Sourcery (1/31-2/4)

FTX Trading, Chargebee, Ramp, Phantom, Mos, Lex, Athelas, ConcertoCare, Future, Jasper Health, CertifyOS, Neura Health, LoadSmart, ICEYE, Torii, Dune Analytics, Crisp, Wonderment, Zero, Citrix...

Last Week (1/31-2/4):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include FTX Trading, Chargebee, Ramp, Phantom, Wayflyer, Tribal, Lunchbox, Mos, Lex, Pluto, Athelas, ConcertoCare, Future, Jasper Health, Codoxo, First Dollar, CertifyOS, Neura Health, LoadSmart, RenoRun, ICEYE, Productboard, Island, Pixel Vault, Jellyfish, Torii, Dune Analytics, Pecan AI, Crisp, Olipop, Deepnote, Waldo, Unblocked, RareCircle, Wonderment, Lula, Novi Connect, Zero Acre Farms, Modern Electron, Zero, Cloud Paper; Citrix, Violet Grey, Accusonus, Dive Technologies, Ilia Beauty, MyCrypto; Appgate, Zepz; Wag

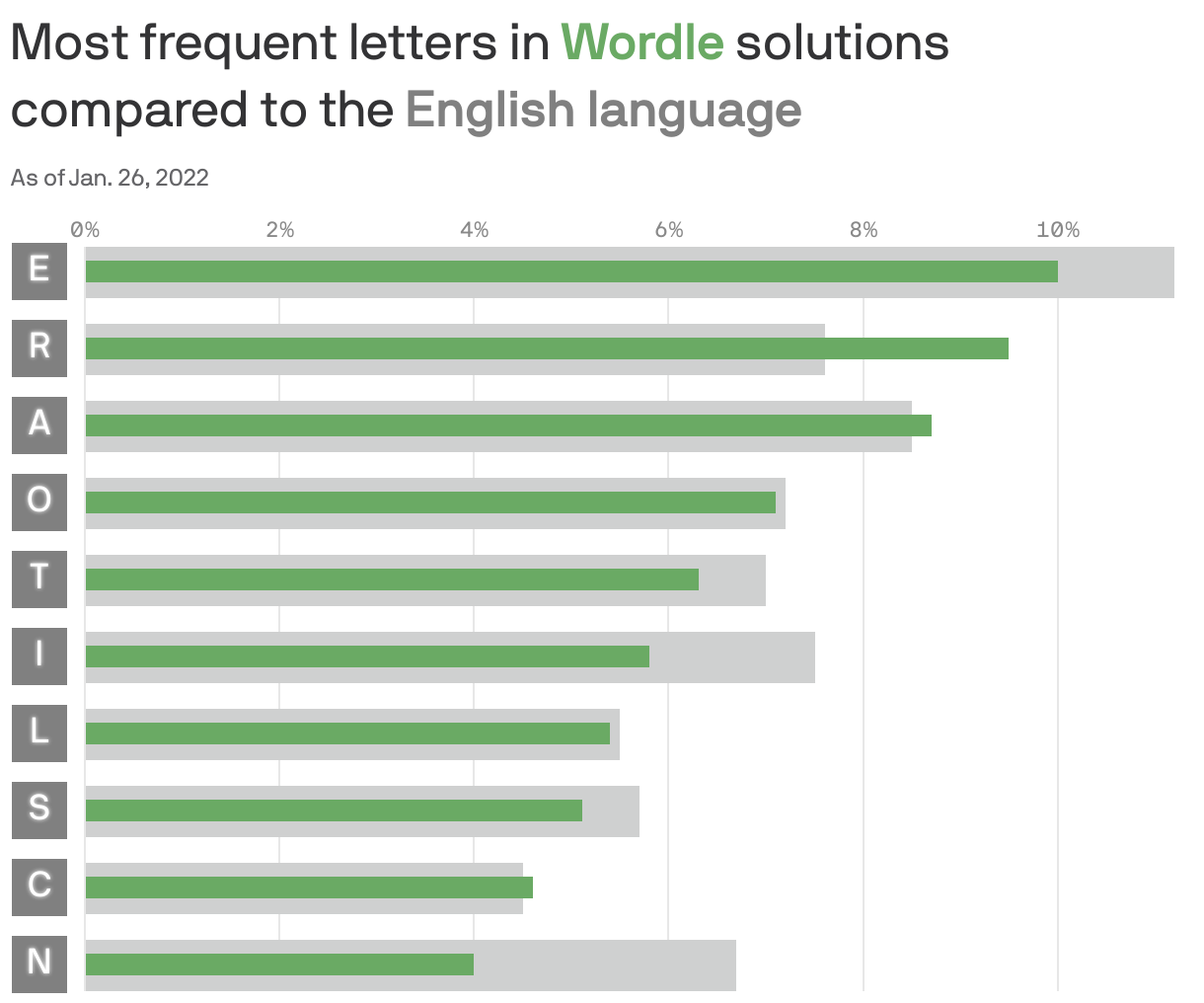

Final numbers on Most Frequent Wordle Letters at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- FTX Trading, a Bahamas-based crypto exchange, raised $400 million in Series C funding at a $32B valuation from Temasek, Paradigm, Ontario Teachers’ Pension Plan Board, NEA, IVP, SoftBank Vision Fund, Lightspeed Venture Partners, Steadview Capital, Tiger Global, and Insight Partners.

- Chargebee, a Walnut, Calif.-based subscription management platform, raised $250 million in funding. Tiger Global and Sequoia Capital co-led the round and were joined by investors including Insight Partners, Sapphire, and Steadview Capital.

- Ramp, a New York-based corporate card management company, raised at least $200 million in funding led by Founders Fund, per The Information.

- KOHO Financial, a Toronto-based banking and money management fintech provider, raised $165.5 million in Series D funding. Eldridge led the round and was joined by investors including Drive Capital, TTV Capital, HOOPP, Round13, and BDC.

- Trust Machines, a remote Bitcoin app ecosystem, launched and raised $150 million from investors including Breyer Capital, Digital Currency Group, GoldenTree, Hivemind, and Union Square Ventures.

- Descartes Underwriting, a Paris-based corporate insurance technology company that addresses climate and emerging risks, raised $120 million in Series B funding. Highland Europe led the round and was joined by investors including Eurazeo, Serena, Cathay Innovation, Blackfin Capital Partners, Seaya Ventures, and Mundi Ventures.

- Phantom, a San Francisco-based crypto wallet app for the Solana ecosystem, raised $109 million in funding led by Paradigm.

- Wayflyer, a Dublin-based financing platform for e-commerce merchants, raised $100m at a $1.6b valuation. DST Global and QED Investors co-led, and were joined by Prosus, Madrone Capital Partners, JPMorgan and insiders Left Lane Capital and Guillaume Pousaz. http://axios.link/Moul

- Tribal, B2B payments and financing startup focused on emerging markets, raised $60m in Series B funding. SoftBank led, and was joined by BECO Capital, QED Investors and Rising Tide. www.tribal.credit

- Lunchbox, a New York-based digital ordering platform for enterprise restaurant chains and ghost kitchens, raised $50m in Series B funding. Coatue led, and was joined by Primary Venture Partners and 645 Ventures. www.lunchbox.io

- Happy Money, a Tustin, Calif.-based unsecured lending company that partners with credit unions, raised $50 million in Series D funding from Anthemis Group and CMFG Ventures.

- Mos, a San Francisco-based banking app for students, raised $40 million in Series B funding led by Tiger Global and was joined by investors including Sequoia Capital, Lux Capital, Emerson Collective, and Plural VC

- Withco, a New York-based commercial property ownership platform for SMBs, raised over $30m from firms like Canaan Partners, Founders Fund, Initialized Capital, NFX, Enlightened Hospitality Investments and Lennar. http://axios.link/EMYZ

- Tint, an SF-based embedded insurance startup, raised $25m in Series A funding. QED Investors led, and was joined by insiders Nyca, Deciens, YC and Webb Investment Network. www.tint.ai

- OpenGamma, a London-based financial software-as-a-service firm, raised $21m led by Allianz X. http://axios.link/ugWt

- Lex, a New York-based commercial real estate securities marketplace, raised $15m in Series A funding. Peak6 led, and was joined by Khosla Ventures, MetaProp, Two Lanterns, MUFG Innovation Partners and Gaingels. http://axios.link/mhjX

- Pluto, a corporate spend management startup focused on the Middle East, raised $6m in seed funding. GFC led, and was joined by Adapt VC, Soma Capital, Graph Ventures and OldSlip Group. www.plutocard.io

- Flexio, a Mexico City-based B2B payments platform, raised $3 million in seed funding led by Costanoa Ventures and was joined by investors including Soma Capital, Latitud Fund, Omri Mor, Daniel Kahn, Diego Oppenheimer, and others.

- Method Financial, a debt repayment rails startup, raised $2.5m from YC, Ardent Ventures, LiveOak Venture Partners and Runa Capital. www.methodfi.com

- Pay Theory, a Cincinnati-based payments platform, raised $2 million in seed funding led by Zeal Capital Partners.

. . .

Care:

- Athelas, a Mountain View, Calif.--based remote patient monitoring company, raised $132 million in funding. General Catalyst and Tribe Capital led the round and were joined by investors including Sequoia Capital, YCombinator, Greenoaks, Human Capital, and Initialized Capital.

- ConcertoCare, a New York-based care provider of at-home care for seniors and other adults, raised $105 million in Series B funding led by Wells Fargo Strategic Capital and was joined by investors including Obvious Ventures, Vast Ventures,The Schusterman Family Foundation, SteelSky Ventures, Pennington Partners, and Deerfield Management.

- Future, a San Francisco-based digital fitness coaching app, raised $75 million in Series C funding. SC.Holdings and Trustbridge Partners led the round and were joined by investors including Kleiner Perkins, Fabletics co-founder Kate Hudson, actor and podcast host Oliver Hudson, pro bowler J.J. Watt, and others.

- Vynca, a Palo Alto-based provider of care solutions for those with serious illnesses, raised $30m in growth funding. Questa Capital led, and was joined by Generator Ventures, First Trust, 4100 Group and OCA Ventures. www.vyncahealth.com

- Jasper Health, a New York-based cancer care navigation and experience platform, raised $25 million in Series A funding. General Catalyst led the round and was joined by investors including Human Capital, W Health Ventures, Redesign Health, and 7wireVentures.

- Codoxo, an Atlanta, Ga.-based healthcare artificial intelligence solutions company, raised $20 million in Series B funding led by QED Investors and was joined by investors including Sands Capital Management, 111 West Capital, Brewer Lane Ventures, Spider Capital, and GRA Venture Fund.

- Getlabs, a Miami, Fla.-based infrastructure for remote healthcare delivery providers, raised $20 million in Series A funding. Emerson Collective and the Minderoo Foundation led the round and were joined by investors including Tusk Venture Partners, Labcorp, Healthworx, Byers Capital, 23andMe CEO Anne Wojcicki, YouTube CEO Susan Wojcicki, and Capsule CEO Eric Kinariwala.

- First Dollar, a digital health wallet for insurance members with tax-advantaged plans, raised $14m in Series A funding led by Blue Venture Fund.

https://www.firstdollar.com

- Synapticure, a Chicago-based teleneurology startup focused on patients with ALS, raised $6m in seed funding. GV led, and was joined by LifeForce Capital, Martin Ventures, Byers Capital and YC. www.synapticure.com

- CertifyOS, a New York-based provider credentialing and licensing company for healthcare professionals, raised $4.6 million in seed funding led by Upfront Ventures and was joined by investors including Max Ventures, Arkitekt Ventures, Goldline Ventures, and the Hustle Fund.

- The Breakaway, a Truckee, Calif.-based cycling performance app, raised $2.9m from backers like General Catalyst, Norwest Venture Partners and Zone 5 Ventures. www.breakaway.app

- Neura Health, a New York-based virtual neurology clinic, raised $2.2 million in seed funding. Pear VC, Next Play Ventures, and Global Founders Capital led the round and were joined by investors including Index Ventures and Norwest Venture Partners.

. . .

Enterprise & Consumer:

- Cart, a Houston-based e-commerce-as-a-service startup, raised $240m in equity and debt funding led by Legacy Knight Capital Partners. http://axios.link/5AL3

- LoadSmart, a Chicago-based on-demand freight marketplace, raised $200m in Series D funding at a $1.3b valuation. SoftBank led, and was joined by BlackRock, CSX and Janus Henderson. http://axios.link/2xCH

- RenoRun, a Montreal-based e-commerce platform for construction and building materials, raised $142 million in Series B funding led by Tiger Global and was joined by investors including Investissement Quebec, Sozo Ventures, Schneider Electric Ventures, BDC Capital, Fifth Wall, Desjardins Capital, BDC Women in Tech Fund, and Nicola Wealth.

- ICEYE, an Espoo, Finland-based synthetic aperture radar (SAR) data and natural catastrophes (NatCat) solutions provider, raised $136 million in Series D funding led by Seraphim Space and was joined by investors including BAE Systems, Kajima Ventures, Molten Ventures, OTB Ventures, True Ventures, C16 Ventures, Chione, Services Group of America, the National Security Strategic Investment Fund, Space Capital, and Promus Ventures.

- Productboard, a San Francisco-based product management and insights platform, raised $125 million in Series D funding led by Dragoneer Investment Group and was joined by investors including Tiger Global, Bessemer Venture Partners, Sequoia Capital, Kleiner Perkins, Index Ventures, and Credo Ventures.

- Superpedestrian, a Boston-based scooter fleet developer, raised $125m in equity and debt funding from Jefferies, Antara Capital, Sony Innovation Fund, FM Capital and insiders Spark Capital, General Catalyst and Citi. http://axios.link/omuN

- Island, an Israeli cybersecurity service company, raised approximately $100 million in funding from investors including Insight Partners, Sequoia Capital, Cyberstarts and Stripes.

- Pixel Vault, a superheroes and comic book NFT collection, raised $100m from 01 Advisors and Velvet Sea Ventures. http://axios.link/wa9f

- Jellyfish, a Boston-based engineering management platform, raised $71 million in Series C funding led by Accel and was joined by investors including Tiger Global, Insight, and Wing Venture Capital.

- PlexTrac, a Boise, Idaho-based cybersecurity software company, raised $70 million in Series B funding led by Insight Partners and was joined by investors including Madrona Venture Group, Noro-Moseley Partners, and StageDotO Ventures.

- Torii, a New York-based Automated SaaS Management Platform (SMP), raised $50 million in Series B funding led by Tiger Global Management.

- Pavilion Data Systems, a San Jose, Calif.-based data analytics acceleration and NVMe-oF platform, raised $45 million in funding led by Kleiner Perkins and Artiman Ventures.

- Dune Analytics, an Oslo, Norway-based web3 analytics platform, raised $69.4 million in Series B funding. Coatue led the round and was joined by investors including Multicoin Capital and Dragonfly Capital.

- Pecan AI raised $66 million in Series C funding. Insight Partners led the round and was joined by investors including GV, S-Capital, GGV, Dell Technologies Capital, Mindset Ventures, and Vintage investment.

- Rudderstack, a San Francisco-based open source customer data platform (CDP) for building customer data stacks, raised $56M in Series B funding led by Insight Partners and was joined by investors including Kleiner Perkins and S28 Capital.

- Crisp, a New York-based open-data programmatic commerce platform for the consumer goods industry, raised $35 million in Series B funding. 3L led the round and was joined by investors including FirstMark Capital, Spring Capital, Steve Papa, Scott Beattie, Kim Perell, James Brennan, Dermot Halpin, 9Yards Capital, Gaingels, and others.

- OLIPOP, an Oakland, Calif.-based tonic beverage company, raised $30 million in Series B funding from investors including Camila Cabello, Priyanka Chopra Jonas, Nick Jonas, Joe Jonas, Kevin Jonas, Mindy Kaling, Logic, Gwyneth Paltrow, and others.

- Doing Things Media, an Atlanta-based digital media firm known for Instagram meme accounts, raised $21.5m in Series A funding led by Volition Capital. http://axios.link/4ub9

- Deepnote, a San Francisco-based collaborative data science notebook company, raised $20 million in Series A funding. Index Ventures and Accel co-led the round and were joined by investors including Y Combinator and Credo Ventures.

- Midnite, a London-based licensed esports betting platform, raised $16 million in Series A funding led by The Raine Group.

- Waldo, a New York-based no-code test automation platform for mobile apps, raised $15 million in Series A funding led by Insight Partners and was joined by investors including Matrix Partners, First Round Capital, Algolia founder Nicolas Dessaigne, Looker co-founder Ben Porterfield, and Zenhub CEO Tyler Gaffney.

- Nfinite, a New York-based visualization and e-commerce merchandizing startup, raised $15m in Series A funding led by USVP. www.nfinite.app

- Countable, a San Francisco-based community management SaaS platform, raised $13.5 million in Series A funding led by Canaan Partners and was joined by investors including Mighty Capital, Global Catalyst Partners, and Ulysses Management.

- Launch House, a Los Angeles-based social club for founders and engineers, raised $12 million in Series A funding led by a16z and was joined by investors including Michael Ovitz, Electric Ant, 6th Man Ventures, and Ryan Sean Adams.

- Unblocked, a Los Angeles-based NFT company for music and entertainment brands, raised $10 million in seed funding from investors including Tiger Global, Penske Media, Electric Feel Entertainment, Primary Wave Music, Dapper Labs, Oaktree Capital Management, and Marcy Venture Partners.

- Lemonada Media, a podcast network, raised $8m in Series A funding, per The Hollywood Reporter. BDMI led, and was joined by Madison Wells, Greycroft, Spring Point Partners LLC, Intuition Capital, Owl Capital Group and Blue Collective. http://axios.link/re0Q

- Onehouse, a Menlo Park, Calif.-based cloud-native managed lakehouse company, raised $8 million in seed funding co-led by Greylock and Addition.

- RareCircles, a Calgary, Canada-based New York-based NFT membership platform company, raised $7.5 million in seed funding led by Tiger Global and was joined by investors including White Star Capital, Alpaca, Crew Capital, Global Founders Capital, Alumni Ventures, and Detroit Venture Partners.

- Wonderment, a Boston-based SaaS platform offering order tracking technology for Shopify merchants, raised $6 million in seed funding led by CRV and was joined by investors including Underscore VC and Defy.vc.

- Lula, a Philadelphia-based delivery solution for convenience stores, raised $5.5 million in seed funding. Ripple Ventures, Outlander VC, and Up Partners led the round and were joined by investors including SOSV, Simple Capital, NZVC, Stonks.com, EasyPost, Park City Angels, Alumni Ventures, Broad Street Angels, and Ben Franklin Technology Partners.

- Emergent Games, a blockchain gaming and metaverse studio, launched after raising £4 million ($5.4 million) in funding from Pluto Digital.

- Lost Lake Games, a Seattle, Wash.-based cross-platform game studio, raised $5 million in seed funding led by BITKRAFT Ventures and was joined by investors including Lightspeed Venture Partners, Moon Holdings, and 1Up Ventures.

- Pixm, a New York-based Computer Vision (CV) cyber security startup, raised $4.3 million in seed funding led by Gula Tech Ventures and was joined by investors including FirstIn, AIM13, Chaac Ventures, and Precursor Ventures.

- Passage, an Austin, Tex.-based user authentication platform developer, raised $4 million in funding led by LiveOak Venture Partners and was joined by investors including Next Coast Ventures, Tau Ventures, and Secure Octane.

- AllSpice, a Boston-based git platform for hardware development, raised $3.8 million in seed funding. Bowery Capital and Root Ventures led the round and were joined by investors including Flybridge Capital and nTopology co-founder Greg Schroy.

- Sunroom, a Toronto-based content management platform, raised $3.6 million in seed funding from investors including Blackbird, Li Jin, Cyan Bannister, Sarah Downey, Peanut CEO & co-founder Michelle Kennedy, and Brud co-founder Trevor McFedries.

- Voldex, a gaming company focused on user-generated-content that owns and operates several Minecraft and Roblox games, raised $3 million in funding led by Dune Ventures and was joined by investors including Makers Fund, POW! Interactive, angel investor Christian Perez, and others.

- NachoNacho, a Los Altos, Calif.-based subscription management platform to help businesses buy and manage cloud-based products, raised $3 million in seed funding led by AltaIR Capital and was joined by investors including Moving Capital, PMC, and s16vc.

- WhoseYourLandlord, a New York-based online landlord rating and reviewing platform, raised $2.1 million in seed funding led by Black Operator Ventures and was joined by investors including New York Ventures, Ben Franklin Tech Partners, Gold Wynn, and Googleʼs Black Founders Fund.

- Captain Experiences, an Austin-based platform for outdoor sports, raised $2 million in seed funding led by Looking Glass Capital and was joined by investors including a16z, Not Boring Capital, Goodwater Capital, Oliver Hudson, and others.

. . .

Sustainability:

- Novi Connect, a Larkspur, Calif.-based B2B marketplace for sustainable ingredients and packaging, raised $40 million in funding. Tiger Global led the round and was joined by investors including Defy.vc and Greylock.

- Zero Acre Farms, a vegetable oil alternative startup, raised $37m in Series A funding. Lowercarbon Capital and Fifty Years co-led, and were joined by S2G Ventures, Virgin Group, Collaborative Fund and FootPrint Coalition. http://axios.link/pDRK

- Modern Electron, a hydrogen-focused home heating startup based in Bothell, Wash., raised $30m in Series B funding from At One Ventures, Extantia, Starlight Ventures, Valo Ventures, Irongrey, Wieland Group and insiders MetaPlanet and Bill Gates. http://axios.link/Cm1W

- Zero, a Redwood City, Calif.-based plastic-free grocery, home, and personal care delivery startup, raised $11.8 million in seed funding led by Sway Ventures.

- Cloud Paper, a Seattle, Wash.-based tree-free sustainable paper products’ startup on a mission to end deforestation, raised $5 million in funding from Bezos Expeditions, TIME Ventures, Presight Capital, SOUNDWaves, and Re:Build Manufacturing co-founder Jeff Wilke.

Acquisitions & PE:

- Vista Equity Partners and Evergreen Coast Capital agreed to acquire Citrix Systems, a Fort Lauderdale, Fla.-based virtualization software company, for $16.5 billion in cash. As part of the deal, Citrix will merge with TIBCO, a Vista portfolio company.

- FARFETCH Limited acquired Violet Grey, a Los Angeles-based beauty marketplace, from Fernbrook Capital Management. Financial terms were not disclosed.

- Meta (Nasdaq: FB) is in talks to buy Accusonus, an audio software startup founded in Greece and incorporated in Massachusetts, per Reuters. Accusonus investors include VentureFriends and Enterprise Mates. http://axios.link/9hDN

- Glooko, a Palo Alto-based provider of remote patient monitoring and chronic care management for diabetes, acquired Xbird, a Berlin-based predictive analytics platform for diabetes. Glooko has raised over $230m from Health Catalyst Capital, Realization, Canaan Partners, Georgian Partners, Novo Nordisk, Insulet and Mayo Clinic. Xbird backers included Cascara Ventures. http://axios.link/UouI

- Anduril Industries, backed by a16z, acquired Dive Technologies, a Boston-based autonomous underwater vehicles (AUVs) startup. Financial terms were not disclosed.

- KKR acquired a majority stake in PlayOn! Sports, an Atlanta, Ga.-based high school sports media and technology company. Financial terms were not disclosed.

- Famille C agreed to acquire ILIA Beauty, a Laguna Beach, Calif.-based women’s cosmetics brand, from Silas Capital and Sandbridge Capital. Financial terms were not disclosed.

- ConsenSys, a blockchain company valued by VCs at $3.2b, acquired MyCrypto, a Redondo Beach, Calif.-based wallet for managing ethereum accounts that had been backed by Polychain Capital. http://axios.link/myRX

. . .

IPOs:

- Appgate, a Coral Gables, Fla.-based Zero Trust platform for enterprises and governments, filed for an IPO. The company posted $31.4 million in revenue in the nine months ending in Sep. 2021 and $21.9 million in net income. Magnetar Financial backs the firm.

- Zepz, a London-based money transfer service previously known as WorldRemit, is prepping a U.S. IPO at around a $6b valuation, per Bloomberg. It’s raised over $1b from firms like Accel, Farallon Capital Management, TCV and LeapFrog Investments. http://axios.link/udG4

. . .

SPACs:

- Wag Labs, a San Francisco-based dog walking app developer, agreed to go public via a merger with a CHW Acquisition Corp., a SPAC. A deal values the company at around $350 million.

Funds:

- Tiger Global has secured $11 billion for its latest private tech investment fund, and plans to close next month on $12b, per The Information. Last year we reported that it would target $10b.

- ACME Capital, a San Francisco-based venture capital firm, raised $300 million for its fourth fund focused on early-stage companies.

- Seven Seven Six, a Palm Beach Gardens, Fla.-based venture capital firm, raised $500 million across two funds focused on early stages and growth funding.

- Freestyle Capital is raising $125m for its sixth flagship fund and $50m for its fourth opportunities fund, per SEC filings. www.freestyle.vc

- MaC Venture Capital is raising $200m for its second fund, per an SEC filing. www.macventurecapital.com

- Unlock Venture Partners, a Seattle, Wash.-based venture capital firm, raised $60 million for a second fund to invest in startups in Seattle and Los Angeles.

Final Numbers

Reproduced from Christopher Ingraham, the Why Axis; Chart: Kavya Beheraj/Axios

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.