platform, raised $110 million at a $1.8 billion valuation in a funding round led by prior backer Goldman Sachs, with participation from Eurazeo, Convivialité Ventures, Goodwater Capital, Alignment Growth, Vitruvian Partners and Smash Capital. TechEU

- Portside, a San Francisco-based SaaS platform for the business aviation industry, raised $50 million in Series B funding. Insight Partners led the round and was joined by I2BF Global Ventures.

- JOKR, a Luxembourg-based instant grocery delivery startup, raised $50m in Series C funding at a $1.3b valuation, per TechCrunch. G Squared led, and was joined by fellow insiders GGV Capital, Tiger Global Management and HV Capital. https://axios.link/3RtpaX2

- Freeform, a Hawthorne, Calif.-based metal 3D printing company founded by ex-SpaceX employees, raised $45m from Two Sigma Ventures, Founders Fund, and Threshold Ventures.

- The Exploration Company, a French upstart rival to SpaceX, raised €40m in Series A funding. EQT Ventures and Red River West co-led, and were joined by Promus Ventures, Cherry Ventures, Vsquared, Omnes Capital, July Fund, Partech, Possible Ventures, Habert Dassault Finance, Schlumberger and Sista Fund. Go deeper on the state of the space biz.

- Phantom AI, a Mountain View, Calif.-based autonomous driving platform provider, raised $36.5 million in Series C funding. KT Investment, Renaissance Asset Management, InterVest, Shinhan GIB, and Samsung Ventures invested in the round.

- Craft, a San Francisco-based enterprise intelligence company, raised $32 million in Series B funding. BAM Elevate led the round and was joined by Greycroft, Uncork Capital, High Alpha, ServiceNow Ventures, Point Field Partners, and other angels.

- Sentra, a New York and Tel Aviv-based data security posture management company, raised $30 million in Series A funding. Munich re Ventures and Standard Investments co-led the round and were joined by INT3, Moore Capital, Xerox Ventures, Bessemer Venture Partners, and Zeev Ventures.

- Q-CTRL, a Sydney, Australia-based quantum infrastructure software company, raised $27.4 million in Series B extension funding. Salesforce Ventures, Alumni Ventures, ICM Allectus, Mindrock Capital, Airbus Ventures, Data Collective, Horizons, Main Sequence Ventures, Ridgeline Partners, and others invested in the round.

- Triple Whale, a Columbus, Ohio-based data platform for e-commerce brands, raised $25m in Series B funding from NFX, Elephant and Shopify. https://axios.link/3X7U2xO

- AtomicJar, a Newark, N.J.-based open source library provider for developers, raised $25 million in Series A funding. Insight Partners led the round and was joined by boldstart ventures, Tribe Capital, Chalfen Ventures, and other angels.

- Onehouse, a Menlo Park, Calif.-based managed data platform, raised $25 million in Series A funding co-led by Addition and Greylock.

- Recurrency, a San Francisco-based enterprise resource planning automation platform, raised $22 million in funding. Bessemer Venture Partners led the round and was joined by Lachy Groom, Elad Gil, Y Combinator Continuity, and others.

- Freemodel, a Burlingame, Calif.-based home renovation company, raised $19.5 million in Series A funding led by QED Investors.

- Gradient, a San Francisco-based HVAC system startup, raised $18 million in Series A funding. Sustainable Future Ventures and Ajax Strategies co-led the round and were joined by Safar Partners, Climate Tech Circle, Shared Future Fund, At One, Impact Science, and others.

- Nobl9, a Waltham, Mass.-based service-level observability startup, raised $15.8m from ServiceNow, Cisco Investments and insiders Battery Ventures and CRV. www.nobl9.com

- Select Star, a San Francisco-based data discovery and governance platform, raised $15 million in Series A funding. Lightspeed Venture Partners led the round and was joined by Bowery Capital, Sozo Ventures, and Pebblebed.

- Lavender, an Atlanta-based email marketing platform, raised $13.2m in seed and Series A funding. Norwest Venture Partners led, and was joined by Signia Venture Partners, CapitalX and Position Ventures. https://axios.link/3WV6vod

- Optilogic, an Ann Arbor, Mich.-based supply chain design software company, raised $13 million in funding led by MK Capital.

- Beek, a Mexico City-based audiobook subscription startup, raised $13m in Series A funding. Lightspeed Venture Partners led, and was joined by insiders Greylock and Accel. https://axios.link/3jsqrBi

- Samooha, a cross-cloud data collaboration platform, raised $12.5m in Series A funding. Altimeter led, and was joined by Snowflake Ventures. https://axios.link/40tAKWc

- PortPro, a Jersey City-based transportation management software company, raised $12 million in Series A funding led by Avenue Growth Partners.

- Gem Security, New York- and Tel Aviv-based cloud security operations platform, raised $11 million in seed funding led by Team8.

- Profit.co, a Fremont, Calif.-based provider of OKR software, raised $11m led by Elevation Capital. https://axios.link/3Y7DGpE

- Guardz, a Tel Aviv-based cybersecurity company, raised $10 million in seed funding. Hanaco Ventures led the round and was joined by iAngels, GKFF Ventures, and Cyverse Capital.

- Nexus, an Austin-based platform powering Support-a-Creator programs for live-service video games, raised $10 million in funding. Griffin Gaming Partners led the round and was joined by Sony Innovation Fund, Valhalla Ventures, content creators CohhCarnage and Berleezy, Pace Capital, and

- Jetpack.io, an Oakland-based cloud development platform, raised $10 million in seed funding co-led by Coatue and GV.

- Hypernative, a web3 cybersecurity startup, raised $9m in seed funding. Boldstart Ventures and IBI co-led, and were joined by Blockdaemon, Alchemy, Borderless, CMT Digital and Nexo. https://axios.link/3HGR0Mp

- Addressable, a digital fingerprinting startup, raised $7.5m in seed funding from Viola Ventures, Fabric Ventures, Mensch Capital Partners and North Island Ventures. https://axios.link/3WPPHz7

- WARP, a Los Angeles-based freight network logistics company, raised an additional $5.7 million in funding from MaC Venture Capital, Bonfire Ventures, and Frontier Venture Capital.

- Dalia, a Boston-based recruitment marketing automation platform, raised $5 million in Series A funding. Lewis & Clark Ventures led the round and was joined by the family office of Paul Forster, SaaS Ventures, FJ Labs, Remarkable Ventures, and others.

- ToolJet, an SF-based low-code app builder, raised $4.6m in seed funding. Nexus Venture Partners led, and was joined by January Capital and Ratio Ventures. https://axios.link/3Hu3dTh

- Instill AI, a London-based unstructured data infrastructure platform, raised $3.6 million in seed funding. RTP Global led the round and was joined by Lunar Ventures, Hive Ventures, and other angels.

- Kubeark, a New York-based delivery and lifecycle management platform, raised $2.8 million in pre-seed funding. Credo Ventures led the round and was joined by Seedcamp, LAUNCHub Ventures, 500 Emerging Europe, and others.

- TrueBiz, a remote-based business identity automation platform, raised $2.4 million in seed funding. Flourish Ventures led the round and was joined by Y Combinator, Homebrew, and the Fintech Fund.

- Tusk Logistics, a Chicago-based supply chain company, raised $1.6 million in pre-seed funding. Forum Ventures led the round and was joined by TitletownTech and Fulfillment IQ.

- Superlayer, a London-based B2B sales pipeline management startup, raised $1.3 million in pre-seed funding. Triple Point Ventures and Concept Ventures co-led the round and were joined by Notion Capital, Accel, Exor Seeds, and other angels.

. . .

Sustainability:

- Our Next Energy, a Novi, Mich.-based energy storage company, raised $300 million in Series B funding. Fifth Wall and Franklin Templeton led the round and were joined by Temasek, Riverstone Holdings, Coatue, and others.

- Boston Metal, a Woburn, Mass.-based decarbonized steel production company, raised $120 million in Series C funding. ArcelorMittal led the round and was joined by Microsoft's Climate Innovation Fund and SiteGround Capital.

- Enko, a Mystic, Conn.-based crop health company, raised an additional $80 million in Series C funding. Eight Roads Ventures, Nufarm, Endeavor8, and Akroyd invested in the round.

- Risilience, a Cambridge, U.K.-based climate analytics company, raised $26 million in Series B funding. Quantum Innovation Fund led the round and was joined by IQ Capital and National Grid Partners.

- NT-Tao, a Hod HaSharon, Israel-based nuclear fusion energy company, raised $22 million in Series A funding. Delek US and NextGear Ventures co-led the round and were joined by Honda, OurCrowd, and the Grantham Foundation.

- Sunstone Credit, a Baltimore-based clean energy financing platform that helps businesses go solar, raised $20 million in Series A funding led by an affiliated fund of Greenbacker Capital Management.

- Gradient, a SF-based HVAC maker, raised $18m in Series A funding co-led by Sustainable Future Ventures and insider Ajax Ventures, per Axios Pro. https://axios.link/3XZzoB6

- Recycleeye, a London-based waste robotics startup, raised $17m in Series A funding led by DCVC led, and was joined by Promus Ventures, Playfair Capital, MMC Ventures, Creator Fund, Atypical and Seaya Andromeda. www.recycleeye.com

Acquisitions & PE:

- Marqeta acquired Power Finance, a New York-based credit card program management platform. Financial terms were not disclosed.

- Vista Equity Partners acquired KnowBe4, a Clearwater, Fla.-based security awareness training and simulated phishing platform provider, for $4.6 billion.

- QAD, owned by Thoma Bravo, acquired Redzone, a Miami-based workforce platform for manufacturing organizations, for nearly $1 billion.

- Netlify acquired Gatsby, a remote-based cloud platform for web delivery and content orchestration. Financial terms were not disclosed.

- LVMH (Paris: MC) and L’Oréal (Paris: OR) submitted bids for Aesop, an Australian skin care brand owned by Brazil’s Natura Cosmetics, per Bloomberg. A prior report identified other bidders as CVC Capital Partners, L'Occitane (HK: 00973) and Japan’s Shiseido (which Bloomberg says is only considering an offer). https://axios.link/3Y5vYfN

- Saviynt, an El Segundo, Calif.-based provider of identity and access governance solutions, raised $205m from a private credit affiliate of AllianceBernstein. It previously raised $170m in VC funding. https://axios.link/3kVuk22

- Cvent (Nasdaq: CVT), a Tysons, Va.-based events software provider majority owned by Vista Equity Partners, is exploring a sale that could fetch upwards of $4b, per the WSJ. https://axios.link/3kZFzpX

- Ariana Grande will pay $15m to buy back her r.e.m. beauty brand from Forma Brands, the private equity-backed Morphe owner that recently filed for bankruptcy. https://axios.link/3kWgUCW

- AMC Theatres (NYSE: AMC) sold its stake in Saudi Cinema Co. to Saudi Arabia’s Public Investment Fund for $30m. https://axios.link/3WOQnoo

- Standard AI, an SF-based autonomous checkout startup valued by VCs at $1b, acquired Skip, a developer of self-checkout kiosks, as first reported by Axios Pro. https://axios.link/3l4P5bB

. . .

IPOs:

Nothing to see here…

. . .

SPACs:

Nothing to see here…

Funds:

- March Capital raised $650m for its fourth venture growth fund. www.marchcp.com

- defy.vc, a Woodside, Calif.-based venture capital firm, raised $300 million for its third fund focused on investing in 33 core companies.

- Buoyant Ventures, a Chicago-based climate software VC firm led by Energize Ventures co-founder Amy Francetic, raised $76m for its debut fund. Microsoft is among the LPs. https://axios.link/3WZdgFu

Final Numbers

Data: PitchBook; Note: 2022 data includes the first 16 days of 2023; Chart: Axios Visuals

. . .

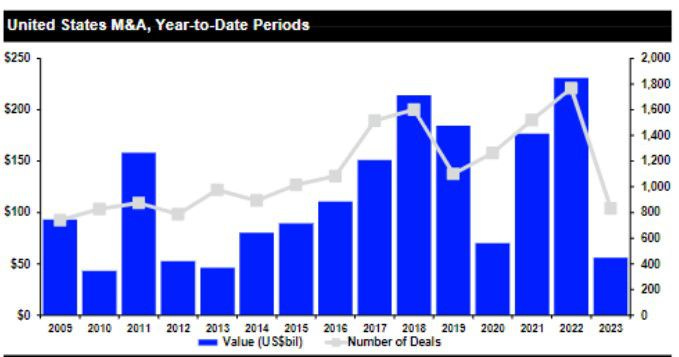

Source: Refinitiv Deals Intelligence. Data through Feb. 2, 2023.

U.S. M&A volume is down 76% from a year ago, including a 71% decline for private equity-backed deals, per Refinitiv.

The global drop is 68%, with the YTD total just shy of $122 billion.

. . .

Startups Are Cutting Spend

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.