Sourcery (4/3-4/7)

Succession ~ LayerZero Labs, Spendflo, Hype, Monite, HeartFlow, OXOS Medical, Wealth, Florence, Earned, Tally Health, Travelport, Cybereason, Honeycomb, Strivacity, Chroma, True Anomaly, Push Security

I won’t ruin Succession if you haven’t watched it yet (ehem Kyle ehem). But the latest episode (S4, Ep 3) sent shockwaves. It was hands down the best one yet. Reaching a series high of 2.5 million viewers on Sunday night. Chuckles the Clown and all.

Moving on.. the entire city of LA (..okay one very loud part of LA) is preparing for its annual shut down and migration out to the desert. Yes. It is time for Coachella. Let’s all hope Revolve Festival has their shuttles scheduled with GenAI this time.

Anyways, back to it. There were a light amount of deals last week as YC likely took most of the attention of tech readers. More below.

. . .

Last Week (4/3-4/7):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include LayerZero Labs, Spendflo, Hype, Monite, HeartFlow, OXOS Medical, Wealth, Florence, Earned, Tally Health, Travelport, Cybereason, Honeycomb, Strivacity, Chroma, True Anomaly, Push Security, Fetcherr, Agnostiq, Trustle, Anvil, Roboto.ai, CarmaCare, LALA, Narrato; Aesop, Scopely, GoodBelly, Acorns/GoHenry, Fanatics/EPI, Boxed

Final numbers on Sweetgreen’s Numbers (it’s just not the same anymore) at the bottom.

Deals

Fintech:

- LayerZero Labs, a Vancouver-based messaging protocol developer, raised $120 million in Series B funding. A16z crypto, BOND, Christie's, Circle Ventures, OpenSea Ventures, Samsung Next, Sequoia Capital, and others invested in the round.

- TerraPay, a British payments infrastructure company, raised $100m in Series B funding. IFC led, and was joined by Prime Ventures, Partech and the U.S. DFC. https://axios.link/3Mhe9b4

- M^ZERO Labs, a Berlin-based decentralized infrastructure company, raised $22.5 million in funding. Pantera Capital led the round and was joined by Road Capital, AirTree, Standard Crypto, The SALT Fund, ParaFi Capital, Distributed Capital, Kraynos Capital, Mouro Capital, and Earlybird.

- Spendflo, a San Francisco-based SaaS buying and management solution platform, raised $11 million in Series A funding co-led by Prosus Ventures and Accel Partners.

- Hype, formerly known as Pico, a New York-based marketing and payments platform for creators and small businesses, raised $10 million in Series A funding. King River Capital led the round and was joined by Bullpen Capital, Precursor Ventures, Bloomberg Beta, Tapestry VC, and Sterling Road.

- Monite, a Berlin-based invoicing and payables automation platform, raised an additional $5 million in seed funding co-led by Third Prime and Point72.

- Field Materials, a construction materials purchasing startup, raised $4.65m in seed funding. Blumberg Capital led, and was joined by Zacua Ventures. www.fieldmaterials.com

- Franklin, a Wilmington, Del.-based cash and crypto payroll company, raised $2.9 million in seed funding. gumi Cryptos Capital and CMT Digital co-led the round and were joined by Arca, Sfermion, Portage Ventures, and Synergis Capital.

- Billy, a New York-based construction insurance startup, raised $2.5m co-led by Entrada Ventures and MetaProp. https://axios.link/3zBUPxm

. . .

Care:

- HeartFlow, a Mountain View, Calif.-based cardiac diagnostic platform, raised $215m in Series F funding. Bain Capital Life Sciences led, and was joined by Janus Henderson and insiders Baillie Gifford, Capricorn Investment Group, Hayfin Capital Management, HealthCor, Martis Capital, USVP and Wellington Management. https://axios.link/43gkh9u

- OXOS Medical, an Atlanta-based safe X-ray solutions developer, raised $23 million in Series A funding. Parkway Venture Capital and Intel Capital invested in the round.

- Wellth, an LA-based behavioral economics and wellness company, raised $20m in Series B funding. SignalFire led, and was joined by Evolent Health CEO Frank Williams, Social Entrepreneurs’ Fund, CD Venture, Yabeo and Partnership Fund for NYC. www.wellthapp.com

- Florence, a New York-based health care enablement software platform, raised $20 million in seed funding. Thrive Capital, GV, and Salesforce Ventures co-led the round and were joined by Vast Ventures, BoxGroup, and Atento Capital.

- Earned, a financial advisory service for physicians, raised $12m in Series A funding. Hudson Structured Capital Management and Breyer Capital co-led, and were joined by Juxtapose. www.earnedwealth.com

- Tally Health, a New York-based consumer biotechnology company, raised $10 million in seed funding. Forerunner Ventures led the round and was joined by L Catterton, G9 Ventures, and Second Sight Ventures.

- Eli, a Montreal-based provider of saliva-based hormone testing for women, raised C$5m in seed funding. Muse Capital led, and was joined by RH Capital and Cake Ventures. www.eli.health

- Teton.ai, a Copenhagen-based A.I. platform for nurses to monitor patients and optimize workflows, raised $5.3 million in funding led by Plural.

- Swehl, an LA-based breastfeeding education and support service, raised $1.1m in pre-seed funding from backers like Cleo Capital. https://axios.link/40PWeME

. . .

Enterprise & Consumer:

- Travelport, a London-based travel retail platform, raised $200 million in funding from Siris Capital Group and Elliott Management.

- Quantexa, a London- and New York-based decision intelligence solutions platform for the public and private sectors, raised $129 million in Series E funding. GIC led the round and was joined by Warburg Pincus, Dawn Capital, British Patient Capital, Evolution Equity Partners, HSBC, BNY Mellon, ABN AMRO, and AlbionVC.

- Cybereason, a Boston-based endpoint detection and cybersecurity software company, raised $100m from existing backer SoftBank. https://axios.link/418jeX4

- Covariant, an Emeryville, Calif.-based A.I. robotics company, raised an additional $75 million in Series C funding. Radical Ventures and Index Ventures co-led the round and were joined by Canada Pension Plan Investment Board, Amplify Partners, Gates Frontier Holdings, AIX Ventures, and Northgate Capital.

- Honeycomb, a San Francisco-based observability platform for cloud application behavior, raised $50 million in Series D funding. Headline led the round and was joined by Insight Partners and Scale Venture Partners.

- Everstream Analytics, a San Marcos, Calif.-based supply chain insights and risk analytics company, raised $50 million in Series B funding. Morgan Stanley Investment Management and StepStone Group co-led the round and were joined by Columbia Capital.

- DataDome, a New York-based online fraud and bot management provider, raised $42 million in Series C funding. InfraVia Growth led the round and was joined by Elephant, ISAI, and others.

- Mojo Vision, a developer of micro-LED display tech, raised $22.4m from NEA, Khosla Ventures, Dolby Family Ventures, Liberty Global Ventures, Fusion Fund, Drew Perkins, Open Field Capital and Edge. https://axios.link/3ZJhUJ9

- Strivacity, a Herndon, Va.-based customer identity and access management platform, raised $20 million in Series A-2 funding. SignalFire led the round and was joined by Ten Eleven Ventures and others.

- Vytelle, a Kansas City-based cattle herd optimization company, raised $20 million in Series B funding. Forage Capital Partners led the round and was joined by Mountain Group Partners, Grosvenor Food, Ag Tech Fund, KCRise Fund, Open Prairie, Fulcrum Global Capital, and Serra Ventures.

- Chroma, a San Francisco-based open-source embedding database provider for generative A.I., raised $18 million in seed funding led by Quiet Capital.

- True Anomaly, a Centennial, Colo.-based space security and sustainability company, raised $17 million in Series A funding. Eclipse led the round and was joined by Riot Ventures, Champion Hill Ventures, Space.VC, and Narya.

- Push Security, a London-based SaaS security platform for IT and cybersecurity teams, raised $15 million in Series A funding. GV led the round and was joined by Decibel and other angels.

- Fetcherr, a Netanya, Israel-based demand prediction and algorithmic pricing optimization solution, raised $12.5 million in Pre-Series B funding co-led by Left Lane Capital and M-Fund.

- Agnostiq, a Toronto-based computing startup, raised $6.1 million in seed extension funding. Differential Ventures led the round and was joined by Scout Ventures, Tensility Venture Partners, Green Egg Ventures, and Jane Street Capital principal Rob Granieri.

- Trustle, a Walnut Creek, Calif.-based provider of cloud access management solutions, raised $6m. Glasswing Ventures led, and was joined by FUSE, Correlation Ventures, and Capital Technology Ventures. www.trustle.io

- Anvil, a San Francisco-based paperwork automation platform, raised $5 million in Series A extension funding. Craft Ventures and Gradient Ventures invested in the round.

- Roboto.ai, a Seattle-based startup data infrastructure provider for robotics companies, raised $4.8 million in seed funding. Unusual Ventures, AI2, and FUSE Ventures invested in the round.

- CarmaCare, a Chicago-based car ownership affordability platform, raised $4.5 million in seed funding. Inspired Capital, Twelve Below, Revelry, and 81 Collection invested in the round.

- Flyby Robotics, a Los Angeles-based drone automation and delivery company, raised $4 million in seed funding. Mac Venture Capital led the round and was joined by Weekend Fund, Anthemis, and Evening Fund.

- Native AI, a Cincinnati- and New York-based market intelligence platform, raised $3.5 million in seed funding. JumpStart Ventures and Ivy Ventures co-led the round and were joined by 11 Tribes Ventures and Connetic Ventures.

- Zyod, an Indian provider of apparel sourcing and manufacturing solutions to fashion brands, raised $3.5m in seed funding led by Lightspeed Venture India Partners. https://axios.link/40D1mUl

- LALA, a remote-based digital collectible marketplace, raised $3 million in seed funding led by Seven Seven Six.

- DappBack, a San Francisco-based Web3 loyalty program provider and marketplace, raised $2.5 million in seed funding co-led by Greenfield and IOSG Ventures.

- Apptile, an SF-based no-code mobile app development SaaS, raised $2.5m in seed funding co-led by Mankekar Family Office and Ramakant Sharma. www.apptile.com

- Coast, an API demo platform for sales teams, raised $2.1m in seed funding from YC, Liquid2 Ventures, GTMFund and Brickyard. https://axios.link/3Ky3FTk

- Narrato, an SF-based AI content creation and collaboration platform, raised $1m in pre-seed funding led by AirTree Ventures. www.narrato.io

. . .

Sustainability:

- Ecosapiens, a San Francisco-based carbon-backed collectible company, raised $3.5 million in seed funding. Collab+Currency led the round and was joined by Slow Ventures, Menlo Ventures, Alumni Ventures Blockchain Fund, and other angels.

Acquisitions & PE:

- Ethos Capital acquired Newforma, a Boston-based project-information management software producer, from Battery Ventures. Financial terms were not disclosed.

- L’Oréal agreed to acquire Aesop, a Melbourne, Australia-based cosmetics brand. The deal is valued at $2.53 billion.

- Savvy Games Group, backed by the Saudi government’s Public Investment Fund, agreed to acquire Scopely, a Los Angeles-based game publisher, for $4.9 billion.

- GoodBelly, a Portland, Ore.-based gut health company, and Cheribundi, a Portland, Ore.-based sports nutrition company, merged into NextFoods. Financial terms were not disclosed.

- Acorns, an Irvine, Calif.-based savings and investment app valued by VCs at $1.8b, acquired GoHenry, a British kid-focused financial education startup that had raised over $100m from firms like Edison Partners, Nexi, Citi Ventures and Revaia. https://axios.link/3Mc0Isz

- Authentic Brands Group agreed to buy Boardriders, an Oaktree Capital Partners-owned apparel maker whose brands include Billabong and Quiksilver. ABG backers include BlackRock, Lion Capital, General Atlantic and CVC Capital Partners. https://axios.link/3MeuoWg

- Cineworld (LSE: CINE), the owner of Regal movie theaters, said it’s reached an agreement with lenders to emerge from Chapter 11 bankruptcy protection. https://axios.link/3K8tNCQ

- Extra Space Storage (NYSE: EXR) agreed to buy Life Storage (NYSE: LSI) for $12.4b. https://axios.link/3nFhcj1

- Fanatics, a Jacksonville, Fla.-based sports merchandising giant most recently valued at $31b, acquired Italian sports apparel and goods retailer EPI. https://axios.link/3ZDB9nn

. . .

IPOs:

Nothing to see here…

. . .

SPACs:

- Boxed (NYSE: BOXD), an online wholesale retailer that went public via SPAC in Dec. 2021, filed for Chapter 11 bankruptcy protection. The company had rejected a $500m takeover offer in 2018 from Kroger. https://axios.link/3U6EUAF

Funds:

- Canaan raised $850m for its 13th flagship VC fund. https://axios.link/3m7ZOD9

- Erin and Sara Foster, founders of the fashion brand Favorite Daughter, launched a VC firm called Oversubscribed Ventures. Backers include Corazon Capital. https://axios.link/3nOF3ga

- Cure Ventures, a Boston-based venture capital firm, raised $350 million for a fund focused on early-stage investments in the life science and biotechnology sector.

- Theory Ventures, Portola Valley, Calif.-based venture capital firm, raised $230 million for a fund focused on investing $1 million to $25 million in early-stage software companies.

- Flume Ventures is launching as a Nevada-based enterprise tech VC firm, per Bloomberg. It will be led by Matt Nordby (ex-Lion Capital), with Imran Khan (Verishop CEO, ex-Snap) and Scott McNealy (co-founder of Sun Microsystems) serving as operating partners. LPs in a $100m-targeted debut fund include Dave Duffield and golfer Annika Sörenstam. https://axios.link/3Get1D9

Chickening out

The 2 day Sweetgreen-Chipotle war is over after the salad maker agreed to change the name of its latest menu offering, the “Chipotle Chicken Burrito Bowl”, after Chipotle filed a lawsuit accusing the chain of copyright infringement.

The move makes sense for Sweetgreen. The company's shares had closed 6% down on the day Chipotle claimed that promotional materials for the product used the fast-Mexican chain’s iconic font and that the new “very similar and directly competitive” bowl could confuse customers.

Wilting

Sweetgreen was dreamed up back in 2007 by 3 college students who’d grown tired of the nutritious-but-overpriced or cheap-but-unhealthy options they’d encountered while at school. The company’s seen impressive growth since, from its debut store in Washington DC, to becoming the “first-ever restaurant unicorn”, with a much-hyped stock market debut following in 2021. Getting the financials into the green, however, hasn’t come easily.

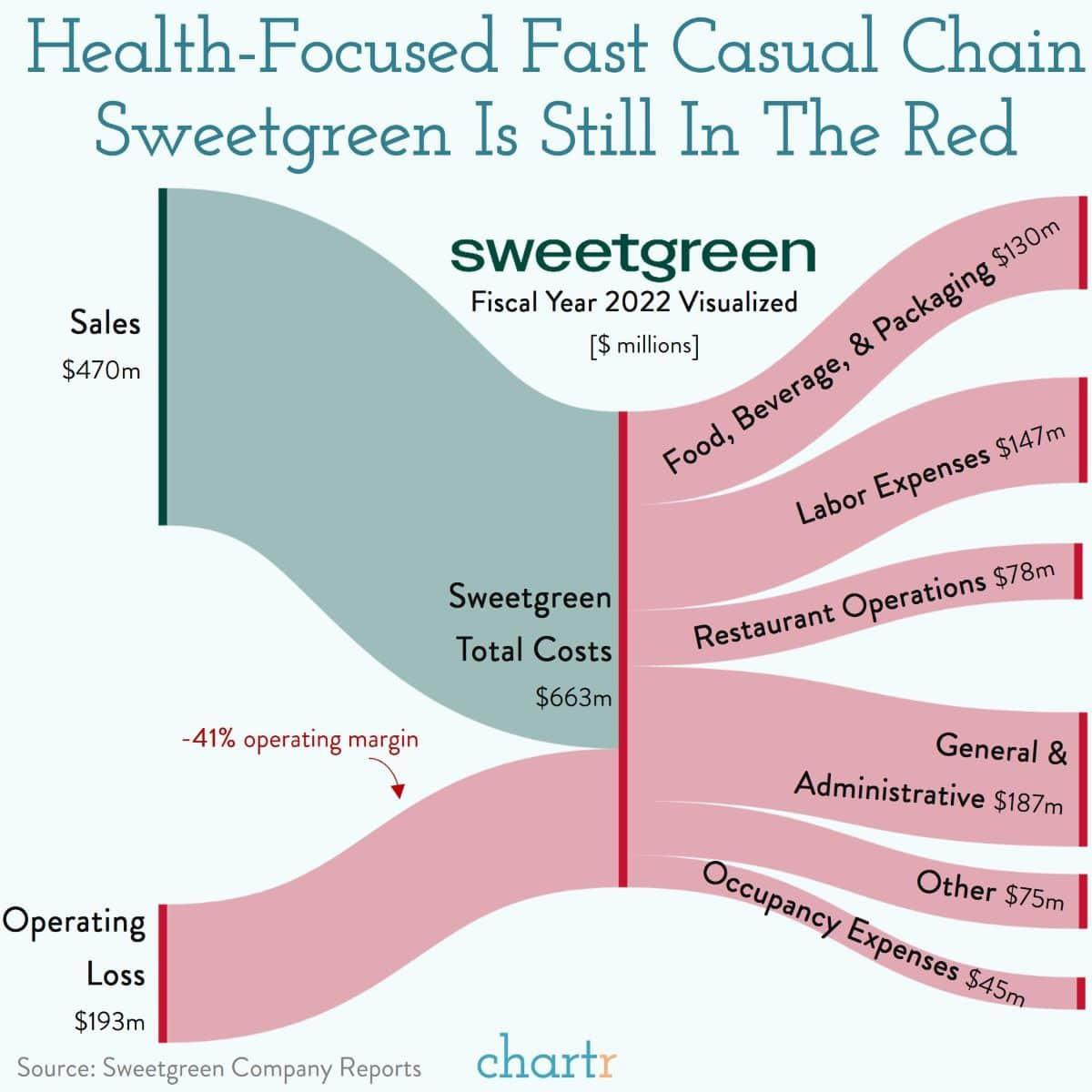

Even though its salads and sides aren’t particularly wallet-friendly — Sweetgreen's bowls can easily cost $15 or more — the company is yet to turn its sales into profit. Despite revenues of $470m in 2022, Sweetgreen posted an operating loss of $193m, building on the $134m loss the year before. Even with the resolution of the lawsuit, the shares are still down ~85% since going public.

. . .

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.