Sourcery (8/30-9/3)

Melio, HomeLight, Offchain Labs, Insurify, Jeeves, Point Card, Syndicate, Solo, Taktile, Whoop, quip, Alma, Solv, Poppi, Joshin, Databricks, Checkr, Humane, Callin, Code Climate, VanMoof, Fieldin...

Last Week (8/30-9/3):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Future of Work, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Melio, HomeLight, Offchain Labs, Insurify, Jeeves, Origin, Vic.ai, Point Card, Syndicate, Owner.com, Solo, Taktile, Whoop, quip, Alma, Solv, Poppi, Joshin, Databricks, Checkr, Humane, Peak, Code Climate, Callin, Clay, Sanas, Thatch, Wanderlog, VanMoof, Fieldin, Kevala, Compound Foods; NuOrder, Drift, Bodhala, Mailchimp; Freshworks, Olaplex, Rivian, Sovos Brands, Sterling Check, Remitly, AllBirds, Amplitude, Cue Health, Samsara, Reddit; Vice Media

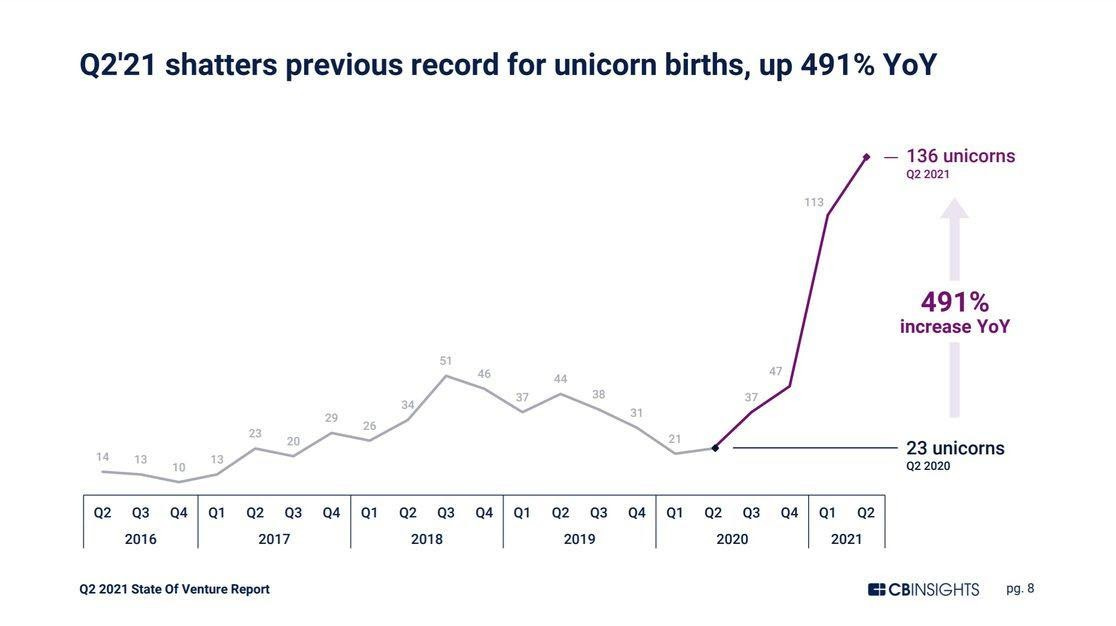

Final numbers on Unicorn Birth Rate at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Melio Payments, New York City-based payments company, is looking to raise at a $4 billion valuation, per the Information. Thrive Capital and General Catalyst are reportedly leading.

- HomeLight, a San Francisco-based real estate tech platform, raised $363 million. Zeev Ventures led the round and was joined by investors including Group 11, Stereo Capital, Menlo Ventures, and Lydia Jett of the SoftBank Vision Fund.

- Offchain Labs, a New York City-based company tackling scaling for Ethereum, raised $120 million in funding. Lightspeed Venture Partners led the Series B round and was joined by investors including Polychain Capital, Ribbit Capital, Redpoint Ventures, Pantera Capital, Alameda Research, and Mark Cuban.

- Insurify, a Cambridge, Mass.-based virtual insurance agent, raised $100 million in Series B funding. Motive Partners led the round and was joined by investors including Viola FinTech, MassMutual Ventures, Nationwide, Hearst Ventures, Moneta VC, Viola Growth, and Fort Ross Ventures.

- Jeeves, a New York City-based expense management platform for startups, raised $57 million in Series B funding at a $500 million valuation. CRV led the round.

- Origin, a San Francisco-based employee financial wellness platform, raised $56 million in Series B funding at a $400 million valuation. 01A, General Catalyst and Lachy Groom co-led, and were joined by insiders Founders Fund, Felicis Ventures and Abstract Ventures. www.useorigin.com

- Vic.ai, a New York-based enterprise accounting automation startup, raised $50 million in Series B funding. Iconiq led, and was joined by insiders GGV Capital, Cowboy Ventures and Costanoa Ventures. http://axios.link/1Qim

- Point Card, a San Francisco-based maker of a debit card, raised $46.5 million in Series B funding. Peter Thiel’s Valar Ventures led the round and was joined by investors including Breyer Capital, YC Continuity, and Human Capital.

- PayEm, a New York City-based maker of a spending platform, raised $27 million in funding. A $7 million seed round was led by Pitango First and NFX while a $20 million Series A was led by Glilot+.

- Flat.mx, a Mexico City-based real estate marketplace, raised $20 million in Series A funding. Anthemis and 500 Startups led the round and were joined by investors including ALLVP and Expa.

- Revenue Grid, a Mountainview, Calif.-based revenue platform, raised $20 million in Series A funding. W3 Capital led the round and was joined by investors including ICU Ventures.

- Syndicate, a maker of infrastructure for decentralized finance investing, raised $20 million in Series A funding. Andreessen Horowitz led the round and was joined by investors including Cultural Leadership Fund, IDEO CoLab Ventures, Variant, Electric Capital, CoinFund, Scalar Capital, and Bill Ackman’s Table Management.

- Oddup, an investment data and crypto custody startup, raised $12.8 million in Series C funding from IRO Capital, Elliot Capital, Jervois Hillier and insiders Click Ventures, White Capital and The Times Group. www.oddup.com

- Owner.com, a San Francisco-based platform for restaurants, raised $10.7 million in seed funding. SaaStr Fund led the round and was joined by investors including Redpoint Ventures, Day One Ventures, Naval Ravikant, Marcus Lemonis (host of CNBC’s The Profit), Kimbal Musk (The Kitchen Restaurant Group), Joshua Browder (Founder of DoNotPay), Dylan Field (founder of Figma), and The Chainsmokers.

- Hum Capital, a New York City-based company using A.I. for the fundraising process, raised $9 million in Series A funding. Future Ventures led the round and was joined by investors including Webb Investment Network, Wavemaker Partners, and Partech.

- OneRail, an Austin-based point-of-sale startup, raised $9 million in Series A funding. Ironspring Ventures led the round.

- Shepherd, a San Francisco-based provider of insurance for commercial construction, raised $6.2 million in seed funding. Spark Capital led the round and was joined by investors including Susa Ventures, Procure Technologies, YC, Greenlight Reinsurance, and Oldslip.

- Solo, a Seattle-based time and income optimization platform for app-based gig workers, raised $5.3 million in seed funding led by Slow Ventures. www.worksolo.com

- Taktile, a platform for financial services companies to deploy machine learning applications, raised $4.7 million in seed financing. Index Ventures led the round and was joined by investors including Y Combinator, firstminute Capital, and Plug and Play Ventures.

- Sphere, a California-based company focused on green investments in 401(k) plans, raised $2 million in funding. Pale Blue Dot led the round.

- Octane, a New York City-based billing startup, raised $2 million. Basis Set Ventures led the round and was joined by investors including Dropbox co-founder Arash Ferdowsi, Github CTO Jason Warner, Fortress CTO Assunta Gaglione, and Scale AI CRO Chetan Chaudhary.

. . .

Care:

- Whoop, a Boston-based maker of fitness wearables, raised $200 million in Series F finding at a $3.6 billion valuation. SoftBank Vision Fund 2 led, and was joined by IVP, Cavu Ventures, Thursday Ventures, GP Bullhound, Accomplice, NextView Ventures and Animal Capital. http://axios.link/uCfn

- Petlove&Co, a Brazilian pet supplies and services network, raised around $150 million. Riverwood Capital led, and was joined by Tarpon, SoftBank, L Catterton, Porto Seguro and Monashees.

- quip, a New York City-based oral healthcare company, raised $100 million. Cowen Sustainable Investments led the round.

- Humane, a consumer device startup, raised $100 million in Series B funding. Tiger Global Management led the round and was joined by investors including SoftBank Group, BOND, Forerunner Ventures, and Qualcomm Ventures.

- Genome Medical, a South San Francisco-based genomic care delivery startup, raised $60 million in Series C funding. Casdin Capital led, and was joined by GV, Amgen Ventures and insiders Perceptive Advisors, Canaan Partners, Kaiser Permanente Ventures, Illumina Ventures, LRVHealth, Echo Health Ventures, Revelation Partners, HealthInvest Equity Partners, Avestria Ventures, Flywheel Ventures, Dreamers Fund and Blue Ivy Ventures. http://axios.link/atT2

- Alma, a New York City-based membership based network for therapists, raised $50 million in Series C funding. Insight Partners led the round and was joined by investors including Optum Ventures, Tusk Venture Partners, Primary Venture Partners, Sound Ventures, BoxGroup, and Rainfall Ventures.

- Solv, a San Francisco-based healthcare provider marketplace, raised $45 million in Series C funding. Acrew Capital and Corner Ventures led the round and was joined by investors including Greylock Partners and Benchmark Capital.

- Ellipsis Health, a San Francisco-based maker of a voice app for managing depression and anxiety, raised $26 million in Series A funding. SJF Ventures led the round and was joined by investors including AblePartners, Akhil Paul at Caparo Group, Alumni Ventures, Divesh Makan, Gaingels, Gary Loveman, Generator Ventures, Greycroft, Helmy Eltoukhy, Joanne Bradford, and Khosla Ventures.

- Flip, a Los Angeles-based beauty and wellness social commerce startup, raised $28 million in Series A funding led by Streamlined Ventures. http://axios.link/unKO

- Poppi, a Dallas-based prebiotic soda brand, raised $13.5 million in Series A2 funding. Investors included CAVU Ventures, Russell Westbrook, the Chainsmokers, 24kGoldn, Kygo, Halsey, Kevin Love, Ellie Goulding, Olivia Munn, and Nicole Scherzinger.

- EveryDay Labs, a Redwood City, Calif.-based behavioral health startup focused on student attendance, raised $8 million in Series A funding led by Rethink Impact. www.everydaylabs.com

- Joshin, a Minneapolis-based digital care platform, raised $3 million in seed funding. Anthemis Group and The Autism Impact Fund led the round.

. . .

Future of Work:

- Databricks, a San Francisco-based unified data analytics platform, raised $1.6 billion in Series H funding at a $38 billion post-money valuation. Morgan Stanley led, and was joined by UC Regents, BNY Mellon, Clearbridge, House Fund and insiders like Andreessen Horowitz, BlackRock and Fidelity. http://axios.link/jQyy

- Checkr, a San Francisco-based HR tech business, raised $250 million in Series E funding valuing it at $4.6 billion. Durable Capital led the round and was joined by investors including Fidelity Management & Research Company, Franklin Templeton, BOND Capital, Khosla Ventures, IVP, T. Rowe Price, Coatue, Accel, and Y Combinator.

- Heroes, a London-based Amazon merchant roll-up platform, raised $200 million from Crayhill Capital Management. http://axios.link/Iqtp

- Olsam, a London-based Amazon merchant roll-up platform, raised $165 million in Series A equity and debt funding. Apeiron Investment Group led the equity tranche, and was joined by Elevat3 Capital. North Wall Capital led the debt. http://axios.link/ZOw8

- Humane, a consumer device startup, raised $100 million in Series B funding. Tiger Global Management led the round and was joined by investors including SoftBank Group, BOND, Forerunner Ventures, and Qualcomm Ventures.

- Peak, a U.K.-based A.I. company, raised $75 million in Series C funding. The SoftBank Vision Fund 2 led the round and was joined by investors including MMC Ventures, Oxx, Praetura Ventures, Arete, and Octopus Ventures.

- Panorama Education, a Boston-based K-12 education software platform, raised $60 million in Series C funding. General Atlantic led the round and was joined by investors including Owl Ventures, Emerson Collective, Uncork Capital, CZI, and Tao Capital Partners.

- Botify, a New York City-based search traffic improvement company, raised $55 million in Series C funding. InfraVia Growth led the round and was joined by investors including Bpifrance, Eurazeo, and Ventech.

- Code Climate, a New York City-based automated code platform, raised $50 million in Series C funding. PSG led the round and was joined by investors including Union Square Ventures, Foundry Group, Lerer Hippeau Ventures, and NextView Ventures.

- Harri, a New York City-based employee management platform, raised $30 million. Golub Capital led the round.

- Nifty Games, a Lafayette, Calif.-based video game developer and publisher, raised $26 million in Series B funding. Vulcan Capital led the round.

- Rafay Systems, a Sunnyvale, Calif.-based operations platform, raised $25 million in Series B funding. ForgePoint Capital led the round and was joined by investors including Ridge Ventures, Costanoa Ventures, and Moment Ventures.

- Walnut, a New York City-based sales platform, raised $15 million in Series A funding. Eight Roads Ventures led the round.

- Callin, a San Francisco-based social podcasting app, raised $12 million in Series A funding co-led by Sequoia Capital, Goldcrest Capital and Craft Ventures (which incubated the company).

- Clay, a maker of a relationship management tool, raised $8 million in seed funding. Forerunner Ventures led the round and was joined by investors including General Catalyst.

- Marpipe, a New York City-based company with software for brands and marketing agencies, raised $8 million in Series A funding. Stage 2 Capital led the round and was joined by investors including ValueStream Ventures, Commerce Ventures, Ripple Ventures, and Samsung.

- Explosion, a maker of A.I. tools, raised $6 million Series A today on a $120 million valuation. The round was led by SignalFire.

- Sanas, a Palo Alto, Calif.-based maker of accent-matching tech, raised $5.5 million in seed funding. Investors include Human Capital, General Catalyst, Quiet Capital, and DN Capital.

- Thatch, a San Francisco-based company focused on traveler creators, raised $3 million in a second seed round. Wave Capital led the round and was joined by investors including Freestyle VC’s Jenny Lefcourt and Netflix co-founder Marc Randolph.

- Spinach, an Atlanta-based provider of Zoom App integrations for distributed teams, raised $2.75 million in seed funding. Cardumen Capital led, and was joined by Zoom and Tuesday Capital. www.spinach.io

- Prive, a San Francisco-based startup focused on e-commerce subscriptions, raised $1.7 million in pre-seed funding. Patrick Chung and Brandon Farwell at XFund and Ben Ling from Bling Capital led the round, and were joined by investors including Defy Partners and Halogen Ventures.

- Wanderlog, a San Francisco Bay-area-based road trip planner, raised $1.5 million in seed funding from General Catalyst and Abstract Ventures.

. . .

Sustainability:

- VanMoof, a Dutch e-bike brand, raised $128 million in Series C funding. Hillhouse Investment led, and was joined by Gillian Tans (ex-Booking.com CEO) and insiders Norwest Venture Partners, Felix Capital, Balderton Capital and TriplePoint Capital. http://axios.link/z6Ji

- Fieldin, an American-Israeli agtech startup, raised $30 million in Series B funding. Fortissimo Capital led the round and was joined by investors including Zeev Ventures, Icon Ventures, Maor Investments, and Akkadian ventures.

- Plantible Foods, a San Diego-based food tech company, raised $21.5 million in Series A funding. Astanor Ventures led the round.

- Kevala, a San Francisco-based energy data and analytics company, raised $21 million in Series A funding. C5 Impact Partners and Thin Line Capital led the round.

- Compound Foods, a synthetic coffee startup, raised $4.5 million in seed funding from Lowercarbon Capital, SVLC, Humboldt Fund, Collaborative Fund, Maple VC and Petri Bio.http://axios.link/hG59

Acquisitions & PE:

- Zebra Technologies (Nasdaq: ZNRA) agreed to buy Antuit.ai, a Frisco, Texas-based provider of analytics SaaS for forecasting and merchandising that raised over $70 million from firms like Goldman Sachs and Zodius Capital. www.antuit.ai

- FiscalNote, a Washington, D.C.-based portfolio company of Arrowroot Capital and Runway Growth Capital, acquired Curate Solutions, a Madison, Wis.-based provider of municipal civic intelligence and monitoring services. www.fiscalnote.com

- Playtika will acquire Reworks Oy, a Finnish maker of a design gaming app, for up to $600 million. EQT Ventures backs Reworks.

- Lightspeed (NYSE: LSPD) acquired NuOrder, Los Angeles-based platform connecting retailers to brands, for $425 million from Argentum. Financial terms weren't disclosed.

- Vista Equity Partners acquired a majority stake in Drift, a Boston-based marketing and sales SaaS platform that had raised over $100 million from VC firms like Sequoia Capital, CRV and General Catalyst. http://axios.link/27E6

- Bain Capital acquired an over 40% stake in Berlin Brands Group, a Berlin-based buyer of brands selling on Amazon, from Ardian. It values it at about $1.2 billion including debt.

- Onit acquired Bodhala, a New York City-based spend management software maker, from investors including Edison Partners. Financial terms weren't disclosed.

- Intuit (Nasdaq: INTU) is in talks to acquire Mailchimp, an Atlanta-based email marketing firm, for $10 billion, per Bloomberg.

- Apollo Global Management completed its $5 billion purchase of Verizon's (NYSE: VZ) digital media unit, including Yahoo and AOL. Verizon will retain a 10% stake.

- Xerox (NYSE: XRX) spun outCareAR, a $700 million company that combines CareAR, DocuShare, and XMPie. ServiceNow invested $10 million in the company.

. . .

IPOs:

- Freshworks, a San Mateo, Calif.-based provider of customer support software, filed for an IPO. It will list on the Nasdaq (FRSH) and reports a $10 million net loss on $169 million in revenue for the first half of 2021. The company raised around $400 million, most recently at a $3.5 billion valuation, from firms like Tiger Global (26.2% pre-IPO stake), Accel (25.8%), CapitalG (8.3%), Sequoia Capital India (12.3%) and Steadview Capital Management. http://axios.link/tHtp

-Olaplex, a Santa Barbara, Calif.-based hair products company owned by Advent International, filed for an IPO. It plans to list on the Nasdaq (OLPX) and reports $95 million of net income on $270 million in revenue for the first half of 2021. http://axios.link/7skS

-Rivian, an electric truck maker that’s raised more than $10 billion, said it filed confidentially for a public offering at what could be an $80 billion valuation. Backers include Amazon, T. Rowe Price, Fidelity, Coatue, Ford Motor Co., Dragoneer, Baron Capital and BlackRock. http://axios.link/iqf6

- SovosBrands, a Berkeley, Calif.-based food and beverage company whose brands include Rao's Homemade, filed for an IPO. The company, owned by Advent International, plans to list on the Nasdaq (SOVO) and reports $10 million of net income on $351 million of revenue for the first half of 2021. http://axios.link/fJ66

-Sterling Check, a New York-based provider of background screening and ID verification software, filed for an IPO. It plans to list on the Nasdaq (STER) and reports $4 million of net income on $299 million of revenue for the first half of 2021. Backers include Goldman Sachs. http://axios.link/3u3i

- Remitly, a Seattle-based digital remittance company, filed for an IPO. It plans to list on the Nasdaq (RELY) and reports a $9 million net loss on $202 million in revenue for the first half of 2021. The company raised around $480 million from backers like PayU (23.9% pre-IPO stake), Stripes (12.1%), Threshold Ventures (9.4%), Generation Investment Management (8%) and Trilogy Equity (6.2%). http://axios.link/RHfo

- Brilliant Earth Group, a Dover, De.-based sustainable jewelry company, filed for an IPO. The company posted $251.8 million in net sales in 2020 and net income of $21.6 million. Mainsail Partners backs the firm.

- Allbirds, a San Francisco-based sneaker maker, filed for an IPO (which it's calling a "sustainable public equity offering"). The company plans to list on the Nasdaq (BIRD) and reports a $21 million net loss on $118 million in revenue for the first half of 2021. It raised around $200 million from firms like Maveron, Tiger Global, T. Rowe Price, Fidelity and Lerer Hippeau Ventures. http://axios.link/Babw

- Clearwater Analytics Holdings, a Boise, Id.-based investment accounting and analytics software company, filed for an IPO. It posted $203.3 million in revenue for 2020 and a net loss of $44.2 million. Warburg Pincus, Dragoneer, Welsh Carson, and Permira back the firm.

- Amplitude, a San Francisco-based digital optimization company, filed for a direct listing. The company posted $102.5 million in revenue in 2020 a net loss of $24.6 million. Battery Ventures, Benchmark, Institutional Venture Partners, and Sequoia Capital back the firm.

- Ola, an Indian electric scooter and ridesharing company, is gearing up for an IPO, per Bloomberg. The company may seek a valuation of more than $8 billion. SoftBank and Tiger Global back the firm.

- iFIT Health & Fitness, a Logan, Ut.-based exercise equipment maker, filed for an IPO. The company posted $851.7 million in revenue in 2020 and a net loss of $98.5 million. Pamplona and L Catterton back the firm.

- CueHealth, a San Diego-based developer of portable health testing solutions, filed for an IPO. It plans to list on the Nasdaq (HLTH) and reports $33 million of net income on $202 million in revenue for the first half of 2021. Cue raised nearly $400 million from firms like ACME Capital (13.2% pre-IPO stake), Cove Investors (11%), Decheng Capital (7.3%), Madrone (6.3%), Perceptive Advisors, MSD Capital, Koch Strategic Platforms, J&J and CAVU Ventures. http://axios.link/AmbJ

- Samsara, a San Francisco-based A.I.operations company, filed confidentially for a public offering. Andreessen Horowitz, Dragoneer Investment Group, Tiger Global, and Warburg Pincus back the firm.

- Reddit, a San Francisco-based social media platform, is preparing for an IPO, per Reuters. An IPO could value the company at $15 billion. Fidelity Investments, Andreessen Horowitz, Tencent Holdings, and Sequoia Capital back the firm.

- Cyngn, a Menlo Park, Calif.-based autonomous vehicle technology company, filed for an initial public offering. The company reported a net loss of $8.3 million in 2020 and did not post any revenue. Benchmark, Andreessen Horowitz, and Redpoint Ventures back the firm.

. . .

SPACs:

- Vice Media is raising $85 million from existing investors and putting its SPAC plans on hold, at least for now, per The Information. Backers include Lupa Systems, TPG, TCV and Sixth Street Partners. http://axios.link/bqdQ

Funds:

- Susa Ventures of San Francisco raised $375 million for its fourth fund, and hired Hammad Aslam (ex-Vista Equity, Morgan Stanley) as an investor. http://axios.link/TLUG

- Coral Capital, a Tokyo-based early-stage venture capital investor, is raising $130 million. Investors include Founders Fund.

- Inspired Capital, a New York-based VC firm co-founded by Alexa von Tobel and Penny Pritzker, raised $281 million for its second fund, per an SEC filing. www.inspiredcapital.com

Final Numbers

Source: