Sourcery (2/20-2/24)

Upfront Summit ~ Finch, Here Not There Labs, Chaos Labs, Trust & Will, Brale, Carmoola, Tiplink, Kaito, Polybase, Vytalize, Spreetail, inDrive, Quantum Motion, Tome, But, Vitally, Slync, Zellerfeld

Good Morning Los Angeles! ☀️

This week marks a significant moment for Los Angeles as it hosts one of the largest venture capital summits, the Upfront Summit, showcasing the city’s thriving technology ecosystem and diverse culture. From entertainment to space-tech, gaming, and health, Los Angeles has emerged as a hub for innovation, attracting top talent and investors from around the world.

If you want to follow along for all of the action from athletes to politicians, celebrities to CEOs, you can watch the interviews and panels in the link below Wed & Thurs from 8:30am-6:15pm PT or follow the hashtag #UpfrontSummit - If you’re attending please let me know, would be great to meet you! …And yes, it is too late for an invitation

Link: Upfront Summit 2023 Livestream

Speakers include:

➡️ Former Vice President Al Gore

➡️ Dick Costolo and Adam Bain (former CEO/COO of Twitter)

➡️ V Pappas (COO of TikTok)

➡️ VCs including Mamoon Hamid (Kleiner Perkins) and Sarah Tavel (Benchmark)

➡️ NBA Champion & Entrepreneur Dwyane Wade

🥁 And a surprise guest announced yesterday - Marc Benioff, CEO of Salesforce!

Readings

Updating The Hype Cycle, Reflecting on The AI Moment, Kyle Harrison

Which Customer Segments are Healthiest During the Downturn? Tomasz Tunguz

A survey of perspectives on AI, Ludwig Yeetgenstein

E117: Did Stripe miss its window? Plus: VC market update, AI comes for SaaS, Trump's savvy move, All in Podcast

(0:00) Bestie intro: Jason's Japan trip!

(1:04) Stripe's precarious situation: Did it miss the window? Breaking down its $4B tax bill, slowing growth curve, enterprise vs SMB customers, scalability issues, and more

(23:07) Lessons for founders: How ZIRP can skew CAC and LTV calculations, burn multiple

(29:40) VC market update: ZIRP mistakes, VC as a "must-have" asset class for LPs, how the 2021 vintage can be saved

(39:05) AI's outsized impact on SaaS and real-world businesses

(55:16) Advice from Steve Jobs on customer-first product development, Section 230 update

(1:00:29) Trump's savvy visit to East Palestine and 2024 strategy, Biden's visit to Ukraine, China's position

(1:14:24) Tinfoil hat corner

Love Sourcery and don’t want to see it go away?

Donate yourself or a friend a subscription! Pay what you like and show your support :)

@MollySOShea

. . .

Last Week (2/20-2/24):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Finch, Here Not There Labs, Chaos Labs, Trust & Will, Brale, Carmoola, Tiplink, Kaito, Polybase, Vytalize, Spreetail, inDrive, Quantum Motion, Tome, But, Vitally, Slync, Zellerfeld, Entitle, AeroCloud, BlueCargo, Sublime, Scrut Automation, Chronicle, Earthly, Plum, Strider, GovForce, Glowstick, Source.ag, Swap Robotics, Kita; Everton FC, One Medical/Amazon, Olive AI, Soylent

Final numbers on GenZ Turning to TikTok for News at the bottom.

Deals

Fintech:

- Finch, a San Francisco-based employment API platform for payroll, HRIS, and benefits, raised $40 million in Series B funding. General Catalyst and Menlo Ventures co-led the round and were joined by QED Investors, Altman Capital, and PruVen Capital.

- Here Not There Labs, a developer of a blockchain group messaging app, raised $25.5m in funding led by Andreessen Horowitz, with Benchmark and Framework Ventures also participating. https://axios.link/3kqSC48

- Chaos Labs, a New York- and Tel Aviv-based blockchain risk analytics firm, raised $20 million in seed funding. PayPal Ventures and Galaxy Digital co-led the round and were joined by Coinbase, Uniswap, Lightspeed, Bessemer, and others.

- Trust & Will, a San Diego-based digital estate planning and settlement platform, raised $15 million in funding. Amex Ventures, Northwestern Mutual Future Ventures, SEI Ventures, and USAA invested in the round.

- Brale, a Des Moines, Iowa-based digital assets deployment developer, raised $11.1 million in funding. New Enterprise Associates led the round and was joined by Cloudflare cofounder and CEO Matthew Prince and Albert Wenger.

- Carmoola, a London-based car financing platform, raised £8.5 million ($10.23 million) in Series A funding. QED Investors led the round and was joined by InMotion Ventures.

- Polyhedra Network, a Berkeley, Calif.-based Web3 infrastructure solutions provider, raised $10 million in funding. Binance Labs and Polychain Capital co-led the round and were joined by Animoca Brands and dao5.

- Huma, a DeFi protocol, raised $8.3m in seed funding led by Race Capital and Distributed Global, with ParaFi Capital, Circle Ventures, Folius Ventures, Robot Ventures and others also participating. www.huma.finance

- Tiplink, a New York-based crypto wallet and transaction startup, raised $6m in seed funding led by Sequoia Capital and Multicoin Capital. www.tiplink.io

- Kaito, a Seattle-based AI search engine for crypto, raised $5.3m in seed funding led by Dragonfly Capital, with Sequoia Capital, Jane Street, Mirana Ventures, Folius Ventures and Alpha Lab Capital, and others also participating. https://axios.link/3lZGg3r

- Nestment, a San Francisco, CA-based real estate co-buying platform for groups of friends and family, raised $3.5 million in a financing round led by Protofund and IDEA Fund Partners, with participation from Concrete Rose Capital and VamosVentures. (More in TechCrunch

- Curio Research, a San Francisco-based crypto Web3 gaming company, raised $2.9 million in seed funding. Bain Capital Crypto led the round and was joined by TCG Crypto, Formless Capital, Smrti Lab, Robot Ventures, and other angels.

- Polybase, a New York-based decentralized database startup, raised $2m in pre-seed funding led by 6th Man Ventures, with Protocol Labs, Orange DAO, Alumni Ventures, NGC, CMT Digital, and others also participating. www.polybase.xyz

. . .

Care:

- Vytalize, a Hoboken, N.J.-based value-based senior care enabler, raised $100m in additional Series B funding led by Enhanced Healthcare Partners and Monroe Capital, with North Coast Ventures also participating, Axios Pro reports. https://axios.link/3IKPQjg

. . .

Enterprise & Consumer:

- Spreetail, a Lincoln, Neb.-based e-commerce analytics and logistics company, raised $208m in funding round in part from McCarthy Capital. https://axios.link/3XZOw0y

- inDrive, a Mountain View, CA-based mobility and urban services platform, raised $150 million via an “innovative hybrid instrument” from General Catalyst. VC News Daily

- Chain Reaction, a Tel Aviv-based semiconductor company focused on disruptive blockchain and privacy hardware, raised $70 million in Series C funding. Morgan Creek Digital led the round and was joined by Hanaco Ventures, Jerusalem Venture Partners, KCK Capital, Exor, Atreides Management, and BlueRun Ventures.

- Quantum Motion, British quantum computing company, raised £42m ($50.5m) in new funding led by Bosch Ventures (RBVC), with Porsche, the U.K. government's National Security Strategic Investment Fund (NSSIF), and others also participating. https://axios.link/3SdsPZq

- Tome, a San Francisco-based generative storytelling platform, raised $43 million in Series B funding. Lightspeed Venture Partners led the round and was joined by Coatue, Greylock Partners, Audacious Ventures, Wing Venture Capital, 8VC, and other angels.

- Buk, a Santiago, Chile-based people management platform, raised $35 million in funding led by Base10.

- Vitally, a New York-based customer success platform, raised $30 million in Series B funding. Next47 led the round and was joined by HubSpot Ventures, NewView Capital, and Andreessen Horowitz.

- Slync, a Dallas, TX-based orchestration platform for global shippers and logistics service providers, raised $24 million - a combination of equity and debt - in a financing round led by Goldman Sachs, with participation from Blumberg Capital, ACME Ventures and Gaingels. TechCrunch

- Metomic, a London-based data security solution provider, raised $20 million in Series A funding. Evolution Equity Partners led the round and was joined by Resonance and Connect Ventures.

- Fortem Technologies, a Pleasant Grove, Utah-based airspace awareness, security, and defense company, raised $17.8 million in funding. Lockheed Martin Ventures, Hanwha Aerospace, and AIM13|Crumpton Venture Partners co-led the round and were joined by DCVC and Signia Venture Partners

- Zellerfeld, a Hamburg, Germany- and San Francisco-based 3D-printed shoe company, raised $15 million in seed funding led by Founders Fund.

- Entitle, a New York- and Tel Aviv-based cloud permissions management platform, raised $15 million in seed funding led by Glilot Capital Partners.

- AeroCloud, a Macclesfield, U.K.- and Sarasota, Fla.-based airport management platform, raised $12.6 million in Series A funding. Stage 2 Capital led the round and was joined by I2BF Global Ventures, Triple Point Ventures, Praetura Ventures, and others.

- BlueCargo, a Covina, Calif.-based logistics SaaS platform, raised $11 million in funding co-led by Soma Capital and Left Lane Capital.

- Worldwide Webb, a London-based metaverse gaming platform, raised $10 million in Series A funding from Pantera Capital.

- Sublime, a Washington, D.C.-based open email security platform, raised $9.8 million in funding. Decibel led the round and was joined by Slow Ventures and others.

- Scrut Automation, a Milpitas, Calif.-based governance, risk, and compliance automation platform, raised $7.5 million in funding. MassMutual Ventures led the round and was joined by Lightspeed and Endiya Partners.

- Chronicle, a San Francisco and Sydney-based presentation deck software maker, raised $7.5m in seed funding from Accel, Square Peg, and several angel investors. www.chroniclehq.com

- Earthly Technologies, a San Francisco-based SaaS CI/CD platform, raised $6.5 million in seed+ funding. Innovation Endeavors led the round and was joined by 468 Capital and Uncorrelated Ventures.

- Plum, a Kitchener, Canada-based talent assessment platform, raised $6 million in funding. Pearson Ventures led the round and was joined by JFF Ventures, Strada Education Network, Export Development Canada, Real Ventures, BDC Capital’s Women in Technology Venture Fund, EduLab Capital Partners, and Impact Engine.

- HireLogic, a Dallas-based HR software firm for the interview process, raised $6 million in Series A funding led by former Warburg Pincus partner and co-CEO Joseph P. Landy.

- Kanarys, a Dallas-based diversity, equity, inclusion, and belonging technology company, raised $5 million in Series A funding. Seyen Capital led the round and was joined by Portfolia Rising America, Rackhouse Venture Capital, Revolution’s Rise of the Rest Seed Fund, StartFast Ventures, TechNexus Venture Collaborative, and Tech Square Ventures.

- Strider, a New York-based collaborative storytelling startup, raised $5.5m in a seed funding led by Makers Fund and Fabric Ventures, with Shima Capital, Sfermion, Magic Eden and others also participating. www.strider.xyz

- Tracksuit, a New Zealand-based brand tracking startup, raised $5m in seed funding led by Blackbird, with Shasta Ventures, Icehouse Ventures, Ascential and Mark Ritson also participating. https://axios.link/3lZvav9

- IrisCX, a Calgary-based, smart video platform for virtual product selection, DIY setup, and support, raised $4.6 million in seed funding from Arthur Ventures.

- Autobound, a San Francisco, CA-based startup that increases reply rate by generating hyper-personalized sales emails, raised $4 million in a funding round led by Dundee VC, with participation from AIX Ventures and a number of individual investors. VC News Daily

- Vend Park, a Boston-based digital parking technology startup, raised $3.8m in seed funding led by Floating Point Advisors, with Crossbeam Venture Partners, APA Venture Partners, Alumni Ventures, and others also participating. www.vendpark.io

- Renegade, a startup developing an on-chain version of a dark pool based on multi-party computation (MPC) and zero-knowledge proofs, raised $3.4 million from Dragonfly and a number of individual investors. (More in The Block)

- DEN Outdoors, a Hudson Valley, N.Y.-based home design and construction management company, raised $3 million in seed funding co-led by Gutter Capital and Crossbeam Venture Partners.

- System-3, a Toronto-based talent assessment company, raised CAD $3.6 million ($2.66 million) in seed funding led by Round13 Capital.

- GovForce, a Washington, D.C.-based power performance and compliance company for government contractors, raised $2.5 million in seed funding. QED Investors and Humba Ventures co-led the round and were joined by Cambrian and NextGen Venture Partners.

- Glowstick, a Canadian customer success and account management startup, raised $1.3m in pre-seed funding led by Cleo Capital, with Entrepreneur First, ApSTAT, Saumil Mehta, Josh Tessier, and Mike Janzen also participating. www.glowstick.cx

. . .

Sustainability:

- Source.ag, an Amsterdam, Netherlands-based AgTech startup that helps commercial greenhouse crop growers adjust conditions, optimize resources and maximize yields using AI, raised $23 million in a Series A funding round led by Astanor Ventures, with participation from Acre Venture Partners and several greenhouse operators. TechCrunch

- Swap Robotics, an Ontario-based solar vegetation management platform, raised $7 million in seed funding. SOLV Energy led the round and was joined by SOSV's HAX.

- Kita, a Worcester, U.K.-based insurance provider for the carbon markets, raised £4 million ($4.84 million) in seed funding. Octopus Ventures led the round and was joined by Insurtech Gateway, Carbon13, Climate VC, Chaucer Group, and Hartree Partners.

Acquisitions & PE:

- 777 Partners of Miami is considering an investment in Premier League club Everton FC, per Bloomberg. https://axios.link/3IakTn7

- Amazon closed its acquisition of One Medical after the FTC reportedly decided not to challenge the deal. https://axios.link/3SkNA5A

- Olive AI, a Columbus-based health care automation startup, plans to sell one of the two remaining business lines advertised on its website, per Axios Pro. https://axios.link/3klC1hU

- 5th Century Partners acquired Perspecta, a Langhorne, Pa.-based provider of physician directories and data management tools. www.goperspecta.net

- Starco Brands, a Santa Monica, CA-based consumer goods company, acquired Soylent, a Los Angeles, CA-based nutrition company that had raised over $133 million from GV (Google Ventures), Andreessen Horowitz and The Production Board. TechCrunch

- Vast Space, an El Segundo, CA-based company developing artificial gravity space stations in low Earth orbit, acquired Launcher, a Hawthorne, CA-based space tug and hosted payload platform startup that had previously raised financing from backers including Boost VC. (More in TechCrunch)

. . .

IPOs:

Nothing to see here…

. . .

SPACs:

Nothing to see here…

Funds:

- Link Ventures, a Cambridge, Mass.-based venture capital firm, raised $150 million for a fund focused on early-stage technology startups.

- Altai Ventures, a New York- and Westport, Conn.-based venture capital firm, raised $53 million for a fund focused on insurtech, fintech, and enterprise software for financial services seed and Series A investments.

- SkyBridge is seeking to raise $50m for its "SkyBridge Unicorn Recovery Fund" to invest via secondaries in tech unicorns with lowered valuations, according to an investor letter seen by Axios. https://axios.link/3xI6fyV

Socially searching

A lot has been made in the tech world about the advancements in generative AI, and how advanced bots like ChatGPT might change the internet search landscape forever.

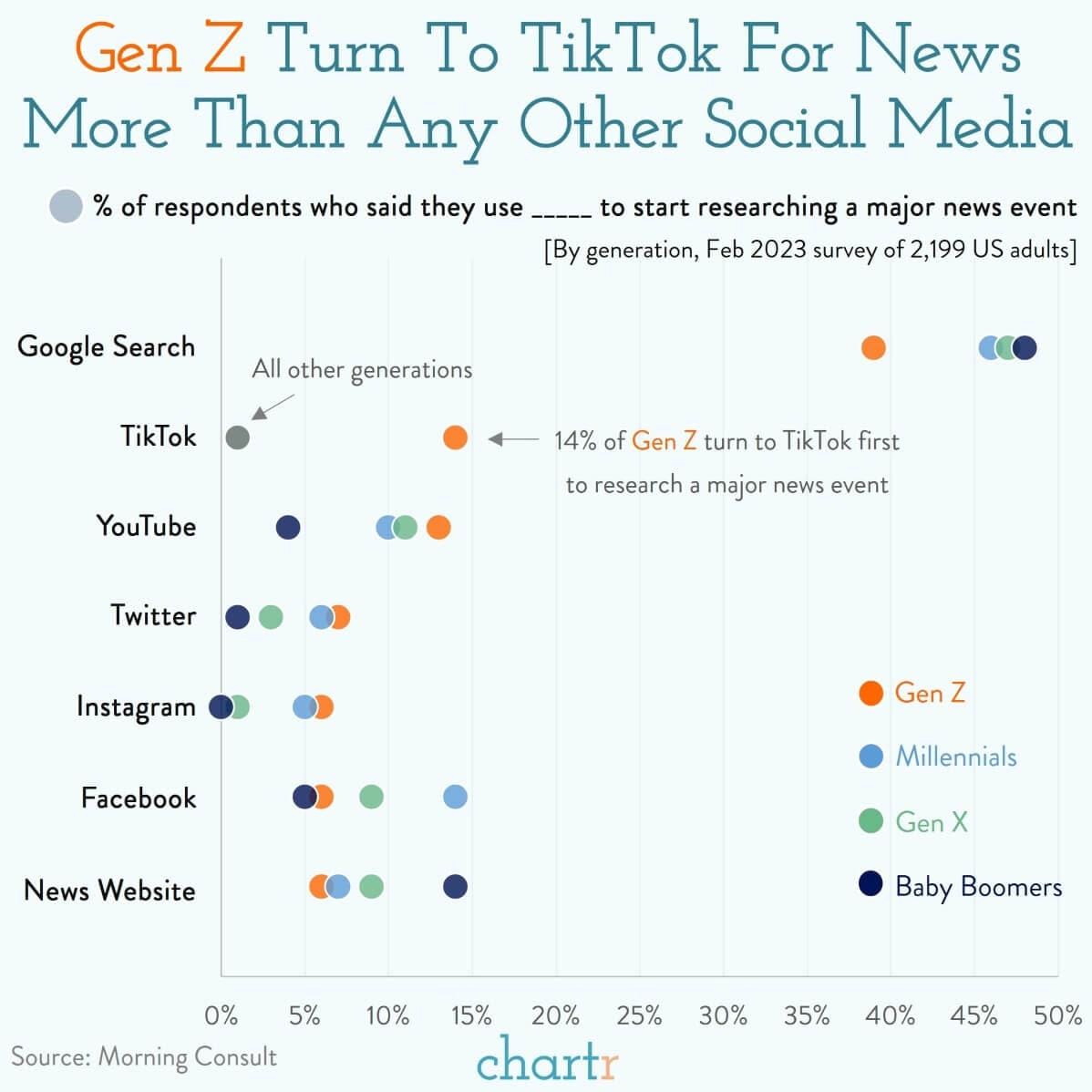

But we may not have to wait for AI to change how we search. Indeed, a new survey from Morning Consult reveals that newer platforms like TikTok have already changed habits for Gen Z. The survey of ~2,200 adults found that some 14% of Gen Zers, when looking into a major news event, would start their search for information on TikToK. For every other generation only 1% reported doing the same.

Google was still the place that most people started their research on a news story — which was true for all age groups — but across the social media landscape, the generational differences are interesting. Gen Z favors TikTok and YouTube, Millennials are more likely to fire up Facebook to start their research, while members of the Baby Boomer gen tend to go directly to a news publisher they trust and start their search there.

Whether AI-enhanced chatbots will eat Google’s lunch is a big unknown. However, Gen Z growing up and searching the internet in a very different way is already happening.

Go Deeper: Explore the full report here.

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.