Sourcery (4/10-4/14)

Coachella Wkd 1 ~ Altruist, Alphasense, Sei, Elevate, Vero, Spendflo, Renew, Rupert, Reef.ai, Kala, Axle, Fire, Recuro Health, 1upHealth, Oshi Health, CTRL Therapeutics, Tandem, Little Journey, Kite

To inject some pop-culture into the tech world, here we go.

Coachella Wkd 1

The festival did it bigger and better than last year, definitely not in terms of the merch store buying experience (still an arduous 2-hour wait, nevertheless, got my CarrotsXCoachella hoodie), but the organization of the event itself, more than ever, was truly spectacular.

Let’s talk about the experiences. The art installations at Coachella were both magical and interactive, transforming the plain grassy polo grounds into two distinct worlds from day to night. The food vendors offered a wide range of options to suit different tastes, including Kreation, Prince Street, pupusas, and more. The festival was more environmentally sustainable than in previous years, thanks to the sale of aluminum water bottles and dedicated refill stations. In addition to this, brand activations provided a burst of energy and included alcohol brands like Absolut, Heineken House, Aperol, as well as Adidas and Amex. There were also numerous outdoor bar areas, including a craft beer barn, a secret lounge behind the Do Lab, VIP and Artist lounges, pink bubbles by the main stage, and even an air-conditioned tent at the Sonora record bar. And if you were brave enough to go all night and make it to after parties like Nylon House, Zenyara or Neon Carnival, power to you. All of these different areas created unique sub-communities within the festival, allowing you and your group to have wildly different realms.

Outside of the typical stages one experience that stood out was “Despacio,” a traveling sound system project that was created by LCD Soundsystem frontman James Murphy and 2ManyDJs (David and Stephen Dewaele). It is essentially a giant custom-built sound system ring that is designed to play music the way it was intended to be heard, in a dark smokey circus tent with a large disco ball in the center with some supporting lights, lasers, and your friends. Essentially it was like a brain massage.

However, out of all of the performances, the top pick actually went to a name not listed in the largest of fonts. It wasn’t a headliner, but the 8th listed name on Friday’s lineup. It went to record producer: Metro Boomin. He played the crowd with dopamine hit after dopamine hit with the most features out of any other performer. The Weeknd, Diddy, Future, Don Toliver, 21 Savage, John Legend. Unfair advantage? Yes. But he took it. Play to your strengths. (ehem, Calvin Harris, ehem).

Second to that was Labrinth with surprise guest Billie Eilish, and Bad Bunny with Post Malone. Full round up here.

Other notable mentions: Rosalia, Kali Uchis, Gorillaz, Remi Wolf, Charlie XCX, Porter Robinson, Jai Wolf, Whipped Cream, Odesza, Pusha T, Rae Sremmurd, Sofi Tukker, Mr Carmack, Blackpink, Aluna, Blink 182(?)

Regarding Frank Ocean's performance, while there were tweets summarizing the controversial aspects (below), it's important to give him some credit. It was his first performance in 6 years after his younger brother died in a tragic car accident. For his fans, I understand that it was very disappointing, it was late, last-minute, and ended up being closer to performance art than a glitzy concert (but it’s okay for Ye to do this?). However, we should give him a bit of a break considering the pressure he was putting himself under, and the grief he was dealing with playing in a large arena that held deep sentimental value to him. Clearly he wanted it to be perfect. He is an artist and his music is deeply emotional. Despite the difficulties, his voice remained beautiful. (Similar for Jai Paul’s 1st ever performance, mental health is important people!)

https://twitter.com/PaulintheFuture/status/1648062488821526528?s=20

Justin Bieber Shares Heartfelt Message to Frank Ocean After Coachella Set

P.S. Not that you asked, but in trying to avoid the cellular dead zones I used Airalo to add additional networks to access greater coverage outside of my current AT&T plan. And boy, did it make a difference.

Next week we’re going to tie all of this back to tech, I swear. And if you want to read something more business-juicy, check out the M&A activity at the bottom.

. . .

Last Week (4/10-4/14):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Altruist, Alphasense, Sei, Elevate, Vero, Spendflo, Renew, Rupert, Reef.ai, Kala, Axle, Fire, Recuro Health, 1upHealth, Oshi Health, CTRL Therapeutics, Tandem, Little Journey, Kite, Kepler, Cybersyn, NetBox Labs, Otterize, Distyl AI, Companion, Assis, Ampersand, Myxt, Argo Space, Emrgy, Noya, Macro Oceans, Haven Energy; Casper Sleep, Alibaba/Softbank, Vox Media/NowThis, Zoom/Workvivo, Starboard/Parler, Walmart/Bonobos

Final numbers on Venture Capital’s current status, in four charts at the bottom.

Deals

Fintech:

- Clear Street, a New York-based independent prime broker, raised $270 million in funding from Prysm Capital.

- Altruist, a Culver City, Calif.-based custodian for registered investment advisers, raised $112 million in Series D funding. Insight Partners led the round and was joined by Adams Street Partners and others.

- Alphasense, a New York-based market intelligence and search platform, raised $100m at a $1.8b valuation led by CapitalG. https://axios.link/3MDDvzT

- Sei, a layer-1 blockchain focused on trading, raised $30m at what TechCrunch reports is an $800m valuation. Backers include Jump Crypto, Distributed Global, Multicoin Capital, Asymmetric Capital Partners, Flow Traders, Hypersphere Ventures and Bixin Ventures. https://axios.link/3zRMDtg

- Elevate, a Denver-based consumer benefits administration startup, raised $28m. Anthemis led, and was joined by Fin Capital, Norwest Venture Partners, Greycroft, Bowery Capital and Firebolt Ventures. https://axios.link/43BvTUv

- Tradier, a Charlotte-based retail brokerage firm, raised $24.6 million in Series B funding. PEAK6 Strategic Capital led the round and was joined by F-Prime Capital and KF Business Ventures.

- Spendflo, an SF-based SaaS buying and management tool, raised $11m in Series A funding co-led by Prosus Ventures and Accel. https://axios.link/4088vLj

- VERO, a New York-based leasing platform for owners and operators, raised $9 million in Series B funding led by Fifth Wall.

- Renew, a New York-based resident renewal process automation platform, raised $8.3 million in seed funding. Upfront Ventures, Goldcrest Capital, Allen & Company, and Walkabout Ventures invested in the round.

- absolute labs, a San Francisco-based wallet relationship management platform, raised $8 million in seed funding. Aglaé Ventures, Alpha Praetorian Capital, The Luxury Fund, Near Foundation, MoonPay, Plassa Capital, Punja Global Ventures, Samsung Next, Sparkle Ventures, and W3i.

- Brassica, a Houston-based banking and investment infrastructure platform, raised $8 million in seed funding. Mercury Fund led the round and was joined by Valor Equity Partners, Long Journey Ventures, NGC Fund, Neowiz, Broadhaven Ventures, VC3DAO, Alpha Asset Management, and others.

- Rupert, a New York-based analytics distribution platform, raised $8 million in seed funding. Cortical Ventures and IA Ventures co-led the round and were joined by Citi Ventures, Joule Ventures, and others.

- Xclaim, a Los Angeles-based crypto bankruptcy claim trading platform, raised $7 million in Series A funding led by The Fund LA managing partner Josh Jones.

- Martini.ai, a Santa Clara, Calif.-based corporate credit market information provider for private companies, raised $6 million in seed funding. Neotribe led the round and was joined by Rocketship.vc.

- Reef.ai, an Oahu, Hawaii-based net revenue retention A.I. platform for B2B businesses, raised $5.2 million in funding led by Struck Capital.

- Kala, a Colombian lending infrastructure startup, raised $4m. Cometa led, and was joined by Canary, Acrew, Clocktower and 99 Startups. https://axios.link/41oYAC7

- Axle, an Atlanta-based insurance verification platform, raised $4 million in seed funding. Gradient Ventures led the round and was joined by Y Combinator, Soma Capital, Contrary Capital, Rebel Fund, BLH Ventures, and other angels.

- Fire, a Miami-based crypto fraud prevention tool, raised $3.5 million in funding led by Atomic.

. . .

Care:

- Recuro Health, a Dallas-based digital health solutions company, raised $47 million in Series B funding. ARCH Venture Partners, the Flippen Group, GPG Ventures, 4D Capital, and others invested in the round.

- 1upHealth, a Boston-based health care data platform, raised $40 million in Series C funding. Sixth Street Growth led the round and was joined by F-Prime Capital, Jackson Square Ventures, and Eniac Ventures.

- Oshi Health, a New York-based virtual care company for gastrointestinal health, raised $30 million in Series B funding. Koch Disruptive Technologies led the round and was joined by Bessemer Venture Partners, Flare Capital Partners, Frist Cressey Ventures, CVS Health Ventures, and Takeda Digital Ventures.

- CTRL Therapeutics, a Chicago-based cell therapy platform development company for treating solid tumors, raised $10 million in seed funding. General Catalyst led the round and was joined by Intermountain Health, FACIT, and others.

- MedArrive, an Irving, Texas-based care management platform company, raised $8 million in funding led by Cobalt Ventures.

- Tandem, a Columbus, Ohio-based child care credentialing and job-matching service, raised $5m from Drive Capital. https://axios.link/3KozvRb

- Little Journey, a London-based hospital procedure preparation platform, raised £3.1 million ($3.88 million) in funding led by Octopus Ventures.

- TARA Mind, a Washington, D.C.-based mental health company, raised $3 million in pre-seed funding from Red Cell Partners.

. . .

Enterprise & Consumer:

- Kite, a New York-based commerce scaling company, raised $200 million in funding from Blackstone and Juxtapose.

- Kepler, a Toronto-based developer of an on-orbit data network, raised US$92m. IA Ventures led, and was joined by Costanoa Ventures, Canaan Partners, Tribe Capital and BDC Capital. https://axios.link/43w4q6N

- Cybersyn, a New York-based data-as-a-service company, raised $62.9 million in Series A funding. Snowflake led the round and was joined by Coatue and Sequoia Capital.

- Gigstream, a Tysons Corner, Va.-based broadband provider, raised $59m from insiders Crestline Investors, RET Ventures, Essex Property Trust and UDR. www.gigstream.com

- Gigstreem, a Tysons Corner, Va.-based residential and commercial broadband networks provider, raised an additional $40 million in funding led by Crestline Investors.

- Carbon Robotics, a Seattle-based robotics company for farmers, raised $30 million in Series C funding. Sozo Ventures led the round and was joined by Anthos Capital, Fuse Venture Capital, Ignition Partners, Liquid2, and Voyager Capital.

- AutoLeap, a Toronto-based auto repair software startup, raised US$30m in Series B funding. Advance Venture Partners led, and was joined by insiders Bain Capital Ventures and Threshold Ventures. https://axios.link/43r1TuH

- NetBox Labs, a New York-based network management and automation company, raised $20 million in Series A funding. Flybridge Capital led the round and was joined by GGV Capital, Grafana Labs CEO Raj Dutt, Mango Capital, Salesforce Ventures, Two Sigma Ventures, IBM, the Founder Collective, and Entrée Capital.

- Fivecast, an Adelaide, Australia-based open-source intelligence software company, raised $19.83 million in Series A funding. Ten Eleven led the round and was joined by the Commonwealth Scientific, Main Sequence, and the South Australian Venture Capital Fund.

- Otterize, a Tel Aviv-based access control solution provider, raised $11.5 million in seed funding. Index Ventures led the round and was joined by Dig Ventures, Vine Ventures, Jibe Ventures, Crew Capital, and Operator Partners.

- REPOWR, a Birmingham, Ala.-based logistics marketplace for B2B asset sharing, raised $8 million in Series A funding led by UP.Partners.

- FRAYT, a Cincinnati-based delivery and logistics platform, raised $7 million in Series A funding. Refinery Ventures led the round and was joined by Capital Midwest, Venture 53, and the JobsOhio Growth Capital Fund.

- Distyl AI, a San Francisco-based A.I. integration platform, raised $7 million in seed funding co-led by Coatue and Dell Technologies Capital.

- Companion, a San Francisco-based interactive device for dogs, raised $6 million in additional funding from Lerer Hippeau and Digitalis Ventures.

- Grand-Attic, a London-based mobile games distribution company, raised $5.3 million in funding led by the Makers Fund.

- Assis, a São Paulo-based virtual assistant for freelancers, raised $5 million in funding. Costanoa Ventures led the round and was joined by MAYA, Canaan, Latitud, Norte, FJ Labs, 1616, BFF, and other angels.

- Ampersand, a San Francisco-based developer platform focused on SaaS interoperability, raised $4.7 million in seed funding. Matrix Partners led the round and was joined by Base Case Capital, Flex Capital, and 2.12 Angels.

- Kuberno, a London-based legal entity SaaS provider for corporate employees, raised £3.5 million ($4.37 million) in Series A funding from Nasdaq Ventures.

- CAT Labs, a Miami-based forensic and cybersecurity tools developer to fight crypto-related crime, raised $4.3 million in pre-seed funding. Castle Island Ventures, Brevan Howard Digital, CMT Digital, and RW3 Ventures co-led the round and were joined by Newark Venture Partners, Hash3, Borderless Capital, Cryptoverse Ventures, and Outshine Ventures.

- NATIX, a Hamburg, Germany-based developer for crowd-sourced camera networks and event detection software, raised $3.5 million in seed funding. Blockchange Ventures led the round and was joined by XYO, Mysterium Network, CVVC, Mulana Capital, Blockarm Capital, Techstars, Plug and Play Ventures, and CoinIX Capital.

- Portrait Analytics, a Boston-based generative A.I. research assistant platform for investment analysts, raised $3 million in pre-seed funding led by .406 Ventures.

- Myxt, a San Francisco-based collaborative audio workplace app, raised $2 million in seed funding led by Accel and Quiet Capital.

- Argo Space, a developer of spacecrafts powered by lunar water, raised $2m. Type One Ventures led, and was joined by Boost VC, Stellar Ventures and Earthrise Ventures. https://axios.link/3GGVMZw

. . .

Sustainability:

- Emrgy, an Atlanta-based distributed hydropower startup, raised $18.4m in Series A funding, as first reported by Axios Pro. Oval Park Capital led, and was joined by Fifth Wall, Blitzscaling Ventures, Overlay Capital and Veriten. https://axios.link/3Urf1M8

- Noya, a San Francisco-based air capture technology developer, raised $11 million in Series A funding. Union Square Ventures and Collaborative Fund co-led the round and was joined by Lowercarbon Capital, Fifty Years, MCJ Collective, EQT Foundation, Climate Capital, Nexwell Group, and others.

- EcoSoul Home, a Bellevue, Wash.-based plant-based home essentials products company, raised $10 million in Series A funding. Accel led the round and was joined by Singh Capital Partners.

- Macro Oceans, a Sacramento and San Francisco-based California biotechnology company that turns seaweed into low-carbon chemicals, raised $5 million in seed funding co-led by Refactor Capital, Lowercarbon Capital, and McKinley Capital.

- Haven Energy, an Austin-based home battery system provider, raised $4.2 million in seed round funding. Lerer Hippeau and Giant Ventures co-led the round and were joined by Quantum Innovation Fund and Raven One Ventures.

Acquisitions & PE:

- Sleep Country Canada (TSX: ZZZ) agreed to buy the Canadian assets of mattress maker Casper Sleep, which was taken private last year by Durational Capital Management. The deal includes $20.6m in cash, plus a $4.5m marketing transition fee and a $20m purchase of convertible notes in Casper Sleep. https://axios.link/3KMi9yU

- Pear Therapeutics (Nasdaq: PEAR), a Boston-based developer of prescription apps for treating addiction and insomnia, filed for Chapter 11 bankruptcy protection. The company went public via SPAC in 2021 at a $1.6b equity value, after having raised $270m in VC funding.

- SoftBank is planning to sell most of its remaining stake in Alibaba (NYSE: BABA), in which it remains the largest outside shareholder with around a 13.7% stake, per the FT. https://axios.link/415LvOr

- Vox Media plans to spin off NowThis, the progressive publisher it acquired as part of Group Nine, to nonprofit Accelerate Change. Vox will retain a minority stake. https://axios.link/3nYQMsq

- Arch Insurance acquired Thimble, a New York-based small biz insuretech that had raised over $22m from backers like IAC, MS&AD Ventures, Gaingels, Slow Ventures, AXA Venture Partners and OpenOcean. https://axios.link/3zW0ZIQ

- Zoom (Nasdaq: ZM) acquired Workvivo, a Cork and Boston-based employee experience app that had raised over $40m from firms like Tiger Global, Enterprise Ireland and Frontline Ventures. www.workvivo.com

- Starboard (fka Olympic Media), a Virginia-based company led by Ryan Coyne, agreed to buy Parler, the social media company that Kanye West previously agreed to purchase. Starboard plans to temporarily shutter the app. https://axios.link/3UxRKs5

- Trillium, an activist investor, asked Getty Images (NYSE: GETY) to explore a possible sale. It also is pushing for a board seat. https://axios.link/3GJtw8j

- Walmart (NYSE: WMT) agreed to sell Bonobos to WHP Global and Express for $75m. It purchased the clothing brand in 2017 for $310m. https://axios.link/3MJEKh8

. . .

IPOs:

Nothing to see here…

. . .

SPACs:

Nothing to see here…

Funds:

- Lux Capital, a Menlo Park, Calif.- and New York-based venture capital firm, raised $1.15 billion for a fund focused on investing in hard science and deep technology companies.

- Canaan, a Menlo Park, Calif.-based venture capital firm, raised $850 million across two funds focused on early-stage investments in tech and health care.

- Eclipse Ventures, a VC firm focused on industrial tech, raised $720m for its fifth flagship fund and $480m for its second growth fund. https://axios.link/3ZUyxBF

- Two Sigma Impact, a New York-based private equity firm, raised $677 million for a fund focused on human capital-centric businesses.

- Reach Capital, a VC firm focused on ed-tech, raised $215m for its fourth fund. www.reachcapital.com

- Future Ventures, a firm co-led by Steve Jurvetson and Maryanna Saenko, raised $200m for its third fund. https://axios.link/3mq3kss

- MetaVC Partners, a San Francisco-based venture capital firm, raised $62 million for a fund focused on early-stage, hard-tech metamaterials startup companies.

- Overwater Ventures, led by Kristina Simmons (ex-a16z, Khosla Ventures), raised $20m for its debut fund. www.overwater.vc

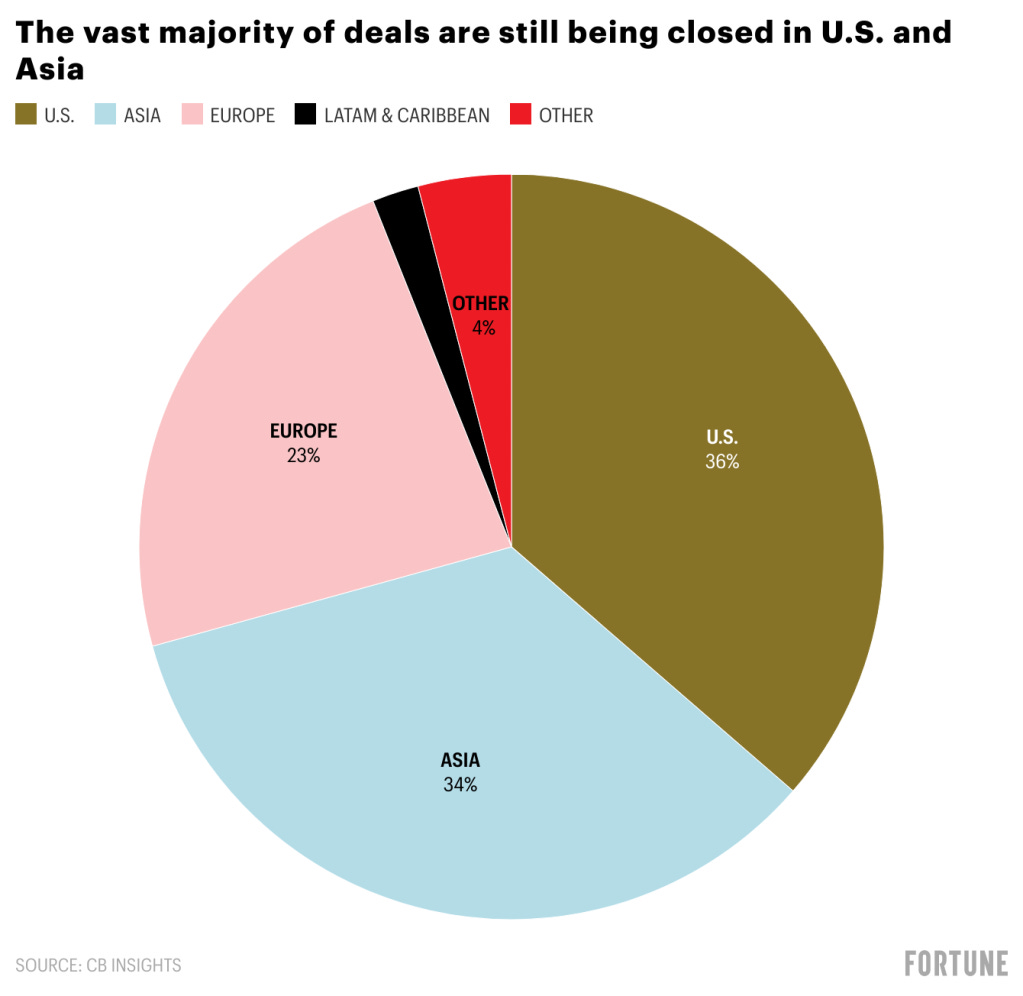

Venture capital’s current status, in four charts:

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.