Sourcery (7/19-7/23)

Bolt, Spendesk, Ethos, Sundae, Titan, Lev, Dwolla, Emcasa, Bbot, Jones, Esusu, Vincent, Allocate, Carbon Health, OM1, Quit Genius, obé Fitness, Swiggy, gopuff, Rappi, JOKR, Choco, Fabric, Opensea...

Last Week (7/19-7/23):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech,Care, Future of Work, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Bolt, Spendesk, Ethos, Sundae, Titan, Lev, Dwolla, Emcasa, Bbot, Jones, Esusu, Vincent, Allocate, Carbon Health, OM1, Quit Genius, obé Fitness, Turquoise Health, Cake, Swiggy, gopuff, Rappi, JOKR, tilting Point, FloQast, Choco, Fabric, Opensea, Loop Returns, Mural, YOOBIC, Cape Analytics, LiveControl, Magic, Dover, Cube Dev, Adway, Traba, Nature’s Fynd, ClimateAI; Five9, Invoice2go, CurrencyCloud; Outbrain, Couchbase, Kaltura, Robinhood, Duolingo, Everside Health Group, Rent the Runway; Kin Insurance

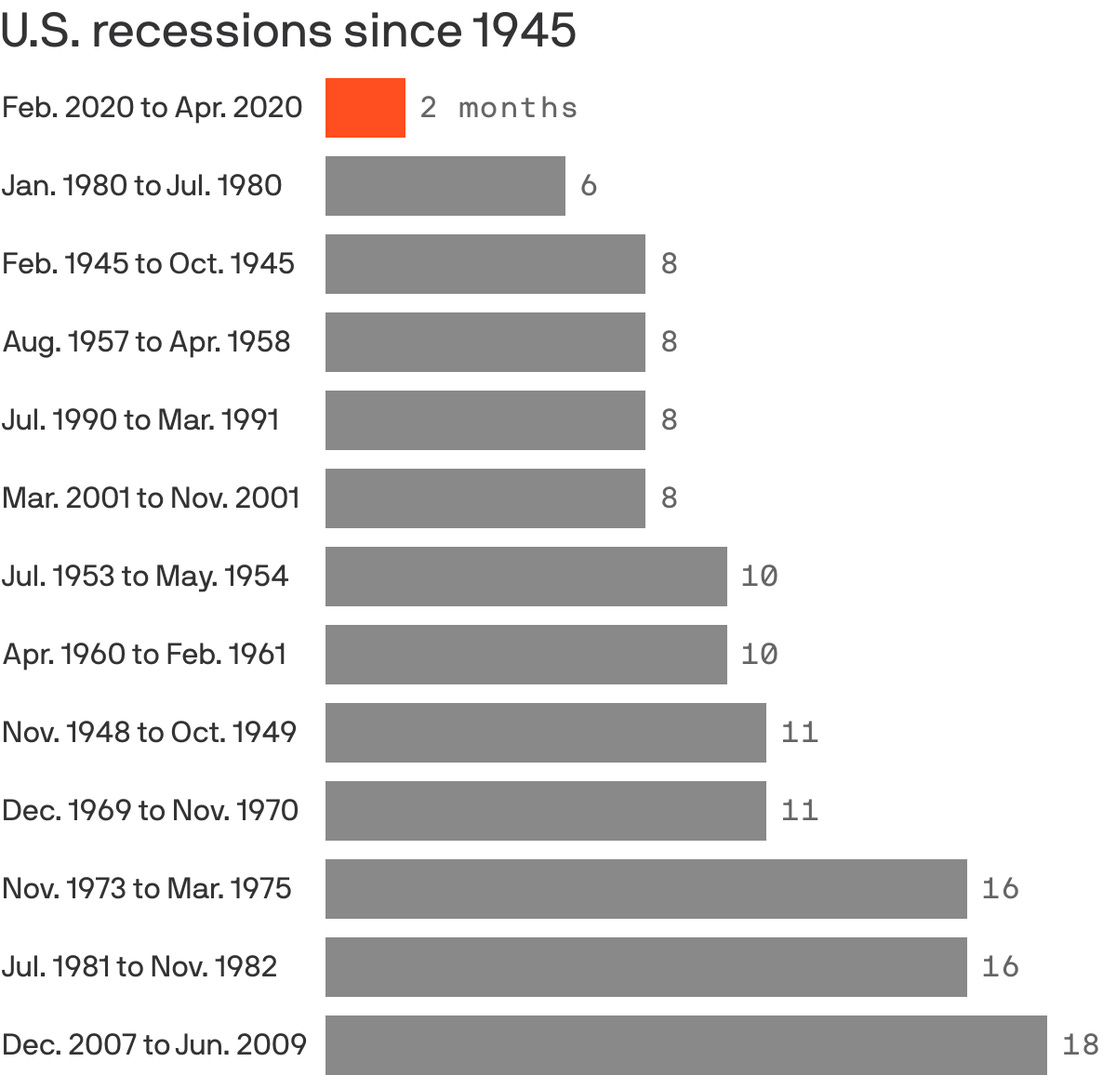

Final numbers on US Recessions Since 1945 at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Bolt, a San Francisco-based checkout software startup, is raising $333 million in Series D funding at a $4 billion valuation, per the Information. Hedosophia is leading the round.

- Soldo, a London-based business payments automation platform, raised $180 million in Series C funding. Temasek led the round.

- Spendesk, a French spend management startup, raised €100 million. General Atlantic led, and was joined by insiders Index Ventures and Eight Road Ventures. http://axios.link/x41q

- Ethos, a San Francisco-based insurance tech company, raised $100 million valuing it at $2.7 billion. SoftBank Vision Fund 2 led the round and was joined by investors including Sequoia Capital, Accel, GV, General Catalyst, Roc Nation, and the investment vehicles of Will Smith and Robert Downey Jr.

- Sundae, a San Francisco-based residential real estate marketplace focused on dated or damaged property, raised $80 million in Series C funding. Fifth Wall and General Global Capital led the round and were joined by investors including QED Investors, Wellington Management, Susa Ventures, Founders Fund, First American Financial, Prudence Holdings, Crossover VC, Intersect Capital, Gaingels, and Oberndorf Ventures.

- Vestwell, a New York City-based 401(k) recordkeeping tech company, raised $70 million in Series C funding. Wells Fargo Strategic Capital and Fin Venture Capital led the round and were joined by investors including Goldman Sachs and Morgan Stanley.

- Titan, a New York City-based investment platform, raised $58 million in Series B funding. Andreessen Horowitz led the round and was joined by investors including General Catalyst, BoxGroup, and Ashton Kutcher's Sound Ventures.

- Yapily, a London-based open banking infrastructure provider, raised $51 million in Series B funding. Sapphire Ventures led the round.

- Properly, a Canadian real estate brokerage, raised $35 million in Series B funding. Bain Capital Ventures led the round and was joined by investors including Intact Ventures and FCT.

- Lev, a New York City-based maker of commercial real estate financing software, raised $30 million at a $130 million valuation. Greenspring led and was joined by investors including First American Title, NFX, Canaan Partners, JLL Spark, Animo Ventures, and Ludlow Ventures.

- Paro, a Chicago-based accounting and financial services startup, raised $25 million in Series B funding. Madrona Venture Group led the round and was joined by investors including Revolution Ventures, Sierra Ventures, and KGC Capital.

- Dwolla, a Des Moines, Iowa-based enterprise payments platform, raised $21 million. Foundry Group led, and was joined by Park West Asset Management, USV, Detroit Venture Partners, Firebrand Ventures and Next Level Ventures.www.dwolla.com

- EmCasa, a Brazilian proptech focused on brokers, raised $21 million. Investors include Globo Ventures, Igah Ventures, and Flybridge.

- Thesis, a New York City-based crypto startup, raised $21 million in Series A funding. Investors include ParaFi Capital, Nascent, Fenbushi Capital, Polychain Capital, and Draper Associates.

- Bbot, a New York City-based ordering and payments process for restaurants, raised $15 million in Series A funding led by CRV.

- Anduin, a Charlotte, N.C.-based invoicing and billing firm, raised $14 million in seed funding. Revolution Ventures led the round.

- Prodigal, a Mountain View, Calif.-based software maker for loan servicing and collection operations, raised $12 million in Series A funding. Menlo Ventures led the round and was joined by investors including Accel, Y Combinator, and MGV.

- Jones, a New York City-based commercial real estate startup for connecting parties with vendors, raised $12.5 million in Series A funding. JLL Spark and Khosla Ventures led the round and were joined by investors including Camber Creek, Rudin Management, DivcoWest, and Sage Realty.

- Esusu, a Harlem, N.Y.-based rent-reporting alternative to credit, raised $10 million in Series A funding. Motley Fool Ventures led the round and was joined by investors including Serena Ventures, The Equity Alliance, Predictive VC, Concrete Rose Capital, Impact America Fund, Global Impact Fund, Next Play Ventures, and Zeal Capital Partners.

- WhenThen, an Irish no-code payment platform, raised $6 million from Stride and Cavalry. http://axios.link/oBWY

- Vincent, a New York City-based online investment search company, raised $6 million. Investors included Jason Calacanis of LAUNCH, Joe Lonsdale of 8VC, and Barry Silbert of Digital Currency Group.

- Percent, a British "Stripe for donations," raised $5 million led by Morpheus Ventures. http://axios.link/zmyx

- Allocate, a San Francisco-based platform for investors to discover and invest in venture funds, raised $5 million in seed funding. Investors included Urban Innovation Fund, Tusk Venture Partners, Basis Set Ventures, Liquid2 Ventures, Fika Ventures, Ulu Ventures, and Anthemis Group.

. . .

Care:

- CarbonHealth, a San Francisco-based primary and urgent healthcare company, raised $350 million. The Blackstone Group led, and was joined by Atreides, Homebrew, Hudson Bay Capital, Intersect Capital, Fifth Wall, Lux Capital, Silver Lake Waterman, BlackRock and insiders Dragoneer Investment Group and Brookfield Technology Partners.www.carbonhealth.com

- OM1, a Boston-based health technology company, raised $85 million in funding. D1 Capital Partners, Kaiser Permanente, and Breyer Capital led the round and were joined by investors including General Catalyst, Polaris Partners, Scale Venture Partners, 7wire Ventures, and Glikvest.

- Quit Genius, a New York City-based digital clinic for treating multiple addictions, raised $64 million in Series B funding. Kinnevik and Atomico led the round and were joined by investors including Octopus Ventures, Triple Point Ventures, and Startup Health.

- Qure4u, A Bradenton, Fla.-based digital health company, raised $25 million. Volition Capital led the round.

- Paradromics, an Austin-based brain-control startup, raised $20 million in seed funding. Prime Movers Lab led the round and was joined by investors including Westcott Investment Group, Dolby Family Ventures, Synergy Ventures, Pureland Global Venture, IT-Farm, and Alpha Edison.

- Sweetch, An Israel-based maker of a health-tracking app, raised $20 million in Series A round funding. Entreé Capital led the round and was joined by investors including Noaber, Kortex Ventures, Insurtech VC, Fin TLV Ventures, Philips, OurCrowd, and Qure Ventures.

- obé Fitness, a New York City-based digital fitness platform, raised $15 million in Series A funding. CAVU Venture Partners led the round and was joined by investors including Athleta, Samsung Next, Tiffany Haddish, Wheelhouse Entertainment, WW International,Cassius Ventures, Ludlow Ventures, Harris Blitzer Sports Entertainment, and BDMI.

- Zone7, a Palo Alto, Calif.-based sports training and analysis provider, raised $8 million in Series A funding. Blumberg Capital led the round and was joined by investors including Resolute Ventures, UpWest, PLG Ventures, and Joyance Ventures.

- Turquoise Health, a San Diego-based healthcare price transparency startup, raised $5 million in seed funding from Andreessen Horowitz, Bessemer Venture Partners and Box Group.http://axios.link/CQzz

- Cake, a Boston-based platform for end-of-life planning, raised $3.7 million in funding. Investors include AARP, InHealth Ventures, Two Lanterns, Portfolia’s Aging, Longevity Fund, Scrum Ventures, Reflect Ventures, GoAhead Ventures, Pillar, and OCA Ventures.

. . .

Future of Work:

- Swiggy, an India-based leading on-demand delivery platform, raised $1.3 billion. Prosus and SoftBank Vision Fund 2 led the round and was joined by investors including Accel and Wellington.

- Gopuff, a Philadelphia-based grocery delivery startup, is seeking to raise $1 billion at a $15 billion valuation, per TechCrunch.

- Rappi, a Colombian delivery startup, raised about $500 million at a $5.3 billion valuation. T. Rowe Price led the round and was joined by investors including Baillie Gifford, Third Point, Octahedron, GIC SoftBank, DST Global, Y Combinator, Andreessen Horowitz, and Sequoia Capital.

- Tilting Point, a New York City-based free-to-play games publisher, raised $235 million. General Atlantic led the round and was joined by investors including Red Ventures and Kamerra.

- JOKR, a New York City-based grocery delivery company, raised $170 million in Series A funding. GGV Capital, Balderton Capital, and Tiger Global Management led the round and were joined by investors including Activant Capital, Greycroft, FJ Labs, Kaszek, and Monashees.

- SmartRecruiters, a San Francisco-based recruiting software company, raised $110 million in Series E funding. Silver Lake Waterman led the round and was joined by investors including Insight Partners and Mayfield Fund.

- FloQast, a Los Angeles-based workflow automation software company, raised $110 million in Series D funding. Meritech Capital led the round and was joined by investors including Redpoint Ventures, Sapphire Ventures, Coupa Ventures, Insight Partners, Polaris Partners, and Norwest Venture Partners.

- Choco, a Berlin-based maker of software for restaurants and suppliers, raised $100 million in Series B funding. Left Lane Capital led the round valuing it at $600 million. Insight Partners, Coatue Management, and Bessemer Venture Partners also joined.

- Fabric, a Seattle-based ecommerce platform, raised $100 million at an $850 million valuation. Stripes led, and was joined by B Capital Group and Greycroft. http://axios.link/4FAN

-Opensea, a New York-based NFT marketplace, raised $100 million in Series B funding at a $1.5 billion valuation led by insider Andreessen Horowitz. Other backers include Coatue, CAA, Michael Ovitz, Kevin Hartz, Kevin Durant and Ashton Kutcher. http://axios.link/IAa1

- Path Robotics, a Columbus, Oh.-based robotics company, raised a $100 million in Series C funding. Tiger Global led the round and was joined by investors including Silicon Valley Bank.

- Loop Returns, a Columbus, Oh.-based retail returns software company, raised $65 million in Series B funding. CRV led the round and was joined by investors including Shopify, Renegade Partners, FirstMark Capital, Ridge Ventures, Peterson Ventures, and Lerer Hippeau. The deal values the company at $340 million.

- Mural, a digital collaboration software startup, raised $50 million in Series C funding valuing it at over $2 billion. Insight Partners and Tiger Global led the round.

- YOOBIC, a New York City-based digital workplace for frontline teams, raised $50 million in Series C funding. Highland Europe led the round and was joined by investors including Felix Capital, Insight Partners, and BNF Capital.

- Tailor Brands, a branding and marketing process automation startup for small businesses, raised $50 million in Series C funding. GoDaddy led, and was joined by OurCrowd and insiders Pitango Growth, Mangrove Capital Partners, Armat Group, Disruptive VC and Richard Rosenblatt. http://axios.link/ntOg

- Pangaea Holdings, a Los Angeles e-commerce company focused on men’s personal care, raised $53 million from Eurazeo. It raised a separate $15 million in Series B funding from investors including Unilever Ventures, GPO Fund, Base10 Partners, and Gradient Ventures.

- Cape Analytics, a Mountain View, Calif.-based provider of geospatial intelligence for property risk and valuation, raised $44 million in Series C funding. Pivot Investment Partners led, and was joined by Aquiline Technology Growth and HSCM Bermuda.www.capeanalytics.com

- Block Renovation, a New York City-based renovation platform, raised $40 million in funding. Giant Ventures led the round and was joined by investors including NEA, Morningside, Lerer Hippeau, and Obvious Ventures.

- LiveControl, a Santa Monica, Calif.-based remote videography company, raised $30 million in Series A funding. Coatue led the round and was joined by investors including First Round Capital, Box Group, Susa Ventures, and TriplePoint.

- Magic, a San Francisco-based passwordless authentication tech company, raised $27 million in Series A funding. Northzone led the round and was joined by investors including Tiger Global, Volt Capital, Digital Currency Group, and CoinFund.

- Numerade, a Los Angeles-based tutoring-focused edtech, raised $26 million in Series A funding. IDG Capital led the round and was joined by investors including General Catalyst, Mucker Capital, and Kapor Capital as well as Alumni Ventures Group, Interplay Ventures, and Toy Ventures.

- Sololearn, an Armenia-based coding instruction and community app, raised $24 million in Series B funding. Drive Capital led the round and was joined by Learn Capital and Prosus Ventures.

- Dover, a recruiting platform, raised $20 million. Tiger Global led the Series A round and was joined by investors including Founders Fund, Abstract Ventures, and Y Combinator.

- Sendlane, a San Diego-based marketing automation platform, raised $20 million in Series A funding. Five Elms led the round.

- Rodo, a New York City-based car buying tech company, raised $18 million in Series B funding. Holman Enterprises and Evolution VC Partners led the round.

- Cube Dev, an open-source company for building business tech tools, raised $15.5 million in Series A funding. Decibel led the round and was joined by investors including Bain Capital Ventures, Betaworks, and Eniac Ventures.

- BlueOcean, a San Francisco-based brand marketing platform, raised $15 million in Series A funding. Insight Partners led the round.

- Vitally, a Brooklyn-based customer and sales analytics software maker, raised $9 million in Series A funding. Andreessen Horowitz led the round.

- RentSpree, a Los Angeles-based rental process software company, raised $8 million in Series A funding. 645 Ventures led the round and was joined by investors including Green Visor Capital and Vesta Ventures.

- Guidewheel , a San Francisco-based manufacturing downtime tracker, raised $8 million in Series A funding. Greycroft led the round.

- Recapped, a New York City-based maker of sales software, raised $6.3 million in seed funding. Charles River Ventures led the round and were joined by investors including Roundtable Accelerator, CoFound, AirAngels, Prime Set, Twenty5Twenty, Peter Kazanjy, and Alan Chunk.

- Visualping, a Canadian startup monitoring price drops on websites, raised $6 million in extended seed funding. FUSE led the round and was joined by investors including Mistral Venture Partners and N49P.

- Adway, a Santa Monica, Calif.-based digital ad network, raised $6 million in seed funding. Upfront Ventures led the round and was joined by investors including Revel Ventures, Watertower Ventures, and Inflection Capital.

- CloudTruth, a Boston-based company focused on the cloud, raised $5.3 million. Glasswing Ventures and Gutbrain Ventures led the round and were joined by investors including Stage 1 Ventures and York IE.

- Okendo, an Australian customer marketing platform for smaller brands, raised $5.3 million in seed funding. Index Ventures led the round.

- Cohley, a New York City-based brand content analyzation platform, raised $5 million. Right Side Capital and Active Capital led the round and were joined by investors including Attentive, Yotpo, Klaviyo, and AdRoll.

- Halla, a New York City-based startup focused on determining and steering shopper behavior in food, raised $4.5 million in Series A1 funding. Food Retail Ventures led the round.

- Traba, a light industrial worker marketplace, raised $3.6 million in Series A funding from firms like General Catalyst and Founders Fund. www.trabapro.com

- Queenly, a San Francisco-based marketplace and search engine for the formalwear industry, raised $6.3 million in funding. Andreessen Horowitz led the round.

. . .

Sustainability:

- Nature’s Fynd, a Chicago-based food company growing protein from microbes linked to geothermal springs of Yellowstone National Park, raised $350 million in Series C funding. SoftBank’s Vision Fund 2 led the round and was joined by investors including Blackstone Strategic Partners, Balyasny Asset Management, Hillhouse Investment, EDBI, SK, and Hongkou.

- ClimateAi, a San Francisco-based climate risk modelling startup, raised $12 million in Series A round funding. Radical Ventures led the round and was joined by investors including Finistere Ventures and FootPrint Coalition Ventures.

Acquisitions & PE:

- Ares Management acquired a majority stake in KPI, a Kansas City-based warehouse logistics company formed by the combination of Kuecker Logistics Group, Pulse Integration, and QC Software. Financial terms weren't disclosed.

- Zoom (Nasdaq: ZM) agreed to buy Five9 (Nasdaq: FIVN), a cloud-based call center operator, for $14.7 billion in stock (13.7% pricing premium over Friday's closing price). http://axios.link/cC7c

- Bill.com (NYSE: BILL) agreed to buy Invoice2go, a Palo Alto-based provider of accounts receivable software, for $625 million in cash and stock. Invoice2go had raised around $65 million from firms like Accel, OCV Partners and Ribbit Capital. www.invoice2go.com

-Rapid7 (Nasdaq: RPD) acquired IntSights Cyber Intelligence, a New York-based external threat protection platform, for $335 million in cash and stock. IntSights had raised over $70 million from firms like ClearSky, Qumra Capital, Blumberg Capital and Glilot Capital Partners. www.intsights.com

- Visa (NYSE: V) agreed to buy Currencycloud, a London-based foreign exchange payments automation platform, for £700 million. Currencycloud raised $188 million from firms like Visa, Sapphire Ventures, GV, Rakuten, Anthemis Group, IFC, SBI Group, BNP Paribas and Siam Commercial Bank. http://axios.link/dKRD

- Veritone (Nasdaq: VERI) acquired PandoLogic, a New York City-based hiring analytics company, for $150 million from Edison Partners.

- Taboola acquired Connexity, a Los Angeles-based e-commerce tech company, for $800 million. STG Partners backed Connexity.

. . .

IPOs:

- Outbrain, a New York-based online content marketing platform, raised $160 million in its IPO, pricing at $20 per share (below $24-$26 range). It will list on the Nasdaq (OB), and had raised nearly $400 million from firms like Viola Ventures (13.9% pre-IPO stake), Lightspeed (13.8%), Gemini Israel Ventures (10.8%) and Gruner & Jahr (5.4%). http://axios.link/JMas

- Couchbase, a Santa Clara, Calif.-based NoSQL database, raised $200 million in its IPO. It priced 8 million shares at $24, versus plans to offer 7 million at $20-$23, for a $1.2 billion fully diluted value. It will list on the Nasdaq (BASE) and raised nearly $300 million from firms like Accel (20.9% pre-IPO stake), North Bridge (13.7%), GPI Capital (13%), Mayfield (10.1%) and Adams Street Partners (5.4%). http://axios.link/bGRv

- Kaltura, a New York-based video SaaS company, raised $150 million in its IPO. It priced at $10 (vs. $11–$13 original range), for $1.24 billion market cap. It had raised over $160 million from firms like .406 Ventures (16.6% pre-IPO stake), Nexus India (15.2%), Avalon Ventures (8.5%), Intel Capital (7.6%) and Sapphire Ventures (7.6%). http://axios.link/pVzP

- Robinhood Markets, a Menlo Park, Calif.-based retail brokerage and trading company, plans to raise up to $2.3 billion in an offering of 55 million shares (up to 5% sold by insiders), priced between $38 and $42 per share. The company posted $958.8 million in net revenue in 2020 and net income of $7.4 million. DST Global, Index Ventures, NEA, and Ribbit Capital back the firm.

- Duolingo, a Pittsburgh-based language learning app company, plans to raise up to $485.1 million in an offering of 5.1 million shares priced between $85 and $95 per share. The company generated $161.7 million in revenue in 2020, and reported a net loss of $15.8 million. Union Square Ventures, CapitalG, and General Atlantic back the firm.

- PowerSchool Holdings, a Folsom, Calif.-based K-12 education technology company, plans to raise up to $789.5 million in an offering of 39.5 million shares priced between $18 and $20 per share. The company generated $434.9 million in total revenue in 2020 and reported a net loss of $46.6 million. Vista Equity Partners and Onex Partners back the firm.

- Everside Health Group, a Denver, Colo.-based direct primary care provider, filed for an initial public offering. The company generated $180.5 million in revenue in 2020 and reported a net loss of $4.8 million. NEA and Greenspring Associates back the firm.

- The Fresh Market Holdings, a Greensboro, N.C.-based gourmet grocery chain, filed for an initial public offering. The company posted sales of $1.9 billion in the year ending in Jan. 2021 and net income of $26.9 million. Apollo Global Management backs the firm.

- Thorne HealthTech, a New York City-based personalized wellness company, filed for an initial public offering. The company posted net sales of $138.5 million in 2020 and a net loss of $4 million. Mitsui Group and Kirin Holdings back the firm.

- Rent the Runway, a New York City-based clothing rental and e-commerce company, confidentially filed for an IPO, per Reuters.

- MeridianLink, a Costa Mesa, Calif.-based cloud-based product company, now plans to raise up to $312 million in an offering of 12 million shares priced between $24 and $26 per share. The company posted $199.3 million in net revenue in 2020 and net income of $9.2 million. Thoma Bravo and Serent Capital back the firm.

. . .

SPACs:

- Kin Insurance, the home insurance tech startup, will go public via merger with Omnichannel Acquisition, valuing it at $1 billion.

Funds:

- Pillar VC, a Boston-based seed-stage venture capital firm, closed its third fund with $69 million and its Pillar Select fund with $23 million.

- Moxxie Ventures, a San Francisco and Boulder-based seed-stage investor, raised $85 million for its second fund.

- Aperture Venture Capital, a New York City-based seed-stage venture firm that invests in Black, Latin and female founders, raised $75 million fund. FIS and Truist Financial anchor the fund and are joined by PayPal.

- Index Ventures, the San Francisco-based venture capital firm, raised $3.1 billion across three funds: early-stage-focused Index Ventures XI ($900 million), growth-focused Index Ventures Growth VI ($2 billion), and a previously announced seed fund ($200 million).

Final Numbers

Source: NBER; Chart: Connor Rothschild/Axios

Go deeper: COVID recession was the shortest on record