Sourcery (6/26-6/30)

Happy 4th! 🇺🇸 Twitter 2.0 vs. Instagram Threads ~ Betr, TreasurySpring, Federato, Picket, Resistant AI, Maza, JustPaid, Revcast, Author, Heard, Blueprint, SOS, AvoMD, Alfie, Inflection AI, Runway

Happy 4th of July!! 🇺🇸

Since you’re all rested from the weekend and excited to read this morning 😅, let’s get into it. Big social news to discuss. Apple hits a new milestone (chart at the bottom). And, of course, juicy deals to explore below (AI).

Twitter 2.0 vs Instagram Threads

Over the weekend chaos ensued as Elon put restrictions around users’ access to Twitter for how many tweets they can read a day.. This included our own profiles. Severely debilitating the functionality of the platform and taking the user experience to the highest friction level. It was useless. We were flying blind. But what was the point? I assumed it was to get us off our phones for the weekend ahead of the holiday and Musk hinted to it by retweeting Jack’s photo of grass, it slightly worked, but the people still wanted to read. Elon said it was for platform maintenance to control data scraping activities. And yet, these onlyfans-esque bots were still liking and following users. (it can’t be that hard to remove them, they literally all have the same profile information, posts, words, pictures, etc).

Nevertheless, Twitter’s biggest strength has always been its biggest weakness. It’s leader. Elon Musk. No, not because of the changes he made to the platform, I actually believe they’ve made the experience 10x better. And I actually also don’t mind paying for Blue because it’s made my feed more curated/discoverable. The only tricky part for getting used to the feed, is coming to the realization that what you interact/react with directly results in the content fed back to you (ie. posting/replying to sh*tposts, gets you more in your feed). I tested it out here. The results are almost immediate.

Okay, sorry, yes, Elon Musk is its biggest weakness. Why? Because though he was the largest figure on the platform pre-acquisition.. post- his distinctive audience was all that remained. Everyone else seemed to leave? Influencers were immediately offended that their free awarded blue check marks were taken away and they had to pay for the new ones, dissuading them from their towers of internet importance, and the platform itself. And still, the tech community remained strong and the audiences shifted to one side. Stan or no stan of Elon, both sides of the community are radicalized by his presence, pro or against. But the diversity of audiences left and the people still complain that it’s not like it used to be. Does it need to be? In restructurings you do need to break everything down to its natural/purest state, to then build it back up again to try to reach its greatest potential. It’s a process of learning, testing, retesting, optimizing and overall grit.

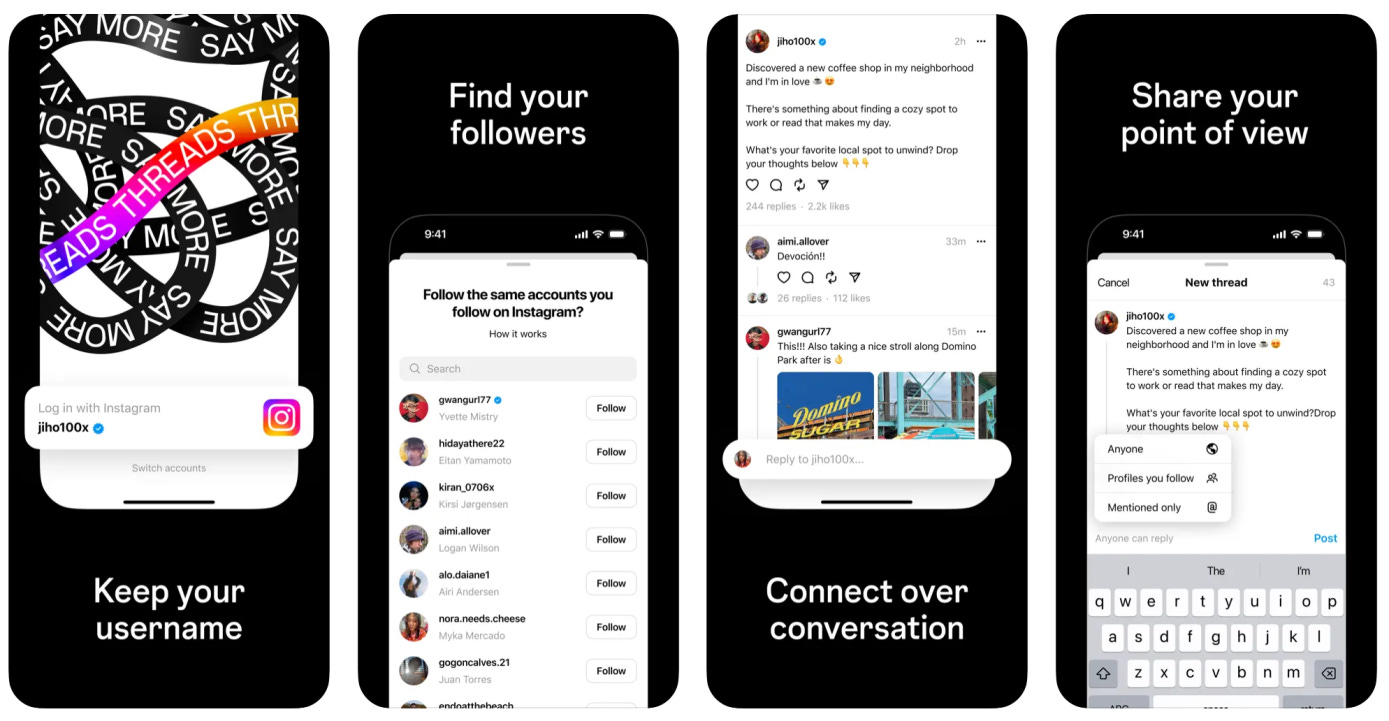

But what about Instagram’s new launch? What does Instagram Threads have in its favor to compete with Twitter? Diversity of audiences, multiple platform leaders, sheer mass, and less friction? They have the opportunity to start net new. Fresh. But will it work? IDK. It could totally flop. But It did work out for Microsoft Teams vs Slack, though. IG’s audiences are used to visual stimulation for reactions and conversations, how does that translate to predominantly text? How do we transfer our Twitter followings over? Will we have writer's block? Or will people just be self-promoting their brands, stirring the pot, providing more life updates, travel recs, memes, etc.? Not sure. But it sounds familiar. I’m excited to test it and find out..

TLDR Nikita Bier’s latest take:

“Elon is out here limiting how many tweets you can view per day and training for a fictitious cage match—while a 1-billion-user audience is about to be dropped on a clone of his product and eviscerate $44 billion.”

If Threads’s mass launch fails because it's messy, unfocused, loud and the algo hasn’t been matured or trained yet, will communities break out into their own platforms? Unbundle? Then maybe Twitter has a chance. Others also took advantage of Elon’s fumble and made their voices heard, here are a couple:

Spill, Founded by two black Ex-Twitter employees, creating visual conversations at the speed of culture

Post, publisher-first, access journalism from premium publishers, without subscriptions or ads

Bluesky, not yet launched, Jack Dorsey’s decentralized social network protocol

Mastodon, free and open-source software for running self-hosted social networking services

Substack Notes, Post short-form content and recommend great posts, quotes, comments, images, and links to the network of writers and readers on Substack

All things considered, one of my favorite quotes:

Without competition, we become complacent.

…And this makes everything way more fun.

. . .

Unchartered Territory in the Hamptons

An invite-only event for an exclusive peek into the minds of the ‘Davos’-like elite

Close friend of Sourcery, Ally Warson, Partner at Up.Partners were our eyes and ears at this breathtaking gathering. She gives us all the deets on Unchartered Conference below. For background Unchartered is a referral-only community of world-class founders, investors, and creatives.

The Unchartered Conference

Although the organizers, Noah Friedman and Michael Loeb had everything mapped out, the Uncharted conference lived up to its title, dealing every participant a menu of captivating experiences throughout the day-long experience.

It was a breath of fresh (Southampton sea) air to have consecutive conversations with people all excelling in different ways. From meeting a founder who was revolutionizing the automotive industry in Germany to meeting one of the most successful NBA players in history (very tall guy in pic #2 below, yes, it’s Shaq) to debating the crypto future with the head of Amazon Music, it felt like a Disneyland experience for one’s brain. Noah challenged every attendee to meet at least 5 new people and everyone took that to heart. Everyone was there to learn and connect.

The day started with a panel discussion titled “Investing in a Crazy World” with individuals including Sallie Krawchek, CEO of Ellevest, Marlon Nichols, GP of Mac Ventures, Mike Ryan, Vice Chairman of UBS, and facilitated by Tyler Mathisen, Anchor of CNBC. From there, the day continued with panelists discussing topics such as the AI Revolution, the Digital Future, and The Second Act in Careers, and there was a fireside chat with Shaquille O’Neal. People ebbed and flowed between listening to the panels and networking. It was sensory overload in the best way.

Overheard at Unchartered:

“Relationships and purpose are the meaning of life” - Dan Doctoroff, Founder/Chairman of Target ALS

“I turned down Howard Shultz’ because his pitch was that he wanted to put Starbucks in the hood,” - Shaq.

Shaq was an early investor in Google, Lyft, among other extremely successful companies. He’s also owned 155 Five Guys Burger & Fries, nine Papa John's, 17 Auntie Anne's pretzels, and a few Krispy Kreme restaurants

“The morality of AI is murky and will be difficult to regulate because it's a horizontal application layer vs. a vertical one. (You can’t have an FAA or FDA for AI…)” - X. Eyeé, Global Strategy Lead, Responsible Innovation, Google

“I wouldn’t be surprised if this becomes one of the most coveted conference invites in 2024” - Random Guest

. . .

Last Week (6/26-6/30):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Betr, TreasurySpring, Federato, Picket, Resistant AI, Maza, JustPaid, Revcast, Author, Heard, Blueprint, SOS, AvoMD, Alfie, Inflection AI, Runway, Cyera, Redpanda, Typeface, Fly.io, Cart.com, Reka, Slang.ai, Datapeople, BentoML, Speakeasy, Clearstory, Metal, Rubber Ducky Labs, GeologicAI, Raincoat, Bluedot; IBM/Apptio, Databricks/MosaicML, Reuters/Casetext, Visa/Pismo

Final numbers on Apple Becomes First Company to Hit $3T Market Cap at the bottom.

Deals

Fintech:

- Betr, a Miami-based sports betting and media company, raised $35 million in Series A2 funding. IA Sports Ventures, Eberg Capital, and Fuel Venture Capital co-led the round and were joined by Joey Levy, Anti Fund, FinSight Ventures, Florida Funders, and Aliya Capital Partners.

- One Trading, a digital asset exchange, spun out from Bitpanda and raised €30m in Series A funding led by Valar Ventures. https://axios.link/44q4kgL

- TreasurySpring, a London-based corporate cash management platform, raised $29m in Series B funding. Baldteron Capital led, and was joined by Mubadala Capital and insiders ETFS Capital, MMC Ventures and Anthemis Group. https://axios.link/44hEk71

- Federato, a Palo Alto, Calif.-based underwriting platform for the insurance industry, raised $25m in Series B funding. Caffeinated Capital led and was joined by Emergence Capital and Pear VC. https://axios.link/4311PAf

- Picket, a Nashville-based residential real estate investing startup, raised $20m in Series B funding. LL Funds led and was joined by RET Ventures. https://axios.link/3XrkrIz

- Resistant AI, a Prague-based provider of fintech anti-fraud tools, raised $11m in Series A extension funding from Notion Capital. https://axios.link/44czwA4

- Neutron, a remote-based cross-chain smart-contract platform for DeFi, raised $10 million in funding. Binance Labs and CoinFund co-led the round and were joined by Delphi Ventures, LongHash, and Nomad.

- Maza, a provider of tax identity solutions to immigrants, raised $8m in seed funding. Andreessen Horowitz led, and was joined by SV Angel, Box Group, Restive Ventures and Global Founders Capital. https://axios.link/3r7iTYh

- JustPaid, a Mountain View, Calif.-based financial tools provider, raised $3.5 million in seed funding. Kleiner Perkins partner Mamoon Hamid, Rebel Fund, and others invested in the round.

- Revcast, a Raleigh, N.C.-based revenue plans management and optimization platform, raised $3 million in seed funding. CRV led the round and was joined by Coughdrop Capital, Firsthand Alliance, IDEA Fund Partners, Lorimer Ventures, and Tiferes Ventures.

. . .

Care:

- Author Health, a Boston-based care and treatment platform for Medicare Advantage recipients with mental illness and substance use disorders, raised $115 million in funding. General Atlantic led the round and was joined by Flare Capital Partners.

- Augmedics, an Arlington Heights, Ill.-based augmented reality surgical navigation company, raised $82.5 million in Series D funding. CPMG led the round and was joined by Evidity Health Capital, H.I.G. Capital, Revival Healthcare Capital, Almeda Ventures, and others.

- Flywheel, a Minneapolis-based medical imaging data and A.I. platform, raised $54 million in Series D funding. Novalis LifeSciences and NVentures co-led the round and were joined by Microsoft, Invenshure, 8VC, Beringea, Hewlett Packard Enterprise, and others.

- Heard, a Seattle-based bookkeeping and taxes platform for therapists, raised $15 million in Series A funding. Headline led the round and was joined by GGV Capital, Footwork, Founders’ Co-Op, Act One, and Heron Rock.

- Blueprint, a Chicago-based tech platform for mental health clinicians, raised $9m in Series A funding. Ensemble VC and Lightbank co-led, and were joined by Bonfire Ventures, Revolution’s Rise of the Rest Seed Fund, TAU Ventures and Data Tech Fund. https://axios.link/3XvIKFb

- SOS, a Boston-based on-the-go health and wellness product provider, raised $7.6 million in funding from Wasserman Ventures and Urban Us Capital.

- AvoMD, a New York-based app-building platform for doctors and hospitals, raised $5 million in seed funding. AlleyCorp, Columbia University, and Mount Sinai Innovation Partners invested in the round.

- Gradient Health, a Raleigh, N.C.-based medical AI data-sharing company, raised $2.75m in seed funding led by ReMY Investors & Consultants. https://axios.link/3NO7Eg0

- Alfie Health, a New York-based virtual clinic for patients with obesity, raised $2.1 million in funding. Y Combinator and Nina Capital co-led the round and were joined by Goodwater Capital, Phoenix Investment Club, and other angels.

- SnapCalorie, a developer of nutrition and calorie approximation imaging tools, raised $2m from Accel, Index Ventures, YC and Eric Roza. https://axios.link/3NQx50F

. . .

Enterprise & Consumer:

- Inflection AI, a Palo Alto-based personal A.I. company, raised $1.3 billion in funding. Microsoft, Reid Hoffman, Bill Gates, Eric Schmidt, and NVIDIA invested in the round.

- Runway, a New York-based applied A.I. research company, raised $141 million in Series C extension funding. Google, NVIDIA, Salesforce, and others invested in the round.

- Cyera, a San Mateo, Calif.-based data security company, raised $100 million in Series B funding. Accel led the round and was joined by Sequoia, Cyberstarts, and Redpoint Ventures.

- Redpanda Data, a San Francisco-based streaming data platform for developers, raised $100 million in Series C funding. Lightspeed Venture Partners led the round and was joined by GV and Haystack VC.

- Typeface, a San Francisco-based generative A.I. platform for enterprise content creation, raised $100 million in Series B funding. Salesforce Ventures led the round and was joined by Lightspeed Venture Partners, Madrona, GV, Menlo Ventures, and M12.

- Fly.io, a remote-based app delivery network company, raised $70 million in Series C funding. EQT Ventures led the round and was joined by Andreessen Horowitz, Dell Capital, and Intel Capital.

- Cart.com, an Austin, Texas-based provider of e-commerce enablement solutions, raised $60m in Series C funding at a $1.2b valuation from B. Riley Venture Capital, Kingfisher Investment Advisors, Snowflake Ventures, Prosperity7 Ventures and Legacy Knight. www.cart.com

- Reka, a Sunnyvale, Calif.-based developer of custom enterprise AI models, raised $58m. DST Global Partners and Radical Venturesco-led, and were joined by Snowflake Ventures. https://axios.link/3prDVjD

- NoTraffic, a Palo Alto- and Tel Aviv-based mobility platform, raised $50 million in Series B funding. M&G Investments led the round and was joined by VNV Global, UMC Capital, Grove Ventures, Vektor Partners, Next Gear Ventures, North First Ventures, Meitav Investment House, Alchimia Investments, and TMG.

- Anzu, a Tel Aviv-based in-game advertising solution provider, raised $48 million in Series B funding. Emmis Corporation led the round and was joined by PayPal Ventures, Evolution, Simon Equity Partners, Bandai Namco Entertainment 021 Fund, and others.

- Nuvocargo, a New York-based provider of U.S.-Mexico cross-border freight services, raised $36.5m in Series B funding at a $250m valuation. QED Investors led, and was joined by Tresalia Capital, Amador Holdings and insiders NFX, Tiger Global and ALLVP. https://axios.link/438wmMp

- Cyware, a New York-based threat intelligence solutions provider, raised $30 million in Series C funding. Ten Eleven Ventures led the round and was joined by Advent International, Zscaler, Emerald Development Managers, Prelude, and Great Road Holdings.

- Venn Software, a New York-based remote work security provider for employees, raised $29 million in Series A Funding led by NewSpring.

- Ramon.Space, a Los Altos, Calif.-based computing infrastructure platform for space, raised $26 million in funding. Ingrasys, the Strategic Development Fund, Grove Ventures, Deep Insight, and UMC Capital invested in the round.

- IP Fabric, a New York-based automated network assurance company, raised $25 million in Series B funding. One Peak led the round and was joined by Senovo and Presto Ventures.

- Astrix Security, a Tel Aviv-based cybersecurity platform, raised $25 million in Series A funding. CRV led the round and was joined by Bessemer Venture Partners and F2 Venture Capital.

- Parabola, a San Francisco-based workflow automation and documentation platform, raised $24 million Series B funding. OpenView led the round and was joined by Matrix, Thrive Capital, and others.

- CalypsoAI, a Washington, D.C.-based A.I. security development and delivery company, raised $23 million in a Series A-1 funding. Paladin Capital Group led the round and was joined by Lockheed Martin Ventures, Hakluyt Capital, Expeditions Fund, and other angels.

- Slang.ai, a New York-based phone answering product, raised $20m in Series A funding. Homebrew led, and was joined by Stage 2 Capital, Wing VC, Underscore VC, Active Capital, Collide Capital, Tom Colichio and Scott Belsky. www.slang.ai

- Dexory, a London-based provider of warehouse inventory management data, raised $19m in Series A funding. Atomico led, and was joined by Lakestar, Maersk, Kindred Capital and Capnamic. https://axios.link/3COicW9

- Zenarate, a Palo Alto-based natural language A.I. simulation training solution for customer and prospect-facing agents, raised $15 million in funding led by Volition Capital.

- JuliaHub, a Cambridge, Mass.-based platform for modeling, simulation and user built applications, raised $13m led by AEI HorizonX. www.juliahub.com

- Datapeople, a New York-based SaaS recruiting predictability platform, raised $13m in Series A funding co-led by GreatPoint Ventures and New Markets Venture Partners. www.datapeople.io

- BeeKeeperAI, a San Francisco-based collaboration software provider for A.I. development and deployment, raised $12.1 million in Series A funding. Sante Ventures led the round and was joined by the Icahn School of Medicine at Mount Sinai, AIX Ventures, Continuum Health Ventures, TA Group Holdings, and UCSF.

- Resistant AI, a Prague-based A.I. and machine learning security company for financial crime, raised an additional $11 million in Series A funding. Notion Capital, GV, Index Ventures, Credo Ventures, and Seedcamp invested in the round.

- Unaric, a London-based Salesforce product suite, raised $10m in seed equity from LocalGlobe, Concentric, FJ Labs and Atempo Growth. It also secured $15m in debt. https://axios.link/3PRhQWL

- Realtime Robotics, a Boston-based autonomous motion planning company for industrial robots, raised an additional $9.5 million in funding from Shinhan GIB and Kyobo Life Insurance.

- Loora, a Tel Aviv-based generative A.I. English language learning company, raised $9.25 million in seed funding. Emerge led the round and was joined by Two Lanterns Venture Partners and Kaedan Capital.

- BentoML, a San Francisco-based platform for A.I. application developers, raised $9 million in seed funding. DCM led the round and was joined by Bow Capital.

- Honey Homes, a Lafayette, Calif.-based membership service for home upkeep and maintenance, raised $9m in Series A funding. Khosla Ventures led, and was joined by Pear VC, Teambuilder Ventures and Moving Capital, www.honeyhomes.com

- Causely, a Boston-based A.I. company for IT, raised $8.8 million in seed funding. 645 Ventures led the round and was joined by Amity Ventures, GlassWing Ventures, and Tau Ventures.

- Quandri, a Vancouver-based digital worker automation platform for the insurance industry, raised $8.5 million in Series A funding. FUSE led the round and was joined by Defined.

- Nokod Security, a Tel Aviv-based security development company for low- and no-code custom applications and robotic process automation, raised $8 million in seed funding. Acrew Capital, Meron Capital, and Flint Capital invested in the round.

- Speakeasy, a San Francisco-based API infrastructure company, raised $7.6 million in seed funding. GV led the round and was joined by Quiet Capital, Firestreak Ventures, Flex Capital, and StoryHouse Ventures.

- Scriptic, a platform for user-generated games, raised $5.7m led by Bitkraft Ventures led, and was joined by Tower 26 and the Amazon Alexa Fund. https://axios.link/3Nu4MDD

- Clearstory, formerly Extracker, a San Francisco-based change order tool for the construction industry, raised $5.5 million in funding. GS Futures led the round and was joined by Jackson Square Ventures, Building Ventures, and Cloud App Capital Partners.

- Patented.ai, a San Francisco-based intellectual property software company, raised $4 million in pre-seed funding. Baseline Ventures’ Steve Anderson led the round and was joined by Boston Seed Capital’s Nicole Stata, Accomplice’s Jeff Fagnan, and others.

- AuditMate, a San Francisco-based elevator and escalator service contract management software platform for building owners and managers, raised $3.5 million in seed funding. MassMutual Ventures led the round and was joined by Moderne Ventures, Blue Field Capital, and others.

- Sixty AI, a Portland, Ore.-based personal relationship management platform, raised $3.5 million in seed funding from 468 Capital.

- 0pass, an SF-based authentication startup, raised $3.5m in seed funding. Initialized Capital led, and was joined by Box Group, 645 Ventures and YC. https://axios.link/3XwmMSr

- Metal, a New York-based LLM developer platform, raised $2.5 million in seed funding. Swift Ventures led the round and was joined by Y Combinator and Chapter One.

- BidSight, a New York-based real estate development software company, raised $2 million in pre-seed funding. Outsiders Fund led the round and was joined by Y Combinator and other angels.

- Invary, a Lawrence, Kansas-based cybersecurity company, raised $1.85 million in pre-seed funding. Flyover Capital led the round and was joined by NetWork Kansas GROWKS Equity program and the KU Innovation Park.

- Rubber Ducky Labs, a San Francisco-based operational analytics platform for recommender systems, raised $1.5 million in seed funding. Bain Capital Ventures led the round and was joined by Cadenza and Y Combinator.

. . .

Sustainability:

- GeologicAI, a Calgary, Canada-based rock and resource digitization services provider, raised $20 million in Series A funding from Breakthrough Energy Ventures.

- Material Evolution, a Middlesbrough, U.K.-based sustainable cement producer from industrial waste streams, raised £15 million ($18.93 million) in Series A funding. KOMPAS VC led the round and was joined by Norrsken VC and Circle Rock.

- Gradient Comfort, a San Francisco-based HVAC company, raised an additional $9 million in Series A funding led by Climate Investment.

- Raincoat, a San Juan, Puerto Rico-based climate insurance solutions company, raised an additional $6.5 million in seed funding. TwoSigma Ventures and Mundi Ventures co-led the round and were joined by Revolution’s Rise of the Rest Seed Fund and EleFund.

- Bluedot, a San Francisco-based EV charging payments platform, raised $5 million in funding. Y Combinator, Leap Forward, Operator Stack, LACI Impact Fund, Caffeinated Capital, Ford Driventure, ScaleX, and other angels.

- Dalan Animal Health, an Athens, Ga.-based bee vaccine developer, raised $4.5 million in seed 3 funding. Prime Movers Lab led the round and was joined by At One Ventures.

- Airmo, a German developer of satellites that monitor greenhouse gas emissions, raised €1.5m in pre-seed funding led by Findus Venture (plus secured a €3.7m contract with the European Space Agency). https://axios.link/3r9zvhK

Acquisitions & PE:

- Cisco agreed to acquire a majority stake in Accedian, a Montreal-based performance analytics and experience solutions provider, from Bridge Growth Partners. Financial terms were not disclosed.

- IBM agreed to acquire Apptio, a Bellevue, Wash.-based financial and operational IT management and optimization software company, from Vista Equity Partners for $4.6 billion.

- Databricks agreed to acquire MosaicML, a San Francisco-based generative A.I. startup. The deal is valued at $1.3 billion.

- Optum agreed to acquire Amedisys, a Baton Rouge, La.-based home health, hospice, and high-acuity care provider, for $101 per share.

- Thomson Reuters Corporation agreed to acquire Casetext, a San Francisco-based artificial intelligence company in the legal sector. The deal is valued at $650 million.

- General Atlantic invested $500 million in Authentic Brands Group, a New York-based brand owner, marketing, and entertainment platform.

- Visa agreed to acquire Pismo, a São Paulo-based issuer processing and core banking platform, for $1 billion.

- ThoughtSpot agreed to acquire Mode Analytics, a San Francisco-based business intelligence platform. The deal is valued at $200 million.

- Socure acquired Berbix, a San Francisco-based document verification solution provider. The deal is valued at approximately $70 million.

- Ramp acquired Cohere.io, a New York-based customer support platform. Financial terms were not disclosed.

- soona acquired Trend.io, a marketplace of curators and brands. Financial terms were not disclosed.

- Vertical Insure, a Minneapolis-based embedded insurance platform for vertical SaaS platforms, and Next Wave, a San Diego-based commercial, accident, and travel insurance products provider to vertical industries, completed a merger. Financial terms were not disclosed.

- Bed Bath & Beyond is splitting the bankruptcy auction for its Buy Buy Baby chain into two parts, per CNBC. The first one would be for IP, while a future one would be for the actual stores. https://axios.link/438JIZ8

. . .

IPOs:

Nothing to see here…

. . .

SPACs:

Nothing to see here…

Funds:

- RTP Global, a London-, New York-, and Paris-based venture capital firm, raised $1 billion across two funds: $660 million will be used to invest in early-stage companies and $340 million will be used to support its portfolio companies.

- Kindred Ventures, a San Francisco-based venture capital firm, raised $312 million across two funds: $200 million will be used to invest in early-stage companies and $112 million will be used to invest in its opportunities fund.

Think different...

Shares in Apple finished trading just a few cents below $194 on Friday, valuing the entire company at a cool $3.05 trillion — the first company in history to close above the “3T” barrier.

The remarkable run up in Apple shares means that the company has now added a whopping $984bn in market cap just this year, equivalent to gaining the value of 12 Airbnbs, 6 Disneys, 2.3 Walmarts or 122 Ralph Laurens.

...but not too different

A long way from the California garage where the company was founded, investors are clearly confident in the ongoing longevity of the iPhone which — as we explored in May — remains the gravity at the center of the Apple galaxy. 16 years since its release, the device still pulls consumers into other Apple products like high-end accessories, music streaming, TV, tablets, laptops and, in the not-so-distant future, Apple's idea of virtual reality.

Changes to the iPhone tend to be more evolution than revolution these days, and consumers are tending to wait longer before upgrading their model. Apple has navigated the maturing market with the release of the more expensive Pro lineup in 2019, helping sales climb higher.

Of course, Apple’s not the only tech company having a good year. Shares in Microsoft, Alphabet (Google), Amazon, Meta and Tesla have all soared in 2023. But no company has had quite as dramatic an ascent as Nvidia. Shares in the company have tripled in just 6 months — making it the newest member of the $1 trillion club — fueled by bets that the company’s semiconductors will prove to be an essential cog in the AI boom.

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.