Sourcery (6/21-6/25)

Mollie, BharatPe, Chainanalysis, SmartAsset*, RoadSync, Atom Finance, Majority, Transmit Security, Anduril, Illumio, GoStudent, G2, Habi, Snackpass, CommerceIQ, Oyster, Via, Waitwhat, Cabana, Vantage.

Last Week (6/21-6/25):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech,Care, Future of Work, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Mollie, BharatPE, Chainanalysis, SmartAsset*, RoadSync, Atom Finance, Majority, Transmit Security, Anduril, Illumio, GoStudent, G2, Habi, Snackpass, CommerceIQ, Oyster, Via, Waitwhat, Cabana, Vantage, Aeroseal, Holy Grail; Wise, Sweetgreen, SentinelOne, Blend Labs, LegalZoom, Clear Secure; Buzzfeed

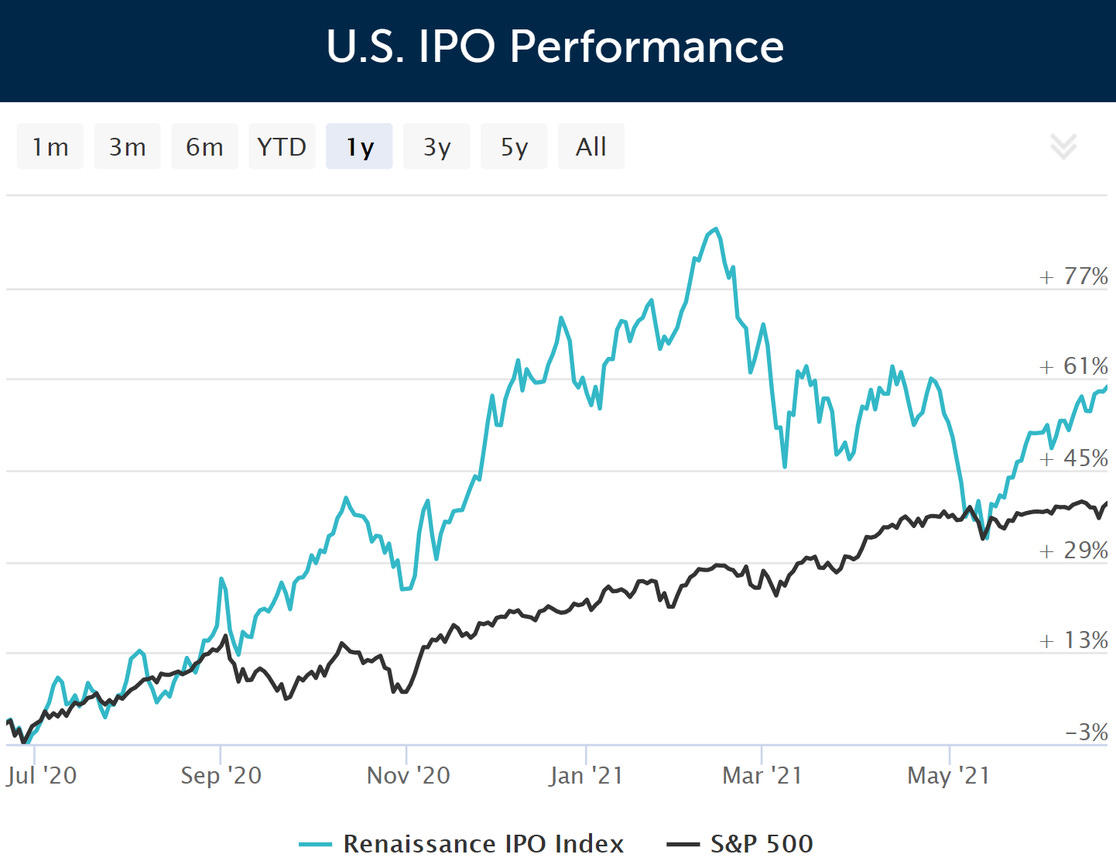

Final numbers on US IPO Perforamnce at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Mollie, an Amsterdam-based payments integration startup (i.e. European rival to Stripe), raised €665 million in equity funding at a €5.4 billion valuation. Blackstone Growth led, and was joined by QT Growth, General Atlantic, HMI Capital, Alkeon Capital and TCV. http://axios.link/3sHo

- BharatPe, an Indian fintech, is in talks to raise about $250 million, per TechCrunch. Tiger Global is expected to lead the deal valuing the company at about $2.5 billion pre-money.

- Upgrade, a San Francisco-based lending startup, is looking to raise $200 million at a valuation of $3 billion, per Bloomberg citing sources.

- Chainalysis, a New York City-based blockchain data platform, raised $100 million in Series E funding. Coatue led the round, valuing it at $4.2 billion. Benchmark, Accel, Addition, Dragoneer, Durable Capital Partners, and 9Yards Capital also increased their investments.

- SmartAsset, a New York City-based maker of a site for financial advice, raised $110 million in Series D funding valuing it at over $1 billion. TTV Capital led the round and was joined by investors including Javelin Venture Partners, Contour Venture Partners, Citi Ventures, New York Life Ventures, North Bridge Venture Partners, and CMFG Ventures.

- Deserve, a Palo Alto, Calif.-based fintech company focused on credit cards, raised $50 million in Series D funding. Mission Holdings, Mastercard, and Ally Ventures led the round and were joined by investors including Goldman Sachs Asset Management and Sallie Mae.

- Securitize, a Miami-based digital assets securitization company, raised $48 million in Series B funding. Blockchain Capital and Morgan Stanley Tactical Value led the round and were joined by investors including Ava Labs, IDC Ventures, Migration Capital, NTT Data, and Sumitomo Mitsui Trust Bank.

- RoadSync, an Atlanta-based financial platform for the logistics industry, raised $30 million in Series B funding. Tiger Global led the round and was joined by investors including Base10 Partners, Hyde Park Venture Partners, and Gaingels.

- Atom Finance, a New York-based investment research platform, raised $28 million in Series B funding. SoftBank Latin America Fund led, and was joined by General Catalyst and Base Partners. www.atom.finance

- DataRails, an Israel-based maker of software for small-to-medium-sized business accounting, raised $25 million in extended Series A funding. Investors included Zeev Ventures, Vertex Ventures Israel, Innovation Endeavors and Vintage Investment Partners.

- Kaiko, a Paris-based cryptocurrency market data provider, raised $24 million in Series A funding. Anthemis and Underscore VC led the round and were joined by investors including Point Nine, Alven, and Hashkey Capital.

- Majority, a Houston-based provider of mobile banking services for migrants, raised $19 million in seed funding. Valar Ventures led, and was joined by Avid Ventures and Heartcore Capital. www.majority.com

- TRM Labs, a San Francisco-based crypto fraud detection company, raised $14 Million in Series A funding. Bessemer led and was joined by investors including PayPal Ventures, Initialized Capital, Jump Capital, Salesforce Ventures, Operator Partners, and Blockchain Capital.

- Sorbet, an Israel-based maker of a platform for converting paid-time-off to cash, raised $15 million in additional seed funding. Dovi Frances’ Group 11 led the round and was joined by investors including Viola Ventures, Meron Capital, and Global Founders Capital.

- D1g1t, a Toronto-based wealth management platform, raised CAD$16 million ($13 million). CI Financial Corp. led the round and was joined by investors including NAventures and MissionOG.

- Taptap Send, a London-based cross-border payments company, raised $13.4 million in Series A funding. Canaan Partners and Reid Hoffman co-led the round.

- Crediverso, an Los Angeles-based fintech focused on the Hispanic population, raised $3.1 million in seed funding. Investors included Bessemer Venture Partners, Act One Ventures, Point 72 Ventures, and Clocktower Ventures.

. . .

Care:

- AlayaCare, a Montreal-based provider of home and community care software, raised C$225 million in Series D funding. Generation Investment Management led, and was joined by Klass Capital and insiders Inovia Capital, CDPQ and Investissement Québec. www.alayacare.com

- Tripp, a Los Angeles-based startup using virtual reality in meditation, raised $11 million in funding. Vine Ventures and Mayfield led the round and were joined by investors including Integrated.

- Frame, a Los Angeles-based maker of a mental health platform, raised $3 million in seed funding. Maven Ventures led the round and were joined by investors including Sugar Capital, Struck Capital, Alpha Edison, and January Ventures.

- Bttn, a Seattle-based maker of a medical supply marketplace, raised $1.5 million in seed funding from investors including Amol Deshpande.

. . .

Future of Work:

- Transmit Security, a Newton, Mass.-based provider of passwordless identity and risk management solutions to brands, raised $543 million in Series A funding at a $2.2 billion valuation. Insight Partners and General Atlantic co-led, and were joined by Cyberstarts, Geodesic, SYN Ventures, Vintage and Artisanal Ventures.http://axios.link/h9SF

- Anduril, an Irvine, Calif.-based defense startup with a drone interceptor, raised $450 million in Series D funding valuing it at $4.6 billion. Elad Gil led the round and was joined by investors including Andreessen Horowitz, Founders Fund, 8VC, General Catalyst, Lux Capital, Valor Equity Partners and D1 Capital Partners.

- Neo4j, a San Mateo, Calif.-based database startup, raised $325 million in Series F funding, valuing it at over $2 billion. Eurazeo led the round and was joined by investors including GV, Creandum, Greenbridge, and One Peak.

- Illumio, a Sunnyvale, Calif.-based cybersecurity company, raised $225 million in Series F funding valuing it at $2.8 billion. Thoma Bravo led the round and was joined by investors including Franklin Templeton, Hamilton Lane, and Owl Rock.

- GoStudent, a Vienna-based K-12 video tutoring marketplace, raised €205 million in Series C funding at a €1.4 billion valuation. DST Global led, and was joined by SoftBank, Tencent, Dragoneer and insiders Coatue, Left Lane Capital and DN Capital. http://axios.link/gFiZ

- The GOAT Group, a Culver City, Calif.-based sneaker and streetwear company, raised $195 million in Series F funding valuing it at $3.7 billion. Investors included Park West Asset Management, Franklin Templeton, Adage Capital Management, Ulysses Management, and T. Rowe Price Associates.

-KeepTruckin, a San Francisco-based trucking fleet management company, raised $190 million in Series E funding, valuing it over $2 billion. G2 Venture Partners led the round and were joined by investors including Greenoaks Capital, Index Ventures, IVP,Scale Venture Partners, and BlackRock.

- G2, a Chicago-based software marketplace, raised $157 million in Series D funding at a $1.1 billion valuation. Permira led, and was joined by HubSpot Ventures, Salesforce Ventures and insiders Accel, Emergence and IVP. www.g2.com

- Firebolt, an Israel-based maker of a cloud data warehouse, raised $127 million in Series B funding. Investors included Dawn Capital and K5 Global as well as Zeev Ventures, TLV Partners, Bessemer Venture Partners, and Angular Ventures.

- Aircall, a New York-based provider of cloud phone systems for call centers and sales teams, raised $120 million in Series D funding. Goldman Sachs Asset Management led, and was joined by DTCP, eFounders, Draper Esprit, Adam Street Partners, NextWorldCap and Gaia. http://axios.link/pzwm

- Primer, a San Francisco-based natural language processing platform whose clients include U.S. national security agencies, raised $110 million. Addition led, and was joined by In-Q-Tel. http://axios.link/gYy1

- Habi, a Colombia-based maker of a residential real estate platform, raised $100 million in Series B funding. SoftBank Latin America Fund led the round and was joined by investors including Inspired Capital, Tiger Global, Homebrew, and 8VC.

- Snackpass, a San Francisco-based e-commerce platform for restaurants, raised $70 million in Series B funding. Craft Ventures led the round and was joined by investors including Andreessen Horowitz, General Catalyst, and Y Combinator.

- ShipHero, a New York City-based fulfillment technology company, raised $50 million. Riverwood Capital led the round.

- CommerceIQ, a Palo Alto-based e-commerce merchandising decision platform for consumer brands, raised $60 million in Series C funding. Insight Partners led, and was joined by insiders Trinity Ventures, Shasta Ventures and Madrona Venture Group. www.commerceiq.ai

- Oyster, a London-based HR platform for distributed workforces, raised $50 million in Boston B funding at a $475 million valuation. Stripes Group led, and was joined by Avid Ventures, Emergence Capital and The Slack Fund. http://axios.link/RiPe

- LeafLink, a New York-based maker of a business platform for cannabis companies, raised $40 million in extended Series C funding. Nosara Capital and L2 Ventures led the round and was joined by investors including Founders Fund and Thrive Capital.

- Tonkean, a San Francisco-based maker of a business operations platform, raised $50 million in Series B funding. Accel led the round.

- Sanity, a San Francisco-based content platform, raised $39 million in Series B funding. ICONIQ Growth led the round and was joined by investors including Lead Edge Capital, Threshold Ventures, Heavybit, and Alliance Venture.

- Anjuna, a Palo Alto, Calif.-based provider of a cloud platform focused on security, raised $30 million in Series B funding. Insight Partners led the round.

- Sporttrade, a Philadelphia-based sports betting marketplace, raised $36 million. Jump Capital led, and was joined by Impression Ventures, Hudson River Trading and Tower Research Ventures. www.getsporttrade.com

- Lessen, a Scottsdale, Ariz.-based marketplace platform for property owners and service professionals, raised $35 million in Series A funding. Fifth Wall led the round.

- SafeAI, a Milpitas, Calif.-based autonomous heavy equipment startup, raised $21 million in Series A funding. Builders VC led the round.

- Rasgo Intelligence, a New York City-based machine learning engineering company, raised $20 million in Series A funding. Insight Partners led the round and was joined by investors including Unusual Ventures.

- Reibus International, an Atlanta-based industrial materials marketplace, raised $20 million in Series A funding. Canaan Partners led the round and was joined by investors including Nosara Capital, Bowery Capital, Initialized, and Stage2 Capital.

- Graylog, a Houston-based log management solution, raised $18 million. Harbert Growth Partners and Piper Sandler Merchant Banking led the round and were joined by investors including Mercury Fund, High-Tech Gruenderfonds, and Integr8d Capital.

- env0, a workflow management company, raised $17 million in Series A funding. M12 led the round and was joined by investors including Boldstart Ventures, Grove Ventures, and Crescendo Ventures.

- Sealed, a New York City-based HVAC startup, raised $16 million in Series B funding. Fifth Wall led the round and was joined by investors including FootPrint Coalition Ventures, Cyrus Capital, and CityRock Ventures.

- Edge Delta, a Seattle-based data intelligence and security company, raised $15 million in Series A funding. Menlo Ventures and Tim Tully (the former CTO of Splunk) led the round and were joined by investors including MaC Venture Capital and Amity Ventures.

- Via, a San Francisco Bay Area-based mobile commerce startup raised $15 million in Series A funding led by Footwork.

- SoleSavy, a Vancouver-based online sneaker community, raised US$12.5 million in Series A funding. Bedrock Capital led, and was joined by Diplo, Bessemer Venture Partners, Banana Capital and Roham Gharegozlou. http://axios.link/Ex5w

- WaitWhat, a New York City-based podcasting and digital production company, raised $12 million. Raga Partners led the round and was joined by investors including Emerson Collective, Lupa Systems, Capital One Ventures, Maywic Select Investments, GingerBread Capital, Burda Principal Investments, Cue Ball Capital, and Reid Hoffman.

- Deduce, a New York City-based cybersecurity company, raised $10 million in Series A funding. Foundry Group led the round and was joined by investors including True Ventures.

- Cabana, a mobile hotel startup, raised $10 million in Series A funding co-led by Craft Ventures and Goldcrest Capital. http://axios.link/3TSB

-Hawk AI, a Munich-based, raised $10 million in Series A funding. BlackFin Capital Partners led, and was joined by Picus Capital. www.hawk.ai

-ResQ, a provider of restaurant back-office operations software, raised $7.5 million in seed funding from Homebrew, Golden Ventures and Inovia Capital. http://axios.link/fn7S

-Vero, a New York-based property leasing infrastructure platform, raised $5 million in Series A funding co-led by Eleven Capital and Bienville Capital. www.sayvero.com

- Vantage, an AWS costs analysis startup, raised $4 million in seed funding led by Andreessen Horowitz. http://axios.link/0xXy

- AtomicJar, a Goleta, Calif.-based developer testing startup, raised $4 million in seed funding. boldstart ventures led the round and was joined by investors including Tribe Capital and Chalfen Ventures.

- Qwoted, a New York City-based platform for journalists and sources, raised $3 million in seed funding. Third Prime led the round and was joined by investors including Gaingels, Prosek Venture Partners, and Vested.

- Spore, a platform for creators to build websites, raised $1 million in pre-seed funding. SignalFire led the round and was joined by investors including GOAT, Canaan, Lenny Rachitsky and Nathan Baschez, Justin Waldron (Zynga founder), and Dave Nemetz ( Bleacher Report founder).

. . .

Sustainability:

- Aeroseal, a Dayton, Ohio-based developer of building seals to reduce carbon emissions, raised $22 million in Series A funding. Breakthrough Energy Ventures led, and was joined by Energy Impact Partners and Building Ventures. www.aeroseal.com

- Holy Grail, a Mountain View, Calif.-based carbon capture startup, raised $2.7 million in seed funding from firms like LowerCarbon Capital and Goat Capital. http://axios.link/dLgV

Acquisitions & PE:

- Uber agreed to buy the 47% stake it doesn’t already own of Cornershop, a Chilean online grocer, for about $1.4 billion.

- Lucid, a South Jordan, Ut.-based provider of visual collaboration software, sold $500 million worth of shares in a secondary sale valuing the business at $3 billion. Investors included Alkeon Capital, Tiger Global, and STEADFAST Capital Ventures.

. . .

IPOs:

- Wise, a U.K.-based payments company, will go public via direct listing on the London Stock Exchange, per Bloomberg. A deal could value the company at $7 billion.

- Sweetgreen, a California-based salad chain, filed confidentially for an IPO. Its investors include T.Rowe Price, Lone Pine Capital, and D1 Capital Partners.

- SentinelOne, a Mountain View, Calif.-based cybersecurity startup, plans to raise $928 million in an IPO of 32 million shares priced between $26 to $29 apiece. Investors include Insight Venture Partners, Tiger Global, and Third Point Ventures.

- LegalZoom.com, a Glendale, Calif,.-based provider of tech for creating legal documents, now plans to raise about $487 million in an IPO of 19.1 million shares priced between $24 to $27 apiece. Investors including Francisco Partners backs the firm.

- Blend Labs, a San Francisco-based digital consumer banking platform, filed for an IPO. It plans to list on the NYSE (BLND) and reports a $75 million net loss on $96 million in revenue. Blend raised nearly $700 million, most recently at a $3.3 billion valuation, from backers like Lightspeed Venture Partners (13.3% pre-IPO stake), Formation8 (8.4%), Coatue (5.8%), Tiger Global (5.8%), General Atlantic (5.4%) and Greylock (5.2%). http://axios.link/OImW

-Couchbase, a Santa Clara, Calif.-based NoSQL database, filed for an IPO. It plans to list on the Nasdaq (BASE), and reports a $40 million net loss on $103 million in revenue for 2020. Couchbase raised nearly $300 million from firms like Accel (20.9% pre-IPO stake), North Bridge (13.7%), GPI Capital (13%), Mayfield (10.1%) and Adams Street Partners (5.4%). http://axios.link/3WlI

-F45 Training, a fitness chain whose SPAC deal collapsed last year, filed for an IPO. It plans to list on the NYSE (FXLV) and reports a $13 million net loss on $93 million in revenue for 2020. Shareholders include Mark Wahlberg (4.6% pre-IPO stake). http://axios.link/gKWT

-Membership Collective Group (d.b.a. Soho House), an operator of luxury restaurants and clubs, filed for an IPO. It plans to list on the NYSE (MCG) and reports a $235 million net loss on $177 million in revenue for 2020. Backers include Yucaipa Companies. http://axios.link/zcaS

-Ryan Specialty Group, a Chicago-based wholesale specialty insurance brokerage backed by Onex Corp., filed for an IPO. It plans to list on the NYSE (RYAN) http://axios.link/gvCX

- Clear Secure, a New York City-based travel security tech company, plans to raise about $355.5 million in an offering of 13.2 million shares priced between $27 to $30 per share. It reported a net loss of $9.3 million in 2020. T. Rowe Price and General Atlantic back the firm.

- EverCommerce, a Denver-based service commerce platform, now plans to raise $324 million in an IPO of 19.1 million shares priced between $16 to $18 per share. It reported a net loss of $60 million in 2020. Providence Strategic Growth and Silver Lake back the firm.

- Intapp, a Palo Alto, Calif.-based firm management software company, now plans to raise $278.3 million in an IPO of 10.5 million shares priced at $25 to $28 per share. It reported gross profit of $115.6 million in the 12 months ending in June 2020. Temasek and Great Hill Partners back the firm.

. . .

SPACs:

- BuzzFeed is nearing a deal to go public via 890 5th Avenue Partners (Nasdaq: ENFA), per the WSJ. http://axios.link/riFS

Final Numbers

Source: Renaissance Capital