Sourcery (8/2-8/6)

BharatPE, Rapyd, Human Interest, MakersPlace, Catch, DoNotPay, Banyan, VersusGame, Modern Animal, MixLab, Lucid Lane, Hopin, Dataiku, GoGuardian, Fullstory, Superhuman, Knowde, Sentilink...

Last Week (8/2-8/6):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Future of Work, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include BharatPE, Rapyd, Human Interest, MakersPlace, Catch, DoNotPay, Banyan, VersusGame, Modern Animal, MixLab, Lucid Lane, Hopin, Dataiku, GoGuardian, BlueCore, Brandless, Mindtickle, Fullstory, Superhuman, Knowde, Sentilink, ReversingLabs, MakerSights, Buildots, Polywork, YELA; HeyDay, Hello Sunshine, Abrigo, Zabo; PolicyBazaar; Pico, Hydrow

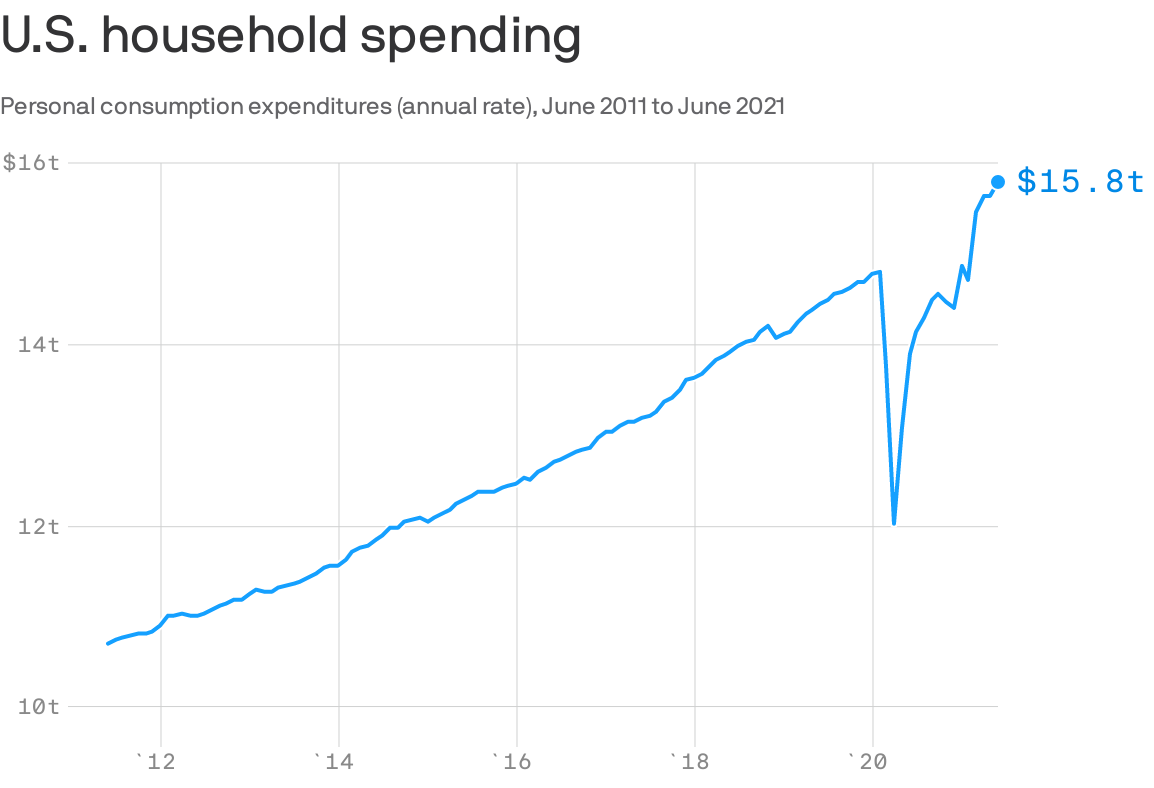

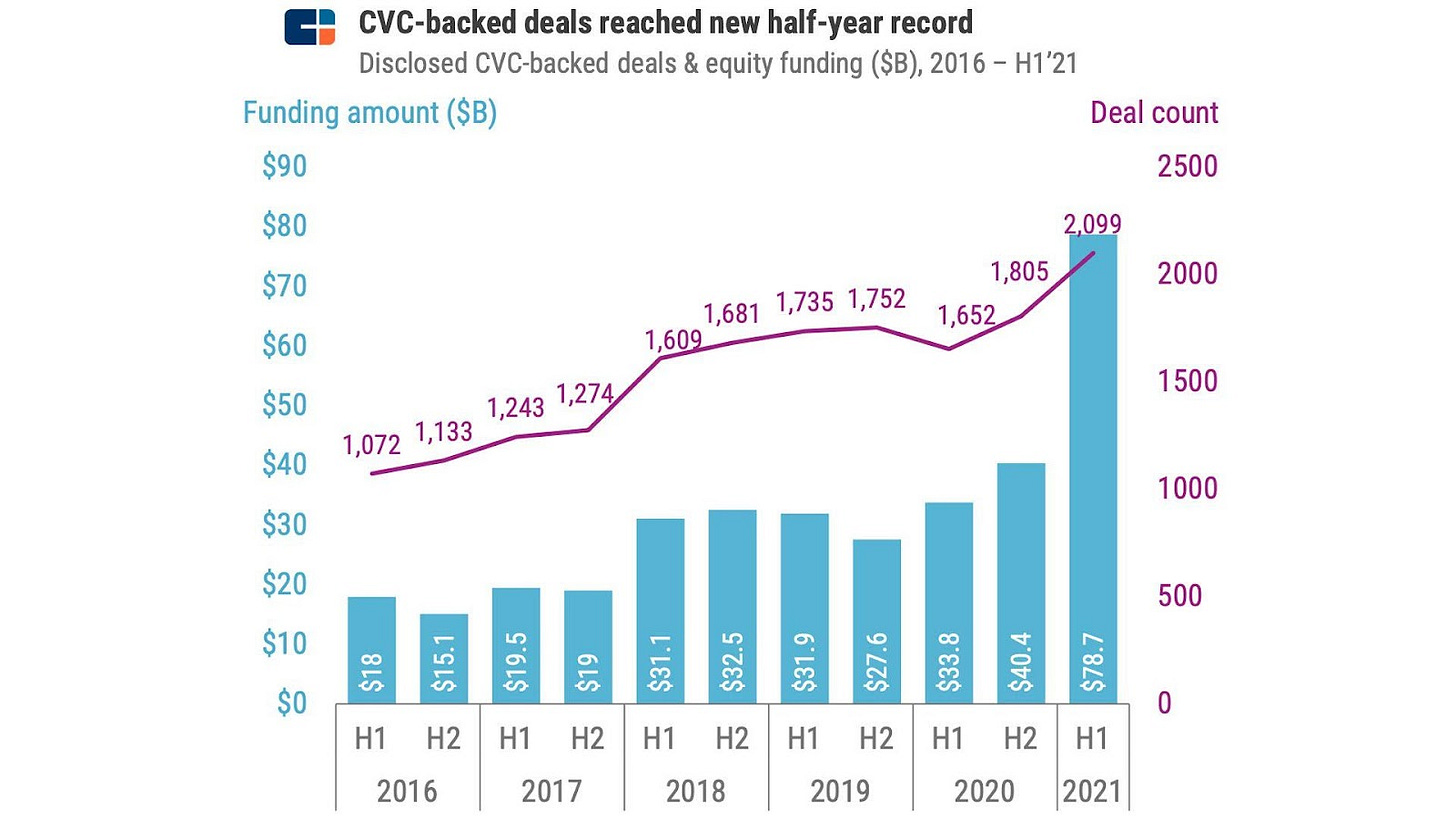

Final numbers on US Household Spend and CVC Investing Activity at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Banking Circle, a business-to-business fintech, is looking to raise about $500 million at a €5 billion ($5.9 billion) valuation, per Bloomberg.

- BharatPE, an Indian fintech startup, has raised $370 million in a Series E led by Tiger Global, with Dragoneer Investor Groupand Steadfast Capitalparticipating. http://axios.link/8ENe

- Rapyd, a London-based fintech company, raised $300 million in Series E funding. Target Global. Investors included Fidelity Management and Research Company, Altimeter Capital, Whale Rock Capital, BlackRock Funds, Dragoneer,General Catalyst, Latitude, Durable Capital Partners, Tal Capital, Avid Ventures, and Spark Capital.

- Human Interest, a San Francisco-based retirement savings company, raised $200 million in Series D funding. The Rise Fund led the round and was joined by investors including SoftBank Vision Fund 2. U.S. Venture Partners, Wing Venture Capital, Uncork Capital, Slow Capital, and Susa Ventures.

- Prime Trust, a San Francisco-based maker of fintech infrastructure, raised $64 million in Series A funding. Mercato Partners led the round and was joined by investors including Samsung Next, Nationwide, Commerce Ventures, Ayon Capital, Kraken Ventures, STCAP, s20 Capital, Seven Peaks Ventures, Diverse Angels, University Growth Fund, and Nevcaut Ventures.

- Octane Lending, a New York City-based financier for ATVs and motorcycles, raised $52 million in Series D funding. Progressive Investment Company led the round and was joined by investors including Valar Ventures, Upper90, Contour Venture Partners, Citi Ventures, Third Prime, and Parkwood. A deal values it over $900 million.

- Tabby, a Dubai-based buy-now-pay-later startup, raised $50 million in Series B funding valuing it at $300 million. Global Founders Capital and STV led the round and were joined by investors including Delivery Hero and CCVA.

- Jupiter, an Indian neobank, raised $45 million in Series B funding. Nubank, Global Founders Capital, Sequoia Capital and Matrix Partners India led the round and were joined by investors including Mirae Assets Venture, Addition Ventures, Tanglin VC, 3one4 Capital, Greyhound, and Beenext.

- Zeni, a Palo Alto fintech company, raised $34 million in Series B funding. Elevation Capital led the round and was joined by investors including Think Investments and Neeraj Arora.

- MakersPlace, a San Francisco-based NFT marketplace for digital art, raised $30 million in Series A funding. Bessemer Venture Partners and Pantera Capital led the round and were joined by investors including Eminem, 3LAU, Larry Fitzgerald Jr., Shari Glazer, Kevin Hartz, Vinny Lingham, and Tobias Lütke.

- Localize, a New York City-based real estate tech firm, raised $25 million in Series C funding. Pitango Growth led the round and was joined by investors including Mizrahi-Tefahot.

- Rentable, a Madison, Wis.-based apartment rental platform, raised $22.5 million in Series B funding. Susquehanna Growth Equity led the round.

- Yaydoo, a Mexico City-based B2B software and payments company, raised $20.4 million in Series A funding. Base10 Partners and monashees led the round and were joined by investors including SoftBank’s Latin America Fund and Leap Global Partners.

- Wildfire Systems, a Solana Beach, Calif.-based financial tech platform, raised $15 million in Series A funding. TTV Capital and QED Investors led the round and were joined by investors including B Capital, the George Kaiser Family Foundation, Daher Capital, Mucker Capital, Bonfire Ventures, Moonshots Capital, and BAM Ventures.

- Catch, a New York City-based benefits platform for independent workers, raised $12 million in Series A funding. Crosslink Capital led the round and was joined by investors including Khosla Ventures, Kindred Ventures, Nyca Partners, and Urban Innovation Fund.

- DoNotPay, a San Francisco-based robot lawyer company, raised $10 million in Series B funding. Investors included a16z, Lux Capital, Tribe, and Day One.

- Banyan, a New York City-based receipt-focused API provider, raised $10 million in funding. Fin VC led the round and was joined by investors including TTV Capital, Motivate Ventures, and Manifold.

- Data Gumbo, a Houston-based maker of a blockchain-powered and secured industrial smart contract network, has closed its $7.7 million Series B, led by Equinor Ventures, with participation from Saudi Aramco Energy Ventures and L37. www.datagumbo.com

- Trading.TV, a New York City-based social livestreaming platform for traders and financial content creators, raised $6.1 million in seed funding. Investors included L Catterton Growth, Activant, Navy Capital, and Tribe Capital.

- ZenLedger, a Seattle-based cryptocurrency tax software and blockchain analytics startup, raised $6 million in Series A funding. Bloccelerate VC led the round and was joined by investors including Mark Cuban’s Radical Ventures, G1 VC, Borderless Capital, 4RC, Centrality, BIGG Digital Assets, and CoinGecko.

- VersusGame, a San Francisco-based predictions app and money marketplace, raised $3 million in seed funding from Mark Pincus, Kevin Hart, Will.i.am, Jeffrey Katzenberg and others. www.versusgame.com

. . .

Care:

- Palta, a London-based health and wellness company, raised $100 million in Series B funding. Per Brillioth at VNV Global led the round and was joined by investors including Target Global.

- Modern Animal, a Los Angeles-based veterinary company, raised $75.5 million in funding. It raised $35.5 million in Series A funding led by True Ventures and Addition and a $40 million Series B led by Founders Fund.

- DayTwo, a Walnut Creek, Calif.-based microbiome sciences company, raised $37 million in funding. Cathay Innovation and aMoon led the round.

- Iterative Scopes, a Cambridge, Mass.-based gastroenterology medicine company, raised $30 million in Series A funding. Obvious Ventures led the round and was joined by investors including Eli Lilly, Johnson & Johnson Innovation, Breyer Capital, and Seae Ventures.

- Connections Health Solutions, Phoenix-based behavioral-health-crisis-focused business, raised $30 million. Heritage Group led the round.

- Mixlab, a New York City-based pet pharmacy, raised $20 million. Sonoma Brands led the round and was joined by investors including Global Founders Capital, Monogram Capital, Lakehouse Ventures, and Brand Foundry.

- Lucid Lane, a Los Altos, Calif.based telehealth solution, raised $16 million in Series A funding. Accel led the round and was joined by investors including Battery Ventures, AME Cloud Ventures, and Morado Ventures.

- Juno Medical, a New York City-based doctor's office, raised $5.4 million in seed funding. Vast Ventures led the round and was joined by investors including Atento Capital, Company Ventures, humbition, RareBreed Ventures, and Lafayette Square.

- HeyRenee, a Los Angeles-based health concierge platform launching next year, raised $3.8 million led by Quiet Capital, with Mucker Capital, Fika Ventures, Tau Ventures, Global Founders Capital and SaaS Venture Capital also participating. ww.heyrenee.co

- Kensho Health, a New York City-based wellness company, raised $3.5 million in seed funding. KB Partners led the round and was joined by investors including Company Ventures and Gaingels.

- Clinify Health, a Chicago-based digital health firm, raised $3.1 million. Seae Ventures led the round and was joined by investors including Better Ventures, Impact Engine, Acumen America and the California Health Care Foundation.

- Humanity, a U.K.-based maker of an app focused on reversing aging, raised $2.5 million. Investors include Alex Tew and Michael Acton-Smith (co-founders of Calm), Taavet Hinrikus (co-founder of Wise), Robin Thurston (co-founder of MyFitnessPal), One Way Ventures, 7Percent, and Seedcamp.

- Revery, a mental health and sleep aid app has raised $2 million led by Sequoia Capital India's Surge program, with GGV Capital, Pascal Capital, zVentures and angel investors participating. http://axios.link/CU0R

. . .

Future of Work:

- Hopin, the London-based events platform, raised $450 million in Series D funding. Arena Holdings and Altimeter Capital led the round and were joined by investors including Adams Street Partners, Untitled Investments, and XN in addition to existing investors Andreessen Horowitz, DFJ Growth, General Catalyst, GIC, IVP, Northzone, Salesforce Ventures, Slack Fund, Temasek, and Tiger Global.

- Dataiku, a New York-based A.I. company, raised $400 million in Series E funding valuing it at $4.6 billion. Tiger Global led the round and was joined by investors including ICONIQ Growth, CapitalG, FirstMark Capital, Battery Ventures, Snowflake Ventures, and Dawn Capital.

- GoGuardian, a Los Angeles-based edtech platform, raised $200 million from Tiger Global Management, valuing the business over $1 billion.

- Bluecore, a New York City-based marketing tech maker, raised $125 million in Series E funding valuing it at $1 billion. Georgian led the round and was joined by investors including FirstMark, Norwest, and Silver Lake Waterman.

- Brandless, a Draper, Utah-based direct-to-consumer e-commerce startup, raised $118 million in equity and debt funding led by Clarke Capital Group, with Keystone National Group as the lender. http://axios.link/YC7F

- FullStory, an Atlanta-based digital analytics platform, raised $103 million in Series D funding. Permira’s growth fund led the round and was joined by investors including Kleiner Perkins, GV, Stripes, Dell Technologies Capital, Salesforce Ventures, and Glynn Capital.

- Mindtickle, a San Francisco-based sales tech company, raised $100 million in Series E funding valuing it over $1.2 billion. SoftBank Vision Fund 2 led the round and was joined by investors including Norwest Venture Partners, Canaan, NewView Capital, and Qualcomm Ventures.

- Nozomi Networks, a cybersecurity business for industrial control systems, raised $100 million in Series D funding. Triangle Peak Partners led the round and was joined by investors including Forward Investments, Honeywell Ventures, Keysight Technologies, Porsche Digital, Telefónica Ventures, and In-Q-Tel.

- Yellow.ai, a San Francisco-based customer chatbot platform, raised $78.2 million in Series C funding. WestBridge Capital led the round and was joined by investors including Sapphire Ventures, Salesforce Ventures, and Lightspeed Venture Partners.

- Superhuman, a San Francisco-based subscription email service, raised $75 million. IVP led the Series C round and was joined by Tiger Global, Drew Houston (CEO of Dropbox), Timothy Young (President of Dropbox), Jason Citron (CEO of Discord), Arianna Huffington (CEO of Thrive), Ashton Kutcher, Will Smith, and the Chainsmokers. The deal values the company at $875 million.

- Knowde, a San Jose, Calif.-based marketplace for ingredients, polymers, and chemistry, raised $72 million in Series B funding. Coatue led the round and was joined by investors including Sequoia Capital, Refactor Capital, Bee Partners, and Cantos Ventures.

- SentiLink, a San Francisco-based identity verification tech company, raised $70 million in Series B funding. David Sacks of Craft Ventures led the round and was joined by investors including Felicis Ventures, Andreessen Horowitz, and NYCA.

- Crehana, a Mexico City-based reskilling and upskilling tech maker, raised $70 million in Series B funding. General Atlantic led the round.

- ReversingLabs, a Cambridge, Mass.-based business focused on supply chain threats, raised $56 million in Series B funding. Crosspoint Capital Partners led the round and was joined by investors including ForgePoint Capital and Prelude.

- Novakid, a San Francisco-based language learning platform, raised $35 million in Series B funding. Owl Ventures and Goodwater Capital led the round and were joined by investors including PortfoLion, TMT Investments, Xploration Capital, LearnStart, LETA Capital, and BonAngels.

- MoEngage, a San Francisco-based customer management platform, raised $32.5 million. Multiples Alternate Asset Management led the round and was joined by investors including Eight Roads Ventures, F-Prime Capital, and Matrix Partners.

- Buildots, a maker of construction tech, raised $30 million in Series B funding. Lightspeed Venture Partners led the round and was joined by investors including TLV Partners, Future Energy Ventures, and Tidhar Construction Group.

- MakerSights, a San Francisco-based retail analytics software startup, raised $25 million in Series B funding led by G2VP, with Golub Capital, Gaingels, Forerunner Ventures, Baseline Ventures, Brett Hurt, Brant Barton, Jared Schrieber, Jon Brelig, and Elizabeth Spaulding also participating. www.makersights.com

- Ahana, a San Mateo, Calif.-based data analytics startup, raised $20 million in Series A funding. Third Point Ventures led the round and was joined by investors including GV (formerly Google Ventures), Leslie Ventures, and Lux Capital.

- Plant Prefab, a Rialto, Calif.-based prefabricated custom home builder, raised $20 million in equity. Asahi Kasei Corporation and Paris Ventures led the round and were joined by investors including Amazon Alexa Fund, Ferguson Ventures, and Obvious Ventures.

- Villa, a San Francisco-based backyard building company, raised $15 million in seed funding. Atomic led the round.

- Suma Brands, a buyer of Amazon-based brands, raised $12.5 million in equity. Pace Capital and Material led the round.

- Polywork, a New York City-based professional social network, raised $13 million in Series A funding. Andreessen Horowitz led the round and was joined by investors including Caffeinated Capital, Goldcrest Capital, Bungalow Capital,20VC, Elad Gil, Nat Friedman, Anthony Pompliano, and Ari Emanuel.

- Statsig, a Seattle-based testing platform, raised $10.4 million in Series A funding. Sequoia Capital led the round and was joined by investors including Madrona Venture Group.

- YELA, an app for custom celebrity videos, raised $2 million in new funding led by Justin Mateen and Sean Rad, with Graph Ventures, Samos Fund and others also participating. http://axios.link/UAJo

. . .

Sustainability:

Acquisitions & PE:

- PAI Partners will acquire some of PepsiCo.’s (NASDAQ: PEP) juice brands including Tropicana and Naked for about $3.3 billion. Pepsi will retain a 39% stake in the ensuing company.

- News Corp. (Nasdaq: NWSA) agreed to acquire S&P Global (NYSE: SPI) and IHS Markit (NYSE: INFO)’s fuel data arm for $1.15 billion.

- Foot Locker (NYSE: FL) agreed to acquire Eurostar, a footwear store operator on the U.S. West Coast for $750 million. It will also acquire Text Trading, a Japanese shoe seller, for $360 million.

- Hootsuite acquired Heyday, a Montreal-based conversational AI platform for brands, for $48 million.

https://www.heyday.ai/

- Reese Witherspoon's Hello Sunshine has sold to a new, unnamed media company backed by Blackstone and led by former Disney executives Tom Staggs and Kevin Mayer, in a deal reported worth over $900 million. http://axios.link/HMOB

- Carlyle invested in Abrigo, an Austin-based software provider to financial institutions, valuing it over $1 billion, per Bloomberg.

- Apax Partners acquired and merged two software businesses into portfolio company Cybergrants in a deal worth $2 billion. It acquired EveryAction, a Washington D.C.-based software maker for non-profits, from Insight Partners. It also acquired Social Solutions, an Austin-based maker of tech for social workers, from Vista Equity Partners.

- Clean Harbors (NYSE: CLH) agreed to acquire HydroChemPSC, a provider of industrial cleaning, specialty maintenance and utilities services, for about $1.3 billion from Littlejohn & Co.

- FiscalNote, has acquired Equilibrium, a Singaporean provider of Environmental, Social, and Governance (ESG) management automation software. http://axios.link/oAVY

- Coinbase (Nasdaq: COIN) agreed to acquire Zabo, a Burleson, Tx.-based crypto data aggregator. Zabo was backed by investors including Digital Currency Group and Moonshots Capital. Financial terms weren't disclosed.

. . .

IPOs:

- Policybazaar, an Indian digital insurance marketplace company, filed for an initial public offering in the country, according to Bloomberg. The firm is backed by SoftBank, Tiger Global Management and Tencent Holdings.

- Weber, a Palatine, Ill.-based grill company, raised $250 million in an offering of 17.9 million shares priced at $14 per share—it previously planned to raise up to $797 million. Weber generated net sales of $1.5 billion in the year ending in Sept. 2020 and reported $609.7 million in gross profit. BDT Capital Partners backs the firm.

- European Wax Center, a Plano, Texas-based hair removal salon chain, raised $180.2 million in an offering of 10.6 million shares (16% sold by insiders) priced at $17 per share. The company generated $103.4 million in 2020 revenue and ran at a net loss of $21.5 million. General Atlantic backs the firm.

. . .

SPACs:

- Pico, a New York City-based financial markets tech company, agreed to go public via merger with FTAC Athena Acquisition Corp., a blank check company backed by Betsy Cohen. The deal values the firm at about $1.8 billion.

- Hydrow, a Cambridge, Mass.-based rowing machine company, is in talks to go public via an acquisition with Sandbridge X2 Corp., a SPAC, per Bloomberg.

Funds:

- BoxGroup, a New York City-based early-stage investor, raised $255 million for two new funds: BoxGroup Five and BoxGroup Strive with $127.5 million each.

- Moderne Ventures, a Chicago-based early-stage venture capital firm, raised a $200 million fund.

- Work-Bench, a New York City-based enterprise-tech-focused investor, raised $100 million for Fund 3.

- Craft Ventures, a San Francisco-based early-stage investor, raised $1.1 billion across two funds, Craft Ventures III ($612 million) and Craft Ventures Growth I ($510 million).

Final Numbers

Data:

Bureau of Economic Analysis via FRED; Chart: Axios Visuals

Credit: CB Insights