Sourcery (6/8-6/12)

Alpha Health, PatientPing, Conversa Health, ClassTag, Doordash, Instacart, Fivetran, M1 Finance, RapidSOS, Origin, Codat, Flatfile, Pando, Vendr.

Last Week (6/8-6/12):

Relevant deals include the 70+ deals across stages below.

I've categorized the deals below into three categories, Care, Future of Work and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include: Alpha Health, PatientPing, Conversa Health, ClassTag, Doordash, Instacart, Fivetran, M1 Finance, RapidSOS, Origin, Codat, Flatfile, Pando, Vendr.

Final numbers on Businesses lost by demographic group, Startup layoffs during pandemic and IPO activity by sector at the bottom.

. . .

As we continue to fight for racial and social equality, amid the month of LBGTQ Pride, I'm to floating this image to the top of the newsletter. We are in a massively historical shift for the future of humankind, the pain is being felt, it is being realized, and it is our responsibility to continue to support change, start conversations and rebuild the fabric of our country, and world.

As investors, we have the powerful opportunity and position to hire and fund businesses to continue to support and enable this.

Photo: Mario Tama/Getty Images

This rainbow-colored message is painted on Hollywood Boulevard, near the famous Grauman's and Dolby theaters.

In Brooklyn yesterday, thousands gathered to support black transgender Americans. Details, photos.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Care:

- ICONIQ Capital invested in QGenda, an Atlanta-based workforce management software to the healthcare industry. Francisco Partners will retain a majority stake. Financial terms weren't disclosed.

- Cue Health, a San Diego-based healthcare technology company, raised $100 million in funding. Investors included Decheng Capital, Foresite Capital, Johnson & Johnson Innovation, and ACME Capital.

- PatientPing, a Boston-based healthcare e-notifications platform, raised $60 million in Series C funding. The round was co-led by Andreessen Horowitz, F-Prime Capital, GV, and Transformation Capital.

- Kahoot!, an Oslo, Norway-based learning platform company, raised $28 million in funding. Northzone Ventures led the round. Read more.

- Alpha Health, a South San Francisco-based automation company for healthcare, raised $20 million in Series A funding. Andreessen Horowitz led the round, and was joined by investors including Costanoa Ventures.

- Conversa Health, a Portland-based virtual care and communication platform, raised $12 million in Series B funding. Builders VC and Northwell Ventures coled.

- CareAcademy, a Boston, Mass.-based home care workforce skilling platform, raised $9.5 million in funding led by Impact America Fund (IAF).

- EnsoData, a Madison, Wis.-based company analyzing health data from wearables and medical devices, raised $9 million in Series A funding. Venture Investors and Zetta Venture Partners led the round.

- Ambler, a Paris-based maker of a platform connecting healthcare transporters and institutions, raised €6 million ($6.8 million) in funding. Investors included Bpifrance, Idinvest Partners, Partech and Kima Ventures.

- TeleVet, an Austin, Texas-based veterinary telemedicine company, raised $5 million in Series A funding. Mercury Fund led the round and was joined by investors including Dundee Venture Capital, Atento Capital, GAN and Urban Capital Network.

- ClassTag, a New York-based communication platform between teachers and parents, raised $5 million in seed funding. Investors include AlleyCorp, Contour Ventures, Founder Collective, John Martinson, Newark Venture Partners, Smart Hub and TMT Investments. Read more.

- Wellsheet, a Newark, NJ-based healthcare records company, raised $3.8 million in Series A funding. SpringTide Investments led the round, and was joined by investors including BioAdvance and Newark Venture Partners.

- Bravrr, a Cañon City, Colorado-based maker of a digital wellness device to combat stress & pain, raised an undisclosed amount of funding (read here)

. . .

Future of Work:

- DoorDash, a San Francisco-based food delivery company, is close to securing new funding that would value it at over $15 billion pre-money. Existing investors T. Rowe Price Group as well as Fidelity Investments are reportedly among the investors, per the Wall Street Journal. Read more.

- Instacart, a San Francisco-based grocery delivery company, secured $225 million at a $13.7 billion valuation from DST Global, General Catalyst, and return backer D1 Capital Partners. http://axios.link/L3eS

- Fivetran, a Oakland, Calif.-based data integration startup, is in advanced talks to raise funding at a valuation above $1 billion from investors including General Catalyst and Andreessen Horowitz, per Bloomberg. Read more.

- Postman, a San Francisco-based platform for API development, raised $150 million in Series C funding. Insight Partners led the round and was joined by investors including CRV and Nexus Venture Partners.

- NS8, a Las Vegas-based provider of fraud prevention tools within e-commerce marketplaces, raised $123 million in funding. Lightspeed Venture Partners led the round and was joined by investors including AXA Venture Partners.Read more.

- DNAnexus, a Mountain View, Calif.-based provider DNA data sets for collaboration on research projects, raised $100 million in Series G funding. Perceptive Advisors and Northpond Ventures co-led the round and was joined by investors including GV, Foresite Capital, TPG Capital, and First Round Capital. Read more.

- Appfire, a Boston, MA-based provider of apps for software development teams, raised $49M in strategic funding (read here)

- Headspace, a Santa Monica, Calif.-based meditation app, raised $47.7 million in extended Series C funding. Read more.

- Domino Data Lab, a San Diego, Calif.-based data science management platform, raised $43 million in funding. Highland Capital Partners led the round, and was joined by investors including Dell Technologies Capital, Sequoia Capital, and Coatue Management.

- M1 Finance, a Chicago-based money management platform, raised $33 million in Series B funding. Left Lane Capital led the round and was joined by investors including Jump Capital, and Clocktower Technology Ventures.

- Kyruus, a Boston, MA-based company that delivers provider search and scheduling solutions for health systems, raised $30m in funding (read here)

- Wave, a virtual concert platform, raised $30 million from Griffin Gaming Partners, NTT DoCoMo Ventures, Avex, Superfly Ventures, Convivialite Ventures, and Raised in Space. http://axios.link/qs1t

- Yugabyte, a Sunnyvale, Calif.-based developer of open-source distributed SQL databases, raised $30 million in Series B funding. 8VC and WiPro co-led, and were joined by return backers investors Lightspeed Venture Partners and Dell Technologies Capital. http://axios.link/xGkH

- Squire Technologies, a New York-based barbershop management and point of sale software maker, raised $27 million in Series B funding. CRV led the round, and was joined by investors including Tiger Global, San Francisco 49ers organization, Charles Phillips (former CEO and Chairman of Infor), and existing investors Trinity Ventures, 645 Ventures, Comcast Ventures’ Catalyst Fund and Y Combinator.

- HeadLight (formerly named Pavia Systems), a Seattle, WA-based photo-based inspection technology company, secured $25.6M in Series B funding (read here)

- Transcend, a San Francisco-based data privacy infrastructure company, raised $25 million in Series A funding. Index Ventures led the round alongside Accel, and was joined by investors including South Park Commons, Phil Venables (Board Member and former CISO, Goldman Sachs), and Dylan Field (CEO, Figma).

- RapidSOS, a New York-based emergency response company, raised $21 million in funding. Transformation Capital led the round and was joined by investors including C5 Capital and Laerdal Million Lives Fund.

- Ontruck, a European l road freight platform, has secured an investment round of €17 million ($19.3 million) led by OGCI Climate Investments. Cathay Innovation, Atomico, Idinvest Partners, Total Carbon Neutrality Ventures, and Endeavor Catalyst also participated.

- Keelvar, an Ireland-based provider of sourcing software, raised $18 million in Series A funding. Elephant and Mosaic Ventures co-led, and were joined by Paua Ventures. http://axios.link/x0Pw

- JIFFY.ai, a Palo Alto, CA-based automation and no-code app development platform for global enterprise companies with a focus on finance and operations, raised $18M in Series A funding (read here)

- Planck, a New York-based data platform for insurance underwriting, raised $16 million in Series B funding. Team8 Capital led, and was joined by Viola FinTech, Arbor Ventures, Nationwide, and Hannover Digital Investments. http://axios.link/qkI9

- Noodle Partners, which helps campuses build online programs, raised $16 million in Series B funding. ValueAct Spring Fund led the round and was joined by investors including Lumina Foundation.

- Concourse Labs, a New York-based automated cloud governance company, raised $15.2 million in Series A funding. ForgePoint Capital led the round and was joined by investors including existing investors 83North and Capri Ventures.

- Ocient, a Chicago-based provider of data analytics solutions for datasets, raised $15 million. OCA Ventures led the round and was joined by investors including In-Q-Tel.

- Ethyca, a New York-based global data privacy solution, raised $13.5 million in Series A funding, PayPal cofounder Max Levchin invested. Read more.

- Sentropy, a Palo Alto-based platform using Ai to track hate speech, raised $13 million in funding. Investors include Initialized Capital, King River Capital, Horizons Ventures, and Playground Global.Read more.

- Origin, a financial planning platform for employees, raised $12.1 million in Series A funding. Felicis Ventures’ Niki Pezeshki led the round and was joined by investors including General Catalyst, Founders Fund and early Stripe employee Lachy Groom.

- NYMBUS, a Miami-based financial services platform, raised $12 million in funding. Insight Partners and Vensure Enterprises led the round.

- Journera, a Chicago-based startup seeking to create seamless travel, raised $11.6 million in Series B funding. Andreessen Horowitz and B Capital led the round, and were joined by investors including Pritzker Group Venture Capital and The Boston Consulting Group.

- Codat, a London-based financial data aggregation platform for small businesses, raised $10 million from Index Ventures. http://axios.link/Ew1i

- Whatifi, a Los Angeles-based interactive movie maker, raised $10 million in funding led by Andreessen Horowitz who was joined by investors including Matrix Partners, David Wells (ex-CFO of Netflix), Ilkka Paananen (Supercell), Max Levchin (Paypal, Affirm), Marc Pincus (Zynga), Michael Birch (Bebo), Taavet Hinrikus (Transferwise), Josh Hannah (Betfair), and Jon McNeill (Tesla, Lyft).

- Pando, a San Francisco-based company focused on managing career risk, raised $8 million in Series A funding. Core Innovation Capital led the round, and was joined by investors including Pear VC, Avalon Ventures, Ulu Ventures, Nimble Ventures, Stanford StartX Fund, WTI and Slow VC.

- Flatfile, a drop-in spreadsheet importer, raised $7.6 million in Seed funding. Two Sigma Ventures led, and was joined by investors including Afore Capital, Designer Fund, and Gradient Ventures.

- Tackle.io, a Boise, Idaho-based software marketplace, raised $7.3 million in Series A funding led by Bessemer Venture Partners.

- Bepro, a German provider of soccer analytics software, raised €8.8 million from Altos Ventures, Softbank Ventures, Saehan Ventures, Springcamp, and Miraeasset Ventures. http://axios.link/1HNM

- Coastal Cloud, a San Francisco-based Salesforce consulting partner, raised an undisclosed amount of capital from Sverica and Salesforce Ventures. www.coastalcloud.us

- Bonusly, a Boulder, Colo.-based employee management and rewards platform, raised $9 million in Series A funding. Access Venture Partners led, and was joined by Next Frontier Capital and Operator Partners. http://axios.link/Fcwc

- Spike, a new email app, raised $8 million in Series A funding. Insight Partners led, and was joined by Wix, NFX, and Koa Labs. http://axios.link/2vg5

- Pinwheel, a New York-based API layer for payroll data, raised $7 million in a seed round. First Round Capital led the round, and was joined by investors including Upfront Ventures.Read more.

- Chargeback, a Salt Lake City, UT-based real-time dispute management platform for merchants, completed a $6.6m in Series A1 funding (read here)

- Zeitworks, a Seattle, WA- and and Los Angeles, CA-based provider of a machine learning powered business process improvement platform, came out of stealth mode and raised $4.5m in seed funding (read here)

- Vendr, a Boston-based software procurement platform, raised $4 million led by Craft Ventures. http://axios.link/S1Qi

- Trade Hounds, a Boston, MA-based professional community built exclusively for the construction industry, closed a $3.2m seed funding round (read here)

- Vectice, the San Francisco-based cloud-based platform, raised $3 million in seed funding. Spider Capital and Crosslink Capital led the round and was joined by investors including Global Founders Capital,.

- Reveal , a Woodside, Calif.-based startup that deploys AI for national security, announced today raised $2.5 million in seed funding. Defy Partners and 8VC led the round.

- TaxProper, a Chicago-based property tax tech company, raised $2 million in funding. Khosla Ventures led the round and was joined by investors including Global Founders Capital, and Clocktower Ventures.

- Canopy, an Indianapolis-based revenue intelligence platform, raised $2 million in seed funding. High Alpha Capital and Elevate Ventures led the round, and was joined by investors including IU Ventures and Service Provider Capital.

- Scope, a San Francisco-based implementation platform, raised $1 million in seed funding. Craft Ventures led the round and was joined by investors including Plaid Co-Founder William Hockey.

- Axio, a New York-based cyber risk management company, raised an undisclosed amount of funding. Fin Venture Capital IA Capital Group co-led the round, and were joined by investors including NFP Ventures.

- Grow Credit, a Santa Monica, CA-based minority-led startup financial inclusion platform, received an investment from Mucker Capital (read here). . .

Sustainability:

- MycoTechnology, a Denver-based food tech startup focused on mushrooms , raised $39 million in Series D funding. Greenleaf Foods, SPC, S2G Ventures, and Evolution Partners co-led the round and were joined by investors including Rich Products Ventures, Tyson Ventures, Continental Grain, Middleland Capital, Bunge Ventures, Seventure Partners, Cibus Investments, and Kellogg's eighteen94 Capital.

- Quaise, a Cambridge, Mass.-based energy company using millimeter wave drilling to access deep geothermal energy, raised $6 million in seed. The Engine led the round, and was joined by investors including Vinod Khosla and Collaborative Fund.

- Clean Crop Technologies, Inc., a Northampton, Mass.-based agtech company, closed a $2.75m seed funding round (read here)

- SimpleLab, a Berkeley, Calif.-based home water testing maker, raised an undisclosed round of funding from Craft Ventures, Spring Point Partners, and Mazarine Ventures.

- Veros Systems, an Austin, Texas-based AI startup focused on the performance and maintenance of industrial machinery, raised $2.2 million in Series C funding. Shell Ventures led, and was joined by Austin Ventures, Chevron Technology Ventures, and LiveOak Venture Partners. http://axios.link/enQO

Exits:

- VMware, Inc. (NYSE: VMW), a Palo Alto, CA-based provider of compute, cloud, mobility, networking and security solutions, is to acquire Lastline, a San Mateo, California-based provider of anti-malware research and AI-powered network detection and response solutions (read here)

- Cloudera (NYSE: CLDR) is exploring a sale after receiving takeover interest, per Bloomberg. Company shares soared more than 18% on the news, giving it a market cap of around $3.5 billion. http://axios.link/H4Px

IPOS:

- Vroom, a New York-based online used car marketplace, plans to raise $468 million in an IPO of 21.3 million shares priced at $22 apiece. It posted revenue of $1.2 billion and losses of $275.7 million in 2019. The company priced 21.3 million shares at $22, versus plans to offer 18.8 million shares at $15-$18, for a fully diluted market value of around $2.8 billion. It will list on the Nasdaq (VRM), used Goldman Sachs as lead underwriter, and reports a $41 million net loss on $376 million in revenue for Q1 2020. The company had raised over $700 million from firms like L Catterton (20.6% pre-IPO stake), T. Rowe Price (16%), Bill Gates (7.2%), General Catalyst (6.4%), Autonation (5.9%), Durable Capital Partners, Annox Capital, Nue Capital, Fraser McCombs Capital, and Detroit Venture Partners.

- SnowflakeComputing, a San Mateo, Calif.-based data warehousing company that’s raised $1.4 billion in VC funding, filed confidential IPO papers, per Bloomberg. It most recently was valued at $12.4 billion, while backers include Sequoia Capital, Sutter Hill Ventures, and Redpoint Ventures. http://axios.link/vb3g

- uCloudlink, a Hong Kong-based mobile data traffic sharing marketplace, raised $36 million in its IPO. The company priced 2 million shares at $18 (low end of range), for a fully diluted market value of $532 million. It will list on the Nasdaq (UCL), used I-Bankers Securities and Valuable Capital as lead underwriters, and reports $5.2 million of net income on $158 million in revenue for 2019. Shareholders include Haitong Momentum Investment Fund and Beijing Cash Capital Venture Partners.

- Palantir, a Palo Alto, Calif.-based big data analyzation company, is weighing an IPO or a direct listing as soon as September, per Reuters. Read more.

- China’s No. 2 online retailer JD.com reportedly raised HK$30.1 billion ($3.9 billion) in its Hong Kong share sale, cementing the world’s second-biggest listing this year. JD’s shares are slated to begin trading in Hong Kong on June 18, which coincides with its largest annual online sales event, reports Bloomberg. More here.

Acquisitions:

- Data Robot acquired Boston Consulting Group’s SOURCE AI technology. Financial terms weren't disclosed.

- Nestle Health Science acquired a majority stake in Vital Proteins, a Chicago-based collagen brand. Sellers include CAVU Venture Partners. http://axios.link/ciGF

Funds

- Collab Capital, an Atlanta-based firm formed to focus on startups led by black founders, is raising $50 million for its debut fund, per TechCrunch. http://axios.link/0krA

- Bungalow Capital is raising $30 million for its debut seed fund, per an SEC filing. The firm is led by David Ambrose (ex-Steadview Capital) and Matthew Ziskie (ex-Airbnb).

- Max Ventures, a New York-based early-stage VC firm, is raising $35 million for its second fund, per an SEC filing. www.maxventures.vc

- True Ventures is raising $415 million for its seventh early stage fund and $340 million for its fourth “select” fund, per SEC filings. www.trueventures.com

- Wing closed its third fund with $450 million in commitments. Read more.

- HarbourVest Partners raised $288 million for its Harbourvest Adelaide fund. Read more.

- Ethos, a new San Francisco-based VC firm led by John Andreini (EvCap Venture Funds) and Michael Eddy (KPMG), is raising its debut fund, per an SEC filing.

Final Numbers

Data: National Bureau of Economic Research; Table: Axios VisualsAxios' Dion Rabouin writes that more American businesses have closed in the last three months than during the Great Recession: The U.S. saw its largest ever decline in the number of business owners between February and April, as at least 3.3 million shut their doors, a new paper from the National Bureau of Economic Research using the Census Bureau's Current Population Survey found.Go deeper

. . .

Final Numbers: Startup layoffs during pandemic

Source: Station F survey of 120 global VC firmsBut, but, but: Station F also found that 48% of startups have added at least some new employees since the beginning of March, and that 78% plan to hire by year-end.

. . .

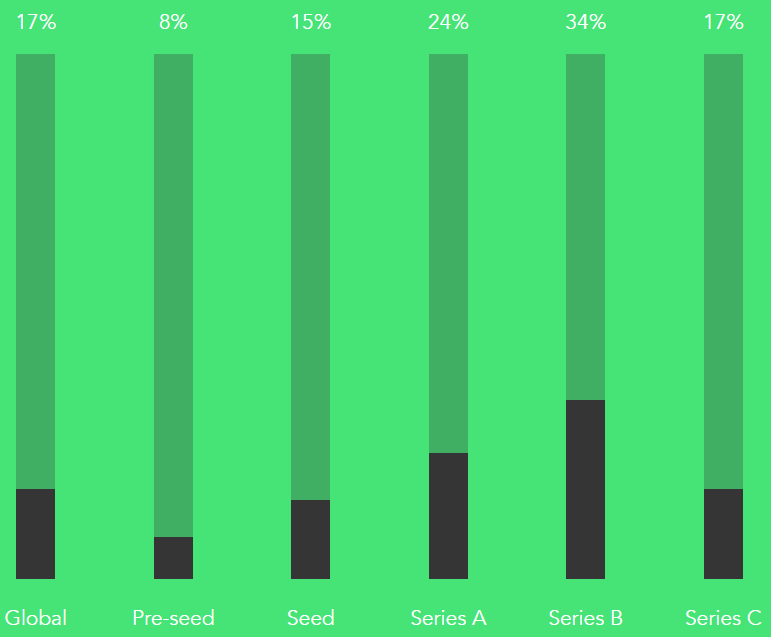

Final Numbers: IPO activity by sector

Source: Renaissance Capital. Data for 12 month period ending 6/12/20