Sourcery (8/7-8/11)

Post-ZIRP Winners & Pitch Decks ☀️ Rightfoot, IVIX, Chargeflow, Pockit, Neuralink, Daybreak, Endear, Resilience, Simon Data, Weights & Biases, Tractian, deepset.ai, Fizz, Haus, Atmosfy, ConductorOne

Happy Tuesday!

Today it's all about ZIRP ‘winners,’ musings, and pitch decks.

And more importantly.. a big HBD to Kobie Fuller! 🥳 I work closely with Kobie, Partner at Upfront Ventures, on all things early stage B2B SaaS. He created the FABRIC framework, but he’s also a fellow leo, enjoys good music, and has great taste in art, design, & fashion (prev CMO at Revolve).

Post-ZIRP

There’s a decent amount of stories coming out on some lucky & unlucky players in the last tech cycle. But what caused this hype-mania? Crossover funds like Tiger? Or access to “free” capital from ZIRP? As the Old El Paso Taco commercial once said: ¿Por qué no los dos? (why not both)

ZIRP, or Zero Interest Rate Policy, had an enormous effect on startups and the tech industry by reducing borrowing costs and encouraging investments - it enabled easier access to capital (much, much easier access). Which resulted in unfortunately pretty reckless spending with large mega rounds and funding to a great deal of companies that probably didn’t need that much money to begin with (or to even know what to do with it). But when money is easy, we get a little too excited, groupthink hits, investors stop doing their diligence just to compete, well, then the next thing you know the founder is headed for jail. Too far? Nope. It happened. A couple of times. (ie. SBF/FTX, Charlie Javice/Frank, Elizabeth Holmes/Theranos, etc read more here)

But, who were the biggest winners of ZIRP?

‘Well-timed’ founders and M&A bankers/PE. As a function of running a newsletter on deal announcements I have seen a thing or two on some themes that come and go. As of late, its founder exits and acquisitions - as well as industrials, climate, & AI (but we’ll save those for later). As it goes..

Founder Leaderboard

Dave Portnoy, Barstool Sports

Sold Barstool Sports to Penn for $500M, Portnoy bought it back for $1. Dave Portnoy wins #1 because he has a big-ole heart and is a fan favorite.

Adam Neumann, WeWork

Raised upwards of $22.5B in total funding for WeWork with a peak valuation of $47B, which is now down to roughly $480M. Ouch.

Neumann’s net worth also had a peak of $14B with an impressive personal portfolio of properties, but it’s now estimated to sit around $2B. Honestly, not much of an ouch here. He is now on to greater opportunities with the launch of his new company Flow which raised $350M from a16z (maybe he’ll pull a Dave Portnoy & buy WeWork back for $1)

Johnny Boufarhat, Hopin

Raised $1B in total funding at a peak of $7.8B.. meanwhile: Hopin just sold off its events management assets to RingCentral for $15M

Johnny, on the other hand, sold an estimated $195M of his shares via secondary (i.e. he pocketed $195M) at its high. Not bad 😅

M&A Bankers/PE

If you run a search for US M&A on Pitchbook you’ll be met with 5K+ transactions YTD with a total value amounting to $400B+. Which isn’t bad. There have definitely been an above-average number of transactions post-covid in 2021 and 2022, though their values (graph 2) has been fairly inconsistent (2021 was ‘great,’ but 2023 might even be <2020 at this rate). M&A has continued to remain active as IPO windows have closed and SPACs have dissolved completely - it seems to be the only viable/reasonable exit option as it allows for strategic positioning/soft landings (in case the co is a 0, employees can hopefully take equity of the ‘more valuable’ acquiring co). I wouldn’t be surprised if this picks back up again as underperforming public co’s need better signals, strategic IP investments (AI?), & talent, as well as growth stage companies that have fewer exit options post-overcapitalization and burning too much $$.

Source: Pitchbook

The top categories YTD include manufacturing, TMT, and life sciences. But my current favorite might be Campbell’s Soup acquiring the parent co of Rao’s Sauce for $2.7B.. the Italian ‘family’ definitely made it out big. To name a few other major ones:

Life Storage acquired by Extra Space Storage for $12.7B

Extra Space will acquire Life Storage in an all-stock transaction.. for a total enterprise value (“EV”) of approximately $47B.

Qualtrics acquired by Silver Lake for $12.5B

Qualtrics (NASDAQ: XM), the leader and pioneer of the experience management (XM) software category.. acquired by Silver Lake, the global leader in technology investing.. in an all-cash transaction that values Qualtrics at approximately $12.5 billion.

Capri acquired by Tapestry for $8.5B

Tapestry, Inc. (NYSE: TPR), a house of iconic accessories and lifestyle brands consisting of Coach, Kate Spade, and Stuart Weitzman, announced it will acquire Capri Holdings Limited (NYSE: CPRI), a global fashion luxury group consisting of Versace, Jimmy Choo, and Michael Kors, in cash for a total EV of approximately $8.5 billion

Coupa acquired by Thoma Bravo for $8B

Thoma Bravo's acquisition of Coupa Software is being financed partly by a group of 19 direct lenders led by Sixth Street that is providing a $2.6 billion loan package. Other direct lenders on the deal include HPS Investment Partners, Oaktree Capital Management, Apollo Global Management Inc (APO.N) and Blackstone Inc (BX.N)

Apptio acquired by IBM for $4.6B

IBM (NYSE: IBM) announced.. Vista Equity Partners to purchase Apptio Inc., a leader in financial and operational IT management and optimization (FinOps) software, for $4.6 billion. The acquisition of Apptio will accelerate the advancement of IBM's IT automation capabilities and enable enterprise leaders to deliver enhanced business value across technology investments.

Companies Sold at the Peak - *Copied directly from Hunter Walk’s blog*

Frame.io acquired by Adobe for $1.275B

“Natural landing spot for a fast-growing SaaS video creation company at reportedly $1.275B in cash. I’m sure the company could have stayed independent and continued building but they exited during a period where multiples were high, antitrust wasn’t an issue, and to a company that can carry the product forward.”

Honey acquired by PayPal for $4B in cash

“..for this incredibly mainstream product – maybe one of the last great non-gaming consumer product acquisitions on the books?”

Locker Room acquired by Spotify for $67M

“Remember when everyone needed their Clubhouse clone? Spotify gave Betty Labs an estimated $67m for the Locker Room app that became Spotify Greenroom.”

Mirror acquired by Lululemon for $500M

“There was some snickering about why would Mirror cash out while Peloton, Tonal, and other connected fitness devices were the future. No one is snickering now. Mirror built an impressive product and then took the $500m buyout, not having to worry about customer retention, hardware supply chain, and post-COVID inflation chill.”

Musings

Why We’re Heading Into the “Perfect Storm” of Startup Closures. Hunter Walk

Current and future states of startups: missed forecasts, moving goalposts, downrounds, returning capital, IP buyouts/acquihires, shutdowns

Surprising Data Points about the Venture Capital Market, Tomasz Tunguz

Downrounds constitute 20% of all rounds, up 2x from historical norms. Bridge rounds account for 38% of all rounds in Q2. Cooley reported 2.9% of rounds recapitalized the company. Recaps effectively delete the previous cap table & start a new one.

20VC Roundtable: Sam Lessin of Slow Ventures, Frank Rotman of QED Investors, and Jason Lemkin of Saastr, Harry Stebbings

**This is probably the best one I listened to this weekend.**

Why the Seed Investing Model is Broken, How to Make Money at Seed Moving Forward; Who Wins and Who Loses, Why Venture Value Add Platforms are BS and Failed and Why There Will be an IPO per Week in H2 2024

E141: State of Series A's, VC dry powder, IPO window opens + more with Bill Gurley & Brad Gerstner, All-in Podcast

“Do stuff that matters. Major in the majors” Bill Gurley

How Wade Foster (Nearly) Bootstrapped Zapier to $5B, Logan Bartlett

Wade discusses why Zapier only raised around $1M, unpacks Zapier’s strategies for growing profitably, building one of the first remote-only companies in tech, and their experience in YC ‘it wasn’t clear who the winners were’

Paul Graham on Ambition, Art, and Evaluating Talent (Ep. 186) Conversations with Tyler

On evaluating founders for YC, admissions processes, walking to think, and how the arts allowed him to think more creatively

Need to build a new deck?

Apparently a lot of people do. And they’re quite passionate about it. Despite rumors that Tome is raising $60M on $600M valuation (zirp is over, I think we can lower this valuation folks..) most of the replies to the xeet below were actually about Pitch.com and beautiful.ai.

However, I definitely needed less DIY, and a bit more IRL experience with storytelling support.. so I went with a pretty impressive alternative, Ari Kohan, founder of 50Proof. Ari helps transform ideas into compelling pitch decks that resonate quite well with investors (ie. his work has led to over $3.3 billion in funding across stages and industries--and was recognized in Forbes 2022 30under30 Marketing list - I can confirm, it works). His process is more hands-on, and pushes entrepreneurs to align their creative visions alongside practical market data for stronger/wider narratives. His email is Ari@50proof.com in case you need him!

. . .

Last Week (8/7-8/11):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Rightfoot, IVIX, Chargeflow, Pockit, Neuralink, Daybreak, Endear, Resilience, Simon Data, Weights & Biases, Tractian, deepset.ai, Fizz, Haus, Atmosfy, ConductorOne, Lightup, Catch+Release, ShapesXR, Middleware, Hushmesh, Dropzone AI, Multiplayer, Birdstop, Verdagy, Parsefoni, Treehouse, SkyCool Systems, Divirod, Nuclearn.ai; Barstool Sports, Capri/Tapestry, Archer Aviation, Apptio/IBM, Simon & Schuster, Sovos Brands/Campbell Soup

Final numbers on ChatGPT Check-In at the bottom.

Deals

Fintech:

- Rightfoot, a San Francisco-based consumer permissioned financial data and payments platform, raised $15 million in Series A funding. Blue Lion Global and Renegade Partners co-led the round and were joined by Bain Capital Ventures, Box Group, and Kraken Ventures.

- IVIX, a New York-based financial crime and tax evasion tracking platform for governments, raised $12.5 million in Series A funding. Insight Partners led the round and was joined by Team8, Citi Ventures, and Cardumen Capital.

- Chargeflow, an anti-chargeback fraud startup, raised $11m in seed funding led by OpenView Venture Partners. https://axios.link/3QvKxbT

- Pockit, a London-based financial app for low-income communities, raised $10 million in funding. Puma Private Equity led the round and was joined by The North East Development Capital Fund and the European Regional Development Fund.

- Knot, a New York-based platform for card issuers to switch saved payment methods, raised $10 million in Series A funding. Nava Ventures led the round and was joined by Amex Ventures, Plaid, and others.

- Parcha, an SF-based compliance and risk management automation startup, raised $5m. Kindred Ventures and Initialized Capital co-led, and were joined by Propel, Fin Capital, Liquid2 Ventures, Comma Capital, CapitalX and Popular Impact Fund. https://axios.link/3KyD0W6

- Grapevine, a New York-based collaborative giving platform, raised $1.85 million in seed funding. PJC led the round and was joined by Ulu Ventures, WTI, and Focus Impact Partners.

. . .

Care:

- Neuralink, a Fremont, Calif.-based brain-implant company founded by Elon Musk, raised $280 million in funding led by Founders Fund.

- Daybreak Health, a San Francisco-based mental health services platform, raised $13 million in Series B funding. Union Square Ventures led the round and was joined by Lux Capital, Lightspeed Venture Partners, Maven Ventures, and Y Combinator.

- Endear Health, a Miami-based digital health engagement platform, raised $8 million in funding. Optum Ventures, Blue Cross of Idaho, 8VC, and others invested in the round.

. . .

Enterprise & Consumer:

- Resilience, a San Francisco-based cyber risk solution company, raised $100 million in Series D funding. Intact Ventures led the round and was joined by Lightspeed Venture Partners, General Catalyst, and Founders Fund.

- Simon Data, a New York-based customer data platform, raised $54 million in Series D funding. Macquarie Capital led the round and was joined by Polaris, .406, and F-Prime.

- Weights & Biases, a San Francisco-based MLOps platform, raised $50 million in funding. Daniel Gross and Nat Friedman led the round and were joined by Coatue, Insight Partners, Felicis, BOND, and Bloomberg Beta.

- Tractian, an Austin, Texas-based industrial asset monitoring startup, raised $45m at a $205m post-money valuation co-led by General Catalyst and Next47. https://axios.link/3qkkdqq

- One Model, an Austin-based people analytics software company, raised $41 million in funding led by Riverwood Capital.

- Virtualitics, a Pasadena, Calif.-based artificial intelligence and data exploration company, raised $37 million in Series C funding. Smith Point Capital led the round and was joined by Citi, advisory clients of The Hillman Company, and others.

- Trove, a Brisbane, Calif.-based branded fashion and apparel resale and trade-in company, raised $30 million in Series E funding. Wellington Management and ArcTern Ventures co-led the round and were joined by CVC Fund, G2 Venture Partners, Prelude Ventures, and others.

- deepset.ai, a Berlin-based enterprise platform for building applications with LLMs, raised $30 million in funding. Balderton Capital led the round and was joined by GV and Harpoon Ventures.

- Fizz, a San Francisco-based social media platform for college students, raised $25 million in Series B funding. Owl Ventures led the round and was joined by NEA.

- Osano, an Austin-based data privacy management software, raised $25 million in Series B funding. Baird Capital led the round and was joined by Jump Capital, LiveOak Venture Partners, NextCoast Ventures, and TDF Ventures, and First Ascent Ventures.

- Boston Micro Fabrication, a Maynard, Mass.-based manufacturing solutions provider, raised $24 million in Series D funding led by Guotai Junan Securities.

- Symmetry Systems, a San Mateo, Calif.-based data security management company, raised $18 million in funding. OVN Capital led the round and was joined by Adit Capital, TSG, and Forgepoint Capital.

- Haus, a Mountain View, Calif.-based marketing ROI analytics startup, raised $17m in Series A funding. Insight Partners led, and was joined by insiders Baseline Ventures, Haystack, Upside Partnership, Octave Ventures and Mantis VC. https://axios.link/3YqKJeD

- Veza, a Palo Alto-based identity management platform, raised $15 million in funding co-led by Capital One Ventures and ServiceNow.

- Local Logic, a Montreal-based location intelligence insights provider, raised $13 million in Series B funding. GroundBreak Ventures and Investissement Québec co-led the round and were joined by Band Capital Partners, Cycle Capital, Desjardins Group, Jones Boys Ventures, Second Century Ventures, and Shadow Ventures.

- Atmosfy, a San Francisco-based video platform for reviewing live dining and nightlife experiences, raised $12 million in seed funding. Redpoint Ventures led the round and was joined by Kygo, Streamlined Ventures, Industry Ventures, Canaan Partners, Village Global, Progression Fund, and Convivialite Ventures.

- Sweet Security, a Tel Aviv-based cloud security company, raised $12 million in seed funding. Glilot Capital Partners led the round and was joined by CyberArk Ventures and other angels.

- ConductorOne, a Portland-based identity security platform, raised $12 million in funding led by Felicis.

- Rootly, a San Francisco-based incident management platform, raised $12 million in Series A funding. Renegade Partners led the round and was joined by Google Gradient Ventures, and XYZ Ventures.

- Lightup, a Mountain View, Calif.-based data quality monitoring platform developer, raised $9 million in Series A funding. Andreessen Horowitz and Newland Ventures co-led the round and were joined by Spectrum 28 Capital, Shasta Ventures, Vela Partners, and Incubate Fund.

- Catch+Release, a San Francisco-based content licensing marketplace for brands and creators, raised an additional $8.8 million in Series A funding. Accel led the round and was joined by Cervin, Stagwell, HarbourVest Partners, and others.

- ShapesXR, a Palo Alto-based VR design and collaboration platform, raised $8.6 million in seed funding. Supernode Global led the round and was joined by Triptyq VC, Boost VC, Hartmann Capital, and Geek Ventures.

- Language I/O, a Cheyenne, Wyo.-based multilingual customer support company, raised $8 million in Series A1 funding. Joint Effects led the round and was joined by Wyoming Business Council’s Wyoming Venture Capital Fund, Gutbrain Ventures, PBJ Capital, and Omega Venture Partners.

- Middleware, a San Francisco-based, cloud observability platform provider, raised $6.5 million in seed funding. 8VC led the round and was joined by Fin Capital and other angels.

- Tromzo, a Mountain View, Calif.-based app security posture management startup, raised $8m in seed funding. Venture Guides led, and was joined by Alumni Ventures and Uncorrelated Ventures. www.tromzo.com

- BioFlyte, an Albuquerque, N.M.-based biothreat detection firm, raised $5.4 million in Series B funding. Scout Ventures and Cottonwood Technology Fund co-led the round and were joined by New Mexico Vintage Fund.

- Hushmesh, a Falls Church, Va.-based cybersecurity company, raised $5.2 million in funding. Paladin Capital Group led the round and was joined by Akamai Technologies.

- Gomboc.ai, a New York-based cloud infrastructure remediation platform, raised $5.2 million in seed funding co-led by Glilot Capital and Hetz Ventures.

- Dynamon, a Southampton, U.K.-based data analytics and simulation tools software company for commercial transport and logistics companies, raised £4 million ($5.02 million) in funding from bp ventures.

- Flo Recruit, an Austin-based legal recruitment software company, raised $4.2 million in seed funding. LiveOak Venture Partners and Moneta Ventures co-led the round and were joined by Tau Ventures and Alumni Ventures.

- Dropzone AI, a Seattle-based autonomous alert investigation platform for security operations teams, raised $3.5 million in seed funding. Decibel Partners led the round and was joined by Pioneer Square Ventures Fund and other angels.

- Kivera, a New York-based cloud cybersecurity company, raised $3.5 million in seed funding. General Advance, Round 13 Capital, and other angels.

- Multiplayer, a New York-based collaborative tool for distributed software teams, raised $3m. Bowery Capital led, and was joined by Okapi VC. www.multiplayer.app

- Birdstop, a Concord, Calif.-based remote sensing startup, raised $2.3m in seed funding. Lerer Hippeau led, and was joined by Anorak Ventures, Correlation Ventures, Data Tech Fund, Graph Ventures, Techstars and Timberline Holdings. www.birdstop.io

. . .

Sustainability:

- Verdagy, a Moss Landing, Calif.-based water electrolysis technology company for the production of green hydrogen, raised $73 million in Series B funding. Temasek and Shell Ventures co-led the round and were joined by Bidra Innovation Ventures, BlueScope, Galp, Samsung Venture Investment, Toppan Ventures, Tupras Ventures, Yara Growth Ventures, and Zeon Ventures.

- Persefoni, a Mesa, Ariz.-based climate management and accounting platform, raised $50 million in Series C1 funding. TPG Rise led the round and was joined by Clearvision Ventures, NGP, Prelude Ventures, Parkway Ventures, The Rice Investment Group, Bain and Co., EDF, Alumni Ventures, and ENEOS Innovation Partners.

- Treehouse, a Detroit-based EV charging installation company, raised $10 million in funding. Montage Ventures and Trucks Venture Capital co-led the round and were joined by CarMax, Assurant Ventures, Acrew Capital, Gutter Capital, Detroit Venture Partners, Holman, and Automotive Ventures.

- SkyCool Systems, a Mountain View, Calif.-based developer of cooling panels, raised $5m in seed funding. Nadel and Gussman Ventures co-led, and were joined by D3 Jubilee Partners. https://axios.link/3qpEGdE

- Divirod, a Boulder, Colo.-based provider of flood management and water risk analytics software, raised $3.6m from GHD, Thin Line Capital, and TDK Ventures. www.divirod.com

- Nuclearn.ai, a Phoenix-based process automation solutions provider for the nuclear industry, raised $2.5 million in seed funding. AZ-VC led the round and was joined by Nucleation Capital.

- Nature Coatings, a Las Vegas-based biochemicals company, raised $2.45 million in seed funding. Regeneration.VC and The 22 Fund co-led the round and were joined by Leonardo DiCaprio, Safer Made, and Portfolia.

Acquisitions & PE:

- Dave Portnoy, the founder of Barstool Sports, a New York-based sports and media entertainment company, bought back 100% of Barstool Sports from PENN Entertainment. Financial terms were not disclosed, but PENN said in a statement that the deal included certain non-compete and other restrictive covenants, and that PENN has the right to receive 50% of the gross proceeds received by Dave Portnoy in any subsequent sale.

- Tapestry (NYSE: TPR), the parent of Coach and Kate Spade, agreed to buy Capri (NYSE: CPRI) the owner of Versace, Michael Kors and Jimmy Choo, for $8.5b in cash, or $57 per share (65% premium to yesterday's closing price), per the WSJ. https://axios.link/3DPQWqN

- Archer Aviation (NYSE: ACHR), a Santa Clara, Calif.-based eVTOL developer, raised $215m in new equity funding from Stellantis, Boeing, United Airlines and ARK Invest. It also settled ongoing trade secret litigation with Wisk Aero, a joint venture of Boeing and Google co-founder Larry Page's Kitty Hawk. https://axios.link/44aTpGV

- IBM acquired Apptio, a Bellevue, Wash.-based financial and operational IT management and optimization software company, from Vista Equity Partners for $4.6 billion.

- Ares Management is investing an additional $75 million in Inter Miami CF, a Miami-based soccer team.

- KKR acquired Simon & Schuster, a New York-based publishing company, from Paramount Global for $1.62 billion.

- Campbell Soup Co. (NYSE: CPB) agreed to buy Sovos Brands (Nasdaq: SOVO), a Berkeley, Calif.-based food and beverage company whose brands include Rao's Homemade, for $2.7b. Sellers include Advent International, which took Sovos public in 2021 and still holds a 44% ownership stake. https://axios.link/45h8DLx

- GTCR agreed to acquire ADT’s Commercial fire and security business from ADT. The deal values the company at approximately $1.6 billion.

- Advent International agreed to acquire a majority stake in ZIMMERMANN, a Sydney, Australia-based luxury fashion brand. Financial terms were not disclosed.

- Clayton Dubilier & Rice agreed to buy Atlanta-based printing and packaging company Veritiv (YSE: VRTV) for around $2.3b, or $170 per share (20% premium to last Friday's closing price). https://axios.link/47jT1J8

- European antitrust regulators said they've opened an in-depth investigation into Adobe's (Nasdaq: ADBE) proposed $20 billion takeover of Figma, a Palo Alto, Calif.-based digital design software maker most recently valued at $10b in a 2021 venture round led by Durable Capital Partners.

- Rubrik, a Palo Alto, Calif.-based data management "unicorn," agreed to buy Laminar, a data security company that raised over $60m from firms like Insight Partners, SentinelOne, Salesforce Ventures, Tiger Global Management, TLV Partners and Meron Capital. No financial terms were disclosed, but TechCrunch pegs the price at $200m-$250m. https://axios.link/3OQkqeI

. . .

IPOs:

- Amazon (Nasdaq: AMZN) is in talks to be an anchor investor in the upcoming IPO for chipmaker Arm, per Reuters. https://axios.link/452uXJ8

Funds:

- Draper Associates, Tim Draper’s San Mateo-based venture capital firm focused on seed and early stage investments, raised $152.3 million for its seventh fund, according to an SEC filing.

- Ribbit Capital raised $800m for its 10th fintech-focused VC fund, per an SEC filing.

The genie is out

When OpenAI launched ChatGPT at the end of November last year, the tech world and the Extremely Online community went into something of a meltdown, racing to try the chatbot and sample its hilarious / genuinely insightful responses. The process was simple: put in a prompt — anything from “solve this complex coding problem” to “come up with rap battle verses between a caveman and Shakespeare” — and ChatGPT would often spit out exactly what you were after.

Back in December, the chatbot was making waves as one of the quickest platforms in history to reach 1 million users — hitting the milestone ~15x faster than Instagram and ~30x quicker than Spotify. Indeed, by the time the new year rolled around, ChatGPT already had 25 million users. Since then, however, even as more details of the bot’s full capabilities and ever-developing skillset have emerged, ChatGPT’s usage has started to temper.

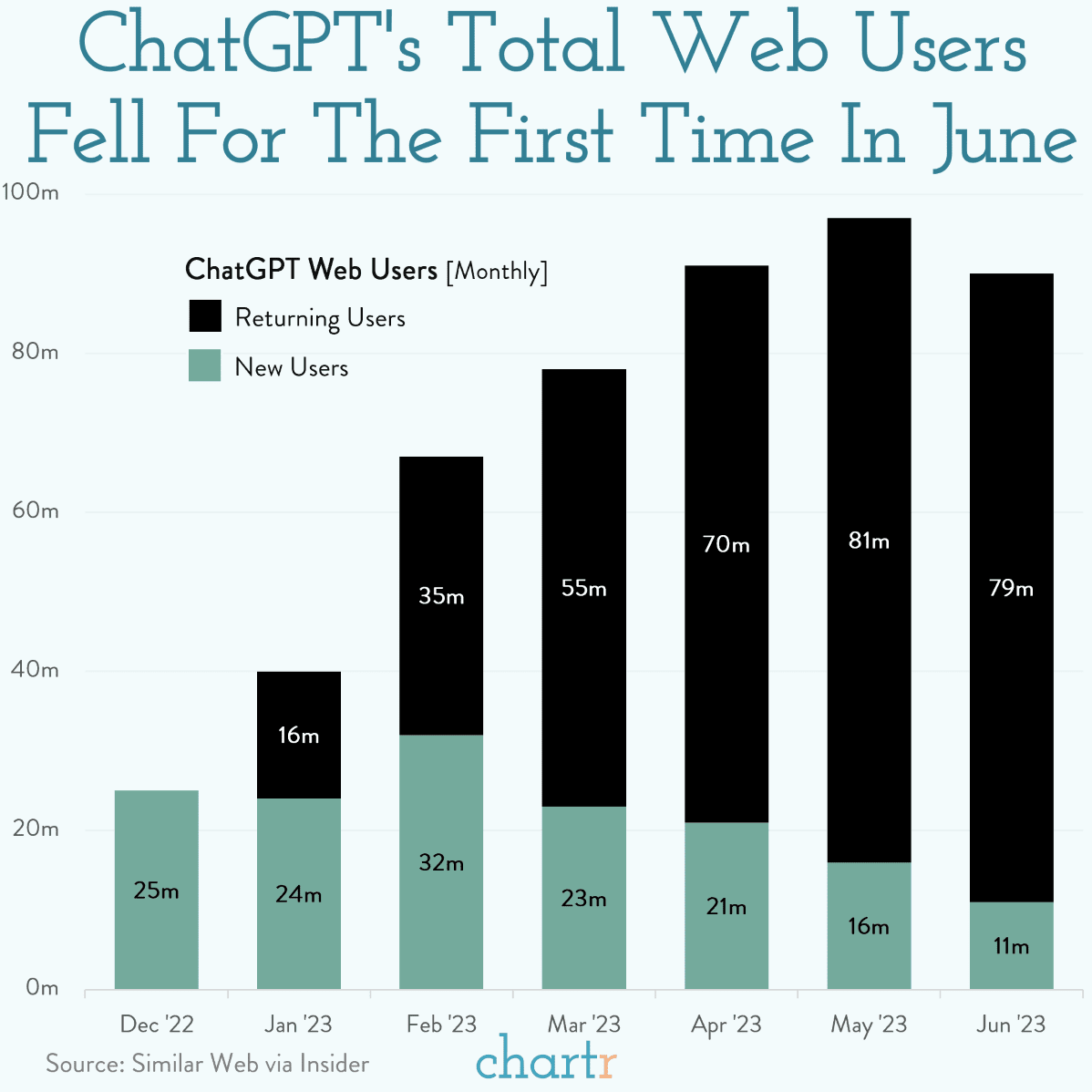

Data from Similar Web, via Insider, reveals that total users had been growing every month until May, when visitors to chat.openai.com hit 97 million, but they fell for the first time in June. Indeed, traffic to the site dropped more than 7%, and new users fell by almost a third — a sign that ChatGPT may have lost some of its novelty as the tech’s developed and more AI has come to the public fore.

Et tu, reddit?

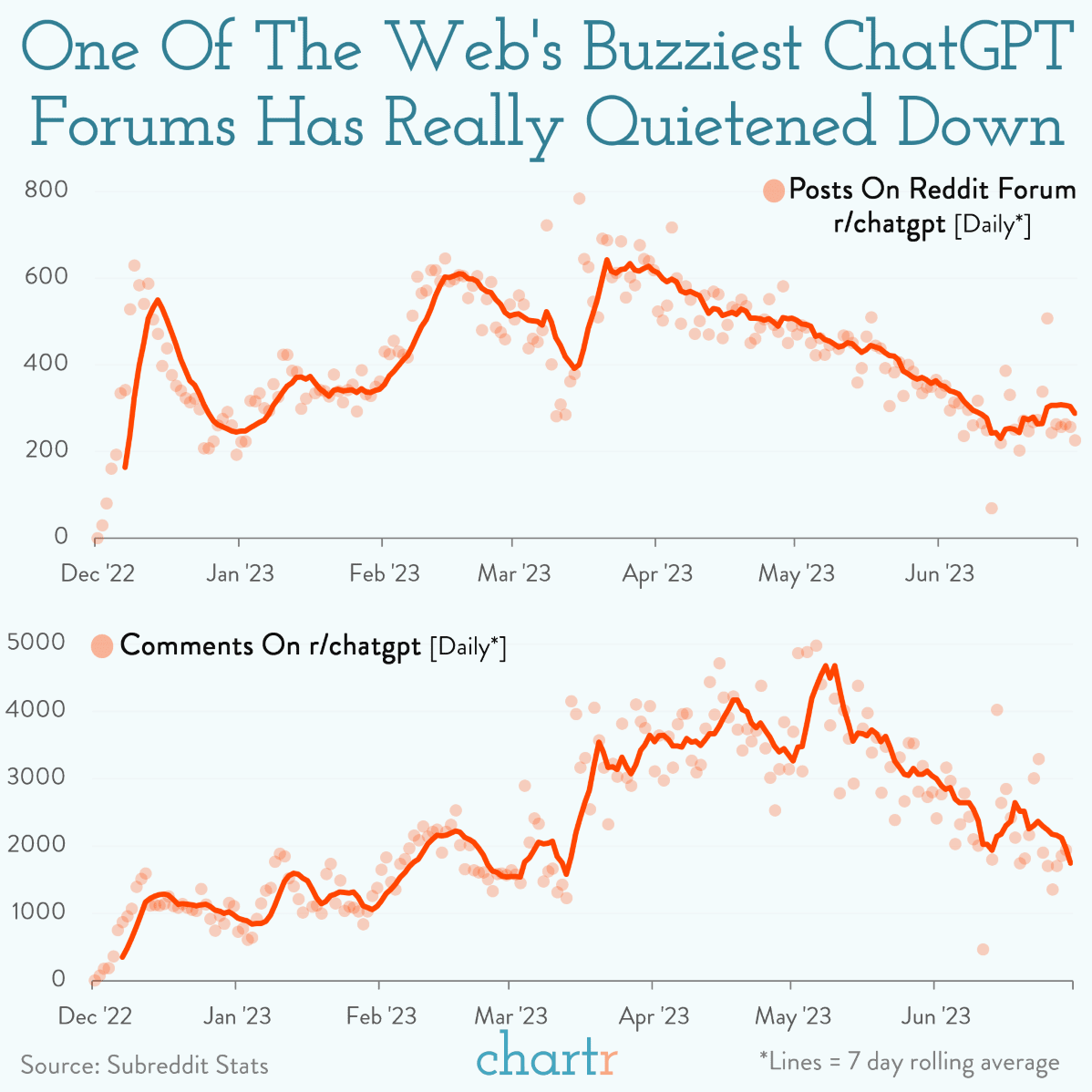

Even arenas where the most fervent fans of the tech once gathered have started to empty, as consumer enthusiasm looks to be fading. Thousands of posters on the social platform reddit immediately flocked to the forum r/chatgpt, flaunting their interactions with the chatbot and sharing mischievous ways to push its parameters and get the technology to flout its own rules. Comments on the subreddit reached a peak of 5,800 in a single day back in May after a post from a worker expressing dismay at losing their job to AI racked up ~3,000 comments in less than 24 hours.

The forum r/chatgpt now has 2.8 million members, but the rate of growth of new members has slowed, and activity on the subreddit has dwindled. Daily posts now hover around 200-300 and comments have also dropped to roughly half of what they were back in April. Google searches for “chatgpt” have also dropped by roughly half.

Substandard

Furthermore, many of the most popular posts on the site now seem to be negative about the tool. The most “liked” post from the last month is a meme about how the tool has supposedly been “dumbed down” from the version that was originally released. It seems that, even for ChatGPT superfans, conversation with and around the chatbot could be starting to run a little dry.

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

Happy Birthday!!!!! Kobie. Great article Molly. Your insight on the deals were huge. Mirror is doing something right. Lol.