Sourcery (5/2-5/6)

Kentucky Derby ~ Lev, Kevin, Zora, Bitcoin.com, Minka, Kard, Concerto, LootRush, Heard, Decrypt, Stakes, Hello Heart, Curebase, WILE, Anthropic, Zepto, Mosyle, Material Bank, Teleport, Tailscale...

The longest shot won.

Two iconic races happened this weekend and I was fortunate enough to make it to one of them, the 148th Kentucky Derby in Louisville, KY. The other being the very first F1 Crypto.com Miami Grand Prix, and Kudos to the winner Max Verstappen, whom you’ve likely grown to love in Drive to Survive. But this morning, we’re going to break down the OG horsepower.

Churchill Downs was exploding with excitement, mint juleps and champagne were flying around, pastel suits and large hats were blocking views, and Epicenter (3) a favorite pick was leading the pack. But at the very last second, Rich Strike found windows, weaved, increased speed and with a large amount of luck, broke through. The club room and stadium went from a 12 on volume to 0, no one knew who the horse was, and race day magazines were pulled to identify the swift & mysterious winner. Everyone. lost. their. bets. Sports history was made. Rich Strike, the last minute entry with 80-1 odds, was let into the race <24 hours before and his jockey Sonny Leon threw the ultimate hail Mary and gave it all they got, because what’s there to lose?

Underdog story sound familiar? This type of unpredictable high multiple event has occurred time and again in different capacities for startups, founders, public companies, and even venture funds. At one point Amazon lost 90% of its value in its early innings but since has proven remarkably strong leadership, adaptability, and resilience. Beating expectations and dancing in the trillion dollar winners circle alongside Apple, Microsoft and Google. It just takes the right timing and one asymmetric lucky winner to break out of the pack.

Sort of like the Derby… looks like the majority have been demolished in public, late-stage private, crypto, and apparently all other markets. Now it’s a race to find the winners.

To all my NYC readers, I’m visiting next week and hosting an early-stage commerce tech/consumer internet founders breakfast for Upfront Ventures alongside Varun Sridhar of VMG Catalyst & Marissa Cohen of Silicon Valley Bank. If you’re an early stage founder and are interested in joining sign up here!

--

Follow us on Twitter Linkedin for just the top deals recap

. . .

Last Week (5/2-5/6):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Neo Financial, Point, Lev, Kevin, Zora, Bitcoin.com, Minka, Kard, Concerto, Possible Finance, Allocate, LootRush, Cometh, Heard, Decrypt, Ownwell, Stakes, Masa Finance, Hello Heart, Curebase, Capable Health, WILE, Anthropic, OneFootball, Zepto, Mosyle, Material Bank, Teleport, Tailscale, Sentry, Edge Delta, Traceable AI, AccelByte, Veza, LinearB, Prisma, Lottiefiles, Lumos, Sleuth, Phylum, Switchboard, Baseten, Ava, Logseq, Kabata, Group14 Technologies, Cavnue, Pachama, Brimstone, Voyage Foods, Tomorrow Farms, YvesBlue, Sealed, Scoot Science; Funko, Starz, Vice Media, Postmark, Deliverr, Soundcloud, Comparably; Bausch + Lomb

Notable funds raised include Unusual Ventures $485M third fund, Aquiline Capital Partners raised $365M across early and growth stage, Flybridge raised $110M for its sixth seed fund and $50M for its first opportunities fund, Home Depot Ventures raised $150M, and Afore Capital raised $110M for pre-seed investments

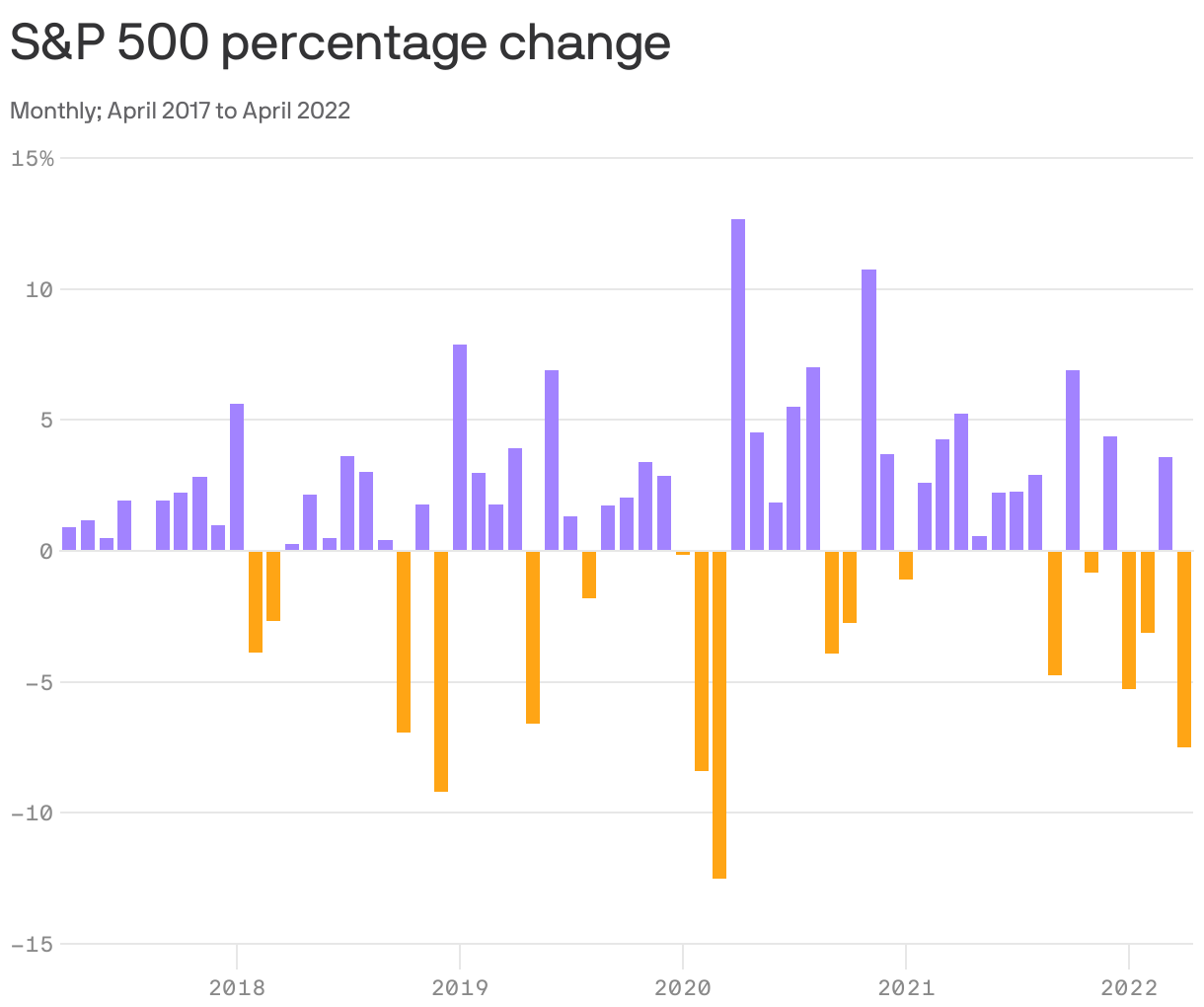

Final numbers on S&P 500 % Change YoY and Market Rout at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Neo Financial, a Canadian neobank, raised C$185m. Valar Ventures led, and was joined by Tribe Capital, Altos Ventures, Blank Ventures, Gaingels, Maple VC and Knollwood Advisory. http://axios.link/uO0S

- Point, a Palo Alto, Calif-based fintech company and home equity platform, raised $115 million in additional Series C funding led by WestCap and was joined by investors including Andreessen Horowitz, Ribbit Capital, Redwood Trust, Atalaya Capital Management, DAG Ventures, Deer Park Road Management, The Palisades Group, and Alpaca VC.

- Lev, a New York-based digital commercial real estate transaction platform, raised $70 million in Series B funding. Parker89 and Cross River Digital Ventures led the round and were joined by inventors including NFX, Canaan, JLL Spark, Animo Ventures, Capital One Ventures, Citi Ventures, Citi SPRINT, and StepStone Group.

- kevin., a Vilnius, Lithuania-based payments infrastructure company for online and in-store sales, raised $65 million in Series A funding led by Accel and was joined by investors including Eurazeo, OTB Ventures, Speedinvest, OpenOcean, Global Paytech Ventures 20VC founder Harry Stebbings, CEO & co-founder of Supercell Ilkka Paananen, former CEO of Venmo Amitabh Jhawar, and other angels.

- Zora, a public protocol for buying, selling, and creating NFTs, raised $50 million in funding led by Haun Ventures and was joined by investors including Coinbase Ventures, Kindred Ventures, and others.

- Bitcoin.com, a cryptocurrency accessibility provider, raised $33.6 million via a VERSE token sale from investors including Digital Strategies, KuCoin Ventures, Blockchain.com, ViaBTC Capital, Redwood City Ventures, 4SV, BoostX Ventures, and other angels.

- Venly, a Belgian blockchain wallet startup, raised €21m in Series A funding. Courtside Ventures led, and was joined by Transcend Fund, Coinbase Ventures, Tioga Capital, High-Tech Gründerfonds, Fortino, Plug and Play, Leadblock Partners, Imec Istart, Powerhouse and Alpaca VC. http://axios.link/lOD5

- Minka, a Colombian provider of last-mile APIs and shared ledgers for national payment networks, raised $24m co-led by Tiger Global and Kaszek. http://axios.link/ZHlI

- Kard, a New York-based API service for card issuers and brands, raised $23m in Series A funding. Tiger Global led, and was joined by Fin Capital, s12f and Underscore VC. www.getkard.com

- Concerto, an Austin-based credit card partnerships platform, raised $21 million in Series A funding led by Matrix Partners and was joined by investors including PayPal Ventures and GoldenTree Asset Management.

- Possible Finance, a Seattle-based lending startup, raised $20m from Euclidean Capital and insiders Union Square Ventures, Canvas Ventures and Unlock Venture Partners. http://axios.link/MnVa

- Acern, a New York-based AI for analyzing online financial documents and conversations about companies, raised $20m in Series B funding. Mighty Capital led, and was joined by Tribe Capital, Shasta Ventures, Gaingels and Fusion Fund. http://axios.link/CfJ8

- Allocate, a San Francisco-based digital investment platform for investors to access venture funds and co-investments, raised $15.3 million Series A funding led by M13 and was joined by investors including Bedrock, SignalFire, Intera Capital, Tusk Venture Partners, Urban Innovation Fund, Fika Ventures, Anthemis, Basis Set Ventures, and Broadhaven Ventures.

- LootRush, a San Francisco-based blockchain & NFT video games platform, raised $12 million in seed funding led by Paradigm and was joined by investors including Andreessen Horowitz, Y Combinator, and other angels.

- Cometh, a Paris-based Web3 gaming studio, raised $10 million in seed funding. White Star Capital, Ubisoft, and Stake Capital co-led the round and were joined by investors including Serena Capital, Shima Capital, and IDEO Colab Ventures.

- Heard, a remote bookkeeping and tax platform for mental health professionals, raised $10 million in Series A funding led by Footwork and was joined by investors including Founders Co-Op, Act One Ventures, and other angels.

- Decrypt, a crypto media content company, spun out from blockchain incubator ConsenSys Mesh and raised $10m at a $50m valuation, per Axios’ Sara Fischer. Backers include Hack.VC, Hashkey Capital, Canvas Ventures, Protocol Labs, SK Group and four DAOs. http://axios.link/XbiB

- Line, an SF-based inclusive lending fintech, raised $7m in equity financing and $18m in debt. Massive led, and was joined by TASC Ventures, Goodwater Capital, SustainVC, Avesta Fund, Strada Education Network, The Josephine Collective, Overtime VC and Techstars. http://axios.link/Z8LJ

- GamerGains Lab, a crypto-based play-and-earn platform, raised $5.8m in seed funding. Cadenza Ventures led, and was joined by FTX Ventures, Tiger Global, Winklevoss Capital, Alumni Ventures Group, CMS Holdings, Third Prime, Global Founders Capital, Lightbank and BlockFi. www.gamergains.com

- Ownwell, an Austin-based property tax management services company, raised $5.75 million in seed funding led by First Round Capital and was joined by investors including Wonder Ventures, Founder Collective, Long Journey Ventures, and former PayPal board member Scott Banister.

- Stakes, a New York-based Web3 social wagering platform, raised $5.3 million in seed funding from investors including Digital Currency Group, FBG Capital, CMS Holdings, LD Capital, Cadenza Ventures, Matrixport Ventures, and Sterling Select Group.

- Masa Finance, a decentralized credit protocol, raised $3.5m from backers like Unshackled Ventures and Lateral Capital. http://axios.link/kWA5

- Cheq, a Wilmington, Del.-based crypto payments platform, raised $2 million in pre-seed funding led by Connect Ventures and was joined by investors including Semantic Ventures, firstminute Capital, and other angels.

. . .

Care:

- Hello Heart, a Menlo Park, Calif.-based heart health-focused digital therapeutics company, raised $70 million in Series D funding led by Stripes and was joined by investors including IVP, Resolute, and BlueRun Ventures.

- Curebase, a San Francisco-based software company providing access to clinical studies, raised $40 million in Series B funding led by Industry Ventures and was joined by investors including Acrew Capital, World Innovation Lab, Positive Sum, GGV Capital, Bold Capital, Xfund, and Gilead Sciences.

- Healthmap, a Tampa, Fla.-based kidney population health management company, raised $35 million in funding led by GuideWell and Highmark Ventures and was joined by investors including Windrose, DCHP, Shulman Ventures, and others.

- Capable Health, a New York-based app-building platform for virtual care startups, raised $6m in seed funding, per Axios Pro. M13 led, and was joined by AlleyCorp and Able Partners. http://axios.link/DqMI

- WILE, a Portland-based hormonal wellness brand for women 40+, raised $3 million in pre-seed funding led by Serena Ventures and is joined by investors including Springdale Ventures, angel investor Sara Bright, Coyote Ventures, and others.

. . .

Enterprise & Consumer:

- Anthropic, a SF-based AI research firm, raised $580m in Series B funding. FTX CEO Sam Bankman-Fried led, and was joined by Caroline Ellison, Jim McClave, Nishad Singh, Jaan Tallinn and the Center for Emerging Risk Research. http://axios.link/TyLl

- OneFootball, a German soccer media platform, raised $300m. Liberty City Ventures led, and was joined by Animoca Brands, Dapper Labs, Senator Investment Group, DAH Beteiligungs, Quiet Capital, RIT Capital Partners, Alsara Investment Group. http://axios.link/sM4Y

- Zepto, a grocery delivery startup, raised $200m at around a $900m valuation. YC led, and was joined by Kaiser Permanente and insiders Nexus Venture Partners, Glade Brook Capital and Lachy Groom. http://axios.link/tIzE

- Mosyle, a Winter Park, Fla.-based Apple device management and security platform provider, raised $196 million in Series B funding led by Insight Partners and was joined by investors including StepStone Group, Elephant, and Album VC.

- Material Bank, a Boca Raton, Fla.-based online materials marketplace, raised $175 million in funding led by Brookfield Growth and was joined by Fifth Wall.

- Teleport, an Oakland, Calif.-based identity-based infrastructure access management provider, raised $110 million in Series C funding led by Bessemer Venture Partners and was joined by investors including Insight Partners, Kleiner Perkins, and S28 Capital.

- Fictiv, a San Francisco-based custom on-demand manufacturing company, raised $100 million in Series E funding led by Activate Capital and was joined by investors including Angeleno Group, Cross Creek, The Westly Group, William Blair Merchant Bank, Accel, Bill Gates, G2 Venture Partners, and Standard Industries.

- Tailscale, a Toronto-based VPN services provider, raised $100 Million in Series B funding. CRV and Insight Partners led the round and were joined by investors including Accel, Heavybit, Uncork Capital, and other angels.

- Sentry, a San Francisco-based application monitoring company, raised $90 million in Series E funding. BOND and Accel led the round and were joined by investors including New Enterprise Associates and K5 Global.

- Edge Delta, a Seattle-based data observability platform, raised $63 million in Series B funding led by Quiet Capital and was joined by investors including BAM Elevate, Earlybird Digital East, Geodesic Capital, Kin Ventures, ServiceNow, Cisco Investments, Menlo Ventures, MaC Venture Capital, and Amity Ventures.

- Traceable AI, a San Francisco-based API security company, raised $60 million in Series B funding led by IVP and was joined by investors including BIG Labs, Unusual Ventures, Tiger Global Management, CISO angel investors.

- AccelByte, a Redmond, Wash.-based game development infrastructure startup, raised $60m in Series B funding. SoftBank led, and was joined by Sony Interactive Entertainment and insiders Galaxy Interactive and NetEase. http://axios.link/O07M

- Veza, a Palo Alto, Calif.-based data security platform, raised $50 million in Series C funding led by Accel.

- LinearB, a Santa Monica, Calif.-based engineering analytics and developer workflow optimization startup, raised $50m in Series B funding. Tribe Capital led, and was joined by Salesforce Ventures and insiders Battery Ventures and 83North. www.linearb.io

- Prisma, a Berlin-based open-source database toolkit for developers, raised $40m. Altimeter led, and was joined by insiders Amplify Partners and Kleiner Perkins. http://axios.link/zqvN

- LottieFiles, an animation platform startup with offices in SF and Kuala Lumpur, raised $37m in Series B funding. Square Peg Capital led, and was joined by XYZ VC, GreatPoint Ventures and insiders 500 Startups and M12. http://axios.link/dz43

- Team Liquid, a Santa Monica and Utretcht, the Netherlands-based e-sports organization, with parent company aXiomatic, raised $35 million in funding led by funds managed by Ares Management and was joined by investors including Revolution Growth and Hiro Capital.

- Clerk, an Austin-based retail marketing and merchandising solution, raised $30 million in Series B funding led by Sageview Capital.

- Lumos, a San Francisco-based SaaS management and identity governance software company, raised more than $30 million in funding from Andreesen Horowitz, Neo, Lachy Groom, Google Cloud CISO Phil Venables, OpenAI CTO Greg Brockman, and others.

- Valence, a New York-based teamwork platform, raised $25 million in Series A funding led by Insight Partners and was joined by others.

- Sleuth, a San Francisco-based engineering efficiency platform, raised $22 million in Series A funding led by Felicis and was joined by investors including Menlo Venture and CRV.

- Kintent, a remote-based compliance platform, raised $18 million in Series A funding led by OpenView and was joined by Tola Capital.

- Phylum, an Evergreen, Colo.-based supply chain cybersecurity platform, raised $15 million in Series A funding led by ClearSky and was joined by investors including Atlassian Ventures, SixThirty Ventures, First In, and TechOperators.

- Federated Wireless, an Arlington, Va.-based shared spectrum and CBRS technology company, raised $14 million in additional Series D funding from investors including Fortress Investment Group, Giant Leap Capital, LightShed Ventures, GIC, and Singapore’s sovereign wealth fund.

- Switchboard, a remote-based collaboration platform for remote work, raised $13.8 million in funding from Sequoia, XYZ Ventures, The General Partnership, Spark Capital, and other angel investors.

- Baseten, a remote-based machine learning models developer for full-stack apps, raised $12 million in Series A funding led by Greylock.

- Ava, a San Francisco-based A.I.-based live caption company for the deaf and hard-of-hearing, raised $10 million in Series A funding led by Khosla Ventures and was joined by investors including Initialized Capital, Lerer Hippeau Ventures, LeFonds VC, Ring Capital, and Sorenson’s Enable Ventures.

- Henry, a Buenos Aires-based technical education company for Latin America, raised $10 million in funding co-led by Cathay Innovation, Seeya Ventures, and Kayyak Ventures and was joined by investors including Accion Venture Lab, Tim Draper, DILA Capital, and other angels.

- Pando, a San Francisco-based career progression platform, raised $6.9 million in seed funding from investors including Lerer Hippeau, Craft Ventures, and others.

- hampr, a Lafayette, La.-based on-demand laundry marketplace, raised $5 million in funding from investors including Gurtin Ventures, Benson Capital Partners, Ochsner Ventures and Techstars.

- Kahoona, a San Diego-based first-party data generation and activation platform, raised $4.5 million in Seed funding led by Global Founders Capital and was joined by investors including Cardumen Capital, Plug and Play, and Fourth Realm.

- Logseq, a remote-based knowledge management system, raised $4.1 million in seed funding Strip CEO Patrick Collison, former CEO of GitHub Nat Friedman, founder of Shopify Tobias Lütke, general partner at a16z Sriram Krishnan, Craft Ventures, Matrix Partners, Day One Ventures, founder of Expo/Quora Charlie Cheever, and Dave Winer, and others.

- JackBe, an Edmond, Okla.-based on-demand pick-up-only grocery service, raised $3.75 million in Seed funding led by RCC Ventures and was joined by Purpose Equity.

- Fohlio, a New York-based provider of workflow software for architects and interior designers, raised $3.2m in seed funding. Brick & Mortar Ventures led, and was joined by Ocean Azul, Dreamit Ventures and GZ Real Estate. www.fohlio.com

- Seaspire, a Boston and New York-based skincare startup, raised $3 million in seed funding led by The Engine and was joined by investors including MassMutual through the MM Catalyst Fund, MassVentures, Alumni Ventures, Safar Partners, and angel investors Drs. Daniel Siegel and Susan Bryde.

- Kabata, a Los Angeles-based workout platform, raised over $2 million in funding from investors including Courtside Ventures, Detroit Venture Partners, Tribe Capital, NBA athlete Zaza Pachulia, EVP of Basketball Ops for the Golden State Warriors Kirk Lacob, AngelList founder Naval Ravikant, Caraway Home founder and CEO Jordan Nathan, Bonobos co-founder and CEO Andy Dunn, My First Million podcast co-host Sam Parr, and pro soccer player Daniel Sturridge.

- Upgrade, a Houston-based wig and supporting resources marketplace, raised $1 million in seed extension funding from investors including ANIM, Logitech CEO Bracken P. Darrell, The Artemis Fund, and Mercury Fund.

. . .

Sustainability:

- Group14 Technologies, a Woodinville, Wash.-based battery tech company, raised $400 million in Series C funding led by Porsche AG and was joined by investors including OMERS Capital Markets, Decarbonization Partners, Riverstone Holdings, Vsquared Ventures, Moore Strategic Ventures, and others.

- Cavnue, a Detroit-based autonomous roadways company, raised $130 million in Series A funding led by SIP and Ford Motor Company and was joined by investors including Openvia and Landstar System.

- Pachama, a San Francisco-based carbon capturing technology company, raised $55 million in Series B funding led by Future Positive and was joined by investors including Breakthrough Energy Ventures, LowerCarbon Capital, Ellen Degeneres, Portia De Rossi, Plus Capital, ReGen Ventures, 20VC, and Reddit co-founder Alexis Ohanian.

- Brimstone, an Oakland-based carbon-negative cement developer, raised $55 million in Series A funding. Breakthrough Energy Ventures and DCVC co-led the round and were joined by investors including Collaborative Fund, AccelR8, Amazon’s Climate Pledge Fund, Fifth Wall Climate Tech, Impact Science Ventures, S2G Ventures, Gatemore Capital Management, Osage University Partners, and SystemIQ.

- Voyage Foods, an Oakland-based food technology company re-creating foods using sustainable ingredients and sourcing practices, raised $36 million in Series A funding co-led by funds managed by UBS O’Connor and Level One Fund and was joined by investors including Horizons Ventures, SOSV’s Indie Bio, and Social Impact Capital.

- Tomorrow Farms, a New York-based sustainable food-tech company, raised $8.5 million in seed funding led by Lowercarbon Capital and was joined by investors including Maveron, Valor Siren Ventures, Simple Food Ventures, and SV Angel.

- YvesBlue, a New York-based data analytics and reporting platform for ESG analysis and portfolio management, raised $5 million in seed funding led by Illuminate Financial and was joined by investors including Aflac Ventures, Tribeca Early Stage Partners, SixThirty, Day One Ventures, and Walter Ventures.

- Sealed, a New York-based climate tech company focused on home energy waste, raised $29.5 million in Series B extension led by Fifth Wall Climate Tech and was joined by investors including Robert Downey Jr. 's FootPrint Coalition, CityRock Venture Partners, Cyrus Capital, and Keyframe Capital.

- Sensible Weather, a Santa Monica, Calif.-based climate risk technology company, raised $12 million in Series A funding led by Infinity Ventures and was joined by investors including Certares Ventures, Wonder Ventures, Group1001, and other angels.

- Scoot Science, a Santa Cruz, Calif.-based ocean analytics company, raised $4.1 million round in seed funding led by Third Kind Venture Capital and was joined by investors including Rackhouse, Climate Capital, My Climate Journey, Hawktail, Liquid 2 Ventures, Impact Assets, Box Group, and other angels.

- RideTandem, a London-based shared-transportation startup, raised £1.75 million ($2.2 million) in seed funding led by 1818 Venture Capital and was joined by investors including Conduit Connect, Low Carbon Innovation Fund, Ascension, Seedrs, and angels including the founders of Allplants and OLIO.

Acquisitions & PE:

- The Chernin Group agreed to lead a $263 million investment for a 25% stake in collectible toymaker Funko (Nasdaq: FNKO). Other members of the group include eBay, Bob Iger, Rich Paul and limited partners in TCG funds. This is about the evolving relationship between content and merchandising. It used to move almost entirely in one direction (make a movie, then make figurines/etc. of the IP), but now it's more of a two-way flow (e.g., Lego movies, upcoming Barbie movie, etc.). Don't be surprised is Funko "characters" on a streaming service or the big screen. Plus, of course, NFTs… TCG has a long history with toy and games companies (e.g., Exploding Kittens), and partner Jesse Jacobs says the firm first identified Funko as an opportunity around two years ago. But the company demurred, since its shares were in the toilet. The two sides remained in touch, and began working on this deal when existing backer Acon Investments — which bought Funko in 2015 — was looking to exit its remaining stake (80% of this deal involves Acon shares). "In the media space, diversification is key." — Tim Baysinger, Axios Pro

- Apollo Global Management and Roku (Nasdaq: ROKU) made a joint bid for a minority stake in TV channel Starz, as first reported by the WSJ and confirmed by Axios Pro. Current owner Lions Gate (NYSE: LGF) paid $4.4b for Starz in 2016, but now the combined company is worth just around $3b. http://axios.link/Ep4H

- Vice Media, which has raised over $2.3b in funding, has hired financial advisers to explore a sale of the entire company, per CNBC. Separately, the company reportedly is seeking buyers for its studios business,

- ActiveCampaign acquired Postmark, a Philadelphia-based transactional email provider. Financial terms were not disclosed.

- Shopify agreed to acquire Deliverr, a San Francisco-based e-commerce shipping fulfillment company, for $2.1 billion.

- Qantas Airways agreed to acquire the rest of Alliance Aviation Services, a Brisbane, Australia-based aviation company for $553 million.

- OurFamilyWizard acquired Cozi, a Seattle-based family organizing app. Financial terms were not disclosed.

- SoundCloud acquired Musiio, a Singapore-based artificial intelligence company for the music industry. Financial terms were not disclosed.

- Spirit Airlines (NYSE: SAVE) rejected an unsolicited $3.6b takeover offer from JetBlue (Nasdaq: JBLU), citing antitrust concerns, and instead will continue pursuing its merger with fellow low-cost carrier Frontier (Nasdaq: ULCC). http://axios.link/kBfk

- ZoomInfo acquired Comparably, a Santa Monica, Calif.-based recruitment marketing and employer branding platform. Financial terms were not disclosed.

- Shell agreed to acquire Sprng Energy, a Pune, India-based renewable power supplier, for $1.55 billion.

- MGM Grand offered to acquire LeoVegas, a Stockholm-based online gaming company, for $607 million.

- G-III agreed to acquired a majority stake in Karl Lagerfeld, a Paris-based fashion brand, for $210 million.

- Helen of Troy agreed to acquire Recipe Products, a London-based maker of Curlsmith, for $150 million. As part of the deal, BFG Partners exited.

- Google Cloud acquired Mobiledgex, a San Jose, Calif.-based computing management company. Financial terms were not disclosed.

- Coinbase (Nasdaq: COIN) ended talks to buy the parent company of Mercado Bitcoin, a Brazilian crypto exchange backed by SoftBank and Tribe Capital, per Bloomberg. http://axios.link/xhTh

- Glanbia (Dublin: GL9) is being pressured by activist investor Clearway Capital to spin off some of its branded businesses, including SlimFast. http://axios.link/bl0g

- The Jordan Company acquired a majority stake in Flywheel Software, a San Francisco-based data activation platform for enterprise. Financial terms were not disclosed.

- Anthem (NYSE: ANTM) completed its acquisition of Integra Managed Care, a managed long-term care plan in New York. www.integraplan.com

- Bally's (NYSE: BALY) rejected a takeover offer from Standard General, which had offered to pay $38 per share for the 79% stake it doesn't already hold. The casino operator also said it will initiate a cash tender offer of upwards of $500m. http://axios.link/2cxB

- Glencore (LSE: GLEN) invested $200m in Canadian battery recycler Li-Cycle (NYSE: LICY), as part of a strategic supply deal. http://axios.link/SLhb

- Vista Outdoor (NYSE: VSTO), an Anoka, Minn.-based company with a market cap north of $2b, plans to split its outdoor and sporting goods units into separate, publicly traded companies. http://axios.link/2p5P

. . .

IPOs:

- Bausch + Lomb, a Bridgewater, N.J.-based supplier of contact lenses and eye care products, raised $630m in its IPO. The company priced 35m shares at $18, below its $21-$24 range, will list on the NYSE (BLCO) and is being carved out of Canada's Bausch Health Cos. (NYSE: BHC). Sure, the company must be disappointed by the price. But any completed IPO right now is, by definition, a successful IPO.

. . .

SPACs:

Nothing to see here…

Funds:

- Unusual Ventures raised $485m for its third fund. http://axios.link/GOSr

- Aquiline Capital Partners, a London and New York-based private investment firm, raised more than $365 million for a fund focused on early- and growth-stage technology companies in the fintech, insurtech and enterprise solutions sectors.

- HOF Capital, a New York-based VC firm, raised $300m for its second fund. http://axios.link/YsH9

- Flybridge of Boston raised $110m for its sixth seed fund and $50m for its first opportunities fund. www.flybridge.com

- Home Depot Ventures, the Atlanta-based venture capital arm of Home Depot, allocated $150 million for a fund focused on early-stage retail and home improvement companies.

- Afore Capital, a San Francisco-based venture capital firm, raised $150 million for a fund focused on pre-seed stage investments.

- Magnify Ventures, co-led by Julie Wroblewski (ex-Pivotal Ventures) and Joanna Drake (Core Ventures Group), raised $52m for its debut fund. http://axios.link/F5Mc

Final Numbers

Data: FactSet. Chart: Will Chase/Axios

Go deeper: April's stock skid

Market rout

Data: Yahoo Finance; Chart: Axios Visuals

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

Great read. I had Big strike. It was a nice win for me. Very good analogy. Truly an underdog story. It was a great Kentucky Derby.