Sourcery (9/6-9/10)

Queen's Corgis ~ Mysten Labs, Mesh payments, 21.co, Chargezoom, Luabase, CertifyOS, Millie, Bitwarden, Varjo, Arize AI, ZineOne, QA Wolf, Uiflow, Delli, Edda, Remento, Smoothie, Tesseract, CEEZER

After a bit of a lull, last week was marked with some pretty large world events.

First, from a pop-culture standpoint, everyone returned from burning man. Still trying to clean the dust out of their ears, these ‘open minded’ souls seeking the deep desire to find their inner self, get off the grid, fight for survival in the desert, as well as celebrate art, life, and take some substances, will be talking about ‘the playa’ until this time next year. The police reports are out here, and to learn about the incredible feat to build, live and deconstruct a city in a week, read the history of burning man here.

Second, switching to a more serious note. Having taken the throne in 1952, Queen Elizabeth II passed away after serving over 70 years as the UK’s longest surviving Monarch. Apart from what you may have watched on The Crown, the Queen’s history and her reign was even more substantial and remarkable. From Winston Churchill to Liz Truss, 15 Prime Ministers served under her, and from Truman to Biden, she met with 13 of the 14 US Presidents during her time (yes, even Trump; and sometimes even awkward). As for her Corgis, you can find the story of her infatuation and the corgi family tree here.

Lastly, this past weekend was the 21st anniversary of 9/11. I get the chills every time this day comes around. Growing up in CT and being close to the city, I knew friends and their family members who were affected, as well as those who helped out. My own godfather and uncle Mike, a policeman in Westchester county, went directly to the site with his team to assist. It was, and still is, so unthinkable and tragic.

About a year ago our team met Charlie Greene, who lost his father in 9/11, and was on a very meaningful mission with the creation of his company Remento. He tells his story to CNN via Video and in Forbes here.

Remento makes it easier than ever to capture your family’s story through recorded conversations with a family member. The Remento iOS mobile app recommends conversation prompts crafted by professional storytellers and scientists to uncover precious memories of a loved one’s past, each of which is recorded and processed directly within the app for easy sharing.

View their website: https://www.remento.co/

Download the iOS app: here

Disclosure: Upfront is an investor in Remento

. . .

Last Week (9/6-9/10):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into four categories, Fintech, Care, Enterprise & Consumer, and Sustainability, and ordered from later-stage rounds to early-stage rounds. Highlighted deals include Mysten Labs, Mesh payments, 21.co, Chargezoom, Luabase, CertifyOS, Millie, Bitwarden, Varjo, Arize AI, ZineOne, SaaS Alerts, QA Wolf, Uiflow, Delli, Edda, Remento, Smoothie, Tesseract, CEEZER; ADT, Seedrs, Flyy, The Factual, Shine/Headspace

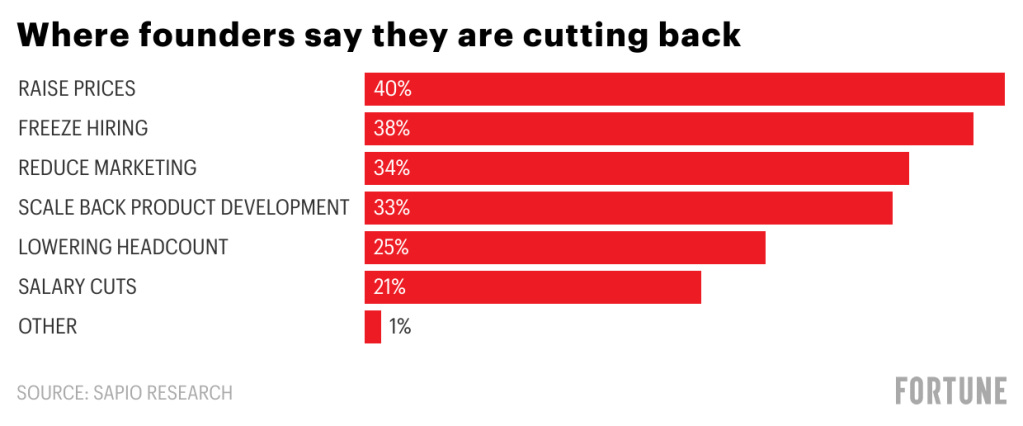

Final numbers on Founders are cutting back at the bottom.

Deals

Sources: TS, Pro Rata, FinSMEs, Pitchbook, StrictlyVC

Fintech:

- Mysten Labs, a Palo Alto-based Web 3 infrastructure company and developer of the Sui Layer 1 blockchain, raised $300 million in Series B funding. FTX Ventures led the round and was joined by investors including a16z crypto, Jump Crypto, Apollo, Binance Labs, Franklin Templeton, Coinbase Ventures, Circle Ventures, Lightspeed Venture Partners, Sino Global, Dentsu Ventures, Greenoaks Capital, O’Leary Ventures, and others.

- Mesh Payments, a New York-based finance automation platform, raised $60 million in funding. Alpha Wave led the round and was joined by investors including Tiger Global, TLV Partners, Entreé Capital, and Meron Capital.

- 21.co, a New York and Zurich-based crypto access provider, raised $25 million in funding. Marshall Wace led the round and was joined by investors including Collab+Currency, Quiet Ventures, ETFS Capital, and Valor Equity Partners.

- Chargezoom, an Irvine, Calif.-based billing and integrated payments platform, raised $10 million in Series A funding. Panoramic Ventures and Softbank Opportunity Fund led the round and were joined by investors including SaaS Venture Capital, Stout Street Capital, and Okapi Venture Capital.

- Luabase, a Philadelphia-based data stack company for blockchain, raised $4.5 million in seed funding. Costanoa Ventures and 6th Man Ventures co-led the round.

. . .

Care:

- CertifyOS, a New York-based health care provider intelligence platform, raised $14.5 million in Series A funding. General Catalyst led the round and was joined by investors including Upfront Ventures, Max Ventures, and Arkitekt Ventures.

- Millie, a Berkeley, Calif.-based maternity clinic, raised $4 million in seed funding. TMV Ventures and BBG Ventures led the round and were joined by investors including Venn Growth Partners, Looking Glass Capital, Learn Capital, Hustle Fund, and other angels.

- Scan.com, a London-based diagnostic imaging platform for booking and receiving results from medical scans, has raised $2.5 million in funding. Triple Point Ventures led the round and was joined by investors including StartUp Health, Plug and Play Ventures, and YZR Capital.

. . .

Enterprise & Consumer:

- Bitwarden, a Santa Barbara, Calif.-based password management company, raised $100 million in funding. PSG led the round and was joined by Battery Ventures.

- Varjo, a Helsinki-based VR/XR hardware and software provider, raised $40 million in funding. EQT Ventures, Atomico, Volvo Car Tech Fund, Lifeline Ventures, Mirabaud, and Foxconn invested in the round.

- Isovalent, a Cupertino, Calif.-based networking, security, and observability platform, raised $40 million in Series B funding led by Thomvest Ventures.

- Arize AI, a Berkeley, Calif.-based machine learning observability company, raised $38 million in Series B funding. TCV led the round and was joined by investors including Battery Ventures, Foundation Capital, and Swift Ventures.

- Everphone, a Berlin-based B2B phone-as-a-service company, raised $32.1 million in Series C extension funding led by Cadence Growth Capital.

- Hebbia, a New York-based search engine platform, raised $30 million in Series A funding. Index Ventures partner Mike Volpi led the round and was joined by investors including Yahoo founder and CEO Jerry Yang, and investor Ram Shriram.

- ZineOne, a Milpitas, Calif.-based marketing platform, raised $27.4 million in Series C funding. SignalFire, Norwest Venture Partners, and others invested in the round.

- SaaS Alerts, a Wilmington, N.C.-based cybersecurity company for managed service providers, raised $22 million in funding from Insight Partners.

- SteelEye, a London-based compliance technology and data analytics firm, raised $21 million in Series B funding. Ten Coves Capital led the round and was joined by investors including Fidelity International Strategic Ventures, Illuminate Financial, Beacon Equity Partners, and others.

- QA Wolf, a Seattle-based quality assurance platform, has raised $20.1 million in funding. Inspired Capital led the round and was joined by investors including Notation Capital, CoFound, and other angels.

- Uiflow, a San Francisco-based no-code app building and scaling platform for businesses, raised $15 million in Series A funding. Addition and Transpose Platform led the round and were joined by investors including Together Fund and other angels.

- ELISE, a Bremen, Germany-based connected engineering platform, raised $14.8 million in Series A funding. Spark Capital led the round and was joined by investors including BMW i Ventures, Cherry Ventures, UVC Partners, and Venture Stars.

- Gameplay Galaxy, a San Francisco-based decentralized gaming ecosystem, raised $12.8 million in seed funding. Blockchain Capital led the round and was joined by investors including Merit Circle, Com2uS, Mysten Labs, Solana Ventures, Yield Guild Games, and Hustle Fund.

- Netspeak Games, a remote-based games studio, raised $12 million in Series A funding. Lakestar and Project A led the round and were joined by investors including Makers Fund and other angels.

- Delli, a London-based food and beverage company, raised $7.2 million in funding. Balderton and HV Capital co-led the round.

- D’Amelio Brands, the Los Angeles-based business venture of the D’Amelio family, raised $6 million in seed funding. Richard Rosenblatt, entrepreneur and business executive Michael Rubin, developer and e-commerce entrepreneur Elena Silenok, Apple's senior vice president of services Eddy Cue, Lions Gate Entertainment CEO Jon Feltheimer, and other angels invested in the round.

- Edda, a Paris-based collaborative software company for investors, raised $5.8 million in funding. Mucker Capital, Plug&Play, FJ Labs, Tony Fadell’s Future Shape, and angel investor Arnaud Bonzom invested in the round.

- Velaris, a London-based customer success platform for B2B tech, raised £4.7 million ($5.4 million) in seed funding. Octopus Ventures led the round and was joined by investors including Zaka and Fintech 365.

- Zeet, a San Francisco-based DevOps automation platform, raised $4.3 million in seed funding. Sequoia Capital led the round and was joined by Race Capital.

- EarlyDay, a San Francisco-based early childhood education hiring platform, raised $3.25 million in seed funding. Alpaca VC and Struck Capital co-led the round and were joined by investors including Precursor Ventures, Bright Horizons, Revolution’s Rise of the Rest Seed Fund, and FJ Labs.

- Remento, a Los Angeles-based conversation prompts library app, raised $3 million in seed funding. Upfront Ventures led the round and was joined by other angels.

- Gig and Take, a Mechanicsburg, Pa.-based manufacturing software startup, raised $1.5 million in pre-seed funding. Schematic Ventures led the round and was joined by investors including Motivate and SHRM.

- Smoothie, a New York-based Web3 discovery platform, raised $1.2 million in funding. Former Coinbase CTO Balaji Srinivasan, Youbi Capital, LongHash Ventures, Ghaf Capital, King River Capital, Cyberconnect, Stateless Ventures, and others invested in the round.

. . .

Sustainability:

- Tesseract, a London-based energy company, raised $78 million in funding. Balderton Capital and Lakestar co-led the round and were joined by investors including Accel, Creandum, Lowercarbon Capital, Ribbit, BoxGroup, and other angels.

- CEEZER, a Berlin-based B2B carbon credits marketplace, raised €4.2 million ($4.16 million) in funding. Carbon Removal Partners led the round and was joined by investors including Norrsken VC and Picus Capital.

- CorePower Magnetics, a Pittsburgh-based magnetic solutions company for electric vehicles and the grid, raised $2.5 million in pre-seed funding. Volta Energy Technologies led the round and was joined by investors including Evergreen Climate Innovations and Innovation Works.

Acquisitions & PE:

- Church & Dwight acquired Hero Cosmetics, a New York-based cosmetics company, from Aria Growth Partners for $630 million.

- State Farm agreed to invest $1.2 billion in ADT, a Boca Raton, Fla.-based security systems and services provider.

- Republic acquired Seedrs, a London-based crowdfunding platform, for £86.5 million ($100 million).

- Dropp acquired Flyy, a New York-based social metaverse platform, for $25 million.

- Instacart agreed to acquire Rosie Applications, an Ithaca, N.Y.-based online grocery startup. Financial terms were not disclosed.

- Yahoo acquired The Factual, a San Mateo, Calif.-based news rating company. Financial terms were not disclosed.

- Headspace Health acquired the Shine app, a New York-based mental health and wellness support platform. Financial terms were not disclosed.

- Metadata.io acquired Reactful, a Santa Barbara, Calif.-based web optimization and personalization platform for digital marketers. Financial terms were not disclosed.

- SharpLink Gaming agreed to acquire SportsHub Games Network, a Minneapolis-based fantasy and sports game provider. Financial terms were not disclosed.

. . .

IPOs:

Nothing to see here…

. . .

SPACs:

Nothing to see here…

Funds:

- Kapor Capital, an Oakland-based venture capital firm, raised $126 million for a fund focused on tech startups affecting social change in low income communities and communities of color.

- Building Ventures, a Boston-based venture capital firm, raised $95 million for a fund focused on seed to Series A construction and real estate tech startups.

- Bessemer Venture Partners, a San Francisco-based venture capital firm, raised $4.6 billion across two funds. The firm raised $3.85 billion for its twelfth fund focused on seed and early-stage investments across sectors and geographies, and $780 million for its BVP Forge fund focused on growth buyout and minority deals in software and tech-enabled services businesses.

- Ardian, a Paris-based private investment house, raised $2.1 billion for a fund focused on mid-market U.S. and other OECD American infrastructure assets in the telecommunications, transportation, and energy transition sectors.

- PowerPlant Partners, a Hermosa Beach, Calif.-based investment firm, raised $330 million for its third fund focused on sustainable growth stage consumer-facing brands.

- Glasswing Ventures, a Boston-based venture capital firm, raised $158 million for its second fund focused on seed stage enterprise and security startups.

Final Numbers: Recalibrating the Business Model

Venture-backed startups are also looking to alternative sources of capital to keep the lights on, whether it be from banks, or even family members. Here’s where they are looking for cash:

In general, founders could be better positioned. A majority of them have less than six months of cash on the balance sheet, according to Wiss’ research. And founders should pay heed to recent memory: At the beginning of COVID, many startup lenders abruptly stopped lending to early-stage companies, Barbieri recalls, and companies had to scramble to figure out how to make payroll.

Thus far, there are options. “I’ve seen rounds shrink. I’ve seen term sheets disappear. But I’ve also seen people work it out,” Barbieri says.

The material presented on Molly O’Shea’s website are my opinions only and are provided for informational purposes and should not be construed as investment advice. It is not a recommendation of, or an offer to sell or solicitation of an offer to buy, any particular security, strategy, or investment product. Any analysis or discussion of investments, sectors or the market generally are based on current information, including from public sources, that I consider reliable, but I do not represent that any research or the information provided is accurate or complete, and it should not be relied on as such. My views and opinions expressed in any website content are current at the time of publication and are subject to change. Past performance is not indicative of future results.