Sourcery (3/20-3/24)

Fed up, Cash App Fraud, GPT-4 ~ Rippling, Rain, Two, Kin, CrossX, Beam, Thematic, Gravie, Artera, Switch Therapeutics, Bend, Vital, Character AI, CCP Games, OP3N, Hex, Workera, DragonflyDB, Britive,

The Story Continues…

As the strength of OpenAI grows into its next evolution with GPT-4, the mesmerizing glow of infatuation begins to fade and realization of all of its consequences, good and bad, begin to settle in. Tech leaders are starting to speak out emphasizing their concerns, and the reality is, consumer facing products are powerful. With the ease of widespread access to immense information, limited moderation, coupled with creation capabilities, models can be manipulated to serve its user and take over the world. JK, not really, IDK. We’ll see.

Nonetheless, there is a lot of doomsday sentiment being shared articulating fears over what happens when this technology gets into the hands of bad actors. We’ve seen this story before with individuals taking advantage of social media platforms, search engines, and application layers for specific niche communities to engage crowds. This is already happening and there are an unbelievable amount of startups forming using LLMs to reach any and all audiences. Time will tell to see what sticks, but if anything about the recent web3 wave taught us, is that people crave community, gather around passions, and also want quick fixes to make money.

…And if you thought the bank failures were tough to process, Harry and EmRata have the pop-culture world shook. No, not Prince Harry, if you don’t know, I’ll leave it to you to discover.

Readings

Fed Update and 2023 Full Year Cloud Software Guides, Jamin Ball

Spotify has used just 10% of its $100m Creator Equity Fund, money set aside to fund diversity initiatives following controversy surrounding podcaster Joe Rogan last year.

Elon Musk has reportedly valued Twitter at just $20bn, less than half of the $44bn he bought it for only 5 months ago.

Advice to Startup Founders and Employees: Strength Doesn’t Always Come in Numbers, Chamath Palihapitiya

The potential perils of following the crowd in venture capital during a down market, also includes a couple of illuminating charts on VC performance

OpenAI Plugins Transform ChatGPT Into An App Platform, Ark Disrupt

What to Watch in AI: Ten AI companies that investors and founders are keeping a close eye on. The Generalist

Watch/Listen

Fmr. Google CEO Eric Schmidt on the Consequences of an A.I. Revolution

The dark side of rapid access to information

Sam Altman: OpenAI CEO on GPT-4, ChatGPT, and the Future of AI | Lex Fridman Podcast

Incredibly strange monotone conversation on the potential harm of AI

E121: Macro update, Fed hike, CRE debt bubble, Balaji's Bitcoin bet, TikTok's endgame & more, All-in Podcast

(2:58) Fed hikes 25 bps

(32:35) Balaji bets on Bitcoin $1M, predictions for hyperinflation, crypto crackdown in the US

(54:27) Should the commercial real estate sector receive a similar treatment as regional banks? Math and solutions on 100% FDIC insurance

(1:16:04) TikTok CEO grilled by US lawmakers: What is TikTok's endgame in the US?

(1:25:46) Relativity Space shoutout and bestie wrap!

. . .

Last Week (3/20-3/24):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Rippling, Rain, Two, Kin, CrossX, Beam, Thematic, Gravie, Artera, Switch Therapeutics, Bend, Vital, Character AI, CCP Games, Reebelo, OP3N, Hex, Workera, DragonflyDB, Britive, Luma AI, Blank Street Coffee, Vue Storefront, Illumix, Numbers Station, Aembit, dope.security, Clerk, Coactive AI, Sifflet, Frontier Aerospace, Backlash Security, Turnkey, Tavus, Butlr, Windfall Bio, Alcove Labs; UBS/Credit Suisse, Cover Genius/Clyde, Karat/Triplebyte, JPM/Aumni, Maven Clinic

Final numbers on Block Shares vs Cash App’s “Fraud” Case at the bottom.

Deals

Fintech:

- Rippling, a San Francisco-based employee benefits and payroll management platform, raised $500 million in Series E funding led by Greenoaks.

- Rain, an LA-based earned-wage access company, raised $66m at a $250m valuation co-led by QED Investors and Invus Opportunities co-led, and were joined by WndrCo, Tribe Capital and Dreamers VC. The company also secured $50m in debt. https://axios.link/3n46FgR

- Two, an Oslo-based B2B transactions platform, raised €18 million ($19.29 million) in Series A funding. Shine Capital and Antler co-led the round and were joined by Sequoia Capital, Day One Ventures, Alumni Ventures, LocalGlobe, The Visionaries Club, Alliance VC, and others.

- Auros, a Hong Kong and New York-based trading and market-making firm, raised $17 million in funding. Vivienne Court led the round and was joined by Bit Digital, Trovio, Epoch Capital, Primal Capital, and others.

- Kin, a Chicago, IL-based direct-to-consumer home insurance company, raised additional $15 million in a funding round led by Geodesic Capital, QED Investors and others, bringing its total Series D to $109 million. FinSMEs

- Gryfyn, a custodial wallet joint venture between Animoca Brands and Hex Trust, raised $7.5m from Liberty City Ventures, Leadblock Partners, Mind Fund and GameFi Ventures. https://axios.link/3Jv5vT8

- CrossX, a crypto trading venue, raised $6.35m in seed funding from Two Sigma, Flow Traders, Wintermute Ventures and Nomura's Laser Digital. https://axios.link/3LIMCyW

- Beam, a general contractor payment platform, raised $4m in seed funding led by Accel. https://axios.link/3z2VMyK

- Thematic, a San Francisco-based investment infrastructure software company, raised $2.3 million in seed funding. Lux Capital led the round and was joined by AirAngels and others

. . .

Care:

- Gravie, a Minneapolis-based employer health benefits company, raised $179 million in funding. General Atlantic led the round and was joined by FirstMark Capital and AXA Venture Partners.

- Artera, a San Francisco-based predictive and prognostic cancer tests developer, raised $90 million in funding. Coatue, Johnson & Johnson Innovation, Koch Disruptive Technologies, Walden Catalyst Ventures, TIME Ventures, Breyer Capital, The Factory, and other angels invested in the round.

- Switch Therapeutics, a San Francisco-based preclinical stage RNA science-focused biotechnology company, raised $52 million in Series A funding. Insight Partners and UCB Ventures co-led the round and were joined by Upfront Ventures, BOLD Capital Partners, Eli Lilly and Company, Ono Venture Investment, Digitalis Ventures, Dolby Family Ventures, Free Flow Ventures, PhiFund Ventures, and others.

- Janus Health, a Brooklyn, N.Y.-based revenue cycle management company, raised $45m from Enhanced Healthcare Partners, per Axios Pro. https://axios.link/3TzjdJa

- Bend Health, a Madison, Wis.-based youth and family telemental health startup, raised $32m from Maveron, SteelSky Ventures and WVV Capital. www.bendhealth.com

- Vital, a Claymont, Del.-based patient experience digital health company, raised $24.7 million in Series B funding. Transformation Capital led the round and was joined by Threshold Ventures and others.

- AERA Health, a Basel, Switzerland- and Berlin-based preventive health tech startup, raised €4 million ($4.29 million) in pre-seed funding. Former Amazon Consumer CEO Jeff Wilke, Logitech president and CEO Bracken Darrell, Neworld.Global, Korify Capital, and Evoleen invested in the round.

- Previse, a Baltimore-based precision medicine startup, raised $3 million in seed funding. TEDCO, Wexford Science and Technology, Riptide Ventures, Gaingels, and other angels invested in the round.

- Bionic Clinic, a Durham, N.C.-based "AI health clinic," raised $3m in seed funding from IDEA Fund Partners, Studio VC, Alumni Ventures, Tweener Fund, AI Operator's Fund and Operator.VC. https://axios.link/3K09hoQ

. . .

Enterprise & Consumer:

- Character.AI, a Palo Alto, CA-based AI chatbot open-ended conversational applications startup, raised $150 million at a $1+ billion valuation in a new funding round led by Andreessen Horowitz. Reuters

- Adeptia, a Chicago-based B2B data integration and business data exchange platform, raised $65 million in funding led by PSG.

- CCP Games, a Reykjavík, Iceland-based game developer, raised $40 million in a funding round led by Andreessen Horowitz, with participation from Makers Fund, Bitkraft, Kingsway Capital, Nexon, Hashed and additional participants. VentureBeat

- Reebelo, a San Mateo, Calif.- and Singapore-based consumer electronics marketplace, raised $29 million in funding. Cathay Innovation led the round and was joined by Moore Strategic Ventures, Gandel Invest, and Antler.

- OP3N, a web3 chat superapp, raised $28m in Series A funding. Animoca Brands led, and was joined by Dragonfly, SuperScrypt, CAA, Connect Ventures, Republic Crypto, Avalanche, Galaxy Interactive and Warner Music Interactive. www.op3n.world

- Hex, a New York- and San Francisco-based collaborative data science platform, raised $28 million in funding. Sequoia led the round and was joined by a16z, Amplify Partners, and Snowflake.

- Operto Guest Technologies, a Vancouver-based automated solutions provider for the hospitality industry, raised $25 million in Series B funding. Centana Growth Partners led the round and was joined by Thayer Ventures, FUSE, Blackpines Capital Partners, and Derive Ventures.

- Strangeworks, an Austin, TX-based quantum computing startup, raised $24 million in a Series A round of funding led by Hitachi Ventures, with participation from IBM and Raytheon Technologies, as well as existing investors Lightspeed Venture Partners, Great Point Ventures and Ecliptic Capital, bringing the total funds raised to $28 million. Silicon Hills News

- 1X, an Oslo-based android manufacturer and inventor, raised $23.5 million in Series A2 funding. The OpenAI Startup Fund led the round and was joined by Tiger Global.

- Workera, a Palo Alto-based skills intelligence platform, raised $23.5 million in Series B funding. Jump Capital led the round and was joined by NEA, Owl Ventures, AI Fund, and Sozo Ventures.

- Wingtra, a Zurich-based mapping drone manufacturing and software company, raised $22 million in Series B funding. DiamondStream Partners, EquityPitcher Ventures, Verve Ventures, the European Innovation Council Fund, and others invested in the round.

- DragonflyDB, an in-memory datastore for cloud environments, raised a total of $21m in seed and Series A funding led by Redpoint Ventures and Quiet Capital, respectively. www.dragonflydb.io

- Britive, a Glendale, Calif.-based cloud identity security platform, raised $20.5 million in Series B funding. Pelion Venture Partners led the round and was joined by Liberty Global Ventures, Crosslink Capital, and One Way Ventures.

- Luma AI, a Sunnyvale, Calif.-based provider of 3D capture software, raised $20m in Series A funding. Amplify Partners led, and was joined by NVIDIA, General Catalyst and insiders Matrix Partners and South Park Commons. www.lumalabs.ai

- Blank Street Coffee, a Brooklyn, N.Y.-based coffee shop chain, raised $20m from Left Lane Capital, HOF Capital, General Catalyst and Tiger Global. https://axios.link/3Z7EtH6

- Vue Storefront, an SF-based frontend e-commerce infrastructure startup, raised $20m in Series A extension funding. Felix Capital led, and was joined by insiders Creandum, Earlybird and SquareOne. https://axios.link/3ngOWTk

- Illumix, a San Francisco-based augmented reality solutions company, raised $18 million in Series A funding. LightShed Ventures, KKR cofounder Henry Kravis, Epyllion CEO Matthew Ball, Maveron, Lightspeed, Mark Cuban, and others invested in the round.

- Numbers Station, an Austin, Texas-based startup for incorporating AI into data stacks, raised $17.5m in Series A funding. Madrona led, and was joined by Norwest Venture Partners and Factory. https://axios.link/40fIBpw

- Powers Gymnastics, an Austin-based youth sports, facilities, equipment, and gymnastics program provider, raised $16.8 million in Series A funding led by Relevance Ventures.

- Aembit, a Silver Spring, Md.-based workload identity and access management platform, raised $16.6 million in seed funding from Ballistic Ventures and Ten Eleven Ventures.

- dope.security, a Mountain View, Calif.-based secure web gateway company, raised $16 million in Series A funding. Google Ventures led the round and was joined by boldstart ventures and Preface.

- Clerk, a San Francisco-based authentication and user management solution, raised $15 million in Series A funding. Madrona led the round and was joined by Andreessen Horowitz, S28 Capital, and Fathom Capital.

- Revolv, a San Francisco-based electric commercial fleet provider, raised $15 million in Series A funding from Greenbacker Capital Management.

- Mecanizou, a Brazilian auto parts marketplace, raised $14.5m in Series A funding. Monashees led, and was joined by Alexia Ventures, FJ Labs and Dalus Capital. https://axios.link/3Z8t7mi

- Coactive AI, a San Jose, Calif.-based visual content analytics and search platform, raised $14m. Andreessen Horowitz and Bessemer Venture Partners co-led, and were joined by SV Angel, AME Cloud Ventures, Cloud All Star Fund and Next Play Capital. www.coactive.ai

- Sifflet, a Paris-based data observability platform, raised €12 million ($12.92 million) in Series A funding led by EQT Ventures.

- Caramel, a Los Angeles-based car checkout platform, raised $12 million in seed funding co-led by Zeev Ventures, Primera Capital, and Hearst Ventures.

- Engrain, a Denver-based interactive mapping technology and data visualization software company, raised $12 million in Series A funding led by RET Ventures.

- CodiumAI, a Tel Aviv-based code testing platform for developers, raised $11 million in seed funding co-led by Vine Ventures and TLV Partners.

- Frontier Aerospace Corporation, a Simi Valley, Calif.-based liquid rocket engine company, raised $10 million in Series A funding round from AEI HorizonX.

- StructShare, an Austin-based construction procurement and inventory platform for specialty contractors, raised $8 million in funding. KOMPAS led the round and was joined by SeedIL and CEMEX Ventures.

- Backslash Security, a Tel Aviv-based application security solution for application security teams, raised $8 million in funding co-led by StageOne Ventures, First Rays Venture Partners, D. E. Shaw Group, and others.

- Turnkey, a New York-based private key infrastructure for crypto developers, raised $7.5 million in seed funding co-led by Sequoia Capital, Variant, and Coinbase Ventures.

- Dylibso, a Boulder, CO-based web assembly tools provider, raised $6.6 million in a Seed funding round led by Felicis, with participation from Boldstart ventures, Pebblebed and Crew Capital. TechCrunch

- Vacation, a Miami-based sunscreen company, raised $6 million in Series A funding. Silas Capital led the round and was joined by True Beauty Ventures, BFG Partners, and other angels.

- Emma, a Luxembourg-based no-code multi-cloud management application platform, raised $6m in seed funding. RTP Global led, and was joined by AltaIR Capital and CircleRock Capital. www.emma.ms

- Tavus, a San Francisco-based video personalization platform, raised $6.1 million in seed funding. Sequoia Capital led the round and was joined by REMUS Capital, Y Combinator, SV Angel, Liquid 2 Ventures, GTM Fund, Mantis Capital, Hack VC, Terra Nova, Accel, Lightspeed Venture Partners, Index Ventures, Soma Capital, Zillionize, and others.

- Butlr, a Burlingame, Calif.-based anonymous people sensing platform, raised $5 million in funding from Qualcomm Ventures and Carrier Global.

- Togal.AI, a Miami-based construction software company, raised $5 million in pre-Series A SAFE funding from Florida Funders.

- Rwazi, a Los Angeles-based market intelligence startup, raised $4 million in seed funding led by Bonfire Ventures.

- Patch, a London-based workspace company, raised £3 million ($3.68 million) in funding. JamJar Investments, Blue Wire Capital, Vectr7 Investment Partners, Active Partners, and Triple Point Ventures.

- Aspecta, a developer of AI-vetted coder profiles, raised $3.5m in seed funding. ZhenFund led, and was joined by HashKey Capital and Foresight Ventures. https://axios.link/40lJBIE

- Coqui, a Berlin-based generative-A.I. speech company, raised $3.3 million in funding. ScaleX Ventures, Mango Capital, DNX Ventures, and other angels invested in the round.

- Loupe, an Atlanta-based streaming art platform, raised $3 million in funding seed+ funding. ALIAVIA Ventures led the round and was joined by CityRock Ventures, Goal Ventures, Phoenix Capital Ventures, SoundMedia Ventures, Yolo.io, and Atlanta Technology Angels.

- Gamify, a Lehi, Utah-based business intelligence platform and gamification tool, raised $2.5 million in seed funding. New Stack Ventures led the round and was joined by Hannah Grey VC and Pipeline Ventures.

- Appbrew, an SF-based mobile app building platform for marketers, raised $2m in seed finding led by Accel. https://axios.link/4076IY1

- Daimon Labs, a New York-based large language model chatbot developer, raised $1.5 million in pre-seed funding. LDV Capital led the round and was joined by Data Community Fund, Myelin VC, and other angels.

. . .

Sustainability:

- IntegrityNext, a Munich-based sustainability software platform, raised €100 million ($108.85 million) in funding from The EQT Growth fund.

- Candela, a Stockholm-based electric hydrofoil technology company, raised $20 million in funding. EQT Ventures and investors Joel Eklund and Svante Nilo Bengtsson co-led the round and were joined by Ocean Zero.

- Andes, an Alameda, Calif.-based climate tech startup, raised an additional $15 million in Series A funding. Voyager VC, Yamaha Motor Ventures, Leaps by Bayer, Cavallo Ventures, KdT Ventures, Venturance, Germin8, and Accelr8 invested in the round.

- Revolv, a San Francisco, CA-based provider of electric medium-to-heavy commercial fleets, raised $15 million in a Series A funding round led by Greenbacker Capital Management. FinSMEs

- Windfall Bio, a Menlo Park, Calif.-based agriculture startup transforming methane emissions into soil nutrients, raised $9 million in seed funding. Mayfield led the round and was joined by Untitled, B37 Ventures, Baruch Future Ventures, Breakthrough Energy Ventures, Bessemer Venture Partners, and Cavallo Ventures.

- Alcove Labs, a New York-based provider of carbon credit management software, raised $3m in seed funding, per Axios Pro. Seven Seven Six led, and was joined by First Round Capital. https://axios.link/3FH2NZA

- PoLoPo, an Israeli maker of animal proteins from potatoes, raised $1.75m in pre-seed funding led by FoodLabs. https://axios.link/4047i8O (I’m sorry… whaaaaat)

Acquisitions & PE:

- UBS agreed to acquire Credit Suisse, a Zurich-based investment bank and financial services firm, for $3.25 billion.

- Cover Genius acquired the platform and material contracts and other assets of Clyde Technologies, a New York-based embedded warranty provider. Financial terms were not disclosed.

- Karat, a Seattle-based HR interviewing platform valued by VCs at $1.1b, acquired Triplebyte, an SF-based recruitment company that had raised around $50m from firms like Founders Fund, YC, Summit Peak Investments, Initialized Capital and Caffeinated Capital. https://axios.link/40iuBLR

- Tom Brady bought a minority stake in the Las Vegas Aces franchise in the WNBA. https://axios.link/42EiGdm

- SonderMind, a Denver-based behavioral health startup valued by VCs at over $1b, acquired the assets of Mindstrong, a telemental health company that had raised $160m in VC funding from firms like Arch Venture Partners and General Catalyst.

- JPMorgan (NYSE: JPM) agreed to buy Aumni, a Salt Lake City-based investment analytics platform for private markets. Aumni raised around $230m in VC funding from JPM, Pelion Venture Partners, WndrCo, Citadel Securities, Invesco Private Capital, Vanderbilt University, Kera Capital and insiders SVB Financial, DLA Piper, Next Frontier Capital, Kickstart Fund, First Trust Capital Partners and Mercato Partners https://axios.link/3Z8l35c

- Aura acquired a minority stake in Kidas, a Philadelphia-based technology solutions company for anticyberbullying and predator protection software for online gaming platforms. Financial terms were not disclosed.

- Maven Clinic acquired Naytal, a London-based digital health company. Financial terms were not disclosed.

- Splashtop acquired Foxpass, a San Francisco-based network and server access solutions for IT and DevOps systems. Financial terms were not disclosed.

- Accel-KKR acquired a majority stake in StoreForce, a Toronto-based workforce management and performance platform. Financial terms were not disclosed.

- Hunter Point Capital acquired a minority stake in L Catterton, a Greenwich, Conn.-based investment firm. Financial terms were not disclosed.

- Mastercard (NYSE: MA) acquired Baffin Bay Networks, a Swedish cybersecurity company backed by EQT Ventures. www.baffinbaynetworks.com

. . .

IPOs:

Nothing to see here…

. . .

SPACs:

Nothing to see here…

Funds:

- Hunter Point Capital is buying a passive minority stake in private equity firm L Catterton. https://axios.link/3ZgcDbT

Bad rap

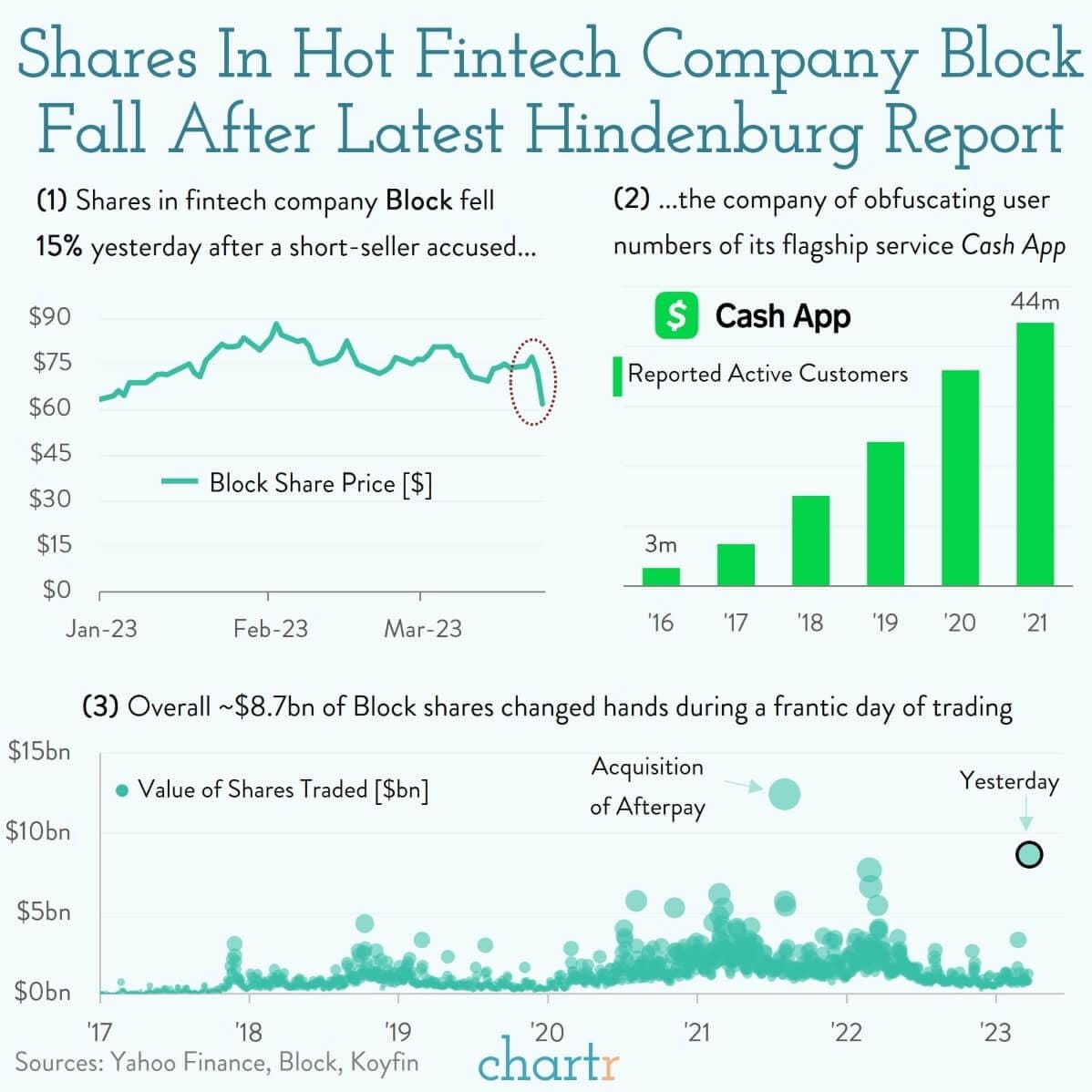

Block, the fintech company responsible for payment platforms Square and Cash App, has become the latest target of Hindenburg Research, just 2 months after the infamous short-seller accused the Adani Group of fraud.

Hindenburg accuses Block — which is still run by Twitter founder Jack Dorsey — of obfuscating the user numbers of its service Cash App. The report claims that somewhere between 40% and 75% of Cash App accounts reviewed “were fake, involved in fraud, or were additional accounts tied to a single individual”. The report also accused Cash App of facilitating crime, owing to how easy it is to get an account, even going so far as to put together a compilation video of rappers who claim to use Cash App for various nefarious deeds.

On a frantic day of trading yesterday, some $8bn+ of Block stock changed hands, with the share price down 15% despite the company's protestations that the report was “factually inaccurate” and “designed solely to allow short sellers to profit from a declined stock price”.

Appetite for a fight

This latest report puts Hindenburg in the firing line for another potential legal battle, as the firm continues to argue its case against Adani Group — the Indian conglomerate it targeted in January. Indeed, according to Bloomberg, Hindenburg has now bet against some 30 companies since 2020, with its standard procedure — shorting the stock and making a lot of noise about it — proving effective. Bloomberg estimates that six months after a report is published, a typical Hindenburg target is down ~26%.

. . .

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.