Sourcery (2/1-2/5)

Divvy Homes, Valon, Axoni, DealerPolicy, Flink, Lockstep, TrustLayer, CapitalRx, Alma, Folx Health, Infinitus, Flywheel, Plume, Garner Health, Dame, UiPath, Databrix, Vivino, TopHat, Zetwerk, Slync.io

Last Week (2/1-2/5):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech,Care, Future of Work, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Divvy Homes, Valon, Axoni, DealerPolicy, Flink, Lockstep, TrustLayer, CapitalRx, Alma, Folx Health, Infinitus, Flywheel, Plume, Garner Health, Dame, UiPath, Databricks, Vivino, TopHat, Zetwerk, Slync.io, Brightwheel, Rescale, Weights and Biases, Granulate, Quantifind, Vendia, ELSA, Workstep, SecurityAdvisor, Alloy Automation. Svante, Gardyn, Klir. The Honest Co, Bumble, 1stdibs.com, Signify Health. 23&me, WheelsUp, Payoneer.

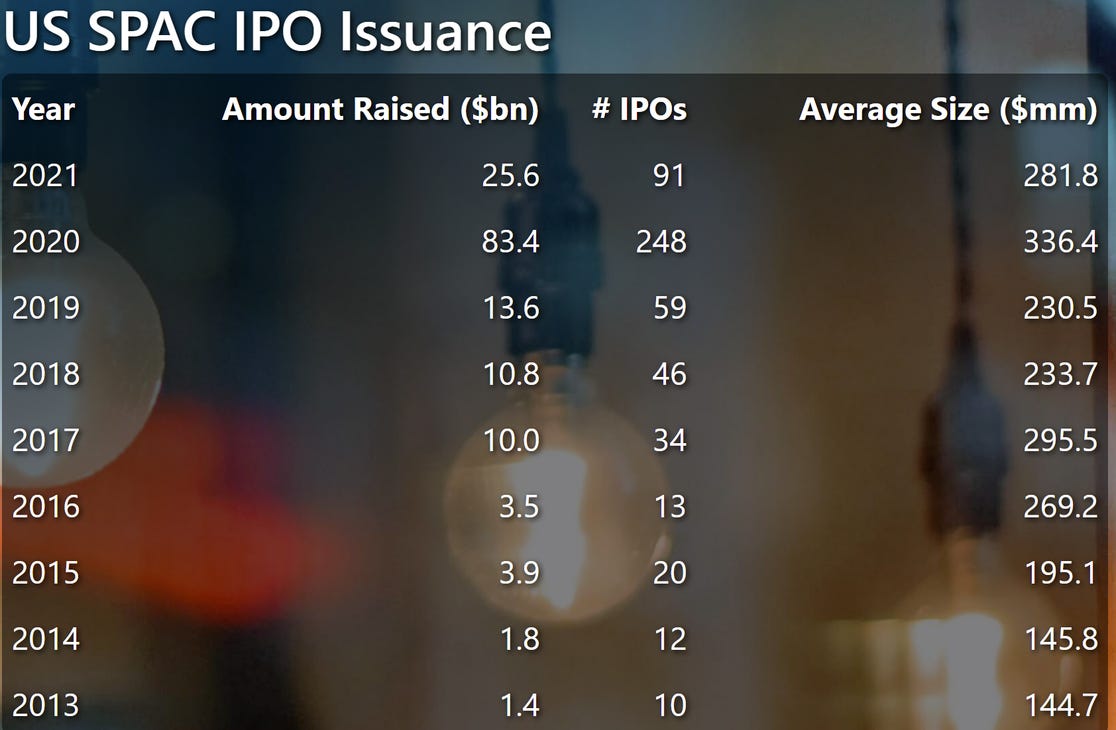

Final numbers on US SPAC IPO Issuance at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Divvy Homes, a San Francisco-based developer of “flexible homeownership programs,” raised $110 million in Series C funding. Tiger Global led, and was joined by GGV Capital, Moore Specialty Credit and JAWS Ventures. http://axios.link/UhEA

- Valon, a New York-based residential mortgage servicer, raised $50 million in Series A. Andreessen Horowitz led the round and was joined by investors including Jefferies Financial Group, New Residential Investment Corporation, Fortress Investment Group, and Adam Neumann’s 166 2nd.

- Axoni, a New York-based blockchain startup, raised an additional $31 million. Investors included Deutsche Bank, Intel Capital, and UBS.

- DealerPolicy, a Burlington, Vt.-based insurance marketplace for auto retailers, raised $30 million in Series B funding co-led by 3L Capital and HSCM Bermuda Management. http://axios.link/Lc5H

- Narmi, a New York city-based digital banking tech maker, raised $20.4 million in Series A funding. New Enterprise Associates led the round.

- Flink, a Mexican retail investing startup, raised $12 million in Series A funding. Accel led, and was joined by AllVP and Clocktower Ventures. http://axios.link/4JRK

- Lockstep, a Seattle-based accounting solution, raised $10 million in Series A funding. Point72 Ventures led the round and was joined by investors including Clocktower Ventures and Revel Partners.

- TrustLayer, a San Francisco-based maker of an insurance verification platform, raised $6.6 million in seed funding. Abstract Ventures led the round and was joined by investors including Propel Venture Partners, NFP Ventures, BoxGroup, and Precursor Ventures.

- Balance, a San Francisco-based B2B payments startup, raised $5.5 million from Lightspeed Venture Partners, Stripe and SciFi VC. http://axios.link/fORx

- Rightfoot, a San Francisco-based provider of debt repayment APIs, raised $5 million in seed funding. Bain Capital Ventures led the round and was joined by investors including BoxGroup and SemperVirens Venture Capital.

- Routefusion, an Austin, Texas-based cross-border payments fintech for other businesses, raised $3.6 million in seed funding. Silverton Partners led the round and was joined by investors including Initialized Capital, NextWorld Capital, and William Hockey (co-founder of Plaid).

- Vested Finance, a San Francisco and Mumbai-based online investment platform, raised $3.6 million in seed funding. Investors included Moving Capital, Ovo Fund,TenOneTen Ventures, Inflection Point Ventures and Venture Catalysts.

. . .

Care:

- Capital Rx, a New York-based pharmacy benefit manager, raised $50 million in Series B funding. Transformational Capital led the round and was joined by investors including Edison Partners.

- Alma, membership-based network for mental health care providers, raised $28 million in Series B funding. Insight Partners led, and was joined by Optum Ventures and insiders Tusk Venture Partners, Primary Venture Partners, Sound Ventures, BoxGroup and Rainfall Ventures. www.helloalma.com

- FOLX Health, a Boston-based digital healthcare service provider designed for the medical LGBTQIA+ community, raised $25 million. Bessemer Venture Partners led the round and was joined by investors including Define Ventures and Polaris.

- SwordHealth, a New York-based maker of physical therapy hardware, raised $25 million. Transformation Capital led, and was joined by return backers Khosla Ventures, Founders Fund, Green Innovations, Vesalius Biocapital and Faber. http://axios.link/4Fsp

- Infinitus, a robotic process automation startup focused on healthcare, raised $21.4 million in Series A funding. Kleiner Perkins and Coatue co-led, and were joined by Gradient Ventures, Quiet Capital, Firebolt Ventures and Tau Ventures. http://axios.link/bGS0

- Cellino, a Cambridge, Mass.-based personalized regenerative medicine company, raised $16 million in seed funding. The Engine and Khosla Ventures led the round and were joined by investors including Humboldt Fund and 8VC.

- Flywheel, a Minneapolis-based maker of a data management platform for medical research and collaboration, raised $15 million in Series B funding. Beringea and 8VC led the round and were joined by investors including Novartis dRx Capital, Hewlett Packard Enterprise, Great North Labs, iSelect, and Argonautic Ventures.

- Casana, a Rochester, N.Y.-based in-home health monitoring company, raised today $14 million in Series A funding. General Catalyst and the Outsiders Fund led the round and were joined by Bemis Manufacturing Company.

- Plume, a Denver-based health tech company built for the transgender community, raised $14 million in Series A funding. Craft Ventures led the round and was joined by investors including General Catalyst, Slow Ventures, and Town Hall Ventures.

- Garner Health, a New York-based health tech company that helps recommend doctors, raised $12.5 million in Series A funding. Founders Fund led the round and was joined by investors including Maverick Ventures and Thrive Capital.

- Bold, a Los Altos, Calif.-based maker of personalized exercise programs for older adults, raised $7 million in seed funding. Julie Yoo of Andreessen Horowitz led the round. Read more.

- HealthTensor, a Santa Monica, Calif.-based company using A.I. to make medical diagnoses, raised $5 million in seed funding. Calibrate Ventures led the round.

- Crush Capital, a Los Angeles company making a series focused on investing, raised $3.3 million in seed funding. Investors included Arlan Hamilton (managing partner of Backstage Capital), Chris Burch, (co-founder of Tory Burch), and Walter Cruttenden (co-founder and chairman of Acorns).

- Dame Products, a Brooklyn, N.Y.-based sex tech company, raised $4 million. Listen led the round and was joined by investors including Chingona Ventures, The Community Fund, Her Capital, HP Reformation Ventures, IgniteXL Ventures, and Joyance Partners.

- Vamstar, a London-based healthcare marketplace, raised $1.7 million in seed funding. btov led the round and was joined by investors including Antler and Begin Capital.

. . .

Future of Work:

- UiPath, a New York-based process automation startup that has filed to go public, raised $750 million in Series F funding valuing it at $35 billion. Alkeon Capital and Coatue led the round and was joined by investors including Altimeter Capital, Dragoneer, IVP, Sequoia, Tiger Global, and T. Rowe Price Associates.

- Databricks, a San Francisco-based data analytics and A.I. company, raised $1 billion in Series G funding. Franklin Templeton led the round, valuing it at $28 billion. Other investors include Canada Pension Plan Investment Board, Fidelity Management & Research, Whale Rock, Amazon Web Services, CapitalG, and Salesforce Ventures.

- Vivino, a San Francisco-based maker of e-commerce wine marketplace, raised $155 million in Series D funding. Kinnevik led the round and was joined by investors including Sprints Capital, GP BullHound, and Creandum.

- Top Hat, a Toronto-based maker of software for higher-ed teachers, raised US$130 million in Series E funding from return backer Georgian Partners. http://axios.link/KDhd

- Zetwerk, an Indian B2B marketplace for manufacturing inputs, raised $120 million in Series D funding. Greenoaks Capital and Lightspeed Venture Partners co-led, and were joined by fellow insiders Sequoia Capital and Kae Capital. http://axios.link/CwR7

-Good Eggs, a San Francisco-based online marketplace for delivery high-end groceries, raised $100 million in funding. Glade Brook Capital Partners led the round and was joined by investors including GV, Tao Invest, Finistere Ventures, and Rich’s, Benchmark Partners, Index Ventures, S2G, DNS Capital, and Obvious Ventures.

- Tealium, a San Francisco-based customer data analysis company, raised $96 million in Series G funding. Georgian and Silver Lake Waterman led the round, valuing the business at $1.2 billion.

- Omnispace, a Tyson, Va.-based developer of a 5G network, raised $60 million. Fortress Investment Group led the round and was joined by investors including Columbia Capital, Greenspring Associates, TDF Ventures, and Telcom Ventures.

- Slync.io, a Dallas, Texas-based logistics company, raised $60 million in Series B funding. Goldman Sachs Growth led and was joined by investors including ACME Ventures, 235 Capital Partners, and Correlation Ventures.

- Touchcast, a New York-based virtual events platform, raised $55 million in Series A funding. Investors included Accenture Ventures, Alexander Capital Ventures, Saatchi Invest, and Ronald Lauder.

- Brightwheel, a San Francisco-based maker of an early education platform, raised $55 million valuing it above $600 million. Addition led the Series C round and was joined by investors including Emerson Collective, Next Play Ventures, Julia and Kevin Hartz, Daniel Shapero, GGV Capital, Bessemer Venture Partners, and Eniac Ventures.

- Rescale, a San Francisco-based enterprise software maker, raised $50 million in Series C funding. Microsoft, Nvidia and Samsung led the round.

- Weights and Biases, a San Francisco, Calif.-based maker way to track the building of machine learning models and operations, raised $45 million in Series B funding. Insight Partners led the round and was joined by investors including Coatue, Trinity Ventures, and Bloomberg Beta.

- Leadspace, a San Francisco-based customer data analysis platform, raised $46 million. JVP led the round.

- Class, a Washington D.C.-based maker of software for classes based on Zoom, raised $30.8 million in Series A funding. Insight Partners and Owl Ventures led the round and were joined by investors including Reach Capital, Catalysis Capital Management, and Diligent Software.

- Tovala, a Chicago-based smart oven and meal kit service, raised $30 million in Series C funding. Left Lane Capital led, and was joined by Finistere Ventures, Comcast Ventures, OurCrowd, Origin Ventures, Pritzker Group VC and Joe Mansueto. http://axios.link/6Us6

- Granulate, a Tel Aviv-based provider of computing workload optimization, raised $30 million in Series B funding. Red Dot Capital Partners led the round and was joined by investors including Insight Partners, TLV Partners, and Hetz Ventures.

- Quantifind, a Menlo Park, Calif.-based provider of solutions for financial crimes investigations, raised $22 million. Investors included S&P Global, In-Q-Tel, and Snowflake Ventures.

- Physna, a Cincinnati-based 3D search company using deep learning, raised $20 million in Series B funding. Sequoia Capital led the round and was joined by investors including Drive Capital.

- Oyster, a London-based HR platform for globally distributed companies, raised $20 million in Series A funding. Emergence Capital led the round.

- Honeycomb, a San Francisco-based provider of a way to debug production systems, raised $20 million in Series B funding. e.ventures Growth led the round and was joined by investors including Industry Ventures.

- Evinced, a Palo Alto, Calif.-based accessibility software company, raised $17 million in funding. M12, BGV, and Capital One Ventures led the round and were joined by Engineering Capital.

- Vendia, a San Francisco-based maker of code sharing platform, raised $15.5 million in Series A funding. Canvas Ventures led the round and was joined by investors including BMW i Ventures and Sorenson Ventures.

- Cialfo, Singapore-based college search platform for international students, raised $15 million in Series A funding. SIG and Vulcan Capital led the round and were joined by January Capital and Bisk Ventures.

- ELSA, a San Francisco-based maker of an app for improving English speaking skills and pronunciation, raised $15 million in Series B funding. VI (Vietnam Investments) Group and SIG led the round and were joined by investors including Gradient Ventures, SOSV, Monk’s Hill Ventures, Endeavor Catalyst, and Globant Ventures.

- Scratchpad, a San Mateo, Calif.-based platform for sales notes, raised $13 million in Series A funding. Craft Ventures led the round and was joined by investors including Accel.

- vFunction, a Palo Alto, Calif.-based maker of a platform for changing Java applications into microservices, raised $12.2 million in seed funding. Shasta Ventures and Zeev Ventures led the round and were joined by investors including Engineering Capital and Khosla Ventures.

- Waitwhile, a San Francisco-based queue management platform, raised $12 million from CRV as part of its Series A.

- Hip, a New York and Tel Aviv-based mobility startup, raised $12 million in funding. NFX and Magenta Venture Partners and were joined by investors including AltaIR Capital.

- Nerd Street Gamers, a Philadelphia-based national esports infrastructure company, raised $11.5 million. Founders Fund led the round.

- Promenade, a Los Angeles-based maker of software for florists and small businesses formerly known as BloomNation, raised $11 million in Series B funding. B. Riley Venture Capital led the round.

- WorkStep, a San Francisco-based provider of HR software for large supply chain employers, raised $10.5 million in Series A funding. FirstMark Capital led, and was joined by Prologis Ventures. www.workstep.com

- Limitless, a London-based customer experience platform, raised $10 million in Series B funding. Redline Capital led the round and was joined by investors including Genesys, AlbionVC, and Unilever Ventures.

- Beam, a maker of a web browser, raised $9.5 million in Series A funding. Pace Capital led the round. Read more.

- Superb AI, a San Mateo, Calif.-based data training platform using A.I., raised $9.3 million in Series A funding. Antinum Investment led the round and was joined by investors including Premier Partners, Stonebridge Ventures, Murex Partners, KT Investments, and Duke University’s Angel Network.

- VEERUM, a Canadian maker of software to visualize physical assets, raised $7.4 million in Series A funding. BDC’s Industrial Innovation Venture Fund and Builders VC led the round and were joined by Brick & Mortar Ventures, Evok Innovations, Intergen, and Creative Ventures.

- SecurityAdvisor, a Sunnyvale, Calif.-based cyber security company, raised $7.3 million in Series A funding. ClearSky Security led the round and was joined by investors including Crosslink Capital, SixThirty Ventures, and Cyber Mentor Fund.

- Balance, a San Francisco-based maker of a digital checkout platform, raised $5.5 million in seed funding. Investors included Lightspeed Venture Partners, Stripe, Max Levchin (Affirm founder), Y-Combinator, and UpWest.

- Iteratively, a Seattle-based customer data and analytics company, raised $5.4 million in seed funding. Gradient Ventures led the round and was joined by investors including Fika Ventures and PSL Ventures. Read more.

- Alloy Automation, a San Francisco-based e-commerce automation startup, raised $5 million across two rounds. Bain Capital Ventures and Abstract led the latest round and were joined by Color Capital, BoxGroup, and Laura Behrens Wu (Shippo). Read more.

- Learn To Win, a San Francisco-based mobile-first learning platform, raised $4 million in seed funding. Norwest Venture Partners led the round and was joined by investors including Pear VC and the 20|20 Fund.

- Axela Technologies, a Miami-based platform for the homeowner association industry, raised $4 million in Series A funding. Blueprint Equity led the round.

- Versus Game, a San Francisco-based consumer prediction and social wagering marketplace, raised $4 million in seed funding. Raised In Space and Plus Eight Equity Partners led the round.

- NWO.ai, a New York-based predictive A.I. platform for identifying microtrends, raised $3.5 million in seed funding. Investors included Hyperplane, Wavemaker, and Colle Capital, who were joined by Adit Ventures and SuperAngel.

- Prisidio, a Chicago-based maker of a way to securely store important documents and information, raised $3.3 million in seed funding. OCA Ventures and Origin Ventures led the round.

- Upkey, a Chicago-based maker of career readiness tools for students, raised $2.6 million in seed funding. S3 Ventures led the round and was joined by investors including Tensility Venture Partners, Bronze Valley, and Lofty Ventures.

- Polytomic, a San Francisco-based maker of a data syncing system, raised $2.4 million in seed funding. Caffeinated Capital led the round and was joined by investors including Bow Capital. Read more.

- Urban SDK, a Jacksonville, Fla.-based urban safety analytics platform, raised $1.7 million in funding. Florida Opportunity Fund and DeepWork Capital invested.

- Landed, an app connecting hourly food and retail workers with employers, raised $1.4 million in seed funding. Javelin Venture Partners led, and was joined by YC and Palm Drive Capital. www.gotlanded.com

- Automotus, a Los Angeles-based maker of a video analytics platform that monitors curbside traffic, raised $1.2 million. Investors included Quake Capital, Techstars Ventures, Kevin Uhlenhaker (co-founder & CEO at NuPark, acquired by Passport), and Baron Davis.

- FanUp, a Philadelphia-based fantasy sports company, raied $1 million in seed funding. Investors included Alumni Ventures Group, Ozone Ventures, Value Asset Management, and Reno Seed Fund.

- Anthill, a Chicago-based maker software designed for deskless workforces, raised $1.2 million in seed funding. Origin Ventures led the round.

- Arkose Labs, a San Francisco-based maker of online fraud and abuse prevention software, raised an undisclosed amount of funding from Sony Innovation Fund by Innovation Growth Ventures.

. . .

Sustainability:

- Svante, a Canadian developer of carbon capture solutions, raised $75 million in Series D funding. Temasek led, and was joined by Chart Industries, Carbon Direct, EDC and return backers OGCI Climate Investments, BDC Cleantech Practice, Chevron Technology Ventures, The Roda Group and Chrysalix VC. http://axios.link/nnaA

- Gardyn, a Washington, D.C.-based maker of a way to grow food indoors and at home, raised $10 million in Series A funding. JAB Holding Company led the round.

- Klir, an Irish maker of water compliance software, raised $3.1 million. Investors included Bowery, Spider Capital, and SaaS Ventures.

Acquisitions:

- Knotel, an office sharing company, filed for bankruptcy in Delaware and will be acquired by Newmark Group. It has been valued at over $1 billion by investors including Wafra.

- CoStar Group (Nasdaq: CXGP) had bid to acquire CoreLogic (NYSE: CLGX), an Irvine, Calif.-based real estate data business, in a deal valuing the latter at $6.7 billion, per Bloomberg. Read more….

- Stone Point Capital and Insight Partners agreed to buy Irvine, Calif.-based property data and analytics firm CoreLogic (NYSE: CLGX) for around $6 billion. The $80 per share price represents a 51% premium to CoreLogic shares last June, before news of deal talks was first reported. www.corelogic.com

-Alliance Holdings, a portfolio company of Align Capital Partners, acquired Aeros Environmental, a Bakersfield, Calif.-based provider of source emission testing. www.aerosenvi.com

-AppLovin, a Palo Alto-based portfolio company of KKR, agreed to buy Adjust, a Berlin-based maker of app performance measurement tools that raised around $280 million from firms like Highland Europe, Active Venture Partners, Eurazeo, Morgan Stanley, IDinvest Partners, Telefónica Ventures and Sofina. Bloomberg pegs the price tag at $1 billion. http://axios.link/5aUR

- Daimler said it will split up its luxury cars unit from its trucks unit, listing the latter by year-end and renaming itself Mercedes-Benz. http://axios.link/30mA

-Intuit (Nasdaq: INTU) agreed to buy OneSaaS, an Australian provider of omnichannel sales data SaaS. www.onesaas.com

-Rolls-Royce (LSE: RR) agreed to sell Bergen Engines, a Norwegian diesel engines maker, to Russia’s TMHGroup for €150 million. http://axios.link/sSVK

. . .

IPOs:

- The Honest Co., a Los Angeles-based baby and beauty products company backed by Jessica Alba, is preparing for an IPO, per Bloomberg citing sources. Its investors include L Catterton. Read more.

- Bumble, an Austin, Texas-based dating app, set IPO terms to 34.5 million shares at $28–$30. It would have a fully diluted market value of $5.8 billion, were it to price in the middle, compared to its $3 billion valuation when The Blackstone Group acquired a majority stake in late 2019. http://axios.link/0t3F

- 1stDibs.com, a New York-based high-end goods and art, is preparing for an IPO this year that could value it at above $1 billion, per Bloomberg. Investors include T. Rowe, Insight Partners, and Groupe Artémis. Read more.

- Signify Health, a Norwalk, Conn.- maker of a payment program for healthcare companies, plans to raise $423 million in an offering of 23.5 million shares priced between$17 to $19. New Mountain Capital backs the firm. Read more.

. . .

SPACs:

- Wheels Up Partners, a New York-based private jet company, agreed to go public via merger with Aspirational Consumer Lifestyle, a SPAC valuing it at about $2.1 billion. L Catterton will be a minority shareholder.

- 23andMe, a Sunnyvale, Calif.-based consumer genomics company, agreed to to go public at a $3.5 billion valuation via Virgin Group Acquisition Corp. (NYSE: VGAC). 23andMe CEO Anne Wojcicki and Virgin's Richard Branson each will invest $25 million into the deal's $250 million PIPE, while 23andMe had raised nearly $900 million in VC funding from firms that included Sequoia Capital and NEA. http://axios.link/PX9V

- Nerdy, an edtech company, plans to go public via merger with TPG Pace Tech Opportunities (NYSE: PACE), a SPAC. A deal would value the firm at $1.7 billion. The deal also includes $150 million in PIPE financing from investors including Franklin Templeton, Healthcare of Ontario Pension Plan, Koch Industries, and Learn Capital.

- Otonomo, an Israeli automotive data exchange platform, is going public at a $1.7 billion valuation via a reverse merger with Software Acquisition Group Inc II (Nasdaq: SAII). Otonomo raised nearly $100 million from Delphi Midstream Partners, NTT Docomo Ventures, Avis Budget UK, Alliance Ventures, StageOne Ventures and Hearst Ventures. http://axios.link/eOcb

- Payoneer, a New York-based payments company, will go public via merger with FTAC Olympus Acquisition, a SPAC. The deal values the business at $3.3 billion. Payoneer has been backed by TCV, Susquehanna Growth Equity, Viola Ventures, Wellington Management, Nyca Partners, and Temasek.

Funds:

- Activant Capital, a Greenwich, Conn.-based growth equity firm, is seeking to raise $400 million for its fourth fund, per the WSJ. Read more.

- Refactor Capital, a Burlingame, Calif.-based venture firm, is seeking to raise $50 million for its third fund. Read more.

- Kindred Ventures, a San Francisco-based seed investor, raised $100 million for its second fund. http://axios.link/E306

- Halogen Ventures raised $21 million for its second fund. The firm, led by Jesse Draper, focuses on consumer tech startups with at least one woman in their founding teams. www.halogenvc.com

- KCRise Fund, a VC firm focused on the Kansas City region, raised $41 million for its second fund. www.kcrisefund.com

- Sapphire Ventures, a Palo Alto, Calif.-based venture firm, raised $1.7 billion across multiple funds.

- Lobby Capital, led by David Hornik and Eric Carlborg, is raising $250 million for its debut fund, per an SEC filing. This comes two years after the quasi-shutdown of Hornik and Carlborg's prior firm, August Capital. www.lobby.vc

-North Island Ventures, a crypto VC firm led by James Hutchins (ex-Coatue), his father Glenn (ex-Silver Lake) and Travis Sher (ex-DCG), raised $72 million for its debut fund. http://axios.link/dvdL

- Frontline Ventures raised $80 million for its third seed fund focused on U.S. and European startups. www.frontline.vc

-Scribble Ventures, led by Elizabeth Weil (ex-137 Ventures, A16Z), raised $42 million for its debut fund. http://axios.link/L3u1

-SJF Ventures of Durham, N.C. raised $175 million for its fifth fund. www.sjfventures.com

Final Numbers

Source: SPAC Research, as of Jan. 29, 2020.