Sourcery 🌳 Keith Rabois, State of VC, rabbit r1, SaaS, Coachella

(1/8-1/12) Perplexity AI, Quora, Hyperexponential, Rainbow, OneAdvisory, Nabla, Vita Health, PursueCare, Parallel Learning, Credo, WTHN

Happy Wednesday!

For those wondering, Sourcery gets published every Tues AM but when we’re off on Mondays for holidays it gets pushed to Wednesday (the new Tuesday?).

Hopefully, you’ve had enough time to get to inbox zero. 😅

There is a lot to share this week across the state of the VC markets, SaaS, CES, Coachella.. oh, and the floodgates of “AI for X” companies have finally started to hit the deal announcement news cycle.. see below. This next year should be interesting.

. . .

Musings

Macro

Moving from Founders Fund to Khosla with @Khosla Managing Director Keith Rabois, 20VC

Keith Rabois is a Managing Director @ Khosla Ventures and one of the most respected venture investors of the last decade. Keith has led investments in Stripe, Faire, Ramp, Affirm and many more. Just last week, Keith announced he would be rejoining Khosla from Founders Fund, where he spent an immensely successful 5 years as a General Partner. Prior to Founders Fund, Keith started his career at Khosla where he spent 6 years and led investments in DoorDash, Opendoor, Webflow and more.

The Puritans of Venture Capital: a16z vs Benchmark, Accel, Kyle Harrison

History of the VC-machine, its leaders, and how the asset class has grown to date

Shout out to Upfront’s Mark Suster → Does the Size of a VC Fund Matter?

Hard Truths: Reinventing Founder Friendliness - Back to the Future, Jamin Ball

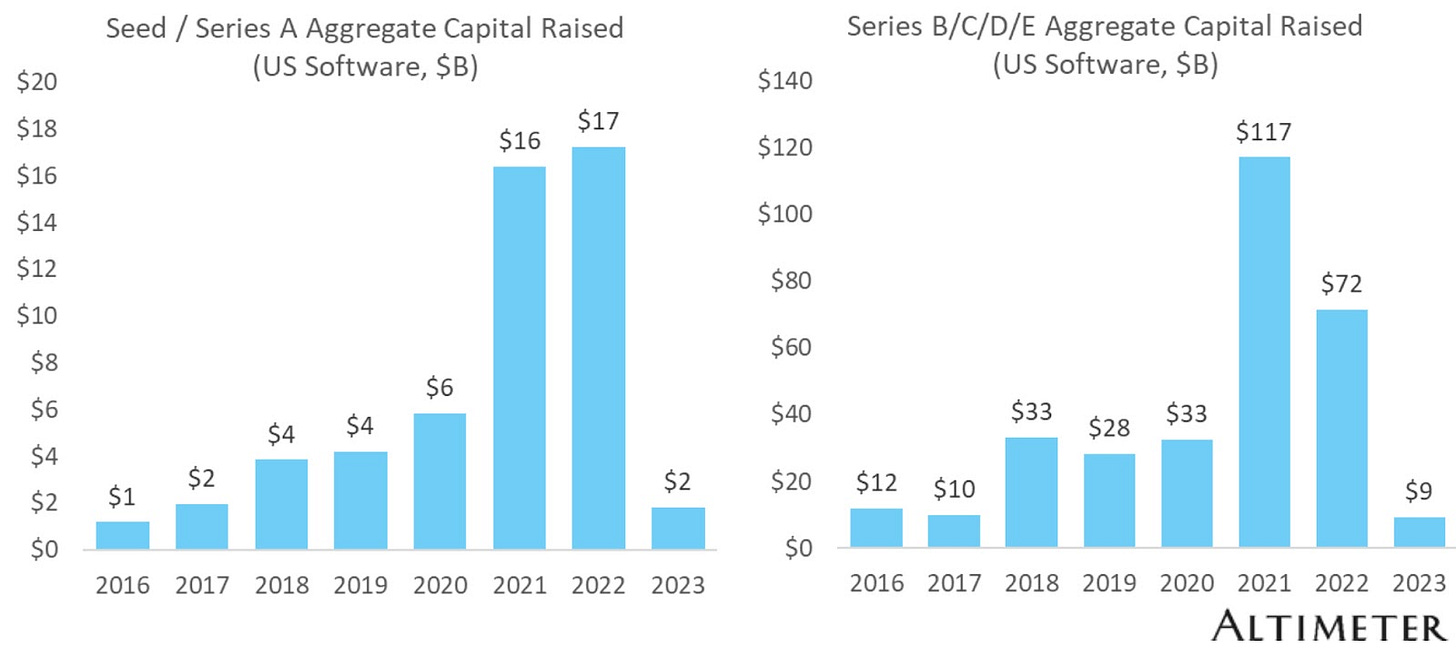

“In 2021 and the first half of 2022 (when most of the 2022 activity happened) we essentially crammed 5 years worth of funding into an 18 month period. Series Bs and Cs were raised when companies were at the typical Series A milestones. Normal round sizes doubled or tripled. Every type of investor was broadly operating in a “risk on” mindset given the ZIRP environment, and the venture capital ecosystem was no exception.”

Listen to the full conversation → Did Figma Kill M&A Markets in 2024, The Three Biggest Mistakes Made in Growth Investing, The Three Requirements Companies Need to IPO in 2024 with Ed Sim of Boldstart Ventures & Jamin Ball of Altimeter, 20VC

SaaS

Inverting SaaS: Services as Software, Andrew

LLMs represent a phase change in software that could remake the SaaS business model. What will software companies look like a decade from now? And who stands to benefit?

GitHub for X Companies, Peter Zakin

TLDR: People often describe startups as being Github for X. The analogy actually references two very distinct ideas: version control platforms and open-source hubs.

Version control tools are strategically rich (Perforce, Gitlab).

Open-source hubs are strategically less interesting but can feature more explosive growth (HuggingFace).

Github is exceptionally rare in being both a version control tool (which is a nexus for collaboration) and an open-source hub

Read more → Peter ‘open-sourced’ his Google Doc of ideas on the history of Github, the essential characteristics behind it, and where opportunities may lay for expansion

Building here? → Reach out to Peter

Creator Economy

Immigrant to $250M CEO: How Circle Powers the Creator Economy with Co-founder and CEO Sid Yadav, The Split

Sid’s story is the perfect encapsulation of the American Dream: he immigrated with his family from India to New Zealand, started the tech blog Rev2 as a high schooler, moved to the U.S. and joined Teachable as employee #2, and co-founded Circle in 2019 which has scaled to over $16 million in ARR by December 2023

HardTech

The Rabbit R1 is an AI-powered gadget that can use your apps for you, The Verge

This is a gorgeous demo, great music, seamless transitions, strong voice.. it’s almost as if someone from Apple made it? Check out some of the viral videos from rabbit below:

Introducing r1 (2.1M Views)

rabbit r1: $199, no subscription. (3.7M views)

With a well-timed CES launch, a low entry price point, and the third batch already sold out, this team went hard. But how do they monetize in the long term if there’s no subscription and they’re powering a potentially cost-intensive model?

Bonus

. . .

Last Week (1/8-1/12):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into five categories, FinTech, Care, Enterprise & Consumer, HardTech, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Perplexity AI, Quora, Hyperexponential, Conta Simples, Rainbow, OneAdvisory, Harbor Health, Nabla, Vita Health, PursueCare, Parallel Learning, Credo, WTHN, Second Dinner, PerformYard, Luma AI, anecdotes, Overmoon, 1X, Vortexa, Burro, SynMax, Recurrent; HP/Juniper Networks, IAC’s Mosaic Group/Bending Spoons, SentinelOne/PingSafe, Harness/Armory, Thoma Bravo/BlueMatrix

Final numbers on The Weeknd Breaks Streaming Record at the bottom.

Deals

Fintech:

- hyperexponential, a London, U.K.-based pricing decision intelligence platform for insurers, raised $73 million in Series B funding. Battery Ventures led the round and was joined by a16z and existing investor Highland Europe.

- Conta Simples, a São Paulo, Brazil-based expense management platform and corporate card provider, raised $41.5 million in Series B funding. Base10 Partners led the round and was joined by existing investors Valor Capital, Jam Fund, Y Combinator, and others.

- Rainbow, a small-business insurance underwriter, raised $12m in seed funding from Caffeinated Capital, Altai Ventures, Zigg Capital, 8VC, Buckley Ventures, Habitat Partners, and Arch Capital Group. https://axios.link/3vtzSWS

- OneAdvisory, a Miami, Fla.-based client data management platform for registered investment advisors, raised $8 million in seed funding. F-Prime Capital led the round and was joined by Fika Ventures, Great Oaks, and Twelve Below.

- Korr, a New York City-based provider of claims processing and policy administration technology for the insurance industry, raised $3.2 million in seed funding. Motive Ventures led the round and was joined by Tokio Marine Future Fund.

- Bracket Labs, a volatility trading product, raised $2m in pre-seed funding from Binance Labs, NGC Ventures, Cypher Capital, and 0x Capital. www.bracketx.fi

. . .

Care:

- Harbor Health, an Austin, Texas-based primary and specialty clinic group, raised $95.5 million in second-round funding led by General Catalyst.

- Nalu Medical, a Carlsbad, Calif.-based developer of miniature neurostimulation devices, raised $65m. Novo Holdings led, and was joined by insiders Gilde Healthcare, MVM Partners, Endeavor Vision, Decheng Capital, Longitude Capital, Advent Life Sciences, Pura Vida, and Aperture Venture Partners. https://axios.link/3NSClQX

- Nabla, a Boston, Mass.-based AI-powered copilot that generates clinical notes, raised $24 million in Series B funding. The round was led by Cathay Innovation and was joined by investors including ZEBOX Ventures.

- Vita Health, a New Haven, Conn.-based suicide intervention startup, raised $22.5m in Series A funding, per Axios Pro. Backers include LFE Capital, Athyrium Capital Management, Flare Capital Partners, CVS Ventures, Connecticut Innovations, HopeLab, and CU Innovations. https://axios.link/3RTe1Q1

- PursueCare, a Middletown, Conn.-based digital addiction treatment provider, raised $20m in Series B funding. T.Rx Capital and Yamaha Motor Ventures co-led, and were joined by Seyen Capital and OCA Ventures. https://axios.link/41OElzn

- DigitalOwl, a New York-based natural language processing startup focused on medical records, raised $12m from Reinsurance Group of America. www.digitalowl.com

- Parallel Learning, a New York-based teletherapy platform for school districts, raised $6m in Series A funding led by Rethink Impact. https://axios.link/3RTjuGn

- Peerlogic, a Scottsdale, Ariz.-based AI assistant for dental offices, raised $5.7 million in seed funding. AZ-VC led the round and was joined by In Revenue Capital, Cervin Ventures, Singularity Capital, and Revere Partners.

- Credo, a Denver, Colo.-based company using AI to analyze medical records, raised $5.3 million in seed funding. FCA Venture Partners led the round and was joined by existing investors Hannah Grey VC, FirstMile Ventures, and SpringTime Ventures.

- WTHN, a wellness startup that offers products based on traditional Chinese medicine, raised $5m in Series A funding. L Catterton led, and was joined by Halogen Ventures. https://axios.link/3vzdgUB

. . .

Enterprise & Consumer:

- Second Dinner, an Irvine, Calif.-based game development studio, raised $100 million in Series B funding. Griffin Gaming Partners led the round and was joined by others.

- PerformYard, an Arlington, Va.-based employee performance management platform, raised $95 million in funding from Updata Partners.

- Quora, a Mountain View, Calif.-based question-and-answer website, raised $75 million in funding from Andreessen Horowitz.

- Perplexity AI, raised $73.6 million in a funding round led by IVP with additional investments from NEA, Databricks Ventures, former Twitter VP Elad Gil, Shopify CEO Tobi Lutke, ex-GitHub CEO Nat Friedman and Vercel founder Guillermo Rauch. Other participants in the round included Nvidia and — notably — Jeff Bezos

- Aqua Security, a Boston, Mass. and Ramat Gan, Israel-based cloud native security platform, raised $60 million in extended Series E funding. The round was led by Evolution Equity Partners and joined by Insight Partners, Lightspeed Venture Partners, and StepStone Group.

- Anecdotes, a Palo Alto, Calif.-based enterprise GRC startup, raised $55m in Series B funding. Vertex and DTCP co-led, and were joined by Gilot Capital Partners, and insiders Red Dot Capital Partners, Vintage Investment Partners, and Shasta Ventures. https://axios.link/41O3Q3P

- Luma AI, a Palo Alto, Calif.-based developer of AI software designed to turn text prompts into videos and 3D objects, raised $43 million in Series B funding from a16z and others.

- Robin AI, a London-based AI-powered legal copilot, raised $26 million in Series B funding led by Temasek. Investors including QuantumLight, Plural, and AFG Partners joined the round.

- anecdotes, a Palo Alto, Calif.-based provider of governance, risk, and compliance technology, raised $25 million in Series B funding. Glilot Capital Partners led the round and was joined by Red Dot Capital Partners, Vintage Investment Partners, Shasta Ventures, and others.

- Sway, a Los Angeles, Calif.-based customer-focused delivery and returns platform for retailers, raised $19.5 million in Series A funding. 7GC led the round and was joined by Blackhorn Ventures, Lightshed Ventures, Rise of the Rest Revolution, and others.

- Ask-AI, a Toronto, Canada and Tel Aviv, Israel-based AI assistant designed to integrate into employee workflows and cut down on repetitive tasks, raised $11 million in Series A funding. Leaders Fund led the round and was joined by Vertex Ventures, State of Mind Ventures, GTMFund, and others.

- GolfForever, an at-home training system for golfers, raised $10m in Series A funding led by Clerisy. https://axios.link/3tOqMDv

- Overmoon, a San Francisco-based vacation rental platform, raised $10 million in seed funding from NFX, Khosla Ventures, Camber Creek, 1Sharpe, Sunsar Capital, and others.

- Mercor, a San Francisco-based platform that uses AI to connect companies with talent, raised $3.6 million in seed funding. General Catalyst led the round and was joined by Scott Sandell, Soma Capital, and others.

- Intrinsic, a San Francisco-based AI system for trust and safety teams, raised $3.1 million in seed funding from investors including Urban Innovation Fund, Y Combinator, 645 Ventures, and Okta.

- NumberEight, a London, U.K.-based platform designed to help advertisers identify audiences through the use of AI, raised $2.7 million in pre-Series A funding. ACF Investors led the round and was joined by Nauta Capital, Ascension Ventures, and others.

. . .

HardTech:

- 1X, a Moss, Norway-based developer of androids designed to work alongside humans in various sectors, raised $100 million in Series B funding from EQT Investors and others.

- Vortexa, a London-based energy and freight software company, raised $34m in Series C funding. Morgan Stanley Expansion Capital led, and was joined by Notion Capital, Monashees, Metaplanet, FJ Labs, and Communitas Capital. https://axios.link/48pBQGg

- Burro, a Philadelphia, Penn.-based developer of robots designed to work in outdoor industries, raised $24 million in Series B funding. Catalyst Investors and Translink Capital led the round and were joined by S2G Ventures, Toyota Ventures, F-Prime Capital, and Cibus Capital.

- SynMax, a Houston-based geospatial data intelligence company, raised $13m at a $50m pre-money valuation, led by energy trader Bill Perkins. www.synmax.com

- PierSight, a Gujarat, India-based satellite surveillance provider for the maritime industry, raised $6 million in seed funding. Alpha Wave Ventures and Elevation Capital led the round and was joined by existing investor Techstars.

- Labrys Technologies, a London-based software platform for defense and commercial companies and organizations to manage global workforces, raised $5.5 million in seed funding led by Project A Ventures.

- Xaba, a Toronto, Canada-based developer of software designed to automate the programming and deployment of industrial robots, raised $2 million in a seed extension. BDC Capital led the round and was joined by Hitachi Ventures and Hazelview Ventures.

. . .

Sustainability:

- Recurrent, a Seattle-based EV battery data startup, raised $16m in Series A funding, per Axios Pro. ArcTern Ventures led, and was joined by Automotive Ventures, Goodyear Ventures, Wireframe Ventures, and Pioneer Square Labs. https://axios.link/3TRs0sn

Acquisitions & PE:

- Hewlett Packard Enterprise agreed to acquire Juniper Networks, a Sunnyvale, Calif.-based networking hardware company, for approximately $1.4 billion.

- IAC (Nasdaq: IAC) agreed to sell Mosaic Group, a portfolio of mobile phone apps and IPO to Italy's Bending Spoons for more than $100m, per Bloomberg. Bending Spoons has raised more than $500m from firms like Neuberger Berman, Cox Enterprises, Tamburi Investment Partners, NUO Capital, Annox Capital, Baillie Gifford, and Cherry Bay Capital Group. https://axios.link/3HgC4DE

- SentinelOne agreed to acquire PingSafe, a San Francisco-based cloud native application protection platform (CNAPP) provider. The acquisition will be a combination of cash and stock, but financial terms were not disclosed.

- Harness, an SF-based software delivery platform valued by VCs at $3.7b in 2022, acquired the assets of Armory, an SF-based continuous deployment startup that had raised over $80m from firms like B Capital, Bain Capital Ventures, Lead Edge Capital, Insight Partners, Crosslink Capital, Mango Capital, Javelin Venture Partners, and YC. https://axios.link/3Sf1qrJ

- YouGov (LSE: YOU) acquired KnowledgeHound, a Chicago-based data analytics and visualization startup that had raised over $4m from Bridge Investments, Seyen Capital, and Breakpoint Ventures. https://axios.link/4aM3wXq

- Society Brands aquired Primal Life Organics, a personal care product purveyor. Financial terms were not disclosed.

- Unilever agreed to acquire K18, a San Francisco-based molecular repair haircare brand. Financial terms were not disclosed.

- Thoma Bravo acquired a majority stake in BlueMatrix, a Durham, N.C.-based content creation and distribution platform for investment research providers. Financial terms were not disclosed.

- Sphera, backed by Blackstone, acquired SupplyShift, a Santa Cruz, Calif.-based developer of software designed to monitor and improve the ESG impact of company supply chains. Financial terms were not disclosed.

. . .

IPOs:

- Circle, the Boston-based stablecoin issuer that once tried to go public via SPAC, filed confidential IPO papers. The company has raised over $1b from firms like General Catalyst, Goldman Sachs, IDG Capital, BlackRock, Fidelity, Marshall Wace, Bitmain, DCG, and Fin Capital. https://axios.link/3SbN0bZ

Funds:

- BDT & MSD Partners raised $14b for their first fund since Byron Trott's firm merged last year with Michael Dell's family office (led by Gregg Lemkau). It's officially called BDT Capital Partners Fund 4. https://axios.link/48sywKo

- Venrock raised $650m for its 10th flagship VC fund. https://axios.link/3vssz1H

- Vintage Investment Partners of Israel raised $200m for its fourth growth equity fund. www.vintage-ip.com

Starboy

Just as the singing-acting-producing artist teases his 6th — and possibly final — album, The Weeknd (real name Abel Tesfaye) has earned another career-defining accolade: his 2019 smash-hit Blinding Lights has become the first song to surpass 4 billion streams on Spotify.

Having spawned countless TikToks as a pandemic-era dance challenge, the track overtook Ed Sheeran’s Shape of You (2017) to become the most-played song ever on Spotify in 2022, and has only furthered its lead since. Fans are anticipating the final installment of the artist's 3-part album series, but Tesfaye has expressed a desire to “close The Weeknd chapter” with its release… though not ruling out releasing music under his real name.

Save your tears

Despite being over 4 years old, Blinding Lights still garners ~2m daily listens on Spotify, which — even under the oft-criticized music streaming payout structures — works out to roughly $6-8k in royalties every day… for one song, on one streaming platform. Indeed, Variety estimates that the track's 4 billion streams would have netted a total ~$20m just from Spotify alone since its release.

And, if the Canadian-Ethiopian star does continue to make music, there’s likely to be more megahits on the way: of the 566 songs to break 1 billion streams on Spotify, 10 are from The Weeknd’s discography.

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

You going to Coachella weekend 1 or 2?

Oh cool. Perfect make sure you holla at me. I’ll be at Weekend 2. You should talk to Sabrina Carpenter. She’s dope. Jhene Aiko is a friend. So pumped to see Tyler the Creator he does camp flag nog I was there in 2018. And Lana Del Rey is special.