Sourcery (5/10-5/14)

CloudWalk, Arkose Labs, Kin, Lili, Stampli, Treasury Prime, Relay, FinLync, Sanlo, Cue, Ethos, Unmind, Birdie, Memora, Vinted, Masterclass, Handshake, JellysmackAirkit, Waybridge, Cycode, GRIN...

Last Week (5/10-5/14):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Future of Work, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include CloudWalk, Arkose Labs, Kin, Lili, Stampli, Treasury Prime, Relay, FinLync, Sanlo, Cue, Ethos, Unmind, Birdie, Memora, Vinted, Masterclass, Handshake, JellysmackAirkit, Waybridge, Cycode, GRIN, BluBracket, CognitOps, Transcend, Blair, BigBrain, Smol, Voltus; Ooda Health, Happy Returns, Rx Saver; SimilarWeb; Gingko Bioworks, Better

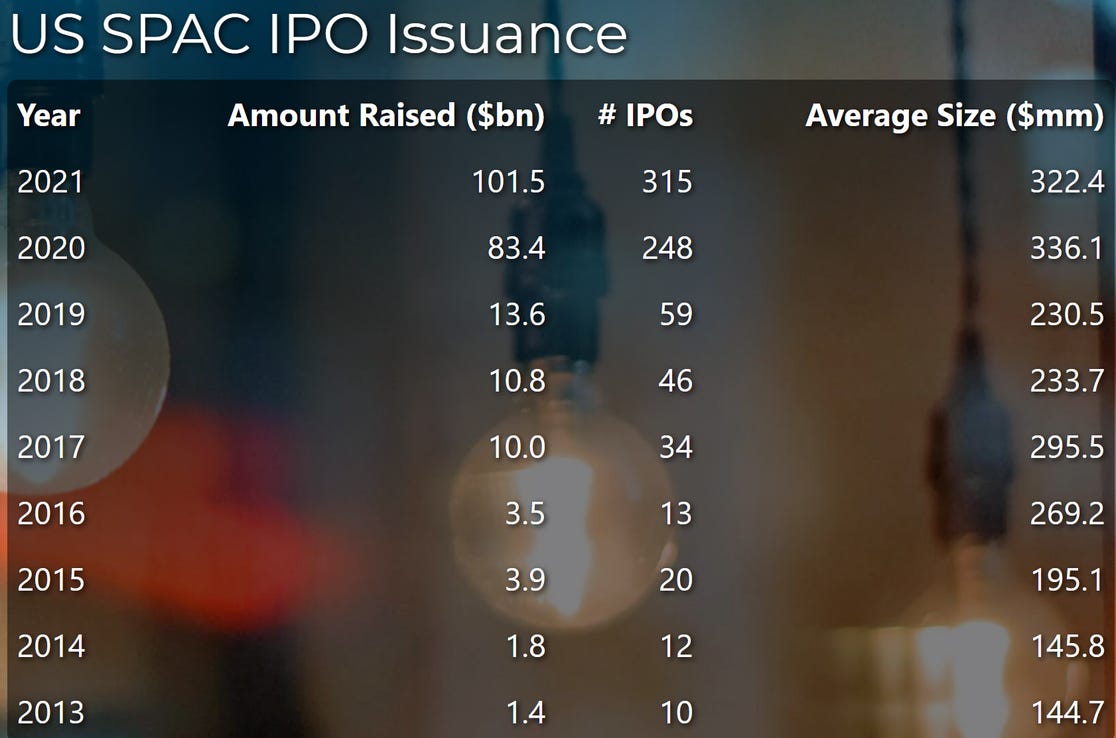

Final numbers on SPACs at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- CloudWalk, a Brazilian open payments networking company, raised $190 million in Series B funding. Coatue led, and was joined by DST Global and insiders FIS, The Hive Brazil and Valor Capital. www.cloudwalk.io

- Arkose Labs, a San Francisco-based provider of online fraud and abuse prevention technology, raised a $70 million in Series C funding. SoftBank Vision Fund 2 led the round and was joined by investors including Wells Fargo Strategic Capital, M12 and PayPal Ventures.

- Kin, a home insurance company, raised $63.9 million in Series C funding. Senator Investment Group and Hudson Structured Capital Management led the round and was joined by investors including University of Chicago, Allegis NL Capital, and Alpha Edison.

- Lili, a New York-based mobile banking service for freelancers, raised $55 million in Series B funding. Group 11 led the round and was joined by investors including Target Global and AltaIR.

- Stampli, a Mountain View, Calif.-based invoice management software company, raised $50 million in Series C funding. Insight Partners led the round and was joined by investors including Signal Fire and Nextworld Capital.

- Hashdex, a Brazil-based asset management company specialized in crypto investments, raised $26 million. Valor Capital Group led the round and was joined by investors including SoftBank, Coinbase Ventures, and Globo Ventures, Canary, Igah, Alexia, Fuse, and Endeavor Catalyst.

- Treasury Prime, a San Francisco-based banking-as-a-service startup, raised $20 million in Series B funding. Deciens Capital and QED Investors led the round and was joined by investors including Susa Ventures and SaaStr Fund.

- Planck, a New York-based commercial insurance data analytics platform, raised $20 million. 3L Capital and Greenfield Partners co-led, and were joined by insiders Team8, Viola Fintech, Arbor Ventures and Eight Roads.http://axios.link/oqSL

- Collective, a San Francisco-based back office platform, raised $20 million in Series A funding. General Catalyst led the round and was joined by investors including Sound Ventures.

- Relay, a Toronto-based digital banking platform for small businesses, raised $19.4 million in funding. That includes a $15 million Series A led by Bain Capital Ventures, who was joined by Better Tomorrow Ventures, Garage Capital, Tribe Capital, Panache, and Amaranthine.

- Upsie, a Minneapolis-based consumer warranty startup, raised $18.2 million in Series A funding. True Ventures led the round and was joined by investors including Concrete Rose VC, Avanta Ventures, Kapor Capital, Samsung Next, Massive, Backstage Capital, Awesome People Ventures, Draft Ventures, Matchstick Ventures, M25, Silicon Valley Bank and Uncommon VC.

- FinLync, a New York-based finance and treasury app maker, raised $16 million. Point72 Ventures led the round and was joined by investors including Nyca Partners, former Palantir CFO Colin Anderson, and Plaid Founder William Hockey.

- Spinwheel, a consumer debt management platform, raised $11 million in first-round funding. QED Investors led, and was joined by Core Innovation Capital, Fika Ventures and Firebolt Ventures. http://axios.link/hEVN

- Ontop, a Colombia-based multi-country payroll manager for Latin America, raised $4.5 million in seed funding. Point72 Ventures led the round and was joined by investors including Funders Club, ClockTower Technology Ventures, H2O Capital, Magma Partners, SOMA Capital, and Supernode.

- Sanlo, a San Francisco-based financial products company for gaming and app businesses, raised $3.5 million in funding. Index Ventures and Initial Capital led the round and were joined by investors including LVP, Portag3 Ventures, and XYZ Venture Capital.

- Caplight, a San Francisco-based platform for buying and selling private equity derivatives, raised $1.7 million. Fin VC led the round and was joined by investors including Susquehanna Private Equity Investments, Clocktower Ventures, and Dash Fund.

. . .

Care:

- Cue Health, a San Diego-based developer of portable health testing solutions, raised $325 million from Perceptive Advisors, MSD Capital, Koch Strategic Platforms and insiders J&J, Decheng Capital, CAVU Ventures and ACME Capital. Cue reportedly has hired bankers for an IPO. www.cuehealth.com

- Ethos Technologies, a San Francisco-based life-insurance startup, raised $200 million in funding valuing the business at over $2 billion. General Catalyst led the round and was joined by investors including Sequoia Capital, Accel and GV.

- Axtria, a Berkeley Heights, N.J.-based provider of life sciences data analytics software, raised $150 million from Bain Capital at nearly a $1 billion valuation, per Bloomberg. http://axios.link/uPPy

- Aetion, a New York-based healthcare tech firm, raised $110 million in Series C funding. Warburg Pincus led the round and was joined by investors including B Capital, Foresite Capital, New Enterprise Associates, and Flare Capital Partners.

- Impress, a Barcelona-based direct-to-consumer dentistry company, raised $50 million in Series A funding. CareCapital (a dental division of Hillhouse Capital in Asia) led the round and was joined by investors including Nickleby Capital, UNIQA Ventures, Michael Linse, Valentin Pitarque, Peter Schiff, Elliot Dornbusch, TA Ventures and Bynd VC.

- Unmind, a London-based workplace mental health platform, raised $47 million in Series B funding. EQT Ventures led the round and was joined by investors including Project A, Felix Capital, and True.

- Birdie, a London-based elderly care tech business, raised $11.5 million (£8.2 million). Index Ventures led the round and was joined by investors including Kamet Ventures.

- Memora Health, a San Francisco-based virtual health care delivery platform, raised $10.5 million. Andreessen Horowitz led, and was joined by AlleyCorp, Martin Ventures, Thirty Five Ventures, Sachin Jain, Operator Partners, Edward Elmhurst Health and B Capital. www.memorahealth.com

- Elucid, a Boston-based medical technology company focused on cardiovascular disease detection, raised $8 million in Series A funding. MedTex Ventures and Global Health Impact Fund led the round and was joined by investors including Checkmate Capital, IAG Capital, BlueStone Venture Partners, University of Michigan - Wolverine Venture Fund, Willamette Valley Capital, and Angel Physicians Fund.

- DeepScribe, a San Francisco-based medical documentation startup, raised $5.2 million in seed funding. Bee Partners led the round and was joined by investors including Industry Ventures, Stage II Capital,Tsingyuan Ventures, 1984 Ventures, Wavemaker 360, Supernode Ventures, Skydeck, Plug and Play and Sequoia Scout Fund.

. . .

Future of Work:

- Vinted, a second-hand goods startup, raised €250 million ($303 million) valuing it at €3.5 billion ($4.5 billion). EQT Growth led the round and was joined by investors including with Accel, Burda Principal Investments, Insight Partners, Lightspeed Venture Partners, and Sprints Capital.

- MasterClass, a San Francisco-based streaming platform with curated lessons, raised $225 million in Series F funding. Fidelity Management & Research Company led the round and was joined by investors including Baillie Gifford, Balyasny Asset Management, Eldridge, IVP, Javelin, NEA, and Owl Ventures.

- Acquco, an Amazon marketplace rollup founded by a pair of Amazon vets, raised $160 million in Series A equity and debt funding from backers like CoVenture, Singh Capital Partners and Crossbeam.http://axios.link/edH9

- Forte, a gaming infrastructure startup using blockchain, agreed to raise $185 million at a valuation of roughly $1 billion, per Axios. Griffin Gaming Partners led the round and was joined by investors including Union Grove Venture Partners,Andreessen Horowitz, and Battery Ventures.Tiger also sought to invest in the firm, per the report.

- CircleCI, a San Francisco-based integration and continuous delivery platform, raised $100 million in Series F funding, valuing it at $1.7 billion. Greenspring Associates led the round and was joined by investors including Eleven Prime, IVP, Sapphire Ventures, Top Tier Capital Partners, Baseline Ventures, Threshold Ventures, Scale Venture Partners, Owl Rock Capital, and Next Equity Partners.

- NetSPI, a Minneapolis-based testing and cybersecurity attack management company, raised $90 million. KKR led the round and was joined by investors including Ten Eleven Ventures.

- Lyst, a U.K.-based maker of a platform for high fashion brands to sell to consumers, raised $85 million. Investors included Fidelity International, Novator Capital, Giano Capital and C4 Ventures.

- Handshake, a San Francisco-based early career network, raised $80 million in Series E funding to value it at $1.5 billion. Lightspeed Venture Partners and Spark Capital led the round and was joined by investors including Coatue Management, Valiant Peregrine Fund, True Ventures, Kleiner Perkins, EQT Ventures, GGV Capital, the Chan Zuckerberg Initiative and Emerson Collective.

- Jellysmack, a Los Angeles-based creator company, raised an undisclosed amount of Series C funding valuing it above $1 billion. SoftBank Vision Fund 2 led the round.

- SiMa.ai, a San Francisco-based machine learning company, raised $80 million in Series B funding. Fidelity Management & Research Company led the round and was joined by investors including Adage Capital Management.

- Legion, a Redwood City-based A.I.-powered workforce management company, raised $50 million in Series C funding. Stripes led the round and was joined by investors Norwest Venture Partners, First Round Capital, XYZ Ventures, Webb Investment Network, and Dollar General.

- Zenlayer, a Los Angeles-based edge cloud service provider, raised $50 million in Series C funding. Anatole Investment and Prospect Avenue Capital led the round and were joined by investors including Volcanics Venture.

- Airkit, a Palo Alto-based customer experience platform, raised $40 million in Series B funding. EQT Ventures led the round and was joined by investors including Accel, Emergence Capital, and Salesforce Ventures.

- Blind, a Berkeley, Calif.-based anonymized networking and employee chat site, raised $37 million in Series C funding. Mainstreet Investment led the round and was joined by investors including Cisco Investments and Pavilion Capital.

- Engageli, a Palo Alto, Calif.-based digital learning platform focused on higher education, raised $33 million in Series A funding. Maveron led the round and was joined by investors including Corner Ventures, Good Friends, and Educapital.

- Contractbook, a Copenhagen-based contract automation platform, raised $30 million in Series B funding. Tiger Global led the round and was joined by investors including Bessemer Venture Partners, byFounders, and Gradient Ventures.

- Waybridge, a New York-based supply chain platform for raw materials, raised $30 million in Series B funding co-led by Rucker Park Capital and Craft Ventures. www.waybridge.com

- Cycode, a San Francisco-based cybersecurity startup focused on the developer pipeline, raised $20 million in Series A funding. Insight Partners led the round and was joined by investors including YL Ventures.

- Optimal Dynamics, a New York-based logistics and supply chain management startup, raised $18.4 million in Series A funding. Bessemer Venture Partners led the round and was joined by investors including Fusion Fund, The Westly Group, TenOneTen Ventures, Embark Ventures, and FitzGate Ventures.

- Authomize, a Tel Aviv-based security management platform, raised $16 million in Series A funding. Innovation Endeavors led the round and was joined by investors including Blumberg Capital, Entree Capital and M12.

- Liquid Death, a Santa Monica, Calif.-based beverage brand that packages water in cans, raised $15 million in funding. Investors included Live Nation, Machine Gun Kelly, Tony Hawk, Wiz Khalifa, Steve Aoki, Kelly Campbell (president of Hulu) and Michael Dubin (founder of Dollar Shave Club).

- GRIN, a Sacramento, Calif.-based influencer marketing software maker for direct-to-consumer brands, raised $16 million. Imaginary Ventures led the round and was joined by investors including Good Friends Venture Capital.

- BluBracket, a Palo Alto-based provider of source code repository security, raised $12 million in Series A funding. Evolution Equity Partners led, and was joined by insiders Unusual Ventures, Point72 Ventures, SignalFire and Firebolt Ventures. http://axios.link/KhvG

- CognitOps, an Austin-based provider of A.I.-based warehouse operating applications, raised $11 million in Series A funding. FirstMark led the round and was joined by investors including Chicago Ventures, Schematic Ventures, Haystack, and CEAS Investments.

- Anvilogic, a Palo Alto, Calif.-based cybersecurity detection automation company, raised $10 million in Series A funding. Cervin Ventures led the round and was joined by investors including Foundation Capital, Point 72 Ventures, and Dan Warmenhoven.

- VIA, a Somerville, Mass.-based blockchain and A.I. company for the energy industry, raised $10 million in Series A funding. Westly Group led the round.

- Transcend Software, a Princeton, N.J.-based design and engineering automation tool maker, raised $10 million. Aspen Capital Group, HG Ventures, and PureTerra Ventures led the round.

- Salted, a Los Angeles-based company for Quick Service Restaurant brands, raised $9 million in seed funding. Kamine Development Corporation led the round and was joined by investors including Craft Ventures, Valor Equity Partners, Proof Ventures, and Wonder Ventures.

- Chef Robotics, a San Francisco-based food prep automation company, raised $7.7 million in pre-seed and seed funding. Investors include Kleiner Perkins, Promus Ventures, Construct, Bloomberg Beta, BOLD Capital Partners, Red and Blue Ventures, Gaingels, Schox VC, Stewart Alsop and Tau Ventures.

- Plunk, a Bellevue, Wash.-based mobile app helping homeowners make decisions to increase their home’s value, raised $6.5 million in seed funding. Unlock Ventures led the round and was joined by investors including Sony Innovation Fund, Plug and Play Ventures, Vectr Fintech Partners, and Second Century Ventures.

- Blair, a San Francisco area-based business with income-share-agreement programs with schools, raised $6.3 million in seed funding. Tiger Global Management led the round and was joined by investors including Rainfall and 468 Capital.

- Legionfarm, a Redwood City, Calif.-based gaming platform for gamers to game with pro players, raised $6 million in Series A funding. Investors include SVB, Y Combinator, Scrum VC, Kevin Lin, Altair Capital, and Ankur Nagpal.

- BigBrain, a New York-based trivia app, raised $4.5 million from FirstRound Capital, Box Group, Ludlow Ventures, and Golden Ventures.

- BluePallet, a Chicago-based marketplace for the chemical industry, raised $4 million. Investors include Terry Hill, CEO of North America Barenz; Mathew Brainerd, CEO of Brainerd Chemical Co.; and Bruce Schechinger, former Chairman of NACD.

- Just Women’s Sports, a San Francisco-based media platform for women’s sports, raised $3.5 million in seed funding. Will Ventures led, and was joined by Thirty Five Ventures, Drive by DraftKings, OVO Fund and Supernode Global.www.justwomenssports.com

- ArmorCode, a Palo Alto-based application security platform, raised $3 million in seed funding. Sierra Ventures, Tau Ventures, and Z5 Capital invested and were joined by investors including Andreas Kuehlmann (CEO, Tortuga Logic) and Prithvi Rai (CEO, Borneo).

- Twosense, a New York-based biometric authentication startup, raised $3 million. Atypical Ventures and Preface Ventures led the round and were joined by investors including Jonathan Cogley (LogicBoost Labs), Glasswing Ventures, Entrepreneurs Roundtable Accelerator, and Brand New Matter Ventures.

. . .

Sustainability:

- Smol, a London-based provider of sustainable homecare products, raised $34 million in Series B funding. Eight Roads led, and was joined by GV, Latitude and insiders Balderton and Jam Jar.www.smolproducts.com

- Voltus, a San Francisco-based maker of energy management products, raised $31 million in Series C funding. Activate Capital led the round and was joined by investors including NGP Energy Technology Partners III, Prelude Ventures, and Ajax Strategies.

- Sylvera, a London-based carbon offset ratings provider, raised $7.8 million in funding. Index Ventures led the company’s seed round, and was joined by investors including Seedcamp, Speedinvest and Revent.

Acquisitions & PE:

- Cedar will acquire OODA Health, a San Francisco-based healthcare tech company, for $425 million. Oak HC/FT backed OODA.

- Walmart announced plans to acquire Zeekit, a Tel Aviv-based maker of a way to try on clothes virtually. Financial terms weren't disclosed.

- Apax agreed to buy a stake in Nulo, an Austin-based pet food brand, from CAVU Venture Partners and Main Post Partners. Financial terms weren't disclosed.

- PayPal will acquire Happy Returns, a Los Angeles-based return drop-off logistics company. PayPal Ventures was an investor along with US Venture Partners.

- GoodRx (Nasdaq: GDRX) acquired Vericast’s RxSaver, a discount drug company, for $50 million, per Bloomberg.

- Cisco (Nasdaq: CSCO) agreed to buy Kenna Security, a Santa Clara, Calif.-based vulnerability management platform that had raised nearly $100 million from firms like Costanoa Ventures, PeakSpan Capital, Sorenson Capital, Bessemer Venture Partners and USVP.www.kennasecurity.com

. . .

IPOs:

- Similarweb, a Tel Aviv-based provider of a freemium platform for website traffic analytics, raised $176 million in an offering of 8 million shares (6% insider sold) priced at $22 apiece. Viola Group and Naspers back the firm.

. . .

SPACs:

- Better, a New York-based home mortgage startup, agreed to go public at an implied $7.7 billion valuation via Aurora Acquisition Corp. (Nasdaq: AURC), a SPAC sponsored by Novator Capital. Better raised around $950 million from firms like SoftBank, CapitalG, Ping An, L Catterton, Activant Capital, Fenway Summer Ventures, IA Ventures, 1/10 Capital and Goldman Sachs. http://axios.link/F6yv

- Ginkgo Bioworks, a Boston-based developer of microorganisms for such purposes as flavoring, agreed to go public at an implied $15 billion valuation via Soaring Eagle Acquisition (Nasdaq: SNRG), a SPAC formed by Harry Sloan and Jeff Sagansky. Ginkgo raised around $1.9 billion in private funding from firms like Illumina, General Atlantic, In-Q-Tel, DCVC, Baillie Gifford and Viking Global. Soaring Eagle raised $1.5 billion in its IPO. If it only used some of its proceeds for its initial acquisition, it could spin off the rest into a new SPAC. But it appears all the money is going into Ginkgo.

-Bustle, a New York-based digital media group, tells Axios' Sara Fischer that it still plans to go public via SPAC in 2021.

- Vice Media, a Brooklyn-based cable and online entertainment group, is in talks to go public via merger with 7GC & Co., a SPAC, per Bloomberg. A deal could value the firm at $3 billion.

- AgileThought, an Irving, Texas-based tech services company, will go public via merger with LIV Capital Acquisition, a SPAC. A deal values the firm at $491 million. AgileThought’s investors include Nexxus Capital.

- Plus, an autonomous truck company, will go public via merger with Hennessy Capital Investment Corp. V, a SPAC, valuing it at $3.3 billion.

Funds:

- Alex Rodriguez and former Walmart e-commerce boss Marc Lore have formed a venture capital firm called Vision/Capital/People (VCP). The strategy, not the people. VCP plans to build a concentrated portfolio, acquiring between 40% and 80% stakes in startups. It's antithetical to VC conventional wisdom, particularly at the earlier stages when success is tough to guarantee. VCP will begin with $50 million of the pair's own money, but may seek to raise hundreds of millions in outside capital. It also is investing $10 million for a 40% stake in NOW//with, a U.S. social commerce startup that's preparing to launch."Owning 40% to 80% of a company means that you don't really need as many hits. One big hit at a 40% stake pays for everything else. I do like the idea of these concentrated bets rather than just sprinkling dollars around. We have the ability to actually influence and be a leader.” — Marc Lore to CNBC

- YouTube, the Alphabet-backed video platform, created a $100 million YouTube Shorts Fund to pay creators on its TikTok competitor platform.

- VamosVentures, an L.A.-based venture capital fund, raised $50 million for a fund focused on early-stage investments in tech companies led by Latinx and diverse founders. Apple is contributing to the fund.

- BLCK VC, Sequoia and Lightspeed partnered to create a scout program for Black investors.

- IVP, a Menlo Park, Calif.-based venture firm, raised $1.8 billion for growth-stage deals.

- RRE Ventures is raising its eighth fund, per an SEC filing. Its current fund closed on $265 million in 2017. www.rre.com

Final Numbers

Source: SPAC Research

The death of SPACs has been greatly exaggerated.

Yes, there has been a slowdown in new issuance. Most of that is due to new SEC guidance and service providers working through the paper backlog.

Yes, PIPE investors have gotten a bit pickier.

But there are around 420 active SPACs seeking deals — all of which have an expiration date — with another 278 in the IPO pipeline.

The bottom line: SPAC sponsors don't get paid if they don't do a deal. So they will find deals to do.