Sourcery (7/20-7/24)

Cohere Health, Sidecar Health, Hippo, Coursera, Misfit Markets, Hims, and Mercado Labs

Last Week (7/20-7/24):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into three categories, Care, Future of Work and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Cohere Health, Sidecar Health, Hippo, Coursera, Misfit Markets, Hims, and Mercado Labs. Oh, and TikTok is launching a $200M creator’s fund.

Final numbers on 2020 US IPO Performance and Total Market Cap for Top 10 Public Cos at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Care:

- Cohere Health, a Boston-based healthcare administration company between physicians and health plans, raised $10 million in Series A funding. Flare Capital Partners led the round and was joined by investors including Define Ventures.

- Sidecar Health, a Los Angeles-based digital health company for consumers to shop around for services, raised $20 million. Cathay Innovation led the round and was joined by investors including Comcast Ventures, Kauffman Fellows and Anne Wojcicki (co-founder and CEO of 23andMe).

- Tasso, a Seattle-based company with an at-home blood-testing kit, raised $17 million in Series A funding. Hambrecht Ducera Growth Ventures led the round and was joined by investors including Foresite Capital, Merck Global Health Innovation Fund, Vertical Venture Partners, Techstars, and Cedars-Sina.

- OrthoFX, a San Francisco-based orthodontic and teeth straightening service, raised $13 million in funding. Signalfire led the round.

- Vive Organic, a Venice, Calif.-based maker cold-pressed wellness shots, raised $13 million in Series B funding. Monogram Capital led the round and was joined by investors including Cambridge SPG and Powerplant Ventures.

- Sprout, a San Francisco-based platform for seeking autism care, raised $10 million in seed funding from investors including General Catalyst, Bling Capital, and Felicis Ventures.

- Neurovalens, a Belfast and San Diego-based maker of non-invasive neurostimulation products, raised £5.1 million ($6.5 million) in funding. IQ Capital led the round and was joined by investors including Wharton Asset Management Company, The Angel CoFund, Techstart Ventures, Clarendon Fund Managers, and the Government’s Future Fund.

- The Helper Bees, a New York-based home care company, raised $6 million in Series A funding. Silverton Partners led the round and was joined by investors including Austin Impact Capital, and Techstars.

- Arrive Outdoors, a Santa Monica, Calif.-based outdoor travel company, raised $4.7 million in seed funding. Freestyle Capital led the round and was joined by investors including Science Inc., Corigin Ventures, Narrative Fund, AVG Basecamp Fund, and James Reinhart and John Voris, CEO and former COO of thredUP.

- Angle Health, a San Francisco-based health insurance carrier, raised $4 million in seed funding. Blumberg Capital led the round and was joined by investors including Y Combinator, Correlation Ventures, TSVC, and Liquid 2 Ventures..

- Roundtrip, a Philadelphia-based digital healthcare transportation company, raised $4 million in funding from Motley Fool Ventures, ZOLL Medical Corp., UH Ventures, and Grays Ferry Capital.

- Ready, Set, Food, a Los Angeles-based childhood food allergy prevention startup, raised $3 million in second round funding from Danone Manifesto Ventures, Mark Cuban. and AF Ventures. www.readysetfood.com

- Readout Health, a St. Louis-based digital metabolic biomarker startup, raised $2.2 million in seed funding. iSelect Funds led the round.

- Aō Air, a Portland, Ore.-based maker of an air pollution protection device, raised $1.8m USD in funding (read here)

. . .

Future of Work:

- Innovium, a San Jose, Calif.-based a leading provider of switch silicon solutions for cloud and edge data centers, raised $170 million in funding. Investors including Premji Invest, DFJ Growth, funds and accounts managed by BlackRock, Greylock, Capricorn, WRVI, Qualcomm Ventures, Redline, S-Cubed Capital and DAG.

- Hippo, the Palo Alto-based home insurance company, raised $150 million in Series E funding, valuing its business at $1.5 billion. Investors included FinTLV, Ribbit Capital, Dragoneer and Innovius Capital.

- Talkdesk, a San Francisco-based provider of a cloud contact centers, raised $143 million, valuing it at over $3 billion. Investors included Franklin Templeton, Willoughby Capital, Skip Capital and Lead Edge Capital.

- Coursera, a Mountain View, Calif.-based online learning company, raised $130 million in Series E funding at around a $2.5 billion valuation led by return backer NEA. http://axios.link/x5sO

- Ceros, a NYC based provider of a platform to create graphics and websites without coding, raised $100M in funding (read here)

- Misfits Market, a New York-based food delivery service, raised $85 million in Series B funding. Valor Equity Partners led the round and was joined by investors including Greenoaks Capital, Third Kind Venture Capital, and Sound Ventures.

- Revolut, the five-year-old, London-based digital banking alternative for instant payment notification, free international money transfers, and global fee-free travel, the just announced that it has raised $80 million as part of its Series D round that it announced in February. The new influx of funding comes from TSG Consumer Partners.The round, which saw it raise $500 million led by TCV at a $5.5 billion valuation, now stands at $580 million; the valuation remains the same. TechCrunch has more here.

- Quantexa, a London-based decision intelligence software company, raised $64.7 million in Series C funding. Evolution Equity Partners led the round and was joined by investors including Dawn Capital, AlbionVC, HSBC, British Patient Capital,ABN AMRO Ventures, and Accenture Ventures.

- Dexterity Robotics, a Palo Alto, Calif.-based robot-as-a-service startup, raised $56 million from Lightspeed Venture Partners, Kleiner Perkins, and Obvious Ventures. http://axios.link/6JD6

- AB Tasty, a New York-based customer experience company, raised $40 million in funding. Credit Mutuel Innovation led the round and was joined by investors including Korelya Capital, Omnes, Partech and XAnge. Read more.

- Chowbus, a Chicago-based food delivery app specific to Asian restaurants and grocery stores, raised $33 million in Series A funding. Altos Ventures and Left Lane Capital led the round and were joined by investors including Hyde Park Angels, Fika Ventures, FJ Labs, and Silicon Valley Bank.

- Wave.tv, a sports media startup, raised $32 million in equity and debt funding during its Series A. CoVenture and GPS Partners led the round. Read more.

- CyCognito, a 3.5-year-old, Palo Alto, Ca.-based network security analysis platform whose bot network probes potential attack vectors, has raised $30 million in Series B funding. Accel led the round, joined by earlier investors Lightspeed Venture Partners, Sorenson Ventures and UpWest. VentureBeat has more here.

- CreatorIQ, a 6.5-year-old, Culver City, Ca.-based maker of influencer marketing software, has raised $24 million in Series C funding. Kayne Anderson led the round, joined by TVC Capital and Unilever Ventures. Built in L.A. has more here.

- Branch, an Ohio-based startup that bundles home and auto insurance, raised a $24 million in Series A funding. Greycroft and HSCM Bermuda co-led the round and were joined by investors including SignalFire, SCOR Global P&C, and Elefund.

- Propeller, a Denver-based developer of 3D mapping and worksite analytics hardware and software, raised $18 million in Series B funding co-led by Blackbird and Costanoa Ventures. http://axios.link/OFqc

- CalypsoAI, a Washington, D.C.-based cybersecurity provider for artificial intelligence, raised $13 million in Series A funding. Paladin Capital Group led the round and was joined by investors including Frontline Ventures, 8VC, Lightspeed Venture Partners, Lockheed Martin Ventures, Manta Ray Ventures, and Pallas Ventures.

- Mira, a Los Angeles-based augmented reality startup, raised $13 million. Sequoia Capital and Happiness Ventures led the round and were joined by Blue Bear Capital.

- Shelf Engine, a five-year-old, Seattle-based company that optimizes the process of stocking store shelves for supermarkets and groceries, has raised $12 million in financing to go to market. Initialized Capital and GGV Capital led the round, joined by Foundation Capital, Bain Capital, 1984 and Correlation Ventures. TechCrunch has more here.

- Religion of Sports, a sports media company co-founded by Gotham Chopra, Tom Brady and Michael Strahan, raised $10 million in funding. Investors included Elysian Park, Advancit, Courtside Ventures and LinkinFirm.

- Meemo, a San Francisco-based social financial application, raised $10 million in funding. Investors include Saama Capital, Greycroft, monashees and Sierra Ventures.

- Mitiga, a hybrid managed service for incident readiness and response, raised $7 million in seed funding from Clearsky Security. Glilot Capital, Flint Capital, Rain Capital, and DNX Ventures. www.mitiga.io

- Episode Six, an Austin-based financial technology provider, raised $7 million in Series A funding. HSBC led the round and was joined by investors including Mastercard and SBI Investment Co.

- MeetElise, a New York-based leasing agent software, raised $6.5 million in Series A funding. Navitas Capital led the round.

- Kudo, a New York-based multilingual web conferencing platform, raised $6 million in seed funding. Felicis Ventures' Niki Pezeshki led the round and was joined by investors including Global Founders Group, ID8 Investments and Advancit Capital.

- Claim Genius, a three-year-old, Iselin, N.J.-based startup that produces instant vehicle damage assessments, has raised $5.5 million in Series A funding from Financial Link and SIRI Info Solutions. More here.

- Safehub, a San Francisco-based platform for building earthquake damage information, raised $5 million in seed funding. Fusion Fund and Ubiquity Ventures co-led the round and were Bolt, Promus Ventures, Blackhorn Ventures, Maschmeyer Group Ventures, and Team Builder Ventures.

- Sotero, a Burlington, Mass.-based maker of a data protection platform, raised $5 million in funding. Gutbrain Ventures led the round and was joined by investors including Boston Seed Capital and PBJ Capital.

- SmartHop, a Miami, Fla.-based dispatch solution for small trucking companies, raised $4.5 million in seed funding. Equal Ventures led, and was joined by Greycroft and Las Olas VC. www.smarthop.co

- Enduvo, a Chicago-based no-code AR/VR platform, raised $4 million in seed funding. Math Venture Partners led, and was joined by UL Ventures. http://axios.link/MAxn

- Turbo Systems, a Campbell, Calif.-based no-code engagement platform, raised $3.5 million in extended Series A funding. Mayfield led the round and was joined by investors including B Capital and Nassau Street Ventures.

- Matik, a San Francisco-based startup focused on business reports, raised $3 million in seed funding. Menlo Ventures led the round and was joined by investors including BoxGroup and Oceans Ventures. Read more.

- Rah Rah, a New York-based provider of community engagement software for higher ed, raised $2.8 million in seed funding from Workday co-founder Dave Duffield and vice chairman Phil Wilmington. http://axios.link/D6uD

- FLX Distribution, a Basking Ridge, N.J.-based networking platform for asset management firms and independent distribution professionals, raised $2.5 million in seed funding led by RiverNorth Capital Management. www.flxdst.com

- Quorum Chat, a 14-month-old, Dublin, Ireland-based mobile chat startup, has raised $2 million in seed funding co-led by Adjacent and LocalGlobe. Earlier backers Amaranthine and Y Combinator also joined the round. The Irish Times has more here.

- Buzz Solutions, a Palo Alto, Calif.-based ai image analyzation maker for detecting infrastructure flaws, raised $1.2 million. Blackhorn Ventures led the round and was joined by investors including Ulu Ventures, Vodia Ventures, and Advisors.fund.

- Teller, a San Francisco, CA-based blockchain project for decentralized lending incubated by A16Z’s crypto startup school, raised $1m in seed funding (read here)

. . .

Sustainability:

- Taranis, a Sunnyvale, Calif.-based agricultural company, raised $30 million in Round C funding. Vertex Growth and Kuok Group’s Orion Fund led the round. New investors in this round include Hitachi Ventures, Mitsubishi UFJ Capital, Micron Ventures, UMC Capital, La Maison, Mindset Ventures, iAngels and Gal Yarden.

- Sea Machines Robotics, a six-year-old, Boston-based company that makes a line of autonomous control and navigation systems for commercial boats and ships, has raised $15 million in Series B funding. Accomplice led the round, joined by Toyota AI Ventures, Brunswick, Geekdom Fund, NextGen Venture Partners, Eniac VC, and LaunchCapital. VentureBeat has more here.

- Mori (formerly known as Cambridge Crops), a Boston, MA-based food tech company reducing waste and creating a more sustainable supply chain, raised $12m in Series A funding (read here)

- Afresh Technologies, a San Francisco-based AI-based supply chain platform for grocers, raised $12 million in Series A funding. Innovation Endeavors led the round and was joined by investors including Food Retail Ventures, Maersk Growth, Impact Engine, and existing investor Baseline Ventures.

- Smol, a London-based detergent-to-your-door brand, raised £8 million in Series A funding. Balderton Capital led the round and was joined by investors including JamJar Investments.

- Mercado Labs, a Dallas-based supply chain platform maker, raised $2.5 million. Investors included Supply Chain Ventures, LiveOak Venture Partners, Schematic Ventures, Story Ventures, and Amplifier.

PE:

- Rosetta Stone (NYSE: RST) is considering strategic alternatives, including a possible sale, per Bloomberg. The language learning software provider has a market cap of nearly $500 million. http://axios.link/Uwfv

- Sumeru Equity Partners invested $100 million in Ceros, a New York-bsed cloud-based design platform.

- Parthenon Capital recapped Nuvem Health , a Mount Laurel, N.J.-based provider of pharmacy claims administration. Financial terms weren't disclosed.

. . .

IPOs:

- Jamf, a Minneapolis-based Apple device management company, raised $468 million in an offering of 18 million shares priced at $26. It posted revenue of $204 million in 2019 and a loss of $32.6 million. Vista Equity backs the firm. It plans to list on the Nasdaq as “JAMF.” Read more.

- Topgolf, a Dallas-based driving range company, is reportedly going public via merger with Churchill Capital Corp II, a SPAC. Read more.

- Ant Financial, the fin-tech unit of Alibaba Group (NYSE: BABA), said it’s begun the process of a dual listing in Hong Kong and Shanghai. Reuters recently reported on the plans, which the company at the time denied. http://axios.link/HLsu

- Vertex, a King of Prussia, Penn.-based provider of business tax software, set IPO terms to 21.15 million shares at $14-$16. It would have a market cap of $2.15 billion, were it to price in the middle, and plans to list on the Nasdaq (VERX) with Goldman Sachs and Morgan Stanley as lead underwriters. The company reports $7.3 million of net income on $75 million in revenue for Q1 2020. http://axios.link/PeQk

- Hims, the three-year-old, San Francisco-based, venture-backed online provider of mens’ healthcare and consumer products, ranging from hair loss treatments to Viagra, is exploring going public through a merger with a blank-check acquisition company that could value it at more than $1 billion, according to The Business of Fashion. It says Hims is already working with investment bank LionTree Advisors on negotiating a potential sale to a SPAC. More here.

- Duck Creek Technologies, a 20-year-old, Boston-based company that sells software-as-a-service to insurers including Liberty Mutual, The Progressive Corp. and American International Group and is majority owned by Apax Partners, just filed to go public. The offering will be "closely watched by the startups in Greater Boston’s burgeoning insurance technology sector," says the Boston Business Journal.

. . .

SPACS:

- Pershing Square Tontine Holdings, a New York-based SPAC founded by Bill Ackman, raised $4 billion in an offering of 200 million units priced at $20 apiece. Read more.

- BowX Acquisition, a SPAC formed by Sacramento Kings owner and Bow Capital founder Vivek Ranadivé, filed for a $350 million IPO. http://axios.link/pit3

- Holicity, a TMT-focused SPAC led by telecom exec Craig McCaw, filed for a $250 million IPO. http://axios.link/ampu

- Yucaipa Acquisition, a SPAC led by private equity exec Ron Burkle, filed for a $300 million IPO. http://axios.link/0jtD

- Gores Holdings V, a new SPAC led by Alex Gores, filed for a $400 million IPO. http://axios.link/Wj7c

- ARYA Sciences Acquisition III, a New York-based blank check company focused on healthcare, filed to raise up to $125 million. Perceptive Advisors backs the firm. Read more.

- Property Solutions Acquisition, a real estate-focused SPAC, raised $200 million in its IPO. http://axios.link/wEH9

- Dragoneer Investment Group, a growth equity firm known for investments in high-profile technology companies, is the latest investor to join the blank-check company rush. Dragoneer Growth Opportunities Corp. filed today with the SEC for an IPO that would raise $600 million. The special purpose acquisition company, or SPAC, plans to sell 60 million units at $10 each, according to the filing. Bloomberg has the story here.

. . .

Acquisitions:

- Autodesk (Nasdaq: ADSK) agreed to buy Pype, a Herndon, Va.-based provider of automation software for construction project management that had raised VC funding from firms like Blackhorn Ventures. www.autodesk.com

Funds:

- CRV, a San Francisco, Palo Alto and Boston, MA-based venture capital firm, closed CRV XVIII, a $600m early-stage venture capital fund (read here)

- Forerunner Ventures raised $500 million for its fifth fund. www.forerunnerventures.com

-TikToklaunched a $200 million content creator fund.

- Abby Levy, a former SVP at SoulCycle and the president for roughly 15 months at Thrive Global (the wellness company founded by Arianna Huffington), is raising looking to raise up to $40 million for a venture fund under the brand Primetime Partners. The outfit's focus is on "transforming the quality of living for older adults," and according to an SEC filing first flagged by Axios, it has already secured $32 million in capital commitments.

2020 US IPO Performance

Source: Renaissance Capital. Data through July 21, 2020

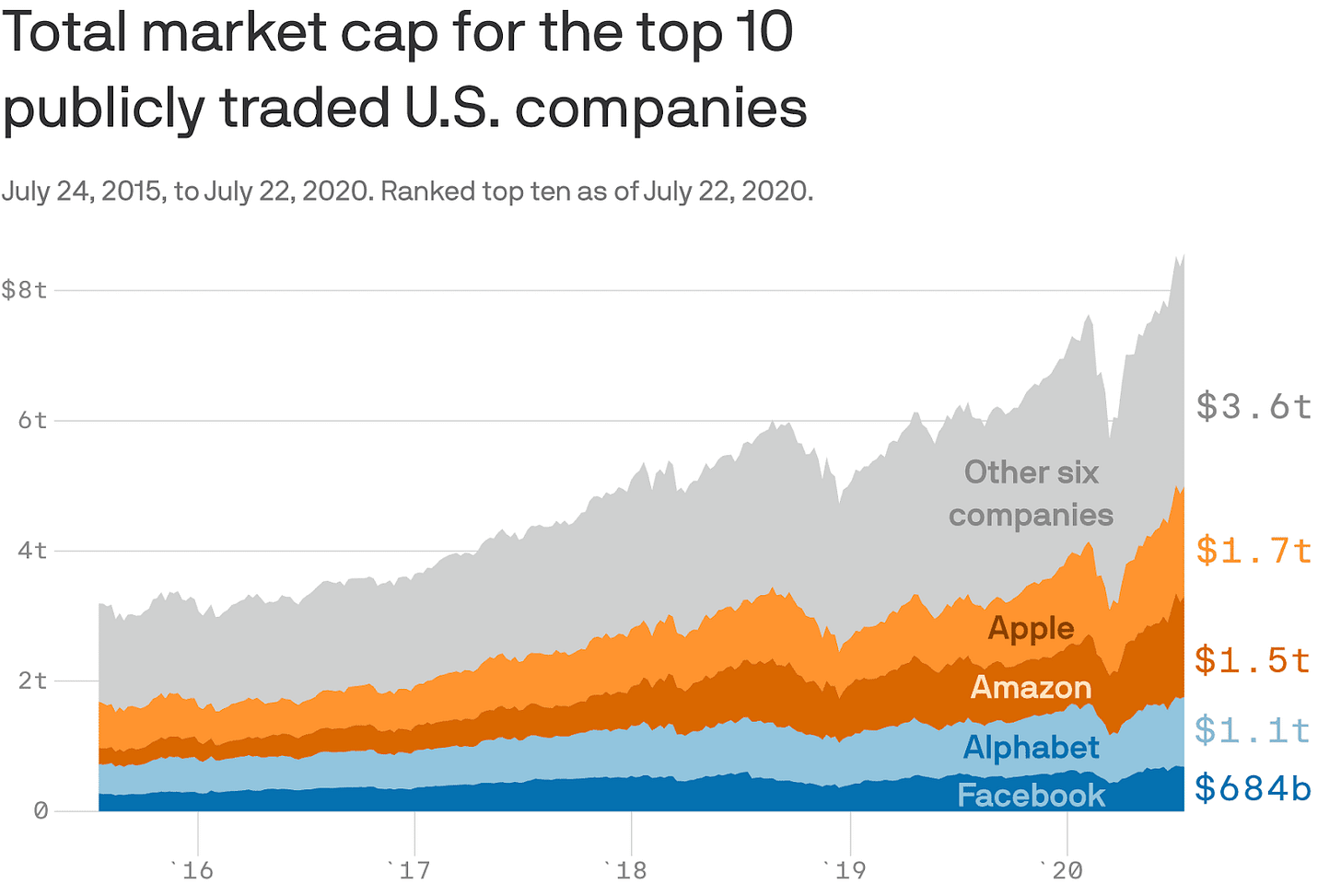

Total Market Cap for Top 10 Public Cos

Data: FactSet; Chart: Naema Ahmed/Axios

Go deeper: Big tech's Congressional antitrust hearing has been postponed