Sourcery (8/29-9/2)

EarlySalary, Solid, Alloy, Fairmatic, Landa, Sei, Theranica, Power, Landing, OneSignal, PROOF, Fairmarkit, StarTree, Zumper, Tarci, Zilla Security, Astro, Stacked, Carbon Counts

Hope everyone had an enjoyable last leg of summer with the official close out of LDW.

And now… welcome to the official countdown to the holiday season. (ha)

In an effort to help lighten the load for this short week back, I’ve kept it rather quick.

But stay tuned next week for some exciting announcements!

. . .

Last Week (8/29-9/2):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include EarlySalary, Solid, Alloy, Fairmatic, Landa, Sei, Theranica, Power, Landing, OneSignal, PROOF, Fairmarkit, StarTree, Zumper, Tarci, Zilla Security, Astro, Stacked, Blue World, Carbon Counts; Carta, Instacart, Medtronic

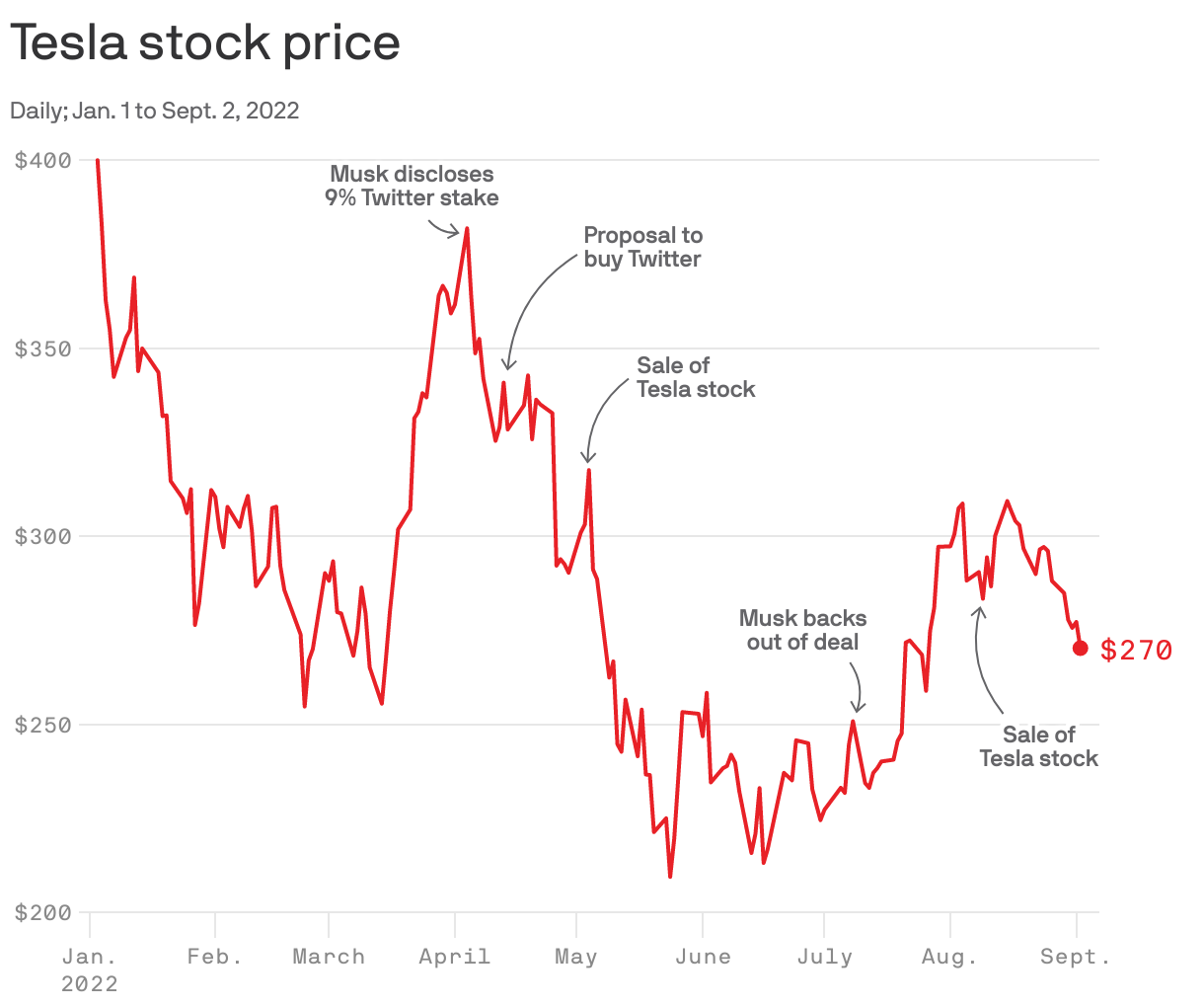

Final numbers on Tesla Stock Price Changes Overtime at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- EarlySalary, a Pune, India-based consumer lending fintech, raised $110 million in Series D funding. TPG’s The Rise Fund and Norwest Venture Partners led the round and were joined by investors including Piramal Capital and Housing Finance Limited.

- Solid, a San Mateo, Calif.-based infrastructure provider for companies to launch and scale fintech products, raised $63 million in Series B funding. FTV Capital led the round and was joined by Headline.

- Alloy, a New York-based identity decisioning platform for banks and fintechs, raised an additional $52 million in funding. Lightspeed Venture Partners and Avenir Growth led the round and were joined by investors including Canapi Ventures, Bessemer Venture Partners, Avid Ventures, and Felicis Ventures.

- Fairmatic, a remote-based fleet insurance company, raised $42 million in Series A funding. Foundation Capital led the round and was joined by Aquiline Technology Growth.

- Landa, a New York-based real estate investing company, raised $25 million in Series A funding. NFX, 83North, and Viola Ventures invested in the round.

- Billogram, a Stockholm-based invoicing and payment platform, raised €15 million ($15.08 million) in funding led by Swisscom Ventures.

- FX HedgePool, a London and New York-based peer-to-peer matching platform for foreign exchange transactions, raised $8 million in Series A funding. Information Venture Partners led the round and was joined by investors including Fidelity International Strategic Ventures and NAventures.

- Willow Servicing, a San Francisco-based mortgage servicing platform, raised $6 million in seed funding led by Thomvest Ventures.

- Sei, a New York-based layer 1 blockchain for DeFi, raised $5 million in funding. Multicoin Capital led the round and was joined by investors including Coinbase Ventures, Delphi Digital, Hudson River Trading, GSR, Hypersphere, Flow Traders, Kronos Research, and other angels.

- StepFunction, a Palo Alto-based SaaS revenue growth solutions provider, raised $5 million in post-seed funding. Dallas Venture Capital led the round and was joined by investors including Hummer Winblad Venture Partners, Inventus Capital Partners, and Z5 Capital.

. . .

Care:

- Theranica, a Montclair, N.J.-based migraine-focused digital therapeutics company, raised $45 million in Series C funding. New Rhein Healthcare Investors led the round and was joined by investors including aMoon, Lightspeed Venture Partners, LionBird, Takoa Invest, and Corundum Open Innovation.

- Apricity, a London-based virtual fertility clinic, raised €17 million ($16.91 million) in Series B funding. MTIP led the round and was joined by Iris Ventures.

- Avenda Health, a Culver City, Calif.-based prostate cancer health care company, raised $10 million in Series B funding. VCapital led the round and was joined by investors including Plug & Play Ventures and Wealthing VC Club.

- Power, a San Francisco-based clinical trials startup, raised $7 million in seed funding. Footwork and CRV led the round and were joined by investors including Artis Ventures, South Park Commons, and AirAngels.

- PsycApps, a London-based mental health video game developer, raised £1.5 ($1.73 million) in seed funding from Morningside Ventures.

. . .

Enterprise & Consumer:

- Landing, a Birmingham, Ala.-based apartment rental platform, raised $75 million in Series C funding. Delta-v Capital led the round and was joined by investors including Greycroft and Foundry.

- OneSignal, a San Mateo, Calif.-based customer engagement platform, raised $50 million in Series C funding. BAM Elevate led the round and was joined by investors including Nimble Partners, SignalFire, and Zach Coelius.

- PROOF, a Los Angeles-based NFT-focused podcast and events platform, raised $50 million in Series A funding. A16z crypto led the round and was joined by investors including Seven Seven Six, True Ventures, Collab+Currency, Flamingo DAO, SV Angel, and VaynerFund.

- Fairmarkit, a Boston-based automated sourcing platform, raised $35.6 million in Series C funding. OMERS Growth Equity led the round and was joined by investors including GGV Capital, Insight Partners, HighlandX, and ServiceNow.

- StarTree, a Mountain View, Calif.-based analytics platform, raised $47 million in Series B funding. GGV Capital led the round and was joined by investors including Sapphire Ventures, Bain Capital Ventures, and CRV.

- Zumper, a San Francisco-based privately owned rental marketplace, raised $30 million in Series D extension funding led by Kleiner Perkins.

- Caju Benefícios, a São Paulo, Brazil-based benefits management platform, raised $25 million in Series B funding. K1 Investment Management led the round and was joined by investors including Valor Capital Group, Caravela Capital, Clocktower Ventures, and FJ Labs.

- Ambassador Labs, a Boston-based developer experience company, raised $20 million in funding led by Insight Partners.

- Recurve, a Mill Valley, Calif.-based open-source platform for virtual power plant planning, procurement, and demand flexibility, raised $18 million in Series B funding. Calpine Energy Solutions, Quantum Innovation Fund, Toshiba Energy Systems & Solutions, and Energy Foundry invested in the round.

- Tarci (formerly Leadgence), a Tel Aviv-based data intelligence platform, raised $17 million in Series A funding. Sound Ventures led the round and was joined by investors including Liberty Mutual Strategic Ventures, Global Founders Capital, and others.

- VRGL, a Dallas-based analytics and automated data extraction platform for the wealth management industry, raised $15 million in Series A funding. MissionOG and FINTOP Capital led the round and were joined by investors including Sallyport Investments, Checchi Capital, Dynasty Financial Partners, Northwestern Mutual Future Ventures, Flyover Capital, Fin Capital, and The Compound Capital.

- Zilla Security, a Boston-based identity security platform, raised $13.5 million in Series A funding. Tola Capital and FirstMark Capital led the round and was joined by Pillar VC.

- Astro, formerly Austin Software, an Austin-based management platform for development teams in Latin America, raised $13 million in Series A funding. Greycroft led the round and was joined by investors including Obvious Ventures and others.

- Stacked, a Los Angeles-based Web3 video and live streaming platform, raised $12.9 million in Series A funding. Pantera Capital led the round and was joined by investors including GFR Fund, Z Venture Capital, Scale AI founder Alexandr Wang, GOAT CEO Eddy Lu, and OnePlus co-founder and Nothing CEO Carl Pei.

- Learnsoft, a San Diego-based learning and talent platform, raised $16.7 million in Series A funding led by Elsewhere Partners.

- Deliverider, a Tel Aviv-based logistics solution platform for e-grocery, raised $2 million in seed funding co-led by Millennium Group’s private equity fund and NC Capital.

. . .

Sustainability:

- Blue World Technologies, an Aalborg, Denmark-based methanol fuel cells developer and manufacturer, raised €37 million ($37.07 million) in Series B funding. Breakthrough Energy Ventures led the round and was joined by investors including Vaekstfonden and DEUTZ AG.

- Carbon Counts, a Cambridge, Mass.-based climate change gaming platform, raised an additional $4.5 million in seed funding. Borderless Capital, Algorand, and the Algorand Foundation led the round and were joined by investors including the Grantham Environmental Trust, Susquehanna Foundation, Oceans Ventures, Winklevoss Capital, Capital Factory, and others.

Acquisitions & PE:

- Kinside acquired LegUp, a Seattle-based universal child care enrollment system. Financial terms were not disclosed.

- Carta acquired Capdesk, a London-based equity management platform. Financial terms were not disclosed.

- Instacart acquired Eversight, a Palo Alto-based pricing and promotions platform for CPG brands and retailers. Financial terms were not disclosed.

- Measurabl acquired WegoWise, a Santa Barbara, Calif.-based software platform for utility data automation and residential real estate. Financial terms were not disclosed.

- Smartsheet acquired Outfit, a Brisbane-based brand management, templating, and creative automation platform. Financial terms were not disclosed.

- Medtronic (NYSE: MDT) completed its $675m acquisition of Affera, a Newton, Mass.-based cardiac mapping and ablation tech company that had raised over $80m from Bain Capital Life Sciences, Elysia Capital, Innogest Capital, BAMCAP and Norwich Ventures. www.affera.com

. . .

IPOs:

Nothing to see here…

. . .

SPACs:

Nothing to see here…

Funds:

Also empty…

Final Numbers

Data: Yahoo Finance; Chart: Kavya Beheraj/Axios

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.