Sourcery (3/12-3/17)

UBS & Credit Suisse ~ Stripe, Fiarmatic, Parker, Tilia, Wingspan, Payabil, Maribel Health, HelloSelf, OpenLoop, Fount, Adept, Nimble, Zed Industries, K2 Space, Powered by People

What the Franc is Going on!?

. . .

Last Week (3/12-3/17):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Stripe, Fiarmatic, Parker, Tilia, Wingspan, Payabil, Maribel Health, HelloSelf, OpenLoop, Fount, Adept, Nimble, Zed Industries, K2 Space, Powered by People, Trala, Genpop, HeadRace, Jungle, Captain Experiences, SolarCycle, Viridos; Qualtrics, Leesa Sleep, Blablacar, T-Mobile/Mint Mobile, Via/Citymapper

Final numbers on UBS & Credit Suisse and OpenAI’s Model Growth at the bottom.

Deals

Fintech:

- Stripe, a Dublin, Ireland- and San Francisco-based payment processing platform, raised $6.5 billion in funding. Andreessen Horowitz, Founders Fund, Goldman Sachs, Temasek, and others invested in the round.

- Fairmatic, an SF-based commercial auto insurance startup, raised $46m led by Battery Ventures. https://axios.link/42uFYCr

- Parker, a New York-based credit card company for e-commerce brands, raised $31.1 million in Series A funding led by Valar Ventures.

- Tilia, a payments platform for metaverse projects, raised $22 million led by JPMorgan, per Axios Pro. https://axios.link/3JEotIh

- Wingspan, a New York-based payroll platform for managing freelance workforces, raised $14 million in Series A funding. Andreessen Horowitz led the round and was joined by Distributed Ventures, Long Journey Ventures, Ludlow Ventures, 186 Ventures, and others.

- Payabli, a Miami-based payments infrastructure company, raised $8 million in seed extension funding. TTV Capital, Fika Ventures, and Bling Capital invested in the round.

- Aeqium, an SF-based compensation management platform, raised $5.8m in seed funding from Vestigo Ventures and Ridge Ventures. www.aeqium.com

- Tweed, a New York and Tel Aviv-based wallet and payment solution platform, raised $4 million in seed funding. Accel led the round and was joined by Communitas Capital Partners, Zero Knowledge Ventures, and other angels.

- Soul Wallet, a San Francisco-based smart contract wallet, raised $3 million in funding from Struck Crypto.

. . .

Care:

- FIRE1, a Dublin-based heart failure management company, raised $25 million in funding. Andera Partners and Novo Holdings co-led the round and were joined by Gilde Healthcare, Gimv, the Ireland Strategic Investment Fund, Lightstone Ventures, Medtronic, New Enterprise Associates, and Seventure Partners.

- Maribel Health, a Hanover, N.H.-based home and community care models designer for health systems, raised $25 million in Series A funding led by General Catalyst.

- HelloSelf, a London-based digital therapy platform, raised $20 million in Series B funding. Octopus Ventures led the round and was joined by Omers, Mantaray, and Oxford Capital.

- OpenLoop, a Des Moines-based telehealth support services provider, raised $15 million in Series A funding. Nava Ventures led the round and was joined by UnityPoint Health Ventures, PrimeTime Ventures, SpringTide Ventures, and ManchesterStory.

- Fount, a Los Angeles-based health and performance optimization startup, raised $12 million in Series A funding. Amity Ventures led the round and was joined by Elysian Park Ventures, Not Boring Capital, Allen & Co, Champion Hill Ventures, and other angels.

- Allermi, a San Francisco-based direct-to-consumer allergy relief telehealth service provider, raised $3.5 million in seed funding led by Nelstone Ventures.

. . .

Enterprise & Consumer:

- Adept, a San Francisco-based AI startup focused on executing software workflows, raised $350 million in Series B funding co-led by General Catalyst and Spark Capital. Others investors include Addition, Greylock, Atlassian Ventures, Microsoft, NVIDIA, Workday Ventures, Caterina Fake, Frontiers Capital, PSP Growth, SV Angel and A.Capital.

- Nimble, a San Francisco-based autonomous logistics and A.I. robotics company, raised $65 million in Series B funding. Cedar Pine led the round and was joined by DNS Capital, GSR Ventures, and Breyer Capital.

- Mitiga, a New York-based cloud and SaaS incident response company, raised $45 million in Series A funding. ClearSky Security led the round and was joined by Samsung Next, Blackstone, Atlantic Bridge, and DNX.

- CAST AI, a Miami-based kubernetes automation and cost management startup, raised $20 million in funding led by Creandum.

- Zed Industries, a San Francisco-based collaborative code editor developer, raised $10 million in Series A funding. Redpoint Ventures led the round and was joined by Root Ventures and other angels.

- Almentor, a Cairo-based online video learning platform in Arabic, raised $10 million in pre-Series C funding. e& capital led the round and was joined by Partech, Sawari Ventures, Egypt Ventures, Sango Capital, and Endure Capital.

- Shinydocs, a Kitchener, Canada-based digital information management software company, raised $9.75 million in funding co-led by First Ascent Ventures and Export Development Canada.

- K2 Space, a Los Angeles-based spacecraft company, raised $8.5 million in seed funding. First Round Capital and Republic Capital co-led the round and were joined by Boost VC, Also Capital, Countdown Capital, and others.

- Powered by People, a Nairobi and Toronto-based digital wholesale platform, raised $8 million in Series A funding. Altos Ventures led the round and was joined by Golden Ventures and Susa Ventures.

- Trala, a Chicago-based online music school, raised $8 million in Series A funding. Seven Seven Six led the round and was joined by Lachy Groom Fund, Altman Capital, Next Play Ventures, and Concrete Rose Ventures.

- Genpop, a Los Angeles-based independent game studio, raised $6.5 million in seed funding. Makers Fund led the round and was joined by 1Up Ventures and Good Smile Company.

- HeadRace, an Austin-based recruiting marketplace platform for employers and independent recruiters, raised $6 million in seed funding. Greylock, Susa Ventures, and Breyer Capital invested in the round.

- Jungle, a São Paulo-based Web3 game publisher, raised $6 million in seed funding. BITKRAFT Ventures and Framework Ventures co-led the round and were joined by Delphi Digital, Karatage, Fourth Revolution Capital, Monoceros, 32bit Ventures, Stateless Ventures, Snackclub, Bodhi, and Norte Ventures.

- Elate, an Indianapolis-based cloud-based planning software company, raised $4.9 million in Series A funding led by WestWave Capital.

- Monitaur, a Boston-based A.I. governance software company, raised $4.6 million in funding. Cultivation Capital led the round and was joined by Rockmont Partners, Presidio Ventures, Plug and Play, Studio VC, and others.

- Upduo, a San Francisco-based peer-to-peer learning platform for data-driven teams, raised $4 million in seed funding. Impact Venture Capital led the round and was joined by Sky9 Capital and other angels.

- Captain Experiences, an Austin-based outdoor sports guide booking platform, raised $2 million in funding. Bullish led the round and was joined by TechNexus Venture Collaborative, Cartograph Ventures, Carnrite Ventures, Victorum Capital, Riverside Ventures, Mana Ventures, and other angels.

- FrontM, a London-based collaboration platform for the maritime industry, raised $1.5 million in pre-Series A funding co-led by Jenson Funding Partners, Tradeworks.vc, and Motion Ventures.

. . .

Sustainability:

- SOLARCYCLE, an Oakland, Calif.-based solar panel recycling company, raised $30 million in Series A funding. Fifth Wall and HG Ventures led the round and were joined by Prologis Ventures, Urban Innovation Fund, and Closed Loop Partners.

- Viridos, a La Jolla, Calif.-based developer of algae-based jet and diesel fuel, raised $25m in Series A funding. Breakthrough Energy Ventures led, and was joined by Chevron USA and United Airlines Ventures. www.viridos.com

Acquisitions & PE:

- Silver Lake, the Canada Pension Plan Investment Board, and others agreed to acquire Qualtrics, a Provo, Utah-based software developer. The deal is valued at $12.5 billion.

- 3Z Brands acquired Leesa Sleep, a Virginia Beach, Va.-based direct-to-consumer mattress brand. Financial terms were not disclosed.

- PointClickCare acquired Patient Pattern, a Buffalo, N.Y.-based digital health care management platform. Financial terms were not disclosed.

- BlaBlaCar, a French long-distance ridesharing company that's raised over $500m, agreed to buy French carpooling startup Klaxit, whose VC backers include Sodexo Ventures, RATP Capital Innovation, MAIF Avenir, Inco Ventures and Via ID. https://axios.link/3LwpsvD

- Meta (Nasdaq: META) said it’s exploring strategic alternatives for Kustomer, an enterprise customer service SaaS provider for which it paid $1b to acquire last year. https://axios.link/3ZFARgQ

- Blackstone agreed to buy CVent (Nasdaq: CVT), a Tysons, Va.-based events and hospitality tech provider, for $4.6b, or $8.50 per share. Vista Equity Partners is CVent's majority shareholder, while Blackstone is joined on the buyside by Abu Dhabi Investment Authority.

- T-Mobile US (Nasdaq: TMUS) agreed to buy Mint Mobile, the Fountain Valley, Calif.-based budget wireless provider owned by actor Ryan Reynolds, for $1.35b in cash and stock. https://axios.link/3yFTxRv

- FairMoney, a Nigerian digital banking platform that’s raised over $55m in VC funding, acquired merchant payment services firm PayForce for between $15-$20m in cash and stock, per TechCrunch. https://axios.link/3ZN7SaH

- Sean "Diddy" Combs became the third known suitor for BET Group, joining Byron Allen and Tyler Perry. https://axios.link/3ZSlRMz

- Via, a transportation startup valued by VCs at $3.5b, acquired Citymapper, a London-based urban mapping app that had raised over $60m from backers like Index Ventures, Balderton Capital, Greenspring Associates, Benchmark and DST Global. https://axios.link/40aVnps

. . .

IPOs:

Nothing to see here…

. . .

SPACs:

Nothing to see here…

Funds:

- Amboy Street Ventures, a VC firm focused on women’s health and sexual health for all genders, raised $20m for its debut fund. www.amboystreet.vc

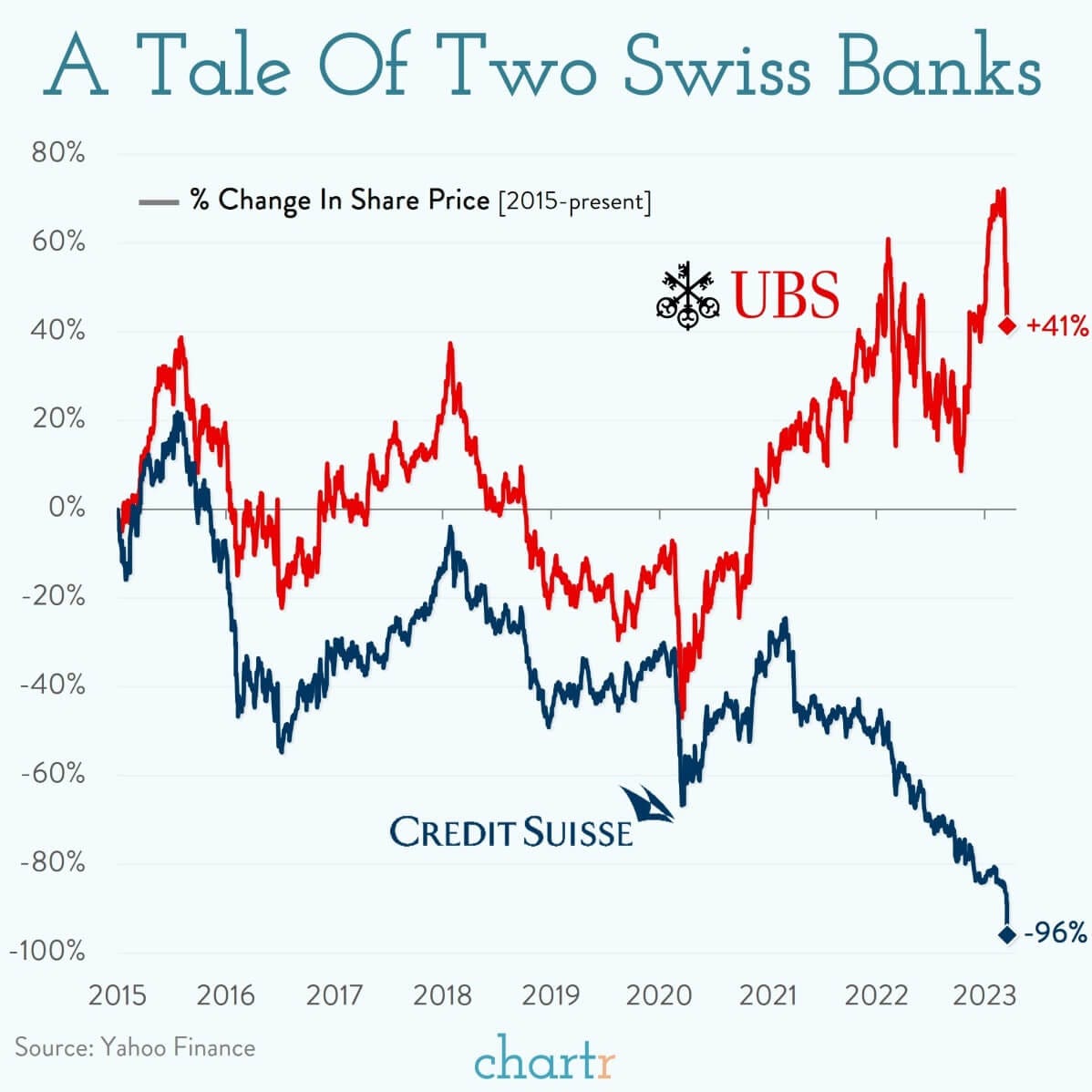

A marriage of convenience

Credit Suisse, an institution since 1856, is set to be taken over by bitter rival UBS in a deal worth ~$3bn, after a chaotic weekend of offers, counter-offers and matchmaking from Swiss regulators.

The deal crystallizes an enormous loss for any Credit Suisse shareholders and marks the end of intense competition between the two pillars of Swiss finance — a one-sided rivalry in recent years, as Credit Suisse rocked from crisis to crisis.

Credit sus

A string of recent controversies turned Credit Suisse from an underperforming bank into a ticking time bomb, starting with a 2019 spying scandal in which the bank admitted to hiring private detectives to follow former staff, shaking confidence in the usually oh-so-discreet Swiss banking sector.

If that predominantly harmed Credit Suisse's reputation, other scandals hurt its bottom line as the firm was found to be deep in both the Greensill Capital and Archegos Capital blow-ups. The latter turned out to be a $5bn+ mistake, essentially wiping out a decade’s worth of net profits at the bank.

Scandals followed over the CEO's breach of COVID rules, a leak of data that reportedly showed the firm served human rights abusers and corrupt politicians, and a guilty verdict in a cocaine cash laundering case.

With trading losses, mounting litigation costs and clients of the firm leaving in droves, Credit Suisse reported its largest ever annual loss — leaving it more exposed than ever to a crisis like that of the last month.

It has been 0 days since the last bank blow-up

This is the largest tie-up of systemically important banks since the Global Financial Crisis, and comes less than 2 weeks after the collapse of SVB and Signature Bank in the US, prompting coordinated action from global central banks this morning.

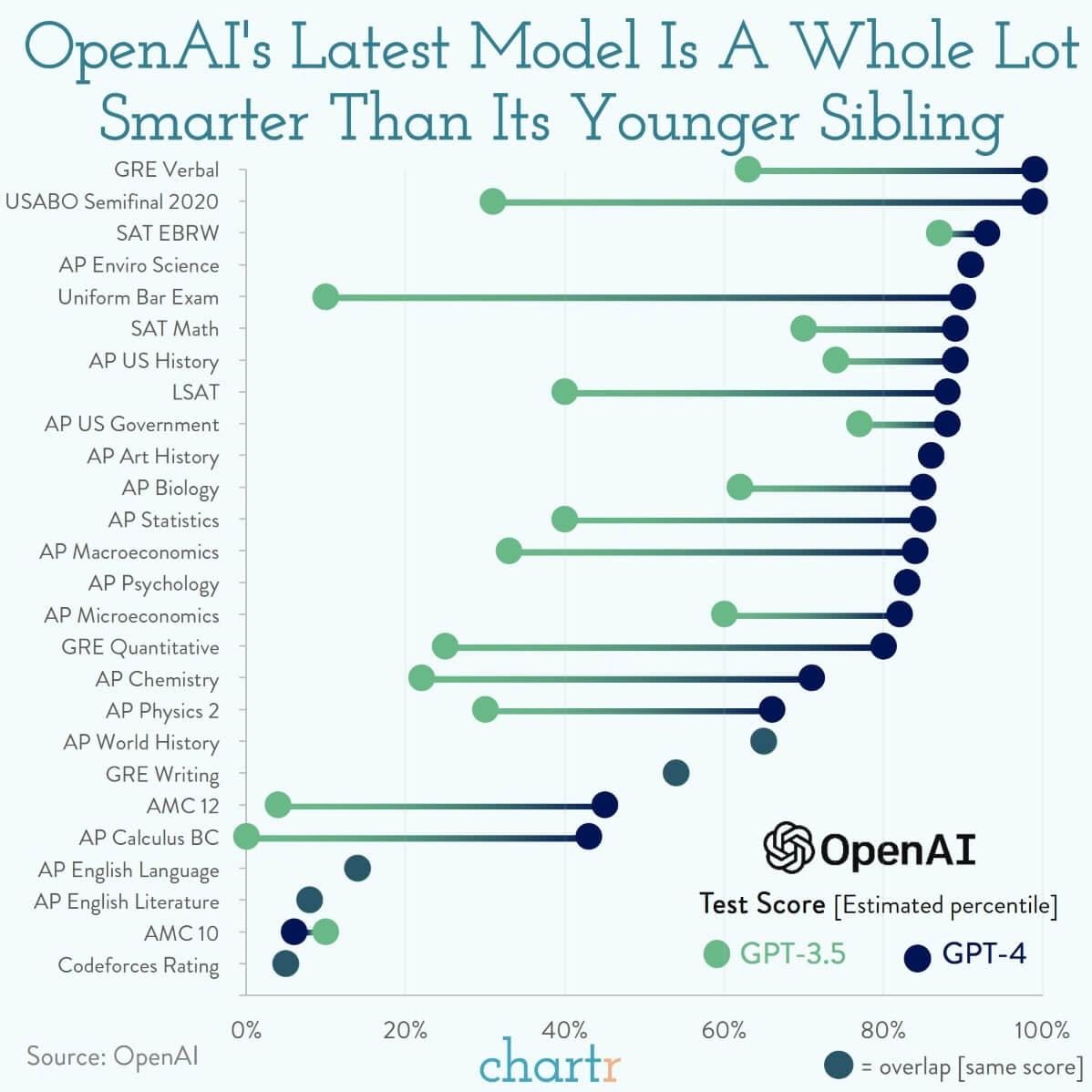

The world of artificial intelligence just got a lot more exciting, or scary, depending on your perspective, as the tech firm behind the wildly-popular and surprisingly-addictive ChatGPT unleashed its new model.

OpenAI’s latest creation, GPT-4, is a smarter, more powerful version of the tech behind the viral chatbot — on a series of benchmark tests, the engine’s ability to outperform humans is staggering.

Revision

While GPT-4 is locked behind OpenAI’s paywall, Microsoft revealed that it’s been powering Bing’s chatbot for 6 weeks now. Even though that test of the language model’s capabilities hasn’t always run smoothly, the new version has outscored its predecessor on nearly every academic and professional exam.

GPT-4, for example, would apparently beat a staggering 90% of lawyers attempting to pass the bar, compared to GPT-3.5 which would have been in the bottom 10%. Indeed, in 12 of the 15 AP exams the pair took, GPT-4 scored ahead of 50% of students. The model still has some revision to do in the English department, however, showing no improvement in language or literature.

Aside from acing exams, GPT-4 is also able to accept images as inputs — a key factor in one of its first implementations where the model will be used to power a “virtual volunteer” for those with visual impairments.

. . .

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.