Sourcery ✨ Google I/O AI AI AI AI

(5/8-5/12) Petal, Slash, Cable, Triumph, Salsa, Charlie, Zamp, Amino, Wellthy, Lucem, Stella, Mother Science, Autonomize AI, Builder.ai, Fourthwall, 8fig, AudiencePlus, PermitFlow, Orby AI

Google I/O AI AI AI AI AI AI…

& the difference between public company pitches vs startup pitches

Sundar’s Google I/O keynote last week was a beautiful performance in market cap reclamation and investors’ confidence in their business (when things go right). Each time the word AI was said in his 15min presentation it led to ~$400M mcap increase that day - in total, AI was said over 140 times in the 2hr event. This added ~$131B back to recover a $1.5T market cap after two days, then ending the week up 10%. For context, Alphabet lost $100B immediately after the botched Bard demo in early February (and began gaining it back mid-March). Now it’s on its way up to its previous Nov 2021 peak.

But why is it working for Alphabet? Well, because they’ve been doing this since the dawn of time. I worked as a PM at their incubator in NYC in 2016 and experienced a taste of their OKRs, workflows, network and influence back then - it was intense. They didn’t get to $T without innovation and execution, and now they're reinstating their reach - something investors can more easily believe than let’s say… others.

While the repetitive usage of “AI” in a presentation can work for a trusted public company who’s market cap is reliant on signal to remain ‘competitive’ and ‘defensible’ (through the largest disruption in tech in quite a while)... for early stage companies we’re going to have to be a little bit more prepared.

Yes, it is easy to reorient the deck to include AI. And in order to raise money in this climate you do need to play the field, but that also comes with its own consequences. Raising in a hype environment with hype terms creates a new set of responsibilities - words you need to live up to.

At the end of the day it is investors' jobs to see through the fluff and get down to the technicalities, in other words.. truth. Does the team actually have the 10x talent, engineering, idea, and GTM strategy to build right now? Are they thinking long term? Is this a band aid solution? Is this defensible? Or is this a product that will be copied and highly commoditized in a week? (Yes, things are moving that fast). Startups are popping up left and right with the same idea but different teams. A pattern that typically goes for any hype cycle.

So what do we do? For founders, stay true to your skills and expertise. Sure, layer in AI in a genuine and validated way if it’s there, but for the most part AI is now table stakes, not the main event. To the trained ear, authenticity, expertise, and execution, speak louder than hype. For investors, don’t get caught in the mix of a great sales pitch, take your time.

Paul Graham tweeted this a couple days after I wrote this (gotta love confirmation bias).

Bad example: Chegg didn’t message AI well and their stock took a massive hit, more at the bottom.

Top tweets from the I/O AI event (Substack better get these previews back):

How to effectively pitch your startup to raise $Bs, @MattTurck

GooglexSesameStreet, @TurnerNovak (this is chaotic)

AI Musings

Why The Future of AI Is Open Not Closed, Why We Are Years Away From AI Being Autonomous, Why AI Founders Do Not Need to Move to the Valley & Why Founders Should Not Meet Investors in Between Rounds with Clem Delangue @ Hugging Face on 20VC

Seeking a Distribution Advantage with AI, Tomasz Tunguz

In the last five major cycles (internet, social, mobile, cloud, web3), startups seized the new technologies of the era to create a distribution advantage.

E128: Google enters AI wars, Druck’s warning, Trump crushes CNN & more, All-in Podcast

Solo VC Elad Gil, the AI Whisperer, StrictlyVC

Here are 8 things impossible on ChatGPT but that Bard can do (for free)

. . .

Last Week (5/8-5/12):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Petal, Slash, Cable, Triumph, Salsa, Charlie, Zamp, Amino, Wellthy, Lucem, Stella, Mother Science, Autonomize AI, Builder.ai, Fourthwall, Everseen, 8fig, AudiencePlus, PermitFlow, Orby AI, Antimetal, Tenon; Amazon/Snackable AI, Baked by Melissa, Go1/Blinkist, Oura/Proxy, Shopify/6 River System

Final numbers on Chegg’s AI Stock Blow at the bottom.

Deals

Fintech:

- Petal, a New York-based credit card fintech company, raised $35 million in funding. Valar Ventures led the round and was joined by Synchrony, Samsung Next, Story Ventures, Core Innovation Capital, RiverPark Ventures, and others.

- Slash, a San Francisco-based online banking platform for young entrepreneurs, raised $15 million in Series A funding. NEA, Y Combinator, and the founders of Plaid invested in the round.

- Blockworks, a New York-based crypto media company, raised $12 million in funding. 10T Holdings led the round and was joined by Framework Ventures and crypto investor Santiago Santos.

- Firmbase, a Tel Aviv-based financial planning and analysis platform, raised $12 million in funding. S Capital led the round and was joined by Meron Capital and others.

- Cable, a London- and San Francisco-based financial crime and compliance platform, raised $11 million in Series A funding. Stage 2 Capital and Jump Capital co-led the round and were joined by CRV.

- Triumph, a San Francisco-based monetization tool for game developers, raised $10.2 million in Series A funding. General Catalyst led the round and was joined by Heroic Ventures, Hanover Technology Investment Management, SteelPerlot, RavenOne, Box Group, Great Oaks, NOMO, Strike, and Valhalla Ventures.

- Salsa, a San Francisco-based payroll infrastructure platform, raised $10 million in funding. Greycroft, Better Tomorrow Ventures, and Definition co-led the round and were joined by Cambrian’s Rex Salisbury, and Forum Ventures.

- Charlie, a Los Angeles-based banking platform, raised $7.5 in funding. Better Tomorrow Ventures, Expa, Carbon Health chief product officer Ayokunle Omojola, and Gokul Rajaram invested in the round.

- Zamp, a New York-based managed sales tax solution platform for online sellers, raised $4 million in funding. Valor Equity Partners, Soma Capital, Day One Ventures, and others invested in the round.

. . .

Care:

- Amino Health, an SF-based health benefits navigation startup, raised $80m in equity and debt funding co-led by Transformation Capital and Oxford Finance, per Axios Pro. https://axios.link/3BfrSIC

- Wellthy, a New York-based digital concierge for caregivers, raised $25m co-led by insiders Hearst and Eldridge. Other backers include Citi Impact Fund, Cercano Management, Stardust Equity and ReThink Impact. https://axios.link/3VTblnc

- Hygieia, a Livonia, Mich.-based digital diabetes therapeutics company, raised $22m in Series B funding led by Firstime Ventures. https://axios.link/42E9ox9

- Lucem Health, a Davidson, N.C.-based clinical A.I. technology and solutions provider, raised $7.7 million in Series A funding. Mayo Clinic, Granger Management, and Mercy (St Louis) co-led the round and were joined by Rally Ventures.

- Stella, a Chicago-based post traumatic stress, anxiety, stress, depression, traumatic brain injury, and Long COVID treatment platform, raised $7 million in funding from Sterling Partners.

- Mother Science, a Los Angeles-based skincare brand, raised $6.2 million in seed funding led by Female Founders Fund.

- Autonomize AI, an Austin, Texas-based health care data analysis startup, raised $4m in seed funding. Asset Management Ventures led, and was joined by ATX Venture Partners, Loop Ventures and The Next Practices Group. https://axios.link/3B89eCe

. . .

Enterprise & Consumer:

- Builder.ai, a London-based low-code/no-code app development platform, raised an undisclosed amount of strategic funding from Microsoft. It previously raised $195m from backers like Insight Partners, WndrCo. and Nikesh Arora. https://axios.link/3Mj9yV3

- Fourthwall, an LA-based commerce platform for creators that had raised $17m in VC funding, raised an undisclosed amount of funding from Jellysmack. https://axios.link/42Jtkyv

- Everseen, an Irish developer of computer vision and hyper automation solutions, raised €65m in Series A extension funding led by Crosspoint Capital Partners. https://axios.link/3HZLBQh

- 8fig, a provider of supply chain management tools for online retailers, raised $40m in Series B equity funding led by Koch Disruptive Technologies and $100m in debt. https://axios.link/3NSSZR1

- Blockworks, a crypto-focused media company, raised $12m at a $135m post-money valuation, Axios was first to report. 10T Holdings led, and was joined by Framework Ventures and Santiago Santos. https://axios.link/41lsXt4

- AudiencePlus, a Scottsdale, Ariz.-based media software company for B2B brands, raised $5.4 million in seed funding. Emergence Capital led the round and was joined by Forum Ventures, Worklife Ventures, and GTMfund.

- PermitFlow, a San Jose-based construction permitting workflow and automation software provider, raised $5.5 million in seed funding led by Initialized Capital.

- Orby AI, a Sunnyvale, Calif.-based work automation platform, raised $4.5 million in seed funding. Pear VC and New Enterprise Associates co-led the round and were joined by Wing VC.

- Antimetal, a New York-based cloud cost optimization platform, raised $4.3 million in seed funding. Framework Ventures led the round and was joined by Chapter One, IDEO CoLab Ventures, and others.

- Tenon, an Indianapolis-based marketing workflow company, raised $3 million in seed funding co-led by High Alpha and ServiceNow Ventures.

- AudioShake, a San Francisco-based A.I. music company, raised $2.7 million in seed funding. Indicator Ventures led the round and was joined by Precursor Ventures, Side Door Ventures, and others.

- Optery, a San Francisco-based personal information removal platform, raised an additional $2.7 million in seed funding. Bayhouse Capital led the round and was joined by Global Founders Capital, Goodwater Capital, Pioneer Fund, Soma Capital, TRAC, Y Combinator, and others.

- BurnerPage, a New York-based web page optimization platform, raised $2 million in pre-seed funding. LDV Capital led the round and was joined by Freestyle Capital and others.

- Overplay, a New York-based user-generated gaming platform, raised $1.2 million in funding from retail investors via Wefunder.

. . .

Sustainability:

- Modern Hydrogen (fka Modern Electron), a Bothell, Wash.-based developer of on-site hydrogen machines, raised $32.8m in Series B-2 funding. NextEra Energy led, and was joined by Miura, National Grid Partners and insiders Gates Frontier, Irongrey, Starlight Ventures, Valo Ventures and Metaplanet. https://axios.link/3WbbBOF

- Werewool, a New York-based developer of sustainable performance fibers, raised $3.7m in seed funding co-led by Material Impact and Sofinnova Partners. https://axios.link/41u0Tnl

- Mycocycle, a Chicago-based waste reduction biotech using mushrooms, raised $2.2 million in seed funding. Anthropocene Ventures led the round and was joined by the TELUS Pollinator Fund for Good, Alumni Ventures, Telescopic Ventures, and others.

Acquisitions & PE:

- Amazon (Nasdaq: AMZN) late last year quietly acquired Snackable AI, an audio content discovery startup that had been seeded by Greycroft, Amplify and Tera Ventures. https://axios.link/3nBhgAr

- Tiff’s Treats acquired a minority stake in Baked by Melissa, a New York-based cupcake brand. Financial terms were not disclosed.

- Go1 acquired Blinkist, a Berlin-based learning app that summarizes books and podcasts. Financial terms were not disclosed.

- Yellow Wood Partners acquired Suave, the beauty and personal care brand of Unilever. Financial terms were not disclosed.

- Tempur Sealy agreed to acquire Mattress Firm, a Houston-based mattress retailer. The deal is valued at approximately $4 billion.

- Oura, a Finnish maker of sleep-tracking wearables valued by VCs at $2.55b, acquired Proxy, an SF-based digital identity signal startup whose backers include Scale Venture Partners, SVB, West Ventures, Kleiner Perkins and YC. https://axios.link/42k1BEV

- MUFG Bank invested $40 million in Liquidity Capital, a New York- and Tel Aviv-based investment firm.

- Solo Brand acquired TerraFlame, a Laguna Niguel, Calif.-based fireplaces and fuels company. Financial terms were not disclosed.

- Shopify (NYSE: SHOP) sold 6 River System, a Waltham, Mass.-based warehouse automation it bought for around $400m in 2019, to Ocado Group (LSE: OCDO) for an undisclosed amount. https://axios.link/42CsyDv

- Babylon (NYSE: BBLN), an Austin, Texas-based provider of value-based health care, agreed to go private via a restructuring led by AlbaCore Capital. https://axios.link/44PIKDg

- Tom Brady is in talks to become a minority owner in the Las Vegas Raiders, per ESPN. https://axios.link/44XGt91

. . .

IPOs:

Nothing to see here…

. . .

SPACs:

Nothing to see here…

Funds:

- Bessemer Venture Partners said it would allocate $1b of existing fund commitments to back AI startups. https://axios.link/3nHUgzM

- Mayfield, a Menlo Park, Calif.-based venture capital firm, raised $955 million across two funds. $580 million will be dedicated to its 17th flagship Seed to Series A fund, and $375 million will be dedicated to its 2nd portfolio company follow-on fund, with allocation for new Series B opportunities.

- Andreessen Horowitz, a Menlo Park, Calif.-based venture capital firm, allocated $500 million for a fund focused on early-stage companies that support American national interests, such as reshoring manufacturing, public safety, or defense.

Talk is cheap

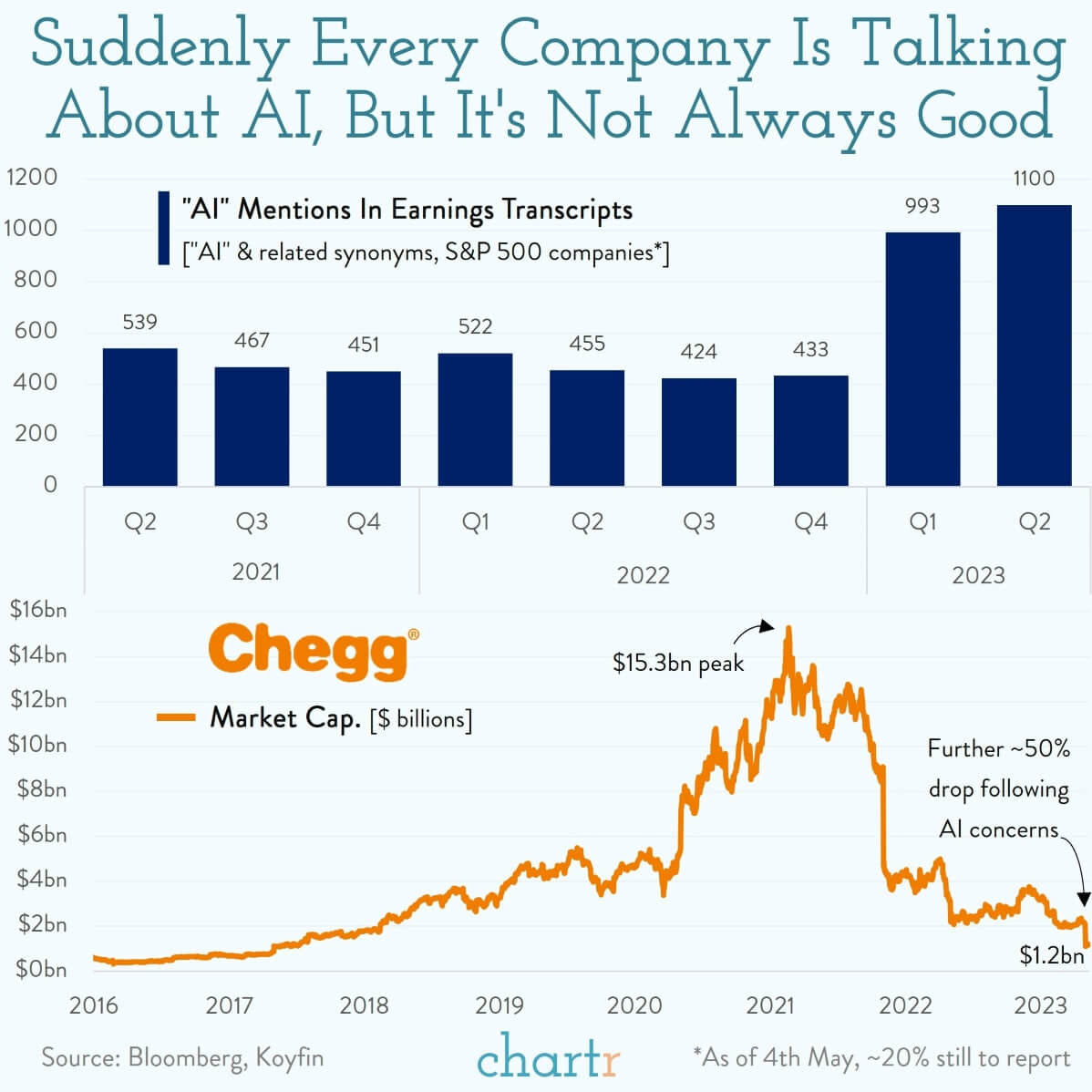

Not ones to miss out on a hot trend, the management teams at America’s largest companies can’t stop talking about AI (e.g. Google).

Indeed, there were more than a thousand references to “AI” and related synonyms in the latest round of quarterly conference calls from S&P 500 companies (per Bloomberg data), as an ever-growing swathe of the world’s biggest businesses look to lay out how the tech will figure into future plans.

Talk is expensive

It’s fair to categorize most of the AI chatter as positive — with execs keen to explain why AI breakthroughs could be a great boon for their company. But attempts to address the issue of AI head-on haven’t always worked out, and some companies now appear to be facing an existential threat that, 6 months ago, wasn't even on their radar.

Chegg, for instance, saw a billion dollars of market cap evaporate overnight, as its share price was cut in half after the company raised concerns over how it would be impacted by AI. The edtech company, which tripled in value during the pandemic as students “chegged” their way through homework and online tests (paying to access Chegg’s wide database of millions of textbooks to get the answers), conceded last week that ChatGPT is “having an impact on our new customer growth rate”. Good luck to the teachers having to mark AI-written essays from now on.

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.