Sourcery (4/24-4/28)

Bruce in Barcelona ~ Super.com, Clara, m3ter, Summer, Flow, Ansa, Plumery, Dori, TympaHealth, Third Way Health, Pinecone, Ursa Major, Replit, Cosmose AI, SPAN, Community, Fireside, Katmai, AIXplain

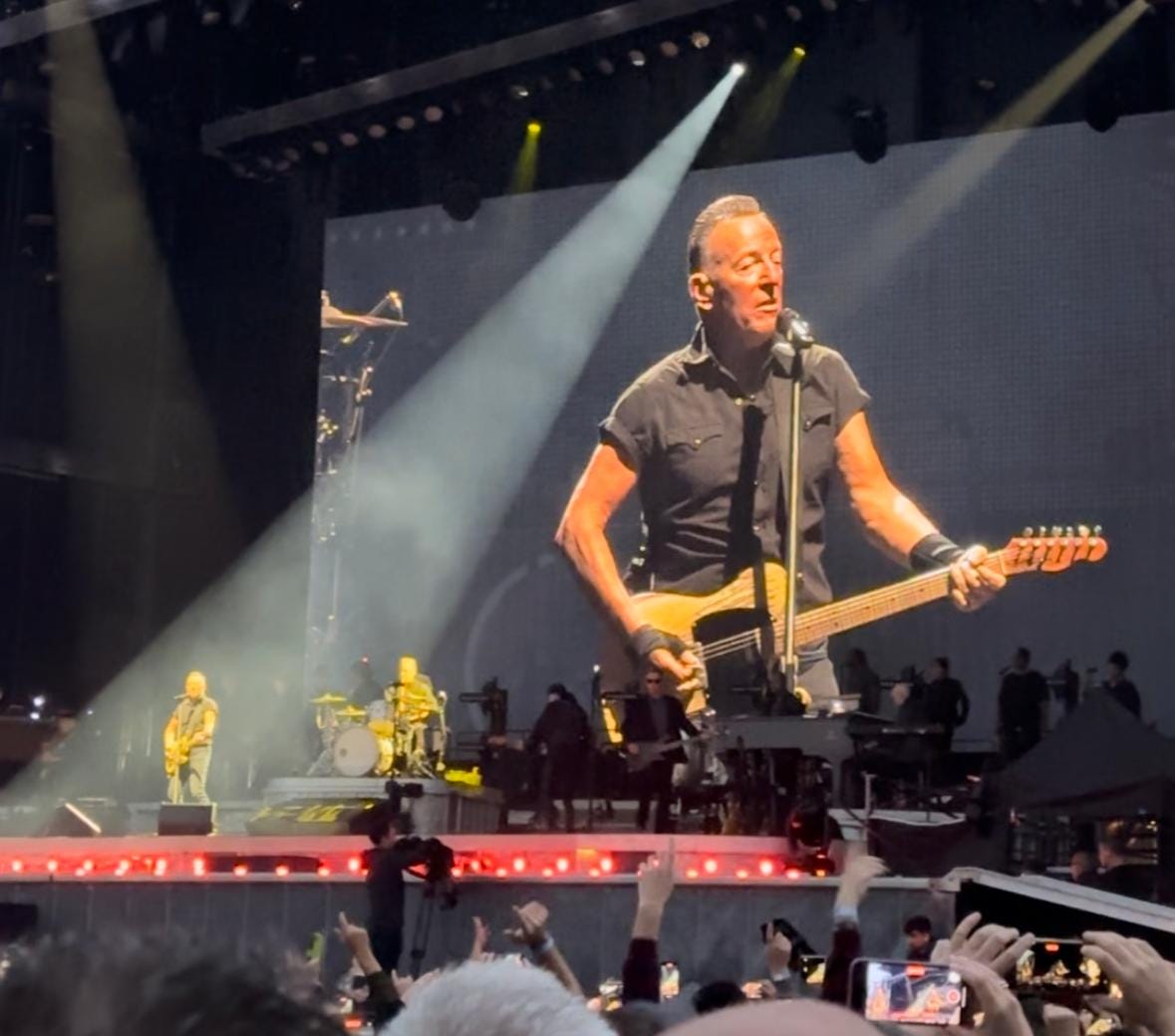

Bruce in Barcelona

Let’s be real, this experience is going to speak to a wildly different audience than Coachella. 😂 But what do we have here? Range. When a good friend offers a spontaneous trip to come out and see their favorite artist, Bruce Springsteen, play in another country, what do we do? We check our PTO, say yes, and buy a ticket. We were born to run.

With a hungry heart we’re going to be dancing in the dark with Rosalita and eating tapas (and for him too much jamon y pan con tomate). Living the glory days, thinking about the streets of Philadelphia (for a family where every single member went to UPenn lol). I’m on fire (that’s a creepy song). My hometown.

Bruce’s music is wholesome. And him too. He’s been married for over 32 years to his wife, Patti Scialfa, whom he met in a bar and is also in the band. You can feel the authenticity, love for music, and electricity with every song. For a 73y/o it’s impressive!

A bonus is that he’s buddies with Obama. They landed right after us, there were dogs sniffing, polizia surrounding the small terminal, and a select few paparazzi waiting to snap pics. They threw a private afterparty after night 1 at our hotel bar so naturally we waited in the lobby until 4am not to miss the chance of Bruce walking through. We saw every member of the band but Bruce. Nonetheless, super-fan Cory was super happy. When it came to the Sunday night 2 show, we knew well enough to get back to the hotel bar early, and ended up hanging out with the entire E Street band after their massive performance. It was almost too casual.

While it may not be as expected as you’d think, Barcelona is his favorite place to play. The locals are obsessed. Every restaurant was playing his albums. Every Spaniard in the audience knew every single lyric. This was a good lesson in embracing your unintended audiences. For someone whose music is centered around Born In the USA, it’s quite peculiar how Bruce has established such a rich fan base in Spain. Enough to grab his buddies the Obama’s and Spielberg’s to make the unique trip. But once Bruce’s energy hit the stage (& it was nonstop for 3 hours!) you knew why. He was radiant and captivating, enough to get any language or culture to follow along. Additionally, it is intriguing to consider how such cultural connections can help improve diplomatic relationships between the US and Spain…

Outside of the concert, one of the best parts about coming to Europe is being in a different time zone and taking advantage of the relaxed cafe society. Walking around the city, resting, late long dinners, dancing, site-seeing. It’s all very restorative. Next stops on the trip are Mallorca and Copenhagen. If you have any recs shoot them over!

Musings

First Republic Bank Is Seized by Regulators and Sold to JPMorgan Chase, NYT

E126: Big Tech blow-out, Powell’s recession warning, lab-grown meat, RFK Jr shakes up race & more, All-in Podcast

Dr. Matthew MacDougall: Neuralink & Technologies to Enhance Human Brains, Dr. Huberman Podcast

Dr. Matthew MacDougall discusses Neuralink's revolutionary technology that merges the human brain with computers, providing insights into the exciting possibilities and ethical dilemmas surrounding the enhancement of cognitive abilities, telepathic communication, and neurological disorder treatments.

No, airpods won’t penetrate the blood brain barrier and give you brain cancer (..what a relief)

Keith Rabois’s Most Contrarian Takes on Start-Ups, Logan Bartlett Show

Keith Rabois is most known as an Investor at Founders Fund, led by Peter Thiel. Keith discusses why he hates OKRs, why he’d never invest in a remote-first company and the lessons he’s learned from working under Peter Thiel and Reid Hoffman.

Eat What You Kill, The Meritocracy of Venture Capital, Kyle Harrison

Kyle explores the commission-based pay model prevalent in the VC industry, analyzing its impact on employee motivation, performance, and organizational culture, while also exploring the potential drawbacks and benefits of this system.

“Building a replicable, disciplined, long-term success engine is more than just "getting deals done." It's building a culture, product, institution, and mentality that drives towards success. That's the kind of output that I want to measure, and that I want to be held accountable for building.”

. . .

Last Week (4/24-4/28):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Super.com, Clara, m3ter, Summer, Flow, Ansa, Plumery, Dori, TympaHealth, Third Way Health, Pinecone, Ursa Major, Replit, Cosmose AI, SPAN, Community, Fireside, Katmai, Hydrosat, Bobsled, TinyTap, AIXplain, AirOps, Aadya Security, Hana Kuma, Openlayer, Stack Identity, Operant, Ohmium, Virta, Radiant Industries, Avalanche Energy, Woodoo, CarbonChain; Tripleseat, EverCommerce, PlayStation, Wagr/Yahoo; Kenvue

Final numbers on Big Techs Good Start to the Year at the bottom.

Deals

Fintech:

- Super.com, a San Francisco-based savings app company, raised $85 million in Series C funding. Inovia Capital led the round and was joined by Hyphen Capital, EDC, Plaza Ventures, and others.

- Clara, a São Paulo-based business spend management platform for Latin American companies, raised $60 million in funding led by GGV Capital.

- Berachain, a Layer 1 blockchain, raised $42m. Polychain Capital led, and was joined by Hack VC, Shima Capital, Robot Ventures and Goldentree Asset Management. https://axios.link/3Lopi8Z

- Axoni, a New York-based data synchronization technology and financial market infrastructure provider, raised $20 million in funding. EJF Ventures led the round and was joined by Laurion Capital Management, Communitas Capital, and others.

- m3ter, a London-based pricing operations platform, raised $14 million in Series A funding. Notion Capital led the round and was joined by Insight Partners, Union Square Ventures, and Kindred Capital.

- Credora, a New York-based lending infrastructure provider, raised $6 million in funding from S&P Global and Coinbase Ventures.

- Summer, a New York-based student loan repayment platform, raised $6 million in Series A extension funding from General Catalyst and QED.

- DFlow, a decentralized payment for order flow protocol, raised $5.5m. Framework Ventures led, and was joined by Coinbase Ventures, Circle Ventures, Cumberland, Wintermute Ventures, Spartan Group and ZeePrime. www.dflow.net

- Ansa, a San Francisco-based digital wallet infrastructure platform, raised $5.4 million in seed funding. Bain Capital Ventures led the round and was joined by Box Group, Wischoff Ventures, Cambrian Ventures, The Fintech Fund, Susa Ventures, and others.

- Kluster, a London-based B2B SaaS revenue forecasting platform, raised $5 million in Series A funding. Foresight Group led the round and was joined by SuperSeed and other angels.

- Plumery, a component-based banking tech startup, raised $4.5m in seed funding from Better Tomorrow Ventures, Headline, Seedcamp and Cocoa Ventures. https://axios.link/41T9Ozd

- Dori, an Atlanta-based generative-A.I. platform for private market transactions, raised $2 million in seed funding. Counterpart Ventures, Correlation Ventures, Service Provider Capital, and others.

- Teahouse Finance, a Taiwan-based decentralized asset management and strategy platform provider, raised $2 million in funding from AppWorks.

- YELO Funding, a New York-based college financing solution platform, raised $1.2 million in pre-seed funding from Stéphane Conrard and other angels.

. . .

Care:

- Therini Bio, a San Francisco-based inflammatory neurodegenerative and retinal disease biotech company, raised $36 million in Series A funding co-led by Dementia Discovery Fund, MRL Ventures Fund, Sanofi Ventures, and SV Health Investors’ Impact Medicine Fund.

- TympaHealth, a London-based hearing assessment and diagnostic solution platform, raised $23 million in Series A funding led by Octopus Ventures.

- Third Way Health, an LA-based provider of front-of-office administrative tools for medical practices, raised $1.55m in pre-seed funding led by ApolloMed. www.thirdway.health

. . .

Enterprise & Consumer:

- Pinecone, a San Francisco-based vector database company, raised $100 million in Series B funding. Andreessen Horowitz led the round and was joined by ICONIQ Growth, Menlo Ventures, and Wing Venture Capital.

- Ursa Major, a Berthoud, Colo.-based rocket engine maker, raised $100m in Series D funding from backers like BlackRock and Space Capital, per TechCrunch.

- Replit, an SF-based online integrated development environment, raised $97.4m at a $1.2b valuation from backers like Andreessen Horowitz, Khosla Ventures and Coatue. https://axios.link/40xR5bv

- Cosmose AI, a retail customer data analytics platform, raised an undisclosed amount of strategic funding from the Near Foundation at a $500m valuation. https://axios.link/3LoMFPB

- SPAN, a San Francisco-based home electrification technology provider, raised $96 million in Series B2 funding. Wellington Management led the round and was joined by Congruent Ventures, Capricorn Investment Group, Qualcomm Ventures, Fifth Wall, Munich Re Ventures, A/O PropTech, and Amazon’s Alexa Fund, among others.

- Avalor, a Tel Aviv-based security info organization company, raised $25 million in Series A funding. TCV led the round and was joined by Salesforce Ventures.

- Community, an SMS engagement platform co-founded by Ashton Kutcher and Guy Oseary, raised $25m from Morgan Stanley's Next Level Fund, HubSpot, Pier 70 Ventures, Verizon Ventures, GSW Ventures, Backstage Capital, Wocstar Fund and insider Salesforce Ventures. https://axios.link/3HwuwNN

- Fireside, an interactive entertainment app, raised $25m in Series A funding at a $138m post-money valuation, per TechCrunch. Backers include Mark Cuban, Paris Hilton, Tim Connors, Zeke Bronfman, Evan Abraham, Redbeard Ventures and David DeVoe. https://axios.link/449w9dW

- Katmai, a New York-based video conferencing startup that includes a 3D engine a New York-based, raised $22m in Series A finding led by Starr Insurance Cos. www.katmaitech.com

- Bobsled, a Los Angeles-based cross-cloud data-sharing platform, raised $17 million in Series A funding funding co-led by Greycroft and Madrona.

- Hydrosat, a Washington, D.C.-based climate tech company, raised $15 million in Series A funding. Statkraft Ventures led the round and was joined by Blue Bear Capital, Hartree Partners, OTB Ventures, Freeflow Ventures, Cultivation Capital, Techstars, Santa Barbara Venture Partners, Expon Capital, and Hemisphere Ventures.

- Levitate, a Raleigh, N.C.-based CRM software startup, raised $14m in Series C funding from Bull City Venture Partners, Tippet Partners, Protagonist and The Tweener Fund. https://axios.link/3AvOc0f

- Relay, a Raleigh, N.C.-based cloud platform for frontline teams, raised $13 million in Series A funding from Sovereign's Capital, Wind River Ventures, and others.

- Arado, a São Paulo-based platform connecting fruit and vegetable producers to restaurants and retailers, raised $12 million in funding. Acre Venture Partners led the round and was joined by Syngenta Group Ventures, Globo Ventures, Valor Capital, MAYA Capital, and SP Ventures.

- Ctrl, a London- and Tel Aviv-based workspace automation platform, raised $9 million in funding. LocalGlobe and Earlybird led the round and were joined by Dig Ventures, Jibe Ventures, and others.

- TinyTap, a Tel Aviv-based educational gaming platform, raised $8.5 million in funding. Sequoia China, Liberty City Ventures, Kingsway Capital, Shima Capital, Polygon, GameFi Ventures, and others invested in the round.

- AIXplain, a low-code/no-code AI app development platform, raised $8m in seed funding co-led by Transform VC and Calibrate Ventures. https://axios.link/41QLApk

- AirOps, a Miami-based A.I. deployment company, raised $7 million in seed funding. Wing VC led the round and was joined by Founder Collective, XFund, Village Global, Apollo Projects, and Lachy Groom.

- Sonet.io, a San Jose-based onboarding platform for remote workers, raised $6 million in seed funding co-led by The Hive and WestWave Capital.

- Hakimo, a Menlo Park, Calif.-based security monitoring platform, raised $6 million in funding. Rocketship.vc led the round and was joined by defy.vc, Neotribe Ventures, Firebolt Ventures, and Carrier Ventures.

- AaDya Security, a Detroit-based cybersecurity software company, raised $5 million in Series A funding. Left Lane Capital led the round and was joined by 645 Ventures, Firebrand Ventures, Gaingels, and Invest Detroit.

- Hana Kuma, Naomi Osaka's production company, raised $5m and will spin off from SpringHill, which invested alongside Epic Games, Fenway Sports Group, The Kinoshita Group and Disruptive. https://axios.link/3N83f7H

- POSH, a New York-based live experiences management and monetization platform, raised $5 million in seed funding. Companyon Ventures and EPIC Ventures co-led the round and were joined by Cameron Dallas, Day One Ventures, Pareto Holdings, Joshua Browder, and others.

- Openlayer, an AI and ML model testing platform, raised $4.8m in seed funding. Quiet Capital led, and was joined by Picus Capital, YCombinator, Hack VC, Liquid2 Ventures and Mantis VC. https://axios.link/44awjkY

- Stack Identity, a Menlo Park, Calif.-based identity and access management (IAM) governance automation platform, raised $4 million in seed funding co-led by WestWave Capital and Benhamou Global Ventures.

- Onin, a London-based calendar extension platform, raised £2.75 million ($3.43 million) in seed funding from Octopus Ventures.

- Operant, a San Francisco-based runtime application protection platform, raised $3 million in seed funding led by Felicis.

- WunderGraph, a Miami-based backend framework platform for frontend development, raised $3 million in seed funding led by Aspenwood Ventures.

. . .

Sustainability:

- Ohmium International, a Fremont, Calif.-based green hydrogen company, raised $250 million in Series C funding. TPG Rise Climate led the round and was joined by Hanover Technology Investment Management, Energy Transition Ventures, and Fenice Investment Group.

- Virta, a Helsinki-based electric vehicle charging platform, raised €65 million ($71.39 million) in funding. Jolt Capital led the round and was joined by Future Energy Ventures and others.

- Radiant Industries, an El Segundo, Calif.-based portable nuclear reactor development company, raised $40 million in Series B funding. Andreessen Horowitz led the round and was joined by Founders Fund, Decisive Point, McKinley Alaska, Draper Associates, Cantos, and BoostVC.

- Avalanche Energy, a Seattle-based fusion energy company, raised $40 million in Series A funding. Lowercarbon Capital led the round and was joined by Founders Fund and Toyota Ventures.

- Woodoo, a Paris-based maker of composite materials, raised $31m in equity and debt funding. Lowercarbon Capital led, and was joined by One Creation and Purple. https://axios.link/3LzXsH7

- CarbonChain, a London-based carbon accounting platform, raised $10 million in Series A funding co-led by Union Square Ventures and Voyager Ventures.

Acquisitions & PE:

- General Atlantic acquired a majority stake in Tripleseat, a Concord, Mass.-based event management software and payments solution provider for the hospitality industry, from Vista Equity Partners. Per the terms of the deal, Vista Equity Partners, Level Equity, and Enlightened Hospitality Investments will retain a minority stake. Financial terms were not disclosed.

- Steve Apostolopoulos, a Canadian billionaire, claims he's still in the running to buy the NFL's Washington Commanders from Dan Snyder, who has a deal in principle with Josh Harris.

- EverCommerce (Nasdaq: EVCM), a Denver-based management software provider with a $2.5b market cap, hired Centerview Partners to explore a sale, per Reuters. https://axios.link/3H7H2CW

- EQT agreed to buy IMG Academy, a Bradenton, Fla.-based student athlete development program, from Endeavor (NYSE: EDR) for $1.25b. https://axios.link/41JqauM

- PlayStation, a division of Sony Interactive Entertainment (NYSE: SONY), agreed to acquire game developer Firewalk Studios from ProbablyMonsters Inc. https://axios.link/3AlzhW6

- Yahoo, a portfolio company of Apollo Global Management, acquired Wagr, a sports betting app that raised around $10m in VC funding from backers like Greycroft, Seven Seven Six, Pear, Villhard Growth Partners, HBSE Ventures, BITKRAFT Ventures and The Kraft Family Foundation. https://axios.link/3Nd7b7m

- Lookout, an SF-based enterprise security company last valued by VCs at $1.75b, agreed to sell its consumer mobile security business to listed Finnish company F-Secure for around $223m. https://axios.link/3Va1h95

. . .

IPOs:

- Kenvue, the consumer health products business being spun out of Johnson & Johnson (NYSE: JNJ), set IPO terms to 151.2m shares at $20-$23. It would have a fully diluted market value of $40.6b, were it to price in the middle, and the $3.3b raise would be the largest U.S. IPO since Rivian in late 2021. https://axios.link/41FtWVY

. . .

SPACs:

Nothing to see here…

Funds:

- Twitter is seeking to sell LP stakes in several small venture capital funds, threatening to default on capital calls if it cannot find a buyer, per Forbes. The commitments were made prior to Elon Musk's takeover. https://axios.link/3ozoWU1

Meta, Microsoft, Alphabet, and Amazon all announced solid quarterly earnings this week as big tech continues to bounce back from 2022, a year in which the four shed nearly $3 trillion of market cap between them.

Every cloud...

Meta has had a tough time since its name-change 18 months ago. However, the social media giant reminded everyone that its apps are still wildly popular, reporting over 3 billion daily active users for the first time across its family of Facebook, Messenger, WhatsApp and Instagram. Also well-received was the return to revenue growth after 3 consecutive quarters of decline. That paves the way for Zuckerberg to continue investing in his biggest bets: AI and the much-maligned metaverse.

Microsoft continues to march on. Revenue grew 7% year-over-year, and its Azure cloud-computing business held up better than expected, growing 27%. Elsewhere, the company’s partnership with OpenAI, the maker of ChatGPT, promises continuing innovations for the entire Microsoft suite. Those developments have contributed to a ~$480bn increase in MSFT's market cap since the beginning of 2023 — equivalent to gaining the value of about 8 Ubers.

Google’s owner Alphabet posted more measured results as the firm continues to play catch-up since the rollout of AI-powered search from Microsoft. The company’s ad revenue fell, although not as sharply as expected, and lower costs helped the bottom line beat expectations.

Amazon nearly delivered a win. The company’s shares initially soared as much as 10% on the back of a better-than-expected quarter… but cautious comments about its all-important cloud division — where growth slowed to 16% from 37% last year — sparked fears for the future.

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.