Sourcery (3/15-3/19)

Coalition, Fireblocks, Genesis, Republic, Trullion, Unite Us, Strive Health, Clarify Health, Viz.ai, Riva Health, Digbi Health, Dataminr, Squarespace, Weee!, Airtable, SecurityScorecard, SafeGraph...

Last Week (3/15-3/19):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech,Care, Future of Work, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Coalition, Fireblocks, Genesis, Republic, Zeller, Asteya, Vega, Trullion, Unite Us, Strive Health, Clarify Health, Happify Health, Viz.ai, Riva Health, Digbi Health, Dataminr, Squarespace, Weee!, Airtable, SecurityScorecard, SafeGraph, Flowspace, OctoML, Docker, Secureframe, Oso, Gumroad, Noon Energy. FanDuel, Next Caller, Voyage. Chime, Kahoot, TrustPilot, ThredUp, Coinbase. eToro, IronNet Security, Offerpad.

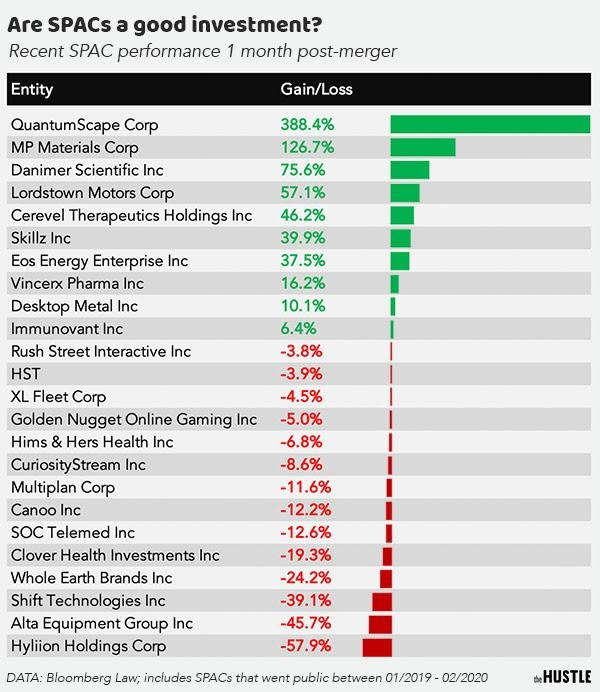

Final numbers on Are SPACs a Good Investment? at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Coalition, a San Francisco-based cyber risk platform, raised $175 million at a $1.75 billion post-money valuation. Index Ventures led, and was joined by General Atlantic and insiders like Ribbit Capital, Valor Equity Partners, Hillhouse Capital, Felicis Ventures, Vy Capital, Greyhound Capital and Greenoaks Capital Partners.www.coalitioninc.com

- Fireblocks, a New York-based crypto infrastructure company, raised $133 million in Series C funding. Coatue, Ribbit, and Stripes led the round and were joined by The Bank of New York Mellon and SVB.

- PayFit, a French payroll and HR software startup, raised $107 million in Series D funding (€90 million). Eurazeo Growth and Bpifrance’s Large Venture fund led the round. Read more.

- Pollinate, a London-based cloud banking startup, raised $50 million in Series C funding. Insight Partners led, and was joined by insiders NatWest Group, Mastercard, National Australia Bank, EFM Asset Management and Motive Partners. www.pollinate.co.uk

- Genesis, a London-based low-code platform for fintechs, raised $45 million in Series B funding. Accel led, and was joined by GV, Salesforce Ventures and insiders Citi, Illuminate Financial and Tribeca Venture Partners. http://axios.link/7CSV

- Republic, a New York City based investment platform, raised $36 million in Series A funding. Galaxy Interactive led the round and was joined by investors including Prosus Ventures, Tribe Capital, Motley Fool Ventures, and Broadhaven Ventures.

- Zeller, an Australian fintech focused on SMBs, raised A$25 million in Series A funding. Addition led, and was joined by insiders Square Peg Capital and Apex Capital. http://axios.link/QzNw

- Invstr, a New York-based maker of an investing app, raised $20 million in Series A via a convertible note offering. Investors included Ventura Capital, Finberg and Jari Ovaskainen.

- JetClosing, a Seattle-based maker of home closing software and services, raised $11 million in Series B funding. T. Rowe Price Associates, Pioneer Square Labs, and Trilogy Equity invested.

- Asteya, a Miami-based income insurance startup led by Alex Williamson (ex-chief brand officer for Bumble), raised $10 million. Backers include I2BF Ventures, Capital Factory, Cap Meridian Ventures, Northstar Ventures, Atrum and Whitney Wolfe Herd.http://axios.link/m6Fv

- Gatsby, a New York-based stock trading mobile app, raised $10 million in Series A funding. Investors included Techstars Ventures and Beta Bridge Capital.

- Vega, a decentralized protocol for derivatives market trading, raised $5 million. Arrington Capital and Cumberland DRW co-led, and were joined by Coinbase Ventures, ParaFi Capital, Signum Capital, CMT Digital, CMS Holdings and Three Commas.http://axios.link/Ukiy

- Trullion, a New York and Tel Aviv-based financial workflow automation company formerly known as SMRT, raised $3.5 million in funding. Greycroft and Aleph led the round and was joined by investors including Verissimo Ventures.

- GloveBox, a Denver-based maker of a self-service app for insurance policy holders, raised $3 million. Mercato Partner led the round and was joined by investors including Heffernan Insurance Brokers

- Honeycomb Credit, a Pittsburgh-based loan crowdfunding platform, raised $1.8 million in seed funding. The American Family Insurance Institute for Corporate and Social Impact led the round.

. . .

Care:

- Unite Us, a New York-based enterprise tech company focused on the health and social care ecosystem, raised $150 million in a Series C funding. ICONIQ Growth led the round and was joined by investors including Emerson Collective, Optum Ventures, and Transformation Capital, Define Ventures, Salesforce Ventures, and Town Hall Ventures.

- Strive Health, a Denver-based kidney care delivery firm, raised $140 million in Series B funding. CapitalG led the round and was joined by investors including Redpoint, NEA, Town Hall Ventures, Ascension Ventures, and Echo Ventures.

- Clarify Health, a San Francisco-based enterprise analytics company for healthcare organizations, raised $115 million in Series C funding. Insight Partners led the round and was joined by investors including Spark Capital, Concord Health Partners, HWVP, KKR, Rivas Capital, and Sigmas Group.

- Happify Health, a New York-based software healthcare platform, raised $73 million in Series D and “related financing.” Deerfield Management Company led the round and was joined by investors including Omega Capital Partners, and ION Crossover Partners.

- Viz.ai, a San Francisco-based maker of a tech platform for stroke and acute care, raised $71 million in Series C funding. Scale Venture Partners and Insight Partners led the round and were joined by Greenoaks, Kleiner Perkins, Threshold Ventures, CRV, Innovation Endeavors, and Susa Ventures.

- Gravie, a Minneapolis, Mich.-based defined contribution healthcare company, raised $28 million in Series D funding. AXA Venture Partners led the round and was joined by investors including FirstMark Capital, Split Rock Ventures, and Revelation Partners.

- 100Plus, a San Francisco-based remote patient monitoring platform, raised $25 million in seed funding. Investors included Henry Kravis and George Roberts.

- Riva Health, a Burlingame, Calif.-based mobile cardiology app provider, raised $15.5 million in funding. Menlo Ventures led the round and was joined by investors including UCHealth and the University of Colorado Innovation Fund.

- Harmonize Health, a San Francisco-based remote monitoring and care platform, raised $10 million in Series A funding. Launchpad Digital Health led the round and was joined by investors including Stanford University, Gaingels, Trinity Ventures, and Liquid 2 Ventures.

- Digbi Health, a Mountain View, Calif.-based provider of gut microbiome and genetic care programs, raised $5.4 million in Series A funding. Accel led the round and was joined by investors including Wisdom, Ocean Azul Partners, and Seraph Venture.

. . .

Future of Work:

- Dataminr, a New York-based artificial-intelligence platform, is in talks to raise funding at a valuation of over $3.6 billion, per Bloomberg. Read more.

- Squarespace, a New York-based website building and e-commerce platform, raised $300 million valuing it at $10 billion. Investors included Dragoneer, Tiger Global, D1 Capital Partners, Fidelity Management & Research Company, T. Rowe Price Associates, Spruce House, Accel, and General Atlantic.

- Weee!, a Fremont, Calif.-based online grocer specializing in Hispanic and Asian foods, raised over $300 million, valuing it at $2.8 billion, per Bloomberg. DST Global led the round and was joined by investors including Blackstone Growth, Arena Holdings, and Tiger Global. Read more.

- Airtable, a San Francisco-based cloud collaboration company, raised $270 million. Greenoaks Capital led the round and was joined by investors including WndrCo, Caffeinated Capital, CRV, and Thrive.

- Yotpo, a New York-based marketing platform, raised $230 million in Series F funding. Bessemer Venture Partners and Tiger Global led the round.

- Dutchie, a Bend, Ore.-based online marketplace for cannabis dispensaries, raised $200 million in Series C funding at a $1.7 billion valuation. Tiger Global led, and was joined by Dragoneer, DFJ Growth and insiders Casa Verde Capital, Thrive Capital, Gron Ventures and Howard Schultz. http://axios.link/UFSD

- SecurityScorecard, a New York-based security ratings company, raised $180 million in Series E funding. Investors included Silver Lake Waterman, T. Rowe Price Associates, Kayne Anderson Rudnick,Fitch Ventures, Evolution Equity Partners, Accomplice, Riverwood Capital, Intel Capital, NGP Capital, AXA Venture Partners, GV, and Boldstart Ventures.

- Socure, a New York-based digital identity trust company, raised $100 million in Series D funding. Accel led the round and was joined by investors including Commerce Ventures, Scale Venture Partners, Flint Capital, Citi Ventures, WellsFargoStrategic Capital, Synchrony, Sorenson, and Two Sigma Ventures.

- SafeGraph, a San Francisco-based geospatial data startup, raised $45 million in Series B funding. Sapphire Ventures led, and was joined by insiders Alex Rosen, DNX Ventures and Peter Thiel. www.safegraph.com

- Flowspace, a Los Angeles-based on-demand warehouse fulfillment startup, raised $31 million in Series B funding. BuildGroup led, while insiders include Canvas Ventures, Industrious Ventures, Moment Ventures, 1984 Ventures, eGateway Capital and YC.http://axios.link/AcLO

-Cyware, a New York-based "virtual cyber fusion" platform, raised $30 million in Series B funding. Advent International led, and was joined by Ten Eleven Ventures and insiders Prelude Fund, Emerald Development Managers, Great Road Holdings and Zscaler.www.cyware.com

- OctoML, a Seattle-based machine learning deployment company, raised $28 million in Series B funding. Addition Capital led the round and was joined by investors including Madrona Venture Group and Amplify Partners.

- Docker, a Palo Alto, Calif.-based cloud native container company, raised $23 million in Series B funding. Tribe Capital led the round and was joined by investors including Benchmark and Insight Partners. Read more.

- Opensea, a New York-based NFT marketplace, raised $23 million led by Andreessen Horowitz. http://axios.link/yC1W

- Vulcan Cyber, a Tel Aviv-based application and cloud security company, raised $21 million in Series B funding. Dawn Capital led the round and was joined by investors including Wipro Ventures,YL Ventures, and Ten Eleven Ventures.

- DeepSee.ai, a Salt Lake City-based process automation company, raised $22.6 million in Series A funding ForgePoint Capital led the round and was joined by investors including AllegisCyber Capital and Signal Peak Ventures.

- Act-On Software, a Portland-based marketing automation platform, raised $20 million. Investors included U.S. Venture Partners, Technology Crossover Ventures, Norwest Venture Partners, Voyager Capital, founder Raghu Raghavan, and Beedie Capital.

- Secureframe, a San Francisco-based cybersecurity compliance startup, raised $18 million in Series A funding. Kleiner Perkins led, and was joined by Gradient Ventures and Base10 Partners.www.secureframe.com

- Fridge No More, a New York-based "cloud grocery" startup, raised $15.4 million in Series A funding. Insight Partners led, and was joined by Altair Capital. http://axios.link/FM9Y

-Noogata, an Israeli provider of no-code AI data an analytics for enterprises, raised $12 million in seed funding. Team8 led, and was joined by Skylake Capital. www.noogata.com

- Oso, a New York-based company for building authorization in applications, raised $8.2 million in Series A funding. Sequoia led the round and was joined by investors including SV Angel, Company Ventures, and Highland Capital.

- Fetcher, a New York-based recruiting automation platform focused on diversity, raised $6.5 million in Series A funding. G20 Ventures led the round and was joined by investors including KFund, Accomplice, and Slow Ventures.

- Slapdash, a San Francisco-based developer of a workplace apps command bar, raised $3.7 million in seed funding from S28 Capital, Quiet Capital, Quarry Ventures, UP2398 and Twenty Two Ventures. http://axios.link/0sE2

- UpCodes, a San Francisco-based provider of code compliance tools, raised $3.4 million in seed funding led by Point Nine Capital. http://axios.link/ne40

- Gumroad, a San Francisco-based marketplace for creators, plans to raise as much as $6 million. It raised $1 million from investors including Naval Ravikant at a $100 million valuation and plans to raise the rest via crowdfunding. Read more.

. . .

Sustainability:

- Noon Energy, a Palo Alto, Calif.-based developer of low-cost battery technology, raised $3 million in seed funding. Prime Impact Fund led the round and was joined by investors including At One Ventures, Collaborative Fund, and Xplorer Capital.

Acquisitions & PE:

- Flutter Entertainment is weighing potential options for FanDuel, its U.S.-based sports betting site, including an IPO. Read more.

- SailPoint Technologies Holdings (NYSE: SAIL) agreed to acquire ERP Maestro, a Fort Lauderdale, Fla.s-based governance, risk and compliance solution. AdvancedStage Capital backs the firm.

- Cruise, a self-driving subsidiary of GM (NYSE: GM), acquired Voyage, a Palo Alto-based autonomous vehicle startup that’s raised around $50 million from firms like Franklin Templeton, InMotion Ventures, MS&AD Ventures, Chevron Technology Ventures and Khosla Ventures. http://axios.link/JrMu

- Pindrop, an Atlanta-based phone fraud detection company, acquired Next Caller, a -based provider of call verification and fraud detection solutions for contact centers. Pindrop has raised over $220 million from firms like Andreessen Horowitz, CapitalG, Vitruvian Partners, Goldman Sachs and Citi Ventures. Next Caller had raised over $10 million, plus got a PPP loan, from firms like TSVC, Pegasus Tech Ventures and CRCM Ventures. http://axios.link/G3Jt

- Chubb (NYSE: CB) offered to buy rival property and casualty insurer Hartford Financial Services Group (NYSE: HIG) for $23.24 billion in cash and stock. This would be the largest U.S. P&C merger since the current version of Chubb itself was created in January 2016, via the nearly $30 billion merger with Evan Greenberg's Ace Ltd. Chubb's offer works out to $65 per Hartford share, representing a 13.2% premium to Wednesday's close.

. . .

IPOs:

- Sprinklr, a New York-based customer experience management platform, said it’s filed confidential IPO documents. It’s raised around $880 million from firms like Hellman & Friedman, Sixth Street, JC2 Ventures, Iconiq, Revolution and Battery Ventures. www.sprinklr.com

- ThredUp, an Oakland, Calif.-based marketplace for second hand clothing, plans to raise as much as $168 million in an IPO of 12 million shares priced at $12 to $14 apiece. Goldman Sachs backs the firm. Read more.

- Kahoot, a Norway-based education games maker, is exploring a secondary listing in New York or another major European exchange. SoftBank backs the firm. Read more.

- Trustpilot Group, a Denmark-based consumer review site, is set to raise as much as 434 million ($600 million), in its London listing. Read more.

- Chime, a San Francisco-based fintech, has held early talks about an IPO in the country that could value it at over $30 billion, per Reuters. Read more.

- Coinbase disclosed in an SEC filing that it will float up to 115 million shares in its upcoming direct listing, and also that some 2021 secondary sales priced as high as $375.01 per share. Were Coinbase to open trading at that mark, it would be valued at around $100.5 billion.

. . .

SPACs:

- eToro, a London-based no-fee trading app, agreed to go public at an implied $10.4 billion valuation, via acquisition by FinTech Acquisition Corp. V (Nasdaq: FTCV). This could help set an IPO price range for rival Robinhood, whose filing was temporarily delayed by February's GameStop debacle. eToro, a 13-year-old company that expanded into the U.S. in 2018, claims to have more "registered users" than Robinhood has "customers," but we don't yet have active user comps. FTCV, chaired by Betsy Cohen, will contribute $250 million. The deal also includes a $650 million PIPE from ION Investment Group, SoftBank, Third Point, Fidelity and Wellington Management. eToro raised around $150 million in VC funding, from firms like Spark Capital, China Minsheng Financial, SBI Holdings, Bracket Capital, Korea Investment Partners, DCG, Ping An Insurance, Anthemis Group and CommerzVentures.

- IronNet Cybersecurity, a McLean, Va.-based cybersecurity firm, agreed to go public via merger with LGL Systems Acquisition, a SPAC, valuing the combined firm at $1.2 billion. Investors including Bridgewater Associates, ForgePoint Capital, and Kleiner Perkins are investors.

- OfferPad, a Chandler, Ariz.-based online platform for home-sellers, agreed to go public at a $3 billion implied valuation via Supernova Partners Acquisition (NYSE: SPNV), a SPAC led by former Zillow CEO Spencer Rascoff. Offerpad raised around $450 million from firms like LL Funds. http://axios.link/AchT

Funds:

- High Alpha Capital, an Indianapolis-based software venture firm, closed a $110 million fund focused on enterprise cloud companies.

- Juxtapose, a New York-based consumer tech VC firm, raised $300 million for its second fund. www.juxtapose.com

-Lakehouse Ventures of Brooklyn is raising $35 million for its third fund, per an SEC filing. www.lakehouse.vc

- 1984 Ventures, led by Ramy Adeeb, is raising $60 million for its second fund, per an SEC filing. www.1984.vc

-LongJump, a Chicago-based "first check" VC firm, is raising $10 million for its debut fund, per an SEC filing. www.longjump.vc

-Inovia Capital of Montreal raised US$450 million for its second growth equity fund. http://axios.link/JD26

-Insight Partners is raising $1.25 billion for a "follow-on" fund that will make new investments in portfolio companies from Insight Venture Partners X, a flagship vehicle raised in 2017. http://axios.link/Ad72

- Commonfund Capital, a Wilton, Conn.-based today investment firm, closed Commonfund Venture Partners XIII with $625 million.

A Bloomberg analysis of 24 SPAC stocks that went public between January 2019 and February 2021 found that more than half depreciated in value 1 month after a merger was announced.

Research by Bain has shown similar outcomes: a review of 121 SPACs showed that 60% underperformed the S&P 500 post-merger.

Data via Bloomberg Law; graphic: Zachary Crockett / The Hustle

Among Bloomberg’s sample size of SPACs, the average return was 22.9%. By comparison, in 2020:

The S&P 500 index saw a gain of +18.4%

Nasdaq saw a gain of +43.6%

Traditional IPOs saw an average gain of +75%