Sourcery (5/16-5/20)

Bear Market Dip ~ SpotOn, Xendit, Modulr, Belong, Arrived Homes, Metatheory, Azra Games, Legacy, Homethrive, Lassie, Arise, Pique, Polygon, Mirvie, GoPuff, Optibus, Glean, Vivun, A.Team, Forma.ai...

Buongiorno! Reporting live from Lake Como, Italy. Where Davos is just around the corner… as well as Kourtney Kardashian’s wedding.

I just wrapped a beautiful tour to my hometown-city of the last 7 years, NYC (before moving to LA in fall ‘21). The weather was top notch, sunny, breezy, and vibrant. Allergies were peaking and people were sneezing. The gym TVs had Bloomberg and CNBC on, vs typical LA celeb-noise of Bravo and E!. And the hustling New Yorkers were a bit friendlier. #grinddontstop

I hosted a NYC Commerce Founders breakfast for Upfront Ventures alongside VMG Catalyst, sponsored by Silicon Valley Bank. It was delicious. Thank you maman! Sign up for the next here.

Last week was also one of the worst weeks for the stock market in quite some time, momentarily dipping us into bear market territory…

As Elon Musk says, recessions aren’t necessarily a bad thing, the more time the market is in a boom, the more money is misallocated. People end up doing things that are silly and not relevant. Useful products rise and un-useful products go bankrupt. This is all to say most downturns last a 12-18 month bumpy ride, and the most adaptive survive (just as everyone happened to adapt to being a web3 company to raise fast capital). All-In Podcast (1:04:18)

What does this mean for startup/VC deals and announcements?

We’re going to start to see a pull back in new VC deal activity. This often has a delayed effect for subsequent funding announcements as companies typically announce 3-6-12 months after raising (startup funding announcements are a signal-game, timing is important for recruiting top talent, strategic partnerships, acquiring customers, and seeking additional capital for the next round). This hasn’t quite hit Sourcery just yet as companies whom you’re seeing announce rounds now likely closed months ago and are on the cusp of raising again or are actively trying to. I’d expect a majority of companies announcing now are hitting the ‘send’ button as quickly as possible to drive on that momentum before markets really close.

For a broader perspective on this changing tech landscape. North American startup funding fell 11% in Q1 2022, the first quarterly decline in 2 years. Q2 2022 will likely dip further, CB Insights predicts a 19% drop QoQ. The number of Sourcery reported deals in the peak froth of the market, like a fluffy TikTok inspired dalgona coffee, was averaging 100+ “quality” companies/wk. I expect this to nearly cut in half and go down to ~60+ deals in the next couple of weeks. CB Insights reported in February, there were over 1,000+ unicorns (companies valued over $1B+), but, we may start to see those valuations decline as down rounds occur (see Klarna below) and overvalued companies are internally resetting valuations or topping off capital at the last round’s price.

Like Elon said, it’s not necessarily a bad thing. A lot of companies raised too high and this is a healthy reset to get back to reasonable market prices.

As we say in Italiano, è troppo caro per me, può farmi uno sconto? (“It’s too expensive for me, can you do me a discount?”). Andiamo!

More trends we’re noticing:

Increased M&A pressure

From underperforming SPACs (the majority), trying to build up their revenue streams by acquiring other companies balance sheets, customers and strategic product expansion

Crypto markets may continue to go down

Fed rate hikes affect crypto as they view it as a risk asset, most risk assets are selling off now as investors are turning to risk-free assets that actually provide yield to investors

Web3 shifts towards utility

Weeding out the hype-driven and oversaturated NFT/web3 mania, attention is shifting towards utility-based and infrastructure projects

Valuation haircuts & resets

Swedish buy now pay later “BNPL” giant and Europe’s most valuable startup, Klarna, is reportedly seeking new funding at a valuation in the low ~$30Bs, a ~30% drop from its $46B last round post-val, and laying off 10% of its workforce. Klarna appears to be the second major unicorn, following Instacart earlier this year, to be slicing billions off its valuation in the private market amid the public tech stock spiral.

Shout out to fellow Italian travel buddy Cory Moelis of Ground Up Ventures!

Follow us on Twitter Linkedin for just the top deals recap

. . .

Last Week (5/16-5/20):

Relevant deals include the 80+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Velocity Global, SpotOn, Xendit, Thought Machine, Caribou, Dock, Modulr, Unit, Belong, Noyo, Arrived Homes, Metatheory, TipTop, Column Tax, DoraHacks, FreshCut, Azra Games, CyberConnect, Medallion, Parcl, Circit, Legacy, Homethrive, Reverence, Lassie, CarePoint, Mahmee, Anja Health, Arise, Pique, Polygon, Mirvie, GoPuff, Recurrent, Imply Data, Glean, Masterschool, Vivun, Cornami, Flink, A.Team, Carma, Eridan, Instabug, Forma.ai, Torch, Bravado, Heartex, UrbanFootprint, Akuity, LucidLink, Pipedream, Legl, OtterTune, Candor, Glisser, TopShip, Inspiration Mobility, Zolar, Perennial, Sustain.Life, HowGood; SpaceX, Brex, Strava, MakerBot, JetBlue, Joby Aviation; Samba TV; Surf Air, zSpace

Notable funds raised include: a16z raised $600M for its first gaming-focused VC fund, Threshold Ventures raised $375M for early stage and $75M for follow-on opportunities, Tusk Ventures raised $140M for startups in highly regulated industries

Final numbers on Q2’22 VC Funding on Pace For a Drop & DeFi’s Competing with Banks at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Velocity Global, a Denver-based global talent firm, raised $400m in Series B funding co-led by Eldridge and Norwest Venture Partners. http://axios.link/jKLN

- SpotOn, an SF-based provider of point-of-sale payment solutions, raised $300m in Series F funding at a $3.6b valuation. Dragoneer led, and was joined by G Squared and insiders Andreessen Horowitz, DST Global, Franklin Templeton and Mubadala. http://axios.link/0ZxJ

- Xendit, a payments infrastructure platform for Southeast Asia, raised $300m. Coatue and Insight Partners co-led, and were joined by Accel, Tiger Global, Kleiner Perkins, EV Growth, Amasia, Intudo and Goat Capital. http://axios.link/1dzw

- Thought Machine, a London-based B2B banking platform, raised $160m at a $2.7b valuation. Temasek led, and was joined by Intesa Sanpaolo, Morgan Stanley and insiders JPMorgan Chase, Lloyds Banking Group and SEB. http://axios.link/0Onj

- Elwood Technologies, a crypto trading platform founded by British hedge fund manager Alan Howard, raised funding at a $500m valuation from backers like Goldman Sachs, Barclays, Dawn Capital, Commerzbank and Galaxy Digital. http://axios.link/8Yie

- Caribou, a Washington D.C.-based automotive financing platform, raised $115 million in Series C funding led by Goldman Sachs Asset Management and was joined by investors including Innovius Capital, Harmonic, Accomplice, CMFG Ventures, Curql Fund, Firebolt Ventures, Gaingels, Moderne Ventures, Motley Fool Ventures, and others.

- Dock, a São Paulo-based full-stack payments and digital banking platform in Latin America, raised $110 million in funding. Lightrock and Silver Lake Waterman led the round and were joined by investors including Riverwood Capital, Viking Global Investors, and Sunley House Capital.

- Modulr, a London-based embedded payments platform for digital businesses, raised $108m in Series C funding. General Atlantic led, and was joined by insiders Blenheim Chalcot, Frog Capital, Highland Europe and PayPal Ventures. http://axios.link/ZiVr

- Unit, a Redwood City, Calif.-based banking-as-a-service startup, raised $100m in Series C funding at a $1.2b valuation. Insight Partners led, and was joined by Accel, Better Tomorrow Ventures and Flourish Ventures. http://axios.link/9UtO

- In3, a Dutch BNPL startup, raised $83.5m in Series B equity and debt funding from Force Over Mass, Waterfall Asset Management and Finch Capital. www.payingin3.eu

- Elwood Technologies, a London-based digital asset platform for institutions, raised $70 million in Series A funding. Dawn Capital and Goldman Sachs co-led the round and were joined by investors including Barclays, BlockFi Ventures, Chimera Ventures, CommerzVentures, Digital Currency Group, Flow Traders, and Galaxy Digital Ventures.

- Belong, a San Mateo, Calif.-based rental property management startup, raised $50m in equity funding (plus $30m in debt). Fifth Wall led, and was joined by insiders Battery Ventures, Andreessen Horowitz and GGV Capital. http://axios.link/v0AT

- Noyo, a San Francisco-based employee benefits platform, raised $45 million in Series B funding led by Norwest Venture Partners and was joined by investors including Workday Ventures, Gusto, Cap Table Coalition, Costanoa Ventures, Spark Capital, Homebrew, Operator Collective, Fika Ventures, Precursor Ventures, Garuda Ventures, Core Innovation Capital, and Webb Investment Network.

- Arrived Homes, a Seattle-based real estate investing platform, raised $25 million in Series A funding led by Forerunner Ventures and was joined by investors including Bezos Expeditions, Good Friends, former Zillow CEO Spencer Rascoff, Core Innovation Capital, PSL Ventures, and Neo.

- Metatheory, a web3 gaming and entertainment startup led by Twitch co-founder Kevin Lin, raised $24m in Series A funding. Andreessen Horowitz led, and was joined by Pantera Capital and FTX Ventures, Breyer Capital, Merit Circle, Recharge Thematic Ventures, Dragonfly Capital Partners, Daedalus, Sfermion and Global Coin Research. http://axios.link/1hUR

- TipTop, a stealthy crypto startup led by Postmates founder Bastian Lehmann, raised $23m in Series A funding led by Andreessen Horowitz. http://axios.link/pei6

- Improvado, a San Diego-based revenue and sales data analytics startup, raised $22m in Series A funding led by Updata Partners. www.improvado.io

- Column Tax, a New York-based personal income tax software company, raised $21.7 million in Series A funding led by Bain Capital Ventures and was joined by investors including Felicis, Not Boring, Core Innovation Capital, and South Park Commons.

- DoraHacks, a Singapore-based hacker movement and Web3 developer platform, raised $20 million in Series B1 funding. FTX Ventures and Liberty City Ventures led the round and were joined by investors including Circle Ventures, Gemini Frontier Fund, Sky9 Capital, Crypto.com Capital, and Amber Group.

- FreshCut, a Los Angeles-based Web3 short-form gaming content platform, raised $15 million in funding from investors including Galaxy Interactive, Polygon, Animoca Brands, Republic Crypto, and Twitch co-founder Kevin Lin.

- Azra Games, a Sacramento-based developer of collectible and combat role-play games, raised $15m in seed funding. Andreessen Horowitz led, and was joined by NFX, Coinbase Ventures, Play Ventures and Franklin Templeton. www.azragames.com

- CyberConnect, a Palo Alto-based decentralized social graph protocol for Web3 connections, raised $15 million in Series A funding. Animoca Brands and Sky9 Capital co-led the round and were joined by investors including Delphi Digital, Protocol Labs, Tribe Capital, GGV Capital, Spartan Group, Amber Group, IOSG Ventures, Polygon Studios, and SevenX Ventures.

- Medallion, a New York-based Web3 technology company building relationships between musicians and their fans, raised $9.15 million in seed funding led by The Chernin Group.

- QuestBook, a funding platform for web3 developers, raised $8.3m in Series A funding. Lemniscap led, and was joined by Coinbase Ventures, Alameda Research, Dragonfly, Hashed and Polygon. http://axios.link/F9lS

- Joystick, a Puerto Rico-based P2E gaming company, raised $8 million in seed funding from investors including Axie Infinity creator Jeffrey "Jiho" Zirlin and others.

- Faye, a Tel Aviv-based travel insurance startup, raised $8 million in seed funding led by Viola Ventures and F2 Venture Capital and was joined by investors including Portage Ventures, and former NBA player Omri Casspi.

- Parcl, a New York-based blockchain real estate investing platform, raised $7.5m from Fifth Wall, JAWS, IA Capital, Eberg Capital, Big Brain Holdings and Santiago Santos. www.parcl.co

- Circit, an Irish audit confirmation and open banking startup, raised €6.5m in series A funding co-led by Aquiline Technology Growth and MiddleGame Ventures. www.circit.io

- Evaluate.Market, a Brooklyn-based NFT portfolio management platform, raised $4m in seed funding. Rho Capital led, and was joined by Drive by DraftKings, Castle Island Ventures, Arca, Notation Capital, Flamingo Capital Syndicate, Dapper Labs, Visary Capital, Niche Capital and Dan Nova. www.evaluate.market

- Blinq, a Melbourne-based digital business card company, raised AUD$5 million ($3.5 million) from investors including Blackbird and Square Peg Capital.

- Pigeon Loans, a Miami-based P2P lending startup, raised $2.5m in seed funding. FundersClub led, and was joined by 305 Ventures, Ascendo VC, Dhuna Ventures and Pareto Holdings. http://axios.link/J3tp

. . .

Care:

- Legacy, a Boston-based digital sperm fertility clinic, raised $25 million in Series B funding led by Bain Capital Ventures and was joined by investors including FirstMark Capital, Section 32, TQ Ventures, and Valor Equity Partners.

- Homethrive, a Northbrook, Ill.-based homecare management startup for seniors, raised $20m in Series B funding, per Axios Pro. Human Capital led, and was joined by Allianz, 7wireVentures and Pitango HealthTech. http://axios.link/N872

- Reverence, a New York-based in-home digital health company, raised $9.5 million in funding led by Target Global.

- Deciphex, an Irish provider of pathology software and services, raised $11.5m in Series B funding. ACT VC led, and was joined by Charles River Labs, Novartis, IRRUS Investments, Nextsteps Capital and HBAN Medtech Syndicate. www.deciphex.com

- Lassie, a Stockholm-based pet insurance startup, raised €11m in Series A funding. Felix Capital led, and was joined by Inventure and Passion Capital. www.lassie.co

- CarePoint, a telemedicine and micro-clinic operator in Africa, raised $10m from Delle, Breyer Capital, Beyond Capital Ventures, M3, Asia Pacific Land/ Natural World and Sixth Street CEO Alan Waxman. http://axios.link/KFNq

- Mahmee, an LA-based maternal care startup, raised $9.2m in Series A funding. Goldman Sachs led, and was joined by Revolution Rise of the Rest, Muse Capital, Backstage Capital, The Helm and Pipeline Angels. http://axios.link/XNjv

- EvolvedMD, a Scottsdale, Ariz.-based provider of psychiatric collaborative care management services, raised a $5.4m in Series A funding co-led by Waterline Ventures and Conductive Ventures. www.evolvedmd.com

- Anja Health, a Los Angeles-based stem cell treatment startup, raised $4.5 million in seed funding led by Seven Seven Six founder Alexis Ohanian and was joined by investors including Harvest Ventures, Crista Galli Ventures, and others.

- Arise, a New York-based provider of virtual care for eating disorders, raised $4m in seed funding co-led by BBG Ventures and Greycroft. www.wearise.com

- Pique, a virtual sexual health clinic focused on enjoyment rather than reproduction, raised $4 million in seed funding led by Maveron, per Axios Pro. http://axios.link/SPhd

- Polygon, a Santa Monica, Calif.-based provider of remote evaluations and support for dyslexia and ADHD, raised $3.6m led by Spark Capital. www.hellopolygon.com

- Aumio, a German meditation app for kids, raised €3m in seed funding co-led by Partech and byFounders. www.aumio.de

- Mirvie, an SF-based maker of a blood test for predicting pregnancy complications, raised an undisclosed amount of Series B funding. Decheng Capital led, and was joined by BlackRock, Foresite Capital, General Catalyst, GV, Khosla Ventures and Mayfield. www.mirvie.com

. . .

Enterprise & Consumer:

- Gopuff, the Philadelphia-based instant delivery company, received a new investment from former Disney CEO Bob Iger, who will serve as an advisor to the company.

- Recurrent, a Miami-based digital media company, raised $300 million in funding led by funds managed by Blackstone Tactical Opportunities.

- Inflection AI, a Palo Alto-based ML startup led by Mustafa Suleyman (ex-DeepMind), raised $225m in new equity funding, per an SEC filing. Directors include Greylock’s Reid Hoffman. http://axios.link/g5e7

- Imply Data, a Burlingame, Calif.-based database provider for analytics applications, raised $100 million in Series D funding led by Thoma Bravo and was joined by investors including OMERS Growth Equity, Bessemer Venture Funds, Andreessen Horowitz, and Khosla Ventures.

- Optibus, a Tel Aviv-based software platform for public transportation planning and operations, raised $100 million in Series D funding from investors including Insight Partners, Bessemer Venture Partners, Verizon Ventures, Pitango First & Pitango Growth, Tencent, SOMV Momentum, and others.

- Glean, a Palo Alto-based virtual work assistant, raised $100 million in Series C funding led by Sequoia Capital.

- Masterschool, a Tel Aviv-based network of tech career-training schools, raised $100 million in seed funding led by Group 11 and was joined by investors including Target Global, Pitango Ventures, Dynamic Loop Capital, Sir Ronald Cohen, and others.

- Vivun, an Oakland-based buyer experience software provider, raised $75 million in Series C funding led by Salesforce Ventures and was joined by investors including Tiger Global, Menlo Ventures, Accel, and Unusual Ventures.

- Cornami, a Campbell, Calif.-based quantum encryption startup, raised $68m. SoftBank led, and was joined by Impact VC and Octave Ventures. http://axios.link/ZvqC

- Flink, a German instant grocery delivery startup, raised between €60m and €70m in new funding from Carrefour. It also agreed to buy Cajoo, a French instant delivery upstart that had raised over $40m from firms like Carrefour, Frst Capital, Siparex XAnge Venture and Headline. http://axios.link/V2Jx

- Buildots, an Israeli construction management software startup, raised $60m in Series C funding. Viola Growth and O.G. Tech co-led, and were joined by insiders Lightspeed Venture Partners, Future Energy Ventures and Maor Investments. www.buildots.com

- A.Team, a New York-based members-only network for creating workplace teams, raised $55 million in Series A funding. Tiger Global Management, Insight Partners, and Spruce Capital Partners co-led the round and were joined by investors including Jay-Z’s Rocnation, Adam Grant, and others.

- Carma, a Sydney, Australia-based used car platform, raised $52 million in Series A funding led by General Catalyst Partners and Tiger Global.

- Eridan, a Mountain View, Calif.-based radio frequency communication technology developer, raised $46 million in funding. Capricorn’s Technology Impact Fund and Monta Vista Capital led the round and were joined by investors including Social Capital, Diamond Edge Ventures, and Pilot Grove Management.

- Instabug, a San Francisco-based mobile monitoring, crash, and bug reporting solution for mobile teams, raised $46 million in Series B funding led by Insight Partners and was joined by investors including Accel, Forgepoint Capital, and Endeavor.

- Forma.ai, a Toronto-based sales performance management solution, raised $45 million in Series B funding led by ACME Capital and was joined by investors including Crosslink Capital, Golden Ventures, Uncork Capital, Xfund, and Gaingels.

- Komodor, a Tel Aviv-based Kubernetes troubleshooting platform, raised $42 Million in Series B funding led by Tiger Global and was joined by investors including Felicis, Accel, NFX Capital, OldSlip Group, Pitango First, and Vine Ventures.

- Major League Cricket raised $44m in Series A funding led by Microsoft CEO Satya Nadella, plus a commitment for another $76m within the next year. http://axios.link/2Sxm

- Torch, an SF-based people development platform, raised $40m in Series C funding. 137 Ventures led, and was joined by Initialized Capital, Norwest Venture Partners and Obvious Ventures. www.torch.io

- The Professional Fighters League, an MMA league, raised $30m in Series E funding at a $500m valuation. Waverley Capital led, and was joined by Alex Rodriquez. http://axios.link/JmdT

- Fetcher, a New York-based recruiting automation platform, raised $27 million in Series B funding led by Tola Capital and was joined by investors including G20 Ventures, KFund, and Accomplice.

- Bravado, a San Francisco-based professional network for B2B sales teams, raised $26 million in Series B funding led by Tiger Global and was joined by investors including Redpoint Ventures, XYZ Ventures, Freestyle Capital, Precursor, and other angels.

- Pangea Cyber Corporation, a Palo Alto, Calif.-based security services provider for cloud and mobile app developers, SaaS platform providers, and security operations centers, raised $25 million in Series A funding led by Ballistic Ventures and was joined by investors including SYN Ventures, Splunk former chairman and CEO Godfrey Sullivan, CrowdStrike founder and CEO George Kurtz, and former AWS Security Products Vice President Dan Plastina.

- Heartex, an SF-based provider of data labeling software, raised $25m in Series A funding. Redpoint Ventures led, and was joined by Unusual Ventures, Bow Capital, and Swift Ventures. http://axios.link/T0qH

- UrbanFootprint, a Berkeley, Calif.-based urban planning software platform, raised $25m in Series B funding. Citi and Social Capital co-led, and was joined by 2150, A/O PropTech, Assured Guaranty, Dcode Capital, Valo Ventures and Radicle Impact. http://axios.link/F6KN

- Keelvar, an Irish sourcing tech startup, raised $24m in Series B funding. 83North led, and was joined by insiders Elephant, Mosaic and Paua. www.keelvar.com

- Akuity, a Sunnyvale, Calif.-based provider of app delivery software for Kubernetes, raised $20m in Series A funding co-led by Lead Edge Capital and Decibel Partners. http://axios.link/IINj

- LucidLink, an SF-based provider of SaaS for connecting creative teams, raised $20m in Series B funding. Headline led, and was joined by Top Tier Capital Partners and insiders Baseline Ventures and Bright Cap Ventures. www.lucidlink.com

- Pipedream, an SF-based app integration startup, raised $20m. True Ventures led, and was joined by CRV, Felicis Ventures and World Innovation Lab. http://axios.link/tSRf

- US Mobile, a New York-based prepaid phone carrier, raised $19.5 million in Series A2 funding led by Volition Capital and was joined by investors including Stonks.com founder Ali Moiz, SquareTrade founder and former CEO Ahmed Kaishgi, Avenue Growth Partners co-founder Brian Goldsmith, Tiny Partner co-founder and general partner Andrew Wilkinson and Jeremy Giffon, and James Beshara.

- Legl, a London-based provider of law firm operations SaaS, raised $18m in Series B funding led by insider Octopus Ventures. http://axios.link/TtBN

- Predibase, a San Francisco-based declarative machine learning platform developer, raised $13.5 million in Series A funding led by Greylock and was joined by others.

- Credo AI, a Palo Alto-based “responsible AI governance” platform, raised $12.8m in Series A funding. Sands Capital led, and was joined by insiders Decibel and AI Fund. www.credo.ai

- OtterTune, a Pittsburgh-based database maintenance automation startup, raised $12m in Series A funding. Intel Capital and Race Capital co-led, and were joined by Accel. http://axios.link/t132

- Credo AI, a remote-based governance platform for managing A.I. risk and compliance, raised $12.8 million in Series A funding led by Sands Capital and was joined by investors including Decibel and AI Fund.

- FloorFound, an Austin-based reusable ecommerce platform for oversized retail products, raised $10.5 million in Series A funding. Next Coast Ventures and LiveOak Venture Partners led the round and were joined by investors including FlyBridge Capital Partners, Schematic Ventures, and Datapoint Capital.

- RAIN Technologies, a New York-based voice and conversational AI company, raised $11 million in Series B funding from investors including Valor Capital, McLarty Diversified Holdings, and Burch Creative Capital.

- CipherMode Labs, a Los Angeles-based data privacy and sharing encryption platform, raised $6.7 million in seed funding led by Innovation Endeavors and was joined by investors including Pillar VC, the National Science Foundation, and others.

- Flexspace, a flexible workspace booking and management platform, raised $6m in seed funding. M13 led, and was joined by R-Squared Ventures and Magenta Venture Partners. www.flexspace.ai

- Adgile Media Group, a New York-based advertising company, raised $5 million in seed funding led by Brand Foundry Ventures and was joined by investors including Amity Supply, Finn Capital Partners, Consumer Ventures, and others.

- Candor, a New York-based professional network platform, raised $5 million in funding from investors including Contrary Capital, Afore Capital, Worklife, Village Global, Global Founders Capital, Banana Capital, and other angels.

- Glisser, a London-based hybrid meetings and events platform, raised $4.9m in new funding from Downing Ventures and Gresham House. www.glisser.com

- ZincSearch, an SF-based search engine startup, raised $3.6m in seed funding. Nexus Venture Partners led, and was joined by Dell Technologies Capital, Secure Octane and Cardinia Ventures. www.zincsearch.com

- Included, a Seattle-based employee engagement and people analytics platform, raised $3.5 million in seed funding led by Trilogy Equity Partners and was joined by investors including Flying Fish Partners, SignalFire, and Alumni Ventures.

- Cyscale, a London-based cloud security analysis startup, raised €3m led by Notion Capital. www.cyscale.com

- Very Good Ventures, a New York-based Flutter app development consultancy, raised $3m in Series A funding from Celesta Capital. www.verygood.ventures

- SIQ, an LA-based maker of smart basketballs, raised $3m. KB Partners led, and was joined by Tera Ventures. www.siqbasketball.com

- Topship, a Nigerian provider of international shipping logistics for e-commerce, raised $2.5m in seed funding. Flexport led, and was joined by YC, Soma Capital, Starling Ventures, Olive Tree Capital, Capital X and True Capital. http://axios.link/F3MJ

. . .

Sustainability:

- Inspiration Mobility, a Washington, D.C.-based EV fleet management and investment startup, raised $215m co-led by Macquarie Asset Management and Ferrovial, per Axios Pro. http://axios.link/rmjN

- Zolar, a German supplier network for small solar systems, raised €100m in Series C funding. Energy Impact Partners and GIC co-led, and were joined by Inven Capital, Heartcore Capital, Statkraft Ventures and Pirate Impact Capital. http://axios.link/Wqgh

- Perennial, a Boulder, Colo.-based soil carbon measurement, reporting, and verification platform for soil-based carbon removal, raised $18 million in funding. Temasek and Bloomberg co-led the round and were joined by investors including SineWave Ventures and the Microsoft Climate Innovation Fund.

- Sustain.Life, a New York-based sustainability management software provider, raised $16 million in seed funding. Tapestry VC and Sustain.Life co-founder Mike Hanrahan co-led the round and were joined by investors including Active Impact Investments, Kompas, Agya Ventures, and Seyen Capital.

- HowGood, a sustainability data SaaS, raised $12.5m led by Titan Grove. http://axios.link/3feC

- UtilityAPI, an Oakland-based provider of data sharing software for electric utilities, raised $10m led by Aligned Climate Capital. www.utilityapi.com

- Optivolt, a San Mateo, Calif.-based developer of solar tech for shady areas, raised $8.2m in seed funding. Atlas Innovate led, and was joined by Impact Capital, Pure Ventures and City Light Capital. http://axios.link/AHxL

- ChargeFUZE, a Los Angeles-based mobile charging provider, raised $5 million in seed funding led by Beverly Pacific, TR Ventures, VA2, Carro co-founder and president Jason Goldberg, and former Walt Disney Parks and Resorts president of worldwide operations Al Weiss, and were joined by others.

Acquisitions & PE:

- SpaceX is launching an employee tender at a $125b valuation, per Bloomberg. No word on if Elon Musk is selling into it. http://axios.link/ExjH

- Brex, an SF-based corporate credit card company focused on startups, closed a $250m employee tender. The company was most recently valued by VCs at $12.3b. http://axios.link/SyFS

- Adani Group, the Indian infrastructure firm led by billionaire Gautam Adani, agreed to buy the Indian assets of Swiss cement giant Holcim for $10.5b, becoming the country’s second-largest cement maker. http://axios.link/AebZ

- Candle Media, the Blackstone-backed media rollup led by ex-Disney execs Tom Staggs and Kevin Mayer, is acquiring ATTN:, the digital media company that focuses on social change content for millennials and Gen Z, for about $150m in an all-cash deal, as first reported by Axios.

- MannKind Corporation acquired V-Go, an insulin wearable patch, from Danbury, Conn. and Westlake Village, Calif.-based Zealand Pharma for $10 million upfront plus sales-based milestones.

- Strava acquired Recover Athletics, a Boston-based injury prevention app for runners. Financial terms were not disclosed.

- EQT agreed to acquire Redwood Capital Group, a Chicago-based investment manager. Financial terms were not disclosed.

- MakerBot, a Brooklyn-based 3D printing company, and Ultimaker, an Utrecht, Netherlands-based 3D printing company, agreed to merge. The deal is backed by NPM Capital and Stratasys and is valued at $62.4 million.

- BMG, backed by KKR, and Warner Music (Nasdaq: WMG) are among the reported bidders for Pink Floyd's back catalog. http://axios.link/llgR

- Cornerstone OnDemand, a portfolio company of Clearlake Capital, completed its acquisition of EdCast, a Mountain View, Calif.-based learning experience software provider that had raised over $100m from firms like Avathon Capital, REV Venture Partners, National Grid Partners, Sterling Partners and State Street Global Advisors and Cervin Ventures. http://axios.link/YGA2

- Digital World Acquisition Corp., the SPAC taking Truth Social public, filed its S-4 document with the SEC. Not a ton of new info in there, except that the SPAC appears to still be under SEC investigation. We also learned a bit more about what former President Trump can and can't do, when it comes to posting on Twitter, were he to be reinstated by Elon Musk.

- JetBlue (Nasdaq: JBLU) launched a hostile takeover offer for Spirit Airways (NYSE: SAVE), which previously rejected its unsolicited acquisition bid in favor of an existing agreement with Frontier (Nasdaq: ULCC). It's unclear if U.S. antitrust regulators would allow JetBlue to buy Spirit (despite what JetBlue argued this morning). But, if the deal happens, it could spark a series of airline industry mergers.

- McDonald's (NYSE: MCD) plans to sell its Russia business to a local buyer, after more than 30 years of operating in the country.

- Clavis Capital Partners and Green Hills Partners acquired UCC Environmental, a Chicago-based provider of air pollution and wastewater environmental systems for power plants and heavy industry. www.uccenvironmental.com

- Appreciate, a Minnetonka, Minn.-based single Family Rental marketplace and management platform, agreed to go public via a merger with PropTech Investment Corp., a SPAC. A deal is valued at $416 million.

- Bridgepoint is seeking a buyer for Kyriba, a San Diego-based provider of treasury management software that could fetch more than $2b, per Bloomberg. http://axios.link/WI87

- Class, a Washington, D.C.-based virtual classroom software startup backed by firms like SoftBank, paid around $210m to buy virtual class tool Collaborate from Blackboard, a portfolio company of Veritas Capital and Leeds Equity Partners, per TechCrunch. Both Class and Blackboard were founded by Michael Chasen. http://axios.link/rKsx

- Unleashed Brands, the Bedford, Texas-based parent company of such brands as Urban Air Adventure Parks and The Little Gym, is seeking a buyer, per Axios Pro. Sellers would include MPK Equity Partners. http://axios.link/zcEZ

- Joby Aviation (NYSE: JOBY), an eVTOL developer, acquired Avionyx, an Indialantic, Fla.-based aerospace software engineering firm. http://axios.link/UmUK

. . .

IPOs:

- Samba TV, a San Francisco-based software provider for television advertising and analytics, withdrew its $75 million IPO plans.

. . .

SPACs:

- Surf Air, a subscription-based "all you can fly" airline for business travelers, agreed to go public at an implied $1.42b enterprise value via Tuscan Holdings II (Nasdaq: THCA), a SPAC formed by InterPrivate Capital, and to acquire Southern Airways. Surf Air, which tried to IPO a couple of years ago, raised around $90m (plus got a PPP loan), from firms like Velos Partners, IVP, NEA, ff Venture Capital and Base Ventures. http://axios.link/RKq1

- zSpace, a San Jose, Calif.-based provider of VR and AR tech for the education market, agreed to go public at an implied $195m enterprise value via Edtech Holdings Acquisition (Nasdaq: EDTXU), a SPAC formed by IBIS Capital. ZSpace raised around $117m from firms like Artiman Ventures and Gulf Islamic Investments. www.zspace.com

Funds:

- Generation Investment Management, the PE firm co-founded by Al Gore, raised $1.7b for its fourth “sustainable solutions” fund. http://axios.link/kkue

- Andreessen Horowitz raised $600m for its first gaming-focused VC fund. http://axios.link/6YR3

- Threshold Ventures, a Menlo Park, Calif.-based venture capital firm, raised $450 for two funds. Their Threshold IV fund raised $375 million and focuses on early-stage/Series A investments. Their Threshold Select fund raised $75 million and focuses on companies they have previously invested in.

- Infinity Ventures, formed by three ex-PayPal Ventures investors, raised $158m for its debut fund, per Axios Pro. http://axios.link/UheA

- Tusk Ventures, a New York-based venture capital firm, raised $140 million for a third fund focused on early-stage technology companies operating in highly regulated industries.

- Pear, an SF-based VC firm, is raising up to $410m for its fourth fund, per an SEC filing. www.pear.vc

- Third Point Ventures, led by hedge fund manager Dan Loeb, is raising its second fund, per an SEC filing. www.thirdpointventures.com

Final Numbers

Source: CB Insights Mid-Q2 report

CB Insights released a mid-Q2 report on VC funding, which finds that global volume is expected to see a similar drop between April and June that it saw between January and March.

The biggest anticipated drop would be in Asia, down 37%. European VC is expected to fall by 16%, while U.S. VC would be off 13%.

New "unicorn births" would hit their lowest level since 2020, while mega-funding rounds ($100m or more) would hit a six-quarter low.

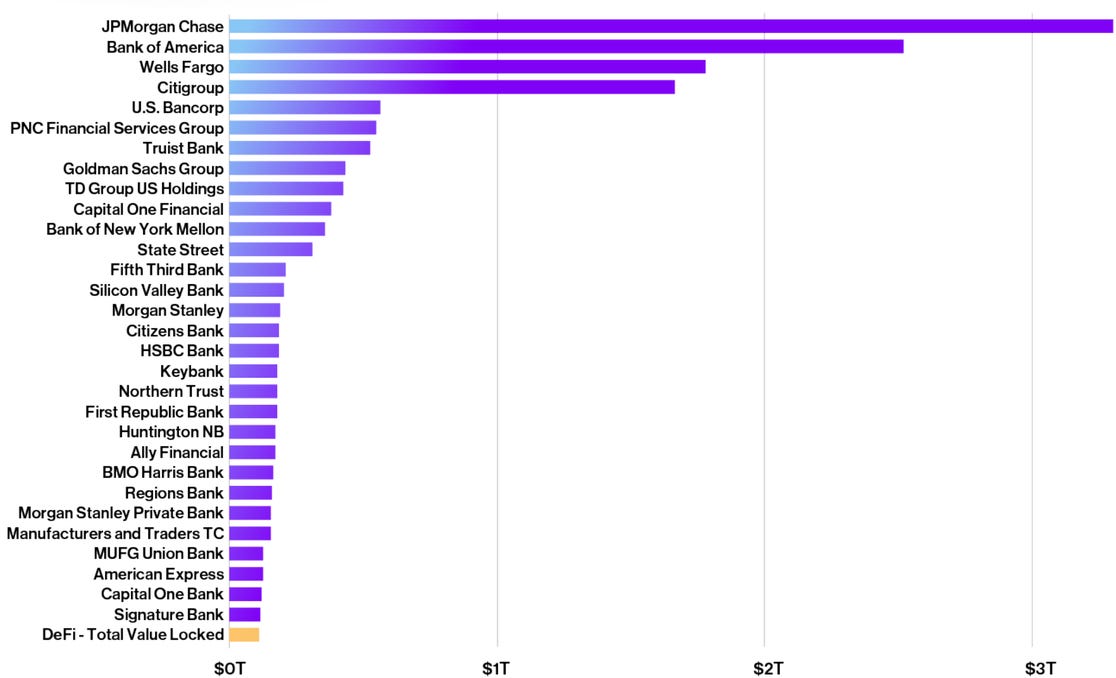

DeFi = 31st Largest Bank

Source: Andreessen Horowitz "State of Crypto" report. Bank AUM data per 12/31/22; DeFi TVL data as of 5/12/22.

Decentralized finance would represent the 31st largest U.S. bank by AUM, according to a "State of Crypto" report issued this morning by venture capital firm Andreessen Horowitz.

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

Great read. Glad you had so much fun in NYC.! That’s awesome you did the upfront breakfast. That’s big time. You are doing big things. That looked like a great breakfast. Thank you for the little Italian I learned reading this article. Congrats to you on all your success. You deserve it.