Sourcery (4/5-4/9)

Plaid, Fetch Rewards, Ramp, TrueLayer, Komodo Health, Firefly Health, Inbox Health, Empathy, Patreon, Skims, Phenom, Canva, StockX, Community, CaptivateIQ, Snorkel AI, Alyce, Mercato, Comet, Mickey...

Last Week (4/5-4/9):

Relevant deals include the 60+ deals across stages below, mostly funded by Tiger Global.

I've categorized the deals below into four categories, Fintech, Care, Future of Work, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Plaid, Fetch Rewards, Ramp, TrueLayer, Komodo HealthFirefly Health, Inbox Health, Empathy, Patreon, Skims, Phenom, Gupshup, Sendbird, WhiteSource, Canva, StockX, Community, CaptivateIQ, Snorkel AI, Streamlit, Alyce, Mercato, Pathlight, Comet, Rapid Robotics, Mickey, dClimate, Nth Cycle; Pinterest/VSCO, Box, Therapy Brands, Galvanize, Clubhouse.

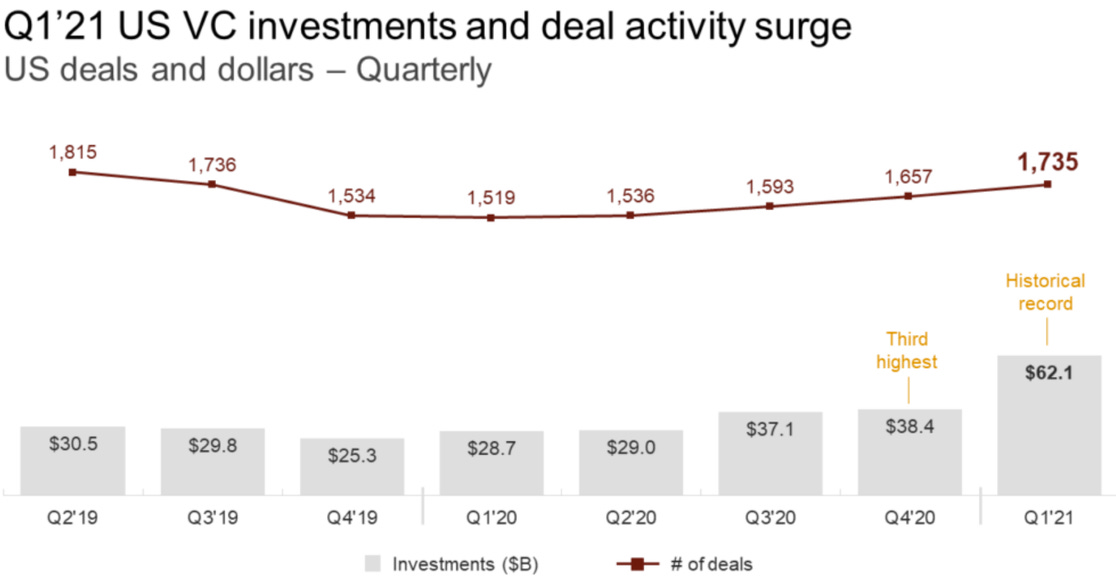

Final numbers on Q1’21 US VC Surge at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Plaid, which connects fintech apps to bank accounts, announced $425 million in Series D funding led by Altimeter at a $13.4 billion post-money valuation. Plaid recently bailed on a deal to be bought by Visa, primarily because the $5.3 billion price-tag had become antiquated. "Most consumers now believe that living their financial lives online is the new normal, and we've also seen another inflection point in the number of companies building digital-first financial products ... and the emergence of embedded finance like stored value and rewards and points," Plaid CEO Zach Perret explains. Or, as Plaid investor Mary Meeker puts it: "A new era of finance is underway.” If you combine Plaid's new valuation with the recent $95 billion mark for Stripe, it's just a hair below the market cap for Goldman Sachs. And all of this is the fintech appetizer for next week's Coinbase direct listing feast.

- Fetch Rewards, a Madison, Wis.-based consumer-loyalty app, raised about $210 million in Series D funding. SoftBank Vision Fund 2 led the round and was joined by investors including ICONIQ, DST, Greycroft, and e.ventures.

- Ramp, a New York-based provider of digital corporate cards and spend management software, raised $115 million over two new funding rounds. The first was led by D1 Capital Partners, while the second was led by Stripe at a $1.6 billion valuation. http://axios.link/4H1X

- TrueLayer, a London-based open banking platform, raised $70 million in Series D funding. Addition led, and was joined by Visionaries Club and insiders Anthemis Group, Connect Ventures, Mouro Capital, Northzone and Temasek. http://axios.link/mUgK

- Windfall Data, a San Francisco-based wealth intelligence platform, raised $21 million in Series A funding. En Pointe led, and was joined by EPIQ Capital Group and insiders investors Bonfire Ventures, Bullpen Capital, Cherubic Ventures and ValueStream Ventures.www.windfalldata.com

. . .

Care:

- Komodo Health, a San Francisco-based maker of digital healthcare maps, raised $220 million in Series E funding. Tiger Global led, and was joined by Casdin Capital and insiders Iconiq, Andreessen Horowitz and SVB Capital. http://axios.link/YWdG

- Pendulum Therapeutics, a San Francisco-based microbiome startup, raised $54 million. Meritech Capital Partners led, and was joined by insiders Sequoia Capital, True Ventures and Khosla Ventures. www.pendulumlife.com

- Firefly Health, a Watertown, Mass.-based virtual healthcare company, raised $40 million in Series B funding. Andreessen Horowitz led the round and was joined by investors including F-Prime Capital and Oak HC/FT.

- Inbox Health, a New Haven, Conn.-based patient payments startup, raised $15 million in Series A funding. Commerce Ventures led, and was joined by Vertical Venture Partners, Healthy Ventures, Collaborative Fund, Fairview Capital, CT Innovations, and I2BF Global Ventures. www.inboxhealth.com

- Empathy, a digital assistant for family bereavement, raised $13 million in seed funding led by General Catalyst and Aleph. http://axios.link/oq43

- Real, a group therapy startup, raised $10 million in Series A funding led by Lightspeed Venture Partners. http://axios.link/aPuK

. . .

Future of Work:

- OneStream Software, a Rochester, Mich.-based corporate performance management software company, raised $200 million in Series B funding valuing it at $6 billion. D1 Capital Partners led the round and was joined by investors including Tiger Global and Investment Group of Santa Barbara.

- Patreon, a San Francisco-based platform that connects creators with paying fans, raised $155 million in Series F funding at a $4 billion valuation. Tiger Global led, and was joined by Woodline Partners and insiders Wellington Management, Lone Pine Capital, NEA, Glade Brook Capital and DFJ Growth. http://axios.link/ARqW

- Skims, the shapewear brand founded by Kim Kardashian, raised $154 million led by Thrive Capital at a $1.6 billion valuation. Other company investors include Imaginary Ventures and Alliance Consumer Growth. Word is that Thrive approached Skims, rather than the other way around, with the round including both primary and secondary capital. "Skims has defined itself by aiming for a younger market and emphasizing inclusivity, offering nine sizes and as many skin-tone shades. It reported $145 million in sales last year, and has sold more than four million units since its founding in late 2019." — Michael de la Merced, NY Times

- MasterClass, which sells subscriptions to online courses taught by experts, is raising new funding led by Fidelity at a $2.5 billion valuation, per Axios. http://axios.link/mcxm

- SendBird, an in-app chat, voice and video company, raised $100 million in Series C funding. Steadfast Ventures led, and was joined by Emergence Capital, Softbank Vision Fund 2, World Innovation Lab and insiders Iconiq Growth, Tiger Global and Meritech Capital Partners. www.sendbird.com

- Phenom, an Ambler, Pa.-based hiring and recruitment platform, raised $100 million in Series D funding. B Capital Group led the round and was joined by investors including Dragoneer Investment Group, OMERS Growth Equity, and GoldenArc Capital.

- Gupshup, a San Francisco-based conversational messaging platform, raised $100 million in Series F funding led by Tiger Global at a $1.5 billion valuation. http://axios.link/tIpI

- SafeSend, an Ann Arbor, Mich.-based provider of e-sign and workflow automation software for CPAs and tax preparers, raised an undisclosed amount of funding from Lead Edge Capital. www.safesend.com

- WhiteSource, an Israeli provider of open source security and management software, raised $75 million in Series D funding. Pitango led, and was joined by insiders M12, Susquehanna Growth Equity and 83North. www.whitesourcesoftware.com

- CANVA: Australia-based graphic design software startup Canva is now valued at $15 billion after a $71 million round of funding.

-Bryter, a Berlin-based no-code development platform, raised $66 million in Series B funding. Tiger Global led, and was joined by insiders Accel, Dawn Capital, Notion Capital and Cavalry Ventures. http://axios.link/KbAZ

- StockX, a New York-based reseller of sneakers and other goods, raised $60 million in Series E-1 funding, and also sold $195 million via a secondary offering, valuing it at $3.8 billion. Altimeter Capital led the round and was joined by investors including Dragoneer.

- CaptivateIQ, a San Francisco-based sales team platform, raised $46 million in Series B funding. Accel led the round and was joined by investors including Sequoia, Y Combinator, Amity, and S28.

- Community, a Los Angeles-based text messaging platform, raised $40 million. Salesforce Ventures was the investor.

- Snorkel AI, a Palo Alto, Calif.-based enterprise A.I. company, raised $35 million in Series B funding. Lightspeed Venture Partners led the round and was joined by investors including Greylock, GV, In-Q-Tel, and Nepenthe Capital.

- Streamlit, a San Francisco-based machine learning startup, raised $35 million in Series B funding. Sequoia led the round and was joined by investors including Gradient Ventures and GGV Capital. Read more.

- Alyce, a Boston-based sales and marketing platform, raised $30 million in Series B funding. General Catalyst led the round and was joined by investors including Boston Seed Capital, Golden Ventures, Manifest, Morningside, and Victress Capital.

- Mercato, a San Diego-based online grocery platform, raised $26 million in Series A funding. Velvet Sea Ventures led the round and was joined by investors including Team Europe, Greycroft, and Loeb.nyc. Read more.

- Prosimo, a Santa Clara, Calif.-based app experience infrastructure startup, raised $25 million in seed and Series A funding co-led by General Catalyst and WRVI Capital. www.prosimo.io

- Pathlight, a San Francisco-based remote management platform for customer-facing teams, raised $25 million. Insight Partners led, and was joined by Uncorrelated Ventures, Jeremy Stoppleman, David Glazer, Michael Ovitz and insiders Kleiner Perkins and Quiet Capital.www.pathlight.com

-Upsolver, a no-code data lake engineering platform, raised $25 million in Series B funding. Scale Venture Partners led, and was joined by insiders JVP, Vertex Ventures US and Wing VC. www.upsolver.com

- SnackMagic, a New York-based gift box platform, raised $15 million in Series A funding. Craft Ventures led the round and was joined by investors including Luxor Capital

- Comet, a New York-based ML model building tool, raised $13 million in Series A funding. Scale Venture Partners led, and was joined by insiders Trilogy Equity Partners and Two Sigma Ventures. http://axios.link/MOCP

- Rapid Robotics, a San Francisco-based industrial robotics startup, raised $12 million in Series A funding. NEA led, and was joined by insiders Greycroft, Bee Partners and 468 Capital. www.rapidrobotics.com

- Mickey, a New York-based company focused on exports for small to midsize suppliers, raised $10 million. Lerer Hippeau and LightBank led the round.

- Grata, a New York-based maker of a search engine for discovering small to middle market private companies, added $6.2 million to its seed round. Investors included Flex Capital and Touchdown Ventures.

- Mem, a note-taking app, raised $5.6 million in seed funding. Andreessen Horowitz led, and was joined by Dreamers.vc, Floodgate, Unusual Ventures and Shrug Capital. http://axios.link/wG3d

- ConductorOne, a Portland, Ore.-based platform for granting access and managing permission, raised $5 million in seed funding. Accel led the round and was joined by investors including Fuel Capital, Fathom Capital, and Active Capital.

- Formation, a San Francisco-based coding education platform, raised $4 million led by Andreessen Horowitz. http://axios.link/nM0p

- Realworld, a New York-based app for helping Gen Z navigate “adulthood” tasks, raised $3.4 million in seed funding led by Fitz Gate Ventures. http://axios.link/Kv7S

- HearHere, a Santa Barbara, Calif.-based audio entertainment startup, raised $1.2 million in pre-seed funding. Investors included Marcus Lemonis (The Profit on CNBC), Camping World, Kevin Costner, and Cooley.

. . .

Sustainability:

- dClimate, a New York-based decentralized network for climate data, raised $3.5 million in seed funding. CoinFund led the round and was joined by investors including Multicoin Capital and Republic Labs.

- Nth Cycle, a Boston-based recycling technology firm extracting metals from batteries, e-waste, low-grade ore, and mine tailings, raised $3.2 million in funding from Clean Energy Ventures.

Acquisitions & PE:

- Pinterest (NYSE: PINS), a San Francisco-based social media company, has been in talks to acquire Visual Supply, an Oakland, Calif.-based company also known for its VSCO photo-editing app, per the New York Times. Read more.

- KKR invested $500 million in Box, a Redwood City, Calif.-based cloud content management platform. Financial terms weren't disclosed.

- KKR agreed to acquire a majority interest in Therapy Brands, a practice management and electronic health record software platform for mental, behavioral, substance use recovery, from Lightyear Capital LLC, Oak HC/FT, and Greater Sum Ventures. Existing investor PSG will remain a minority shareholder. Financial terms weren't disclosed.

- Diligent completed its $1 billion acquisition of Galvanize, a Canadian provider of governance, risk and compliance SaaS that had raised $50 million from Norwest Venture Partners. Diligent backers include Insight Partners, Clearlake Capital Group and The Blackstone Group. www.diligent.com

- Twitter (NYSE: TWTR) held talks to buy audio app Clubhouse for around $4 billion, but discussions are no longer active, per Bloomberg. http://axios.link/uv72

. . .

IPOs:

- Bright Health Group, a Minneapolis-based digital health company, is planning for an IPO that could raise $1 billion later this year, per Bloomberg. Investors include Bessemer Venture Partners and Greenspring Associates. Read more.

- COINBASE: Ahead of a direct listing slated for next week, the cryptocurrency exchange revealed it had one heck of a start to 2021. It had surpassed its revenues from 2020 in just the first three months of this year alone, with revenue of $1.8 billion in the first quarter of the year compared to $1.3 billion in all of last year. That could set it up for a very positive turn in public markets, despite the recent shakiness in the market for tech stocks.

. . .

SPACs:

- Better Therapeutics, a San Francisco-based prescription digital therapeutics company, plans to go public via merger with Mountain Crest Acquisition II, a SPAC, that values the firm at $187 million.

- Sonder, a San Francisco-based short-term rental start, is in talks to go public via merger with Gores Metropoulos II, a SPAC. a deal would value the company at about $2.5 billion, per Bloomberg. Read more.

Funds:

- Index Ventures, a San Francisco and London-based venture firm, announced a $200 million seed fund dubbed Index Origin.

- Serena Ventures is raising outside capital for a new fund, Axios has learned. The firm, formed in 2019, to date had been capitalized exclusively by tennis star Serena Williams.

Final Numbers

Source: PwC/CB Insights MoneyTree Report Q1 2021

Inside the numbers: Mega-rounds drove last quarter's U.S. VC activity, accounting for 64% of total funding. The number of mega-rounds rose from 102 in Q4 2020 to 184 in Q1 2021.