Sourcery (8/31-9/4)

Wish, GoodRx, Boxed, Bumble, Compass Pathways; Pharmapacks, Hazel Health, PicnicHealth, Carewell, Unacademy, Patreon, Legion, InCountry, InfoSum, Turing.com, Cloudentity

Last Week (8/31-9/4):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Future of Work and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted IPOs include Wish, GoodRx, Boxed, Bumble, Compass Pathways. Highlighted deals include Pharmapacks, Hazel Health, PicnicHealth, Carewell, Unacademy, Patreon, Legion, InCountry, InfoSum, Turing.com, Cloudidentity, Narrative, Capchase, Steno, Avo.

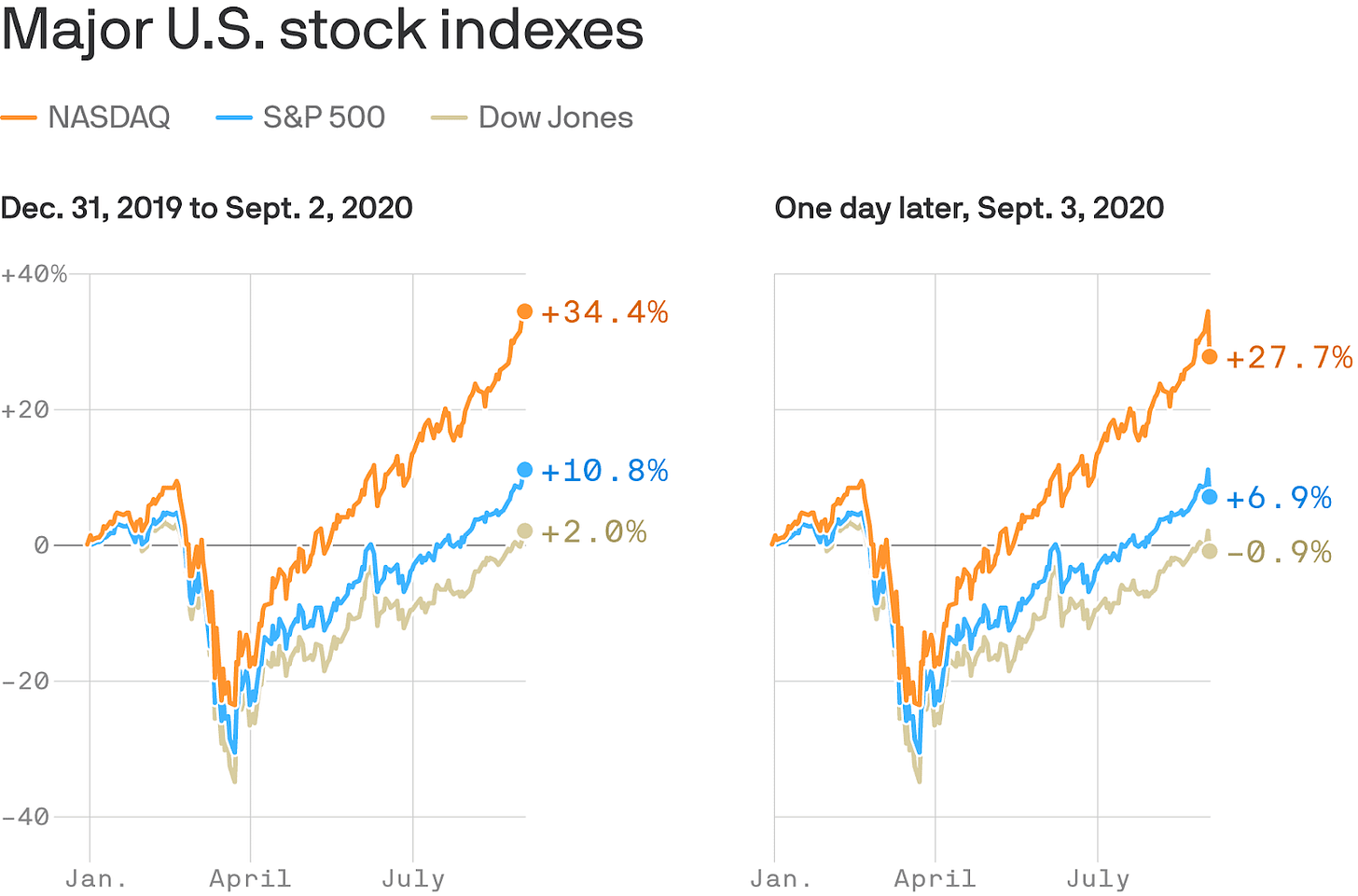

Final numbers on Changes in Major Stock Indexes at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Neon Pagamentos, a Brazilian fintech, raised $300 million in Series C funding. General Atlantic led the round and was joined by investors including BlackRock, Vulcan Capital, PayPal Ventures,Endeavor Catalyst, Monashees, Flourish Ventures, and BBVA.

- Viva Republica, the operator of peer-to-peer payment service Toss, raised $173 million. Investors including Sequoia Capital China led the round and was joined by investors including Aspex Management, Kleiner Perkins Digital Growth Fund, Altos Ventures, Goodwater Capital, and Greyhound Capital. Read more.

- Esusu, a NYC-based financial technology platform for individuals to save money and build credit, closed a $1.6m seed funding round (read here)

. . .

Care:

- Biofourmis Inc., which uses artificial intelligence-based analytics to monitor patients affected by Covid-19, raised $100 million in funding. SoftBank Vision Fund 2 led the round.

- Pharmapacks, a New York-based e-commerce platform, raised $40 million in bridge financing. Reckitt Benckiser, The Craftory, The Straus Group, The Emerson Group, and Sawaya Capital Partners invested.

- Hazel Health, a San Francisco-based provider of healthcare to K-12 students, raised $33.5 million in Series C funding. Owl Ventures and Bain Capital Ventures led the round.

- NeuroPace,a Mountain View, Calif.-based medical technology company, raised $33 million in funding. Accelmed Partners led the round and was joined by investors including Revelation Partners, Soleus Capital, KCK Group and OrbiMed Advisors.

- PicnicHealth, a San Francisco-based company for secure medical records, raised $25 million in funding. Felicis Ventures. Read more.

- Movano Inc., a Pleasanton, Calif.-based healthtech company focused on chronic conditions such as diabetes, raised a $12.5 million bridge round. Investors were not disclosed.

- PhotoniCare, an Illinois-based provider of physicians with better diagnostic tools, raised $5.2 million in Series A funding. i2E Management Company led the round and was joined by investors including OSF Ventures, Sony Innovation Fund, and Dreampact Ventures.

- Carewell, a Charlotte, N.C.-based online supplier of home health products, raised $5 million in seed funding. Investors included e.ventures, NextView Ventures, and Primetime Partners.

. . .

Future of Work:

- Unacademy, an Indian exam prep company, raised $150 million at a $1.45 billion post-money valuation. SoftBank led, and was joined by Facebook, Blume Ventures, Nexus Partners, General Atlantic, and Sequoia Capital. http://axios.link/uT67

- Patreon, the seven-year-old, San Francisco-based crowdfunding site for content creators, has raised $90 million in funding Series E funding at a $1.2 billion post-money valuation, it announced this afternoon, hours after The Information reported a big round was in the works. New Enterprise Associates, Wellington Management and Lone Pine were new investors in this latest tranche; earlier investors Glade Brook Capital, Thrive Capital, DFJ Growth, and Index Ventures also joined the round. More here.

- Bambuser, a Stockholm-based live video startup, raised $45 million in funding this year. Investors include Consensus Asset Management, Handelsbanken, Harmony Partners, Lancelot Asset Management, Tenth Avenue Holdings, and TIN Fonder. Read more.

- Transposit, a San Francisco-based engineering operations company for the enterprise, raised $35 million in Series B funding. Altimeter Capital led the round and was joined by investors including Sutter Hill Ventures, SignalFire, and Unusual Ventures.

- Legion, a Redwood City, Calif.-based workforce management solution, raised $22 million in Series B funding. Stripes led the round and was joined by investors including Workday Ventures, NTT DOCOMO Ventures, Norwest Venture Partners, First Round Capital, XYZ Ventures and Webb Investment Network.

- Conversica, a Foster City, Calif.-based customer conversation platform, raised $20 million in Series D funding. Hollyport Capital led the round and was joined by investors including Providence Strategic Growth, Toba Capital, and Savano Capital Partners.

- InCountry, a San Francisco-based provider of solutions for data residency, raised $18 million in additional funding. Caffeinated Capital and Mubadala Capital led the round and was joined by investors including Accenture Ventures, Arbor Ventures, Felicis, Ridge Ventures, Bloomberg Beta, and Team Builder Ventures.

- InfoSum, a London-based provider of marketing infrastructure, raised $15.1 million. Upfront Ventures and IA Ventures led the round and was joined by investors including Ascential, Akamai, Experian, ITV and AT&T’s Xandr.

- One Concern, a Menlo Park, Calif.-based maker of A.I.-based tech for disaster risk reduction, raised $15 million from SOMPO.

- Cosmose, a New York-based data analytics platform for physical retail customer behavior, raised $15 million in Series A funding. Tiga Investments led, and was joined by return backers OTB Ventures and TDJ Pitango. http://axios.link/htx4

- Mosaic, a construction technology company for homebuilding, raised $14.3 million in Series A funding. A16z led the round. Read more.

-Turing.com, a Palo Alto-based automated platform for hiring software engineers, raised $14 million in seed funding led by Foundation Capital. http://axios.link/mec6

- Cloudentity, a Seattle-based provider of cloud application security, raised $13 million in Series A funding. Forgepoint Capital led the round and was joined by investors including WestWave Capital.

- OK Play, a Los Angeles-based maker of an app for young children and their parents, raised $11 million in funding. Investors included Obvious Ventures, Forerunner Ventures, Greycroft, Abstract Ventures, Dreamers VC, Collab + Sesame, LEGO Ventures, Muse Capital, Progression Fund, and individual investors including Twitter’s Biz Stone, Thrive Capital’s Josh Kushner, Headspace’s Rich Pierson, FabFitFun’s Michael and Daniel Broukhim, K5 Global’s Michael Kives and Bryan Baum, as well as Tamara Mellon, Kevin Wall, Sue Smalley, and Michael Ovitz.

- Narrative, a 4.5-year-old, New York-based data streaming platform that aims to simplify the buying and selling of information, has raised $8.5 million in Series A funding led by G20 Ventures, with additional funding from earlier backers Glasswing Ventures, MathCapital, Revel Partners, Tuhaye Venture Partners and XSeed Capital. Narrative had previously raised $5.3 million in funding. TechCrunch has more here.

-Apna, an Indian reskilling and job-finding app, raised $8 million in Series A funding. Lightspeed India and Sequoia Capital India co-led, and were joined by Greenoaks Capital and Rocketship VC. http://axios.link/hUgf

- Boundless Immigration, a Seattle-based system for navigating immigration, raised $7.5 million in Series A-1 funding. The Foundry Group led the round. Boundless also acquired RapidVisa. The deal will allow Boundless Immigration to help thousands of additional immigrants each year and improve organizational efficiencies.

- Climax Foods, a Berkeley, Calif.-based food data science company, raised $7.5 million in seed funding. Investors in the round include At One Ventures and S2G Ventures.

- Reachdesk, a New York-based direct mail and corporate gifting software platform, raised $6 million. Five Elms Capital led the round.

- Capchase, a Boston-based startup that helps SaaS companies get cash from accounts receivable, raised $4.6 million in seed funding from Caffeinated Capital, Bling Capital, SciFi VC, BoxGroup, and OneVC. http://axios.link/MfsO

- Anvilogic, a Palo Alto-based collaborative SOC content platform, raised $4.4 million in seed funding led by Foundation Capital, per CrunchBase News. http://axios.link/xtkq

- Steno, a Los Angeles-based legal service startup, raised $3.5 million in seed funding. First Round Capital led the round. Read more.

- Avo, an analytics governance platform, raised $3 million in seed funding. GGV Capital led, and was joined by Heavybit and YC. http://axios.link/qnuh

- Mathison, a New York-based hiring platform for diverse communities, raised $2 million in seed funding. Animo Ventures led the round.

. . .

Sustainability:

- Fashionphile, a Carlsbad, Calif.-based seller of second-hand luxury accessories, raised $38.5 million in Series B funding. NewSpring Growth led the round. Read more.

- SenseHawk, a San Francisco-based SaaS company for developing solar and other infrastructure sites, raised $5.1 million in Series A-1 funding. Alpha Wave Incubation led the round.

Acquisitions:

- Bayer agreed to buy Care/of, a New York-based online retailer of vitamins and health supplements, for $225 million. Care/of had raised around $87 million in VC funding from backers like Goodwater Capital, Tusk Ventures, RRE Ventures, and Goldman Sachs. http://axios.link/zHMt

- Optimizely, an 11-year-old, San Francisco-based company that became synonymous with A/B testing and that raised more than $200 million over the years, including from Goldman Sachs and Andreessen Horowitz, is being acquired. Episerver, a 26-year-old Swedish company that offers tools to marketers looking to manage their digital content and which is currently owned by Insight Partners, is the buyer. Terms of the deal aren't being disclosed. TechCrunch has more here.

- TCV acquired Oversight, an AI-powered platform for spend management, from Luminate Capital Partners, which will maintain a minority interest. Financial terms weren't disclosed.

- Cognizant (NASDAQ: CTSH) agreed to acquire 10th Magnitude, a Chicago-based cloud company. Pamlico Capital backed 10th Magnitude. Financial terms weren't disclosed.

- Gong acquired Vayo, an Israel-based startup specializing in data analytics for sales teams. Financial terms weren't disclosed.

- Dialpad acquired Highfive, a video conferencing company. Highfive investors have included Lightspeed and Dimension Data. Financial terms weren't disclosed.

- Unilever agreed to acquire Liquid I.V., a California-based electrolyte drink mix brand. Liquid I.V. was backed by investors including CircleUp. Financial terms weren't disclosed.

. . .

IPOs:

- Wish, a San Francisco-based e-commerce company last valued at more than $11 billion, and run by ContextLogic, filed confidentially for an IPO.

- GoodRx Holdings, a Santa Monica, Calif.-based app for discounting medicines, filed for an $100 million IPO. It posted revenue of $388.2 million and income of $42.7 million in 2019. Silver Lake, Francisco Partners, and Spectrum back the firm. Read more.

- Compass Pathways, a London-based developer of mental health therapies, filed for a $100 million IPO. The pre-revenue company plans to trade on the Nasdaq (CMPS) with Cowen as lead underwriter, and raised around $133 million from ATAI Life Sciences (29% pre-IPO stake), Founders Fund (7.5%), McQuade Center for Strategic R&D (5.8%), Able Partners, Camden Partners, Perceptive Advisors, Skyviews Life Science, and Soleus Capital. http://axios.link/AIpn

- Boxed, a New York-based wholesale retailer, is exploring strategic options including a sale or going public through a merger with a blank-check acquisition company that could value it at around $1 billion, per Reuters. The company has raised funding from investors including American Express and GGV Capital. Read more.

- Bumble, the dating app operator, is preparing for an IPO that could value it at between $6 billion to $8 billion, per Bloomberg. Read more.

- LairdSuperfood, a plant-based beverages maker co-founded by surfers Laird Hamilton and Paul Hodge, filed for a $40 million IPO. The Sisters, Ore.-based company plans to list on the NYSE American (LSF) with Canaccord Genuity and Craig Hallum Capital Group as underwriters, and reports a $5 million net loss on $11 million in revenue for the first half of 2020. Backers include Danone Manifesto Ventures (13.4% pre-IPO stake). http://axios.link/R0dh

- Mission Produce, an Oxnard, California-based avocado producer, filed for a $100 million IPO. It plans to list on the Nasdaq (AVO) with BAML as lead underwriter, and reports a $13 million net loss on $419 million in revenue for the six months ending April 30, 2020. http://axios.link/b8Iu

- KnowBe4, a Clearwater, Florida-based cybersecurity awareness training company backed by KKR, is prepping an IPO that could value the company at over $2 billion, per Reuters. http://axios.link/Roip

. . .

SPACs:

- Skillz, a San Francisco-based mobile gaming company, is going public via a reverse merger with a SPAC led by the same executives who recently acquired DraftKings. Skillz will have an initial market cap of $4.3 billion, while the deal includes nearly $160 million in new investment from Wellington Management, Fidelity, Franklin Templeton, and Neuberger Berman. It previously raised $137 million in VC funding from backers like Telstra Ventures, Accomplice, and Wildcat Capital Management. http://axios.link/o9Ft

Funds:

- Owl Ventures, a San Francisco-based edtech-focused venture firm, closed on a pair of funds with $585 million. Owl Ventures IV has $415 million while a growth stage opportunity fund has $170 million committed.

- Cota Capital, a San Francisco-based enterprise tech investment firm, is raising $100 million for its second fund, per an SEC filing.

-Luminate Capital, a mid-market PE firm focused on software and software-enabled businesses, is raising $700 million for its third fund, per PEI. http://axios.link/aP5L

Final Numbers

Data: FactSet; Chart: Axios Visuals