Sourcery (2/27-3/3)

Upfront Summit Recap ~ Equisoft, Flock, Pagos, Quantifind, Marco, Spade, Kindbody, CodaMetrix, BetterNight, Ryse Health, Wiz, SkyDio, Bitwise, Temporal, Shef, Typeface, Attio, Hexa, Jump, Bonusly...

Summit Summary

This will be rather brief because my brain is still a bit fried.. but in case you missed it, watch:the opening of the 2023 Upfront Summit and read some of the initial media coverage below. Videos of the panels and interviews featuring Al Gore, Dick Costolo, Ciara, Lawrence H. Summers, Jamie Lee Curtis, Hailey Bieber, Jennifer Gardener, Alok, Marc Benioff and many more.. to be released in the coming days. Stay tuned!

Big shoutout to Kerry, Mayu, and Lacey for organizing such a phenomenal event!

At Upfront Summit 2023, AI is the omnipresent celebrity, TechCrunch

Adobe’s Scott Belsky talks generative AI — and why it’s not going to end up like web3, TechCrunch

Jennifer Garner on 'Disrupting' the Baby Food Industry, dot.LA

Filmmaker Darren Aronofsky Doesn't Think A.I. Is Strong Enough to Replace Human Creatives…Yet, dot.LA

Upfront Ventures Summit: The Chainsmokers Journey From Music to Venture, dot.LA

Pall and Taggart shared the stage with WndrCo’s managing partner Jeffrey Katzenberg to dive deeper into what their music career has taught them and how it translated over to their venture firm Mantis.

Benchmark is ‘Very Active’ in AI Right Now, Says General Partner, The Information

Biggest takeaway: Sheesh. You never know how hard venture is until you’re tasked with telling prominent GPs and LPs to make room for others in the theater by moving over a couple seats. They will look you straight in the eyes… and then completely ignore you. 😂😅

Musings:

ANGEL: Upfront’s Mark Suster on the power of alignment, setting reality, and raising capital | E1683, Jason Calacanis

Incorporating Generative AI Today, Emergence

The 2023 MAD (Machine Learning, Artificial Intelligence & Data) Landscape, Matt Turck

. . .

Last Week (2/27-3/3):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Equisoft, Flock, Pagos, Quantifind, Marco, Spade, Kindbody, CodaMetrix, BetterNight, Ryse Health, Wiz, SkyDio, Bitwise, Temporal, Shef, Typeface, Attio, Hexa, Jump, Bonusly, Rebuy, Adrena, Gable, EvolutionIQ, Champions Round, Zarta, Crstl, Trackd, Divert, BlocPower, Pili, Domatic; Thoma Bravo/Coupa

Final numbers on The Least Affordable Housing Market in Decades at the bottom.

Deals

Fintech:

- Equisoft, a Montreal-based provider of insurance and investment software, raised C$125m from Investissement Québec, the government of Québec, Export Development Canada and Fondaction. https://axios.link/3ZtHSkb

- StudentFinance, a Madrid-based income share agreement startup for students, raised €39m in Series A funding. Iberis Capital led, and was joined by Armilar Venture Partners, Mustard Seed Maze, Giant Ventures and Seedcamp. https://axios.link/3Yb46Gw

- Flock, a British drone insurance startup, raised $38m in Series B funding. Octopus Ventures led, and was joined by CommerzVentures and insiders Social Capital, Dig Ventures and Foresight Ventures. https://axios.link/3Z0HZUy

- Pagos, a Hermosa Beach, Calif.-based payment intelligence infrastructure startup, raised $34m in Series A funding. Arbor Ventures led, and was joined by Infinity Ventures, Underscore VC and Point 72 Ventures. https://axios.link/3KK74Ps

- Quantifind, a Palo Alto, Calif.-based financial crimes risk management solutions provider, raised $23 million in funding. DNS Capital led the round and was joined by Citi Ventures, US Venture Partners, Valor Equity Partners, and S&P Global.

- Archway, a Seattle-based internal infrastructure and data platform for banks, raised $15 million in funding co-led by Madrona and WaFd Bank.

- Marco, a Miami-based trade finance platform for LatAm exporters, raised $8.2m in equity funding led by Arcadia Funds and a $200m credit facility from MidCap Financial and Castlelake. www.marcofi.com

- Ramp, a London-based forecasting analytics company, raised $5 million in seed funding. AlbionVC and Eurazeo co-led the round and were joined by Triple Point Ventures and others.

- Spade, a credit card transaction data API, raised $5m in seed funding. Andreessen Horowitz led, and was joined by YC, Gradient Ventures and Dash Fund. https://axios.link/3ZmZyxL

. . .

Care:

- Kindbody, a New York-based provider of women's fertility services, raised $100m at a $1.8b valuation led by Perceptive Advisors, per Axios Pro. https://axios.link/3kGqMRn

- CodaMetrix, a Boston-based health care revenue cycle services startup, raised $55m in Series A funding, as first reported by Axios Pro. SignalFire led, and was joined by Frist Cressey Ventures, Martin Ventures, Yale Medicine, University of Colorado Healthcare Innovation Fund, and Mass General Brigham.

- BetterNight, a San Diego-based virtual care platform for sleep, raised $33m. NewSpring led, and was joined by HCAP Partners and Hamilton Lane. www.betternightsolutions.com

- SafKan Health, a Seattle-based developer of an earwax removal system, raised $8m in Series A funding led by Unorthodox Ventures. www.otoset.com

- Ryse Health, an Arlington, Va.-based diabetes care startup, raised $6.5m, per Axios Pro. Route 66 Ventures led, and was joined by W Health and CareFirst BlueCross BlueShield. https://axios.link/3YgCIHt

. . .

Enterprise & Consumer:

- Wiz, a New York-based cloud security platform, raised $300 million in Series D funding. Lightspeed Venture Partners led the round and was joined by Greenoaks Capital Partners and Index Ventures.

- Skydio, a Redwood City, Calif.-based autonomous drone-maker, raised $230m in Series E funding at a $2.2b valuation. Linse Capital led, and was joined by Hercules Capital, Axon and insiders Andreessen Horowitz, Next47, IVP, DoCoMo, NVIDIA, the Walton Family Foundation and UP Partners. https://axios.link/3IX9mZX

- Bitwise Industries, a Fresno, Calif.-based tech training company, raised $80m. Kapor Center and Motley Fool co-led, and were joined by Goldman Sachs and Citibank. https://axios.link/3IFw6wg

- Temporal, a Seattle-based durable execution systems company, raised $75 million in Series B-Prime funding. Greenoaks, Amplify Partners, Index Ventures, Sequoia Capital, Madrona, and Addition Ventures invested in the round.

- Shef, an SF-based chef-to-consumer marketplace, raised $73.5m in Series B funding (including $7m of venture debt). CRV led, and was joined by Andreessen Horowitz, Amex Ventures and a group of celebrity chefs and other angel investors. The company also secured $7m in venture debt. www.shef.com

- ProsperOps, an Austin-based autonomous cloud cost optimization platform, raised $72 million in funding led by H.I.G. Growth Partners.

- Typeface, a San Francisco-based generative-A.I. application for enterprise content creation, raised $65 million in funding. Lightspeed Venture Partners, GV, M12, and Menlo Ventures invested in the round.

- Fulfil Solutions, a Mountain View, Calif.-based developer of online grocery fulfillment robots, raised $60m in Series B funding. Eclipse led, and was joined by Khosla Ventures and DCVC. www.fulfil.com

- Wunderkind, a New York-based behavioral marketing platform for brands, raised $76m in Series C funding led by Neuberger Berman. https://axios.link/3YeXTta

- Attio, a London-based customer relationship management platform, raised $23.5 million in Series A funding. Redpoint Ventures led the round and was joined by Balderton Capital and Point Nine.

- Hexa, an Israeli 3D asset visualization and management platform, raised $20.5m in Series A funding from Point72 Ventures, Samurai Incubate, Sarona Partners and HTC. https://www.hexa3d.io/

- Jump, a Los Angeles-based fan experience platform for sports teams, raised $20 million in seed funding. Forerunner Ventures led the round and was joined by Marc Lore, Alex Rodriguez, Courtside Ventures, Drive by DraftKings, Mastery Ventures, MetaLab, Will Ventures, and others.

- Bonusly, a Boulder, Colo.-based employee recognition and rewards platform, raised $18.9m in Series B funding. Ankona Capital led, and was joined by FirstMark Capital, Access Venture Partners, and Next Frontier Capital. www.bonus.ly

- REALLY, an Austin-based phone service provider, raised $18 million in seed funding led by Polychain.

- Rebuy, a Minneapolis-based e-commerce personalization company, raised $17 million in Series A funding. M13 led the round and was joined by Dynamism Capital, R-Squared Ventures, Peterson Ventures, and Sidekick Partners.

- BelliWelli, a Los Angeles-based probiotic brownie company, raised $15.4 million in Series A funding led by The Invus Group.

- Entitle, an Israeli permissions management startup, raised $15m in seed funding led by Gilot Capital Partners. https://axios.link/3xZceiR

- Andrena, a New York-based ISP, raised $15m in Series A funding. Dragonfly Capital led, and was joined by Blockchange Ventures, Moonshot Research, EV3 and insiders Afore Capital, FJ Labs, Castle Island Ventures, Chaos Ventures, KohFounders and J Ventures. https://axios.link/41xcKly

- Gable, an SF-based remote work management platform, raised $12m in Series A funding. SemperVirens and Foundation Capital co-led, and were joined by Tishman Speyer Ventures, Ulu Ventures and January Ventures. https://axios.link/3IDR2nk

- Qwak, a Tel Aviv-based machine learning operations platform, raised $12 million in funding. Bessemer Venture Partners, Leaders Fund, StageOne Ventures, and Amiti invested in the round.

- Edurino, a Munich-based hybrid learning platform, raised €10.5 million ($11.3 million) in Series A funding. DN Capital led the round and was joined by Tengelmann Ventures, FJ Labs, btov Partners, Jens Begemann, and Emerge Education.

- Savant Labs, a San Mateo, Calif.-based automation platform for data analysts, raised $11 million in seed funding. Cota Capital led the round and was joined by WestWave Capital, Bloomberg Beta, Uncorrelated Ventures, and Handshake Ventures.

- Robin AI, a London-based generative A.I. startup, raised $10.5 million in funding. Plural led the round and was joined by Episode 1 and others.

- immi, a San Francisco-based plant-based instant ramen brand, raised $10 million in Series A funding led by Touch Capital.

- EvolutionIQ, a New York-based claims guidance platform for disability, workers’ compensation, and property and casualty insurance, raised $7 million in Series B funding. Brewer Lane Ventures led the round and was joined by First Round Capital, FirstMark Capital, Foundation Capital, and Principal Financial Group.

- Champions Round, an LA-based fantasy sports startup, raised $7m in Series A funding. Point72 Ventures and Goodwater Capital co-led, and were joined by Pipeline Capital, Quest Venture Partners, Mana Ventures, Band of Angels and Gaingels. https://axios.link/3Y6Oq7p

- Cycle, a French collaboration tool for product managers, raised $6m from Boldstart, eFounders, Base Case, 20VC Fund, SV Angel, BoxGroup and Hummingbird Ventures. https://axios.link/3Z8cfwW

- Zarta, a San Francisco-based pay-per-view video platform for creator content, raised $5.7 million in seed funding. Andreessen Horowitz, Endeavor, AirAngels, Dragonfly Capital, and others invested in the round.

- CollX, a Haddonfield, N.J.-based trading card evaluation app, raised $5.5m. Brand Foundry Ventures led, and was joined by Next Coast Ventures, FJ Labs, 114 Ventures, Ben Franklin Technology Partners and Morrison Seger Venture Capital Partners. https://axios.link/3IWNzSg

- Crstl, a San Francisco-based no-code electronic data interchange SaaS application and platform for brands, manufacturers, and wholesalers, raised $4.4 million in seed funding. Mastry Ventures led the round and was joined by Village Global, Alumni Ventures, SuperAngel VC, On Deck, Mensch Capital Partners, Harizury, and other angels.

- Vend Park, a Boston-based digital parking solution, raised $3.8 million in seed funding. Floating Point Advisors led the round and was joined by Crossbeam Venture Partners, APA Venture Partners, Alumni Ventures, and others.

- Trackd, a Reston, Va.-based vulnerability remediation automation startup, raised $3.35m in seed funding. Flybridge led, and was joined by Lerer Hippeau, SaaS Ventures and Expa. www.trackd.com

- Archetype, a New York-based revenue infrastructure solution for APIs, raised $3.1 million in seed funding. MaC Venture Capital led the round and was joined by Hustle Fund, Magic Fund, NOMO Ventures, Soma Capital, and others.

- DEVYCE, a London-based digital phone number provider to businesses, raised $2.7 million in seed funding co-led by Y Combinator, FoundersX Ventures, and Garage Capital.

- Term Labs, a San Diego-based blockchain R&D startup, raised $2.5m in seed funding. Electric Capital led, and was joined by Coinbase Ventures, Circle Ventures, Robot Ventures and MEXC Ventures. www.termfinance.io

. . .

Sustainability:

- Divert, a Concord, Mass.-based food waste management startup, raised $100m in equity funding and $1b in structured project finance. Enbridge led the equity, and was joined by insider Ara Partners. https://axios.link/3mdHDLO

- BlocPower, a New York-based climate technology company, raised $24.6 million in Series B funding. VoLo Earth Ventures led the round and was joined by Microsoft Climate Innovation Fund, Credit Suisse, Builders Vision, New York State Ventures, Unreasonable Collective, and others.

- Pili, a Toulouse, France-based sustainable dyes and pigments producer, raised $15.8 million in Series A funding. Ecotechnologies 2, Famille C Participations, Elaia Partners, SOSV, and Startupangels.de invested in the round.

- Rubi, a San Leandro, Calif.-based manufacturing company, raised $8.7 million in seed funding. Talis Capital, Tin Shed Ventures, and H&M Group co-led the round and were joined by Collaborative Fund and Necessary Ventures.

- Domatic, an SF-based programmable electrical system for building efficiency, raised $4m in seed funding. Brick & Mortar Ventures led, and was joined by Catapult VC, Alchemist and Third Sphere. www.domatic.io

Acquisitions & PE:

- Thoma Bravo completed its $8b take-private buyout of Coupa Software, a San Mateo, Calif.-based provider of business spend management software. https://axios.link/3Yk1pEa

- Haleon (LSE: HLN) is seeking a buyer for its ChapStick lip balm band, which could fetch around $600m, per Bloomberg. https://axios.link/3kwqyw9

- Molekule Group agreed to acquire Aura Air, a Tel Aviv-based air purification company. The deal is valued at $10 million.

- General Atlantic offered to buy Showtime from Paramount Global (Nasdaq: PARA) for more than $3b, but was rebuffed, per the WSJ. GA partnered on the bid with former Paramount executive David Nevins. https://axios.link/41A0voA

- General Catalyst and Mastry Ventures agreed to buy a majority stake of Athletes First, a talent agency that represents such athletes as Aaron Rogers, Aaron Donald and (sigh) Deshaun Watson. Sellers include Dentsu. https://axios.link/3mhF8Z2

- OneSpan (Nasdaq: OSPN), a Chicago-based identity management software firm under activist pressure, hired Evercore to explore a sale, per Reuters. Shares climbed around 12% on the news, giving OneSpan a $739m market cap. https://axios.link/3ZwjyhA

. . .

IPOs:

Nothing to see here…

. . .

SPACs:

- Jet Token, a Las Vegas-based private aviation booking and membership company, agreed to public via Oxbridge Acquisition Corp. (Nasdaq: OXAC). https://axios.link/3Z8hjBc

Funds:

- Bain Capital Ventures raised $1.4b for its latest flagship fund, plus $493m for a new opportunities fund. https://axios.link/3xY5kKJ

- 8VC, the venture firm led by Joe Lonsdale, raised $880m for its fifth fund. https://axios.link/3J75NAC

- Felicis, a San Francisco-based venture capital firm, raised $825 million for its ninth fund.

- B Capital, a Los Angeles-based investment firm, raised over $500 million to invest across the digital and biotech health care sector.

- TTV Capital, an Atlanta-based venture capital firm, raised $275 million for a fund focused on investing in early-stage fintech companies.

- Venture Guides, a new VC firm led by Ben Nye (former co-managing partner of Bain Capital Ventures), raised $215m for its debut fund. https://axios.link/3kDOspA

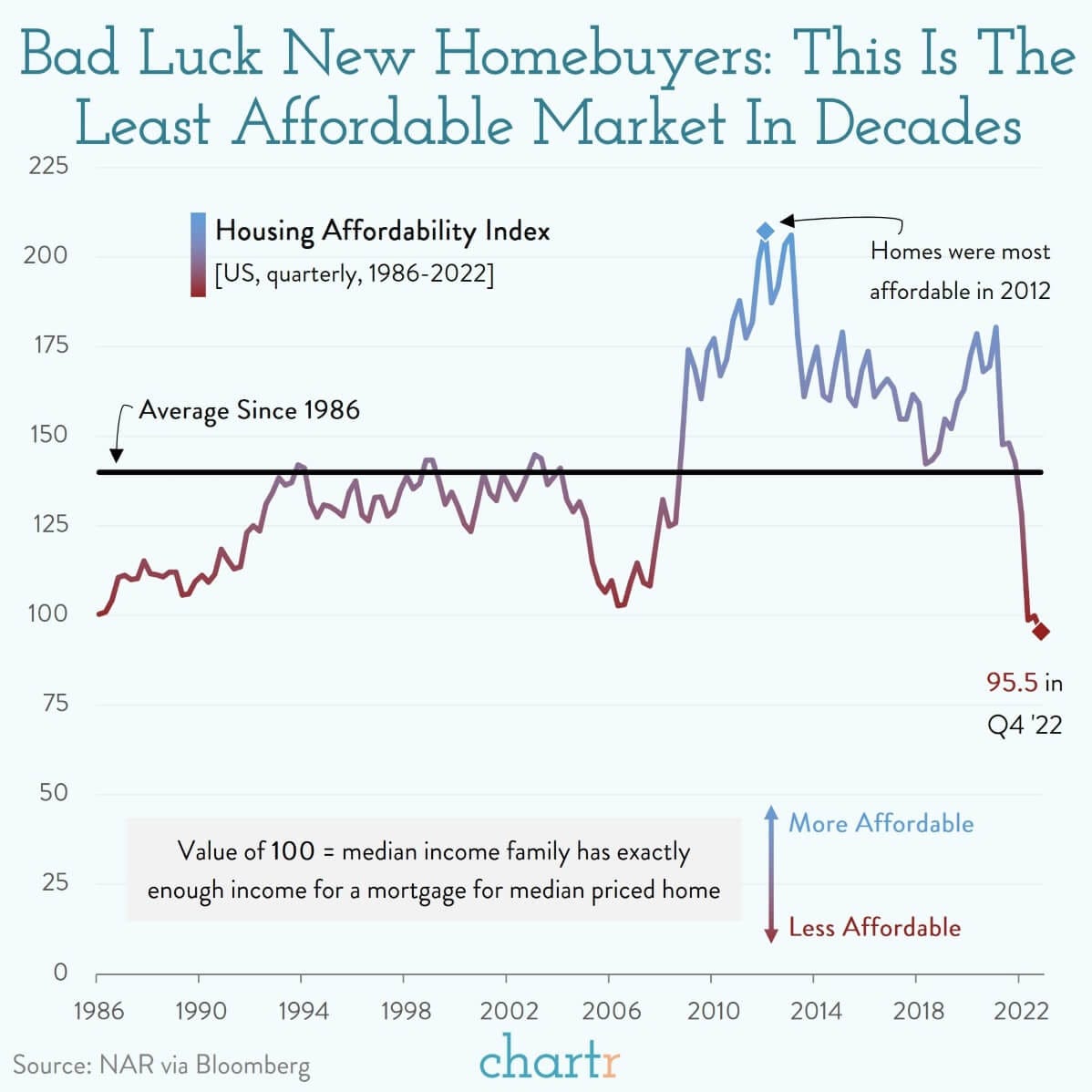

Perfect storm

Last week the average rate on a 30-year fixed mortgage passed 7%, compounding the misery for would-be homeowners who now face a perfect storm of higher borrowing costs and still-elevated home prices.

That combination has sent the National Association of Realtors' housing affordability index down to 95.5 in the latest quarterly figures. A reading of 100 on the index means that a median income family will have exactly enough to qualify for a mortgage on a median priced home. The data shows that this is the least affordable housing market for nearly 40 years, with a lower reading not seen since the mid 1980s.

The theory is that higher rates will cool demand, and house prices will fall — but few things translate from the textbook to reality that quickly. It may take months for sellers to realize they aren’t getting the offers they want before slashing prices, and a construction slowdown has meant that the market isn't currently flooded with new homes either.

As spring fast approaches, a time when young families often try to find houses before summer and a new school year, many prospective homebuyers may find themselves scrolling a lot further down on Zillow to find a house they can actually afford.

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.