Sourcery (6/20-6/23)

Elon vs Zuck ☀️ MosaicML ~ Accelerant, Volt, Hyperline, Concordia, Aledade, DexCare, Octave, Caraway, Outbound AI, Sollis Health, EvolvedMD, DUOS, Limble, Render, Warp, Rose Rocket, Captions, Fero Lab

Elon vs Zuck

Keeping this one ‘short’ to help offset last week… But also, focused on spending time researching, reflecting, and building out theses 🙂 Check out my recent exciting announcement here.

There’s a lot to unpack in the markets right now from the signals of announcements, shifts in economy, labor forces, early stage fundings, public companies, etc.. But hopefully we end up getting a cage match for charity??

Twitter continues to remain strong.

Vinod Khosla’s account has taken over, and he’s telling everyone what he’s really thinking.. I don’t know what he’s having but I want some.

If you need female biz/tech podcast recs, here is the complete guide

AI companies are getting eaten up

Just Google “AI Acquisition” - This is a hot & commoditized space, no other way around it. The one that holds the data wins, those are large incumbents. They’re going to be on an acquisition rampage over the next 18-24 months.

Large software companies with cute new AI funds, are going to be actively testing, monitoring, and probably acquiring early ideas/new companies. Not a bad thing. But also a constraint and something to be mindful of for building and investing in ‘long term’ businesses.

Examples

Databricks acquires MosaicML for $1.3B (Matt Turck of FirstMark believes companies will have to pay up for these emerging GenAI opportunities - this one net out to $21M per employee!)

Thomson Reuters to acquires legal tech provider Casetext for $650M

ThoughtSpot Acquires Mode Analytics for $200M

IBM acquires Apptio from Vista for $4.6B

Musings

AI-Powered Microchip Design, Chip Design for 'X', Nkechi Iregbulem

This is really good.

AI and The Burden of Knowledge: A story of superior intelligence and possible obsolescence, Mario Gabriele

The Scramble Landscape: Acquisitions, Shutdowns, and Layoffs Oh My, Kyle Harrison

A great round up of the latest company extremes as told by Twitter screenshots..

Twitch Co-Founder Emmett Shear: How Twitch Won Over Streamers, Logan Bartlett Show

Emmett shares product frameworks he used to grow and retain streamers, how he learned to not suck at management, and why he thinks remote is bad for most tech start-ups.

AI Areas of interest: Developer playgrounds, design-to-code automation, agents as users, Peter Zakin

. . .

Last Week (6/20-6/23):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Accelerant, Volt, Hyperline, Concordia, Aledade, DexCare, Octave, Caraway, Outbound AI, Sollis Health, EvolvedMD, DUOS, Limble, Render, Warp, Rose Rocket, Captions, Fero Labs, Leap, Oso, beehive, Augmenta, Parrot, Kitt, Hyper, Refuel.ai, Reask, Glystn, Yellow, GreenPlaces, Superciritcal, WindBorne Systems, CleanHub; Tymeshift, Sev, SmartPay

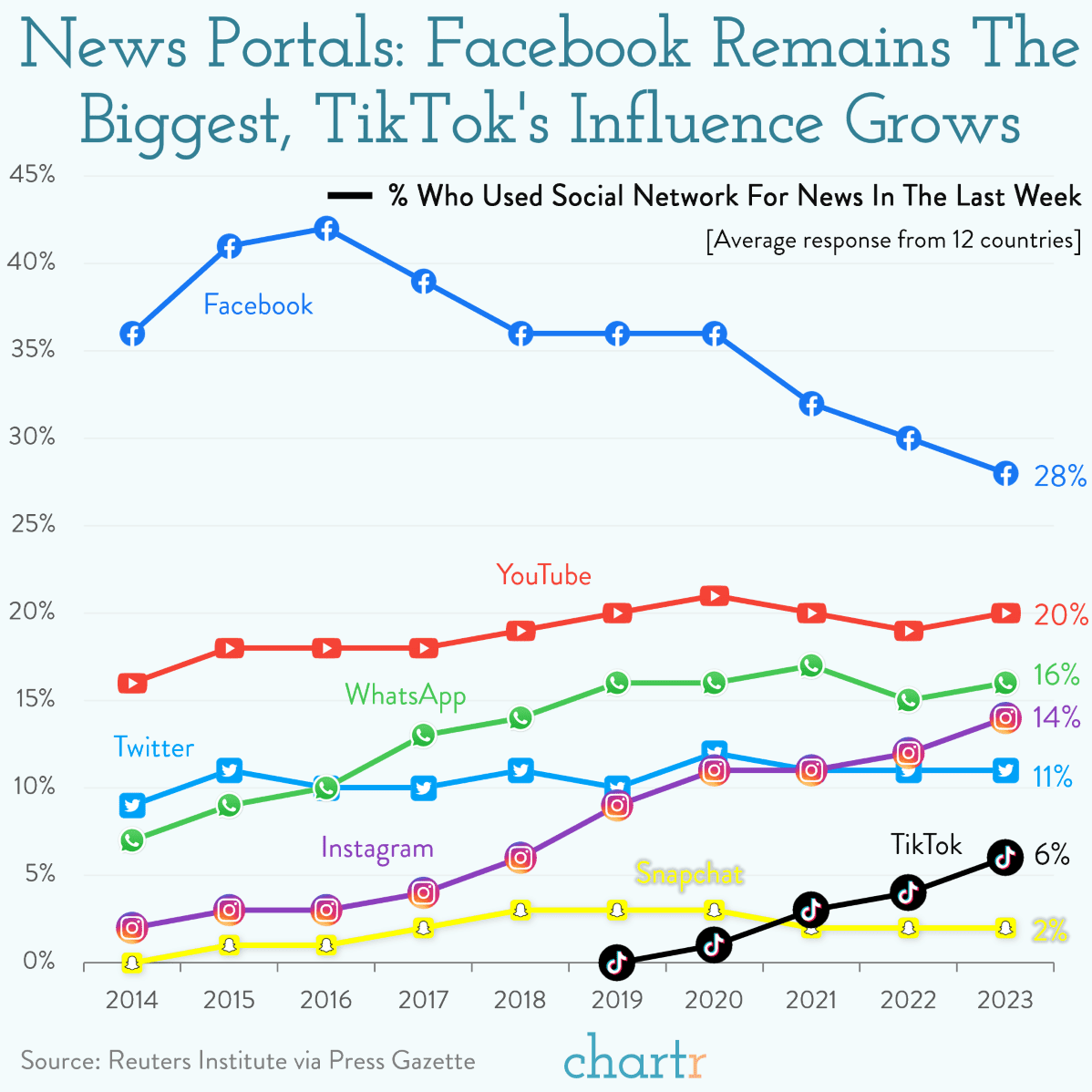

Final numbers on Most Popular Social News Sources at the bottom.

Deals

Fintech:

- Accelerant, an Atlanta-based insurance risk exchange, raised $150m led by Barings at a $2.4b valuation. https://axios.link/3Xljd1g

- Volt, a London-based infrastructure provider for real-time payments, raised $60 million in Series B funding. IVP led the round and was joined by CommerzVentures, EQT Ventures, Augmentum Fintech PLC, and Fuel Ventures.

- Yendo, a Dallas-based vehicle-secured credit card company, raised $24 million in Series A funding. FPV Ventures led the round and was joined by Human Capital and Autotech Ventures.

- Hyperline, a Paris-based revenue platform for B2B SaaS businesses, raised $4.4 million in seed funding. Index Ventures led the round and was joined by Cocoa and other angels.

- Concordia, a British Virgin Islands-based risk and collateral management protocol for digital assets, raised $4 million in seed funding. Tribe Capital and Kraken Ventures co-led the round and were joined by Cypher Capital, Saison Capital, and others.

- Chexy, a Toronto-based rewards platform for on-time rent payments, raised US$1.3m in pre-seed funding. Crossbeam Ventures led and was joined by Groundbreak Ventures and Ferst Capital Partners. www.chexy.co

. . .

Care:

- Aledade, a Bethesda, Md.-based primary care practice network, raised $260 million in Series F funding. Lightspeed Venture Partners led the round and was joined by Venrock, Avidity Partners, OMERS Growth Equity, and Fidelity Management & Research Company.

- HighFive Healthcare, a Birmingham, Ala.-based dental partnership organization, raised $100 million in funding led by Norwest.

- DexCare, a Seattle-based patient demand and care access platform, raised $75 million in Series C funding led by ICONIQ Growth.

- Octave, an SF-based hybrid behavioral health company, raised $52m in Series C funding. Cigna Ventures, Novo Holdings and Avidity Partners co-led, and were joined by insiders Health Velocity Capital, Greycroft, Felicis, Company Ventures and Obvious Ventures. www.findoctave.com

- Caraway, a provider of women's mental, physical and reproductive health services, raised $16.75m in Series A funding. Maveron and GV led the round, and were joined by 7wireVentures, Hopelab Ventures, Wellington Partners, Ingeborg Investments and The Venture Collective. https://axios.link/3qU6abd

- Outbound AI, a Seattle-based conversation A.I. platform for the health care industry, raised $16 million in seed funding. Madrona Venture Group and SpringRock Ventures co-led the round and were joined by Epic Ventures, Ascend, and KCRise Fund.

- Sollis Health, a New York-based private urgent care platform, raised $15 million in Series A extension funding. Torch Capital, Strand Equity, Arkitekt Ventures, and Read Capital invested in the round.

- EvolvedMD, a Scottsdale, Ariz.-based provider of primary care collaborative care management services, raised $14m in Series A funding. Conductive Ventures led, and was joined by FCA Venture Partners, Healthworx, Tectonic Ventures and Waterline Ventures. https://axios.link/3PdDsfq

- DUOS, a Minneapolis-based digital health company, raised an additional $10 million in funding co-led by Primetime Partners, SJF Ventures, and CEOC’s Aging Innovation Fund.

- Macro Trials, a Los Angeles-based research platform for clinical trials, raised $6 million in seed funding. MBX Capital led the round and was joined by INITIATE Ventures, Healthy VC, Inflect Health, and Village Global.

- Oliva, a Norwich, U.K.-based mental health support provider to employees, raised €5 million ($5.49 million) in funding. Molten Ventures led the round and was joined by Stride VC, Alumni Ventures, and other angels.

- nyra health, a Vienna, Austria-based digital therapy platform for neurological patients, raised €4.5 million ($4.93 million) in seed funding co-led by MassMutual Ventures and Wellington Partners.

- bitewell, a Denver-based corporate food health benefits provider, raised $4.1 million in seed funding. Lake Nona Sports & Health Tech Fund and Refinery Ventures co-led the round and were joined by Trybe Ventures, Mudita Venture Partners, Harvest Ridge Capital, BDMI, and others.

. . .

Enterprise & Consumer:

- Limble, a Lehi, Utah-based computerized maintenance management systems provider, raised $58 million in Series B funding led by the Growth Equity business within Goldman Sachs Asset Management.

- Render, a San Francisco-based cloud application hosting platform for developers and teams, raised $50 million in Series B funding. Bessemer Venture Partners led the round and was joined by Addition, General Catalyst, and the South Park Commons Fund.

- Warp, a New York-based terminal design company for developers, raised $50 million in Series B funding. Sequoia Capital led the round and was joined by Figma cofounder and CEO Dylan Field, GV, Neo, BoxGroup, Jeff Weiner, Marc Benioff, Sam Altman, and others.

- Rose Rocket, a Toronto-based transportation management software provider for trucking companies and 3PLs, raised $38 million in Series B funding. Scale Venture Partners led the round and was joined by Addition Capital, Shine Capital, Scale-Up Ventures, Funders Club, and Y-Combinator.

- Sharrow Marine, a Philadelphia-based maker of propellers for boats and ships, raised $32m led by the family offices of John McFadden and David Dolby. https://axios.link/3qNCYCB

- Captions, a New York-based A.I. creative studio, raised $25 million in Series B funding. Kleiner Perkins led the round and was joined by Sequoia Capital, Andreessen Horowitz, and SV Angel.

- Acryl Data, a Mountain View, Calif.-based productivity platform for data teams, raised $21 million in Series A funding. 8VC partner Bhaskar Ghosh led the round and was joined by Sherpalo Ventures founder Ram Shriram, and Vercel founder and CEO Guillermo Rauch.

- ElevenLabs, a London- and New York-based voice technology research company, raised $19 million in Series A funding. Nat Friedman, Daniel Gross, and Andreessen Horowitz co-led the round and were joined by Credo Ventures, Concept Ventures, and other angels.

- Fero Labs, a New York-based manufacturing process optimization software company, raised $15 million in funding. Climate Investment led the round and was joined by Blackhorn Ventures, Innovation Endeavors, and DI Technology.

- Leap, a New York-based retail platform for brands, raised $15 million in funding. BAM Elevate and Costanoa Ventures co-led the round and were joined by Equal Ventures, Hyde Park Ventures, and others.

- Oso, a New York-based authorization platform for developers, raised $15 million in Series A-1 funding. Felicis led the round and was joined by Sequoia and Harpoon Ventures.

- System Initiative, a San Francisco-based intelligent automation platform for devops, raised $15 million in Series A funding led by Scale Venture Partners.

- GoodBuy Gear, a Denver-based online resale marketplace for baby and kid gear, raised $14 million in funding. Interlock Partners and Revolution Ventures co-led the round and were joined by Crawley Ventures, Mana Ventures, Access Ventures, Relay Ventures, and Denver Angels.

- beehiiv, a New York-based newsletter platform, raised $12.5 million in Series A funding. Lightspeed Venture Partners led the round and was joined by Social Leverage, Creator Ventures, Blue Wire Capital, and Contrarian Thinking Capital.

- Augmenta, a Toronto-based building design automation company for the construction industry, raised $11.75 million in seed extension funding. Eclipse led the round and was joined by Hazelview Ventures, BDC Capital’s Deep Tech Venture Fund, and Suffolk Technologies.

- Parrot, a New York-based deposition transcribing and management platform, raised $11 million in Series A funding co-led by Amplify Partners and XYZ Venture Capital.

- Kitt, a London-based office design and experiences provider, raised $8 million in seed extension funding led by Hoxton Ventures.

- Alvys, a Solana Beach, Calif.-based operating system for middle-mile logistics companies, raised $6.3 million in seed funding. Bonfire Ventures led the round and was joined by RTP Global and other angels.

- goodbuy, a Boise, Idaho-based e-commerce platform connecting small businesses with consumers, raised $6.3 million in seed funding. StageDotO Ventures led the round and was joined by Capital Eleven and others.

- Cargobot, a Miami-based digital freight company, raised $6 million in Series A funding. BPBI led the round and was joined by Total Management 2 and others.

- BetterBrand, a Los Angeles-based food tech company, raised $6 million in Series A funding. VERSO Capital led the round and was joined by Gaingels Fund, Seven Seven Six, Craft Lane, and other angels.

- Hypar, a Culver City, Calif.-based generative building platform, raised $5.5 million in Series A funding. Brick & Mortar Ventures led the round and was joined by Building Ventures.

- Refuel.ai, a San Francisco-based dataset creation and labeling automation platform, raised $5.2 million in seed funding co-led by General Catalyst and XYZ Ventures.

- Reask, a Sydney-based risk data company, raised $4.6 million in seed funding. Mastry Ventures and Collaborative Fund co-led the round and were joined by Macdoch Ventures, Tencent, SV Angel, and Hawktail.

- Glystn, a San Francisco-based community engagement platform for creators and brands, raised $4 million in seed funding. Eniac Ventures, Hannah Grey VC, Precursor Ventures, and Future Perfect Ventures invested in the round.

- Orson, a Winter Garden, Fla.-based automated video storytelling platform, raised $3 million in funding. Cyan Banister, Long Journey Ventures, and others invested in the round.

- Metal, an enterprise AI app builder, raised $2.5m in seed funding. Swift Ventures led, and was joined by YC and Chapter One. www.getmetal.com

. . .

Sustainability:

- Guardian Agriculture, a Woburn, Mass.-based electric vertical take-off and landing systems developer for sustainable farming, raised $20 million in Series A funding led by Fall Line Capital.

- Yellow, a Malawi-based provider of solar energy asset financing solutions, raised $14m in Series B funding. Convergence Partners led, and was joined by Energy Entrepreneurs Growth Fund and Platform Investment Partners. https://axios.link/3NxJqGJ

- GreenPlaces, a Raleigh, N.C.-based sustainability platform, raised $13 million in Series A funding. Redpoint Ventures led the round and was joined by Felicis, Tishman Speyer Ventures, and Bull City Venture Partners.

- Supercritical, a London-based carbon removal marketplace, raised $13 million in Series A funding. Lightspeed Venture Partners led the round and was joined by RTP Global, Greencode Ventures, MMC Ventures, and others.

- TreaTech, a Lonay, Switzerland-based waste treatment company, raised CHF 9 million in Series A funding. Engie New Venture and Montrose Environmental Group co-led the round and were joined by the EIC Fund, Sipchem Europe, CMA CGM Fund for Energies, and Holdigaz.

- Hyfé, a San Francisco-based wastewater transformation company, raised $9 million in seed funding. Synthesis Capital led the round and was joined by The Engine, Refactor Capital, Supply Change Capital, Overwater Ventures, X Factor Ventures, and Alumni Ventures.

- WindBorne Systems, a Palo Alto-based climate tech company operating smart weather balloons, raised $6 million in seed funding. Footwork led the round and was joined by Khosla Ventures, Pear VC, Ubiquity Ventures, Harvest Ventures, Humba Ventures, Jetstream, and Convective Capital.

- CleanHub, a Berlin-based ocean plastic prevention company, raised $7 million in funding. Integra Partners and Lakestar co-led the round and were joined by Silence VC, 468 Capital, and Übermorgen Ventures.

- Squake, a Berlin-based climate tech startup focused on travel and logistics emissions, raised €3.5m. Simon Capital led, and was joined by Schenker Ventures and Rivus Capital. www.squake.earth

- Highwood Emissions Management, a Calgary, Canada-based emissions management software and services firm, raised $3 million in seed funding. Energy Capital Ventures led the round and was joined by Veritec Ventures.

Acquisitions & PE:

- KKR will acquire up to $43b of PayPal's (Nasdaq: PYPL) BNPL loans originated in Europe. https://axios.link/3XeObbm

- Harvest Partners Ascend acquired a majority stake in Sparq, an Atlanta-based digital engineering provider. Financial terms were not disclosed

- Robinhood Markets (Nasdaq: HOOD) agreed to acquire SF-based credit card startup X1 for $95m in cash. X1 had raised over $60m from Rogue Capital, Spark Capital, FPV Ventures and Soma Capital. https://axios.link/43UqzeJ

- Zendesk (NYS: ZEN) acquired Tymeshift, a Fairfield, Iowa-based workforce management solution in which Zendesk had previously invested. www.tymeshift.com

- Beem Global (Nasdaq: BEEM), a San Diego-based maker of EV products and tech, agreed to acquire Amiga, a Serbian maker of street lights and other energy infrastructure. https://axios.link/3qOwWS9

- Levine Leichtman Capital Partners acquired SEV, a Burbank, Calif.-based medspas operator and manager. Financial terms were not disclosed.

- Fortis acquired SmartPay, a Santa Barbara, Calif.-based embedded payments provider. Financial terms were not disclosed.

- Insurance Quantified acquired Groundspeed Analytics, an Ann Arbor, Mich.-based underwriting platform for commercial insurance. Financial terms were not disclosed.

- Labrador acquired Argyle, an Atlanta-based advisory, design, and ESG firm. Financial terms were not disclosed.

- Michael Jordan agreed to sell the NBA’s Charlotte Hornets franchise for $3b to hedge fund manager Gabe Plotkin and private equity pro Rick Schnall (Clayton Dubilier & Rice). Jordan had acquired the team in 2010 for just $275m, and will retain a minority stake in the team. https://axios.link/468zkDB

. . .

IPOs:

- Savers Value Village, a Bellevue, Wash.-based for-profit thrift store operator owned by Ares Management, set IPO terms to 18.8m shares at $15-$17. It would have a $2.8b fully diluted market value, were to price in the middle, and plans to list on the NYSE (SVV). https://axios.link/3JoJK8p

. . .

SPACs:

Nothing to see here…

Funds:

- Dropbox (Nasdaq: DBX) launched a $50m AI-focused venture fund. https://axios.link/43RZngA

Blocked

Meta is planning to follow through on threats to block Canadians from sharing any news on Facebook and Instagram after the country’s Senate passed a law requiring that social media platforms pay news outlets for their content.

The new law, known as the Online News Act, intends to create a more level playing field between big tech and the publishing industry — forcing search engines and social media platforms to engage in some kind of negotiation for licensing news content.

Drop the news, it's cleaner

Although not quite the news portal it once was, Facebook is still the most common social media site to go to for information. 28% of people in a recent survey by the Reuters Institute said they had used the platform for news in the last week, more than YouTube (20%), Twitter (11%), and Meta's other property, Instagram (14%).

Canada, however, isn’t the first country to entertain this kind of legislation. In 2021, Meta blocked news from its platform in Australia after the country passed a similar law — eventually leading to deals between major publishers and the site.

Related reading: Keep an eye out on Sunday for our latest deep dive into digital media.

. . .

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

Thank you. You are so knowledgeable. I’m like literally relying on you to know about all deals going on in tech.