Sourcery (4/19-4/23)

Revolut, Deel, Chargebee, Clearbanc, Cherre, MANTL, Alto*, My Percent, Signal Advisors, Per Diem, Brella Insurance*, PursueCare, Ophelia, adyn, Oath, Clubhouse, Dataiku, Misfits Market, Productboard..

Last Week (4/19-4/23):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech,Care, Future of Work, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Revolut, Deel, Chargebee, Clearbanc, Cherre, MANTL, Alto*, My Percent, Signal Advisors, Per Diem, Seed Health, Small Door, Brella Insurance*, PursueCare, Ophelia, adyn, Oath Care, Clubhouse, Dataiku, ActiveCampaign, Misfits Market, Productboard, RapidAPI, Kandji, Sift, HYPR, BigID, Outlier.org, JOKR, Level, Cape Privacy, Catch&Release, Mathison, Authzed; Atlassian, Mastercard, GoodRX, Affirm, NYDIG; UiPath, DoubleVerify, Endeavor, KnowB4; SmartRent

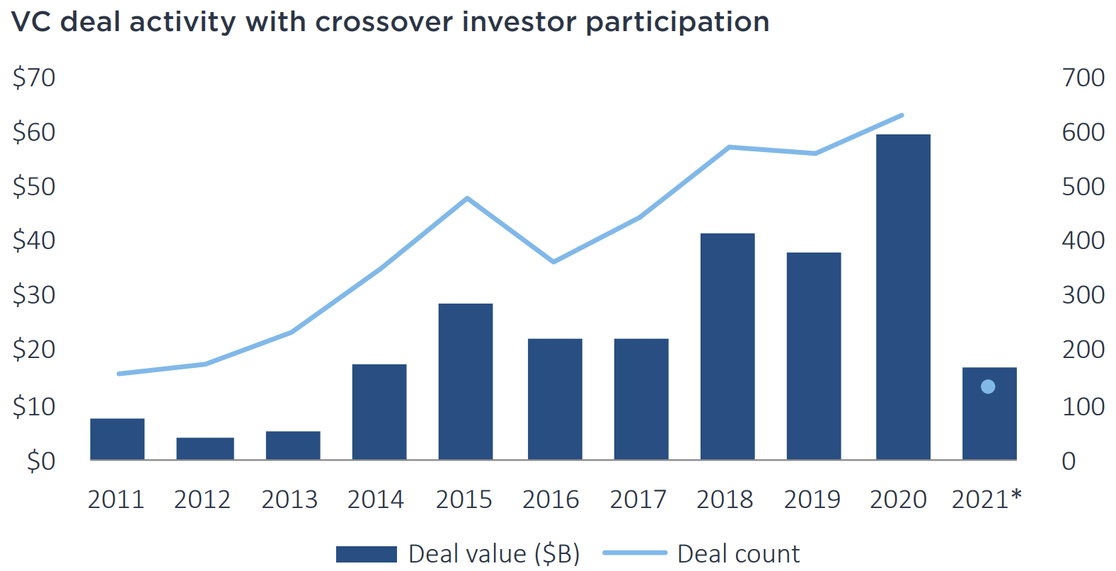

Final numbers on VC Deals w/ Crossover Fund Participation (*Tiger*) at the bottom.

* NYL Ventures Participated

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Revolut, the U.K.-based fintech, is raising funding at an $10 billion valuation, per Sky News.

- Deel, a San Francisco-based payroll company, raised $156 million in Series C funding. The YC Continuity Fund led the round and was joined by investors including Andreessen Horowitz and Spark Capital. Dara Khosrowshahi, Lachy Groom, Jeffrey Katzenberg, Jeff Wilke, and Anthony Schiller also participated in the round valuing it at $1.3 billion.

- Chargebee, a San Francisco and India-based a provider of subscription-billing software, raised $125 million in Series G funding. Sapphire Ventures led the round and was joined by investors including Tiger Global and Insight Partners.

- Clearbanc, a Canadian-based e-commerce investor and lender, raised $100 million in Series C funding, valuing it at about $2 billion. Oak HC/FT led the round.

- Classy.org, a San Diego-based provider of cloud-based fundraising tech for nonprofits, raised $118 million in Series D funding. Norwest Venture Partners led the round.

- Zilch, a London-based "buy now, pay later" startup, raised $80 million in Series B funding at a valuation north of $500 million, from backers like Gauss Ventures and M&F Fund. http://axios.link/jYHS

- Cherre, a New York-based real estate data management and analytics platform, raised $50 million. Trustbridge Partners led the round and was joined by investors including Glilot Capital Partners, former Goldman Sachs Vice Chairman Mark Schwartz, Intel Capital, Navitas Capital, and Carthona Capital.

- MANTL, a New York-based digital account solution for banks and credit unions, raised $40 million in Series B funding. CapitalG led the round and was joined by investors including D1 Capital Partners, BoxGroup, Point72 Ventures, Clocktower Technology Ventures, and OldSlip Group.

- Candex, a Miami-based payment processing platform, raised $20 million as part of a Series A round. Altos Ventures led the round and was joined by investors including NFX, American Express Ventures, J.P. Morgan, Edenred Capital Partners, and Commerce Ventures.

- Payhawk, a payments and expense management platform, raised $20 million in Series A funding. QED Investors led the round.

- Alto Solutions*, a Nashville, Tenn.-based IRA platform, raised $17 million in Series A funding. Unusual Ventures led the round and was joined by investors including Moment Ventures,Acrew Capital, and Alpha Edison, as well as Carta, Coinbase Ventures, Franklin Templeton, New York Life Ventures, and Stone Ridge Holdings Group.

- My Percent, a New York-based investing platform, raised $12.5 million in Series A funding. White Star Capital and B Capital led the round.

- Signal Advisors, a Detroit-based distributor of annuities and life insurance, raised $10 million in Series A funding. General Catalyst led the round and was joined by investors including Detroit Venture Partners, Ludlow Ventures, General Catalyst, Mercury Fund, Annox Capital, and SV Angels.

- Knox Financial, a Boston-based fintech focused on investment properties, raised $10 million in Series A funding. G20 Ventures led the round and was joined by investors including Greycroft, Pillar VC, 2LVC, and Gaingels.

- Bespoke Financial, a Los Angeles-based lending service to the cannabis industry, raised $8 million in Series A funding. Casa Verde Capital and Sweat Equity Ventures led the round and was joined by investors including Ceres Group Holdings, Greenhouse Capital Partners,Philip Barach (DoubleLine Capital’s former president ), and Robert Stavis.

- Till Financial, a New York-based banking platform focused on kids, raised $5 million. Investors included Elysian Park Ventures, Pivotal Ventures, Magnify Ventures, Afore Capital, Luge Capital, Alpine Meridian Ventures, The Gramercy Fund, SM Ventures, and Lightspeed Venture Partners (Scout Fund).

- Causal, a maker of a spreadsheet app, raised $4.2 million in seed funding. Accel led the round and was joined by investors including Coatue, Passion Capital, Verissimo Ventures, Naval Ravikant, and Varadh Jain.

- Fintor, a San Francisco-based fractional real estate investing mobile app, raised $2.5 million in seed funding. Investors included 500 Startups, Hustle Fund, Ankur Nagpal (Teachable Founder), Jonathan Wasserstrum (SquareFoot Founder) and Manny Khoshbin ( Influencer).

- Per Diem, a New York-based startup for small businesses to create subscriptions, raised $2.3 million in seed funding. Two Sigma Ventures led the round, and was joined by Decent Capital and DNX Ventures.

- Tribal Credit, a San Francisco-based financial services company for SMEs in emerging markets, raised $34.3 million in debt and equity. QED Investors and Partners for Growth led the round.

. . .

Care:

- Alan, a French health insurer, raised €185 million at a €1.4 billion valuation. Coatue led, and was joined by Dragoneer, Exor and insiders Index Ventures, Ribbit Capital and Temasek. http://axios.link/l7ml

- Current Health, a Boston-based remote care management platform, raised $43 million in Series B funding. Northpond Ventures led the round and was joined by investors including LRVHealth, OSF HealthCare, Section 32, and Elements Health Ventures.

- Seed Health, a Los Angeles-based microbial sciences company, raised $40 million in Series A funding. The Craftory led the round and was joined by investors including ARTIS Ventures, GISEV, Founders Fund, and 8VC.

- Small Door Veterinary, a veterinary startup co-founded by former SoftBank Capital partner Josh Guttman, raised $20 million in Series A funding. Toba Capital led, and was joined by Pentland Group and insiders like Lerer Hippeau, Primary Ventures and Brand Foundry. www.smalldoorvet.com

- Medchart, a Dallas-based startup focused on medical records, raised $17 million in Seed and Series A funding. Crosslink Capital and Golden Ventures led the round and were joined by investors including Vast Ventures, Union Ventures, iGan Partners, Stanford Law School, and Nas.

- Brella Insurance*, Claymont, De.-based health insurance startup, raised $15 million in Series A funding. Brewer Lane led the round and was joined by investors including Fidelity Security Life Insurance Company, SymphonyAI, Digitalis Ventures, Two Sigma Ventures, New York Life Ventures, and Founder Collective.

- Hydrant, a New York-based maker of hydration packets, raised $8.5 million in funding. Rx3 Growth Partners led the round.

- PursueCare, a Middletown, Ct.-based telehealth addiction treatment company, raised $11 million in Series A funding. Investors included OCA Ventures, Seyen Capital, and Wasabi Investors.

- Ophelia, a New York-based healthcare tech startup providing treatment for opioid addictions, raised $15 million in Series A funding. Menlo Ventures led the round and were joined by investors including Y Combinator, General Catalyst, and Refactor Capital.

- Seqster PDM, a San Diego-based healthcare data tech company, raised $12 million in a Series A funding. OmniHealth Holdings led the round and was joined by investors including Takeda Digital Ventures and 23andMe's CEO and Founder, Anne Wojcicki.

- RazorMetrics, an Austin-based drug spend savings platform for employers and health plans, raised $6 million in Series A funding. Sopris led the round.

- Aloe Care Health, a New York City-based startup focused on voice-activated eldercare solutions, raised $5 million in seed funding. Investors include City Light, Laerdal’s new Million Lives Fund, the Springbank Collective, and Drumbeat Ventures.

- adyn, a Seattle-based precision medicine company, raised $2.5 million in seed funding. Lux Capital and M13 led the round and were joined by investors including Civilization Ventures, Concrete Rose Capital, Y Combinator, Madrona Pioneer Fund, and Ascend VC.

- Oath Care, a San Francisco-based social healthcare startup focused on motherhood, raised $2 million. Investors included XYZ Venture Capital, General Catalyst, Muse Capital, and Eros Resmini.

. . .

Future of Work:

- Clubhouse, the live audio content app, raised an undisclosed amount of funding at a $4 billion post-money valuation led by existing backer Andreessen Horowitz. Other participants included DST Group, Tiger Global and Elad Gil. The startup, which raised at a $1 billion valuation in January, declined to say if the funding was primary, secondary or a mixture. http://axios.link/G3nz

- Dataiku, a New York-based A.I. and machine learning platform, raised an undisclosed amount of funding from Snowflake Ventures.

- ActiveCampaign, a Chicago-based customer experience platform, raised $240 million in Series C funding, valuing it at over $3 billion. Tiger Global led the round and was joined by investors including Dragoneer, Susquehanna Growth Equity, and Silversmith Capital Partners.

- Misfits Market, a Delanco, N.J.-based online grocer, raised $200 million in Series C funding. Accel and D1 Capital led the round and were joined by investors including Valor Equity Partners, Greenoaks Capital, Sound Ventures, and Third Kind Ventures.

- Druva, a Sunnyvale, Calif.-based cloud protection company, raised $147 million. Caisse de dépôt et placement du Québec led the round.

- Digital Asset, a developer of enterprise tools for using digital ledgers, raised over $120 million in Series D funding from 7Ridge and Eldridge. http://axios.link/MXMc

- Deep Instinct, a New York-based deep learning cybersecurity startup, raised $100 million in Series D funding. BlackRock led the round and was joined by investors including Untitled Investments, The Tudor Group, and Anne Wojcicki.

- Hive, a A.I. data training company, raised $85 million in Series D funding valuing it at $2 billion. Glynn Capital led the round and was joined by investors including General Catalyst, Tomales Bay Capital, Jericho Capital, and Bain & Company.

- Productboard, a San Francisco-based product management platform, raised $72 million in Series C funding. Tiger Global led the round and was joined by investors including Index Ventures, Kleiner Perkins, Sequoia Capital, and Bessemer Venture Partners.

- Kyligence, a San Jose, Calif.-based data analytics company, raised $70 million in Series D funding. SPDB International led the round and was joined by investors including Alpha Square Group, CICC, Gopher Asset Management, Shanghai Growth Capital, PUXIN Capital, and Jumbo Sheen Group.

- RapidAPI, a San Francisco-based API platform, raised $60 million in Series C funding. Green Bay Ventures led the round and was joined by investors including Stripes.

- Kandji, a San Diego-based Apple device management platform, raised $60 million in Series B funding. Felicis Ventures led the round and was joined by investors including SVB Capital, Greycroft, and Okta Ventures

- Sift, a San Francisco-based digital trust platform, raised $50 million in funding valuing it at over $1 billion. Insight Partners led the round and was joined by investors including Union Square Ventures and Stripes.

- IRL, a San Francisco-based group messaging app, is in talks to raise over $50 million at a $1 billion valuation, per the Information. Investors could include Tiger Global and IVP.

- ExecOnline, a New York-based online leadership development company for enterprises, raised $45 million in Series D funding. OMERS Growth Equity led the round and was joined by investors including Kaplan, ABS Capital Partners, NewSpring, and Osage Venture Partners.

- AppOmni, a San Francisco-based provider of security management, raised $40 million in Series B funding. Scale Venture Partners led the round and was joined by investors including Salesforce Ventures and ServiceNow Ventures.

- Aisera, a Palo Alto-based automation startup, raised $40 million in Series C funding. Icon Ventures led the round World Innovation Lab and existing investors True Ventures, Menlo Ventures, Norwest Venture Partners, Khosla Ventures, First Round Capital, Webb Investment Network, and Sherpalo.

- HYPR, a New York-based passwordless security company, raised $35 million in a Series C funding. Advent International led the round.

- Unsupervised, a Boulder, Colo.-based automated analytics platform, raised $35 million in Series B funding. Cathay Innovation and SignalFire led the round and was joined by investors including Coatue, Eniac Ventures, NextGen Venture Partners and Elad Gil.

- Welcome Tech, a Los Angeles-based platform for immigrants, raised $35 million in Series B funding. Investors included TTV Capital, Owl Ventures and SoftBank Group Corp’s SB Opportunity Fund, Crosscut Ventures, Mubadala Capital, Next Play Capital, and Owl Capital.

- Archipelago, a San Francisco-based commercial property risk analysis platform, raised $34 million in Series B funding. Scale Venture Partners led the round and was joined by investors including Canaan Partners, Ignition Partners, and Zigg Capital.

- BigID, a New York-based privacy-focused data intelligence company, raised $30 million. Advent International was the investor, valuing the company at $1.3 billion.

- Outlier.org, a New York-based online education platform focused on student debt, raised $30 million in Series B funding. GV led the round and was joined by investors including Unusual Ventures, GSV,Harrison Metal, and Gaingels.

- Aleo, a San Francisco-based platform for private applications, raised $28 million in funding. Andreessen Horowitz led the round and was joined by investors including Placeholder VC, Galaxy Digital, Variant Fund, and Coinbase Ventures.

- Boundless Immigration, a Seattle-based immigration-focused startup, raised $25 million in Series B funding. Foundry Group led the round and was joined by investors including Emerson Collective and Jerry Yang from AME Cloud Ventures.

- JOKR, an e-commerce platform, raised an undisclosed amount of funding. HV Capital led the round and was joined by investors including Tiger Global, Softbank, and Market One Capital.

- Level, an employee benefits startup, raised $27 million in Series A funding. Khosla Ventures and Lightspeed Venture Partners co-led, and were joined by Operator Collective, First Round Capital and Homebrew. http://axios.link/Yfwg

- RippleMatch, a New York-based career recruiting platform, raised $23.5 million. Invus Opportunities led the round and was joined by investors including Renegade Partners and Gaingels as well as G20, Work-Bench, Alleycorp, Bullpen Capital, and Accomplice.

- Cape Privacy, an encrypted learning platform, raised $20 million in Series A funding. Evolution Equity Partners led the round and was joined by investors including Tiger Global Management, Ridgeline Partners and Tom Noonan of Downing Lane.

- Phenix, a real-time streaming technology platform that delivers synchronized streams with sub-half second latency at broadcast quality and scale, raised $16.7 million in in Series B funding at a valuation of $90 million. KB Partners led the round and was joined by investors including Verizon Ventures and Manheim Investments, Inc.

- Catch&Release, a San Francisco-based content-licensing platform, raised $14 million in Series A funding. Accel led the round and was joined by investors including Cervin Ventures.

- Class, an edtech startup that integrates with Zoom, raised about $12.3 million. Investors include Salesforce Ventures, Sound Ventures, and Tom Brady.

- Synthesia, a London-based A.I. video generation platform, raised $12.5 million. FirstMark led the round.

- Pragma, a California-based developer of infrastructure for online live games, raised $12 million in Series A funding. David Thacker at Greylock led the round and was joined by investors including Zynga founder Mark Pincus, Oculus founder Nate Mitchell, Cloudera founder Amr Awadallah, Upfront Ventures, and Advancit Capital.

- soona, a Denver-based virtual content creation platform for e-commerce companies, raised $10.2 million in Series A funding. Union Square Ventures led the round.

- Affogata, a Tel Aviv-based customer analysis platform, raised $5.5 million in seed funding. Mangrove Capital Partners and PICO Venture Partners led the round and was joined by investors including Micha Kaufman (Fiverr Founder).

- Creatively, a West Hollywood, Calif.-based jobs platform, raised $5 million. Investors include Link Ventures, AmplifyHer Ventures, Michael Eisner’s Tornante Company and Shari Redstone’s Advancit Capital.

- Chain.io, a Philadelphia-based provider of a cloud supply chain integration platform, raised $5 million. Grand Ventures and Mercury led the round and were joined by investors including Honeywell Ventures and Engage.

- Mathison, a New York-based platform for diversity hiring, raised $4.2 million in seed funding. Bain Capital Ventures led the round and was joined by investors including SemperVirens, Animo VC, Grand Central Tech, Gaingels, and Springbank Collective.

- Quala.io, a Boston-based customer platform, raised $4 million in seed funding. Underscore VC led the round.

- Authzed, a New York-based API services company, raised $3.9 million in seed funding. Work-Bench led the round and was joined by investors including Amplify Partners and Y Combinator.

- The Expert, a Los Angeles-based platform for video consultations with interior designers, raised $3 million in seed funding. Forerunner Ventures led the round and was joined by investors including Sweet Capital, Promus Ventures, Golden Ventures, WndrCo, AD 100 designer Brigette Romanek and founder of goop, Gwyneth Paltrow.

- Leo AR, an augmented reality company, raised $3 million in seed funding. Great Oaks Ventures led the round and was joined by investors including Dennis Phelps of IVP,betaworks, Deutsche Telekom, and Quake Capital.

- Swarm Engineering, an Irvine, Calif.-based provider of food supply chain software, raised $2.7 million in seed funding. S2G Ventures led the round and was joined by investors including Serra Ventures,Harvard Business School Alumni, Wells Street Capital, VTC Seed Fund, and Rinvest.

. . .

Sustainability:

- Universal Hydrogen, a Los Angeles-based carbon-free flight startup, raised $20.5 million in Series A funding. Playground Global led the round and was joined by investors including Fortescue Future Industries, Coatue, Global Founders Capital, Plug Power, Airbus Ventures, JetBlue Technology Ventures, Toyota AI Ventures, Sojitz Corporation, and Future Shape.

Acquisitions & PE:

- Atlassian (Nasdaq: TEAM) acquired ThinkTilt, an Australian maker a no-code/low-code form builder called ProForma. www.thinktilt.com

- Mastercard (NYSE: MA) acquired Ekata, a Seattle-based identity verification company, for $850 million.

- GoodRx acquired HealthiNation, a New York-based virtual healthcare company backed by MK Capital. Financial terms weren't disclosed.

- Affirm (Nasdaq: AFRM) agreed to acquire Returnly, a San Francisco-based online return experiences and post-purchase payments company, for about $300 million. Mundi Ventures and Ariel Poler back the firm.

- Aquiline Capital Partners agreed to acquire Xact Data Discovery, a Mission, Ks.-based provider data management and managed review services, from JLL Partners. Aquiline and Stone Point Capital will combine it with Consilio. Financial terms weren't disclosed.

- NYDIG acquired Arctos Capital, a San Francisco-based commercial lender that provides financing solutions to bitcoin holders, investors, and mining businesses. Financial terms weren't disclosed.

. . .

IPOs:

- DoubleVerify, a a New York-based digital media engagement analytics company, raised $360 million in its IPO. It priced at $27 per share (high end of range), for a fully diluted value of $4.6 billion. It will list on the NYSE (DV) and reports $20 million of net income on $244 million in revenue for 2020. The company is controlled by Providence Equity Partners, and had recently raised $350 million from Tiger Global, Fidelity, BlackRock and Neuberger Berman. http://axios.link/W2cm

- Endeavor, the talent agency and live events company led by Ari Emanuel, set IPO terms to 21.3 million shares at $23–$24. It also plans to raise another $1.8 billion via a concurrent private placement to a group of investors that include Capital Research, Coatue, Dragoneer and Elliott Management. Endeavor would have a fully diluted value of $10.3 billion, were it to price in the middle, plans to add Elon Musk to its board and lists Silver Lake among its shareholders. http://axios.link/KKp5

- KnowBe4, a Clearwater, Fla.-based cybersecurity awareness training company backed by KKR, raised $152 million in its IPO. It pieced 9.5 million shares at $16, versus plans to offer 11.8 million shares at $16-$18, for a fully diluted market value of $2.9 billion. It will list on the Nasdaq (KNBE) and reports a $2.4 million net loss for 2020 on $175 million in revenue. http://axios.link/PdB9

- UiPath, a robotic process automation software company, raised $1.3 billion in its IPO by pricing at $56 per share. It closed its first day of trading (NYSE: PATH) at $73.76, for a $44.4 billion market cap, and reports a $92 million net loss on $607 million in revenue for the fiscal year ending Jan. 31, 2021, and had raised funding from firms like Accel, Earlybird and CapitalG. http://axios.link/qfVB

- Blend Labs, a San Francisco-based fintech, filed confidentially for an IPO.

- Squarespace, a New York-based website building company, filed for a direct listing. Accel, General Atlantic, and Index Ventures back the firm.

- Oatly, the Swedish oat milk company backed by The Blackstone Group, Oprah and Jay-Z, filed for a $1 billion IPO. It plans to list on the Nasdaq (OTLY) and reports a $60 million net loss on $421 million of revenue for 2020 (vs a $36M net loss/$306M in rev for 2019). http://axios.link/sVES

- Confluent, a Mountainview, Calif.-based events streaming platform, filed confidentially for an IPO.

. . .

SPACs:

- SmartRent, a Scottsdale, Ariz.-based provider of smart home automation solutions, is going public at an implied $2.2 billion valuation via Fifth Wall Acquisition Corp (Nasdaq: FWAA), per the WSJ. SmartRent has raised nearly $200 million from firms like Fifth Wall (the SPAC sponsor), Spark Capital, Lennar, Energy Impact Partners, the Amazon Alexa Fund, Bain Capital Ventures and RET Ventures. http://axios.link/UozX

Funds:

- Zoom (Nasdaq: ZM) launched a $100 million strategic VC fund http://axios.link/BT4l

- Kleiner Perkins, a Menlo Park, Calif.-based venture firm, closed Kleiner Perkins Select with $750 million.

Final Numbers

Source: PitchBook. Data: U.S. geography through March 8, 2021.

More from PitchBook: "Crossover investors have become ubiquitous in the cap tables of VC-backed companies that end up going public. 74% of 2020's IPOs by count and 77% by value included crossover investment in pre-IPO rounds."

No crossover firm has been more active this year than Tiger Global, which seems to appear every day atop our "VC Deals" section (including today). In case you missed it, The Information's Kate Clark recently wrote a great dive inside the Tiger deals machine (sub req).