Sourcery (4/4-4/8)

Oh hi lol its Elon, again ~ Binance.US, Sky Mavis, Fractal, Community Gaming, Oura, Future Family, Conceive, Fanatics, Remote, Fetch Rewards, Nord Security, Climeworks, Waterplan, Hypebeast

Much ado about nothing.

Are we surprised Elon isn’t joining Twitter’s board? No. The hail mary offer from Twitter (TWTR) did seem like an opportunistic ‘let’s see if this sticks’ for Parag Agrawal after the stock shot up from his generous hobby-stake announcement last week (FYI this was the only substantial movement for the company since it took a nose-dive in value after July 2021). But, let’s be realistic here, as much as we want to romanticize Elon potentially joining the board of Twitter he is already the CEO of two mega companies, $1T Tesla (TSLA) and $100B SpaceX. Of which, for comparative value, are actually consequential for the world (hint climate change) over a social media platform that will either end up continuing to chug along publicly, go private, or ultimately get bought by someone like Bezos. On the bright side, this is an exciting little shakeup and a step towards what we in the tech world call.. “Innovation”. Parag is making some moves, being ambitious, and taking a little risk for a company with little to no new features for years. So let’s give Parag a thumbs up… and then let’s let Elon be Elon and live in his 10x10 prefab tiny home, give him an edit button, and let him keep bringing emissions & rockets back down to earth.

Follow us on Twitter Linkedin for just the top deals recap

@MollySOShea @MarissaCohen @Kirsten_Stainer

. . .

Last Week (4/4-4/8):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include NEAR Protocol, Binance.US, Sky Mavis, CertiK, Fidel API, Ellevest, Fractal, Rattle, Community Gaming, Creative Juice, Novel, Starlight, Leap, NationsBenefits, Oura, Clarify Health, Enable Medicine, Season Health, Evernow, Future Family, Eleos Health, Eon, Conceive, Fanatics, Remote, Fetch Rewards, Grafana Labs, Nord Security, Collectors Holdings, Hadrian, Lilt, OpenPhone, Tinybird, Thunkable, Appwrite, ReadySet, KarmaCheck, 8Base, Prepared, Songfinch, Lucky, Climeworks, Sweep, ClimeCo, Better Origin, Brilliant Planet, Waterplan; Elon Musk, Shein, Niantic, Bolt Financial, Farfetch; Hypebeast

Final numbers on VC 2022 Slowdown at the bottom.

Notable fund-raises… I Squared Capital raised $15 billion for a fund focused on climate change, supply chains, and energy transition, Lead Edge Capital raised $2B, Imaginary Ventures raised $500M, Base10 Partners raised $460M for early stage, Expa the venture group led by Garrett Camp raised $200M, Wireframe Ventures focused on climate and health raised $77M

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- NEAR Protocol, a smart contract blockchain platform, raised $350m. Tiger Global led, and was joined by Republic Capital, Hashed, FTX Ventures and Dragonfly Capital. http://axios.link/cnLN

- Binance.US, the digital asset exchange and marketplace's U.S. division, raised $200 million in seed funding from investors including RRE Ventures, Foundation Capital, Original Capital, VanEck, Circle Ventures, Gaingels, and Gold House.

- Sky Mavis, the crypto gaming studio behind Axie Infinity, raised $150 million to reimburse users affected by the recent Ronin Bridge hack. Ronin was one of the largest crypto thefts in history, totaling over $600 million, and this appears to be the first time a hacked crypto company has raised outside funding to make users whole. Binance led, and was joined by Animoca Brands, Andreessen Horowitz, Dialectic, Paradigm and Accel.

- CAIS, a New York-based alternative investment platform, raised $100 million in funding from Reverence Capital Partners.

- CertiK, a New York-based web3 and blockchain security company, raised $88m in Series B3 funding at a $2b valuation from Insight Partners, Tiger Global, Advent International, Goldman Sachs and insiders Sequoia Capital and Lightspeed Venture Partners. http://axios.link/MpNr

- Fidel API, a New York-based financial infrastructure platform, raised $65m in Series B funding. Bain Capital Ventures led, and was joined by insiders NYCA Partners and QED Investors. www.fidelapi.com

- Ellevest, a New York-based digital investment platform for women, raised $53m in Series B funding. BMO and Contour Venture Partners co-led, and were joined by Halogen Ventures, Cleo Capital, New York Ventures of Empire State Development, Stardust Equity, The Venture Collective, Envestnet and Geingels. www.ellevest.com

- Boba Networks, an Ethereum scaling startup, raised $45m in Series A funding at a $1.5b valuation from Crypto.com, Huobi and BitMart. http://axios.link/5va2

- Fractal, a marketplace for gaming NFTs, raised $35 million in seed funding led by Paradigm and Multicoin Capital and was joined by investors including Andreessen Horowitz, Solana Labs, Animoca, Coinbase, Play Ventures, Position Ventures, Zynga founder Mark Pincus, Crossover, Shrug Capital, TerraForm CEO Do Kwon, and Tim Ferriss.

- Coin Metrics, a Boston-based crypto financial intelligence startup, raised $35m in Series C funding. Acrew Capital and BNY Mellon co-led, and were joined by Goldman Sachs, Fidelity Investments, Highland Capital Partners, Avon Ventures and Morningside Technology Ventures. http://axios.link/T1GK

- Rattle, an SF-based revenue orchestration SaaS, raised $26m in Series A funding. Insight Partners led, and was joined by GV and insiders Sequoia Capital and Lightspeed Venture Partners. http://axios.link/wI98

- lemon.markets, a Berlin-based API provider for stock trading and market data, raised €15 million ($16.6 million) in seed funding co-led by Lakestar and Lightspeed and was joined by investors including Creandum, System.one, and others.

- Community Gaming, a New York-based online gaming tournament software platform that offers cryptocurrency in exchange for gameplay, raised $16 million in Series A funding led by SoftBank Group's SB Opportunity Fund and was joined by investors including Animoca Ventures, Binance Labs, BITKRAFT Ventures, and Griffin Gaming Partners.

- Creative Juice, a San Francisco-based creator-focused banking platform, raised $15 million in Series A funding led by Acrew Capital and was joined by angels and investors including lawyer Meena Harris, Concrete Rose, former NFL athlete Larry Fitzgerald, TikToker Jared Waldrom, and others.

- RenoFi, a Philadelphia-based home renovation loan platform provider, raised $14 million in Series A funding led by Canaan joined by investors including Nyca Partners and CMFG Ventures.

- Antimatter, an Oakland, Calif.-based data security company for SaaS applications, raised $12 million in Series A funding led by NEA and was joined by investors including General Catalyst, UNION Labs, and other angels.

- Amplemarket, an SF-based revenue platform, raised $12m in Series A funding. Comcast Ventures and Armilar Venture Partners co-led, and were joined by Flexport and Caixa Capital. www.amplemarket.com

- Afficiency, a New York-based digital life insurance policies marketplace, raised $7 million in Series A funding led by IA Capital Group and was joined by investors including Impression Ventures, SBLI, and Western & Southern Life.

- Datanomik, a Uruguayan B2B open finance API startup, raised $6m in seed funding led by Andreessen Horowitz. http://axios.link/oKg4

- RevenueBase, a Boston-based B2B data SaaS for sales and marketing teams, raised $6m in seed funding led by Bessemer Venture Partners. www.revenuebase.ai

- Novel, a New York-based Web3 commerce platform, raised $6 million in seed funding led by Lerer Hippeau and was joined by investors including VaynerFund, Rothy’s founder Roth Martin, Sugar Capital, and Costanoa Ventures.

- Starlight, a New York-based corporate digital asset management startup, raised $5m in seed funding. Abstract Ventures and A*Capital co-led, and were joined by BoxGroup, SV Angel, Paxos and Brevan Howard. www.starlight.money

- Parallel Finance, a decentralized lending and staking protocol, raised $5 million in funding from investors including Section 32, Coinbase, and others.

- Leap, a wallet for Terra, raised $3.2 million in seed funding co-led by CoinFund and Pantera.

- Clockwork, a Chicago-based financial planning and analysis platform for small businesses, raised $2m from Underscore VC. www.clockwork.ai

. . .

Care:

- NationsBenefits, a Plantation, Fla.-based provider of supplemental benefits to health plans, raised an undisclosed amount of growth funding led by General Atlantic. Return backers included The Pritzker Organization and Denali Growth Partners. www.nationsbenefits.com

- Oura raises an undisclosed amount of capital at a $2.55B valuation for its connected health-tracking rings. Has sold >1M rings to date and logs >2.5B sleep hours.

- Clarify Health, a San Francisco-based cloud analytics and value-based payments platform company, raised $150 million in Series D funding led by SoftBank Vision Fund 2 and was joined by funds and accounts managed by BlackRock and Memorial Hermann Health System. It was also joined by investors including Insight Partners, Spark Capital, KKR, Aspenwood Ventures, Rivas Capital, and Sigmas Group.

- IntelyCare, a Quincy, Mass.-based nurse staffing platform, raised $115m in Series C funding at a $1.1b valuation. Janus Henderson Investors led, and was joined by Longitude Capital, Leeds Illuminate, Endeavour Vision, Revelation Partners and Kaiser Permanente Ventures. www.intelycare.com

- Lightning Labs, a Palo Alto-based startup that enables stablecoin transfers via its bitcoin network, raised $70m in Series B funding. Valor Equity Partners led, and was joined by Ballie Gifford, Goldcrest Capital and Vlad Tenev. http://axios.link/BV63

- Enable Medicine, a Menlo Park, Calif.-based provider of searchable maps of human disease, raised $60m in Series A funding. Anthos Capital and General Catalyst co-led, and were joined by Initialized Capital, Breyer Capital, Presight Capital and Axial. www.enablemedicine.com

- Season Health, an Austin, Texas-based “digital food pharmacy,” raised $34m in Series A funding. Andreessen Horowitz led, and was joined by LRV Health and Company Ventures. http://axios.link/9Rtx

- Evernow, a San Francisco-based menopause telehealth startup, raised $28.5 million in Series A funding led by NEA and was joined by investors including 8VC, Refactor Capital, Coelius Capital, actor and Goop founder Gwyneth Paltrow, and actor and talk show host Drew Barrymore.

- Savana, a Madrid, Spain-based A.I.-based health record management platform, raised $25 million in funding from Conexo Ventures, Knuru Capital, Aldea Ventures, Seaya Ventures, and Cathay Innovation.

- Future Family, a San Francisco-based IVF and egg fertility treatments loan provider, raised $25 million in Series B funding led by Munich Re Ventures and was joined by investors including TriVentures, MS&AD Ventures, ORIX, Aspect Ventures, Mindset Ventures, at.inc/, and OurCrowd.

- Eleos Health, a Boston-based startup that uses voice tech to analyze behavioral health sessions, raised $20m in Series A funding, per Axios Pro. F-Prime Capital and Eight Roads Ventures co-led, and were joined by aMoon Fund, lool ventures and Arkin Holdings. http://axios.link/uCgk

- Eon, a Denver-based provider of incidental findings and screening patient management software, raised $16m led by Integrity Growth Partners. www.eonhealth.com

- PocketHealth, a Toronto-based medical image sharing platform for patients, raised $16 million in Series A funding led by Questa Capital and was joined by Radical Ventures.

- Flexia, a Berkeley, Calif.-based in-home pilates station, raised $4 million in seed funding led by ADvantage and was joined by investors including Phoenix Capital Ventures, Techstars Sports Accelerator, and Calm Ventures.

- Conceive, a fertility startup led by former Andreessen Horowitz investor Lauren Berson, raised $3.7m in seed funding. Kindred Ventures led, and was joined by Great Oaks and Founder Collective. www.weconceive.com

. . .

Enterprise & Consumer:

- Fanatics, the Jacksonville, Fla.-based sports merchandising giant, raised another $1.5b, including $230m from lead investor the National Football League, at a $27b valuation. Other round participants include Major League Baseball and its owners, MLB Players Association, NFL Players Association, the National Hockey League, Joe Tsai's Blue Pool Capital and the Qatar Investment Authority. http://axios.link/eXqU

- Remote, an SF-based distributed workforce management company, raised $300m in Series C funding. SoftBank led, and was joined by insiders Accel, Sequoia, Index Ventures, Two Sigma Ventures, General Catalyst, 9Yards, Adams Street and Base Growth. http://axios.link/52nr

- Fetch Rewards, a Madison, Wis.-based shopping rewards app, raised $240m at a valuation north of $2.5b. Hamilton Lane led, and was joined by SoftBank, Iconiq and DST Global. http://axios.link/RXyd

- Grafana Labs, a New York-based performance monitoring platform developer, raised $240 million in Series D funding led by GIC and was joined by investors including J.P. Morgan, Sequoia Capital, Coatue, Lightspeed Venture Partners, and Lead Edge Capital.

- LogicSource, a South Norwalk, Conn.-based procurement services and technology solutions provider, raised $180 million in funding from FTV Capital.

- Jüsto, a Mexico City-based online grocer in Latin America, raised $152 million in Series B funding led by General Atlantic and was joined by investors including Tarsadia Capital, Citius, Arago Capital, Foundation Capital, Quiet Capital, and others.

- The Honest Kitchen, a San Diego-based pet food brand, raised $150 million in funding from Monarch Alternative Capital.

- Improbable, a U.K.-based metaverse technology company, raised $150 million in funding co-led by Andreessen Horowitz and SoftBank Vision Fund 2 and were joined by investors including Mirana, DCG, CMT, SIG, and Ethereal Ventures.

- Grover, Berlin-based electronics rental platform, raised $110 million in Series C funding led by Energy Impact Partners and was joined by investors including Korelya Capital, Mirae Asset-LG Electronics New Growth Fund, Viola Fintech, Assurant, and coparion.

- LinkSquares, a Boston-based contract management software company, raised $100 million in Series C funding led by G Squared and was joined by investors including G2 Venture Partners and Xerox Ventures.

- Nord Security, a London-based VPN provider founded in 2012, raised $100m in its first funding round at a $1.6b valuation. Novator led, and was joined by Burda Principal Investments and General Catalyst. http://axios.link/JVOu

- Collectors Holdings, a Santa Ana, Calif.-based collectibles authentication, management, and marketplace services provider, raised $100 million in funding led by D1 Capital Partners and was joined by investors including Turner, Cohen Private Ventures, and TCG Capital Management.

- Hadrian, an autonomous manufacturing startup focused on aerospace and defense, raised $90m in Series A funding from Lux Capital, Andreessen Horowitz, Lachy Groom, Caffeinated Capital, Founders Fund, Construct Capital and 137 Ventures. www.hadrian.co

- SamCart, an Austin and Washington D.C.-based eCommerce platform for creators, raised $82 million in Series B funding led by Eldridge and was joined by investors including TTV Capital, Fin VC, the George Kaiser Foundation, and eGateway Capital.

- Built Robotics, an SF-based maker of trenching robots for heavy construction projects, raised $64m in Series C funding led by Tiger Global. www.builtrobotics.com

- Coro, a New York-based cyber security platform, raised $60 million in Series C funding led by Balderton Capital and was joined by Jerusalem Venture Partners.

- Lilt, a San Francisco-based translation software and services company, raised $55 million in Series C funding led by Four Rivers and was joined by investors including Sorenson Capital, CLEAR Ventures, Wipro Ventures, Sequoia Capital, Intel Capital, Redpoint Ventures, and XSeed Capital.

- data.world, an Austin-based data catalog platform, raised $50 million in Series C funding led by the Growth Equity business within Goldman Sachs Asset Management and was joined by investors including Prologis Ventures, Shasta Ventures, Vopak Ventures, Sandbox Insurtech Ventures, and other angels.

- Labster, a Copenhagen-based virtual labs and interactive science platform, raised $47 million in funding led by Sofina Group and Pirate Impact and was joined by investors including Owl Ventures, Andreessen Horowitz, EduCapital, NPF Technologies, GGV Capital, Balderton Capital, Northzone, Swisscom Ventures, and founder of Unity Technologies David Helgason.

- OpenPhone, an SF-based business communications startup, raised $40m in Series B funding. Tiger Global led, and was joined by insiders Craft Ventures, Slow Ventures, Garage Capital and Worklife Ventures. http://axios.link/AyYB

- Tinybird, a New York-based software developer that builds data products, raised $37 million in Series A funding led by CRV and Singular Ventures and was joined by Crane Ventures.

- Ascend.io, a Palo Alto-based provider of data automation products for enterprise customers, raised $31m in Series B funding. Tiger Global led, and was joined by Shasta Ventures and insider Accel. http://axios.link/y2R1

- SmartHop, a Miami-based technology platform for small trucking companies, raised $30 million in Series B funding led by Sozo Ventures and was joined by investors including Union Square Ventures and RyderVentures.

- Thunkable, an SF-based no-code mobile app dev platform, raised $30m in Series B funding. Owl Ventures led, and was joined by Lightspeed Venture Partners, NEA, PJC, Sky9 Capital and Diplo (yeah, that one). www.thunkable.com

- Appwrite, a Tel Aviv-based open source backend-as-a-service platform for web, mobile, and flutter developers, raised $27 million in Series A funding led by Tiger Global Management and was joined by investors including Bessemer Venture Partners, Flybridge Capital Partners, Ibex Investors, and Seedcamp.

- vHive, an Israeli autonomous digital twin software startup, raised $25m in Series B funding. PSG led, and was joined by Octopus Ventures and Telekom Innovation Pool. www.vhive.ai

- ReadySet, a Beverly Hills, Calif.-based database infrastructure startup, raised $24m in Series A funding. Index Ventures led, and was joined by Amplify Partners. http://axios.link/26x9

- Kumo, an SF-based predictive AI SaaS for businesses, raised $18.5m in Series A funding led by Sequoia Capital. www.kumo.ai

- Hivemapper, a San Francisco-based decentralized mapping network developer with a crypto-integrated dashcam, raised $18 million in Series A funding led by Multicoin Capital and was joined by investors including Craft Ventures, Solana Capital, Shine Capital, and 75 and Sunny Ventures.

- Warp, a command-line terminal startup, raised $17m in Series A funding led by Figma CEO Dylan Field. http://axios.link/Bq0k

- Cottage, an SF-based marketplace for building accessory dwelling units, raised $15m in Series A funding led by Fifth Wall. http://axios.link/AQyF

- KarmaCheck, an SF-based employee background check startup led by LinkedIn co-founder Eric Ly, raised $15m in Series A funding. Velvet Sea Ventures led, and was joined by Parameter Ventures, One Way Ventures, NextView Ventures and Dash Fund. www.karmacheck.com

- GOALS, a Stockholm-based online soccer game, raised $15 million in seed funding led by Northzone and was joined by investors including Cherry Ventures, Moonfire Ventures, Banana Capital, Not Boring Capital, Cassius, FC Barcelona’s Gerard Pique, Sorare co-founder and CEO Nicolas Julia, Axie co-founder and COO Aleksander Larsen, and others.

- Airgap Networks, a Santa Clara, Calif,-based cybersecurity platform that prevents ransomware, raised $13.4 million in Series A funding led by Storm Ventures and was joined by investors including Cervin Ventures, Engineering Capital, Sorenson Ventures, and others.

- Corsha, a Washington D.C.-based API security company, raised $12 million in Series A funding. Ten Eleven Ventures and Razor’s Edge Ventures led the round and was joined by 1843 Capital.

- 8base, a Miami-based development platform for building digital products and internal applications, raised $10.6 million in Series A funding led by Foundry Group and was joined by investors including MongoDB Ventures, Techstars, Firebrand Ventures, 11 Tribes Ventures, Argonautic Ventures, LAGO Innovation Fund, and Strawberry Creek Ventures.

- Prepared, a New York-based emergency services technology developer, raised $9.8 million in seed funding led by First Round and was joined by investors including Gradient Ventures, 8VC, and Risk and Return.

- StackBlitz, a San Francisco-based collaborative web development platform, raised $7.9 million in seed funding led by Greylock Partners and was joined by investors including Google Ventures, co-founder of GitHub Tom Preston-Werner, and others.

- Landed, a Bay Area, Calif.-based recruitment platform for the restaurant and hospitality industries, raised $7 million in seed funding led by Javelin Venture Partners and Blockchain Capital, and was joined by investors including Lightspeed Venture Partners and other angels.

- SeeMetrics, an Israeli cybersecurity management platform for CISOs, raised $6m in seed funding from Work-Bench, 8VC, AGP, Essence VC, K5 Global and Verissimo. http://axios.link/gED2

- Flow Club, a San Francisco-based virtual community for remote and flexible workers, raised $5 million in funding led by Worklife Ventures and was joined by investors including Day One Ventures, Soma Capital, Y Combinator, Hustle Fund, Nomo Ventures, Night Capital, Hyphen Capital, and others.

- Songfinch, a Chicago-based personalized music creation startup, raised $5m in seed funding led by Corazon Capital. www.songfinch.com

- Lucky, a product merchandising software startup, raised $3m led by Unusual Ventures. http://axios.link/JUBg

- Playhouse, a San Francisco-based real estate video listing platform, raised $2.8 million in seed funding from investors including Agya Ventures, Gaingels, Goodwater Capital, Nomo Ventures, PKO Investments, Y Combinator, and others.

. . .

Sustainability:

- Climeworks, a Swiss carbon removal startup, raised $650 million co-led by Partners Group and GIC. There's an emerging consensus that carbon emissions removal, in addition to reduction, is key to stemming climate change. But there's little agreement on if it can really be done at scale. This money, the most ever raised for a carbon removal startup, could help answer that question, as Climeworks currently operates the world's largest direct-air capture facility. Other investors include Baillie Gifford, Carbon Removal Partners, Global Founders Capital, John Doerr, M&G, Swiss Re and BigPoint Holding.

- Sweep, a Montpellier, France carbon management platform, raised $73 million in Series B funding led by Coatue and was joined by investors including Balderton Capital, New Wave, La Famiglia, and 2050.

- ClimeCo, a Boyertown, Penn.-based environmental commodities trading company, raised over $50m. Warburg Pincus led, and was joined by The Heritage Group. www.climecogreen.com

- Better Origin, a British developer of insect mini-farms, raised $16m in Series A funding. Balderton Capital led, and was joined by insiders Fly Ventures and Metavallon VC. www.betterorigin.co.uk

- Brilliant Planet, a carbon capture startup that uses algae, raised $12m. USV and Toyota Ventures co-led, and were joined by Future Positive Capital, AiiM Partners, S2G Ventures, Hatch and Pegasus Tech Ventures. http://axios.link/Zvga

- Waterplan, a San Francisco-based water resilience planning SaaS platform, raised $7 million in seed funding led by Transition Global and Giant Ventures and was joined by angel investors including Leonardo DiCaprio, Holly Branson, Joe Montana, Manu Ginobili, and others.

Acquisitions & PE:

- Elon Musk acquired a 9.2% stake in Twitter. He is the company’s largest shareholder.

- Shein, a Chinese fast-fashion company, is in talks with General Atlantic to lead a VC round at around a $100b valuation, per Bloomberg. The company previously raised in mid-2020 at a $15b valuation, from insiders like Tiger Global and Sequoia Capital China. http://axios.link/5auq

- VerSe Innovation, the parent company of news aggregator app Dailyhunt and short video app Josh, raised $805m in Series J funding at nearly a $5b valuation. CPP Investments led, and was joined by Ontario Teachers, Luxor Capital, Sumeru Ventures and insiders Sofina Group and Baillie Gifford. http://axios.link/JpFc

- Niantic, an SF-based maker of augmented reality games like Pokémon Go, bought New Zealand-based AR studio NZXR. Niantic last year raised funding at a $9b valuation. http://axios.link/rBPO

- Bain Capital said it’s considering a takeover bid for all of Toshiba (Tokyo: 6502), after company management failed to secure shareholder support for a breakup plan. http://axios.link/xbuN

- Bolt Financial agreed to acquire Wyre Payments, a San Francisco-based crypto infrastructure payments firm. The deal is valued at around $1.5 billion, according to the Wall Street Journal.

- AMD (Nasdaq: AMD) agreed to buy Pensando, a Milpitas, Calif.-based edge computing company aimed at data centers, for around $1.9b. Pensando had raised over $300m in VC funding, most recently at a reported $2b valuation last summer, from firms like Qualcomm Ventures, Ericsson Ventures, Liberty Global Ventures, HP, Lightspeed Venture Partners, Goldman Sachs, Oracle and GV. http://axios.link/yiWk

- Galaxy Digital (TSE: GLXY) renegotiated its pending acquisition of crypto custodian Bitgo, in order to maintain the $1.2b sale price. Bitgo has raised over $70m from Valor Equity Partners, Craft Ventures, Redpoint Ventures, Inventures and Radar Partners. http://axios.link/qopS

- Microsoft (Nasdaq: MSFT) bought Minit, a European process mining tech vendor that had raised around $12m from firms like Target Global, Salesforce Ventures, Earlybird VC and OTB Ventures. http://axios.link/X1Vp

- Ted Baker (LSE: TED) said it’s open to takeover interest, just weeks after the British fashion retailer rejected a buyout bid from Sycamore Partners. http://axios.link/6d8y

- Traub Capital Partners acquired a majority stake in HITS Shows, a Saugerties, N.Y.-based producer of hunter/jumper horse shows in the United States. Financial terms were not disclosed.

- Ariel Alternatives bought a 52.5% stake in Sorenson, a Salt Lake City-based communications provider to people who are deaf or hard of hearing, at a $1.3b valuation from backers like Blackstone Credit, Franklin Mutual Advisors and KKR. http://axios.link/uPbs

- Skillsoft (NYSE:SKIL) completed its $525m cash-and-stock acquisition of Codecademy, a New York-based coding school that had raised over $80 million in VC funding from Owl Ventures, USV, Prosus Ventures, Bloomberg Beta, Flybridge Capital Partners, Index Ventures and Richard Branson. www.codecademy.com

- Farfetch (NYSE: FTCH) agreed to invest up to $200m into the parent company of Neiman Marcus and Bergdorf Goodman. http://axios.link/Aioe

. . .

IPOs:

- iFIT Health & Fitness, a Logan, Utah-based connected fitness company whose brands include NordicTrack, officially withdrew papers for an IPO designed to raise $600m at a $6.4b valuation. The company, whose shareholders include Pamplona Capital Management and L Catterton, previously postponed the float because of “market conditions.” http://axios.link/M4Ii

. . .

SPACs:

- Hypebeast, a digital media and commerce company that’s listed in Hong Kong, agreed to list on the Nasdaq via a merger with Iron Spark I (Nasdaq: ISAA). The deal values Hypebeast at an implied $530m, and includes a small PIPE from such backers as Tom Brady and Naomi Osaka.

- PrimeBlock, a Bitcoin miner, agreed to go public at an implied $1.2b valuation via 10X Capital Venture Acquisition Corp II (Nasdaq: VCXA). http://axios.link/4AKl

- Westrock Coffee, a Concord, N.C.-based private label coffee company, agreed to go public at an implied $1.1b valuation via Riverview Acquisition Corp. (Nasdaq: RVAC). Westrock backers include BBH Capital Partners, Meaningful Partners and The Stephens Group. www.westrockcoffee.com

Funds:

- I Squared Capital, a Miami-based investment manager, raised $15 billion for a fund focused on climate change, supply chains, and energy transition.

- Lead Edge Capital, a New York and Santa Barbara, Calif.-based investment fund, raised $2 billion for a sixth fund focused on software, internet, and consumer businesses.

- Blue Wolf Capital raised $1.1b for its fifth midmarket PE fund. www.bluewolfcapital.com

- Imaginary Ventures, a New York-based venture capital firm, raised $500 million for a third fund focused on early and late stage companies.

- Base10 Partners, a San Francisco-based venture capital fund, raised $460 million for a new fund for early stage investments.

- Edison Partners, a Princeton, N.J.-based growth equity investing firm, raised $450 million for its tenth fund, focused on markets outside of Silicon Valley.

- Expa, the venture group led by Garrett Camp, raised $200m for its latest fund. http://axios.link/wRYX

- Wireframe Ventures, a San Francisco-based venture capital firm, raised $77 million for a second fund focused on seed and pre-seed investments in the health and climate industries.

Final Numbers

VC 2022 Slowdown

Deals are getting smaller

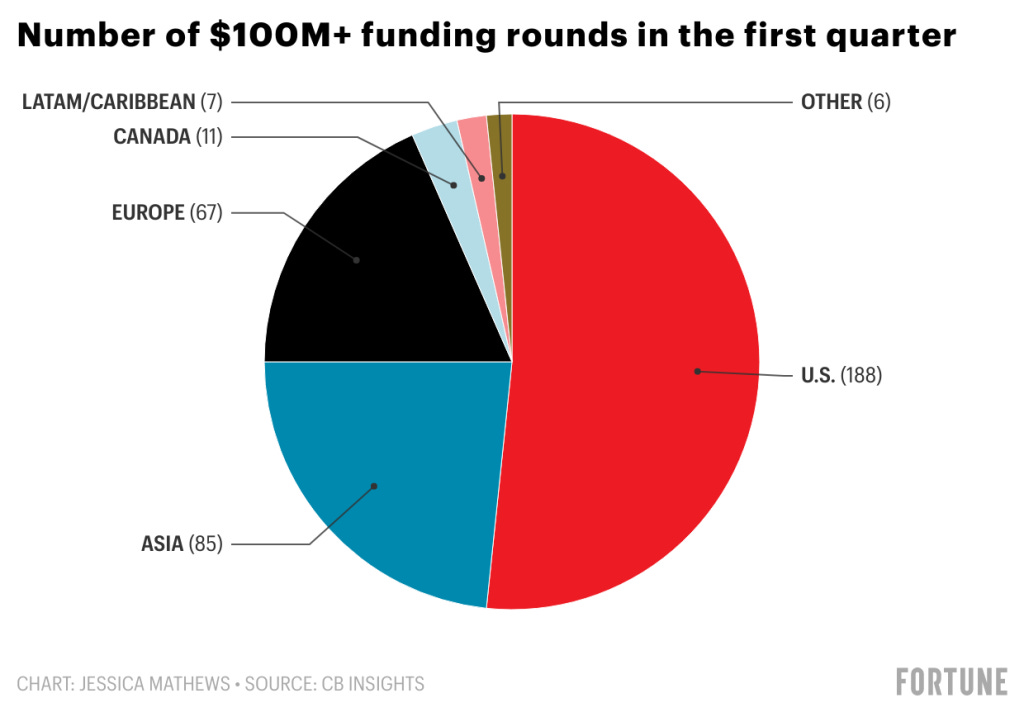

There were fewer mega-rounds this year (meaning those above $100 million in size). While around 59% of venture dollars were invested in mega-rounds last quarter, that number is closer to 51% in the first quarter.

Funding for U.S.-based startups shrinks

There’s still plenty of funding going toward startups in the U.S.—they received 49% of this quarter’s overall global funding—but the dollar-amount is at a five-quarter low after a record 2021. Funding was down in every major U.S. city apart from Philadelphia, Atlanta, and Dallas—although, there were more deals signed in the first quarter than there were the year prior.

Time to look abroad?

While the number of mega-rounds is on the decline in the U.S. and Asia, there was an uptick this quarter in large rounds in Europe, Canada, and Australia. The U.S. and Asia still comprise the lion’s share of the global venture market.

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

I love your work is this is not a huge deal but can you use the usual bullets and create a bigger headlines to separate the sections of the Newsletter? It would be a lot easier to read. It's really valuable info but it hurts my eyes and is not optimized for mobile in the current formatting.