Sourcery (7/6-7/10)

Walgreens + VillageMD, DoD, Truepill, Kernel, Kindbody, GoHealth. New IPO filings: Palantir, Vertex, BlueCity Holdings, nCino, Rocket Companies, Coinbase, and Marqeta

Last Week (7/6-7/10):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into three categories, Care, Future of Work and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include juicy healthcare companies Walgreens + VillageMD, DoD, Truepill, Kernel, Kindbody, and GoHealth. As well as recent IPO filings Palantir, Vertex, BlueCity Holdings, nCino, Rocket Companies, Coinbase, and Marqeta.

Final numbers on Jobless Claims vs. Dow Jones, Nasdaq Divergence, and Food Delivery at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Care:

- VillageMD, a Chicago-based primary health care provider, secured up to $1 billion in equity and convertible debt for a 30% stake from existing backer Walgreens Boots Alliance (Nasdaq: WBA). It includes $250 million in upfront equity, with VillageMD to open at least 500 physician-staffed clinics inside of U.S. Walgreens locations over the next five years. http://axios.link/vGRV

- Perfect Day, a six-year-old, Emeryville, Ca.-based startup that's making animal-free dairy products, has extended its Series C funding round by $160 million. The new funding was led by the Canada Pension Plan Investment Board and brings the total Series C round to $300 million. Food Business News has more here.

- Doctor On Demand, a San Francisco-based virtual care provider, raised $75 million in Series D funding. General Atlantic led the round.

- Kernel, a Los Angeles-based startup focused on neurosciences, raised $53 million in Series C funding. General Catalyst led the round and was joined by investors including Khosla Ventures, Eldridge, Manta Ray Ventures, and Tiny Blue Dot.

- Kindbody, a New York-based fertility startup, raised $32 million in Series B funding. Perceptive Advisors led the round and was joined by investors including RRE, GV, Freemark Capital, Rock Springs Capital, Goodgrower, Claritas Capital, and NFP.

- Truepill, a San Mateo, Calif.-based API-based healthcare infrastructure company, raised $25 million in Series B funding. Investors included TI Platform Fund, Optum Ventures, Initialized Capital, and Sound Ventures.

- FraudScope, an Atlanta, Ga.-based platform for health plans to address fraud, waste, and abuse, raised $7 million in Series A funding. Investors include QED Investors, Brewer Lane Ventures, and the GRA Venture Fund as well as existing investors Spider Capital, Mosley Ventures, and TechSquare Labs. Read more.

- Pocket Outdoor Media, a Boulder, Colo.-based endurance sports media platform, closed a Series A funding and acquired the Healthy Living, Fitness, and Outdoor divisions of Active Interest Media (read here)

- OnlineMedEd, an Austin, Texas-based healthcare training company, raised $5M in funding (read here)

. . .

Future of Work:

- Epic Games, the Cary, N.C.-based games company, raised $250 million from Sony valuing it at $17.9 billion. Read more.

- Caffeine, a Redwood City, Calif.-based social broadcasting platform focused on live rap competitions, raised $113 million from Andreessen Horowitz, Greylock, Fox Corp., Cox Enterprises, and Sanabil Investments. http://axios.link/kpB0

- Instacart, the grocery delivery company, raised an additional $100 million in funding. T. Rowe Price led the round. Read more.

- Wagestream, a two-year-old, London-based platform that enables employees to access their wages as they earn them, has raised £20 million in Series B funding. Northzone led the round, joined by investors including QED Investors, Latitude Ventures and Balderton Capital. The company has now raised £65 million altogether. Tech.eu has more here.

- OwnBackup, a five-year-old, Englewood Cliffs, N.J.-based cloud-to-cloud business continuity platform, has raised $50 million in new funding led by Insight Partners, with participation from Salesforce Ventures and Vertex Ventures. Earlier backer Innovation Endeavors also joined the round, which brings the company’s total funding to over $100 million. TechCrunch has more here.

- Taulia, a San Francisco-based B2B payments platform, raised $60 million. Ping An led, and was joined by JPMorgan, Prosperity7 Ventures, and return backer Zouk Ventures. http://axios.link/olzA

- Notarize, a Boston-based notary platform, raised $35 million in Series C funding. Polaris Partners led the round and was joined by investors including Camber Creek.

- Wagestream, a London-based platform for employees to access their wages, raised £20 million in Series B funding. Northzone led the round and was joined by investors including QED Investors, Latitude Ventures and Balderton Capital.

- LogDNA, a Mountainview, Calif.-based log management solution for DevOps teams, raised $25 million in Series C funding. Emergence Capital led the round and was joined by investors including Initialized Capital, Providence Equity and new investors TI Platform Management, Radianx Capital, Top Tier Capital, and Trend Forward Capital.

- MariaDB, a Finland-based open-source database development startup, raised $25 million in new Series B funding. SmartFin Capital led, and was joined by return backer GP Bullhound. http://axios.link/nzqJ

- The Mom Project, a Chicago, IL-based career destination for moms, raised $25M in Series B funding (read here)

- Material Security, an email security startup,raised $22 million in funding. Investors include Andreessen Horowitz.

- Permutive, a New York and London-based publisher-focussed data management platform, raised $18.5 million in Series B funding. Octopus Ventures led the round and was joined by investors including EQT Ventures.

- Data Dynamics, Inc., a Teaneck, N.J.- and Houston, TX-based unstructured data management company, closed on a $9m financing round (read here)

- Basemark, a Finland-based provider of real-time graphics software for autonomous vehicles, raised €7 million led by ETF Partners. http://axios.link/46a2

- Second Front Systems, a San Francisco-based software company in the aerospace and defense industry, raised $6 million in seed funding. ARTIS Ventures led the round and was joined by investors including Kleiner Perkins, 8VC, Gula Tech Adventures, and Abstract Ventures.

- Quaestor, an automated financial data platform for startups and their investors, raised $5.8 million in seed funding. 8VC led, and was joined by Spark Capital, Abstract Ventures, GFC, Fathom Ventures, and Riot Ventures. www.quaestor.com

- Vendia, a San Francisco, Calif.-based multicloud serverless platform, raised $5.1 million in seed funding. Neotribe’s Swaroop ‘Kittu’ Kolluri led the round and was joined by investors including Correlation Ventures, WestWave Capital, HWVP, Firebolt Ventures, Floodgate, and FuturePerfect Ventures. Read more.

- AgencyKPI, an Austin, Texas-based developer of a business intelligence platform, closed a $5m Series A funding round (read here)

- Optimal Dynamics, a Princeton, N.J.-based AI startup focused on logistics and supply chains, raised $4 million in seed funding. Fusion Fund led, and was joined by The Westly Group, TenOneTen Ventures, Embark Ventures, FitzGate Ventures, and Newark Venture Partners. www.optimaldynamics.com

- Athlane, a 1.5-year-old, San Francisco-based platform looking to connect streamers and brands, facilitating sponsorship and endorsement deals and streamlining communications flows, has raised $3.3 million, including from Y Combinator, Global Founders Capital, Romulus Capital, and Seabed VC, among others. TechCrunch has more here.

- Icon Savings Plan, a Portland-based provider of employee retirement savings plans, raised $3.2 million in seed funding. Tom Blaisdell led, and was joined by Rethink Impact, TASC Ventures, Kelly Innovation Fund, Portland Seed Fund, and Alumni Ventures. http://axios.link/yi1h

- CALA, a New York-based marketplace that provides a plug and play infrastructure for fashion brands, raised $3 million. Maersk Growth and A.P. Moller-Maersk led the round and were joined by Real Ventures.

- Popshop Live, a Los Angeles-based live streaming shopping platform, raised $3 million in funding led by Floodgate and Abstract Ventures, who were joined by investors including Long Journey Ventures, Cyan and Scott Banister, Shrug Capital, Backend Capital and Halogen Ventures.

- Wintermute, an algorithmic liquidity provider for digital assets, raised $2.8 million in Series A funding led by Lightspeed Venture Partners. http://axios.link/Xt3I

- KlariVis, a Roanoke, Va.-based proprietary data analytics software platform developed by bankers for bankers, completed a $2.5m seed funding round (read here)

- MonkeyLearn, a six-year-old, San Francisco-based text analysis platform that allows companies to create new value from text data, has raised $2.2 million in funding led by Uncork Capital and Bling Capital. TechCrunch has more here.

- Nayya, a year-old, New York-based software platform that helps employees choose and use their employee benefits, has raised $2.7 million in seed funding led by Social Leverage, with participation from Guardian Strategic Ventures, Cameron Ventures, Soma Capital, and individual investors. TechCrunch has more here.

- Joe Coffee, a Seattle-based mobile ordering network for independent coffee shops, raised $1.3 million in new seed funding from Craft Ventures and Flying Fish Ventures. http://axios.link/WmkQ

- Docket, an Indianapolis-based software-as-a-service (SaaS) productivity platform for managing effective meetings, secured $1.25M in funding (read here)

- Shadowbox, a Encinitas, Calif.-based developer of a no-code integration and automation platform, raised $1 million in seed funding. Blackbird Ventures led the round and was joined by Crowdsmart.IO.

- Vital4, an Atlanta, GA-based fintech company using machine learning and AI for anti-money laundering, workforce and risk monitoring in the work-from-anywhere economy, raised a seed funding round led by Valor Ventures (read here)

. . .

Sustainability:

- Rivian, a electric vehicle company, raised $2.5 billion. T. Rowe Price Associates Inc. led the round and was joined by investors including Soros Fund Management LLC, Coatue, Fidelity Management and Research Company and Baron Capital Group.

- Solugen, a Houston-based decarbonization startup, raised $30 million in extended Series B funding. Refactor Capital led and was joined by investors including Founders Fund, Knollwood Investment Advisory, Valor Equity, LowerCarbon, Box Group, AeraVC, and YC.

- Liftit, a Colombian trucking and logistics services startup, raised $22.5 million. Cambridge Capital led, and was joined by H2O Capital, AC Ventures, 10x Capital, Alpha4 Ventures, Banyan Tree Ventures, Leonisa, and Grupo Transportes Monterrey. http://axios.link/v19E

- Carbon Clean Solutions Limited , a U.K.-based a carbon dioxide capture and separation tech maker, raised $22 million in Series B funding. Equinor Ventures and ICOS Capital led the round.

- Upward Farms, a Brooklyn, N.Y.-based aquaponics operation firm, raised $15 million in funding. Investors included Prime Movers Lab.

- Swiftmile, a San Carlos, Calif.-based developer of light e-vehicle charging stations, raised $5 million in Series A funding. Thayer Ventures led, and was joined by Alumni Ventures Group and Verizon Ventures. http://axios.link/LhHi

- NUGGS, a New York-based plant based chicken nugget company, raised $4.1 million via parent company SIMULATE. Lerer Hippeau led the round and was joined by investors including AgFunder and Alexis Ohanian.

PE:

- The Carlyle Group acquired a majority stake in Czech translation software company Memsource. http://axios.link/KcHg

- Apax Partners agreed to buy a 49% stake in InnovAge, a Denver-based in-home senior care provider, from Welsh Carson Anderson & Stowe at a $950 million enterprise value, per PE Hub. http://axios.link/RsR9

- Intel Capital invested $254 million into Indian telco Reliance Jio Platforms. http://axios.link/Rrsq

. . .

Seeking Exit:

- Thrive Causemetics, a Los Angeles-based vegan cosmetics company, hired Goldman Sachs to explore a sale or IPO, per Bloomberg. Shareholders include Trinity Ventures. http://axios.link/AehP

. . .

IPOs:

- Vertex, a King of Prussia, Penn.-based provider of business tax software, filed for a $100 million IPO. It plans to trade on the Nasdaq (VERX) with Goldman Sachs and Morgan Stanley as lead underwriters, and reports $7.3 million of net income on $75 million in revenue for Q1 2020. http://axios.link/z8Cj

- Rocket Companies, a Detroit-based mortgage lender operating under the Rocket Mortgage and Quicken Loans brands, filed for an IPO that Renaissance Capital estimates could raise $3 billion. It plans to list on the NYSE (RKT), and reports $97 million of net income on $1.37 billion in revenue for Q1 2020, and is controlled by chairman Dan Gilbert. http://axios.link/Ic0y

- Palantir, a Palo Alto-based big data analytics company, said it has filed confidential IPO papers. It recently announced $500 million in new funding, although an SEC filing suggests it may add hundreds of millions more. http://axios.link/CgJo

- nCino, a Wilmington, Mass.-based cloud-based software for financial institutions, plans to raise $175 million in an offering of 7.6 million shares priced between $22 to $24. It posted revenue of $138.2 million in the year ending Jan. 2020, and a loss of $27.6 million. Investors include Insight Partners (46.6% pre-offering), Salesforce (13.2%), and Wellington Management (9.5%). It plans to list on the Nasdaq as “NCNO.” Read more.

- GoHealth, a Chicago-based health insurance marketplace owned by Centerbridge Partners, set IPO terms to 39.5 million shares at $18-$20. It would have a fully-diluted market value of $6 billion, were it to price in the middle, and plans to list on the Nasdaq (GOCO) and reports $1.4 million of net income on $141 million in net revenue for Q1 2020. http://axios.link/Qt3r

- BlueCity Holdings, a China-based LGBTQ community and dating platform, raised $85 million in an offering of 5.3 million ADSs priced at $16. It plans to list on the Nasdaq as “BLCT.” Read more.

- Coinbase, a San Francisco-based digital currency platform, is prepping an IPO that could come as early as this year, per multiple reports out this morning. The company has raised over $500 million in VC funding, most recently at an $8 billion valuation. http://axios.link/tg6u

- Marqeta, an Oakland-based card issuing platform, is interviewing banks for an IPO, per Reuters. The company has raised $525 million in VC funding, most recently at a $4.3 billion valuation, from Goldman Sachs, Coatue Management, Vitruvian Partners, Visa, 83North, Granite Ventures, and Iconiq Capital .http://axios.link/EFAC

- Trean Insurance Group, a Wayzata, Minn.-based workers’ comp insurer, set IPO terms to 10.7 million shares at $13–$15. It would have an initial market cap of $716 million, were it to price in the middle, and plans to trade on the Nasdaq (TIG). http://axios.link/xyFB

. . .

Acquisitions:

- DocuSign agreed to acquire Liveoak Technologies, an Austin-based digital customer engagement cloud company, for $38 million.

- Slack Technologies, Inc., (NYSE: WORK) acquired Rimeto, a business directory company (read here)

Funds:

- CVC Capital Partners raised €21.3 billion ($24 billion) for its eighth flagship fund. Read more.

- Apollo Global Management (NYSE: APO) formed Apollo Strategic Origination Partners, a platform seeking to lend out some $12 billion.

- Sequoia also raised $3.7 billion across three funds to invest in China and $2.15 billion for U.S.-focused venture and growth funds, per the Wall Street Journal. Read more.

- Engineering Capital, a seed-stage VC firm led by Ashmeet Sidana, raised $60 million for its third fund. http://axios.link/czDL

- Rethink Impact raised $182 million for its second fund. Read more.

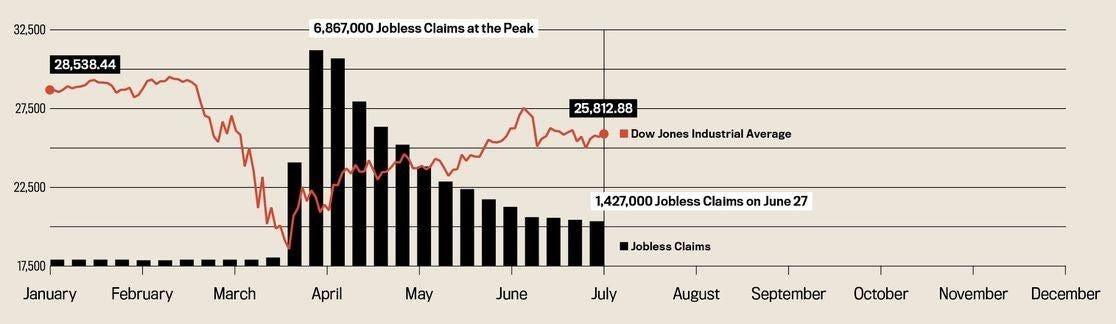

Jobless claims vs. the market:

Courtesy Barron's

. . .

Nasdaq Divergence:

Data: FactSet; Chart: Axios Visuals Go deeper: Worries grow over Nasdaq divergence

. . .

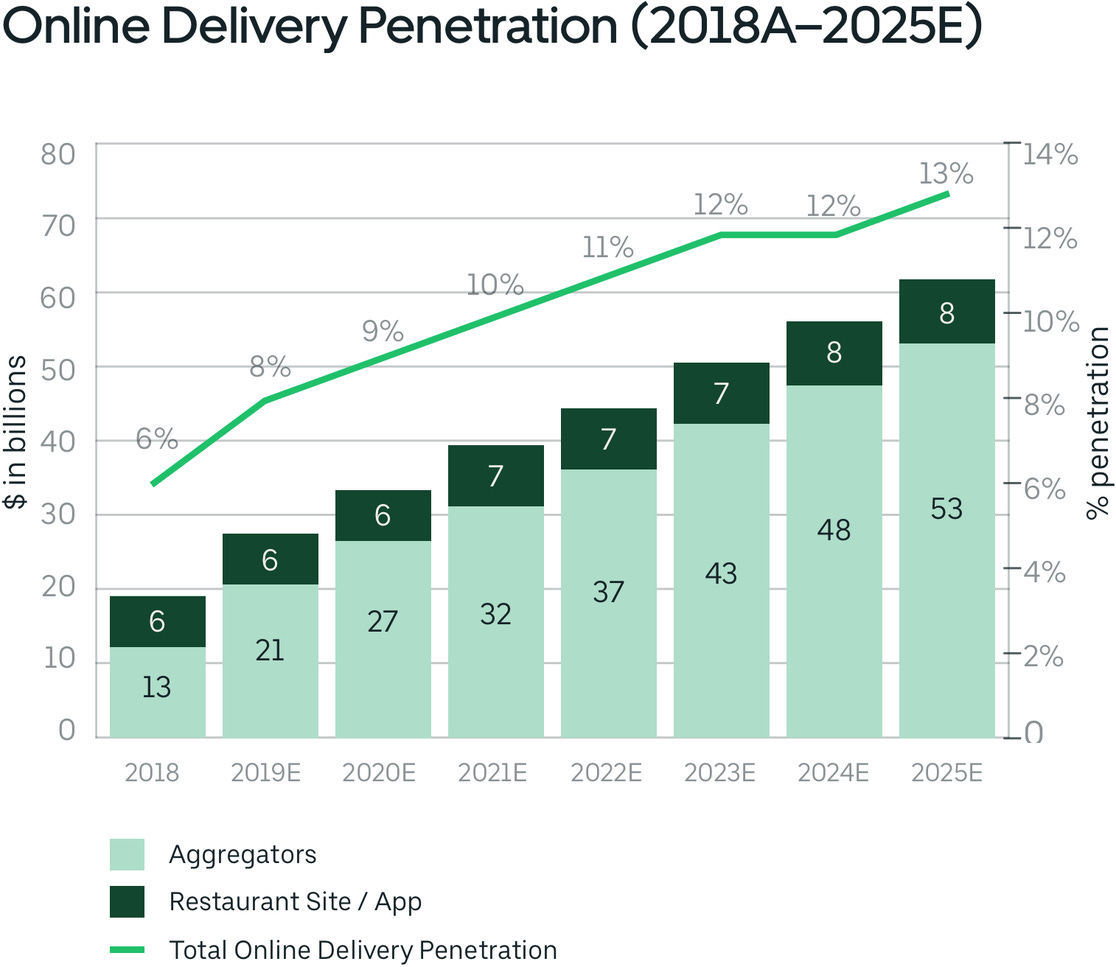

Food delivery:

Source: Source: Uber analysis, Cowen, Morgan Stanley Feb 21, 2020 Research Report