Sourcery (3/6-3/10)

SVB ~ Masstro, Assured Allies, Fynn, Banyan, Droit, Candidly, Proven, Elyn, BetterNight, Felix&Fido, YourPath, Anthropic, Consensus, Humane, Threecolts, Macro, SOCi, CHAOS Industries, Believer . . .

Reflecting on SVB

The last 5 days have been an absolute whirlwind. Glued to the news and Twitter while also prospecting every possible resulting scenario through conversations amongst GPs, peers, and founders about how this massive event will unfold. All of which, when in a crisis, can be very much necessary, but also very much exhausting. I’ve been in VC for about 5 years and startups for 9, but I’m not going to act or talk like a banking expert, a treasury management expert, a board of directors, or a CEO, and so my commentary on this event is limited.

Ultimately, the astonishing part is just the revelation of who shows up and how they react. There were two divergent groups, the people yelling in fear, and the people dedicating every second to finding solutions, supporting those affected and using their platforms to instill positivity, hope, and even offering their own resources. I am, and I think I can speak for many others, grateful for the swift resolution and collaboration of industry leaders who truly understood the complete and totally catastrophic effects of what could have happened.

Like many, I’m sure you probably need a break from consuming these headlines, and so instead I’m sharing some wider-perspective conversations around human behavior.

Musings

Michael Lewis on Stock Market Overconfidence and Revisiting Moneyball, Motley Fool

Yes, their intro music is cringe but the conversation here is insightful, here are some key parts:

How to spot true experts

Unintended consequences of Moneyball

Why single men fare worse in the stock market

How Iceland responded to the Great Recession

How to heal your trauma & achieve greatness: Lewis Howes, mbg Podcast

Yes, each person probably has trauma of some degree, take it or leave it. Key lessons:

Self-doubt can be a major obstacle to achieving one's goals and dreams

During times of uncertainty, it's important to take back one's power and focus on what can be controlled

Realigning oneself during overwhelming moments can involve focusing on one's values and priorities

Focus on progress, not perfection, and to keep striving for growth and improvement

Identifying a meaningful mission can help give purpose and direction in one’s life

. . .

Last Week (3/6-3/10):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Masstro, Assured Allies, Fynn, Banyan, Droit, Candidly, Proven, Synctera, Tweed, Elyn, BetterNight, Felix&Fido, YourPath, Anthropic, Consensus, Humane, Threecolts, Macro, SOCi, CHAOS Industries, Believer Entertainment, Ghost Autonomy, Overhaul, Fly by Jing, BACH, Cubist, Wild xyz, Monnai, Inigo, Tangle, Otherside AI, Adaptis, Palmetto, Rubi Labs, DexMat; Qualtrics, Subway, PrimeFlight, Boardriders, A.P.C., 98point6/Transcarent

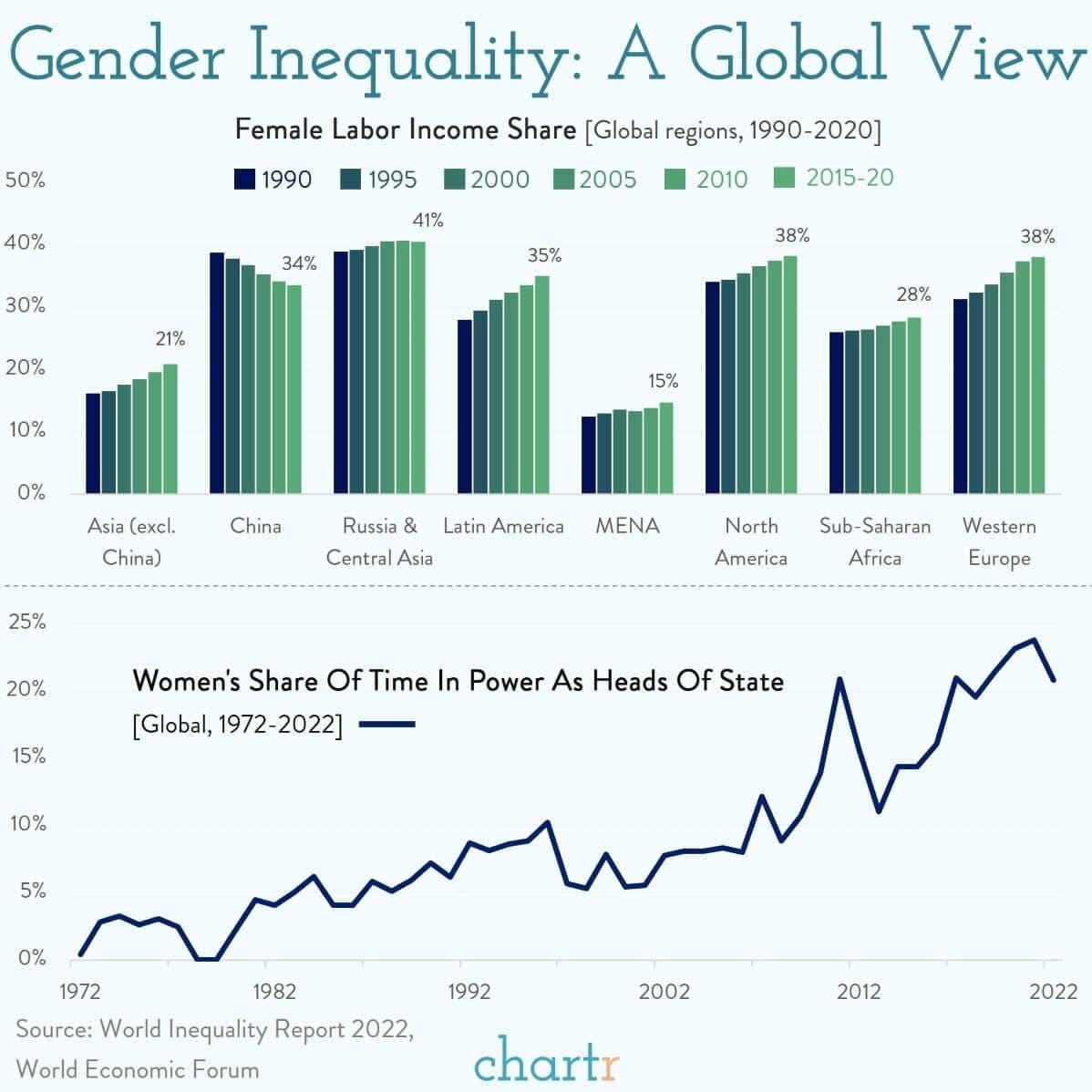

Final numbers on Gender Inequality: A Global View at the bottom.

Deals

Fintech:

- Masttro, a New York-based wealth tech company, raised $43 million in funding. FTV Capital led the round and was joined by Citi Ventures.

- Banyan Infrastructure, a San Francisco-based financing software platform, raised $25 million in Series B funding. Energize led the round and was joined by SE Ventures, Ulu Ventures, VoLo Earth, Elemental Excelerator, and others.

- Kresus, a San Francisco-based crypto wallet and Web3 discovery app, raised $25 million in Series A funding co-led by Liberty City Ventures, JetBlue Ventures, Franklin Templeton, Marc Benioff, Cameron and Tyler Winklevoss, Craft Ventures, and others.

- Droit, a New York, NY-based regulatory compliance firm, closed a $23 million Series B investment round led by Pivot Investment Partners and UBS, with participation from existing investor Goldman Sachs. TechCrunch

- Candidly, a New York-based student debt and savings platform, raised $20.5 million in Series B funding. Altos Ventures led the round and was joined by Cercano Management.

- Proven, a New York-based zero-knowledge proof of solvency solution for crypto firms, raised $15.8 million in seed funding. Framework Ventures, Balaji Srinivasan, Roger Chen, and Ada Yeo invested in the round.

- Synctera, a Palo Alto, Calif.-based banking-as-a-service startup, raised $15m. NAventures led, and was joined by The Banc Funds, Veritex Community Bank, Midland States Bank and Emigrant Bank. https://axios.link/3yqqkdl

- Violet, a Berlin and New York-based privacy-protective compliance and identity infrastructure provider for decentralized finance, raised $15 million in funding. BlueYard Capital, Balderton, Ethereal Ventures, FinTech Collective, Brevan Howard, Coinbase Ventures, and others.

- Fynn, a provider of private student loans for skilled workers, raised $11m in seed funding from YC, Susa Ventures, Village Global, Tenacity VC and Watchfire Ventures. It also secured a $25m debt facility. www.fynncredit.com

- Aeqium, a San Francisco-based automated total compensation management platform, raised $5.8 million in seed funding from Vestigo Ventures and Ridge Ventures.

- FilmHedge, an Atlanta-based fintech platform for film financing, raised $5 million in Series A funding. Collab Capital, WOCStar, SCADPro, and Triple Point Capital invested in the round.

- Barley, a Toronto-based compensation management platform, raised $4 million in seed funding. Golden Ventures led the round and was joined by Union Capital and other angels.

- Tweed, a white-label wallet and web3 payment solution, raised $4m in seed funding. Accel led, and was joined by Communitas Capital Partners and Zero Knowledge Ventures. www.paytweed.com

- Elyn, a Paris-based payments and return solution, raised $2.7 million in funding from Headline and Sequoia Capital.

- Houseware, an SF-based SaaS revenue acceleration startup, raised $2.1m in seed funding. Tanglin Venture Partners led, and was joined by GTMfund and Better Capital. www.houseware.io

. . .

Care:

- Assured Allies, a Boston-based aging insurtech platform, raised $42.5 million in Series B funding. FinTLV Ventures and Harel Insurance co-led the round and were joined by Lumir Ventures, Funds managed by Hamilton Lane, New Era Capital Partners, MS&AD Ventures, Core Innovation Capital, Poalim Equity, EquiTrust Life Insurance Company, Akilia Partners, and Samsung Next.

- BetterNight, a San Diego-based sleep care provider, raised $33 million in funding. NewSpring led the round and was joined by HCAP Partners and Hamilton Lane.

- Wave Life, a Los Altos, Calif.-based mental health platform focused on Gen Z, raised $6m in seed funding. Santé Ventures led, and was joined by Hannah Grey, Joyance Capital, Gaingels, and Telocity Ventures. www.wavelife.io

- Iron Health, a New York-based health care platform for women, raised $4.5 million in seed funding from March of Dimes and others.

- Felix&Fido, an Issaquah, Wash.-based veterinary services company, raised $4 million in pre-seed funding co-led by Pioneer Square Labs and Rover.com.

- Highway Benefits, a Manhattan Beach, Calif.-based employee benefits platform, raised $3.1 million in seed funding led by XYZ Venture Capital.

- YourPath, a St. Paul, Minn.-based recovery care company, raised $2.1 million in funding. Bread and Butter Ventures led the round and was joined by Leadout Capital, Groove Capital, Big Stone Capital Group, and Daren Cotter

. . .

Enterprise & Consumer:

- Anthropic, a San Francisco, CA-based generative AI startup, raised a $300 million round of financing at a $4.1 billion valuation, led by Spark Capital, following investments from Google of $300 million in February 2022, which gave Google a 10% stake in the company, and additional hundreds of millions a month ago. SiliconAngle

- Consensus, an American Fork, Utah-based demo automation platform for enterprise software, raised $110m from Sumeru Equity Partners. https://axios.link/3kZN3tK

- Humane, a San Francisco-based A.I. hardware and services platform, raised $100 million in Series C funding. Kindred Ventures led the round and was joined by Tiger Global, Valia Ventures, Qualcomm Ventures, Forerunner Ventures, Lachy Groom, and OpenAI founder Sam Altman.

- Threecolts, a London-based provider of cloud software for e-commerce, raised $90m in Series A funding. Crossbeam Venture Partners and General Global Capital co-led, and were joined by Stratos and CoVenture. www.threecolts.com

- Macro, an entertainment production and agency firm focused on underrepresented talent, raised over $90m. BlackRock led, and was joined by Harbourview Equity Partners and Goldman Sachs Asset Management. https://axios.link/3yhgxq0

- SOCi, a San Diego-based marketing platform for multilocation brands, raised $80 million in funding. JMI Equity led the round and was joined by Vertical Venture Partners, Blossom Street Ventures, and others.

- CHAOS Industries, a Los Angeles-based defense and industrial applications company, raised $70 million in Series A funding. 8VC led the round and was joined by Alpha Wave Global, Lerner Enterprises, Liquid 2 Ventures, Tamarack Global, and Valar Ventures.

- Believer Entertainment, new gaming studio led by former Riot Games executives, raised $55m in Series A funding. Lightspeed Venture Partners led, and was joined by Andreessen Horowitz, Bitkraft Ventures, Upfront Ventures, Riot Games, 1Up Ventures, Don Thompson’s Cleveland Avenue and Michael Eisner’s Tornante Co. https://axios.link/3kWEGyX

- Plus One Robotics, a San Antonio-based robotic parcel handling software and solutions provider, raised $50 million in Series C funding. Scale Venture Partners led the round and was joined by Top Tier Capital Partners, Tyche Partners, ROBO Global Ventures, Translink, McRock, and Pritzker Group Venture Capital.

- Envisics, a Milton Keynes, U.K.-based holographic technology company, raised $50 million in Series C funding. Hyundai Mobis led the round and was joined by InMotion Ventures and Stellantis.

- Ghost Autonomy, a Mountain View, Calif.-based developer of automated driving solutions, raised over $45m in new funding, per an SEC filing. Existing backers include Khosla Ventures, Sutter Hill Ventures, Coatue and Founders Fund. www.ghostautonomy.com

- Overhaul, an Austin-based software-based supply chain visibility, risk, compliance, and insurance solution, raised $38 million in funding. Edison Partners led the round and was joined by eGateway Capital, StepStone Group, and TRM Ventures.

- SpotDraft, a New York-based contract lifecycle management solution for startups, raised $26 million in Series A funding. Premji Invest led the round and was joined by Prosus Ventures, 021 Capital, Arkam Ventures, Riverwalk Fund, and 100x Entrepreneur Fund.

- Matchday, a Barcelona and San Francisco-based soccer gaming company, raised $21 million in seed funding. Led by Lionel Messi's Play Time, Courtside Ventures, Greylock, HackVC, Capricorn Investment Group, and Horizons Ventures invested in the round.

- Vantage, a New York-based cloud infrastructure spend management startup, raised $21m in Series A funding. Scale Venture Partners led, and was joined by Andreessen Horowitz, Harpoon Ventures, Matthew Prince and Glenn Solomon. https://axios.link/3ykHc5h

- RangeForce, a Norfolk, Va.-based provider of cybersecurity upskilling solutions, raised $20m in Series B funding. Energy Impact Partners and Paladin Capital Group co-led, and were joined by KPN Ventures, Lapa Capital Partners, Lanx Capital and Cisco Investments. www.rangeforce.com

- Starfish Space, a Kent, Wash.-based developer of satellite services vehicles, raised $14m. Munich Re Ventures and Toyota Ventures co-led, and were joined by PSL Ventures, NFX and MaC VC. www.starfishspace.com

- Fly by Jing, a Los Angeles-based Chinese food brand, raised $12 million in Series B funding from Prelude Growth Partners and Pendulum.

- MentorShow, a Paris-based online learning and training platform, raised $11 million in funding. Educapital, Crédit Mutuel Innovation, Left Lane Capital, and others invested in the round.

- Zenhub, a Vancouver-based project management provider for software teams, raised $10 million in Series A funding. Yaletown Partners led the round and was joined by BMO Capital Partners and BDC Capital.

- Owen’s Craft Mixers, a Redwood City, Calif.-based cocktail mixer company, raised $10 million in Series C funding. NBA athlete Jimmy Butler, Live Nation, and others invested in the round.

- pgEdge, an Alexandria, Va.-based edge database platform, raised $9 million in seed funding co-led by Sands Capital Ventures and Grotech Ventures.

- Speedscale, an Atlanta-based Kubernetes traffic replay company, raised $9m in pre-seed and seed funding. Grotech Ventures led, and was joined by Sierra Ventures, Tech Square Ventures, Correlation Ventures, CreativeCo and TIE Atlanta. www.speedscale.com

- BACH, a Philadelphia-based planning app and online marketplace for group travel experiences, raised $9 million in funding. Pritzker Group Venture Capital led the round and was joined by Corazon Capital, Freestyle VC, Oversubscribed Ventures, and others.

- Rebel Girls, a New York-based girl empowerment brand, raised $8 million in Series A funding. Penguin Random House led the round and was joined by Common Sense Growth and other angels.

- Unitary, a London-based contextual A.I. platform for content moderation automation, raised $8 million in funding from Plural and other angels.

- FOUNT Global, a Hamburg-, London-, and Washington, D.C.-based employee feedback platform, raised $8 million in Series A funding. Lavrock Ventures led the round and was joined by Osage Venture Partners and Grotech Ventures.

- Cubist, a Pittsburgh- and San Diego-based Web3 developer tools provider, raised $7 million in seed funding. Polychain Capital led the round and was joined by dao5, Amplify Partners, Polygon, Blizzard, Axelar, and others.

- Wild Xyz, a San Francisco-based experiential art platform for artists and collectors, raised $7 million in seed funding round led by Matrix Partners.

- Monnai, a San Francisco-based consumer insights infrastructure provider for financial institutions, raised $6.5 million in Series A funding. Tiger Global led the round and was joined by Better Tomorrow Ventures, 500 Global, and Emphasis Ventures.

- Wheel the World, a San Francisco-based online travel booking company for people with disabilities, seniors, and their families, raised $6 million in pre-Series A funding. Kayak Ventures led the round and was joined by Detroit Venture Partners, REI Co-op Path Ahead Ventures, former Booking.com CEO Gillian Tans, Dadneo, CLIN Fund, Amarena, and WeBoost.

- LandTrust, a Bozeman, Mont.-based online land-sharing marketplace, raised $6 million in Series A funding. The Wilks Brothers led the round and was joined by Wonder Fund ND.

- Edgeless Systems, a Bochum, Germany-based confidential computing company, raised $5.3 million in seed funding led by SquareOne.

- Inigo, a Palo Alto-based GraphQL API management platform, raised $4.5 million in funding. Engineering Capital and Hetz Ventures co-led the round and were joined by NextGen Venture Partners.

- Tangle, a Cambridge, MA-based virtual platform for teams to connect and collaborate from anywhere, raised $4 million in a funding round led by Qualcomm Ventures, with participation from Presence Capital and Mergelane. (More in Venture Beat

- OthersideAI, a New York-based developer of writing assistant HyperWrite, raised $2.8 million in funding. Cortical Ventures and Active Capital co-led the round and were joined by Madrona and other angels.

- Daily Blends, a Toronto-based food accessibility company, raised $2 million in seed funding co-led by Hustle Fund and 2048 Ventures.

- Adaptis, a Toronto-based modeling platform for buildings, raised $1.5 million in pre-seed funding. 2048 Ventures led the round and was joined by Powerhouse Ventures and Blue Vision Capital.

. . .

Sustainability:

- Palmetto, a Charleston, S.C.-based solar energy company, raised $150m from TPG Rise Climate, as first reported by Axios Pro. https://axios.link/3Zqyazm

- ClearFlame Engine Technologies, a Chicago-based clean and renewable fuels provider for heavy-duty engines, raised $30 million in Series B funding. Mercuria Energy Group led the round and was joined by Breakthrough Energy Ventures, New investors, Rio Tinto, and WIND Ventures.

- XGS Energy, a Palo Alto-based geothermal energy technology company, raised $19 million in Series A funding led by Anzu Partners.

- Rubi Labs, a San Leandro, Calif.-based developer of cellulosic textiles, raised $8.7m from Talis Capital, Tin Shed Ventures, H&M Group, Collaborative Fund and Necessary Ventures. https://axios.link/3ETYCcn

- ViridiCO2, a Southampton, U.K.-based carbon dioxide solutions provider, raised £3 million ($3.79 million) in seed funding led by EQT Ventures.

- RenewWest, a Denver-based environmental asset developer, raised $3.2 million in seed funding. Aspiration and One Small Planet co-led the round and were joined by Clear Sky Advisors.

- DexMat, a Houston-based climate tech startup, raised $2.7 million in seed funding. Shell Ventures led the round and was joined by Overture Ventures, Climate Avengers, and others.

- itselectric, a Brooklyn-based electric vehicle charging company, raised $2.2 million in pre-seed funding. Brooklyn Bridge Ventures led the round and was joined by The Helm, XFactor, Graham & Walker, Clean Energy Venture Group, Pericles, and others.

Acquisitions & PE:

- WHP Global, a New York-based brand management firm, raised $375 million in funding from funds managed by the private equity group of Ares Management Corporation.

- The Healing Company acquired Chopra Global, a New York-based health company. Financial terms were not disclosed.

- Silver Lake and CPPIB made a nonbinding offer to buy Qualtrics (Nasdaq: XM), a Utah-based maker of survey and customer experience software in which Silver Lake has a 4.2% stake. Qualtrics, which has a $10.3b market cap, is majority owned by SAP. https://axios.link/3EZYbgJ

- Subway, the sandwich chain expected to be valued at around $10b, has received indicative takeover offers from Goldman Sachs, Bain Capital, TDR Capital and TPG, per Sky News. https://axios.link/3YoVlZN

- Capitol Meridian Partners and The Sterling Group agreed to buy PrimeFlight, a Sugar Land, Texas-based provider of aviation services, from Carlyle. www.primeflight.com

- Authentic Brands Group is in talks to buy Boardriders, an Oaktree Capital Partners-owned apparel maker whose brands include Billabong and Quiksilver, per Bloomberg. ABG backers include BlackRock, Lion Capital, General Atlantic and CVC Capital Partners. https://axios.link/3Jhc1Ox

- L Catterton acquired A.P.C., the Paris-based fashion brand founded by Jean Touitou, per WWD. https://axios.link/3kVuBCf

- Transcarent, an SF-based "health experience" company valued by VCs at more than $1.8b, acquired 98point6, a text-based virtual primary care company that had raised over $200m from firms like L Catterton, Activant Capital, Goldman Sachs, Optus Capital Partners, MUUS Asset Management, Westway Capital, Summer VC and Ace & Co. https://axios.link/3Ysiuu4

- Arko (Nasdaq: ARKO), one of the largest U.S. convenience store operators, acquired Greenville, S.C.-based Transit Energy Group for $370m. https://axios.link/3JgGnR3

- Metro Boomin sold a portion of its music publishing catalog to Shamrock Capital for about $70m, per Billboard. https://axios.link/3YwOdKE

- Uber (NYSE: UBER) is considering a spinoff of its freight logistics arm, via a public listing or sale, per Bloomberg. https://axios.link/3J0UKYp

. . .

IPOs:

Nothing to see here…

. . .

SPACs:

Nothing to see here…

Funds:

- Salesforce Ventures, the San Francisco-based global investment arm of Salesforce, allocated $250 million for a fund focused on generative A.I.

- Kinship Ventures, co-founded by Gwyneth Paltrow and Moj Mahdara, is raising $75m for its debut fund, per Axios. https://axios.link/3kVRxBn

- MUUS Climate Partners, a New York-based venture capital firm, raised $50 million for a fund focused on climate-focused investments.

Last week was International Women’s Day (IWD), a day to celebrate the amazing women in our lives, around the world and throughout history.

IWD has roots going back to 1911 when the US and a host of European countries set aside March 19th to honor the ongoing fight for women’s rights. However, the celebration as we know it today wasn't calendar-codified until 1975 when the UN began to recognize the event on March 8th.

Zooming out

The day is also a good chance to reflect on where women stand in society. While progress has been made in some areas, like the narrowing of the gender wage gap in the US through the 80s and 90s, there’s still some way to go in others.

In the World Inequality Report 2022, economists estimated the female share of labor income around the world. On this simple metric, which makes global comparisons easier, many regions have made slow, steady progress. In North America, the female share of labor income has risen 4.2% since 1990, in Western Europe it’s up nearly 7%.

Not all regions have trended in the same direction, though. Indeed, China — a country that's had a strong history of women in the workforce — has seen the female share of labor income drop over 5% since 1990.

Of course, income is just one facet of societal progress. On the world stage, female leaders are more common than they’ve been in the past, though equal representation still looks decades away. In 2021, for example, women’s global share of leadership hit its peak, as they held ~24% of time in power as international heads of state, per data from the World Economic Forum.

Go deeper: Explore The Economist’s range of charts covering women’s education, the wage gap, female board members and much more.

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.