Sourcery (8/14-8/18)

Palmer Luckey, Anduril & American Dynamism ☀️ BitGo, Linera, Vio, Mendaera, Lindus Health, Visana Health, Toothio, Anthropic, ProjectDiscovery, Arccos, DynamoFL, Caden, Voiceflow, Highlight, Grit

World, meet Palmer Luckey

Since American Dynamism (ie.strengthening the American industrial complex, infrastructure, & labor forces with technology) is dominating the conversation this year through patriotic X/tech chatter, we’re going to go a bit deeper in this specific musing on its darling founder, Palmer Luckey.

Watch How Palmer Luckey (Founder of Oculus & Anduril) Got Fired For Making a $9,000 Donation, Logan Bartlett Podcast

Logan Bartlett of Redpoint sat down with Palmer Luckey, founder of Oculus at (a VR headset maker that sold to Facebook for $2.3B), and more recently Anduril (an autonomous military technology company valued at $8.5B) over a year ago to discuss: the damage the media did on Palmer’s public reputation, getting fired from Facebook, selling Oculus for billions, the personal sacrifice of doing really hard things, not wanting to be CEO, and the story behind founding Anduril. Overall, this was a surprisingly thoughtful conversation.

Things really start to get good halfway through, highly recommend listening to the whole pod - but here are some key parts:

(31:57) Palmer's biggest takeaways from being fired from Facebook & rewriting false media narratives

“The biggest takeaway is, do not underestimate the long term impact of not correcting falsehoods about your company or yourself.”

“Get out and tell them your story.. make it so the real version of what happened is as easy to find as the false version.. keep talking about what you’re doing now and also what happened then.”

(38:44) Palmer’s background and founding Oculus

(41:39) Why you should follow your talents over your passions

“Never follow your passions, follow your talents.. Most of the things worth loving are not things where you’re going to make money or certainly have an impact. ”

(49:01) Selling Oculus

Breaks down the cost of the $2.3B acquisition, & why talent flees at the end of lock-up periods

(53:45) Founding Anduril after getting fired

“I basically decided more or less immediately.. we officially founded the company June 6th 2017, which is the anniversary of the D-Day invasion..”

(1:13:08) Knowing a little about a lot

(With a generalist newsletter, this is a relief to hear. Long creativity, curiosities, & transferable knowledge)

Side note: As someone who used to be an LP (investor in VCs) in a very famous/large ‘founder-friendly’ fund that invested in Anduril, I was able to tune into the team’s update & demo on their tech/hardware a couple of years ago during an Annual Meeting (VC’s presenting their performance to their investors). And I have to say, Palmer is quite the character, he has a great personality, distinctive fashion taste, is very passionate about his work, seems to be very self-aware, and a bit mad smart. FWIW that specific annual meeting was one of the most impressive and cinematic presentations I’ve ever experienced in my time working in VC. Quality & execution matters! (And being on the LP side isn’t so bad either)

If you’re interested in learning more, check out this intensive technical deep dive on the business:

Read Anduril: The Business of Defense, Mario Gabriele of The Generalist

The weapons manufacturer has scaled revenue at record speeds, reaching a rumored valuation of more than $7 billion in 2022 (actual $8.5B 2023). It may be one of the most important companies of our era.

While we’re on the topic, here’s another for good measure..

Listen The Complete Story of Lockheed Martin, Skunkworks, and the US's Top Secret 1960's Satellite Program, Acquired

Musings

20VC: The Memo: The State of the VC Market:

Why Seed Funds Can’t Invest in “Hot Startups” Anymore, Why Series A & B is Terrible, Why the IPO Market Will Explode in 2024 & Why VC DD is BS & Every VC Has More Fraud in their Portfolio with Jason Lemkin

Jason Lemkin is the Founder of Saastr one of the best-performing early-stage venture funds focused on SaaS. In the past, Jason has led investments in Algolia, Pipedrive, Salesloft, TalkDesk, and RevenueCat to name a few. Prior to SaaStr, Jason was an entrepreneur, selling EchoSign to Adobe for $100M where it is now a $250M ARR product.

Expanding Access to Alternative Investments with Eric Satz, Founder and CEO of Alto, Wharton Fintech Podcast

The rise of alternative investing in a ‘falling’ or ‘quiet’ public market

Alto is a self-directed IRA custodian that facilitates individuals’ tax-advantaged investments in alternative asset classes.

Intel abandons chipmaking acquisition after failing to secure Chinese approval, The Verge

The company has called off its $5.4 billion purchase of Tower Semiconductor, which it had hoped would help its fledgling foundry business.

Future of Retail with Lee Hnetinka, founder and CEO of Future and Darkstore, Village Global

Ever used FastAF? That’s Darkstore’s consumer facing high-end CPG instant delivery service - Lee gives inside intel on what’s actually working in retail

Yieldstreet Nears a Deal to Buy Real Estate Tech Startup Cadre, The Information

“Scoop: Yieldstreet is in talks to acquire real estate tech company Cadre, the Thrive and Andreessen Horowitz-backed startup valued at $800 million six years ago. It's expected to sell for a small fraction of that.” Kate Clark on X

And it all comes back to Anduril…

Today's newsletter is brought to you by Ramp, the #1 corporate card, bill pay, and reimbursement platform designed to help startups and venture funds save money with 1.5% cash-back on every swipe. Trusted by venture-backed startups from pre-seed all the way through IPO like Morning Brew, Seed, Eventbrite, Discord, and yes.. even Anduril.

Get $500 after you spend your first $1K

. . .

Last Week (8/14-8/18):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include BitGo, Linera, Vio, Mendaera, Lindus Health, Visana Health, Toothio, Anthropic, ProjectDiscovery, Arccos, DynamoFL, Caden, Voiceflow, Highlight, Grit, Spearbit, Braid, Birdstop, ShipCalm, Advanced Ionics, Caelux; Parade, Grove Collaborative, Cadre/Yieldstreet, Wheels Up, Splitit; Better.com

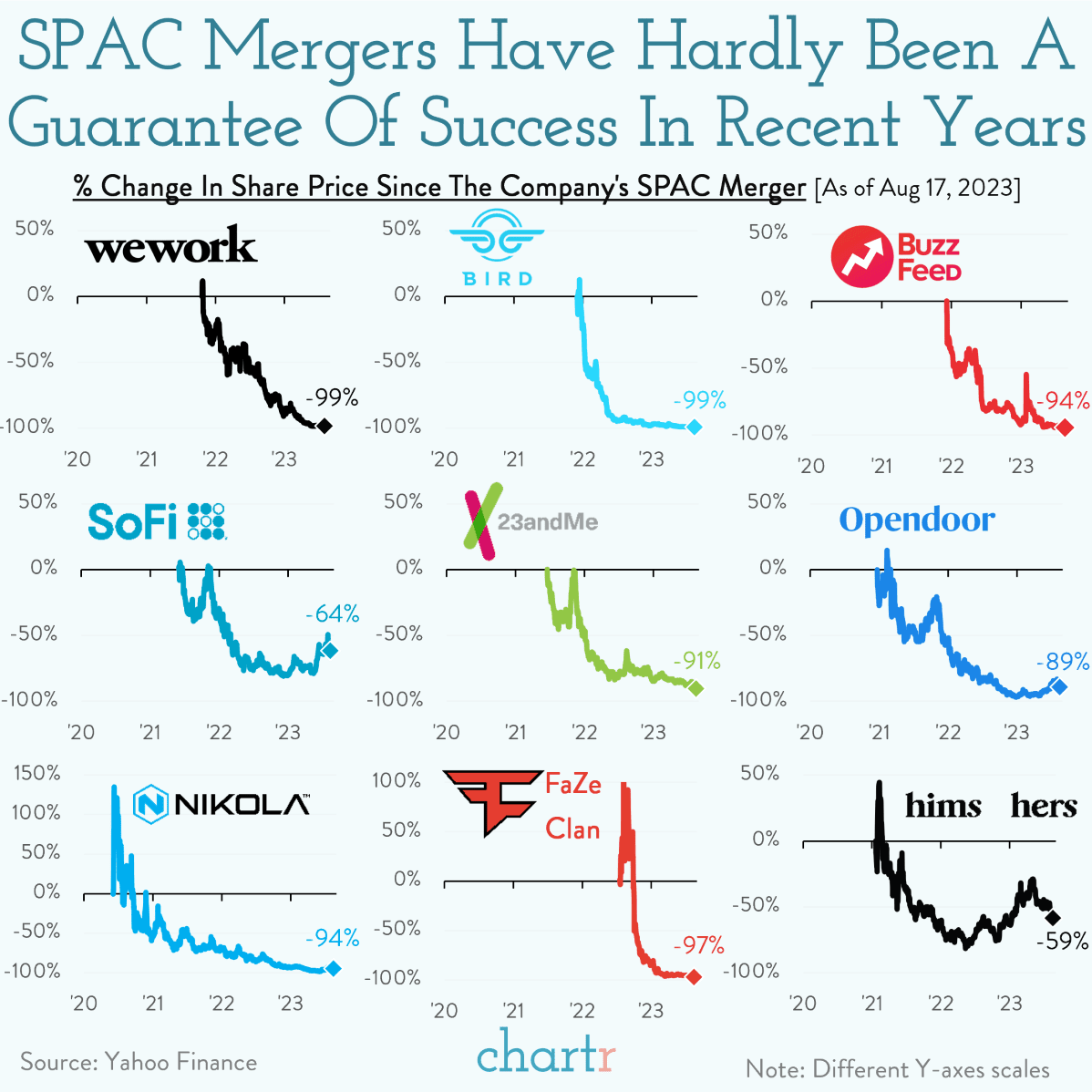

Final numbers on The Pit of Despair for SPACs at the bottom.

Deals

Fintech:

- BitGo, a Sioux Falls, S.D.-based crypto custody startup, raised $100m in Series C funding at a $1.75b valuation. No backers were disclosed, but existing investors include Goldman Sachs, Craft Ventures, DRW, Galaxy Digital Ventures, Redpoint Ventures and Valor Equity Partners. https://axios.link/3OF4iLp

- ClassWallet, a Hollywood, Fla.-based digital wallet-based purchasing and reimbursement platform for public funds, raised $95 million in funding. Guidepost Growth Equity led the round and was joined by Education Growth Partners and Lazard Family Office Partners.

- ZetaChain, a San Francisco-based layer-one blockchain, raised $27 million in funding. Blockchain.com, Human Capital, VY Capital, Sky9 Capital, Jane Street Capital, VistaLabs, CMT Digital, Foundation Capital, Lingfeng Capital, GSR, Kudasai, Krust, and others invested in the round.

- Linera, a San Francisco-based blockchain network, raised an additional $6 million in seed funding. Borderless Capital led the round and was joined by a16z, Laser Digital, Flow Traders, and others.

- Finofo, a Canadian provider of currency risk management solutions, raised US$1.25m led by Motivate VC, per Axios Pro. https://axios.link/47vez5E

. . .

Care:

- Viome Life Sciences, a Bellevue, Wash.-based at-home microbiome test provider, raised $86.5 million in Series C funding co-led by Khosla Ventures and Bold Capital.

- Figur8, a Boston-based musculoskeletal health startup, raised $25m in Series A-1 funding. First Spark Ventures led, and was joined by DigiTx Partners and Phoenix Venture Partners. https://axios.link/3seXgG0

- Mendaera, a San Mateo, Calif.-based healthcare robotics company, raised $24 million in Series A funding. Lux Capital led the round and was joined by Founders Fund, Operator Partners, Allen & Company, and others.

- Lindus Health, a London-based clinical trial platform, raised $18m in Series A funding from Creandum, Peter Thiel and insiders firstminute, Seedcamp, Hambro Perks and Amino Collective. https://axios.link/3DZ7zjZ

- Visana Health, a Minneapolis, Minn.-based virtual-first comprehensive women’s health clinic, raised $10.1 million in seed funding. Flare Capital Partners and Frist Cressey Ventures co-led the round and were joined by InHealth Ventures, Oxeon Partners, Pixel Perfect Ventures, Venture Investors, and others.

- Doc2Doc Lending, an Atlanta-based personal lending platform for physicians and dentists, raised $10 million in funding. Professional Solutions and others invested in the round.

- Venteur, a Berkeley, Calif.-based digital health startup, raised $7.6 million in seed funding. GSR Ventures led the round and was joined by Headwater VC, Revelry Venture Partners, Houghton Street Ventures, Plug and Play, Techstars, CRCM Ventures, and others.

- Toothio, a Phoenix-based dental staffing platform, raised $4 million in seed funding. Craft Ventures led the round and was joined by Burst Capital, Moving Capital, Revere Partners, and Rho Capital Partners

- basys.ai, a Cambridge, Mass.-based health care technology company, raised $2.4 million in funding. Nina Capital led the round and was joined by Eli Lilly & Co., Mayo Clinic, Two Lanterns Venture Fund, Asset Management Ventures, and Chaac Ventures.

. . .

Enterprise & Consumer:

- Anthropic, a SF-based AI research firm, raised $100m from South Korea's SK Telecom. This comes just months after it raised $450m in Series C funding led by Spark Capital. https://axios.link/3KGoueK

- ProjectDiscovery, a San Francisco-based cybersecurity company, raised $25 million in Series A funding. CRV led the round and was joined by Point72 Ventures, SignalFire, Rain Capital, Mango Capital, Accel, Lightspeed, and others.

- Arccos, a Stamford, Conn.-based maker of on-course golf tracking products, raised $20m in Series C funding. PGA Tour led and was joined by Ping, TaylorMade, Cobra Puma Golf and Topgolf Callaway Brands. https://axios.link/3OCY1jp

- Tracer, a New York-based data intelligence platform, raised $18.1 million in Series A funding. NewRoad Capital Partners, Progress Ventures, and BDMI co-led the round and were joined by S4S Ventures and Arbour Way Investors.

- Highlight, a New York-based product testing platform, raised $18 million in Series A funding co-led by Acre Venture Partners and HearstLab.

- Jinx, an LA-based dog food brand, raised $17.9m in Series B funding. The Merchant Club and Align Ventures co-led, and were joined by insiders AF Ventures and Era Ventures, and the Range Group. https://axios.link/44bCd4o

- DynamoFL, a San Francisco-based privacy and compliance-focused generative A.I. solution provider, raised $15.1 million in Series A funding. Canapi Ventures and Nexus Venture Partners co-led the round and were joined by Formus Capital, Soma Capital, and other angels.

- Caden, a New York-based data intelligence company, raised $15 million in Series A funding. Nava Ventures led the round and was joined by AME Cloud Ventures, Streamlined Ventures, Montage Ventures, Industry Ventures, 1707 Capital, AAF Management, and others.

- Voiceflow, a San Francisco- and Toronto-based collaboration platform for building A.I. agents, raised $15 million in funding led by OpenView.

- Verdigris, a Mountain View, Calif.-based smart building management company, raised $10 million in funding. DCVC, Solea Energy, and others invested in the round.

- Highlight, an SF-based app observability startup, raised $8m in seed funding. Afore Capital and Craft Ventures co-led, and were joined by YC, Neo, Day One Ventures, Worklife Ventures and Fuel Capital. https://axios.link/3sc1dez

- Grit, a New York-based technical debt elimination platform, raised $7 million in funding. Founders Fund and Abstract Ventures co-led the round and were joined by Quiet Capital, 8VC, A* Capital, AME Cloud Ventures, SV Angel, Operator Partners, CoFound Partners, and Uncorrelated Ventures.

- Spearbit, a Miami-based smart contract audit and security solutions company, raised $7 million in funding. Framework Ventures led the round and was joined by Nascent, 1kx, Volt Capital, Breed VC, and Robot Ventures.

- Braid, a San Francisco-based text messaging app connecting creators to their fans, raised $6.8 million in seed funding from Andreessen Horowitz and Initialized Capital.

- D'Amelio Brands, a company founded by TikTok stars Charli and Dixie D'Amelio and their parents, raised $5m from Fifth Growth Fund, per Axios. https://axios.link/44evir7

- Olis Robotics, a Seattle-based industrial robotics management startup, raised $4.1m. PSL Ventures led, and was joined by Tectronic Ventures and Ubiquity Ventures. https://axios.link/47tBw9j

- Aircon, a Dallas-based air cargo shipping company, raised $3.3 million in seed funding led by Underscore VC.

- Configu, a Tel Aviv-based open source platform and cloud service for application configuration orchestration, raised $3 million in pre-seed funding led by Cardumen Capital.

- Birdstop, a Concord, Calif.-based remote sensing company, raised $2.3 million in funding. Lerer Hippeau led the round and was joined by Anorak Ventures, Correlation Ventures, Data Tech Fund, Graph Ventures, Techstars, Timberline Holdings, and others.

- Fantasy Life, a fantasy sports and gambling media company founded by NBC Sports analyst Matthew Berry, raised $2m from individual angels like John Legend, Joe Burrow and Josh Allen, per Axios. https://axios.link/449MTAk

- ShipCalm, a Carlsbad, Calif.-based e-commerce fulfilment startup, raised $2m from Montage Capital. www.shipcalm.com

- Whitebalance, a Washington, D.C.-based copyright issues platform for live entertainment, raised $1.5 million in funding. Dundee Venture Capital led the round and was joined by Bread and Butter Ventures and Techstars.

. . .

Sustainability:

- Advanced Ionics, a Milwaukee, Wis.-based hydrogen electrolyzer developer, raised $12.5 million in Series A funding. bp ventures led the round and was joined by Clean Energy Ventures, Mitsubishi Heavy Industries, and GVP Climate.

- Caelux, a Pasadena, Calif.-based solar energy company, raised $12 million in Series A3 funding. Temasek led the round and was joined by Reliance New Energy Limited, Khosla Ventures, Mitsui Fudosan, and Fine Structure Ventures.

- Sapphire Technologies, a Cerritos, Calif.-based energy recovery systems developer and manufacturer for hydrogen and natural gas applications, raised $10 million in Series B funding. Energy Capital Ventures led the round and was joined by Marathon Petroleum, Chevron Technology Ventures, Equinor Ventures, and Cooper and Company.

- ElectroTempo, an Arlington, Va.-based planning and intelligence software provider for electric charging networks, raised $4 million in seed funding. Buoyant Ventures led the round and was joined by Schematic Ventures and Zebox Ventures.

Acquisitions & PE:

- Ariela & Associates International acquired Parade, a New York-based intimates brand. Financial terms were not disclosed.

- Volition Capital invested $10m into Grove Collaborative (NYSE: GROVE), an SF-based DTC platform for natural home and personal care products, marking Volition's first-ever PIPE deal. Volition partner Larry Cheng will join Grove's board of directors. www.grove.co

- Yieldstreet, a VC-backed multi-asset alternative investment platform, is in talks to buy Cadre, a New York-based real estate tech firm, per The Information. Cadre has raised around $130m in VC funding, but the sale price reportedly would be significantly lower than the $800m valuation the company secured in 2017. Cadrew backers include Andreessen Horowitz, Thrive Capital, General Catalyst, Founders Fund, Spur Capital Partners, Khosla Ventures, Lakestar and Jaws Ventures. https://axios.link/3sbKQyy

- Bain Capital agreed to buy Brazilian restaurant chain Fogo de Chão from Rhone Capital. https://axios.link/3qxPDtz

- Wheels Up (NYSE: UP), a New York-based private jet charter company, is giving up 95% of its common stock in exchange for a $500m investment from Delta Airlines, Certares Management and Knighthead Capital Management. https://axios.link/3OCGAj1

- Splitit (ASX: SPT), an Atlanta-based BNPL provider, agreed to go private via a $60m investment from Motive Partners, Thorney Investment Group and Parea Capital. https://axios.link/3E0pwi0

. . .

SPACs:

- Better.com, the embattled home mortgage lender, plans to go public next week after Aurora Acquisition (Nasdaq: AURC) shareholders approved the transaction. The initial market cap could be around $8b, representing a premium to a Series F funding in late 2021 from firms like SoftBank. https://axios.link/3DQXENo

Funds:

- Assembly Ventures, a Detroit-based VC firm focused on mobility, raised $76m for its debut fund. www.assemblyventures.com

Valuation velocity

Vietnamese EV startup VinFast completed its merger with a SPAC on Monday and its shares soared 68% on its first day of trading — catapulting its valuation to $86 billion, above automotive giants like Volkswagen, Ford, and GM. However, by Wednesday, its shares had dropped sharply around 19%.

The rollercoaster debut of VinFast is a familiar tale in the world of SPACs, or special purpose acquisition companies — essentially, a public company with a big blank check that buys a private one. SPACs offer quicker routes to public markets, while skipping some of the due diligence of the traditional IPO process.

SPACs boomed in 2020/21, when they represented a fashionable way to take Silicon Valley's hottest startups public, with prominent examples including the personal finance app SoFi and electric truck company Nikola. Even the likes of WeWork, after its notorious IPO debacle, managed to find solace in a SPAC, and Buzzfeed, the digital media trailblazer, also embraced the trend.

Buzzworthy blunders

Nevertheless, numerous companies that chose the SPAC route have become noteworthy for high-profile missteps under glaring public scrutiny and ongoing struggles with profitability. Buzzfeed was forced to shutter its Pulitzer Prize-winning news division, Nikola's founder Trevor Milton has faced criminal fraud charges, and Bird, a SPAC-aided electric scooter company, admitted to inflating its revenue figures for over 2 years. But it's the plight of WeWork that has occupied headlines in recent weeks: once valued at a staggering $47 billion, it is now worth <$350 million, teetering on the brink of being delisted from the New York Stock Exchange.

Now, as VinFast navigates the post-merger SPAC road, it will be trying not to skid out like so many of its recent predecessors.

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

Your onto something huge Molly. Keep it up. This is great what you are doing and innovative. I know I keep saying it but I see it.