Sourcery → CapEx, Breakdancing

(8/5-8/9) Thank you! Raptor 3 🥳 Groq, Flyr, Abnormal Security, Bilt Rewards, Muon Space, Seeq, H3X, Cloudpay, Freshpaint, Cala Systems, Cocoon

Today’s Sourcery is brought to you by Archer..

Learn more about how Archer is set to open a new world of opportunity for passengers by providing safe and efficient access to people, places, and events across the communities they live at archer.com

Thank you!! 🥳

Last Thursday was my birthday which somehow always feels like the start of a new year.. a time for reflection, manifestation, gratitude, and fun. That being said, I wanted to thank all of you for reading, skimming, clicking, liking, commenting, and sharing Sourcery over the last 4 years!

As a gift back to you - I’m giving away 8 free hats from our merch shop - your choice! First to reply back via email, first serve.

Special shoutout to some of our favorite readers:

Alex, Simon, Jessie, Hunter, Matt, Selina, Somesh, Elad, Marc, Julian, Harry, David, Burak, Topher, Yuri, Mark, Kobie, Jenny, Tarek, Hiten, Elena, Kaveh, Orion, John, Ashley, James, Katie, Lauren, Patrick, Connie, Blake, Kenneth, Aleks, Vinod, Samir, Charlotte, Dana, Alassandra

..PS if you make over $1M a year you are now required to upgrade into our “I can expense it” tier. I don’t make the rules. Thank you!

Musings

Macro

Ep14. Public Market Volatility, AI Air Pocket, $GOOG Ruling [BG2 w/ Bill Gurley & Brad Gerstner]

Elad Gil: Blank Slates, Investing vs Operating, and the Future of AI [Alex LaBossiere]

HardTech

NASA is considering returning the malfunctioning Starliner spacecraft to Earth without its crew, potentially leaving astronauts aboard the ISS until 2025. [Livescience]

SpaceX has scheduled the Polaris Dawn mission, featuring the first private spacewalk, for launch on August 26, 2024. [Space.com]

The U.S. military received its first TITAN system, a critical AI-powered data integration tool, following Palantir's $178 million contract to enhance rapid targeting capabilities. [Axios]

SpaceX’s viral Raptor 3 — SpaceX’s Stunning Rocket Engine Is Complex, Yet Simple & 51% More Powerful [Wccftech]

AI

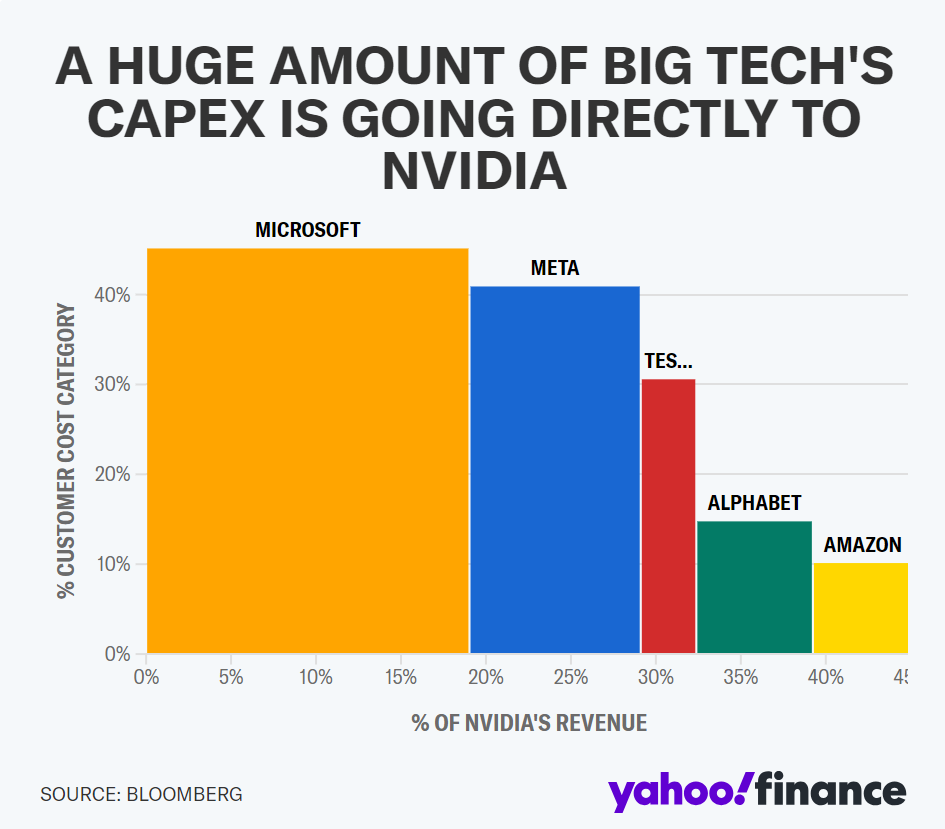

Amazon, Microsoft, Meta, & Google, are significantly increasing their capital spending on AI-related infrastructure, w/ investments expected to yield long-term benefits. [WSJ]

More

Australian Breakdancer Raygun Talks Viral Olympics Performance After Inspiring Memes [Bleacher Report] + more vids [Buzzfeed]

I thought the snake & kangaroo moves were breathtaking, go off queen

Paramount Global and Warner Bros. Discovery both took massive write-downs on their cable TV businesses, leading to significant stock declines as investors doubt their streaming strategies will offset these losses. [Axios]

20VC: How Angel City Makes $33M per Season with Alexis Ohanian

Last Week (8/5-8/9):

Relevant deals include the 90+ deals across stages below.

I've categorized the deals below into eight categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, IPO, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

Highlighted VC Deals include:

Groq, Flyr, Abnormal Security, Bilt Rewards, Muon Space, Seeq, H3X, Cloudpay, Freshpaint, Cala Systems, Cocoon

Acquisitions & PE

Veritas, GubMarket/Good Eggs, Box/Alphamoon, ZipRecruiter/Breakroom, SoundHound AI/Amelia

Funds

Thrive, Stonepack, Knox Lane, XYZ

Final Numbers

Final numbers on credit card debt hits fresh high and Bitcoin bounce could give way to a deeper pullback + New Research at the bottom.

VC Deals

This roundup was customized & powered by Wonder. Start your free trial here.

Fintech:

- Bilt Rewards, an NYC-based loyalty program for the home and neighborhood, secured an additional $150M in funding, led by Teachers’ Venture Growth (TVG) and joined by Vanderbilt University Endowment and the University of Illinois Foundation.

- CloudPay, a Raleigh, NC-based global payroll and payment solutions provider, secured $120M in funding, led by Blue Owl Capital, with support from Rho Capital Partners, The Olayan Group, and Hollyport Capital.

- Octane (Octane Lending, Inc.), an NYC-based fintech company improving the buying experience for major recreational purchases, closed $50M in Series E funding, led by Valar Ventures alongside Upper90.

- Aidatify, a DeFi data analysis company, secured $17.5M in Series A funding at a $150m valuation led by SM Capital.

- Savvy Wealth, an NYC-based digital-first platform for financial advisors, secured an additional $15.5M funding, led by Canvas Ventures and joined Thrive Capital, Brewer Lane Ventures, Index Ventures, The House Fund, and Alumni Ventures.

- Chariot, an NYC-based payments company for donor advised fund (DAF) giving, completed $11M in funding, led by Maveron, with support from Spark Capital, SV Angel, Y Combinator, and angel investors.

- HubiFi, a Columbus, OH-based financial intelligence and revenue recognition solution provider, closed $2.5M in Seed funding, led by Motivate Ventures, Anthemis, and Rev1.

- Nexio, an NYC-based developer of a Bitcoin scaling solution, secured $2.2M in Pre-seed funding, led by Lattice Fund and joined by HTX Ventures.

- LoanBYE, a Pittsburgh, PA-based student loan relief solutions provider as an employer provided benefits package, raised $300K in funding from Richard King Mellon Foundation.

Care:

- Freshpaint, an SF health care privacy platform, secured $30M Series B led by Threshold.

- Seven Starling, a Washington, DC-based virtual provider of women’s behavioral health services, secured $10.9M in Series A funding, led by RH Capital, with support from Pear VC, Expa, Magnify Ventures, Emerson Collective, Inflect Health, Zeal Capital Partners, Ulu Ventures, Fiore Ventures, the March of Dimes, Rogue Venture Partners, Graham & Walker, and Wisdom Ventures.

- Feeling Great, a San Francisco, CA-based AI-powered app for boosting self-esteem and well-being, raised $8M in Seed funding, led by Learn Capital and TitleTownTech, with alongside Lux Ventures, WaveMaker Three-Sixty Health, Pacific Health Ventures, and Treble Capital.

- Salt & Stone, a Los Angeles, CA-based fragrance-driven body care brand, received an undisclosed investment from Humble Growth.

Enterprise/Consumer:

- Groq, a Mountain View, CA-based fast AI inference company, raised $640M in Series D funding, at a $2.8B valuation, led by BlackRock Private Equity Partners and joined by Type One Ventures, Cisco Investments, Neuberger Berman, Global Brain’s KDDI Open Innovation Fund III, and Samsung Catalyst Fund.

- Flyr, a San Francisco, CA-based technology company for the travel industry, raised $295M in funding, led by WestCap and supported by Avianca, BlackRock, Streamlined Ventures, Abu Dhabi Investment Authority (ADIA), and Vista Credit Partners.

- Abnormal Security, a San Francisco, CA-based AI-native human behavior security company, raised $250M in Series D funding, at a $5.1B valuation, led by Wellington Management and joined by Greylock Partners, Menlo Ventures, Insight Partners, and CrowdStrike Falcon Fund.

- Contextual AI, a San Francisco, CA-based customized language models provider for businesses, completed a $80M Series A funding round, led by Greycroft and joined by Bezos Expeditions, NVentures, HSBC Ventures, Snowflake Ventures, Bain Capital Ventures, Lightspeed Ventures, Lip-Bu Tan, Conviction, and Recall Capital.

- Placer.ai, a Walnut, CA-based location data analytics startup, closed $75M at a $1.5B valuation.

- Mechanical Orchard, a San Francisco, CA-based modernization technology company, closed $50M in Series B funding, led by GV and joined by other investors.

- Rewest, a Tampa, FL-based automation platform for managed service providers, secured $45M in funding, led by Sapphire Ventures, with support from Meritech Capital and OpenView.

- Cents, an NYC-based all-in-one business management platform for laundry businesses, closed $40M in Series B funding, led by Camber Creek and supported by Bessemer Venture Partners, Tiger Global, Tech Pioneer Fund, RXR (RADV), Derive Ventures, Alumni Ventures, and other prominent executives.

- Level AI, a Mountain View, CA-based innovator in LLM-native customer experience intelligence and the service automation space, secured $39.4M in Series C funding, led by Adams Street Partners, with support from Cross Creek, Brightloop, Battery Ventures, and Eniac Ventures.

- Neon, a San Francisco, CA-based serverless Postgres database for developers, closed $25.6M in funding, led by M12 and joined by Abstract Ventures, General Catalyst, Menlo Ventures, and Notable Capital.

- Anjuna, the Palo Alto, CA-based universal confidential computing platform, secured $25M in Series B2 funding, led by M Ventures, SineWave Ventures, and AI Capital Partners, with support from Founder Collective, Insight Partners, Playground Global, and Uncorrelated.

- Andrena, a New York City-based internet service provider, secured $18M in funding, led by Dragonfly, and joined by CMT Digital, Castle Island Ventures, Wintermute Ventures, and others.

- Levitate, a Raleigh, N.C.-based CRM software startup, completed a $15M Series Dfunding led by Harbert Growth Partners, Northwestern Mutual Future Ventures, and Bull City Venture Partners.

- Aurascape AI, a Santa Clara, CA-based AI cybersecurity company, closed $12.8M in Seed funding, led by Mayfield Fund and joined by Celesta Capital, StepStone Group, AISpace, and Mark McLaughlin, former Chairman and CEO of Palo Alto Networks.

- Plonts, an Oakland, CA-based plant-based foods company, closed $12M in Seed funding, led by Lowercarbon Capital, with support from Litani Ventures, Accelr8, Pillar, Ponderosa Ventures, and other angel investors.

- Napkin, a Los Altos, CA-based visual AI provider for business storytelling, closed $10M in seed funding, backed by Accel and CRV.

- Hedra, a San Francisco, CA-based AI-powered tools provider for generating video content with human characters, secured $10M in Seed funding, backed by Index Ventures, Abstract, Andreessen Horowitz, and other individual investors.

- Bandana, a Brooklyn, N.Y.-based online job platform, closed $8.5M in funding, led by General Catalyst led and joined by Craft Ventures and Triple Impact Capital.

- InventWood, a Frederick, MD-based company transforming wood into superwood building products, completed an $8M funding round, backed by Grantham Foundation, Builders Vision, Echelon, John Rockwell, and existing investors.

- Hyperbolic, a New York-based GPU resources and AI services through a cloud platform, secured $7M in Seed funding, led by Polychain Capital and Lightspeed Faction, with support from Chapter One, LongHash, Bankless Ventures, Republic Digital, Nomad Capital, CoinSummer Labs, Third Earth Capital, and other angel investors.

- Curio, a San Francisco, CA-based games studio and developer, raised $5.7M in funding, led by Bain Capital Crypto and SevenX Ventures and joined by OKX Ventures.

- Boostly, a Lehi, UT-based marketing platform for restaurants, closed $5.6M in Seed funding, led by Trestle Partners and joined by Relish Works, Singularity Capital, and Y Combinator.

- 375ai, a Palo Alto, CA-based decentralized edge data intelligence network, completed a $5M in Seed funding, led by 6th Man Ventures, Factor, Arca, EV3, Primal Capital, and Auros.

- Carketa, a Lehi, UT-based end-to-end data and intelligence software for the automotive industry, closed $4.4M in funding, led by Capital Eleven and joined by Crosslink Capital, Origin Ventures, Allegis Capital, and Peak Ventures.

- Chaiz, an Austin, TX-based comparison marketplace for extended car warranties, completed a $3.7M Seed funding round, led by ResilienceVC and supported by Anker Capital, Automotive Ventures, Everywhere Ventures, FJ Labs, Monte Carlo Capital, Never Lift Ventures, RedBlue Capital, and Springtime Ventures alongside previous investors.

- Terrantic, a Seattle, WA-based data platform for the food supply chain, secured $3.5M in Seed funding, led by Supply Change Capital and joined by York IE, Vitalize VC, and Array Ventures.

- AmorSui, an NYC-based modern personal protective equipment (PPE) brand dedicated to protecting people and the planet, closed $3.5M in Seed funding, led by Gold House Ventures, The MBA Fund, and The Rev Up Fund, among others.

- Bardeen, a San Francisco, CA-based workflow task automation software, raised $3M in funding, bring the total amount raised to $22M, backed by Dropbox Ventures and HubSpot Ventures.

- Skillfully, a San Francisco, CA-based simulation-driven hiring solutions, closed $2.5M in Seed funding, led by Better Ventures and joined by Silicon Valley Quad, American Student Assistance, Strada Education Foundation, FN Fund, and Inventus Capital Partners.

- Avoli, a Portland, OR-based women athletic and volleyball fashion brand, secured $2.1M in funding, backed by Ho Nam, Blythe Jack, and Pete Saperstone.

- BrandRank.AI, a Cincinnati, OH-based generative AI-based brand search analytics platform, closed $1.2M in Seed and Angel funding backed by Sandberg Bernthal Venture Partners, the Mercury Fund, and other individual investors.

HardTech:

- Riverlane, a British quantum error correction startup, secured $75M in Series C funding, led by Planet First Partners and joined by ETF Partners, EDBI, Cambridge Innovation Capital, Amadeus Capital Partners, NSSIF, and Altair.

- Muon Space, a Mountain View, CA-based end-to-end space systems provider, closed $56M in Series B funding, led by Activate Capital and joined by Acme Capital, Costanoa Ventures, Radical Ventures, and Congruent Ventures.

- Seeq, a Seattle, WA-based industrial analytics, AI, and monitoring company, closed $50M in Series D funding, led by Sixth Street Growth and joined by Insight Partners, Altira Group, Second Avenue Partners, and Saudi Aramco Energy Ventures.

- 3V Infrastructure, an NYC-based electric vehicle charging infrastructure owner and operator, secured about $40M in funding, backed by Greenbacker Capital Management.

- H3X, a Denver, CO-based manufacturer of high power density electric motors, completed a $20M in Series A funding, led by Infinite Capital and joined by Hanwha Asset Management, Cubit Capital, Origin Ventures, Industrious Ventures, Venn10 Capital, Lockheed Martin Ventures, Metaplanet, Liquid 2 Ventures, and TechNexus.

- Datch, an NYC-based AI technology provider for frontline manufacturing, energy and utility sectors, completed $15M in Series A funding, led by Third Prime and joined by Blackhorn Ventures, Blue Bear Capital, and Susquehanna Investment Group.

- Energy Domain, a Fort Worth, TX-based tech-enabled online marketplace, raised $5M in Series A funding, from undisclosed investors.

- Adept Materials, a Somerville, an MA-based advanced materials startup, closed $4M in the first tranche of its Seed funding, led by D.R. Horton and PulteGroup, with participation from Massachusetts Clean Energy Center (MassCEC), and Point Cove LLC.

- Growlink, a Denver, CO-based controlled environment agriculture (CEA) provider of advanced IoT controllers, sensors, and cultivation software, secured $2M in Seed funding, led by Casa Verde.

Sustainability:

- Syso Technologies, a Boston, MA-based market operator of renewable energy and battery storage assets, secured $14.5M in Series B funding, led by Kimmeridge, with support from Lacuna Sustainable Investments.

- Branch Energy, a Houston, TX-based retail energy provider, closed $10.8M in Series A funding, led by Prelude Ventures and joined by Zero Infinity Partners.

- Cala Systems, a Boston, MA-based developer of intelligent heat pump water heaters, closed $5.6M in Seed funding, led by Massachusetts Clean Energy Center (MassCEC) and Clean Energy Venture Group, with support from Burnt Island Ventures, Leap Forward Ventures, CapeVista Capital, Collaborative Fund, and Climate Capital.

- Cocoon, a steel and concrete decarbonization startup, secured $5.4M in Pre-seed funding from Wireframe Ventures, Celsius Industries, Gigascale Capital, and SOSV.

- Climatize, a Santa Cruz, CA-based SEC-registered impact investing platform for renewable energy projects, secured $1.75M in Pre-Seed funding, led by Myriad Venture Partners and joined by Climate Capital, Techstars, Responsibly Ventures, and Temerity Capital.

- CarbonQuest, a Spokane, WA-based distributed carbon capture technology provider, completed an undisclosed amount in Series A funding led by Riverbend Energy Group.

Acquisitions & PE:

This roundup was customized & powered by Wonder. Start your free trial here.

- An affiliate of Veritas Capital is set to acquire the cloud-based digital banking business of NCR Voyix, an Atlanta, GA-based digital commerce solutions provider, for $2.45B in cash.

- GrubMarket, a San Francisco, CA-based tech-enabled food ecommerce company, acquired Good Eggs, an Oakland, CA-based online grocery service provider, for an undisclosed amount.

- Box (NYSE: BOX), a Redwood City, CA-based intelligent content cloud company, acquired Alphamoon Technology, a Wroclaw, Poland-based AI-powered, intelligent document processing (IDP) technology company, for an undisclosed amount.

- ZipRecruiter (NYSE:ZIP), a Santa Monica, CA-based online employment marketplace, acquired Breakroom, a UK-based employer review platform, for an undisclosed amount.