Sourcery (6/15-6/19)

Kaia Health, Cake, UiPath, Palantir, Payfone, Brightside, Clockwise, Drishti Technologies, Syncari, CognitOps.

Last Week (6/15-6/19):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into three categories, Care, Future of Work and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include: Kaia Health, Cake, UiPath, Palantir, Payfone, Brightside, Clockwise, Drishti Technologies, Syncari, CognitOps.

Final numbers on May Retail Sales and Preliminary VC Returns at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Care:

- DocASAP, a Herndon, Va.-based advanced patient access and engagement platform for health systems, health plans and physician groups, raised a round of funding of undisclosed amount (read here)

- Big Health, a San Francisco, Calif.-based digital therapeutics company focused on mental health, raised $39 million in Series B funding. Gilde Healthcare and Morningside Ventures co-led the round and were joined by investors including Kaiser Permanente Ventures, Octopus Ventures; and Samsung NEXT.

- Abacus Insights, a Boston-based data integration and interoperability platform for health plans, raised a $35 million in Series B funding. Blue Venture Fund led the round and was joined by investors including CRV, .406 Ventures, Horizon Healthcare Services Inc., and Echo Health Ventures.

- Kalderos, a Chicago, IL-based creator of a drug discount management solution, secured $28m in Series B funding (read here)

- Kaia Health, a four-year-old, New York-based digital therapeutics startup that uses computer vision technology for real-time posture tracking via a person's smartphone camera to deliver human-hands-free physiotherapy, just raised $26 million in Series B funding. Optum Ventures, Idinvest and capital300 led the round, joined by Balderton Capital, Heartcore Capital, and Symphony Ventures. TechCrunch has more here.

- careMESH, a Reston, Va.-based patient notification platform, raised $5 million in seed funding. Assurance Capital and Pavey Family Investments led the round.

- TeleVet, an Austin, Texas-based mobile telemedicine app for veterinary clinics, raised $5 million in Series A funding. Mercury Fund led, and was joined by Dundee VC, Atento Capital, GAN and Urban Capital Network. www.televet.com

- Playbook, a NYC-based mobile marketplace enabling top instructors in fitness and athletics to turn their iPhone content into a subscription income, raised $3M in seed funding (read here)

- Plume, a Denver-based selling hormone replacement therapy to the trans-community, raised $2.9 million in funding. General Catalyst and Slow Ventures led the round and was joined by investors including Springbank Collective. Read more.

- Cake, a Los Angeles-based sexual wellness company, raised $1.4 million in seed funding. Investors included Brian Spaly (cofounder of Bonobos), Roth Martin (cofounder of Rothy’s), Brand Foundry Ventures, Finn Capital, and others.

. . .

Future of Work:

- Palantir, the 17-year-old, Palo Alto, Ca.-based company that sells software to government agencies and companies for managing and analyzing their data, has raised 54 billion yen ($500 million) from Sompo Japan Nipponkoa Holdings. Bloomberg reports that the "cash lessens the need for Palantir to raise capital through an initial public offering. The company has been considering a direct listing of its shares on an exchange as an option, which would allow Palantir to bypass a roadshow and other formalities of an IPO, though it would not bring in new funds," according to the outlet's sources. More here.

- UiPath, a 15-year-old, New York-based software maker that helps companies automate routine processes, is in talks to raise funding that could value it at more than $10 billion, according to Bloomberg. UiPath was last valued in the spring of last year at $7 billion by its investors, which include Sequoia Capital, Coatue, Kleiner Perkins, and Accel. More here.

- Pagaya, a New York and Tel Aviv-based fintech using AI in institutional investment, raised $102 million in Series D funding. Aflac Global Ventures, Poalim Capital Markets, Viola, Oak HC/FT, Clal Insurance, GF Investments, and Siam Commercial Bank participated.

- Payfone, a 12-year-old, New York-based company that has built a B2B2C platform to identify and verify people using data gleaned from their mobile phones, has raised $100 million led by Apax Digital. TechCrunch has more here.

- Contentful, a German provider of headless content management systems, raised $80 million in Series E funding. Sapphire Ventures led, and was joined by General Catalyst and Salesforce Ventures. www.contentful.com

- Unbounce, a Canadian landing page optimization startup, raised C$52 million led by Crest Rock Partners. http://axios.link/u7Hn

- Outreach, a Seattle-based provider of sales tools, raised $50 million in Series F funding at a $1.33 billion valuation. Sands Capital led, and was joined by Salesforce Ventures, Operator Collective, and return backers Lone Pine Capital, Spark Capital, Meritech Capital Partners, Trinity Ventures, Mayfield, and Sapphire Ventures. http://axios.link/pXew

- Starburst, a Boston, MA-based Presto company which provides a platform for companies to run fast analytics on any data, raised $42m in Series B financing (read here)

- Brightside, a San Francisco-based financial care platform for employers, raised $35.1 million in Series A funding. Andreessen Horowitz led the round and was joined by investors including existing investors Comcast Ventures and Trinity Ventures, the a16z Cultural Leadership Fund, and others.

- Zerto, a Boston-based IT recovery platform, raised $33 million in funding. Investors included Claltech, 83North, Battery Ventures, Harmony Partners, IVP, RTP Ventures, U.S. Venture Partners, and new investors Poalim Capital Markets and Bank Hapoalim.- Degreed, a San Francisco-based upskilling platform, raised $32 million in new funding led by existing backer Owl Ventures. http://axios.link/kMLH- Uptycs, a Waltham, Mass.-based provider of SQL-powered security analytics, raised $30 million in Series B funding. Sapphire Ventures led, and was joined by return backers Comcast Ventures and ForgePoint Capital. www.uptycs.com

- Copado, a Chicago-based DevOps platform for Salesforce, raised $26 million in Series B funding. Insight Partners led the round and was joined by investors including Salesforce Ventures, Lead Edge Capital, ISAI Cap Venture, and Perpetual Investors.

- Drishti Technologies, a Mountain View-based provider of video analytics for the factory floor, raised $25 million in Series B funding. Sozo Ventures led, and was joined by Alpha Intelligence Capital, Toyota AI Ventures, Micron Ventures, Presidio Ventures, Hella Ventures, and return backers Emergence Capital, Benhamou Global Ventures, and Andreessen Horowitz. www.drishti.com

- Botkeeper, a Boston-based bookkeeping company, raised $25 million in Series B funding. Point72 Ventures led the round and was joined by investors including High Alpha Capital, Republic Labs, Oakridge, Peak State as well as existing investors Ignition Partners, Greycroft Partners, Gradient Ventures, and Sorenson Capital.

- MayStreet, a New York-based market data infrastructure platform, raised $21 million in Series A funding led by Credit Suisse Asset Management's NEXT Investors. www.maystreet.com

- Streamlit, a San Francisco-based maker of app framework for machine learning and data science, raised $21 million in Series A funding. GGV Capital and Gradient Ventures co-led the round, and was joined by investors including Bloomberg Beta, Elad Gil, and Daniel Gross.

- Salt Security, a Palo Alto, Calif.-based API security company, raised $20 million in Series A funding. Tenaya Capital led the round.

- Urbint, a New York-based maker of artificial intelligence for utility safety and field risk management, raised $20 million in Series B funding. Energy Impact Partners and Piva co-led the round and were joined by investors including Salesforce Ventures and National Grid Partners.

- Splyt, a five-year-old, London-based company that helps app operators integrate mobility options with other services, has raised $19.5 million in funding led by SoftBank as the Japanese conglomerate "seeks to build its own super app," reports Reuters. More here.

- Zycada, a San Jose, Calif.-based company seeking to speed up the ecommerce shopping experience, raised $19 million through several rounds. Khosla Ventures led and was joined by investors including Cervin Venturers and Nordic Eye Venture Capital.

- Clockwise, a San Francisco-based smart calendar assistant, raised $18 million in Series B funding. Bain Capital Ventures led the round and was joined by investors including Steve Loughlin at Accel and John Lilly at Greylock Partners.

- Wise Systems, a seven-year-old, Cambridge, Ma.-based-based maker of dispatch and routing software, has raised $15 million in funding led by Valo Ventures, with participation from Gradient Ventures, Prologis Ventures, and E14 Fund. Forbes has more here.

- Steady, an Atlanta-based job search platform for workers seeking stable income, today raised $15 million in Series B funding. Recruit Strategic Partners led the round and was joined by investors including Flourish Ventures, Loeb Enterprises, Propel Venture Partners and CMFG Ventures.

- Open Raven, a Los Angeles-based data security platform, raised $15 million in Series A funding. Kleiner Perkins led, and was joined by Upfront Ventures. www.openraven.com

- Wise Systems, a Cambridge, Mass.-based-based maker of dispatch and routing software, raised $15 million in funding. Valo Ventures led the round and was joined by investors including Gradient Ventures, Prologis Ventures, and E14 Fund.

-Kasada, an Australian provider of web traffic security solutions, raised US$10 million in Series B funding. Ten Eleven Ventures led, and was joined by return backers Main Sequence Ventures and Westpac. http://axios.link/hZ74

- 4Degrees, a Chicago, IL-based AI startup enabling people to leverage their professional network, raised funding from Harlem Capital (read here)

- Lane, a Toronto-based workplace experience platform, raised C$10 million in Series A funding. Round13 Capital led, and was joined by Alate Partners and Panache Ventures. http://axios.link/WW4d

- GoFor Industries, an Ottawa-based provider of contactless last-mile delivery for the construction market, raised C$9.8 million. Builders VC led, and was joined by CEMEX Ventures, Mucker Capital, Plug & Play Ventures, Panache Ventures, I2BF Global Ventures, and the Capital Angel Network. http://axios.link/cFvI

- UNest, a Los Angeles-based provider of financial planning and savings tools for parents, raised $9 million from Anthos Capital, Northwestern Mutual, Artemis Fund, Draper Dragon, and Unlock Ventures. http://axios.link/QumU

- DroneBase, a German-based aerial data analytics company, raised $7.5 million in Series C funding. Valor Equity Partners and Razi Ventures invested, joining existing investors Union Square Ventures, Upfront Ventures, Hearst Ventures, Pritzker Group Venture Capital, and DJI.

- DMarket, a Los Angeles, CA-based in-game item trading platform and a monetization technology for game developers, content creators, brands, and players, closed $6.5m in venture funding (read here)

- Localised, a global ecommerce business, raised $6.5m in Series A funding (read here)

- Syncari, a San Francisco, CA-based provider of a data automation platform, raised $6.5M in total seed funding (read here)

- Dumpling, a Seattle-based platform for businesses to set up grocery shopping and delivery, raised $6.5 million in Series A funding. Forerunner Ventures led the round and was joined by investors including Floodgate and FUEL Capital.

- Acquire, a San Francisco-based customer engagement platform, raised $6.4 million in Series A funding. Base10 Partners led the round and was joined by investors including S28 Capital and Fathom Capital.

- MyTutor, a U.K.-based platform secondary school tutoring, raised £4 million ($5 million) in investment, led by existing investor Mobeus Equity Partners. This brings MyTutor’s total funding to-date to £14 million.

- SLAMcore, a U.K.-based developer of spatial AI algorithms for robots and drones, raised $5 million in funding. Octopus Ventures and MMC Ventures led the round.

- Noteable, a Cupertino, Calif.-based collaborative notebook platform for teams, raised over $4 million from firms like Wing VC, per an SEC filing. www.noteable.io

- Sorcero, a Washington, D.C.-based language intelligence platform, raised $3.5 million co-led by Leawood VC and WorldQuant Ventures. http://axios.link/MqyV- Apolicy, a San Francisco-based cloud-native policy orchestration platform, raised $3.5 million in seed funding. StageOne Ventures led the round.

- Trade Hounds, a Boston-based online profess, raised $3.2 million in seed funding. Corigin Ventures and Brick & Mortar Ventures co-led, and were joined by Suffolk Construction and CCS Construction Staffing. http://axios.link/Mqf8

- CognitOps, an Austin, Texas-based AI startup software models automates warehouse management, completed its seed round of $3m (read here)- SuperAnnotate, a San Francisco, Calif.-based AI-powered annotation platform for data scientists, raised $3 million in seed funding. Point Nine Capital led the round and was joined by investors including Runa Capital and Fathom Capital.

- Quolum, a Dublin, Calif.-based company tracking SaaS spend for other firms, raised $2.8 million in seed funding. Investors include Sequoia’s Surge and Nexus Venture Partners.

- Jupiter, a San Francisco-based grocery delivery startup, raised $2.8 million in seed funding. NFX and Khosla Ventures co-led the round.

- HASH Inc., a New York-based maker of a browser-based tool for creating multi-agent simulations, raised $2.5 million in seed funding. Root Ventures and Zetta Venture Partners led the round.

. . .

Sustainability:

- Zero Mass Water, a Scottsdale, Ariz.-based company seeking to make drinking water renewable, raised $50 million in Series C1 funding. BlackRock led the round and was joined by investors including Duke Energy, Breakthrough Energy Ventures, and Material Impact Fund.

Exits:

- In its latest move to compete with pharmacy services, Walmart has bought the medication management software of CareZone, an eight-year-old, San Francisco-based company whose app lets users create medication lists, provides refill reminders, and helps facilitate medication delivery. Terms of the deal weren't disclosed but Walmart will acquire CareZone’s technology platform and key intellectual property it says. The startup had raised more than $160 million, with NEA leading its most recent funding round, according to Crunchbase. MedCity News has more here.

- Mapillary, a seven-year-old, Sweden-based street-level imagery platform that scales and automates mapping using crowdsourced collaboration, cameras, and computer vision, has been acquired by Facebook, according to the company’s blog. Terms of the deal aren’t being disclosed. Per Crunchbase, Mapillary had raised $24.5 million in funding, including from Sequoia Capital and LDV Capital. TechCrunch has more here.

IPOS:

- RoyaltyPharma, a New York-based company that buys biopharma royalty interests, raised $2.2 billion in what is the year’s largest IPO to date. It priced 77.7 million shares at $28 (high end of range), representing a fully-diluted market cap of $16.7 billion, and then closed its first day of trading (Nasdaq: RPRX) at $44.50 per share. Pre-IPO backers included Adage Capital Management. http://axios.link/bTln

- GoHealth, a Medicare-focused health insurance marketplace, filed on Friday with the SEC to raise up to $100 million in an initial public offering. It plans to list on the Nasdaq under the symbol GHTH. GoHealth filed confidentially on May 8, 2020. Goldman Sachs, BofA Securities, Morgan Stanley, Barclays, Credit Suisse, Evercore ISI, RBC Capital Markets, and William Blair are the joint bookrunners on the deal. http://axios.link/LxJS

Acquisitions:

- WeCommerce, a Canadian e-commerce technology holding company, acquired Foursixty Inc., a partner in the Shopify and Instagram ecosystems based in Toronto, Canada (read here)

- Square acquired Verse, a Spanish peer-to-peer payment app. Verse had raised from investors including Spark Capital, eVentures, and Greycroft Partners.

- Permira completed its acquisition of Carlyle’s majority stake in Golden Goose, a Venice, Italy-based luxury fashion brand. Carlyle retains a minority stake in the business. Financial terms weren't disclosed.

- Accelya, backed by Vista Equity Partners, agreed to acquire Farelogix, a Miami-based provider of SaaS solutions for airline retailing. Sandler Capital Management is the seller. Financial terms weren't disclosed.

Funds

- Sam Altman, along with brothers Jack and Max, have a new fund named Apollo that will invest $3 million a piece into about five “moonshot” companies. http://axios.link/PAXF-Bullpen Capital, a San Francisco-based "post-seed” stage firm, is seeking to raise up to $150 million for its fifth fund, per an SEC filing. http://axios.link/Eydo

- FirstMark Capital, the 12-year-old, New York-based venture firm, says it has closed its fifth early-stage fund with $380 million in capital commitments, and its third, opportunity-type fund for the breakout companies in its portfolio, with $270 million in commitments. TechCrunch has more here.

- Rockpoint Groupraised $5.8 billion across two funds.

- Facebook is establishing its own “multimillion dollar” venture arm, per Axios. Read more.

- Endeavour Capital plans to raise $850 million for Endeavour Capital Fund VIII. Read more.

- Insight Partners is set to acquire the fifth fund of Gemini Israel Ventures, an Israeli venture firm, for $500 million, per Calcalist citing sources. Read more .- Fly Ventures, a German VC firm focused on European enterprise and deep tech startups, raised €53 million for its second fund. http://axios.link/6Q0F

- Hoxton Ventures of London raised nearly $100 million for its second fund. http://axios.link/bPCv

-IVP, a later-stage VC firm, is raising its seventeenth fund, per an SEC filing. www.ivp.com

-Louis Dreyfus Co., an agricultural commodities trader, launched a venture capital unit that will be led by existing business development executive Max Clegg. http://axios.link/bh7N

-Menlo Ventures is raising between $450 million and $500 million for its fifteenth flagship fund, per the WSJ. http://axios.link/EjM2

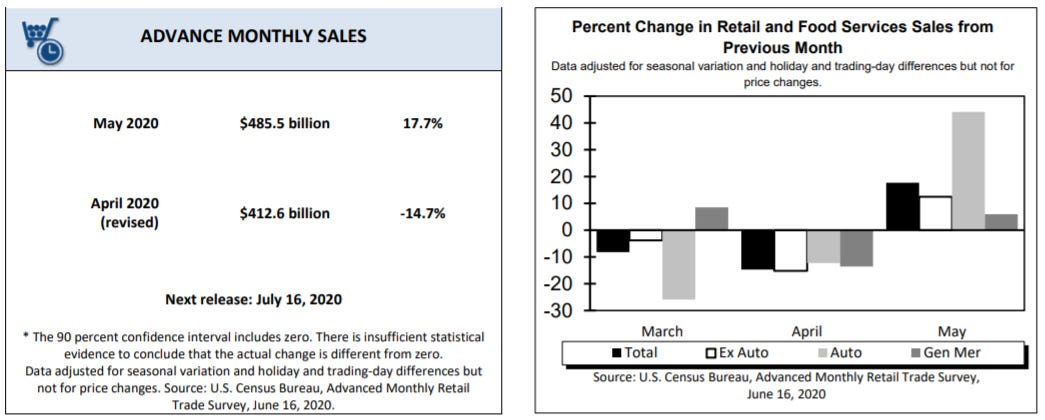

Final Numbers: May Retail Sales

Source: U.S. Commerce Department

. . .

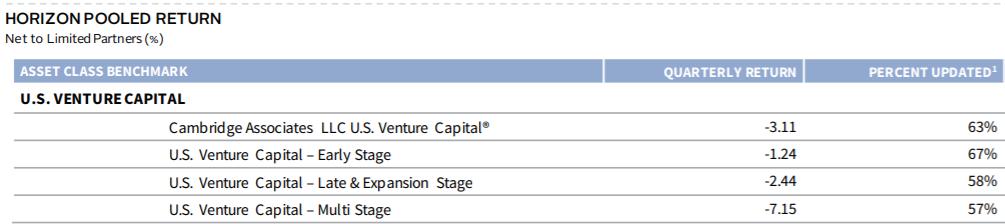

Final Numbers: Preliminary VC returns

Source: Cambridge Associates. Note: The return is a 1-quarter IRR calculation based on data compiled from venture capital funds formed between 1981 and 2019. Preliminary asset class returns are displayed when at least 50% of the number of active funds and prior period's NAVs have been updated.