Sourcery (7/13-7/17)

Breaking down SPACs; Medly Pharmacy, Cityblock Health, NowRX, Robinhood, UiPath, Lattice, Bond, crisp, Openpath, Privacy.com, env0, Videopeel, Bbot, Oatly.

Last Week (7/13-7/17):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into three categories, Care, Future of Work and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include: Medly Pharmacy, Cityblock Health, NowRX, Robinhood, UiPath, Lattice, Bond, crisp, Openpath, Privacy.com, env0, Videopeel, Bbot, Oatly.

Final numbers on US VC Deal Activity, Jio’s Exponential Cap Table, and Global $ in Renewable Energy at the bottom.

. . .

The SPAC

The IPO window is out. The SPAC vacuum is in.

Driving the news: Churchill Capital Corp. III agreed to acquire health cost management services provider Multiplan at an initial enterprise value of $11 billion.

This is the largest-ever SPAC merger, and also includes the largest-ever PIPE associated with a SPAC.

Existing Multiplan owners like Hellman & Friedman and General Atlantic will roll over more than 75% of their collective stake, and own over 60% of the public company.

A source tells Axios that negotiations began before the pandemic.

This too: Spartan Energy Acquisition Corp., a SPAC backed by Apollo Global Management, agreed to buy electric car maker Fisker at a $2.9 billion enterprise value.

Oh, and this: Two more SPACs on Friday filed to go public.

Why now? SPACs have been around for years, but what we're seeing now seems largely driven by public equity froth.

Stock markets are salivating for almost any new issue, whether or not it includes an operating company. That's the perfect petri dish for SPACs, and they're raising billions.

IPOs are also going gangbusters, but often take longer to complete with far more disclosure than do reverse mergers via SPAC. Plus there's rampant underpricing. So why not strike while the iron is hot and (relatively) easy?

Going public via SPAC does have some downsides. For example, you still need shareholder approval, could get hammered by redemptions, and need to give a large slice of economics to the SPAC sponsor.

The bottom line: SPACs, not direct listings, are the 2020 challenge to IPOs and IPO bankers.

AXIOS Pro Rata

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Care:

- Medly Pharmacy, a New York-based digital pharmacy, raised $100 million in Series B funding. Volition Capital and Greycroft led the round and were joined by investors including Horsley Bridge and Lerer Hippeau.

- Cityblock Health, a New York-based healthcare service for marginalized communities, raised $53.5 million in extended Series B funding. Kinnevik led the round and was joined by investors including Goldman Sachs Asset Management and Alphabet. Read more.

- Caption Health, a Brisbane, Calif.-based maker of an artificial intelligence-guided ultrasound, raised $53 million in Series B funding. DCVC led the round and was joined by investors including Atlantic Bridge, Edwards Lifesciences, and Khosla Ventures.

- AristaMD, a San Diego, Calif.-based e-consultancy connecting primary care providers with specialists, raised $24 million in Series B funding. Cigna Ventures and MemorialCare Innovation Fund led the round and were joined by investors including Ascension Ventures and .406 Ventures.

- NowRx, a Mountainview, Calif.-based pharmacy delivery software maker, raised $20 million in Series B funding through crowdfunding via SeedInvest.

- Paige, a New York-based computational pathology company, raised $15 million from Goldman Sachs Merchant Banking Division.

- Gyant, a San Francisco, CA-based care navigation company, closed a $13.6m Series A financing (read here)

- Beekeeper, an Oakland, Calif.-based communication and operations platform for frontline workers, raised $10 million in extended Series B funding. Energize Ventures led the round and was joined by investors including HighSage Ventures, SwissCanto, Thayer, Swisscom, Investiere, Alpana Ventures, and Swiss Post.

- Movano Inc., a Pleasanton, Calif. Health tech company for those with chronic health conditions, raised $10 million in a bridge round led by Tri-Valley Ventures.

- AristaMD, a San Diego, CA-based digital health company, raised approx. $6m in further Series B funding (read here)

- Noteworth, a Hoboken, N.J.-based digital healthcare platform, raised $5 million in seed funding. Laconia Capital Group led the round and was joined by investors including Draper Associates, Frontier Ventures, Techstars Ventures, Wavemaker360, and Springtide Capital.

- Uwill, a mental health startup aimed at college students, raised $3.3 million in seed funding. Run-DMC’s Darryl McDaniels led the round.

- Joshin, a Minneapolis-based disability care app, raised $1.6 million in funding. Anthemis led the round and was joined by investors including M25 and Sure Ventures.

. . .

Future of Work:

- Robinhood, a no-fee digital brokerage, raised $320 million in new Series F funding at an $8.6 billion valuation from such backers as TSG Consumer Partners and IVP. This follows a $280 million first close on the round that was announced in May.

- Thrasio, a Walpole, Mass.-basedacquirer of private label businesses on Amazon.com Inc., raised $260 million in Series C funding reaching $1B Valuation. Advent International led the round.

- UiPath, a New York-based robotics automation company, raised $225 million in Series E funding. Alkeon Capital Management led the round and was joined by investors including Accel, Coatue, Dragoneer, IVP, Madrona Venture Group, Sequoia Capital, Tencent, Tiger Global, Wellington, and funds and accounts advised by T. Rowe Price Associates.

- Qumulo, a Seattle-based file data platform, raised $125 million in Series E funding at a valuation north of $1.2 billion. BlackRock led, and was joined by Highland Capital Partners, Madrona Venture Group, Kleiner Perkins, and Amity Ventures. http://axios.link/mGL9

- Auth0, a Bellevue, Wash.-based identity platform for development teams, raised $120 million in Series F funding. Salesforce Ventures led the round and was joined by investors including DTCP, Bessemer Venture Partners, Sapphire Ventures, Meritech Capital, World Innovation Lab, Trinity Ventures, Telstra Ventures, and K9 Ventures.

- CampusLogic, a 19-year-old, Phoenix, Az.-based education tech company focused on student aid, has raised $120 million from Dragoneer Investment Group. It's the biggest round for a U.S.-based edtech startup this year, says EdSurge. More here.

- BlueVoyant, a New York-based cyber threat intelligence startup, raised $68 million in new Series B funding led by Temasek. http://axios.link/s2X9

- Pricefx, a cloud-native pricing software, raised $65 million in Series C funding. Apax Digital led the round and was joined by investors including Digital+ Partners.

- Bolt, a San Francisco-based checkout platform, raised $50 million in Series C funding. Laurence Tosi at WestCap led the round.

- Lattice, a San Francisco-based human resources platform, raised $45 million in Series D funding. Tiger Global led the round and was joined by investors including Frontline Ventures, Founders Fund, Khosla Ventures, Thrive Capital Partners, Fuel Capital, and Y Combinator.

- Zeotap, a Berlin-based customer prediction platform, raised $42 million in Series C funding from this year and last. Investors include Neue Capital, coparion, MathCapital, and TTCER Partners.

- NS1, a New York-based web and app automation company, raised $40 million in Series D funding. Energy Impact Partners led the round. Read more.

- Openpath, a Culver City, Calif.-based security solution for workplaces, raised $36 million in Series C funding. Greycroft led the round and was joined by investors including Okta, Lincoln Properties, Allegion, and Sentre.

- Bond, a San Francisco-based fintech infrastructure platform, raised $32 million in Series A funding. Coatue led the round and was joined by investors including Goldman Sachs, Mastercard, B Capital and Canaan.Read more.

- Nasuni, a Boston-based cloud file storage company, raised $25 million from investors including Family Offices, Venture Capital and Corporate Venture.

- Traceable, an application security monitoring platform launched by AppDynamics CEO Jyoti Bansal, raised $20 million in Series A funding from Unusual Ventures and BIG Labs.

- TileDB, Inc., a Cambridge, Mass.-based data engine, raised $15 million in Series A funding. Two Bear Capital led the round and was joined by investors including Uncorrelated Ventures, Nexus Venture Partners, Intel Capital, and Big Pi Ventures.

- Snorkel AI, a Palo Alto-based maker of an ML platform that labels and manages training data, raised $15 million in total funding. Greylock led its $12 million Series A, and Greylock and GV co-led the $3 million seed. Other investors include In-Q-Tel.

- Privacera, a Fremont, Calif.-based cloud data governance and security platform, raised $13.5 million in Series A funding. Investors included Accel and existing investors Cervin Ventures, Point72, and Alchemist Accelerator.

- RealityEngines.AI, a machine learning startup rebranding as Abacus.AI, raised $13 million in Series A funding. Index Ventures’ Mike Volpi led the round. Read more.

- Crisp, a New York-based grocery demand analytics firm, raised $12 million in Series A funding. FirstMark Capital led the round and was joined by investors including Spring Capital and Swell Capital.

- Applicaster, a New York-based tv video app company, raised $11 million in funding. Viola Growth led the round and was joined by investors including 83 North, Pitango, Saban Ventures, Planven Investments and La Maison.

- Qualio, a San Francisco-based management system for life sciences companies, raised $11 million in Series A funding. Storm Ventures led the round.

- Privacy.com, a New York-based virtual card platform, raised $10.2 million in Series A funding. Teamworthy Ventures led the round and was joined by investors including Tusk Venture Partners, Index Ventures, Quiet Capital, Exor Seeds and Rainfall Ventures.

- CYR3CON, a Tempe, Ariz-based AI-driven cybersecurity prediction software platform, raised $8.2 million in funding. Pivotal Group led the round and was joined by investors including Trumpf Ventures, 3Lines Venture Capital, DF Enterprises, and Hike Ventures.

- Hummingbird RegTech, a San Francisco-based provider of anti-money laundering compliance technology, raised $8.2 million in Series A funding. Flourish Ventures led the round with and was joined by investors including Stripe alumni Lachy Groom and Jon Zieger, Hombrew, Designer Fund, and TTV Capital.

- Cohesion, a Chicago-based smart office building startup, raised $6.5 million in seed funding led by Hyde Park Angels. http://axios.link/gVwu

- CompanyCam, a Lincoln, Ne.-based app maker for residential contractors, raised $6 million in Series A funding. Blueprint Equity led the round.

- Verikai, a San Francisco-based Insurtech company, raised $6 million in Series A funding. ManchesterStory led the round.

- MadKudu, a Mountainview, Calif.-based AI-based predictive analytics and marketing firm, raised $5.5 million in Series A funding. Benhamou Global Ventures led the round and was joined by investors including Alven and Partech.

- Layer, a Berlin-based productivity platform for spreadsheets, raised €5 million in seed funding. Index Ventures led, and was joined by btov Partners. http://axios.link/EE3k

- Sourcegraph, a San Francisco-based provider of Universal Code Search, raised $5 million in Series B funding. Felicis Ventures led the round.

- The Browser Company, a New York-based browser maker, raised $5 million in funding, per TechCrunch. The company’s backers include LinkedIn’s Jeff Weiner, Medium’s Ev Williams, Figma’s Dylan Field, Notion’s Akshay Kothari, and GitHub’s Jason Warner. Read more.

- Macro, a Boston-based customizable interface for Zoom, raised $4.3 million in funding. Investors include FirstMark Capital, General Catalyst, and Underscore VC.

- Tenovos, a New York-based marketing startup, raised $4 million in Series A funding. Progress Ventures led the round and was joined by investors including Bertelsmann Digital Media Investments, Revel Partners, and Dublin Capital.

- Orbital Witness, a U.K.-based proptech startup, raised £3.3 million ($4 million) in seed funding. LocalGlobe and Outward VC led the round and were joined by Seedcamp and JLL Spark.

- env0, a Sunnyvale, Calif.-based developer of self-service cloud management software, raised $3.5 million in extended seed funding. Crescendo Venture Partners led the round and was joined by investors including M12, Boldstart Ventures, and Grove Ventures.

- Bbot Inc., a New York-based restaurant and hospitality tech startup, raised $3 million in seed funding. Craft Ventures led the round.

- PocketList , a Los Angeles-based housing platform for renters, raised $2.8 million in seed funding. Craft Ventures led the round and was joined by investors including Abstract VC, Wonder Ventures, and Zillow co-founder Spencer Rascoff.

- VideoPeel, a Lehi, Ut.-based video testimonial platform, raised $1.5 million of funding. Active Capital led the round and was joined by investors including Next Coast Ventures, and eonCaptial.

- Digital Asset, a New York-based creator of open source DAML smart contract language, raised an undisclosed amount from VMware as part of its Series C round.

. . .

Sustainability:

- Oatly, a Swedish oat milk maker, raised $200 million. Blackstone Growth led the round. Other investors include Oprah Winfrey, Roc Nation, Natalie Portman, Howard Schultz (Starbucks), Orkila Capital and Rabo Corporate Investments

- Komaza, a Kenyan developer of sustainable forestry tech, raised $28 million in Series B funding from AXA Impact Fund, Novastar Ventures, FMO, and Mirova. http://axios.link/JekF

- GRC (Green Revolution Cooling), an Austin, Texas-based leader in single-phase immersion cooling for data centers, closed a $7m Series B funding (read here)

PE:

- Qualcomm agreed to invest $97 million in Indian telco RelianceJioPlatforms. http://axios.link/YT3s

- Google is in advanced talks to acquire a $4 billion stake in Jio Platforms, an Indian telecom company. Read more.

. . .

IPOs:

- nCino, a Wilmington, N.C.-based digital banking startup, raised $250 million in its IPO. The company priced 8.1 million shares at $31 (above upwardly revised range), for a fully diluted market cap of $3 billion. It will list on the Nasdaq (NCNO), and had raised just over $200 million in VC funding from Insight Partners (46.6% pre-IPO stake), Salesforce (13.2%), Wellington Management (9.5%), T. Rowe Price, and Bessemer Venture Partners. http://axios.link/i0no

- BigCommerce, an Austin, Texas-based outsourced builder of e-commerce sites, filed for a $100 million IPO. It plans to trade on the Nasdaq (BIGC) with Morgan Stanley as lead underwriter, and reports a $4 million net loss on $33 million in revenue for Q1 2020. The company raised $228 million in VC funding from firms like Goldman Sachs, General Catalyst, GGV Capital and Tenaya Capital.http://axios.link/XHp6

- Oak Street Health, a Chicago-based provider of primary care for Medicare patients in the Midwest, filed for a $100 million IPO. It posted revenue of $540 million in 2019 and a loss of $137.2 million. General Atlantic, Newlight, and Humana back the firm. It plans to list on the NYSE as “OSH.” Read more.

- Rackspace, a San Antonio-based managed cloud solutions company owned by Apollo Global Management, filed for an IPO that Renaissance Capital estimates could raise $1 billion. It plans to list on the Nasdaq (RXT) with Goldman Sachs as lead underwriter, and reports a $48 million net loss on $653 million in revenue for Q1 2020. http://axios.link/QdhJ

- MultiPlan, a healthcare services provider, will merged with Churchill Capital Corp III, a SPAC run by former CItigroup banker Michael Klein. The deal gives MultiPlan an enterprise value of about $11 billion. MultiPlan is currently owned by Hellman & Friedman. Read more.

- Montrose Environmental Group, ae Irvine, Calif.-based provider of environmental assessment, plans to raise $160 million in an offering of 10 million shares priced between $15 to $17 .It posted revenue of $233.9 million in 2019 and a loss of $23.6 million. Oaktree (17.2% pre-offering), CTEH Holdings (8.7%) and Yukon Environmental (8.4%) back the firm. It plans to list on the NYSE as “MEG.” Read more.

- Datto, a Norwalk, Conn.-based cloud backup company, filed confidentially for an IPO, per Bloomberg. Vista Equity Partners backs the firm. Read more.

- CommerceHub, an Albany, N.Y.-based e-commerce software company, is preparing for an IPO, per Bloomberg. GTCR and Sycamore Partners back the firm. Read more.

. . .

SPACs:

- Pershing Square Tontine Holdings, a New York-based SPAC founded by Bill Ackman, now plans to raise $4 billion in an offering of 200 million units priced at $20 apiece. Read more.

- NewHold Investment, a SPAC targeting an industrial tech business, filed for a $150 million IOPO. It’s led by Kevin Charlton, co-founder of private equity firm River Hollow Partners. http://axios.link/O8Eq

- Vistas Media Acquisition, a SPAC targeting a media or entertainment business, filed for a $100 million IPO. It’s led by Jacob Cherian, whose prior SPAC acquired Simplicity Esports and Gaming. http://axios.link/7kV3

- Artius Acquisition, a SPAC co-founded by former WorldPay CEO Charles Drucker, raised $630 million in its IPO. http://axios.link/0JH4

- E.Merge Technology Acquisition, a SPAC formed to acquire a tech company, filed for a $500 million IPO. Its CEO is former Eastman Kodak co-CEO Jeff Clark and its chairman is Madrona Venture Group’s Steven Singh. http://axios.link/q31d

- Malacca Straits Acquisition, a SPAC targeting a business in Southeast Asia, raised $125 million in its IPO. http://axios.link/IK3M

- Churchill Capital Corp IV, the fourth SPAC led by Michael Klein, filed for a $1 billion IPO. This comes just days after Klein’s third SPAC agreed to acquire Multiplan, in the largest SPAC-sponsored reverse merger in history. http://axios.link/K0Yw

-D8 Holdings, a SPAC targeting a global consumer brand, raised $300 million in an upsized IPO. It’s led by Nautica founder David Chu. http://axios.link/txGz

. . .

Acquisitions:

- Reliance Industries of India said its plans to sell a 20% stake in its oil-to-chemicals business for to Saudi Aramco won’t close until early 2021. It originally was set to close back in March. http://axios.link/iLc1

Funds:

- TrueBridge Capital Partners closed its sixth venture capital fund-of-funds with $600 million in commitments.

- Wavemaker Partners, a Singapore-based VC firm, raised $111 million for its third fund. http://axios.link/gvXH

- Lance Armstrong's venture fund, Next Ventures, has secured $32.5 million in capital commitments from 62 investors, shows a new SEC filing that lists a $75 million target for the fund. Armstrong has been in fundraising mode since roughly January of last year.

- Coelius Capital, a new VC firm led by angel investor and serial entrepreneur Zach Coelius, raised $15 million for its first early-stage fund and $30 million for its first opportunities fund. Both are solely funded by Industry Ventures. http://axios.link/WD3Q

- CRV raised $600 million for its eighteenth early stage VC fund. It also said that longtime general partner Devdutt Yellurkar is stepping back. http://axios.link/YuUA

US VC Deal Activity by Q

Source: Pitchbook-NVCA Venture Monitor. * As of June 30, 2020

. . .

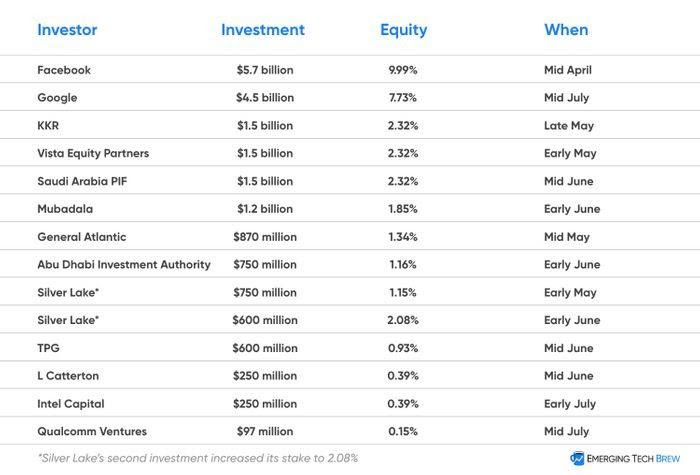

Jio’s Exponential Cap Table

Graphic by Francis Scialabba, data compiled by Ryan

Special edition, featuring a mini Q&A and no Read.

Stat: Google is investing $4.5 billion in Jio for a 7.73% stake. Just like that, Google has completed 45% of its India Digitization Fund investing (which the company announced Monday). I’ve updated the Jio tracker accordingly.

. . .

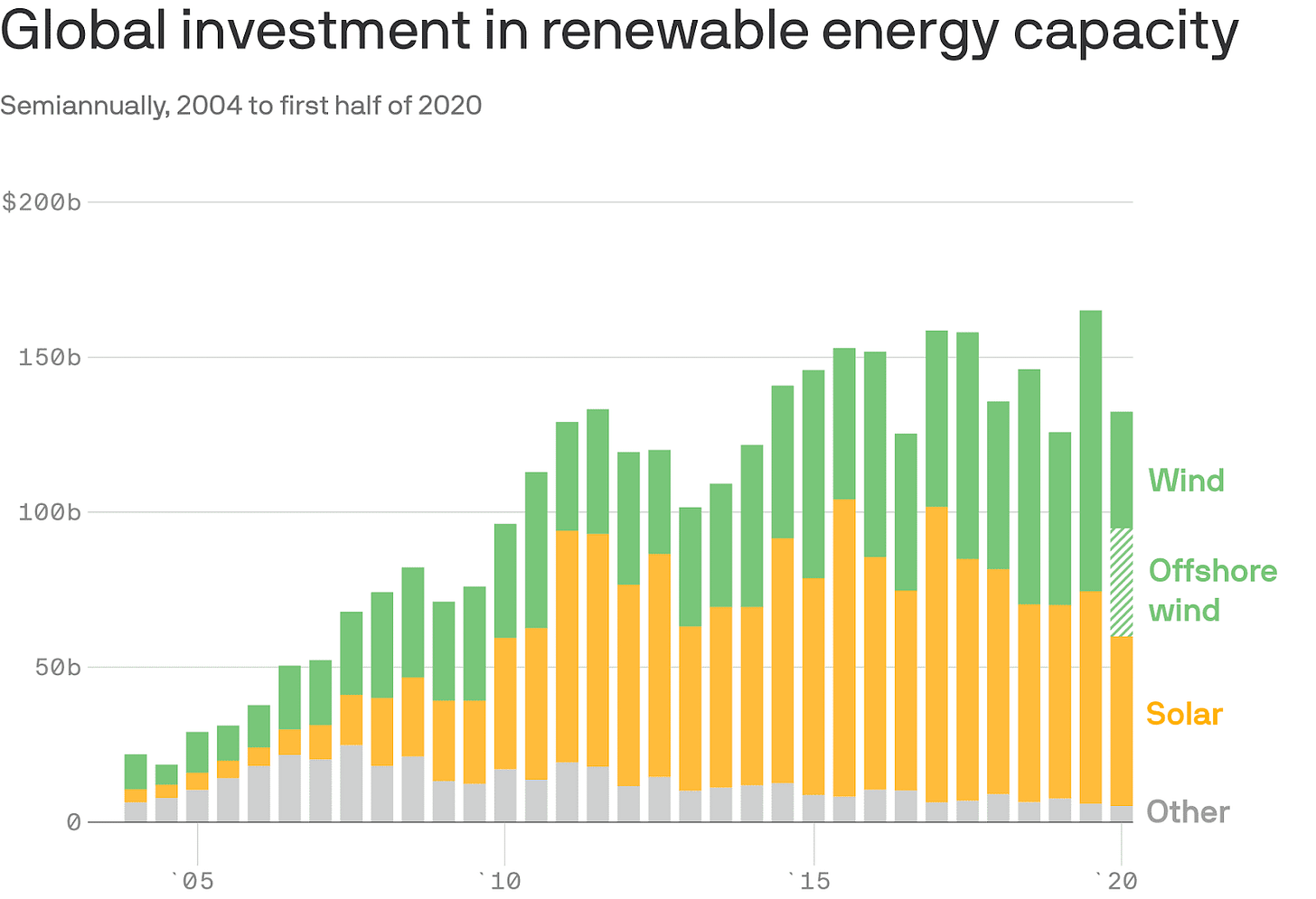

Global $ in Renewable EnergyReproduced from BloombergNEF; Chart: Axios VisualsGo deeper: Biden to push for $2 trillion clean energy spending package