Sourcery (7/25-7/29)

J-Hope ~ Aptos Labs, Unstoppable Domains, Balance, Shares, PriceLabs, Pogo, DSCVR, Reserv, Cleerly, Everside Health, Sage, Summer Health, Lottie, Mable, Whatnot, Kitchen United, Cordial

Chicawgo

First, a HUGE congrats to everyone at Upfront Ventures for the announcement of the new funds and more. Very excited to watch the fund continue to lead the tech community here in Los Angeles across early and growth stages for the years to come. Partner Mark Suster, went deep on the release here: Upfront Ventures Raises > $650 Million for Startups and Returns > $600 Million to LPs

Disclosure: I am an investor at Upfront Ventures

Second, this past week I made a trip out to Chicago for work and a little bit of Lollapalooza. Since I already finished jeen-yuhs, to prepare myself for my journey to Chi-town I started watching The Bear on Hulu. If you haven't seen this, get on it. If you have high blood pressure, be careful. Lots of chef-aggravated yelling.

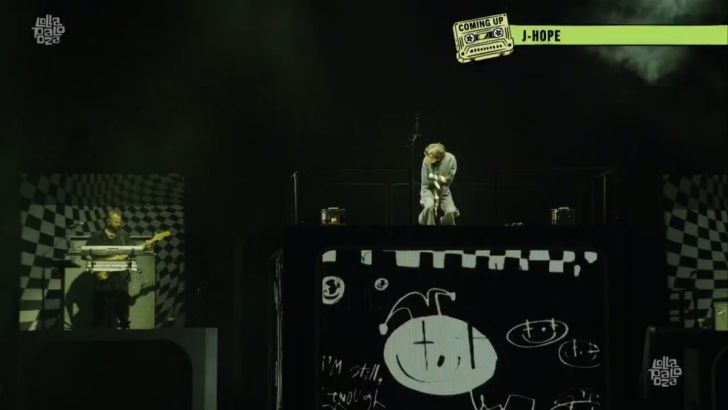

A couple quick observations of the capital of the midwest: it is lovely, the tech scene is humming, the riverwalk is beautiful, the architecture is iconic (AD slideshow here), the people have true midwestern charm, there are lots of Irish people/pubs, and J-Hope (frmly of BTS) absolutely ROCKED the city. DJ D-Sol on the other hand…

Lastly, and most surprisingly. Unlike NYC, Chicago takes deep pride in its smells, and I had no idea. Read the comments to hear about all of the exotic varieties:

P.S. If you have had issues with opening any links from Sourcery here are some tips:

Click out of the email window and open the newsletter in the Substack view

This should automatically resolve within 24 hours of email publishing

Use Chrome or another browser with limited security details (ie. not Brave)

If you have any more issues please email me, I understand this is not ideal!

Follow us on Twitter Linkedin for just the top deals recap

. . .

Last Week (7/25-7/29):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include: Aptos Labs, Unstoppable Domains, Balance, Shares, PriceLabs, Pogo, DSCVR, Nada, Reserv, Cleerly, Everside Health, Theator, Leapfin, Sage, Summer Health, Lottie, Mable, Whatnot, Kitchen United, Spotnana, Cordial, Nabr, Retool, PunchListUSA, Neon, Switchboard, Nash, Butlr, Paragon, Fly.io, Evabot, Players’ Lounge, Datch, Resourcely, XY Sense, ChiselStrike, Impart Security, PixieBrix, Kona, Shypyard, Stack, Arable, Blue Frontier; OpenGov, Spotify; Getty Images

Final numbers on E-Commerce as a % of total retail sales at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Aptos Labs, a Palo Alto, Calif.-based blockchain startup, raised $150m in Series A funding led by FTX Ventures and Jump Crypto, with Andreessen Horowitz, Multicoin Capital, Circle Ventures, and others also participating. Read more.

- Unstoppable Domains, a San Francisco-based NFT domain name provider, raised $65m in Series A funding at a $1bn valuation led by Pantera Capital, with Mayfield, Gaingels, Alchemy Ventures, Redbeard Ventures, Spartan Group, OKG Investments, Polygon, CoinDCX, CoinGecko, We3 syndicate, Rainfall Capital, Broadhaven, EI Ventures, Hard Yaka, Alt Tab Capital, Boost VC, and Draper Associates also participating. Read more.

- Balance, a New York-based B2B e-commerce payments startup, raised $56m in Series B funding led by Forerunner Ventures, with Salesforce Ventures, Hubspot Ventures, Lyra Ventures, and Gramercy Ventures also participating. www.getbalance.com

- Shares, a U.K.-based investment app, raised $40m in Series B funding, led by Valar Ventures. Read more.

- PriceLabs, a Chicago-based pricing and revenue management solutions provider for the short-term rental industry, raised $30 million in funding from Summit Partners.

- Genesis Global, a Miami-based application development platform for financial markets organizations, raised $20 million in funding. Bank of America, BNY Mellon, and Citi invested in the round.

- Topl, an Austin-based blockchain startup, raised $15m in Series A funding led by Mercury, Republic Asia, and Cryptology Asset Group. www.topl.co

- Pogo, a New York-based consumer financial app, raised $14.8m in seed funding led by Buckley Ventures, with Slow Ventures, Village Global, 20VC, Night Ventures, Hyper, Shrug, the Chainsmokers, Sophia Amoruso, Ryan Tedder, Lenny Rachitsky, and others also participating. www.joinpogo.com

- DSCVR, a Los Angeles-based web3 social network, raised $9m in seed funding led by Polychain Capital. www.dscvr.one

- Nada, a Dallas-based real estate fintech startup, raised $8.1m in seed funding led by LiveOak Venture Partners, with Revolution’s Rise of the Rest Seed Fund, Capital Factory, 7BC Venture Capital, Sweater Ventures, LFG Ventures, Badra Capital, and Stonks Fund also participating. www.nada.co

- Reserv, a New York-based claims adjusting software startup, raised $8m in seed funding led by Altai Ventures and Bain Capital Ventures. www.reserv.com

- Alchemon, a Portland, Ore.-based NFT staking, crafting, and trading card game, raised $1 million in funding. Borderless Capital led the round and was joined by investors including Pillar VC and Yieldly.

- FinLync, a New York-based corporate finance software startup, raised an undisclosed amount from Workday Ventures. www.finlync.com

. . .

Care:

- Cleerly, a New York-based heart disease treatment and analytics company, raised $188 million in Series C funding. T. Rowe Price and Fidelity led the round and were joined by investors including Sands Capital, Piper Sandler’s Merchant Banking, Heartland Healthcare Capital funds, Mirae Asset Capital, Peter Thiel, Breyer Capital, Vensana Capital, LRVHealth, New Leaf Ventures, Cigna Ventures, and DigiTx Partners.

- Everside Health, a Denver-based primary care company, raised $164m in growth equity funding at a valuation above $1bn, led by NEA, with Oak HC/FT, Alta Partners, Endeavor Catalyst and others also participating, per Axios Pro’s Sarah Pringle. Read more.

- Theator, a Palo Alto, Calif.-based surgical intelligence platform, raised $24 million in Series A extension funding. Insight Partners led the round and was joined by investors including Blumberg Capital, Mayo Clinic, NFX, StageOne Ventures, iAngels, former Netflix CPO Neil Hunt, iCON, and TripActions’ CEO and co-founder Ariel Cohen.

- Leapfin, a San-Francisco-based financial data management startup, raised $12.2m in Series A funding led by Crosslink Capital, with Work-Bench and Uncorrelated also participating. Read more.

- Sage, a New York-based provider of nurse call systems at senior living facilities, raised $9m in seed funding led by Goldcrest Capital, with ANIMO Ventures, Distributed Ventures and Merus Capita also participating. Read more.

- Summer Health, a New York-based telehealth pediatrics startup, raised $7.5m in funding led by Sequoia Capital and Lux Capital, with Box Group, Chelsea Clinton, Metrodora Ventures, Shrug Capital, Springbank Collective, Coalition Operators, Moving Ventures, and Kate Ryder, Andrew Dudum, Amira Yahyoui, Alyssa Jaffee and others also participating. www.summerhealth.com

- Lottie, a U.K.-based elder care marketplace, raised €7m million in new funding at a €52m valuation led by General Catalyst. Read more.

- RxLive, a St. Petersburg, Fla.-based telehealth pharmacy, raised $5m in Series A funding led by SpringTide with Cardinal Health also participating. www.rxlive.com

- Mulberri, a Sunnyvale, Calif.-based business insurance company, raised $4m in seed funding led by Hanover Technology Management, MS&AD Ventures and Altamont Capital Partners. https://www.mulberri.io/

- Mable, a San Francisco-based migraine telehealth company, raised $3.2m in seed funding led by Y Combinator and Illumina, with First In Ventures, Arkitekt Ventures, and Inaki Berenguer also participating. Read more.

- Remble, a Tulsa, Okla.-based relationship coaching and mental health app, raised $1.4m in pre-seed funding led by Atento Capital. www.remble.com

. . .

Enterprise & Consumer:

- Whatnot, a Marina Del Rey, Calif.-based live stream shopping platform, raised $260 million in Series D funding. CapitalG and DST Global led the round and were joined by investors including BOND, a16z, and YC Continuity.

- Kitchen United, a Pasadena, Calif.-based ghost kitchen and restaurant hub technology company, raised $100 million in Series C funding. Circle K, Kroger, Restaurant Brands International, B. Riley Venture Capital, Simon, Phillips Edison & Co, The HAVI Group, GV, and others invested in the round.

- Spotnana, a New York-based corporate travel management software company, raised $75 million in Series D funding. Durable Capital led the round and was joined by investors including Madrona, ICONIQ Growth, Mubadala Capital, and Blank Ventures.

- Cordial, a San Diego-based marketing and data management platform for brands, raised $50 million in a Series C funding. NewSpring led the round and was joined by ABS Capital.

- Nabr, a New York-based direct-to-consumer housing startup, raised $48m in equity and debt funding led by 2150. Read more.

- Retool, a San Francisco-based software developer tools startup, raised $45m in additional Series C funding at a $3.2b valuation from Sequoia Capital, John and Patrick Collison, Nat Friedman, Elad Gil, Daniel Gross, and Caryn Marooney. Read more.

- PunchListUSA, a Charleston, S.C.-based home repair data and services marketplace, raised $39m in funding led by Sweetwater Private Equity and Morpheus Ventures, with Home Depot Ventures, Second Century Ventures, Palm Drive Capital, IDEA Fund Partners, Meeting Street Capital, Solo Capital Management, VentureSouth, and others also participating. www.punchlistusa.com

- Neon, a San Francisco-based Postgres database services startup, has raised $30m in additional Series A funding led by GGV Capital, with Khosla Ventures, General Catalyst, Founders Fund, Elad Gil, Nat Friedman, Ajeet Singh, Guillermo Rauch, Wes McKinney, Ryan Noon and Søren Brammer Schmidt also participating. Read more.

- Switchboard, a San Francisco-based remote work collaboration startup, raised $25m in Series A funding led by Icon Ventures, with Sequoia Capital, XYZ Venture Capital, and Spark Capital also participating. Read more.

- MenuSifu, a New York-based restaurant POS company, raised $20m in Series B funding led by Challenjers Venture. www.menusifu.com

- Bryte, a Los Altos, Calif.-based connected mattress company, raised $20m in funding led by Tempur Sealy, with ARCHina Capital and others also participating. www.bryte.com

- TestFit, a Dallas-based real estate modeling software company, raised $20m in Series A funding led by Parkway Venture Capital. www.testfit.io

- Nash, a San Francisco-based delivery management startup, raised $20m in Series A funding led by Andreessen Horowitz, with Y Combinator and Rackhouse Venture Capital also participating. www.usenash.com

- Butlr, a Burlingame, Calif.-based anonymous people sensing platform, raised $20 million in Series A funding. Tiger Global and Analog Devices co-founder Ray Stata co-led the round and were joined by investors including E14, Union Labs, Hyperplane Venture Capital, and Tectonic Ventures.

- Paragon, a Los Angeles-based maker of Saas app integration software tools, raised $13m in Series A funding led by Inspired Capital, with FundersClub and Garuda Ventures also participating. www.useparagon.com

- Fly.io, a Chicago-based cloud infrastructure startup, raised $12m in Series A funding led by Intel Capital and $25m in Series B funding led by Andreessen Horowitz, with Dell Technologies Capital, Initialized Capital and Sam Lambert also participating. www.fly.io

- Cartona, an Egyptian e-commerce supply chain marketplace, raised $12m in Series A funding, led by Silicon Badia, with SANAD Fund, Arab Bank Accelerator and Sunny Side Ventures also participating. Read more.

- Evabot, a San Francisco-based corporate gifting startup, raised $10.8m in funding led by Comcast Ventures, with Alumni Ventures, Bloomberg Beta, Precursor Ventures, Forefront Venture Partners and Silicon Valley Bank also participating. Read more.

- Players’ Lounge, a New York-based prize-based gaming startup, raised $10.5m in Series A funding led by Griffin Gaming Partners and Comcast Ventures, with Samsung Next, Vice Ventures, WndrCo, Sharp Alpha Partners, True Capital, Myles Garrett, Josh Norman and Breanna Stewart also participating. Read more.

- Datch, a leading provider of voice-first AI solutions for industrial operations, announced its $10m Series A funding round led by Blackhorn Ventures alongside existing investors Blue Bear Capital, Stage Venture Partners, Boeing Horizon X, and Plug and Play. www.datch.io

- Stadium Live, a Toronto-based sports platform in the metaverse, raised $10 million in Series A funding. KB Partners and Union Square Ventures led the round and were joined by investors including 35 Ventures, Origins Fund, Dapper Labs Ventures, Position Ventures, Valhalla Ventures, 6th Man Ventures, Alumni Ventures, and Breakout Capital.

- Resourcely, a San Jose, Calif.-based cloud management software startup, raised $8m in seed funding led by Andreessen Horowitz and Felicis, with Michael Coates, Talha Tariq, Philip Martin, and others also participating. www.resourcely.io

- XY Sense, an Australian occupancy sensing and analytics startup, raised $8m in new seed funding led by InterValley Ventures, with JCI Ventures and Blackbird also participating. Read more.

- ChiselStrike, a fully distributed backend software maker, raised $7m in seed funding led by Norwest Venture Partners, with Blumberg Capital, Jamstack Innovation Fund, Essence VC, First Star Ventures, and Mango Capital also participating. www.chiselstrike.com

- Impart Security, a Miami-based API security company, raised $6m in seed funding led by CRV, with Haystack, 8-bit Capital, and O'Reilly AlphaTech Ventures also participating. www.impart.security

- PixieBrix, a New York-based low-code web interface automation startup, raised $5.4m in Series A funding from New Enterprise Associates. www.pixiebrix.com

- Kona, a San Francisco-based remote workplace engagement startup, raised $4m in seed funding led by Unusual Ventures, with Evolutionary Ventures, 2.12 Angels, Louis Beryl, David Carrico, James Beshara, Jeff Wilke, and others also participating. www.heykona.com

- Shypyard, a New York-based e-commerce business planning tools makers, raised $3m in seed funding led by Gradient Ventures, with Liquid 2 Ventures, Position Ventures, and others also participating. www.shypyard.com

- Stack, a Dutch maker of a multiplayer spatial browser, raised a $2.5m in seed funding led by Lunar Ventures, with Wayra X, Zemu Venture Capital, Peak Capital, and Charles Songhurst also participating. www.stackbrowser.com

- Island, a Dallas-based enterprise software management tool, raised an undisclosed amount of funding from Cisco Investments as part of its Series B round. www.island.io

. . .

Sustainability:

- Arable, a San Francisco-based agricultural field intelligence company, raised $40m in series C funding led by Galvanize Climate Solutions, with Qualcomm Ventures, Prelude Ventures, S2G Ventures, Ajax Strategies, Grupo Jacto, Middleland Capital, M2O and iSelect also participating. www.arable.com

- Blue Frontier, a Boca Raton, Fla.-based ultra-efficient air conditioning technology company, raised $20m in Series A funding led by Breakthrough Energy Ventures, 2150 Urban Tech Sustainability Fund and VoLo Earth Ventures. www.bluefrontierac.com

Acquisitions & PE:

- FTX is reportedly in talks to potentially acquire Bithumb, a South Korea-based crypto exchange, per Bloomberg. Read more.

- OpenGov, backed by Cox Enterprises, acquired Cartegraph, a Dubuque, Iowa-based infrastructure and building management software company backed by Pamlico Capital. www.cartegraph.com

- Summit Partners invested $30m into PriceLabs, a Chicago-based provider of dynamic pricing and revenue management tools for short-term rentals. www.hello.pricelabs.co

- Spotify has paid €291 million ($295 million) for Findaway, Podsights, Chartable and Sonantic, per a regulatory filing. Read more.

. . .

IPOs:

- Mobile Global Esports, a San Clemente, Calif.-based developer of an esports platform for university competitions in India and South Asia, raised $6m by offering 1.5m shares at $4. It plans to list on the Nasdaq under the symbol MGAM. WestPark Capital acted as sole bookrunner on the deal. Read more.

. . .

SPACs:

- Getty Images completed its SPAC merger with CC Neuberger II, giving it an enterprise value of $4.8bn. It started trading on the NYSE on Monday. Read more.

Funds:

- Upfront Ventures raised $280m for its seventh early-stage venture fund, $200m for its third growth fund, and $175m for its continuation fund. Read more.

- Interplay is raising $10m for its inaugural blockchain-focused venture fund. www.interplay.vc/blockchain

Final Numbers

Data: U.S. Census Bureau; Chart: Erin Davis/Axios Visuals

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

Yes enjoyed the upfront Venture article about the Funds. Y’all are doing it big. Thank you for all you do for our tech community. Holla at ya app Hairstyleglam Hairstyleglamonthego Instagram we got some other great apps were coming out with. But yes really it’s refreshing having a company like you all who get us. And are so friendly and supportive. Can’t say enough about your company and the selflessness. Really you are the gold standard in venture capitalist.

Can I say something? I thoroughly enjoyed this read. It was amazing. So here’s my take. Do you think J Hop is the next Harry Styles? And how would you compare J hops performance to Harry Styles headlining Coachella? Also thank you for the suggestion of the bear. It’s been on my list. I’ve been watching Better Call Saul and Animal Kingdom!! And bummed these are the final seasons. Spoiler alert if you are watching better call saul you might want to watch this week. Walter White and Jesse Pinkmam sighting. Gotta get back to watching Ozark. This was so exciting and Awesome. Keep it up Molly. I keep saying we need a Sourcery podcast. I’d like your opinion on all this stuff. Cause your so brilliant.