Sourcery (8/21-8/25)

The Man in the Arena ☀ Teamshares, LemFi, Koverly, Nodig, Genesis, Gympass, Aily Labs, Axiom Space, Ramp, Hugging Face, SpyCloud, Modular, Elemental Cognition, Grip Security, Ghost, Beamer, Massdriver

So what’s going on in this so-called “arena”??

Last week Chamath pretty much let X/Twitter get the best of him. It was entertaining. Eric Newcomer does a great deep dive into the thick of the backlash in the “Musings” below.

Well, if he’s in the arena, then I’m in my parents garage..

Maybe this ‘grind mindset hustle speak’ would work on X if he were a hungry 20 year-old who actually has nothing to lose and is looking to save the country (dare I say the world) from our own systemic wrongdoings.

But he’s not. He’s already ungodly rich to the point of ‘funding his own’ multi-hundred million dollar deals. So yeah, the people actually don’t really want to hear it from ya.

What do these ‘learnings’ actually teach us? That at any ‘level’, we are always our own worst enemy. We have weak moments where we don’t use our best judgment, or let our egos get the best of us, or just can’t stop competing with ourselves, or are still met with self-doubt. And that’s fine. It happens. You’ll just have to hope and wait until the next juicy profitable S-1 comes out and we’ll get distracted and forget all about it (thank you Klaviyo 😂). All in all, yeah, social media amplification doesn’t quite help with keeping those moments private. Because working hard is messy, and there are times that no one else should be in the arena with you… or even know that you think you’re in one. 😂

And look, I don’t know if he’s actually truly ‘evil’ or if he’s just a super competitive hungry capitalist (hmm I may know a couple of these - they’re mostly good people). If all else fails, he does seem to love & appreciate his family (as seen by the cute baby cameos in pod), and we can certainly get behind that at the minimum - aah the simple things in life.

Lastly, don’t lie, we do love hearing about the extravagant things he does - we’re all a little bit curious to know what the next level looks like, even if we might not want it.

Anyways, what does ‘the arena’ even mean??

“..I don't even know what that means”

”No one knows what it means, but it's provocative”

”..No, it's not, it's gross”

”Gets the people going!”

If you know this reference - secretly reply via email & I’ll send you free Sourcery merch.

Hate it or Love it The Underdogs on Top

(Damn that music video always got me. The Game & 50 Cent)

“Discipline is doing what you hate to do, but do it like you love it.” - Mike Tyson

For those of you not OOO, or ‘checked out,’ or at burning man this week..

But are still working hard til 12:19am, or are just starting up again at 3:21am, or have been up for the past 20hrs traveling to close customers, or are hustling to get a new job with healthcare, or are busy putting out remote team ‘fires’ (or bank accounts) across the world.. or maybe even just editing/writing a silly little newsletter you write every week.

My Dad wanted me to share with you this Mike Tyson quote from the Joe Rogan Experience on hustling through the ‘hard’ stuff.

Because there is a 3-day weekend ahead and you are allowed to enjoy a day or three of it with your family & friends. 😊

You deserve it.

(I may or may not be the one with the silly little newsletter running on 4 lovely hrs of sleep 😅)

Musings

E143: Nvidia smashes earnings, Arm walks the plank, M&A market, Vivek dominates GOP debate & more, All-in Podcast

The capitalists you love to hate, synthesize a huge week of happenings - if you haven’t had the time yet, luckily, we have some extra coming up

(0:00) Bestie intros: Friedberg's interview with NASA Astronaut Woody Hoburg, live from the ISS!

(10:04) Nvidia smashes earnings, GPU market outlook

(37:39) Arm files for IPO: positive sign or plank walk? Plus: State of the IPO market

(49:51) Sacks on current investable metrics right now in VC

(55:33) GOP Debate breakdown: Vivek's statement, DeSantis's strategy, Haley & Christie solidify positions

(1:39:46) Vivek's comments on the Climate Agenda

(1:47:07) Prigozhin crash

Quick S-1 Teardown: Klaviyo, Matt Turck @ FirstMark Capital

The consumer-oriented IPO window is opening…

The Complete History & Strategy of Costco, Acquired

A lot of talk about this podcast, mature consumer companies are in.

“Measured by sales, the biggest CPG brand in the world is Kirkland (Costco’s private label brand). It makes $52B a year - more than Nike.” Alexis Ohanian

Costco has the cheapest prices of any major retailer in America — and also the wealthiest customer base. They pay their hourly workers 30% above the industry norm (and give them excellent healthcare + 401k benefits) — and are almost 3x more profitable on labor than Walmart.

The Scam in the Arena, Newcomer

Chamath Palihapitiya took retail investors for a ride, got away with it, and just can't let himself take the win.

Drop Your Ego — Grow Your Power, Dr. Julie Gurner

She is the GOAT on X/Twitter.

The Decarbonized Economy, Contrary’s latest deep dive on a decarbonized economy, plus new memos on Charm Industrial, Calm, and more, Contrary Research Rundown #49

Ramp raised a lot of money, because people like them (new funding announcement in deals below)

Today's newsletter is brought to you by Ramp, the #1 corporate card, bill pay, and reimbursement platform designed to help startups and venture funds save money with 1.5% cash-back on every swipe. Trusted by venture-backed startups from pre-seed all the way through IPO like Morning Brew, Seed, Eventbrite, Discord, and yes.. even Anduril.

Get $500 after you spend your first $1K

. . .

Last Week (8/21-8/25):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Teamshares, LemFi, Koverly, Nodig, Genesis, Gympass, Aily Labs, Axiom Space, Ramp, Hugging Face, SpyCloud, Modular, Elemental Cognition, Grip Security, Ghost, Beamer, Luxury Presence, Fulcrum, Cerby, Cerby, Anytime, Cypago, Pico MES, Sizzle AI, Massdriver, Modify, Abbey, Crate, Panobi, Pest Share, Wand.app, ScribeUp, Lex, Communion, Blanka, Electric Era, Accure, Jellatech; ForgeRock/Thoma Bravo, SentinelOne; Arm Holdings

Final numbers on IPO Proceeds at the bottom.

Deals

Fintech:

- Ramp, a New York City-based finance automation platform, raised $300 million in Series D funding. Thrive Capital and Sands Capital co-led the round and were joined by General Catalyst, Founders Fund, and existing investors.

- Teamshares, a Brooklyn-based employee ownership platform for small businesses, raised $124 million in Series D funding. QED Investors led the round and was joined by Inspired Capital, Khosla Ventures, Slow Ventures, Spark Capital, and Union Square Ventures.

- LemFi, a Oakland, Calif.-based digital banking service platform for immigrants living in North America and Europe, raised $33 million in Series A funding. Left Lane Capital led the round and was joined by Y Combinator, Zrosk, Global Founders Capital, and Olive Tree.

- Ikigai Labs, a San Francisco-based A.I. spreadsheet platform designed to automate analytics workflows, raised $25 million in funding. Premji Invest led the round and was joined by Foundation Capital and e& capital.

- Koverly, a Boston-based B2B payments solution provider, raised $7.6 million in seed funding. Accomplice VC, Vinyl Capital, and One Way Ventures invested in the round.

- Novig, a New York City-based sports betting exchange, raised $6.4 million in seed funding. Lux Capital led the round and was joined by Y Combinator, Paul Graham, Soma Capital, and others.

- Maple, a Miami-based institutional on-chain capital marketplace, raised $5 million in funding. Blocktower Capital and Tioga Capital led the round and were joined by Cherry Ventures, Spartan Capital, and others.

- Raleon, a Wilmington, N.C.-based web3 engagement platform, raised $3.8 million in seed funding. Blockchange led the round and was joined by Play Ventures, Alliance DAO, and Portal Ventures.

- Communion, a London-based savings app, raised £2.5m in pre-seed funding co-led by Revolut and Target Global. https://axios.link/3QSGhUd

. . .

Care:

- Genesis Therapeutics, a Burlingame, Calif.-based AI drug discovery company, raised $200m in Series funding. Andreessen Horowitz led, and was joined by Fidelity, BlackRock, Nvidia and insiders Rock Springs Capital, T. Rowe Price, Menlo Ventures and Radical Ventures. https://axios.link/3QNe4xM

- Gympass, a New York City-based corporate wellness platform, raised $85 million in Series F funding. EQT Growth led the round and was joined by Neuberger Berman.

- Aily Labs, a Munich-based provider of pharma-focused decision analysis software, raised $20.7m in Series A funding led by Insight Partners, per Axios Pro. https://axios.link/3P81zf0

. . .

Enterprise & Consumer:

- Axiom Space, a Houston-based commercial space station operator, raised $350m co-led by Aljazira Capital and Boryung Co. https://axios.link/3KQAudR

- Hugging Face, a New York-based company that bills itself as "GitHub for machine learning," this morning announced $235 million in Series D funding led by Salesforce Ventures at a $4.5 billion post-money valuation. The actual GitHub is owned by Microsoft, and this round looks like an effort by Microsoft's rivals to make sure GitHub isn't able to become the "GitHub for machine learning.” In addition to Salesforce and Sound Ventures, other investors include Google, Amazon, Nvidia, Intel, AMD, Qualcomm and IBM.

- SpyCloud, an Austin, Tex.-based digital identity protection company, raised $110 million in funding. Riverwood Capital led the round.

- Modular, a Palo Alto, Calif.-based A.I. software development platform, raised $100 million in funding. General Catalyst led the round and was joined by existing investors.

- DICE, a London, England and Brooklyn, New York-based music ticketing platform, raised $65 million in funding. MUSIC and LionTree co-led the round, and were joined by Structural Capital, Ahdritz Capital, Exor Ventures, and Mirabaud Lifestyle Fund.

- Elemental Cognition, a New York City-based generative A.I. company, raised $60 million in Series B funding. Bridgewater Associates, Breyer Capital, AME Cloud Ventures, and Staged Ventures invested in the round, along with others.

- Grip Security, a Tel Aviv, Israel-based SaaS identity risk management provider, raised $41 million in Series B funding. Third Point Ventures led the round and was joined by YL Ventures, Intel Capital, and The Syndicate Group.

- Ghost, a Los Angeles-based B2B marketplace for surplus inventory, raised $30 million in Series B funding. Cathay Innovation led the round and was joined by Union Square Ventures, Equal Ventures, and Eniac Ventures.

- Beamer, a San Francisco-based customer engagement platform, raised $20 million in funding. Camber Partners led the round.

- Luxury Presence, a Santa Monica, Calif.-based provider of marketing software for real estate brokers, raised $19.2m in Series B1 funding. Bessemer Venture Partners led, and was joined by Switch Ventures. https://axios.link/45LWePV

- Fulcrum, a Minneapolis-based cloud software company, raised $18 million in Series A2 funding. Bessemer Venture Partners led the round and was joined by Battery Ventures, Motivate Venture Capital, Schematic Ventures, and others.

- Cerby, an Alameda, Calif.-based access management platform for nonstandard applications, raised $17 million in Series A funding. Two Sigma Ventures led the round and was joined by Outpost Ventures, Ridge Ventures, Founders Fund, Bowery Capital, and others.

- Clockworks Analytics, a Boston-based SaaS building analytics provider, raised $16.1 million in funding. Carom Growth Partners led the round and was joined by SE Ventures.

- Anytype, a Berlin, Germany-based peer to peer open-source builder with an emphasis on privacy, raised $13.4 million in funding. Balderton Capital led the round.

- Cypago, a Tel Aviv, Israel-based developer of a platform that helps organizations adopt, implement, and maintain security standards, raised $13 million in funding. Entrée Capital, Axon Ventures, and Jump Capital led the round and were joined by Ariel Maislos, Prof. Ehud Weinstein, and Ofir Shalvi.

- Pico MES, a San Francisco-based factory and machinery control software company, raised $12.4 million in Series A funding. Bosch Ventures led the round and was joined by Counterpart Ventures, Momenta, Lemnos, and others.

- Sizzle AI, a New York City-based company creating direct-to-learner products powered by A.I., raised $7.5 million in seed funding. Owl Ventures led the round and was joined by 8VC.

- Massdriver, a Littleton, Colo.-based cloud operations platform, has raised $8 million in funding. Builders VC led the round and was joined by 1984 Ventures, Y Combinator, and others.

- Modify, a Los Angeles-based A.I. image editor, raised $7 million in seed funding. New Enterprise Associates led the round and was joined by previous investors.

- Abbey, a San Francisco, Calif.-based secure infrastructure platform for engineers, raised $5.3 million in seed funding. Point72 Ventures led the round and was joined by Haystack, Essence Ventures, and others.

- Crate, a Redwood City, Calif-based A.I.-powered social curation platform, raised $5 million in seed funding. MaC Venture Capital, Bessemer, Collide, and others invested in the round.

- Panobi, a San Francisco-based growth platform for product and marketing teams, raised $5 million in seed funding. Index Ventures led the round and was joined by Stewart Butterfield, Cal Henderson, and others.

- Pest Share, a Boise, Idaho-based SaaS pest control services platform, raised $4.5 million in seed funding. MetaProp and Capital Eleven led the round and were joined by Vesta Ventures and Far Out Venture Capital.

- Wand.app, a Brooklyn, N.Y.-based AI-powered creative tool for artists, raised $4.2 million in seed funding. O’Shaughnessy Ventures led the round and was joined by Long Journey, Notation Capital, Betaworks, Charge Venture, and others.

- Creatively Focused, a Mendota Heights, Minn.-based educator-driven technology company, raised $3 million in seed funding. York IE led the round and was joined by Mairs & Power Venture Capital, Groove Capital, and Gopher Angels.

- ScribeUp, a Los Angeles-based subscription management company, raised $3 million in seed funding. Mucker Capital led the round.

- Lex, a Los Angeles-based A.I.-powered writing platform, raised $2.75 million in seed funding. True Ventures led the round.

- Weekday, a San Francisco-based recruiting and networking platform for software engineers, raised $2.2 million in seed funding. Venture Highway led the round and was joined by others.

- Blanka, a Vancouver, British Columbia-based private label beauty and wellness platform, raised $2 million in seed funding. Dundee Venture Capital led the round and was joined by Storytime Capital, Disruption Ventures, and others.

. . .

Sustainability:

- Electric Era, a Seattle-based electric vehicle battery company, raised $11.5 million in Series A funding. HSBC Asset Management led the round and was joined by SQM Lithium Ventures, Blackhorn Ventures, and Proeza Ventures.

- ACCURE, an Aachen, Germany-based battery safety and performance software provider, raised $7.8 million in funding. Blue Bear Capital and HSBC Asset Management led the round and were joined by Capnamic Ventures and Riverstone Holdings.

- Jellatech, a Raleigh, N.C.-based producer of animal-free collagen and gelatin, raised $3.5m in seed funding. ByFounders led, and was joined by Milano Investment Partners, Joyful VC, Siddhi Capital and Blustein joined. https://axios.link/45iD2tf

Acquisitions & PE:

- Thoma Bravo completed its acquisition of ForgeRock, a San Francisco-based digital identity platform for customers and employees, for $2.3 billion in cash.

- SentinelOne (NYSE: S), a Mountain View, Calif.-based cybersecurity company with a $5b market cap, is seeking a buyer, per Reuters. Shareholders include Insight Partners (11.86%) and Redpoint Ventures (5.98%). https://axios.link/45CgVxJ

. . .

IPOs:

- Arm Holdings, a Cambridge, U.K.-based semiconductor manufacturer, filed to go public in the U.S. The company posted $2.7 billion in total revenue for the year ending in March 2023 and reported $524 million in net income. SoftBank owns the company.

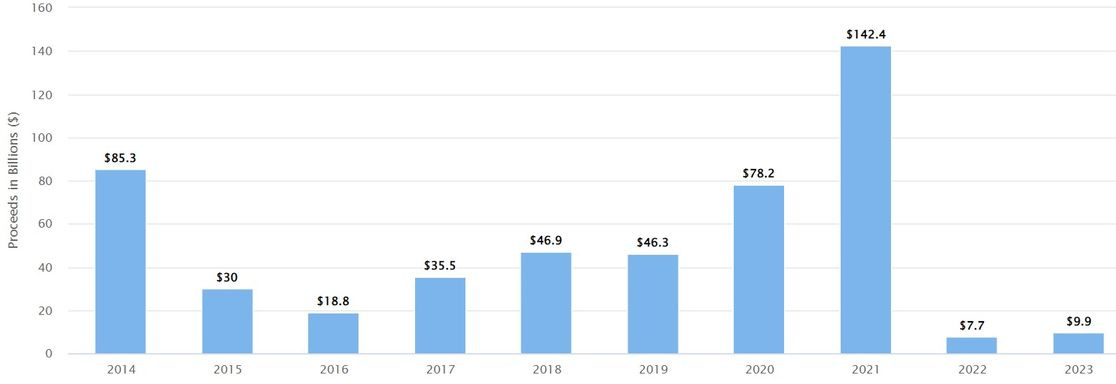

IPO Proceeds.. Yikes

Source: Renaissance Capital. Data through Aug. 21, 2023.

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.