Sourcery (7/26-7/30)

iCapital Network, Ramp, Fireblocks, Lithic, Lolli, Landis, Quansa, Relief, SonderMind, Embark, Veda, Lalo, Oova, goPuff, DataRobot, Squire, Varda Space, inVia Robotics...

Last Week (7/26-7/30):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech,Care, Future of Work, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include iCapital Network, Ramp, Fireblocks, Lithic, Eco, Spot, Cobee, Sila, Lolli, Landis, Quansa, Relief, SonderMind, Embark, ByHeart, Elvie, Veda, Eterneva, Lalo, Oova, goPuff, DataRobot, Contentful, 1Password, Bubble, Covariant, Homebase, Squire, Replicated, Varda Space, Blameless, inVia Robotics, Zenput, Quotapath, Hightouch, Launchable, Norby, Freightify, Serverless Stack, Rivian, NotCo; Clarabridge, APPRL; Duolingo, Riskified, MeridianLink; Vacasa, Nanosys, Manscaped

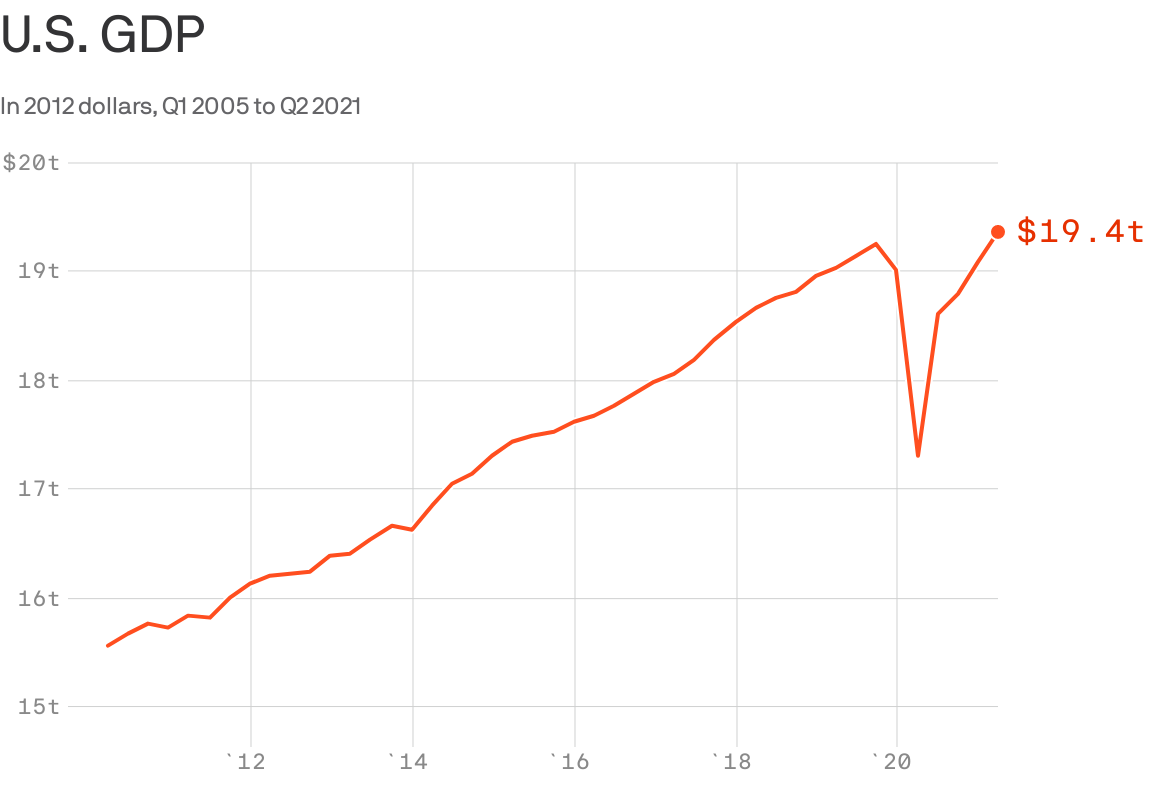

Final numbers on US GDP at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- iCapital Network, a New York-based fintech platform for alternative investing, raised $440 million in equity funding at around a $4 billion valuation. Temasek led, and was joined by Owl Rock, MSD Partners, Noah Holdings, Golub Capital, WestCap, Ping An Voyager Partners, Blackstone, UBS, Pivot Investment Partners, BNY Mellon, Wells Fargo, Morgan Stanleyand Goldman Sachs.www.icapitalnetwork.com

- Ramp, a New York City-based corporate card startup, is in talks to raise at a $3.8 billion valuation, per the Information. Founders Fund is set to lead.

- Fireblocks, a New York City-based digital asset custody company, raised $310 million in Series D funding valuing the business at $2 billion. Sequoia Capital, Stripes, Spark Capital, Coatue, DRW VC, and SCB 10X.

- Solarisbank, a Berlin-based fintech startup, raised €190 million ($224 million) in Series D funding valuing it at €1.4 billion ($1.7 billion). Decisive Capital Management led the round and was joined by investors including Pathway Capital Management, CNP,Ilavska Vuillermoz Capital, Yabeo Capital, BBVA, Vulcan Capital, and HV Capital.

- Nium, a payments platform, raised over $200 million in Series D funding. Riverwood Capital led the round and was joined by investors including Temasek, Visa, Vertex Ventures, Atinum Group of Funds, Beacon Venture Capital, and Rocket Capital Investment.

- At-Bay, a Mountain View, Calif.-based insurance company, raised $185 million in Series D funding. Icon Ventures and Lightspeed Venture Partners led the round valuing it at $1.4 billion.

- Yoco, a South African payments and software company, raised $83 million in Series C funding. Dragoneer Investment Group led the round and was joined by investors including Breyer Capital, HOF Capital, The Raba Partnership, 4DX Ventures, and TO Ventures.

- Lithic, a New York City-based card issuing platform for developers, raised $60 million in Series C funding. Stripes led the round and was joined by investors including Bessemer Venture Partners, Index Ventures, Exor, Rainfall, Tusk Venture Partners, and Commerce Ventures.

- FRISS, a fraud prevention and detection solutions for insurers, raised $65 million in Series B funding. Accel-KKR led the round.

- Eco, a San Francisco-based, crypto-focused digital wallet platform, raised $60 million in Series B funding. Activant Capital and L Catterton led the round.

- Zilch, the London-based buy-now-pay-later fintech, raised about $55 million in funding. Investors in the round included Goldman Sachs Asset Management and DMG Ventures.

- La Haus, a Mexico City-based home buying marketplace, raised $50 million in Series B funding. Acrew Capital and Renegade Partners led the round.

- Paystand, a Scotts Valley, Calif.-based blockchain-enabled payment network, raised $50 million in Series C funding. NewView Capital led the round and was joined by investors including SoftBank’s Opportunity Fund, King River Capital, Industrious Ventures, and Transform Capital.

- Vauld, a Singapore-based crypto trading and borrowing platform, raised $25 million in Series A funding. Valar Ventures led the round and was joined by investors including Pantera Capital, Coinbase Ventures, CMT Digital, Gumi Cryptos, Robert Leshner, and Cadenza Capital.

- Valora, a mobile digital wallet, raised $20 million Series A funding. Investors included Andreessen Horowitz, Polychain Capital, SV Angel, Nima Capital, NFX, and Valor Capital.

- Behalf, a New York and Israel-based provider of buy-now-pay-later, raised $19 million in funding. Migdal Insurance and La Maison Partners led the round and were joined by investors including MissionOG, Viola Growth, Viola Credit, and Vintage Investment Partners.

- Spot, an Austin-based injury insurance provider, raised $17.5 million in funding. GreatPoint Ventures led the round and was joined by investors including Montage Ventures, Silverton Partners, Mutual of Omaha, and MS&AD.

- Cobee, a Madrid-based employee benefits management software maker, raised €14 million ($17 million) in Series A funding. Balderton Capital led the round and was joined by investors including SpeedInvest, Target Global, Encomenda, and Lanai.

- Agentero, an Oakland, Calif.-based digital insurance network, raised $13.5 million in Series A funding. Alma Mundi Ventures led the round and was joined by investors including Foundation Capital,Union Square Ventures, Financial Venture Studio, and Two Culture Capital.

- Sila, a Portland-based maker of a banking API, raised $13 million in Series A funding. Revolution Ventures led the round and was joined by investors including Madrona Venture Group, Oregon Venture Fund, and Mucker Capital.

- Realm, a New York City-based database for homeowners, raised $12 million in Series A funding. GGV Capital led the round and was joined by investors including Primary Venture Partners, Lerer Hippeau, and Liberty Mutual Strategic Ventures.

- Global66, a Santiago, Chile-based B2B and B2C cross-border payments platform, has raised $12 million in Series A funding. Quona Capital led the round, and was joined by Magma Partners, Clocktower Technology Ventures (US), and Venrex Investment Management (UK).

- Lolli, a New York-based bitcoin rewards startup, raised $10 million in Series A funding. Acrew Capital led, and was joined by Banana Capital, Up North Management, and Animal Capital.www.lolli.com

- Saber Labs, a Dallas-based stablecoin exchange, raised $7.7 million in a seed funding. Race Capital led the round and was joined by investors including Social Capital, Jump Capital, Multicoin Capital, and Solana Foundation.

- HiHello, a Palo Alto, Calif.-based business card platform for individuals and businesses, raised $7.5 million in Series A funding. Foundry Group led the round and was joined by investors including Lux Capital and August Capital.

- Spark, a Canada-based real estate software platform, raised $6.3 million in Series A funding. BDC Capital and Pender Ventures led the round and were joined by investors including Groundbreak Ventures.

- Prepaid2Cash, a Birmingham, Ala.-based gift and prepaid card redemption company, raised $5.1 million in Series A funding. Benson Capital Partners led the round and was joined by investors including Relevance Ventures and Alabama Futures Fund.

- Landis, a New York City-based rent-to-own home startup, raised an undisclosed amount of Series A funding. Sequoia Capital led the round and was joined by investors including Arrive, Dreamers VC, and Signia Venture Partners.

- Quansa, a Brazilian financial benefits company, raised $3.6 million in seed funding. Valor Capital Group led the round and was joined by investors including Pear VC, Canary, Norte, Magma, and Sequoia Scouts.

- Amplify Life Insurance, a San Francisco-based life insurance platform, raised $2.5 million in seed funding. Anthemis led the round and was joined by investors including Transverse Ventures Fund.

- Relief, a fintech that negotiates on behalf of users with credit card debt, raised $2 million in seed funding led by Collaborative Fund. http://axios.link/JXET

. . .

Care:

- SonderMind, a Denver-based mental health company, raised $150 million in Series C funding. Drive Capital and Premji Invest led the round and were joined by investors including General Catalyst, Partners Group, Smash Ventures, Kickstart, and F-Prime Capital.

- Embark Veterinary, a Boston genetics startup looking to boost dog lifespans, raised $75 million in funding. Softbank’s Vision Fund 2 led the round and was joined by investors including F-Prime Capital, SV Angel, Freestyle Capital, Slow Ventures, and Third Kind Venture Capital. The deal values the company at $700 million.

- ByHeart, a New York City-based infant nutrition company, raised $90 million in Series B funding. D1 Capital Partners led the round and was joined by investors including OCV Partners, Polaris Partners, Bellco Capital, Two River, and Red Sea Ventures.

- Elvie, a London-based developer of women’s health devices like breast pumps and kegal exercise trackers, raised £58 million in Series C funding. BGF led, and was joined by BlackRock, Hiro Capital, Westerly Winds and insiders Octopus Ventures and IPGL. http://axios.link/y0x9

- Veda, a Madison, Wis.-based AI platform focused on healthcare payers and providers, raised $45 million in Series B funding led by Oak HC/FT. www.vedadata.com

- Nym Health, a New York City-based medical coding company, raised $25 million. Addition led the round.

- Talkiatry, a New York City-based psychiatry service, raised $20 million in Series A funding. Left Lane Capital led the round and was joined by investors including Sikwoo Capital Partners and Relevance Ventures.

- Connie Health, a Boston-based medicare platform, raised $13 million in Series A funding. Khosla Ventures and Pittango Healthtech led the round.

- Eterneva, an Austin-based grief and wellness startup, raised $10 million in Series A funding. Tiger Management led the round and was joined by investors including Goodwater Capital, Capstar Ventures, NextCoast Ventures, and Mark Cuban.

- Peppy, a London-based digital health company, raised £6.6 million ($10 million) in Series A funding. Felix Capital led the round.

- Lalo, a NYC-based DTC baby brand, closed a $5.6m seed funding (read here)

- Oova, a New York City-based fertility company, raised $4.4 million. Investors included BBG Ventures, Company Ventures, David Sable from Special Situations Life Sciences Fund, Thorne Healthtech, and Amplifyher Ventures.

. . .

Future of Work:

- Gopuff, a Philadelphia-based delivery company, confirmed it raised $1 billion in Series H funding valuing it at $15 billion. Investors included Blackstone’s Horizons platform, Guggenheim Investments, Hedosophia, and Adage Capital.

- PsiQuantum, a Palo Alto, Calif.-based quantum computing company, raised $450 million in Series D funding. BlackRock led the round and was joined by investors including Baillie Gifford, M12, Blackbird Ventures, and Temasek.

- DataRobot, a Boston-based A.I. provider, raised $300 million in Series G funding valuing it at $6.3 billion. Altimeter Capital and Tiger Global led the round and was joined by investors including Counterpoint Global, Franklin Templeton, ServiceNow Ventures, and Sutter Hill Ventures.

- Gupshup, a San Francisco-based messaging startup, raised $240 million. Investors include Fidelity Management and Research Company, Tiger Global, Think Investments, Malabar Investments, Harbor Spring Capital, Neuberger Berman Investment Advisers, White Oak, and Neeraj Arora

- Contentful, a content management platform, raised $175 million in Series F funding valuing it at $3 billion. Tiger Global led the round and was joined by investors including Base10 Advancement Initiative and Tidemark.

- Algolia, a San Francisco-based search platform, raised $150 million in Series D funding. Lone Pine Capital led the round valuing it at $2.3 billion. Investors also included Fidelity Management & Research Company, STEADFAST Capital Ventures, Glynn Capital, Twilio,Accel, and Salesforce Ventures.

- Pendo, a Raleigh-based customer analytics startup, raised $150 million Series F at a $2.6 billion valuation. B Capital Group led the round and was joined by investors including Silver Lake Waterman.

- Class, a virtual classroom integrating with Zoom, raised $105 million. SoftBank Vision Fund 2 led the round.

- Dixa, a Danish customer service solution, raised $105 million in Series C funding. General Atlantic led the round and was joined by investors including Notion Capital Project A and Seed Capital.

- ActiveFence, a New York City and Israel-based cybersecurity startup, raised $100 million in Series A and B funding. CRV and Highland Europe led B while Grove Ventures and Norwest Venture Partners led the A.

- 1Password, a Toronto-based provider of password management software, raised US$100 million in Series B funding at a $2 billion valuation led by insider Accel.http://axios.link/MXuW

- Bubble, a New York-based visual programming platform, raised $100 million in Series A funding. Insight Partners led, and was joined by SignalFire, Neo, BoxGroup, ThirdKind and Betaworks.www.bubble.io

- Covariant, a Berkeley, Calif.-based robotics company, raised $80 million in Series C funding. Index Ventures led the round and was joined by investors including Amplify Partners and Radical Ventures.

- Atera, a Tel Aviv-based IT management company, raised $77 million in Series B funding. General Atlantic led the round and was joined by investors including K1 Investment Management.

- MyGlamm, an Indian direct-to-consumer beauty brand, raised $71.3 million. Accel led a $47.8 million tranche while other investors include Amazon, Ascent Capital, Wipro, Bessemer Venture Partners, L’Occitane, Ascent, Amazon, Mankekar family, Trifecta, and Strides Ventures.

- Blaize, an El Dorado Hills, Calfi.-based edge computing company, raised $71 million in Series D funding. Franklin Templeton and Temasek led the round and were joined by investors including DENSO.

- Homebase, a San Francisco-based platform for managing hourly teams, raised $71 million in Series C funding. GGV Capital led the round and was joined by investors including Bain Capital Ventures, Baseline Ventures, Bedrock Capital, Cowboy Ventures, Khosla Ventures, and PLUS Capital.

- Squire, a New York-based provider of barbershop management software, raised $60 million in Series C funding at a $750 million valuation led by Tiger Global. http://axios.link/qmfR

- Replicated, a West Hollywood, Calif.-based company focused on software delivery and management, raised $50 million in Series C funding. Owl Rock led the round and was joined by investors including Lead Edge Capital, Headline, Two Sigma Ventures, Amplify Partners, BoldStart, Ridgeline, and Heavybit.

- Brain Technologies, a startup with an app seeking to replace phone apps, raised $50 million in funding. Investors include Laurene Powell Jobs’ Emerson Collective, Goodwater Capital, Scott Cook, and WTT Investment.

- Varda Space Industries, a California-based space startup, raised $42 million in Series A funding. Khosla Ventures and Caffeinated Capital led the round and were joined by investors including Lux Capital, General Catalyst, and Founders Fund.

- Teikametrics, a Boston-based optimization platform for sellers on Amazon and Walmart, raised $40 million in Series B funding. Intel Capital led the round and was joined by investors including GoDaddy,Centana Growth Partners, and Lydia Jett (head of ecommerce at Softbank Vision Fund).

- SEDNA, a London-based maker of a communications system, raised $34 million in Series B funding. Insight Partners led the round and was joined by investors including Stride.VC, Chalfen Ventures and the SAP.iO fund.

- Teamflow, a virtual office company, raised $35 million in Series B funding. Coatue led the round and was joined by investors including Menlo Ventures’ Naomi Ionita and Battery Ventures’ Neeraj Agrawal.

- Blameless, a platform for engineers, raised $30 million in Series B funding. Third Point Ventures led the round and was joined by investors including Accel, Decibel, and Lightspeed Venture Partners.

- inVia Robotics, a Westlake Village, Calif.-based warehouse automation company, raised $30 million in Series C funding. M12 and Qualcomm Ventures invested along with Hitachi Ventures.

- Orum, a San Francisco-based a “smart calling” app for automating outbound sales workflows, raised $25 million from Craft Ventures, Unusual Ventures and Neo. http://axios.link/oRAc

- Zenput, a San Francisco-based operations software maker, raised $27 million in Series C funding. Golub Capital led the round and was joined by investors including Jackson Square Ventures, MHS Capital, and Goldcrest Capital.

- QuotaPath, a Philadelphia-based commission-tracking software maker, raised $21.3 million in Series A funding. Insight Partners led the round and was joined by investors including ATX Ventures, Integr8d Capital, Stage 2 Capital, and HubSpot Ventures.

- Cyolo, a Tel Aviv-based maker of a secure login system, raised $21 million in Series A funding. Glilot Capital Partners led the round and was joined by investors including National Grid Partners, Merlin Ventures, Flint Capital, Global Founders Capital, and Differential Ventures.

- Spectro Cloud, a Santa Clara, Calif.-based enterprise management platform, raised $20 million in Series A funding. Stripes led the round.

- ConverseNow, a developer of AI ordering assistants for quick-serve restaurants, raised $13 million in Series A funding led by Craft Ventures. http://axios.link/J4tc

- Hightouch, a San Francisco-based customer data syncing software company, raised $12.1 million in Series A funding. Amplify Partners led the round and was joined by investors including Bain Capital Ventures, Y Combinator, and Afore Capital.

- Lumanu, an Oakland, Calif.-based platform for creators, raised $12 million in Series A funding. Origin Ventures led the round and was joined by investors including Alumni Venture Group, Gaingles, and 500 Startups.

- Launchable, a San Jose, Calif.-based software testing startup, raised $9.5 million in Series A funding. Investors include 645 Ventures, Battery Ventures, Unusual Ventures, and GoingVC.

- Sproutl, a U.K.-based gardening tech start-up, raised $9 million in seed funding. Index Ventures led the round and was joined by investors including Ada Ventures.

- Guidewheel, a San Francisco Calif.-based maker of software for manufacturing companies, raised $8 million in Series A funding. Greycroft led the round.

- Daisy, a New York City-based property management company, raised $4.5 million. Aleph led the round.

- Norby, a Brooklyn-based marketing platform for creators, raised $3.8 million in seed funding. Gradient Ventures led the round and was joined by investors including Bungalow Capital, BBG Ventures, Charge VC, and Notation.

- Freightify, a “Shopify for maritime freight,” raised $2.5 million in seed funding. Nordic Eye VC led, and was joined by Tradeworks VC, Venture Catalysts, 9Unicorns and Blume Funders Fund.http://axios.link/4RfS

- Hello Divorce, an online divorce enablement platform, raised $2 million in seed funding. CEAS led, and was joined by Lightbank, Northwestern Mutual Future Ventures and Gaingels. http://axios.link/zmDr

- Serverless Stack, an open-source startup, raised $1 million in seed funding. Investors included Greylock Partners, SV Angel, and Y Combinator.

. . .

Sustainability:

- Rivian, an Irvine, Calif.-based electric car startup, raised $2.5 billion. Amazon’s Climate Pledge Fund, D1 Capital Partners, Ford Motor, and T. Rowe Price Associates invested along with Third Point, Fidelity Management and Research Company, Dragoneer Investment Group, and Coatue.

- NotCo, a New York City-based maker of plant-based foods, raised $235 million in Series D funding. Tiger Global led the round valuing it at $1.5 billion. Other investors include DFJ Growth Fund and ZOMA Lab.

Acquisitions & PE:

- Datasite, a Minneapolis-based portfolio company of CapVest Partners, acquired Firmex, a Toronto-based virtual data room and file-sharing service provider, from Vertu Capital and BDC Growth Equity Partners. http://axios.link/GjQn

- The Jordan Co. agreed to buy Dental365, a New Hyde Park, N.Y.-based dental services group, from Regal Healthcare Capital Partners for a reported $440 million. http://axios.link/sgcx

- Klarna, a Swedish online payment platform and Europe’s most valuable unicorn, bought APPRL, a Stockholm-based provider of influencer marketing software that had raised nearly $10 million from firms like ATM VC and Spintop Ventures. http://axios.link/Nx5n

- SoftBank Group is selling $2.1 billion of its stake in Uber Technologies, the U.S.-based ride-hailing company, per CNBC. The deal comes as SoftBank’s stake in Chinese ride-hailing company Didi falls in value.

- Qualtrics (Nasdaq: XM) agreed to buy Clarabridge, a Reston, Va.-based customer experience platform, for $1.1 billion in stock. Clarabridge had raised around $200 million (plus a PPP loan) from firms like General Catalyst, Summit Partners and Harbert Growth Partners. http://axios.link/trCp

. . .

IPOs:

- Duolingo, a Pittsburgh-based language learning app company, raised $520.8 million in an offering of 5.1 million shares priced at $102—higher than the $510.6 million it had planned to raise. The company generated $161.7 million in revenue in 2020, and reported a net loss of $15.8 million. Union Square Ventures, CapitalG, and General Atlantic back the firm.

- Riskified, an Isreali fraud prevention software company, raised $367.5 million in an offering of 17.5 million shares priced at $21 per share—it had previously planned to raise $350 million. The company posted $169.7 million in revenue in 2020 and a net loss of $11.3 million. General Atlantic and Fidelity Management & Research Company back the firm.

- MeridianLink, a Costa Mesa, Calif.-based credit reporting and lending platform owned by Thoma Bravo, raised $343 million in its IPO. It priced 13.2 million shares at $26, versus plans to offer 12 million at $24-$26, and listed on the NYSE (MLNK). http://axios.link/k1Ws

. . .

SPACs:

- Vacasa, a Portland, Ore.-based vacation rental management platform, agreed to go public at an implied $4.5 billion valuation via TPG Pace Solutions (NYSE: TPGS). It had raised over $600 million from firms like Silver Lake, NewSpring Capital, Riverwood Capital and Level Equity. http://axios.link/x5h2

- Nanosys Inc., a Milpitas, Calif.-based quantum-dot technology company, is in talks to go public via a merger with the SPAC GigInternational1 Inc., per Bloomberg.

- Manscaped, a San Diego-based men’s groin grooming company, is in talks to go public via a merger with Bright Lights Acquisition Corp., a SPAC, per Bloomberg.

Funds:

- Tribe Capital raised $333 million for its second VC fund. http://axios.link/tx7i

Final Numbers

Source: FRED; Chart: Axios Visuals

The U.S. economy grew at an annualized 6.5% rate in Q2 2021. It's a tick higher than Q1 GDP, but well below the 8.4% rate that economists expected. Go deeper.