Sourcery (5/17-5/21)

Trade Republic, Extend, Figure, Pipe, Vise, Lithic, Boost, Payfit, Settle, Noom, PathAI, Wheel, Causaly, Mindful, Back Market, Workrise, Loom, ASAPP, Goldbelly, Ankorstore, Immuta, Pitch, Dooly...

Last Week (5/1-5/14):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech,Care, Future of Work, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Trade Republic, Extend, Figure, Pipe, Vise, Lithic, Boost, Payfit, Settle, Noom, PathAI, Wheel, Causaly, Mindful, Back Market, Workrise, Loom, ASAPP, Goldbelly, Ankorstore, Immuta, Pitch, Dooley, HeyDay, Explorium, Salto, Coiled, Code Ocean, Portside, Authomize, Freightwaves, Found, Britive, &Open, Adalo, Merge, Spokn, Panther, BETA, Eat Just, Daring, Cervest, Zap Energy, WeaveGrid; Therapy Brands, Modern Fertility; Oatly, Procore, Bright Health, Squarespace, Marqeta, Nerd Wallet

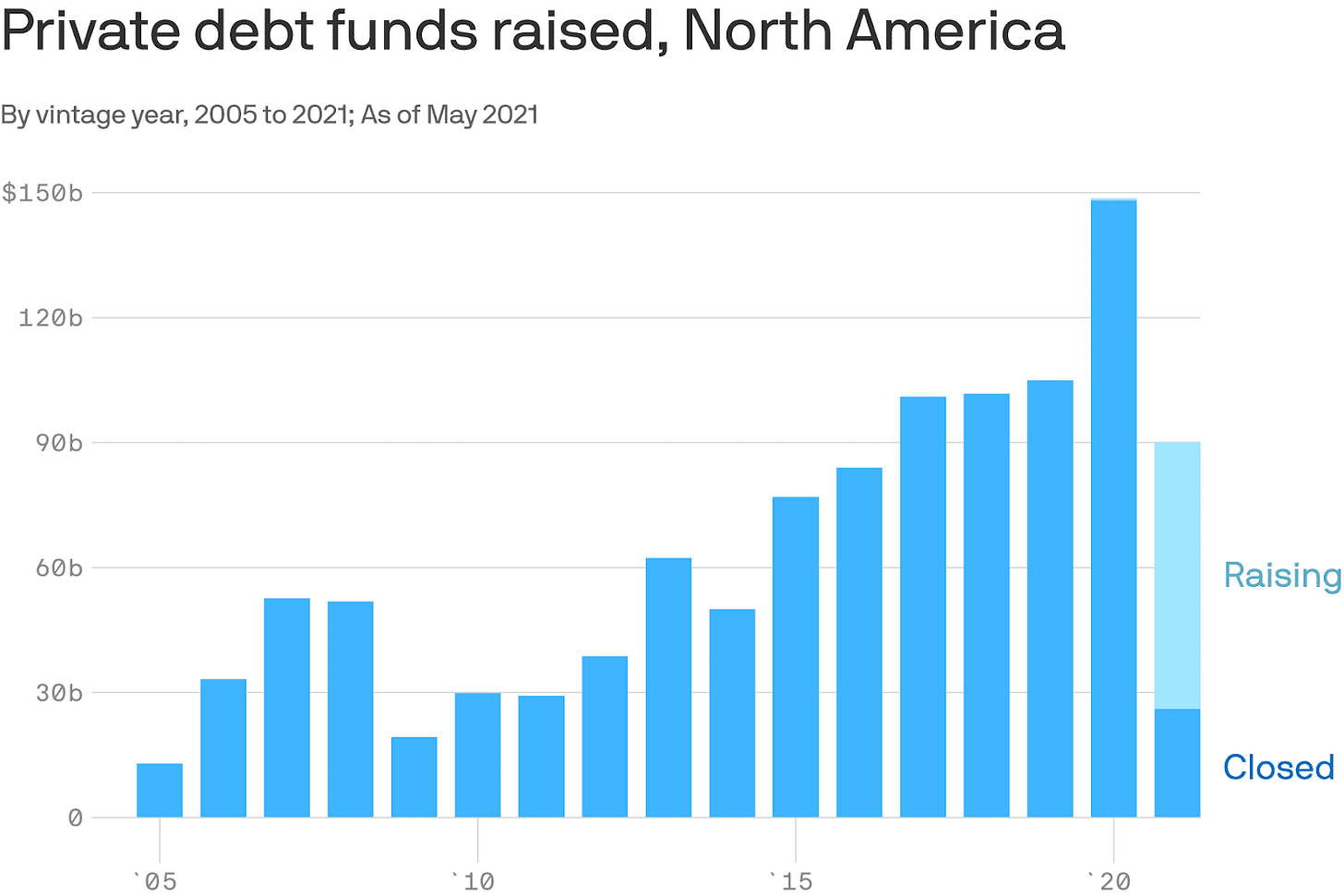

Final numbers on Private Debt Funds at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Trade Republic, a German stock-trading app, raised $900 million in Series C funding, valuing it at $5.3 billion. Sequoia led the round and was joined by investors including TCV, Thrive Capital, Accel, Founders Fund and Creandum.

- Extend, a San Francisco-based provider of extended warranty and product protection plans, raised $260 million in Series C funding led by SoftBank Vision Fund 2, with Meritech Capital Partners, PayPal Ventures, GreatPoint Ventures, Nationwide, Tomales Bay Capital, Launchpad Capital, 10X Capital and 40North also participating. www.extend.com

- Figure Technologies, a San Francisco-based company using blockchain in financial services, raised $200 million in Series D funding, valuing it at $3.2 billion. 10T Holdings and Morgan Creek Digital co-led and were joined by DCM, Digital Currency Group, HCM Capital, Ribbit Capital, RPM Ventures, as well as partners at DST Global.

- DailyPay, a New York City-based provider of on-demand pay solutions for enterprises, raised $175 million in Series D funding. Carrick Capital Partners led the round.

- Sunbit, a Los Angeles-based buy now, pay later company, raised $130 million in Series D funding. Group 11 led the round and was joined by investors including Zeev Ventures, Migdal Insurance, Harel Group, AltaIR Capital, and More Investment House. The deal values the business at $1 billion.

- Amount, a Chicago-based technology provider for financial institutions, raised $100 million in Series D funding. Investors included WestCap,Hanaco Ventures, Goldman Sachs, Invus Group, and Barclays US.

- Pipe, a Miami-based B2B financing platform for SaaS companies, raised $100 million in additional funding at a $2 billion valuation led by Greenspring Associates.http://axios.link/TL6e

-Vise, a New York-based investment portfolio management platform, raised $65 million in Series C funding. Ribbit Capital led, and was joined by insiders like Sequoia Capital.http://axios.link/bp4w

- Thunes, a Singapore-based fintech company that connects payment players, raised $60 million in Series B funding. Insight Partners led the round.

- Super, a San Francisco-based insurtech company that provides subscription care for the home, raised $50 million in Series C funding. Wells Fargo Strategic Capital led the round and was joined by investors including Asahi Kasei, AAA - Auto Club Group, Gaingels, and REACH.

- Copper, a London-based digital asset infrastructure provider, raised $50 million in Series B funding. Dawn Capital and Target Global led the round and were joined by investors including Illuminate Financial Management, LocalGlobe and MMC Ventures.

- Lithic (fka Privacy.com), a New York-based card issuing platform that rebranded as Lithic, raised $43 million in Series B funding. Bessemer Venture Partners led the round and was joined by investors including Index Ventures, Tusk Venture Partners, Rainfall Ventures, Teamworthy Ventures and Walkabout Ventures.

- Rally, a New York-based platform that lets retail investors buy into collectible assets, raised $30 million in Series B funding. Accel led, and was joined by insiders Upfront Ventures and Social Leverage. http://axios.link/RROn

- ThetaRay, an Israeli cross-border payments company, raised $31 million. Investors included Benhamou Global Ventures and Saints Fund, as well as OurCrowd, Bank Hapoalim, and SBT.

- Informed.IQ, a San Francisco-based developer of document verification and analysis tools used by lenders, raised $20 million in Series A funding. Nyca Partners and US Venture Partners led the round.

- Boost Insurance, a New York City-based digital insurance platform, raised $20 million in Series B funding. Investors included Fin VC, Gaingels, Hack VC, Greycroft, Coatue, and Conversion Capital.

- Payfit, a London-based payroll automation startup, raised $15.6 million in Series A funding. General Catalyst led, and was joined by Avid Ventures, LocalGlobe, Point Nine Capital, Moonfire Ventures, Hustle Fund and Seedcamp. http://axios.link/5riu

- Settle, a provider of capital to e-commerce and consumer packaged goods companies, raised $15 million in Series A funding. Kleiner Perkins led the round. Founders Fund led a $6 million seed in the business previously.

- Jerry, a Palo Alto, Calif.-based online insurance brokerage, raised $28 million in Series B funding. Goodwater Capital led the round.

- Zoe Financial, a New York City-based digital marketplace for hiring and vetting financial advisors, raised $10 million in Series A funding. SoftBank’s Opportunity Fund led the round.

- Waffle, a New York City-based consumer insurance solution, raised $5 million in seed funding. Verve Ventures led the round and was joined by investors including BetterLabs Ventures and Techstars.

. . .

Care:

- Noom, a New York-based weight loss app, received pre-IPO funding from Silver Lake at around a $4 billion valuation, per Bloomberg. It previously raised over $120 million from firms like RRE Ventures and Sequoia Capital.http://axios.link/FxTw

- PathAI, a Boston-based digital pathology company, raised $165 million in Series C funding. D1 Capital Partners led the round and was joined by investors including Kaiser Permanente.

- Wheel, an Austin-based virtual care company, raised $50 million in Series B funding. Lightspeed Ventures led the round and was joined by investors including CRV, Silverton Partners, Tusk Venture Partners, J.P. Morgan, and Future Shape.

- Heru, a Miami-based maker of a vision diagnostics wearable, raised $30 million in Series A funding. D1 Capital Partners led the round and was joined by investors including SoftBank Ventures Opportunity Fund, Maurice R. Ferre, M.D., Frederic H. Moll, M.D., and Krillion Ventures.

- Carewell, a Charlotte-based platform for caregivers, raised $25 million. Sageview Capital led the round and was joined by investors including Headline (formerly e.ventures), NextView Ventures and Primetime Partners.

- SymphonyRM, a Palo Alto, Calif.-based healthcare tech company, raised $25 million in Series B funding. TT Capital Partners led the round and was joined by investors including Adams Street Partners.

- Eleanor Health, a Waltham, Mass.-based outpatient addiction and mental health provider, raised $20 million in Series B funding. Investors included Town Hall Ventures, Echo Health Ventures, and Mosaic Health Solutions, as well as from Warburg Pincus.

- Causaly, a London-based platform for biomedical research, raised $17 million. Index Ventures led the round and was joined by investors including Marathon, Pentech and EBRD.

- emocha Health, a Baltimore, Md.-based digital health company focused on medication adherence, raised $6.2 million in Series A funding. Claritas Health Ventures led the round and was joined by investors including Healthworx, BlueCross BlueShield, Kapor Capital, and PTX Capital.

- Wysa, a Boston-based mental health platform, raised $5.5 million in Series A funding. W Health Venture led the round and was joined by investors including Google Assistant Investment program, and existing investors pi Ventures and Kae Capital.

- Rhithm, a Dallas-based edtech startup focused on mental health and social-emotional wellbeing, raised $4 million in seed funding. Reach Capital led the round and was joined by investors including SJF Ventures, Red House Education and Edovate Capital.

- DeltaTrainer, a Pittsburgh-based maker of a one-on-one remote personal training company, raised $3.3 million in seed funding. TenOneTen Ventures led the round and was joined by investors including Alpha Edison and Maven.

- Mindful Health Solutions, a San Francisco-based provider of interventional psychiatry services, raised an undisclosed amount of funding from Norwest Venture Partners. www.mindfulhealthsolutions.com

. . .

Future of Work:

- Back Market, a New York City-based refurbished electronics marketplace, raised $335 million in Series D funding. General Atlantic led the round and was joined by investors including Generation Investment Management,Goldman Sachs Growth Equity, Aglaé Ventures, Eurazeo, and daphni.

- Klaviyo, a Boston-based customer data and marketing automation platform, raised $320 million in Series D funding, valuing it around $9.2 billion. Sands Capital led the round Other investors include Counterpoint Global (Morgan Stanley), Whale Rock Capital Management, ClearBridge Investments, Lone Pine Capital, Owl Rock Capital, Glynn Capital, and Keith Block (former co-CEO of Salesforce), Accel and Summit Partners.

- Workrise (fka RigUp), an Austin-based workforce management platform, raised $300 million in Series E funding. Baillie Gifford led the round and was joined by investors including Franklin Templeton, Founders Fund, Bedrock Capital, Andreessen Horowitz, Moore Strategic Ventures, 137 Ventures, and Brookfield Growth Partners. The deal values the company at $2.9 billion.

- Loom, a San Francisco-based video messaging platform for work, raised $130 million in Series C funding, valuing it at roughly $1.5 billion. Andreessen Horowitz led the round.

- ASAPP, a New York-based provider of call center software, raised $120 million in Series C funding at a $1.6 billion valuation. Fidelity and Dragoneer were joined by insiders John Doerr, March Capital, Emergence Capital, Euclidean Capital, HOF Capital, Telstra Ventures and 40 North Ventures.http://axios.link/bfRC

- Goldbelly, a New York City?-based maker of a food e-commerce platform, raised $100 million in Series C funding. Spectrum Equity led the round and was joined by investors including Intel Capital.

- Ankorstore, a Paris-based curated marketplace for independent brands and retailers, raised $100 million in series B funding. Tiger Global and Bain Capital Ventures led the round and were joined by investors including Index Ventures, Global Founders Capital, Alven, and Aglaé.

- Immuta, a Boston-based provider of cloud data access control, raised $90 million in Series D funding. New investors included Greenspring Associates, March Capital, NGP Capital, and Wipro Ventures, as well as participation from existing investors Ten Eleven Ventures, Intel Capital, DFJ Growth, Dell Technologies Capital, Citi Ventures, and Okta Ventures.

- Pitch, a Berlin-based collaborative presentation platform, raised $85 million in Series B funding. Lakestar and Tiger Global led the round and were joined by investors including Index Ventures and Thrive Capital.

- Piano, a New York City-based provider of analytics and subscription services to publishers, raised $88 million. Updata Partners led the round and was joined by investors including Rittenhouse Ventures and LinkedIn.

- Dooly, a Canadian maker of automation software on Salesforce, raised $80 million. Spark Capital led the round and was joined by investors including Greenspring, Tiger Global,Lachy Groom, boldstart ventures, BoxGroup and Addition.

- Heyday, a San Francisco-based e-commerce company, raised $70 million in Series B funding. General Catalyst led the round and was joined by investors including Khosla Ventures, and Arbor Ventures.

- Explorium, a San Mateo, Calif.-based data science platform, raised $75 million in Series C funding. Insight Partners led the round and was joined by investors including Zeev Ventures, Emerge, F2 Venture Capital, 01 Advisors, and Dynamic Loop Capital.

- Betterworks, a New York City-based maker of strategy execution software for enterprise companies, raised $61 million from current investors.

- Virtuo, a Paris-based car rental startup, raised $60 million in Series C funding. AXA Venture Partners led the round and was joined by investors including Bpifrance, Alpha Intelligence Capital and H14.

- ProducePay, a Los Angeles-based financing, analytics, and marketplace startup for the fresh produce market, raised $43 million in Series C funding. G2VP, International Finance Corp. and IDB Invest led the round and were joined by investors including Anterra Capital, Coventure, Astanor Ventures, IGNIA, and Finistere.

- Salto, a Tel Aviv-based maker of a system for business apps, raised $42 million in Series B funding. Accel led the round and was joined by investors including Salesforce Ventures, Bessemer Venture Partners and Lightspeed Venture Partners.

- Styra, a Redwood City, Calif.-based company with a security and compliance risk platform, raised $40 million in Series B funding. Battery Ventures led the round and was joined by investors including A. Capital, Unusual Ventures, Accel, CapitalOne Ventures, Citi Ventures, and Cisco Investments.

- Esper, a Seattle-based maker of a developer platform for devices, raised $30 million in Series B funding. Scale Venture Partners led the round and was joined by investors including Madrona Venture Group, Root Ventures, Ubiquity Ventures, and Haystack.

- Great Deals, a Philippines-based company for building online retail operations, raised $30 million in Series B funding. Fast Group led the round and was joined by investors including CVC Capital Partners and Navegar.

- Waybridge, a New York-based supply chain platform for raw materials, raised $30 million in Series B funding. Rucker Park Capital and Craft Ventures led the round.

- Artificial, a Palo Alto-based software company with a lab automation platform, raised $21.5 million in Series A funding. M12 led the round and was joined by investors including Playground Global and AME Ventures.

- oneNav, a Palo Alto-based location accuracy company, raised $21 million in Series B funding. GV led the round and was joined by investors including Norwest Venture Partners and GSR Ventures.

- Coiled, a New York-based machine-learning and A.I. data company, raised $21 million in funding. Bessemer Venture Partners led the round.

- Code Ocean, a New York-based computational research platform for sharing scientific discoveries, raised $21 million in funding. Battery Ventures led the $15 million Series A, and was joined by investors including Digitalis Ventures, EBSCO, and Vaal Partners.

- Assignar, a Denver-based construction operations platform, raised $20 million in Series B funding. Fifth Wall led the round and was joined by investors including Tola Capital and Ironspring Ventures.

- Maven, an Austin-based maker of a platform for creating courses, raised $20 million in Series A funding. Andreessen Horowitz led the round.

- 42Crunch, a London-based API security startup, has raised $17 million in a Series A round led by Energy Impact Partners. Adara Ventures also participated.

- Portside, a San Francisco-based maker of software for aviation industry players, raised $17 million. Tiger Global Management led the round and was joined by investors including I2BF Global Ventures and SOMA Capital.

- FreightWaves, a Chattanooga, Tenn.-based supply chain company, raised $16 million. Triangle Peak Partners led the round and was joined by investors including 8VC, Hearst Ventures, Prologis Ventures, Rise of the Rest fund, Fontinalis and Kayne Partners.

- Authomize, a Tel Aviv-based security and identity startup, raised $16 million in Series A funding. Innovation Endeavors led the round and was joined by investors including Blumberg Capital, Entree Capital and M12.

- Found, a San Francisco-based maker of a platform for the self-employed and freelancers, raised $12.8 million. Sequoia led the round.

- Educative, a Seattle-based interactive hands-on skill development platform for software developers, raised $12 million in Series A funding. Matrix Partners led the round and was joined by investors including Trilogy Equity Partners.

- Clinch, a New York-based consumer intelligence company, raised $10 million in Series A funding. D Squared Capital led the round.

- Britive, a Los Angeles-based data access platform, raised $10 million in Series A funding. Crosslink Capital led the round and was joined by investors including Upfront Ventures and One Way Ventures.

- Boox, a Petaluma, Calif.-based sustainable e-commerce infrastructure company, raised $9.3 million in Series A funding. Valor Siren Ventures led the round and was joined by investors including Village Global and Kid VC.

- &Open, a Dublin-based platform for sending gifts to customers, raised $7.2 million. First Round Capital and LocalGlobe led the seed round and were joined by investors including Andrew Robb (Farfetch), Des Traynor (Intercom) and Liam Casey (PCH).

- Adalo, a St. Louis-based no-code app builder platform, raised $8 million in Series A funding. Tiger Global led, and was joined by Oceans Ventures, OldSlip Group and individuals. http://axios.link/SW3Z

- Merge, a San Francisco and New York City-based business-to-business API company, raised $4.5 million in seed funding. NEA led the round.

- Roofr, a San Francisco-based sales platform for roofing contractors, raised $4.25 million in seed funding. Bullpen Capital led, and was joined by Avidbank and Crosslink Capital. http://axios.link/M5TE

- Spokn, a New York City-based podcasting platform, raised $4 million in seed funding. Investors included NEA, Y Combinator,Reach Capital, Funders Club, Liquid2, Share Capital, SOMA Capital, Scribble VC and Hack VC.

- Somewhere Good, a social media company centered around people of color, raised $3.8 million in seed funding. True Ventures led the round and was joined by investors including Dream Machine, Debut Capital, Canvas Ventures, Slauson & Co., NextView Ventures and 2PM.

- Polywork, a New York City-based professional social network, raised $3.5 million in seed funding. Caffeinated Capital led the round and was joined by investors including Steve Chen, Kevin Lin, Max Levchin, Joel Flory, Scott Belsky, and Brianne Kimmel.

- Cortex, a San Francisco-based reliability code company, raised $2.5 million in seed funding. Sequoia Capital led the round.

- The Grand, a New York City-based learning and development platform , raised $2.4 million in pre-seed funding. Seven Seven Six led the round.

- Uptrust, a San Francisco-based startup focused on the incarceration process, raised $2 million in seed financing. the De-carceration Fund, Luminate, and Stand Together Ventures Lab led the round.

- Fave, a platform for fans to congregate around a creator, raised $2.2 million in seed funding. Investors included Female Founders Fund, HYBE, Sony Music, Warner Music, Concord Music, Quality Control, Right Hand Management, Techstars Music, and Betaworks.

- SoftLedger, a Santa Monica, Calif.-based business management software provider, raised $2.1 million in seed funding. Naples Technology Ventures led the round and was joined by investors including Mucker Capital, Newark Venture Partners, and Acceleprise.

- Panther Global, a Tampa, Fla.-based company for hiring, raised $2.5 million in seed funding. Investors included Tribe Capital, Eric Ries, Naval Ravikant, and Carta Ventures.

- Tibles, a New York City-based NFT marketplace, raised $1 million in seed funding. Dapper Labs led the round.

. . .

Sustainability:

- BETA Technologies, a South Burlington, Vt.-based developer of electric aviation tech, raised $368 million. Fidelity Management & Research Company led the round.

- Eat Just, a San Francisco-based maker of plant-based egg products, raised $170 million. Investors were UBS O’Connor, Graphene Ventures, and K3 Ventures.

- Daring, a Los Angeles-based maker of plant-based chicken-meat substitutes raised $40 million in Series B funding. D1 Capital Partners led the round and was joined by investors including Drake, Maveron and Palm Tree Crew.

- Cervest, a London-based maker of a climate risk analysis platform, raised $30 million in Series A funding. Draper Esprit led the round and was joined by investors including Astanor Ventures, Lowercarbon Capital, Future Positive Capital, UNTITLED, the venture fund of Magnus Rausing, and TIME Ventures.

- Zap Energy, a Seattle-based fusion energy startup, raised $27.5 million in Series B funding. Addition led, and was joined by Energy Impact Partners, GA Capital, Fourth Realm and insiders Chevron Technology Ventures and LowerCarbon Capital. www.zapenergyinc.com

- WeaveGrid, a developer of electric vehicle charging solutions, raised $15 million in Series A funding. Coatue led the round and was joined by investors including Breakthrough Energy Ventures, The Westly Group, and Grok Ventures.

- Forager, a Portland, Me.-based company focused on connecting local farmers with grocers, raised $4 million. Investors included Duncan Saville of ICM and Coastal Enterprises.

Acquisitions & PE:

- KKR completed its $1.5 billion buyout of TherapyBrands, a Birmingham, Ala.-based provider of mental and behavioral health practice management software, from Lightyear Capital, Oak HC/FT and Greater Sum Ventures. www.therapybrands.com

- Ro, New York-based DTC pharmacy and primary healthcare platform valued by VCs at around $5 billion, acquired Modern Fertility, a San Francisco-based fertility test DTC company that had raised over $20 million from firms like Forerunner Ventures. No financial terms were disclosed, but Axios has learned the price-tag was $225 million.

- Substack acquired People & Company, a New York-based team-training and community-building consultancy. Financial terms weren't disclosed.

- AT&T is in talks to merge WarnerMedia with Discovery, per Bloomberg. A deal would likely result in a new, publicly traded company.

- Amazon is reportedly in talks to acquire MGM Holdings, the legendary Hollywood studio, according to The Information. The deal could cost between $7 billion and $10 billion.

- The Hershey Company (NYSE: HSY) acquired Lily’s, a Boulder-based confectionery brand, from VMG Partners. Financial terms weren't disclosed.

- Ontario Teachers’ Pension Plan Board acquired Mitratech, a maker of legal tech software, from investors including TA Associates. The deal values Mitratech at about $1.6 billion.

- Smartly.io acquired Viralspace.ai, a Palo Alto, Calif.-based digital advertising A.I. startup. Viralspace investors have included Lightspeed Venture Partners and Quest Venture Partners.

- Ford Motor is considering a divestment from Spin, its electric scooter-sharing service, per Bloomberg.

. . .

IPOs:

- Oatly, the Swedish oat milk company, raised $1.4 billion in its IPO. It priced at the high end of its $15–$17 range, for a fully diluted value of $10.1 billion, will list on the Nasdaq (OTLY), and reports a $60 million net loss on $421 million of revenue for 2020. Backers include The Blackstone Group, Oprah and Jay-Z. http://axios.link/cHSR

- Procore Technologies, a Carpinteria, Calif.-based provider of construction management software, raised $634 million in its IPO. The company priced at $67 per share (above $60–$65 range), for a fully diluted value of $9.6 billion, and will list on the NYSE (PCOR). Procore had raised $640 million from firms like Iconiq (39.5% pre-IPO stake), Bessemer Venture Partners (14.1%), Tiger Global (7.8%) and D1 Capital Partners (5.6%). http://axios.link/UBpF

- BrightHealth, a Minneapolis-based health insurance company, filed for an IPO that Renaissance Capital estimates could raise up to $1.2 billion. It plans to list on the NYSE (BGH) and reports a $248 million net loss for 2020 on $1.2 billion in revenue. Bright Health raised over $1.5 billion in VC funding from firms like NEA, Bessemer Venture Partners, Greenspring Associates, The Blackstone Group, Cross Creek Advisors, Declaration Partners, Flare Capital Partners, Meritech Capital, Redpoint Ventures and Town Hall Ventures. http://axios.link/w5J3

- Squarespace, a New York-based content management platform, was valued at $6.5 billion yesterday when it went public via a direct listing (NYSE: SQSP). The company had raised over $900 million in VC funding, most recently at a $10 billion valuation, and reports Accel, General Atlantic and Index Ventures as its largest outside shareholders. http://axios.link/yV5A

- Marqeta, an Oakland, Calif.-based payments company, filed for an IPO. Granite Ventures and Iconiq back the firm.

- NerdWallet, a San Francisco-based consumer financial advice website, filed confidentially for an IPO, per Reuters. Its investors include iGlobe Partners and IVP.

- Flywire Corp, a Boston-based payments firm, plans to raise as much as $209 million in an IPO of 8.7 million shares priced between $22 and $24 each. Temasek backs the firm.

- Paymentus Holdings, a Redmond, Wash.-based electronic billing platform provider, plans to raise $200 million in an offering of 10 million shares priced at $19 to $21 apiece. Accel-KKR backs the firm.

- WalkMe, an Israeli digital adoption platform for enterprises, filed for a $100 million IPO. It plans to list on the Nasdaq (WKME) and reports a $45 million net loss for 2020 on $148 million of revenue and raised around $157 million from firms like Insight Partners, Greenspring Associates, Scale Venture Partners, Mangrove Capital Partners, Vitruvian Partners and Gemini Israel. http://axios.link/cKhb

- 1stdibs, a New York-based online marketplace for luxury items like art, furniture and jewelry, filed for a $100 million IPO. It plans to list on the Nasdaq (DIBS) and reports a $13 million net loss for 2020 on $82 million in revenue. The company raised over $250 million in VC funding from Benchmark (23.7% pre-IPO stake), Insight Partners (16.4%), Spark Capital (9.1%), T. Rowe Price (8.6%), Sofina Partners (8.5%) and Index Ventures (6.1%). http://axios.link/GQ1Q

- LifeStance Health Group, a Scottsdale, Ariz.-based outpatient mental health services company, filed to raise $100 million. Investors include TPG and Summit Partners.

- monday.com, a Tel Aviv and New York City-based collaboration platform, filed for an IPO. Insight Partners and Stripes back the firm.

. . .

SPACs:

- Kin Insurance, a Chicago-based home insurance startup, is in talks to go public via Omnichannel Acquisition, a SPAC backed by “Shark Tank” guest judge Matt Higgins, per Bloomberg.

Funds:

- Bain Capital Ventures, a San Francisco-based venture firm, raised $1.3 billion in new funds: Some $950 million for its ninth core fund and $350 million for co-investments in larger growth opportunities.

- 83North, a venture capital firm with offices in Tel Aviv and London, raised $550 million for its sixth investment fund.

- White Star Capital, a New York-based VC firm, launched a $50 million digital asset fund. LPs include Bpifrance and Ubisoft. http://axios.link/UAo7

Final Numbers

Source: Reproduced from Preqin Pro; Chart: Axios Visuals

Axios' Kate Marino writes: Private debt funds are tracking to top the average $103 billion raised annually in 2017–2019, and exceed any year before that.