Sourcery (5/18-5/22)

Mindset Health, Big Sky Health, Amwell, Clara Insurance, Tonal, Carta, Brex, Command E, Brainbase, MasterClass

Last Week (5/18-5/22):

Wow. Lots of deals announced last week. Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into our three categories, Care, Future of Work and Sustainability. Highlighted deals include: Mindset Health, Big Sky Health, Amwell, Clara Insurance, Tonal, Carta, Brex, Command E, Brainbase, MasterClass.

Final numbers on SoftBank Vision Fund, Market Share of Transactions on Food Delivery, and Weekly U.S. Jobless Claims at the bottom.

. . .

SelectQuote's IPO is one of the first to issue in the new COVID-era, SelectQuote compares Life, Auto & Home, and Medicare insurance products. It’ll be one to watch as SelectQuote continues to expand into newer verticals like Pet (and possibly take on Pet Insurance Quotes?).

SelectQuote, an Overland Park, Kansas-based insurance policy comparison site backed by Brookside Equity Partners, raised $570 million in its IPO. It priced 28.5 million shares at $20, above its $17-$19 range, for an initial market cap of $3.25 billion.

Why it's the BFD: This is the largest U.S. IPO since early February, and just one of a small handful of non-biotech or non-SPAC issuers to price at all.

Details: SelectQuote will trade on the NYSE (SLQT), while Credit Suisse and Morgan Stanley were lead underwriters. It reports $60 million of profit on $263 million in revenue for the nine months ending March 31, 2020.

The bottom line: "Since late February, the Cboe Volatility Index, known as Wall Street’s fear gauge, has been above the 20-point threshold that most IPO hopefuls monitor to gauge investor jitters. But it has trended downwards in recent weeks, giving some companies confidence to test the market." — Joshua Franklin, Reuters

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook

Care:

- Mindset Health, an Australia-based hynotherapy startup, raised $1.1 million in funding from investors including Fifty Years, YC, Gelt VC, and Giant Leap VC.

- Newlight Partners invested in Zing Health, a Chicago-based Medicare Advantage HMO plan. www.myzinghealth.com

- PresenceLearning, a NYC-based provider of live online special education related services for K-12 schools, raised $27m in Series D funding (read here)

- Tava Health, a Salt Lake City-based mental telehealth platform for employers, raised $3 million in seed funding. Peterson Ventures was the investor.

- Big Sky Health, a Montana-based developer of health and wellness apps, raised $8 million in Series A funding. Greycroft led, and was joined by True Ventures and Trinity Ventures. http://axios.link/ELU6

- Tonal, a San Francisco-based connected fitness company, is seeking to raise at least $250 million in new funding, per Bloomberg. Existing backers include L Catterton, Mayfield, and Sapphire Ventures. http://axios.link/4AzY

- Amwell, a Boston-based telehealth firm, raised $194 million in Series C funding. Early and strategic investors Allianz X and Takeda participated.

- Clara Insurance, a New York-based supplemental benefits provider, raised $5.5 million in seed funding. Two Sigma Ventures led, and was joined by investors including Founder Collective, RGAX LLC, and SymphonyAI.

- ObvioHealth, a five-year-old, Orlando, Fla.-based virtual health research organization that allows subjects to participate in studies and trials from homes, has raised $17 million led by TKS1. More here.

- Mindstrong, a Mountain View, Calif.-based mental health virtual care company, raised $100 million in Series C funding. Investors included General Catalyst, ARCH Venture Partners, Foresite Capital, 8VC, Optum Ventures, and What If Ventures.. . .

Future of Work:

- Quartz Systems, a San Francisco, Calif.-based construction tech company leveraging advanced perception systems to understand everything on a construction site, raised $7.8 million in pre-seed and seed funding. Baseline Ventures led the round, and was joined by investors including Felicis Ventures, Lemnos, and Bloomberg Beta.

- General Atlantic will invest $870 million in Jio Platforms, the Indian telecom giant backed by the likes of Facebook and Silver Lake, taking a 1.34% stake. The company is valued at $65 billion.

- Electric, a 3.5-year-old, New York-based automated IT platform for enterprises, has tacked on $7 million to a (twice) previously closed Series B round. Earlier backers 01 Advisors led the round, with participation from the Slack Fund. Electric had originally raised a $25 million Series B round led by GGV in January of 2019. In March of this year, just before the lockdown, the company says it reopened the Series B at a higher valuation to make room for 01 Advisors (run by former Twitter execs Dick Costolo and Adam Bain). TechCrunch has more here.

- Carta, a startup that manages employee equity for other startups, raised $175 million in new funding co-led by Lightspeed Venture Partnersand Tribe Capital. Earlier reports were that it was seeking $200 million at a $3.5 billion valuation. http://axios.link/o82A

- Brex, a San Francisco-based corporate credit card company focused on startups, raised $150 million in new Series C funding from insiders like DST Global and Lone Pine Capital. http://axios.link/8Jjk

- United Dwelling, a Los Angeles-based affordable housing startup, raised $10 million. Alpha Edison led, and was joined by Lightspeed Venture Partners. http://axios.link/nSfj

- JD MRO, a subsidiary of JD.com that delivers industrial maintenance, repair and operations products and services, raised $230 million in Series A funding. GGV Capital led the round. Read more.

- Contentsquare, a New York-based customer experience analytics platform, raised $190 million in Series D funding. BlackRock’s Private Equity Partners team led the round, and was joined by investors including Bpifrance, Eurazeo Growth, Canaan, GPE Hermes, Highland Europe, H14 and KKR.

- Source Defense, a New York and Israel-based web security firm, raised $10.5 million in Series A+ funding. Capital One Ventures invested, and was joined by investors including IVP, Allegis Cyber, Global Brain, and NightDragon.

- Beeline, a providence, R.I.-based digital home loan lender, raised $7.6 million in seed funding. The investors were not named.

- Tapcart, a Santa Monica, Calif.-based leader mobile commerce company, secured an additional $10M in funding (read here)

- Bevy.com , an event software business, raised $15 million in Series B funding. Accel led the round, and was joined by Ryan Smith and Upfront Ventures. Read more.

- Confluera, a Palo Alto, CA-based cybersecurity company, raised over $20m in Series B funding (read here)

- Truework, a San Francisco-based identity platform, raised $30 million in Series B funding led by Activant Capital Wednesday, with existing investors Sequoia Capital and Khosla Ventures joining the round.

- Katerra, a Menlo Park, Calif.-based construction tech company, will raise $200 million in new funding from its biggest backer, SoftBank.

- Brainbase, a Los Angeles legal tech startup, raised $8 million in a Series A funding. Bessemer Venture Partners led the round, and was joined by investors including Rent-the-Runway co-founder Jenny Fleiss. Read more.

- Syndio, a Seattle-based employee compensation analysis platform, raised $7.5 million in Series A funding. Voyager Capital and the Emerson Collective led the round. Read more.

-Robocorp, a San Francisco-based open-source Robotic Process Automation platform, raised $5.4 million in funding from its existing investors Benchmark, Slow Ventures, and firstminute Capital.

- Command E, a San Francisco-based maker of a unified desktop search tool, raised $4.3 million in seed funding. Investors include Bain Capital Ventures, Craft Ventures, Amplify Partners, Abstract Ventures and Upside Partnership. Read more.

- BetterCloud, a New York-based operations management platform, raised $75 million in Series F funding. Warburg Pincus led, and was joined by Bain Capital Ventures, Accel, Greycroft Partners, Flybridge Capital Partners, New Amsterdam Growth Capital, and e.ventures. http://axios.link/ASLW

- FireHydrant, a New York-based provider of cloud systems management tools and frameworks, raised $8 million in Series A funding. Menlo Ventures led, and was joined by Work-Bench. www.firehydrant.io

- ThoughtTrace, a Houston-based Document Intelligence and Contract Analytics software provider, closed a $10m financing (read here)

- Strapi, a San Francisco, CA and Paris, France-based maker of open source software for creating and delivering digital content across all devices, raised $10M in funding (read here)

- States Title, a San Francisco-based firm using AI to close on real estate deals, raised $123 million in Series C funding. Greenspring Associates led the round.

- MasterClass, a San Francisco-based startup that sells celebrity-taught classes digitally, raised $100 million in Series E funding. Fidelity Management & Research Company led, and was joined by investors including Owl Ventures, 01 Advisors and existing investors NEA, IVP, Atomico and NextEquity Partners. Read more.

- Amplitude, a San Francisco-based product intelligence platform, raised $50 million in Series E funding. GIC led, and was joined by investors including Sorenson Capital and existing investors including Sequoia Capital, Benchmark, Battery Ventures, IVP, and Lead Edge Capital.

- Directly, a startup training customer service chatbots, raised an additional $11 million to close out its Series B at $51 million. Triangle Peak Partners and Toba Capital were the investors. Read more.

- Human Interest, a San Francisco-based 401(k) provider for small and medium-sized businesses, raised an additional $10 million in Series C funding for a round total of $50 million. Glynn Capital led the extension.

- Hudl, a Lincoln, Neb.-based provider of sports video analysis and scouting software solutions, raised an undisclosed amount of funding from Bain Capital Tech Opportunities.

- Samsara Networks, a San Francisco-based provider of IoT sensors and cameras, raised $400 million at a $5.4 billion valuation (down from last mark of $6.3 billion), per Bloomberg. AllianceBernstein, Franklin Templeton, General Atlantic, Sands Capital Management, and Warburg Pincus were joined by return backers Andreessen Horowitz, General Catalyst, Dragoneer, and Tiger Global Management. http://axios.link/nfqx

- Aspiration, a Los Angeles-based provider of socially-conscious financial advisory services, raised $135 million in Series C funding. Alpha Edison led, and was joined by UBS O’Connor Capital Solutions, DNS Capital, Radicle Impact, Sutter Rock, Jeff Skoll, Joseph Sanberg, Social Impact Finance, the Pohlad Companies, and AGO Partners. www.aspiration.com

- Spruce, a New York-based provider of real estate transaction processing software, raised $29 million in new funding. Scale Venture Partners led, and was joined by Zigg Capital and Bessemer Venture Partners. http://axios.link/fB0f

- Rent the Runway, a New York-based clothing rental platform, is in talks to raise at least $25 million led by T. Rowe Price at around a $750 million valuation (down from last mark of $1 billion), per Bloomberg. http://axios.link/3LpO

- Deel, a two-year-old, San Francisco-based payroll platform for remote workers, has raised $14 million in Series A funding led by Andreessen Horowitz. CNBC has more here.

- Chief, a New York-based network for women in leadership, raised $15 million funding. The investors were General Catalyst, Inspired Capital, GGV Capital, Primary Venture Partners, Flybridge Capital, and BoxGroup.

- Run The World, a Mountain View, Calif.-based virtual events startup, raised $10.8 million in Series A funding co-led by earlier backer Andreessen Horowitz and new investor Founders Fund. Read more.

- VergeSense, a San Francisco-based workplace sensor provider, raised $9 million in funding. Allegion Ventures led the round, and was joined by investors including JLL Spark, Metaprop, Y Combinator, Pathbreaker Ventures, and West Ventures.

- PathSpot, a New York-based hand hygiene management scanner that tracks handwashing frequency, raised $6.5 million in Series A funding. Valor Siren Ventures led the round, and was joined by investors including FIKA Ventures and Walden Venture Capital. Read more.

- Skyflow, a Mountainview, Calif.-based maker of an API for privacy, raised $7.5 million in seed funding. Foundation Capital led the round, and was joined by investors including Jeff Immelt (former CEO of GE), Jonathan Bush (former CEO of AthenaHealth).. . .

Sustainability:

- Encamp, an Indianapolis-based environmental, health, and safety (EHS) software platform provider, raised $3.1m in Series A funding (read here)

- Sound Agriculture, an Emeryville, Calif.-based agtech company, closed a $22m Series C funding (read here)

- Imperfect Foods, a San Francisco, CA-based company which aims to eliminate food waste and build an innovative food system, closed a Series C funding round of $72m (read here)

- Xwing, a San Francisco-based company focused on autonomy in aviation, raised $10 million in Series A funding. R7 Partners led the round, and was joined by investors including Thales, Alven, and Eniac Ventures.

- Apollo Agriculture, a Nairobi-based financing platform for small-scale farmers, raised $6 million in Series A funding. Anthemis Exponential Ventures led the round, and was joined by investors including Leaps by Bayer, Flourish Ventures, Sage Hill Capital, To Ventures Food, Breyer Labs, Accion Venture Lab and Newid Capital.

Exits:

- Facebook agreed to acquire Giphy, a New York-based platform for gifs, valuing the company at $400 million, per Axios citing sources. Firms including Betaworks, Lerer Hippeau, IVP, DFJ Growth, GGV Capital, and Lightspeed Venture Partners backed the firm. Read more.

- JDE Peet’s, the world’s second-largest packaged coffee maker, said it plans to raise at least €700 million via an Amsterdam IPO next week. http://axios.link/7fSS

- Vroom, a New York-based platform for buying and selling used vehicles, filed for a $100 million IPO (likely a placeholder amount). It plans to trade on the Nasdaq (VRM) with Goldman Sachs as lead underwriter, and reports a $41 million net loss on $376 million in revenue for Q1 2020. The company has raised over $700 million from firms like L Catterton, General Catalyst, Durable Capital Partners, T Rowe Price, Annox Capital, Autonation, Nue Capital, Fraser McCombs Capital, and Detroit Venture Partners. http://axios.link/4wrq

Acquisitions:

- Guild Education, a Denver-based education benefits platform valued by VCs at $1 billion, paid $80 million to acquire Entangled, a San Francisco-based ed-tech studio that had raised approximately $25 million in VC funding from firms like Rethink Education Management and TDM Growth Partners. http://axios.link/urvB-Microsoft (Nasdaq: MSFT) acquired Softomotive, a software robotic automation platform that had raised around $25 million from firms like Grafton Capital. http://axios.link/qkO6

- Standard Cognition, a San Francisco-based autonomous checkout startup, acquired Italian rival Checkout Technologies. Standard Cognition has raised nearly $100 million in VC funding, while Checkout was seeded by firms like Plug and Play Tech Center and B-Engine. http://axios.link/osnF

Funds

- Bain Capital plans to seek around $9 billion for its 13th flagship buyout fund, per Bloomberg. http://axios.link/0qQw

- Northgate Capital secured $70 million for its seventh VC fund-of-funds, which is targeting a total of $250 million, per an SEC filing. www.northgate.com

- Eos Venture Partners raised $58 million for a VC fund that will back insure-tech startups. www.eosventurepartners.com

- Founder Collective, a seed-stage fund, closed its newest fund with $85 million. Read more.

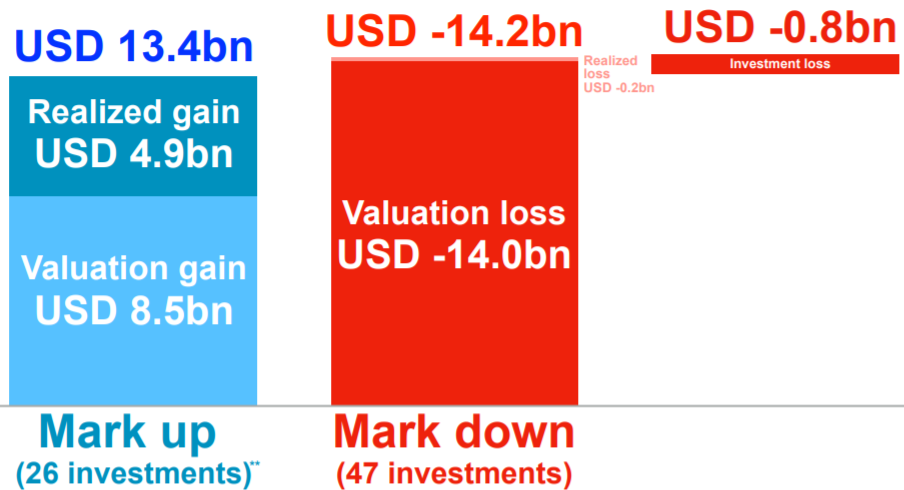

Final Numbers: SoftBank Vision Fund

Source: SoftBank earnings report. Data through March 31, 2020.SoftBank Group reiterated that fundraising is paused for Vision Fund 2, and announced that Alibaba founder Jack Ma is leaving the board after 13 years.Go deeper: SoftBank reports $18 billion loss

. . .

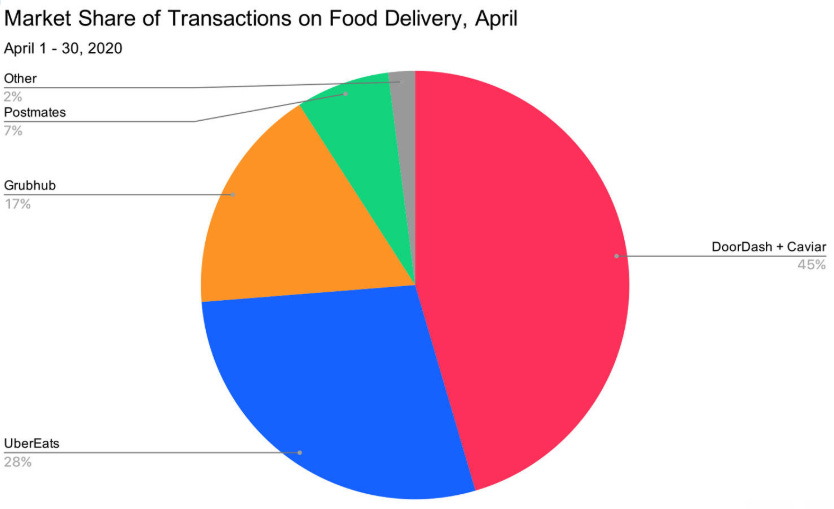

Final Numbers

Source: Edison TrendsWhy it matters: April data suggests that Uber+Grubhub would put it dead even with DoorDash, in terms of market share.Postmates continues to be a distant fourth, with multiple sources saying it's seeking to raise around $100 million in new private-market funding.Be sure to check out this afternoon's Pro Rata Podcast, which will discuss the prospect of food delivery consolidation with Sen. Amy Klobuchar.

. . .

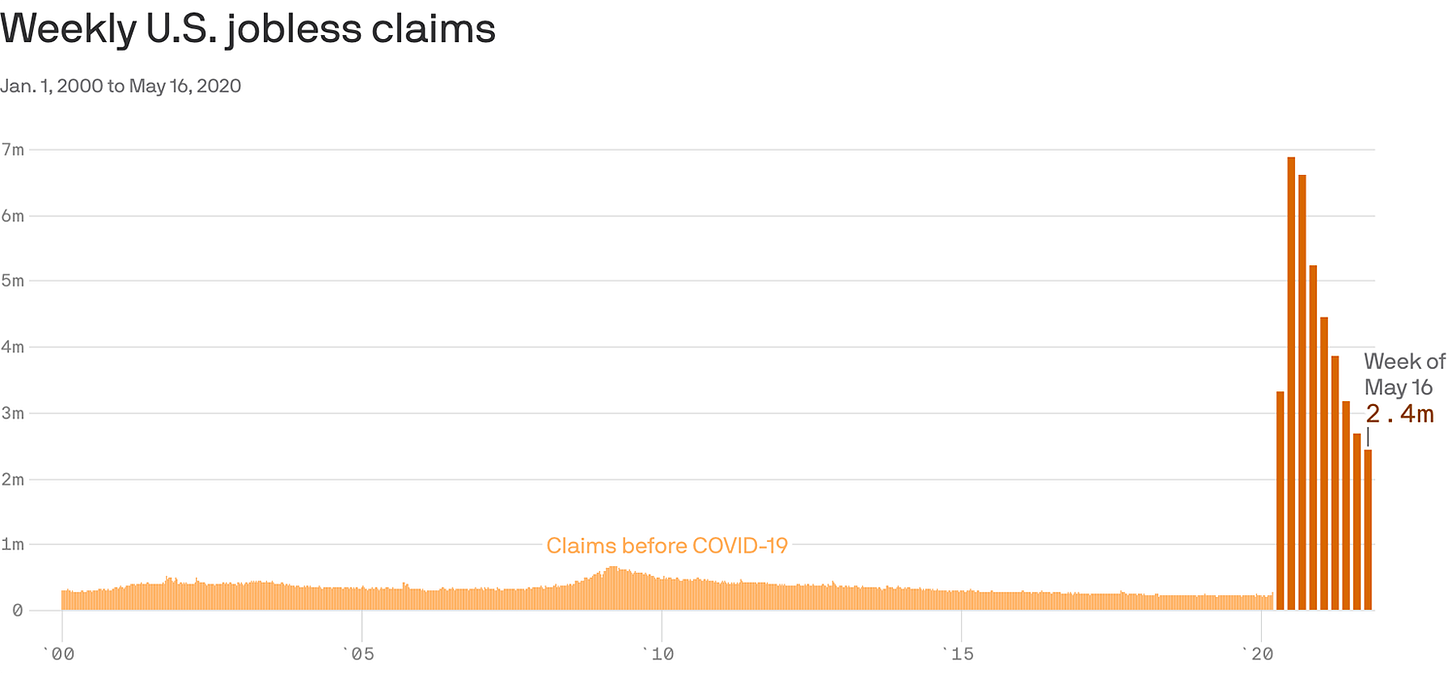

Final Numbers

Data: U.S. Employment and Training Administration via FRED; Chart: Andrew Witherspoon/AxiosGo deeper:Jobless claims keep coming