Sourcery ✨ Bill Ackman, Upfront Summit, Space, Nvidia, Gemini

(2/19-2/23) Antora, Magic.dev, Hadrian, Recognize, Kairos Aerospace, Clumio, Highway 9 Networks, Qloo, Crisp, Dub, Exponential Markets, Helios, FinPilot Fabric, Oula, Power, EngineEars, Nodeshift

Happy Upfront Summit Week! #LongLA

Get ready for some seriously good content. The Upfront Summit is back for 2024 & taking over Los Angeles with the top GPs, LPs, Founders, and yes, some celebrities, yet again.

I’ll be reporting back with a recap of the best talks and takeaways from the key leaders speaking this year from Melinda French Gates, Keith Rabois, Katy Perry, Chris Dixon, Trae Stephens, Nand Mulchandani (CIA), Tracee Ellis Ross, Blake Griffin, Cameron Diaz, Novak Djokovic, and more.

Be sure to use the hashtag #upfrontsummit in any posts! See ya there!

Musings

Macro

NVDA, Chips, AI Compute Build Out, AI Impact on Big Tech w/ Bill Gurley & Brad Gerstner [BG2 Pod]

This is the best new podcast hands down. Brad & Bill come super researched and ready to discuss in great detail the most important topics in business & technology. In this episode, you will learn about earnings, inflation, interest rates, the impact of AI on Big Tech, NVDA, chips, fabs, Altman’s $7T to meet AI Compute needs, & more.

Bill Ackman: Investing, Financial Battles, Harvard, DEI, X & Free Speech [Lex Fridman Podcast]

With almost 1M+ views on YouTube, Bill covers investing fundamentals & the psychology of investing, company research, activist investing, specific investments like General Growth Properties and Canadian Pacific Railway, personal challenges in his career, DEI in universities, free speech, & future outlooks.

Nvidia smashes earnings (again), Google's Woke AI disaster, Groq's LPU breakthrough & more [All-in Podcast]

Hardtech #LongLA

Moon landing → Intuitive Machines' Odysseus lands on the moon & beams home 1st photos from the lunar surface [Space]

Earth landing → Varda Space capsule returns to Earth with space-grown antiviral drug aboard [Space]

See some incredible photos from the recovery of W-1 here

Varda’s launch was our top post of 2023, full circle!

Hadrian’s CEO wants to defy history and revitalize American industry [TechCrunch]

Early investor Xander Oltmann discusses how Hadrian is pulling off attractive margins in a traditionally ‘non-scalable’ industry [Sourcery Pod]

Inside the Future of American Manufacturing: Startup Documentary [John Coogan]

Industrial power is the base of any great civilization & Hadrian is building the future of manufacturing in America [S3]

NVIDIA

NVIDIA Announces Financial Results For Fourth Quarter And Fiscal 2024 [NVIDIA]

Nvidia hits $2 trillion valuation as AI frenzy grips Wall Street [Rueters]

It’s NVIDIA’s world and we’re just living in it! [Motley Fool Podcast]

The NVDA Show, is buying back their stock really the most strategically advantageous thing they could be doing right now? [Motley Fool Podcast]

AI

Google AI (Gemini) Has A Huge Problem, Taylor Swift and Joe Biden's Secret Plans [Pirate Wires]

Google Stock Falls 4.5% After Backlash Over AI Chatbot’s Racial Results [The Information]

Science

Are psychedelics really the key to expanding our consciousness? James Fadiman PhD, who has 60 years of experience in the field, believes they are. [Big Think]

Doing Good

The widow of top Warren Buffett investor donates $1 billion to cover tuition for all future students of Albert Einstein College of Medicine [Fortune]

. . .

Last Week (2/19-2/23):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into five categories, FinTech, Care, Enterprise & Consumer, HardTech, and Sustainability, and ordered from later-stage rounds to early-stage rounds.

Highlighted VC deals include

Antora, Magic.dev, Hadrian, Recognize, Kairos Aerospace, Clumio, Highway 9 Networks, Qloo, Crisp, Dub, Exponential Markets, Helios, FinPilot, Eli, Fabric, Oula, Power, EngineEars, Nodeshift, SigScalr, Buildstock

Acquisitions & PE

Capital One/Discover, Walmart/Vizio, Buzzfeed/Complex, 1Password/Kolide

Funds

.406 Ventures, Hack VC, Golden Ventures, Definition

Final numbers on Nvidia Data Center Revenue & Complex’s ‘First We Feast’ Growth at the bottom.

Deals

Fintech:

- Exponential Markets, New York City developer of financial risk mitigation tools, raised $10.3M in seed funding led by MaC Venture Capital with participation from Citi, Autotech Ventures, and Avanta Ventures.

- Helius, Toronto, Canada platform designed to make building crypto applications on Solana faster and easier, raised $9.5M in Series A funding led by Foundation Capital with participation from Reciprocal Ventures, 6th Man Ventures, Chapter One, Propel, and others.

- Pulsate, Madison, WI provider of a mobile-first member engagement platform for financial institutions, raised $7.8M in Series A funding from TruStage Ventures and Curql Collective.

- Inco, New York, NY Ethereum layer developer, raised $4.5M in seed funding led by 1kx, with participation from Circle Ventures, Robot Ventures, Portal VC, Alliance DAO, Big Brain Holdings, Symbolic, GSR, Polygon Ventures, Daedalus, Matter Labs and Fenbushi.

- Finpilot, Seattle, WA developer of AI technology designed to extract knowledge out of financial data, raised $4M in seed funding led by Madrona lwith participation from Ascend.vc.

. . .

Care:

- Fabric, New York City platform designed to automate clinical and administrative work for health care providers, raised $60 million in Series A funding led by General Catalyst with participation from Thrive Capital, GV, Salesforce Ventures, Vast Ventures, Box Group, and Atento Capital.

- Oula, Brooklyn, NY maternity care clinic, raised $28M in Series B funding led by Revolution Ventures and Maverick Ventures led the round and was joined by GV, Female Founders Fund, 8VC, Alumni Ventures, and Great Oaks.

- Carewell, Miami, FL online retailer for family caregivers, raised $24.7M in Series B funding. MBF Healthcare's principals led, and were joined by Sageview Capital and Headline.

- Blackbird Health, Pittsburg, PA in-person and virtual youth mental health provider, raised $17M in Series A funding led by Define Ventures with participation from Frist Cressey Ventures and GreyMatter.

- Power, a San Francisco-based clinical trial platform, raised $11.9M in Series A funding led by Kin and Contrary with participation from Footwork.

- UnityAI, a Nashville, Tenn.-based developer of AI technology designed to streamline hospital operations, raised $4 million in seed funding led by Max Ventures with participation from Whistler Capital Partners, Nashville Capital Network, and others.

- Elektra Health, New York City provider of evidence-based menopause education, care, and community, raised $3.3M in a seed extension led by UPMC Enterprises with participation from Wavemaker 360 and existing investors Flare Capital Partners and Seven Seven Six Fund.

- Juniper, London, U.K. reproductive health care insurance provider, raised £1.5M ($1.9M) in pre-seed funding led by Insurtech Gateway with participation from 2100 Ventures, Exceptional Ventures, Heartfelt, and angel investors.

. . .

Enterprise & Consumer:

- Magic.dev, San Francisco, CA startup developing an AI software engineer, raised $117M in funding led by Nat Friedman and Daniel Gross with participation from CapitalG and Elad Gil.

- Clumio, Santa Clara, CA developer of software designed to automate data backup, recovery, and compliance for businesses, raised $75M in Series D funding led by Sutter Hill Ventures with participation from Index Ventures, Altimeter Capital, and NewView Capital.

- Synadia Communications, San Mateo, CA developer of open source connective technology, raised $25M in Series B funding led by Forgepoint Capital with participation from Singtel Innov8, LDVP, and 5G Open Innovation Lab.

- Highway 9 Networks, Santa Clara, CA mobile cloud for the AI-enterprise, raised $25M in funding from Mayfield, General Catalyst, Detroit Ventures, and others.

- Qloo, New York City platform designed to predict consumer taste, has raised $25M in Series C fundraising led by AI Ventures with participation from AXA Venture Partners, Eldridge, and Moderne Ventures.

- Orkes, Cupertino, CA microservice and workflow platform, raised $20M in Series A funding. Nexus Venture Partners led the round and was joined by Battery Ventures and Vertex Ventures US.

- Crisp, New York, NY collaborative commerce platform, raised $20M in Series B extension funding from insiders Blue Cloud Ventures, FirstMark Capital, Spring Capital, and 3L It also raised $30M in debt from TriplePoint Capital.

- Astrotalk, New Delhi, India astrology platform, raised $20M in Series A funding from Left Lane Capital.

- Dub, New York, NY copy-trading startup, raised $17M in funding (including $2M in debt) led by Tusk Ventures, with participation from Nathan Rodland, Dara Khosrowshahi, Bill Capuzzi, Roger Ferguson Jr., Ryan Tedder, and others also participating.

- Empowerly, San Francisco, CA provider of personalized college and career guidance, raised $15 million in funding led by Conductive Ventures.

- Loora, Tel Aviv, Israel-based conversational AI platform designed to help users learn fluent English, raised $12M in Series A funding led by QP Ventures with participation from Hearst Ventures, Emerge, Two Lanterns Venture Partners, and others.

- Permit.io, Tel Aviv, Israel developer of permissions and authorization technology, raised $8.3M in Series A funding led by Scale Venture Partners with participation from NFX, Verissimo Ventures, Roosh Ventures, Firestreak.

- Novity, San Carlos, CA developer of predictive maintenance AI technology for machines, raised $7.8M in funding led by WERU Investment with participation from Myriad Venture Partners and others.

- EngineEars, Los Angeles, CA music engineering and studio marketplace, raised $7.5M in seed funding led by Drive Capital, with participation from Slauson & Co., 645 Ventures, FLUS Investment Group, Kendrick Lamar, Ghazi, AlexDaKid, Roddy Ricch, Mustard, YG, DJ Khaled, Russ, Tunde Balogun, and Sean Famoso also participating. www.engineears.com

- Ziplines Education, San Francisco, CA company that provides universities with certificate courses in tech-adjacent fields, raised $6.4M in Series A funding led by Jackson Square Ventures with participation from Wildcat Venture Partners and WGU Labs.

- Apica, El Segundo, CA & Stockholm, Sweden provider of data management and observability software, raised $6M in funding led by Riverside Acceleration Capital with participation from Industrifonden, SEB Foundation, Oxx, and LEO Capital.

- hellohive, New York City-based recruiting platform designed to connect companies with talent from diverse backgrounds, raised $3.4M in Series A funding led by The Tisch Family with participation from The Pearl Fund, Hillside Ventures, Ann Tenenbaum, Jeff Altman, and Robert Bell Wilkins.

- VectorShift, New York, NY generative AI application development platform, raised $3M in seed funding from 1984 Ventures, defy.vc, Formus Capital, Y Combinator, and others.

- Nodeshift, San Francisco-based cloud platform, raised $3.2M in funding led by Inovo.vc with participation from Notion Capital, 10X Founders, and others.

- Evergrowth, New York City-based B2B account-based sales platform, raised $2.2M in funding led by Impellent Ventures and Practica Capital.

- SigScalr, Boston, MA unified application observability platform, raised $1.8M in pre-seed funding led by Scribble Ventures with participation from WestWave Capital and Forward Slash Capital.

. . .

HardTech:

- Antora Energy, Sunnyvale, CA developer of batteries designed to convert renewable electricity into industrial energy, raised $150M in Series B funding led by Decarbonization Partners with participation from Emerson Collective, GS Futures, The Nature Conservancy.

- Hadrian, Torrance, CA automated precision component factory raised $117M in Series B funding, in a mix of equity and debt, with new participation from RTX Ventures, the venture arm of defense prime RTX (formerly called Raytheon). And continued participation from Construct Capital, WCM, Bracket Capital, Shrug Capital, Lux Capital, a16z, Founders Fund, S&A, Silent Ventures, Cubit Capital, Caffeinated, Tru Arrow Partners.

- Recogni, San Jose, CA building nextgen AI inference computing, raised $102m in Series C funding led by Celesta Capital and GreatPoint Ventures, with participation from HSBC and Tasaru Mobility Investments.

- Kairos Aerospace, Sunnyvale, CA provider of technology designed to capture methane emissions data for the energy industry, raised $52M in Series D funding led by BlackRock with participation from Hartree Partners, DCVC, Climate Investment, and Energy Innovation Capital.

- PermitFlow, Milpitas, CA developer of construction permit software, raised $31M in Series A funding led by Kleiner Perkins with participation from Initialized Capital, Y Combinator, Felicis, Altos Ventures, and angel investors.

- Conservation Labs, Pittsburgh, PA AI platform designed to monitor water usage and identify potential leaks, raised $7.5M in Series A funding led by RET Ventures’ Housing Impact Fund with participation from Sustain VC.

- Eli Technologies, Philadelphia, PA startup helping with home electrification financing, raised $6.8M in seed funding led by Lowercarbon Capital and Spero Ventures, with participation from New System Ventures, Looking Glass Capital, Leap Forward Ventures, Untapped Capital, and RallyCap VC also participating.

- Buildstock, New York, NY B2B construction materials marketplace and fintech company, raised $1.6M in pre-seed funding from Precursor, MGV, XFactor, and RefashionD. www.buildstock.com

. . .

Sustainability:

- Clairity Technology, Los Angeles, CA developer of low-cost carbon dioxide removal systems, raised $6.8M in seed funding from Lowercarbon Capital and Initialized Capital.

Acquisitions & PE:

- Capital One (NYSE: COF) has agreed to buy Discover Financial (NYSE: DFS) in an all-stock transaction valued at $35.3B.

- Walmart (NYSE: WMT) agreed to acquire Vizio (NYSE: VZIO), an Irvine, CA smart TV designer and retailer, for $2.3B.

- BuzzFeed (Nasdaq: BZFD) sold Complex, the entertainment media brand it acquired for $300M in 2021, to livestream shopping platform NTWRK for $108.6M.

- Society Brands acquired Clarifion, a Newport Beach, CA provider of air ionizers and purifiers, and Cleanomic, a Henderson, Nev.-based provider of sustainable cleaning, laundry, kitchen, and bathroom products. Financial terms were not disclosed.

- Delinea, backed by TPG, agreed to acquire Fastpath, a Des Moines, IA provider of identity, security, and access control software for businesses. Financial terms were not disclosed.

- Apica, backed by The Riverside Company, acquired Circonus, Malvern, PA telemetry data company. Financial terms were not disclosed.

- Apryse, backed by Thoma Bravo, acquired LEAD Technologies, Charlotte, N.C. provider of AI-powered software designed to assist businesses with integrating recognition, document, medical, and other technologies. Financial terms were not disclosed.

- Siris acquired a minority stake in Gigamon, Santa Clara, CA deep observability company. Financial terms were not disclosed.

- Aquiline Capital Partners and Level Equity acquired a majority stake in DocuPhase, a Tampa, FL provider of accounting and finance process automation software.

- 1Password acquired Kolide, Somerville, MA endpoint security platform.

- Nuview acquired Astraea, Charlottesville, VA geospatial data analytics company.

. . .

IPOs:

- Reddit's US IPO filing reveals $90.8M losses, 21% revenue growth in 2023 [Reuters]

Funds:

- .406 Ventures, a Boston, MA venture capital firm, raised $265M for its fifth fund focused on companies in healthcare, data + AI, and cybersecurity.

- Hack VC, New York, NY digital assets-focused venture firm, raised $150m for its debut fund. [Bloomberg]

- Golden Ventures, Canada venture firm, raised more than $100m for its fifth fund. [TechCrunch]

- Definition, New York, NY early-stage venture capital, raised $80m for its debut fund.

Final Numbers

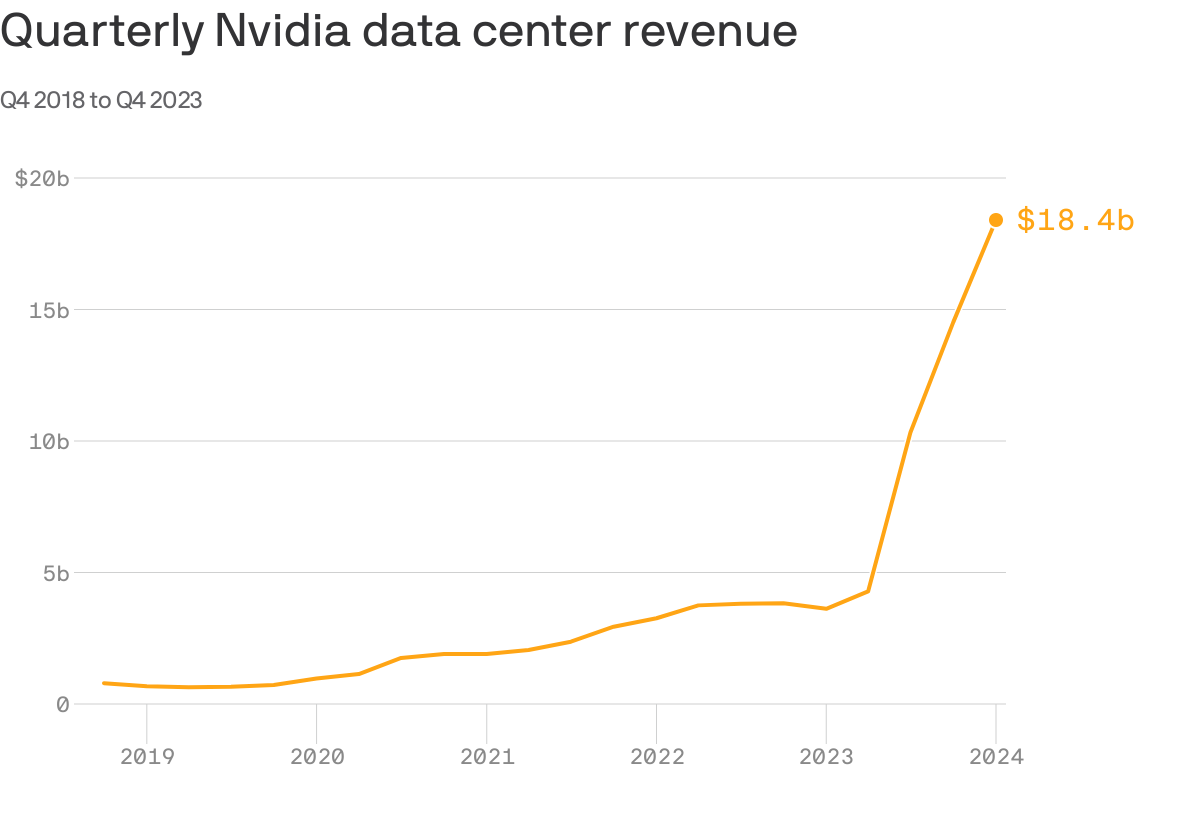

Data: FactSet; Chart: Axios Visuals

Nvidia's much-anticipated quarterly earnings yesterday did not disappoint, with the AI chip leader posting $18.4 billion in Q4 revenue from its data entry business, up 409% from $3.6 billion last year in the same period.

Total revenue was $22.1 billion, up 22% from the previous quarter and up 265% from a year ago.

The stock went up about 10%.