Sourcery (8/8-8/12)

Adam Neumann ~ Truework, Forage, Farther, Patchwork Health, Biofourmis, Modern Life, Maximus, Abridge, Salvo Health, Craniometrix, Afresh, Nightfall AI, Kumospace, CreatorDAO

Hello from SF

This past week might have taken the record for the least amount of deal announcements. This is in part due to the mid-end of summer slump, silent bridge rounds, many OOO notifications, and overall just not many deals are being done right now.

So, what do we think the future holds in store for the tech-world?

Adam Neumann.

Why? Because he is back. And he already has a new pre-product unicorn.

a16z says ‘WeBack’ to WeWork’s Neumann with its biggest check ever, TechCrunch, in a very familiar space…

The storied venture firm wrote its largest individual check ever, at $350 million on a $1B valuation, to Flow, Neumann’s new residential real estate company focused on rentals.

Okay okay, second time founder? ✓, expert in the category? ✓, previous exit? ✓; sounds like a done deal.

To round out this story, if you follow deep silicon valley news, then you’d see the recent controversy the high profile a16z founder Marc has himself tangled in - opposing new housing developments in his hometown. Twitter’s response?

Listenings

E91: SoftBank's $21B+ Vision Fund loss, signals of a bubble, macro picture, Trump raided by FBI, All-In Podcast

“VC is not a scalable business”

3:02 Where Masa and SoftBank went wrong, why VC isn't scaleable, Vision Fund impact

A more grounded conversation with Sheel Mohnot, a fintech entrepreneur turned VC of Better Tomorrow Ventures who keeps his daily burn down to $1/day

Equally important, do you keep your chocolate in the fridge? (I prefer the freezer)

#1840 Marc Andreessen, Joe Rogan

Don’t know Marc of a16z all that well? Take a deep dive into his brain on the early innings of the internet and where he sees future value creation with the one and only Joe Rogan.

Marc Andreessen is an entrepreneur, investor, and software engineer. He is co-creator of the world's first widely used internet browser, Mosaic, co-founder of the social media network platform Ning, and co-founder and general partner of the venture capital firm Andreessen Horowitz.

. . .

Last Week (8/8-8/12):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Truework, Forage, Farther, Patchwork Health, Biofourmis, Modern Life, Maximus, Abridge, Salvo Health, Craniometrix, Afresh, Nightfall AI, Kumpspace, CreatorDAO, Fora, Invisible Universe, OpenSpace, ReturnLogic, Heirloom, Stark, Dropbase, Utility Global, Project Solar; Axios/Cox, Employ/Lever, Cisco/AppOmni, Harver/Pymetrics, Wallbox/COIL

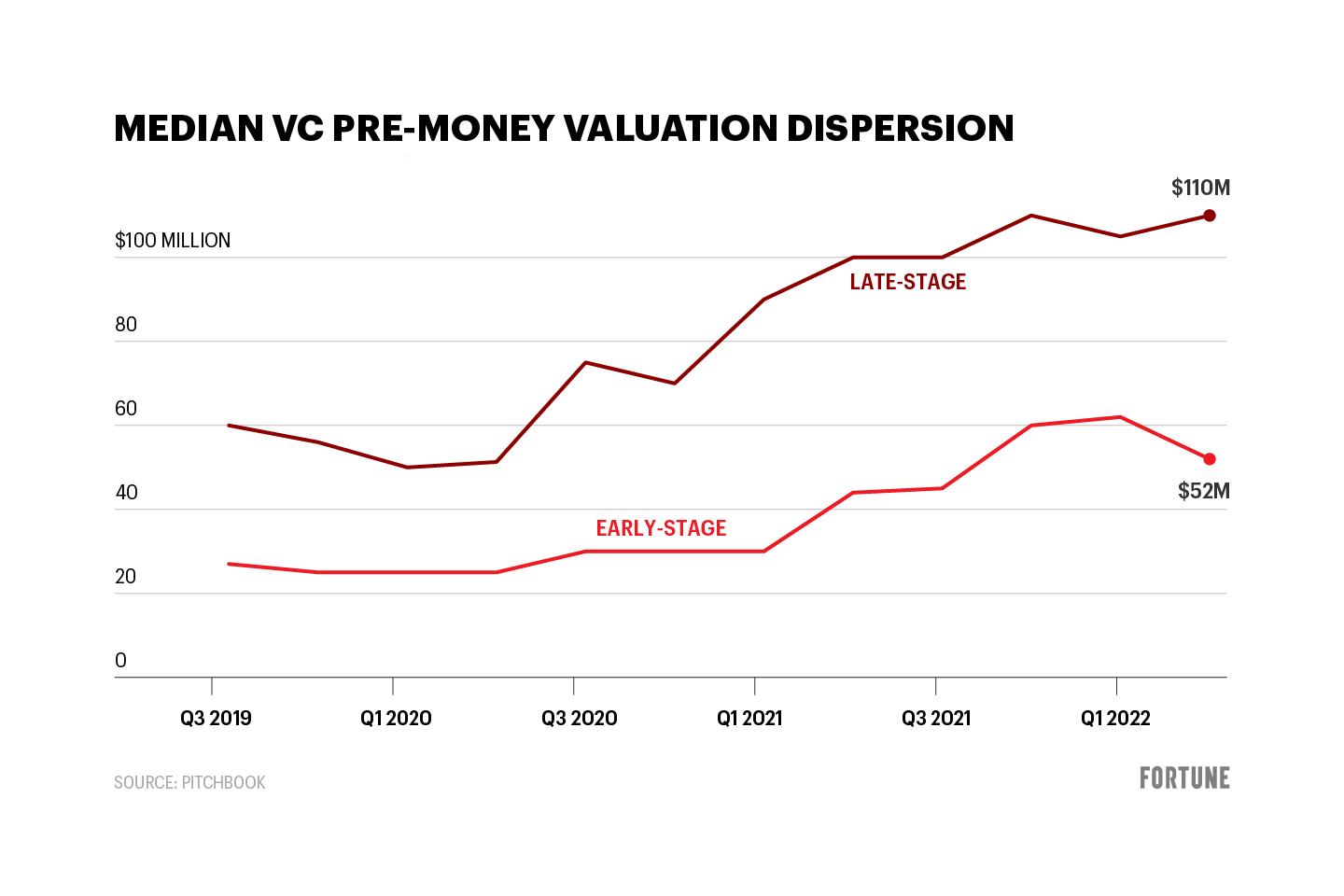

Final numbers on Median VC Pre-Money Valuation Dispersion at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Truework, a San Francisco-based income and employment verification platform, raised $50 million in Series C funding. G Squared Capital led the round and was joined by investors including Sequoia, Activant, Khosla, Indeed, Human Capital, and Four Rivers.

- Forage, a San Francisco-based payments processor for accepting SNAP EBT payments online, raised $22 million in Series A funding. Nyca led the round and was joined by investors including PayPal Ventures, EO Ventures, Instacart founder Apoorva Mehta, and other angels.

- Farther, a New York-based wealth management company, raised $15 million in Series A funding. Bessemer Venture Partners led the round and was joined by investors including Khosla Ventures, MassMutual Ventures, Moneta Venture Capital, Context Ventures, and Cota Capital.

. . .

Care:

- Patchwork Health, a London-based health care workforce platform, raised £20 million ($24.5 million) in Series B funding. Perwyn led the round and was joined by investors including Praetura Ventures, KHP Ventures, Monzo founder Tom Blomfield, and Social Chain co-founder Dominic McGregor.

- Biofourmis, a Boston-based virtual care and digital medicine company, raised $20 million in Series D extension funding led by Intel Capital.

- Modern Life, a New York-based life insurance brokerage company for advisors, raised $15 million in seed funding. Thrive Capital led the round and was joined by other angels.

- Maximus, a Los Angeles-based men’s telemedicine company, raised $15 million in Series A funding. Founders Fund’s Keith Rabois led the round and was joined by investors including 8VC, Abstract Ventures, 10X Capital, Unshackled Ventures, OneVC, Gaingels, Correlation Ventures, Chamaeleon VC, Rational Ventures, WhatIf Ventures, Shrug Capital, Electric Ant, and other angels.

- Abridge, a Pittsburgh-based medical documentation platform, raised $12.5 million in Series A-1 funding. Wittington Ventures led the round and was joined by investors including Union Square Ventures, Bessemer Venture Partners, Pillar Venture Capital, UPMC Enterprises, Yoshua Bengio, and Whistler Capital.

- Salvo Health, a New York-based virtual health clinic focusing on chronic gut conditions, raised $10.5 million in seed funding. Threshold Ventures led the round and was joined by investors including Torch Capital and Felicis

- Nanopath, a Cambridge, Mass.-based molecular diagnostics company, raised $10 million in Series A funding. Norwest Venture Partners and the Medtech Convergence Fund led the round and were joined by investors including Gingerbread Capital and Green D Ventures.

- Interaxon, a Toronto-based consumer neurotechnology company, raised $9.5 million in Series C funding. BDC Capital, Alabaster, and Export Development Canada led the round and were joined by investors including Phyto Partners, Iter Investments, Intretech, and The Clavis Foundation.

- Craniometrix, a New York-based D2C Alzheimer’s care company, raised $6 million in seed funding. Quiet Capital led the round and was joined by investors including YC, defy.vc, Olive Tree Capital, Rebel Fund, J Ventures, and Cathexis Ventures.

. . .

Enterprise & Consumer:

- Afresh, a San Francisco-based fresh food technology provider, raised $115 million in Series B funding. Spark Capital led the round and was joined by investors including Insight Partners, VMG Partners, Bright Pixel Capital, S2G Ventures senior executive partner Walter Robb, Maersk Growth, High Sage, and Innovation Endeavors.

- Nightfall AI, a San Francisco-based cloud data loss prevention platform, raised $40 million in Series B funding. WestBridge Capital led the round and was joined by investors including Next Play Capital, Bain Capital Ventures, Venrock, Pear VC, Paul Rudd, Drew Brees, and Josh Childress.

- Properly, a Toronto-based real estate company, raised $36 million CAD ($28.21 million) in funding. Parker89, Bain Capital Ventures, Prudence, FJ Labs, Golden Ventures, Intact Ventures, Max Ventures, AlleyCorp, Interplay, Industry Ventures, and others invested in the round.

- Kumospace, a remote-based virtual office software company for teams and events, raised $21 million in Series A funding from Lightspeed Ventures.

- CreatorDAO, a Santa Monica, Calif.-based Web3 project focused on investing in content creators, raised $20 million in seed funding. A16z and Initialized Capital led the round and were joined by investors including Paris Hilton’s 11:11 Media, Mantis Ventures, Liam Payne, Michael Ovtiz, M13, Audacious Ventures, 6th Man Ventures, Abstract Ventures, and Liquid 2 Ventures.

- Evidence Partners, an Ottawa-based literature review automation software company, raised $20 million in funding. Thomvest Ventures led the round and was joined by investors including Pender Ventures and Export Development Canada.

- Spin Technology, a Palo Alto-based SaaS data protection platform developer, raised $16 million in Series A funding. Blueprint Equity led the round and was joined by investors including Santa Barbara Venture Partners and Blu Venture Investors.

- Fora, a New York-based travel agency, raised $13.5 million in Series A funding co-led by Heartcore Capital and Forerunner.

- Invisible Universe, a Los Angeles-based animation studio, raised $12 million in Series A funding. Seven Seven Six led the round and was joined by investors including Cosmic Venture Partners, Dapper Labs, Franklin Templeton, Gaingels, Initialized Capital, Schusterman Family Investments, Wheelhouse, and 75 & Sunny.

- Satellite IM, a Boston-based peer-to-peer communications platform, raised $10.5 million in seed funding. Multicoin Venture Fund and Framework Ventures led the round and were joined by investors including Hashed Venture Fund, IDEO CoLab, Solana Ventures, Pioneer Square Ventures Fund, and others.

- OpenSpace, a San Francisco-based 360° jobsite capture and analytics company, raised an additional $9 million in Series D funding. Taronga Ventures and GreenPoint Partners invested in the round.

- ReturnLogic, a Philadelphia-based returns management SaaS platform, raised $8.5 million in Series A funding. Mercury led the round and was joined by investors including Revolution’s Rise of the Rest Fund, White Rose Ventures, and Ben Franklin Technology Partners.

- Heirloom, a Los Angeles-based Web3 accessibility SaaS platform, raised $8 million in seed funding led by Ripple Labs and Forte Labs.

- Stark, a New York-based accessibility software company, raised $6 million in seed funding. Uncork Capital led the round and was joined by investors including Darling Ventures, Indicator Ventures, and other angels.

- Cupixel, a Boston-based augmented reality and artificial intelligence art experience company, raised $5 million in seed funding led by JOANN.

- Mesh Security, a Tel Aviv-based cybersecurity company, raised $4.5 million in seed funding led by Booster Ventures.

- Auddy, a London-based podcast platform, raised $3 million in funding. Pembroke VCT led the round and was joined by investors including Haatch Ventures and Brick Capital Ventures.

- Dropbase, a San Francisco-based collaborative data import and data management platform, raised $1.75 million in refunding. Gradient Ventures led the round and was joined by investors including Y Combinator, Liquid 2 Ventures, Bragiel Brothers, Unpopular Ventures, and other angels.

. . .

Sustainability:

- Utility Global, a Houston-based sustainable hydrogen company, raised $25 million in Series B funding. Ara Partners led the round and was joined by investors including Samsung Ventures, NOVA, and Aramco.

- Project Solar, a Lehi, Utah-based e-commerce brand for solar installations, raised $23 million in Series A funding led by Left Lane Capital.

Acquisitions & PE:

- Cox Enterprises agreed to acquire Axios Media, a Washington D.C. area-based news outlet, for $525 million

- Employ acquired Lever, a San Francisco-based recruiting software company. Financial terms were not disclosed.

- Cisco Investments acquired a minority stake in AppOmni, a San Francisco-based SaaS security provider. Financial terms were not disclosed.

- Next in Natural acquired Lavva, a New York-based plant-based yogurt company. Financial terms were not disclosed.

- Harver acquired pymetrics, a New York-based soft skills assessment platform. Financial terms were not disclosed.

- Wallbox acquired COIL, a San Francisco-based EV charging installation service. Financial terms were not disclosed.

. . .

IPOs:

Nothing to see here…

. . .

SPACs:

Nothing to see here…

Funds:

- Urban Innovation Fund, a San Francisco-based venture capital firm, raised $121 million across two funds focused on companies building technologies for future cities.

VC Pre-Money Valuation Dispersion

According to PitchBook’s second quarter venture capital valuations report, quarter-over-quarter median early-stage valuations saw their first decline in ten quarters. According to PitchBook VC analyst Max Navas, valuations may be decreasing because of investor pushback at the negotiating table. Now that startups are no longer embracing the ‘growth at all costs’ mentality many had last year, investors no longer expect jumps in valuation in subsequent rounds of funding. “In today’s market investors are focused on capital efficiency and making sure their upside potential remains strong,” Navas explained.

Yet while valuations may be falling in the early-stage category, deal values are increasing. The early-stage median deal size in the second quarter of 2022 was $11.9 million—a 19% increase from the $10 million median deal size in this year’s first quarter. Why are these metrics going in different directions? “One of the primary reasons early-stage VC deal sizes are going up is the need to maintain sufficient runway to weather the current economic downturn,” Navas said. Raising more capital now means avoiding the possibility of reentering an even harsher fundraising climate if market conditions worsen.

Late-stage VC valuations show the reverse—deal values have declined slightly while valuations have increased. Because of looming exits, these startups are feeling the heat to justify lofty valuations in the turbulent economic climate and investors are less likely to commit to late-stage funding if there could be a delayed IPO. In the first half of 2022, the median deal size was $14 million, a 7.1% decrease from the $15 million median for the full year of 2021. Yet surprisingly the pre-money valuation for late-stage deals in the first half of 2022 increased 10% from last year—from $100 million to $110 million.

Source: Fortune

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.

Great article. Lots going on in tech. Lots going on in Silicon Valley. There were really some interesting deals going on this week. I like how you organize the deals in different sections.