Sourcery (8/16-8/20)

Plaid, DriveWealth Holdings, Divvy Homes, Branch, Enable, One, Onda, Maven, Carrot Fertility, Opya, Kare, Databricks, Automattic, Postman, Hopper, InfoSum, Monte Carlo, Apeel, Beta Hatch, Starday...

Last Week (8/16-8/20):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Future of Work, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Plaid, DriveWealth Holdings, Divvy Homes, Reali, Branch, Enable, One, Jaris, Onda, PayEngine, Maven, Carrot Fertility, Opya, Kare, Databricks, Automattic, Postman, Hopper, Seismic, InfoSum, Monte Carlo, Split.io, Imubit, Metabase, Tropic, Baffle, TrustLayer, Hashnode, Apeel, Kairos Aerospace, Regrow, Beta Hatch, Starday; Frame.io; iCIMS; Aspiration Partners

Final numbers on Global M&A and PE Deals at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Plaid, a San Francisco-based API fintech, raised an undisclosed amount of funding from J.P. Morgan Private Capital Growth Equity Partners and existing investor Amex Ventures.

- DriveWealth Holdings, a Chatham, N.J.-based fractional trading company, raised $450 million in Series D funding valuing it at $2.9 billion. Insight Partners and Accel led the round and were joined by investors including Greyhound Capital, Softbank Vision Fund, and Point72 Ventures.

- Divvy Homes, a San Francisco-based proptech startup that helps renters build wealth while they save to buy a home, raised $200 million in Series D funding. Tiger Global Management and Caffeinated Capital led the round and were joined by investors including Andreessen Horowitz, GGV Capital, GIC, and Moore Specialty Credit.

- Reali, a San Mateo, Calif.-based real estate buying startup, raised $75 million. Zeev Ventures led the round.

- MobileCoin, a San Francisco-based cryptocurrency privacy company, raised $66 million in Series B funding. Investors include Alameda Research, Berggruen Holdings, BlockTower Capital, Coinbase Ventures, Marc Benioff’s TIME Ventures, Vy Capital, General Catalyst, and Future Ventures.

- CloudPay, an employee pay platform, raised $58 million. The Olayan Group led the round and was joined by investors including Pinnacle Investment Partners and Rho Capital Partners .

- Branch, a Minneapolis-based fintech focused on workforce payments, raised $48 million in Series B funding. Addition led the round and was joined by investors including Drive Capital, Crosscut Ventures, Bonfire Ventures, Matchstick Ventures, and HR Tech Investments.

- Enable, a San Francisco-based software solution for rebate management, raised $45 million in Series B funding. Norwest Venture Partners led the round and was joined by investors including Menlo Ventures and Sierra Ventures.

- One, a Sacramento, Calif.-based banking startup, raised $40 million in Series B funding. Progressive Investment Company led the round and was joined by investors including Obvious Ventures, Foundation Capital, and Core Innovation Capital.

- jaris, a Burlingame Calif.-based provider of a lending solution, raised $31 million in Series B funding. GSR Ventures led the round and was joined by investors including Wing Venture Capital and Franklin Templeton.

- Pngme, a San Francisco and Africa-based fintech company, raised $15 million in Series A funding. Octopus Ventures led the round.

- Balance Re, a German life reinsurance startup focused on asset-liability management, raised $10 million in Series A funding. Anthemis Group led, and was joined by insiders Roland Berger Industries and Talabot Finance. www.balance.re

- Ondo, a New York City-based DeFi company, raised $4 million. Pantera Capital led the round and was joined by investors including Genesis, Digital Currency Group, CMS, CoinFund, Chapter One, Bixin, Divergence, Protoscale Capital, and The LAO.

- PayEngine, a Los Angeles-based white-label payments platform, raised $1.6 million in seed funding. Mucker Capital led the round and was joined by investors including BAM Ventures, I2BF Global Ventures, and HIVE Ventures.

. . .

Care:

- Maven Clinic, a virtual clinic for women's and family health, raised $110 million in Series D funding at a valuation north of $1 billion. Dragoneer and Lux Capital co-led, and were joined by Bond and insiders Sequoia Capital, Oak HC/FT and Icon Ventures. http://axios.link/x79k

- Carrot Fertility, a San Francisco-based fertility benefits provider for employers,, raised $75 million in Series C funding. Tiger Global led, and was joined by OrbiMed, F-Prime, CRV, U.S. Venture Partners and Silicon Valley Bank. www.get-carrot.com

- Ultrahuman, a London-based metabolic fitness platform, raised $17.5 million in Series B funding. Alpha Wave Incubation led the round and was joined by investors including Falcon Edge, Steadview Capital, Nexus Venture Partners, Blume Ventures, and iSeed fund.

- Opya, a San Mateo, Calif.-based autism care company, raised $15.4 million in Series A funding. Investors include Panoramic Ventures, SB Opportunity Fund, Disability Opportunity Fund, and Raven One Ventures.

- Element5, a San Jose, Calif.-based automation company focused on post-acute care, raised $15 million in Series A funding. Insight Partners led the round.

- KARE, a Houston-based digital marketplace for senior care and post acute care facilities, raised $7.9 million. Golden Section Ventures led the round.

. . .

Future of Work:

- Databricks, a San Francisco-based unified data analytics platform, is raising at least $1.5 billion in Series H funding led by Morgan Stanley at a $38 billion valuation, per Bloomberg. Existing backers include Franklin Templeton, Fidelity, Whale Rock, AWS, CapitalG, Microsoft and Salesforce Ventures. http://axios.link/HGfC

- Automattic, the parent company of WordPress.com and Tumblr, raised $288 million in new primary funding from BlackRock, Wellington Management, Schondeld, Alta Park and insiders Iconiq and Aglaé. It also closed a $250 million secondary share buyback at a $7.5 billion valuation. http://axios.link/seP1

- Postman, a San Francisco-based API platform, raised $225 million in Series D funding valuing it at $5.6 billion. Insight Partners led the round and was joined by investors including Coatue, Battery Ventures, BOND, CRV, and Nexus Venture Partners.

- Hopper, a travel-booking company, raised $175 million in Series G funding. GPI Capital led the round and was joined by investors including Glade Brook Capital, WestCap, Goldman Sachs Growth, and Accomplice.

- Seismic, a San Diego-based sales software maker, raised $170 million. Permira led the round and was joined by investors including JMI Equity, Lightspeed Venture Partners, Jackson Square Ventures, Ameriprise, and T. Rowe Price Associates. It also acquired Lessonly, a training company.

- MOLOCO, Redwood City, Calif.-based an adtech startup, raised $150 million in Series C funding. Tiger Global Management led the round valuing it at $1.5 billion.

- Apollo GraphQL, a San Francisco-based open source and commercial API provider, raised $130 million in Series D funding. Insight Partners led the round and was joined by investors including Andreessen Horowitz, Matrix Partners, and Trinity Ventures.

- Adverity, a marketing analytics tech company, raised $120 million. SoftBank's Vision Fund 2 led the round and was joined by investors including Sapphire Ventures.

- InfoSum, a New York City-based data collaboration platform provider, raised $65 million in Series B funding. Chrysalis Investments led the round.

- Monte Carlo, a San Francisco-based data reliability company, raised $60 million in Series C funding. ICONIQ Growth led the round and was joined by investors including Salesforce Ventures, Accel, GGV Capital, and Redpoint Ventures.

- Nacelle, a Los Angeles-based e-commerce tech company, raised $50 million in Series B funding. Tiger Global led the round.

- Split.io, a testing platform, raised $50 million in Series D funding. Owl Rock led the round and was joined by investors including Northgate Capital, Accel, Lightspeed Venture Partners, Harmony Partners, M12, Atlassian Ventures, and ServiceNow.

- RepairSmith, a Los Angeles-based startup focused on automotive repair and maintenance, today raised $42 million in Series B funding. TI Capital, Mercedes-Benz, Porsche Ventures, and Spring Mountain Capital invested.

- Kiddom, a San Francisco-based digital curriculum company, raised $35 million in Series C funding. Altos Ventures led the round and was joined by investors including Owl Ventures, Khosla Ventures, and Outcomes Collective.

- Imubit, a Houston-based maker of A.I. for refiners and chemical operators, raised $30 million. Zeev Ventures led the round and was joined by investors including Insight Partners, Spider Capital, and UpWest.

- Metabase, a San Francisco-based maker of a platform for sharing data and analytics, raised $30 million in Series B funding. Insight Partners led the round and was joined by investors including Expa and NEA.

- Osaro, a San Francisco, Calif.-based robotic automation for logistics company, raised $30 million in Series C funding. Octave Ventures led the round and was joined by investors including J17 Capital, and Tomales Bay Capital.

- Product School, a San Francisco-based product management training company, raised $25 million from Leeds Illuminate.

- Tropic, a New York City-based platform for companies to buy software, raised $25 million in Series A funding. Canaan Partners led the round and was joined by investors including Founder Collective and Shine Capital.

- Baffle, a Santa Clara, Calif.-based data breach prevention startup, raised $20 million in Series B funding. Celesta Capital led, and was joined by National Grid Partners, Lytical Ventures and Nepenthe Capital. http://axios.link/yOJ3

- TrustLayer, a San Francisco-based risk management platform, raised $15.1 million in Series A funding. Craft Ventures led the round and was joined by investors including Abstract Ventures, Box Group, Propel Venture Partners, NFP Ventures, Sure Ventures, and PruVen Capital.

- Blumira, an Ann Arbor, Mich.-based cybersecurity provider, raised $10.3 million in Series A funding. Mercury led the round and was joined by investors including Ten Eleven Ventures and Duo Security and Zendesk executives Zack Urlocker and Jim Cyb.

- Regology, a San Francisco-based company focused on enterprise compliance, raised $8 million in Series A funding. ACME Capital led the round.

- Retrain.ai, a New York City-based training and upskilling platform, raised $7 million from current investors and Splunk Ventures.

- Hashnode, a Dover, Del.-based blogging platform for the software development community, raised $6.7 million in Series A funding. Salesforce Ventures led the round and was joined by investors including Sierra Ventures, Sequoia Capital India’s Surge, and Accel Partners.

- ThirdAI, a Houston-based deep learning company, raised $6 million in seed funding. Neotribe Ventures, Cervin Ventures, and Firebolt Ventures led the round.

- Webiny, a platform for building apps and websites, raised $3.5 million in seed funding. M12 led the round and was joined by investors including Samsung Next, Episode 1, and Cota Capital.

- Out Of Office, a Chicago-based travel app, raised $1.6 million in pre-seed funding. Investors included Brand Foundry, Steven Galanis (CEO of Cameo), Chris Brown (former Chief Product Officer Orbitz), Jessie Dixon (Former Havenly COO), and Liz White (CCO at Ashley Stewart).

- LitPic, a Seattle-based social network for creators, raised $1.5 million in venture capital. Investors included Fritz Lanman (CEO of ClassPass), Kal Vepuri (Brainchild), Adrian Aoun (founder of Forward), Arrington Capital (Founder of TechCrunch), Tod Sacerdoti, Andreas Penna,Tribe Capital, and Coca Rocha.

. . .

Sustainability:

- Apeel, a Santa Barbara, Calif.-based maker of a casing for fruits and vegetables, raised $250 million in Series E funding, valuing it over $2 billion. Temasek led the round.

- Ample, a San Francisco-based electric-vehicle battery swap company, raised $160 million in Series C funding. Moore Strategic Ventures led the round and was joined by investors including Shell Ventures, PTT,Disruptive Innovation Fund, Eneos, and Clayton Christensen's Rose Park Advisors.

- Kairos Aerospace, a Mountain View, Calif.-based identifier of oilfield methane leaks and emissions, raised $26 million in Series C-1 funding. DCVC led the round and was joined by investors including OGCI Climate Investments, John Crane, and Energy Innovation Capital.

- Regrow, a San Francisco-based company focused on the agri-food supply chain, raised $17 million in Series A funding. Ajax Strategies, Tenacious Ventures, and Cargill invested.

- Beta Hatch, a St. Louis-based agtech startup focused on insects, raised $10 million. Lewis & Clark AgriFood led the round and was joined by investors including Cavallo Ventures and Innova Memphis.

- Starday, a healthy and sustainable food products startup, raised $4 million in seed funding. Equal Ventures and Slow Ventures co-led, and were joined by Haystack, Great Oaks Venture Capital, XFactor Ventures and ABV. http://axios.link/JpU6

Acquisitions & PE:

- Adobe (Nasdaq: ADBE) agreed to buy Frame.io, a New York-based video collaboration platform, for $1.27 billion. Frame.io had raised $92 million from firms like Accel, Insight Partners, SignalFire, FirstMark Capital and Shasta Ventures. http://axios.link/sfBf

- Clayton, Dubilier & Rice upped its takeover offer for British supermarket chain Morrisons (LSE: MRW) to £7 billion, or 285 pence per share, and secured board approval. Rival bidder Fortress Investment Group says it's considering its options. http://axios.link/BTYF

. . .

IPOs:

- iCIMS, a Holmdel, N.J.-based recruiting software company backed by Vista Equity Partners and Susquehanna Growth Equity, filed for a $100 million IPO. It plans to list on the Nasdaq (TLNT), and reports a $48 million net loss on $251 million in revenue. http://axios.link/GCkU

. . .

SPACs:

- Aspiration Partners, a Marina Del Rey, Calif.-based sustainable banking startup, plans to go public via a merger with InterPrivate III Financial Partners Inc., a SPAC led by Landmark Value Investments's Ahmed Fattouh. A deal would value the company at $2.3 billion. Aspiration is backed by basketball coach Doc Rivers, and actors Orlando Bloom, Leonardo DiCaprio, Cindy Crawford, Kaia Gerber, and Robert Downey Jr.

Funds:

- Lowercarbon Capital, Chris and Crystal Sacca’s climate-focused fund, raised $800 million.

- Felicis Ventures, a Menlo Park, Calif.-based venture firm, closed its eighth early-stage fund with $600 million and its first opportunity fund with $300 million.

- FinTech Collective, a New York-based venture capital firm, raised $250 million across two funds.

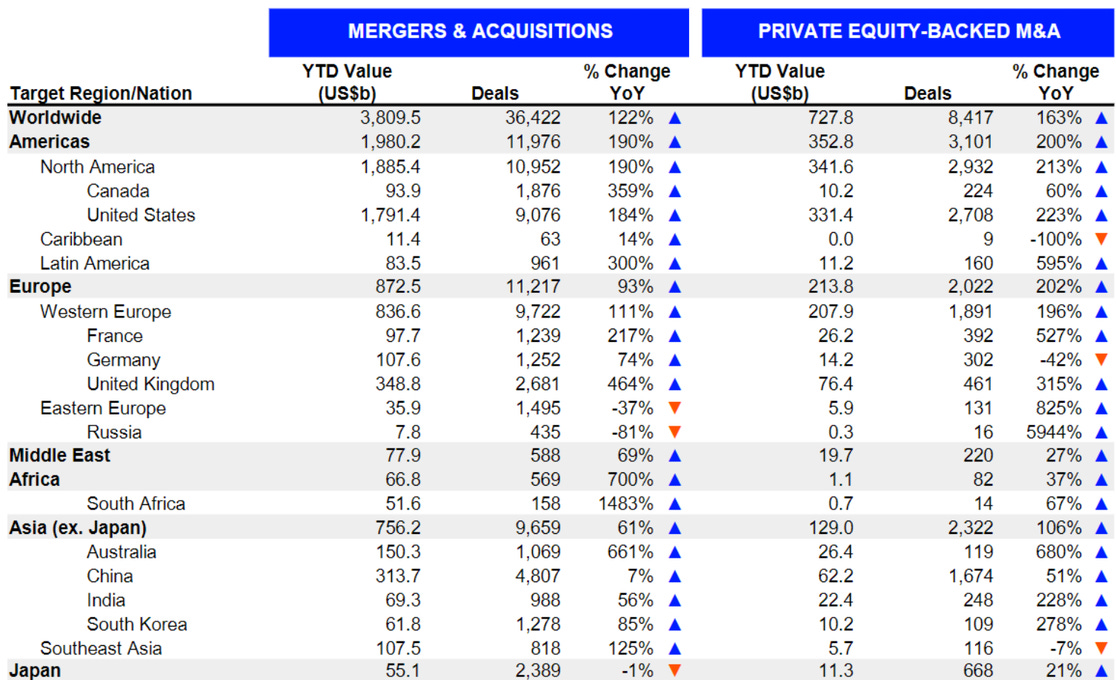

Final Numbers

Source:

Refintitiv Deals Intelligence. Data through Aug. 19, 2021.