Sourcery → Her, NS-25

(5/13-5/17) Potatoes, ChatGPT 4o vs ScarJo, Google vs Perplexity, Blue Origin 🚀 Vercel, Cover Genius, Roam, ByHeart, Ndustrial, Gamma, Kudos, GoodShip, c/side, Firmus, Lumo, Bedrock Materials

Hello from the Kármán Line 🚀

Blue Origin's recent spaceflight on May 19, 2024, marked its first crewed mission since August 2022. This flight was significant because it ended an 18-month hiatus following an anomaly during a previous unmanned mission in September 2022. The successful return to crewed flights underscores Blue Origin's commitment to safety and innovation in space tourism.

The NS-25 mission carried six passengers: Ed Dwight, Mason Angel, Sylvain Chiron, Kenneth L. Hess, Carol Schaller, and Gopi Thotakura. Notably, Ed Dwight, the first Black astronaut candidate selected by President John F. Kennedy in 1961, and at 90 years old, finally realized his spaceflight dream. This diverse group of passengers highlighted various backgrounds and interests, from entrepreneurship and technology to philanthropy and adventure.

Blue Origin’s New Shepard rocket uses the BE-3 engine, which burns liquid hydrogen and liquid oxygen (LH2/LOX). This propulsion system emits primarily water vapor during liftoff, making it one of the more environmentally friendly rockets. The use of hydrogen and oxygen results in steam, which is visible as a white plume during launch. The New Shepard rocket is designed for full reuse, with both the booster and the crew capsule capable of autonomous landing and reuse, significantly reducing the cost and environmental impact of space travel.

Between Blue Origin, SpaceX, and Virgin Galactic each bring unique technological advancements and strategies to the spaceflight industry. Blue Origin’s use of hydrogen-fueled engines emphasizes environmental sustainability, while SpaceX focuses on heavy lift capability and rapid reusability. Virgin Galactic’s air launch system and hybrid engines cater to the burgeoning space tourism market. Each company’s approach contributes to the overall advancement and accessibility of space travel.. kinda insane we got here.

Stats

The rocket attained a top speed of approximately Mach 3 (2,200 mph/3,541 kph) during its flight - more than 3x the speed of sound. The capsule reached an altitude, or apogee, of 351,232 feet (107 kilometers or 66 miles), which is well above the Kármán line, the internationally recognized boundary of space. It’s sort of like a super advanced rollercoaster for serious space enthusiasts.

Note from Sourcery friend & now astronaut, Mason Angel of Industrious Ventures

“At first view the blackness of space is a terrifying sight. It was the loneliest I have ever felt in my entire life, but as I drew my gaze downward I saw the edge of Earth. Swirling white clouds, vast blue ocean, and small specks of land. Suddenly I didn't feel so alone, like a mother's warm embrace after being away from home for far too long. I believe with conviction that mother Earth is home to all of us, now let us take care of her as she has done for us.

Ed Dwight was selected as one of the original Astronaut trainees for the Mercury missions some sixty years ago. For political and social reasons at that time he was never able to fly and ultimately had to retire from the Air Force. The six of us chose the name Endurance for our crew, mostly to honor Ed, a man I have grown to respect and admire these past six few months.”

→ Watch full video of the flight + their Zero-G experience

→ Read more Space.com, Blue Origin

Musings

AI

Scarlett Johansson told OpenAI not to use her voice — and she’s not happy they might have anyway [The Verge]

GPT-4o launches, Glue demo, Ohalo breakthrough, Druck's Argentina bet, did Google kill Perplexity? [All-In Podcast]

OpenAI has disbanded its team focused on the long-term risks of AI, with team members reassigned to other groups within the company, following the departures of team leaders Ilya Sutskever and Jan Leike. [CNBC]

This move comes amid criticism from Leike that OpenAI's safety culture has been overshadowed by a focus on product development.

Google CEO Sundar Pichai on AI-powered search and the future of the web [The Verge]

Google AI previews are one of the most disruptive new product features Google has put out in a while. And they’re amazing. Sitting at a coffee shop in Miami with my former colleague Darshan Somashekar of TMV (Co-Founded Drop.io (sold to Facebook), and EasyBib (sold to Chegg) we tested out the new search UX. Very similar to Perplexity’s format, you get a summary, sources, and bullet points based on data pulled related to the question. It’s very good. The concern to website publishers out there is that it’ll limit reach of user discovery on the classic 10 blue links, but still makes SEO the number 1 priority. Almost ranking the best of the best. TBD on whether or not traffic issues occur, and how their classic Ad based business model is affected. It does give Google a strategic advantage and they’re starting to really catch up to the louder emerging leaders.

A bipartisan group of four senators, led by Majority Leader Chuck Schumer, is advocating for Congress to allocate at least $32 billion over the next three years for AI development and safeguards, emphasizing the need to balance opportunities and risks. [AP News]

Despite challenges in passing AI legislation, especially in an election year, the senators stress the urgency of regulation and innovation incentives, noting consensus on broad policy recommendations amid global competition, particularly from China.

U.S. and Chinese top envoys held closed-door talks in Geneva to discuss mitigating the existential risks of emerging AI technologies, following an agreement by Presidents Biden and Xi in late 2023. [AP News]

OpenAI's latest AI model, GPT-4o, can mimic human speech patterns, detect moods, and reason across text, audio, and video in real-time, evoking comparisons to the AI in the movie "Her." [AP News]

This update will enhance the ChatGPT chatbot's capabilities and be available to all users soon, with demonstrations showing the AI's ability to add emotion to its voice, solve math problems interactively, and assist with complex coding tasks.

HardTech

NVIDIA announced it will enhance quantum computing at global supercomputing centers using its open-source CUDA-Q™ platform. [NVIDIA]

These data centers in Germany, Japan, and Poland will integrate Quantum Processing Units (QPUs) with their NVIDIA-accelerated systems to advance scientific research and quantum applications in AI, energy, and biology.

Boeing has delayed the first crewed flight of its Starliner spacecraft until at least next Tuesday due to a helium leak. This follows previous delays and a recent issue with a pressure valve on the rocket's second stage, which has since been resolved. [Washington Post]

President Joe Biden announced significant tariff increases on several Chinese imports, including semiconductors, electric vehicles, and solar cells, with tariffs on Chinese semiconductors set to double to 50% by 2025. [Tom’s Hardware]

This move underscores the strategic importance of the semiconductor industry, with the U.S. aiming to bolster its own semiconductor capabilities.

Last Week (5/13-5/17):

Relevant deals include the 85+ deals across stages below.

I've categorized the deals below into eight categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

Highlighted VC deals include

Vercel, Cover Genius, Roam, ByHeart, Ndustrial, Gamma, Kudos, GoodShip, c/side, Firmus, Gausium, Lumo, Bedrock Materials, HIF Global, cylib, Princeton NuEnergy, Orange Charger, and Active Surfaces.

Acquisitions & PE

Squarespace, EasyKnock

Funds

FSN Capital, Norrsken VC, NewVale Capital, Accion, and Shilling.

Final numbers

On the total credit card debt in the US & China’s huge lead in building technologies of the energy transition

New Research at the Bottom

VC Deals

This roundup was customized & powered by Wonder. Start your free trial here.

Fintech:

- Cover Genius, an NYC-based insurtech company for embedded protection, closed an $80M Series E funding round, led by Spark Capital, alongside Dawn Capital, King River Capital, and G Squared.

- Aplazo, a Mexico City-based omnichannel payment platform, secured $70M in additional equity financing, including a $45M Series B, led by QED Investors, alongside Volpe Capital, Oak HC/FT, and Kaszek and Picus Capital.

- Canopy, a South Jordan, UT-based provider of enterprise operating systems for accountants, received $35M in funding, led by Ten Coves Capital and Ankona Capital, alongside Pelion Venture Partners, Tenaya Capital, and NewView Capital.

- Aeropay, a Chicago, IL-based B2B Pay-By-Bank solutions company, secured $20M in Series B funding, led by Group 11, with support from other investors, including Chicago Ventures and Continental Investment Partners.

- Annuity.com, an NYC-based fintech and financial media company, received $15.7M in Seed funding from undisclosed investors.

- Plenty, a San Francisco, CA-based wealth-building platform, closed $5M in funding, led by Inovia Capital, alongside Garage Capital, Otherwise Fund, Interplay, Kevin Durant and Rich Kleiman’s 35 Ventures, Charge Ventures, Phenomenal Ventures, Xtripe Angels, Adam Nash, and Mark Goines.

- Roam, A NYC-based platform for assumable mortgages, secured $3M in additional funding from Founders Fund.

- Haven, a NYC-based provider of enhanced accounting solutions, secured an undisclosed amount in Pre-Seed funding from Anthony Pompliano, Charlie Feng, Hari Raghavan, Eric Bahn, and 40 other angel investors.

Care:

- ByHeart, a NYC-based infant nutrition company, received $95M in funding from D1 Capital Partners, Bellco Capital, Polaris Partners, Two River, OCV Partners, AF Ventures, Red Sea Ventures, and Gaingels, among others.

- SmarterDx, an NYC-based clinical AI company for revenue integrity and care quality, closed $50M in Series B funding, led by Transformation Capital, alongside Bessemer Venture Partners, Flare Capital Partners, and Floodgate Fund.

- Chapter, a NYC-based medicare navigation platform, completed a $50M Series C funding round, led by XYZ Venture Capital, alongside Narya Capital, Addition, Susa Ventures, and Maverick Ventures.

- Fay, a San Francisco, CA-based company connecting people with registered dietitian nutritionists, secured $25M in funding, led by General Catalyst, with support from General Catalyst and 1984.

- Truveris, a Wilmington, DE-based company that specializes in pharmacy cost containment and program performance, received $15M in Series E funding, led by Canaan Partners and New Leaf Venture Partners.

- Watershed Health, a New Orleans, LA-based patient care coordination company, secured $13.6M in funding, led by First Trust Capital Partners, with support from FCA Venture Partners, Create Health Ventures, Impact Engine, 450 Ventures, LDH Ventures II/Launchpad Digital Health, MassMutual Ventures, Capstar Partners, and Wanxiang Healthcare Investments.

- Switchboard Health, a Boise, ID-based creator of a high-value specialty care network and software platform, secured a $6.5M Seed funding round, led by First Trust Capital Partners, alongside Route 66 Ventures, InnovateHealth Ventures, Capital Eleven, and Ikigai Growth Partners.

- Crosby Health, an NYC-based AI-powered healthtech company for automating administrative tasks, received $2.2M in Pre-Seed funding, led by Amplo Ventures, alongside NOMO Ventures, and other angel investors.

Enterprise/Consumer:

- Vercel, a San Francisco, CA-based frontend cloud platform, completed a $250M Series E funding round, led by Accel, with support from CRV, GV, Notable Capital, Bedrock, Geodesic Capital, Tiger Global, 8VC, and SV Angel.

- Restaurant365, an Irvine, CA-based provider of a restaurant enterprise management platform, secured $175M in funding, led by ICONIQ Growth, alongside KKR and L Catterton.

- Harness, a San Francisco, CA-based modern software delivery platform company, received $150M in funding from Silicon Valley Bank (SVB) and Hercules Capital, Inc. (NYSE: HTGC).

- Weka, a Campbell, CA-based AI-native data platform company, closed $140M in Series E funding, led by Valor Equity Partners, alongside Generation Investment Management, NVIDIA, Atreides Management, 10D, Hitachi Ventures, Ibex Investors, Key1 Capital, Lumir Ventures, MoreTech Ventures, and Qualcomm Ventures.

- Alkira, a San Jose, CA-based on-demand network infrastructure-as-a-service company, completed a $100M Series C funding round, led by Tiger Global Management, alongside other investors, including Dallas Venture Capital, Geodesic Capital, NextEquity Partners, Kleiner Perkins, Koch Disruptive Technologies, and Sequoia Capital.

- CRMBonus, a São Paulo, Brazil-based marketing automation platform, closed a $75M Series B funding round, led by BOND, alongside Valor Capital, and other prominent investors.

- Polymarket, an NYC-based prediction market platform, secured $70M in funding, led by Founders Fund, 1confirmation, ParaFi, and General Catalyst, alongside Ethereum founder Vitalik Buterin, Kevin Hartz, Airbnb’s Joe Gebbia, Polychain, and other leading investors.

- PolyAI, a London, UK-based enterprise voice assistant provider, secured a $50M Series C funding from Hedosophia, Nvidia’s NVentures, Zendesk, Khosla Ventures, Georgian, Point72 Ventures, Sands Capital, and Passion Capital.

- Steno, a Los Angeles, CA-based AI-powered legal support and court reporting services company, completed $46M in additional funding from undisclosed investors.

- Agora, an NYC- and Tel Aviv, Israel-based real estate investment management solutions platform, closed a $34M Series B funding, led by Qumra Capital, along with Insight Partners and Aleph participating in the round.

- Pepper, a NYC-based technology partner for the food distribution sector, completed a $30M Series B funding round, led by ICONIQ Growth, alongside Index Ventures, Greylock, Imaginary, and Harmony Partners.

- Voxel51, an Ann Arbor, MI-based company vision platform, secured $30M Series B funding, led by Bessemer Venture Partners, with support from Tru Arrow Partners, Drive Capital, Top Harvest Capital, Shasta Ventures, and ID Ventures.

- Gorgias, a San Francisco, CA-based customer experience (CX) platform, closed a $29M funding round, led by SaaStr and Alven, alongside Horsley Bridge, Amplify, Shopify, Sapphire, CRV, and Transpose Platform.

- Metaplane, a Boston, MA-based data observability platform, secured an investment from Snowflake Ventures, bringing the total investment to over $23M, with additional investor participation from Khosla Ventures, Flybridge, Y Combinator, Stage 2 Capital, B37, and SNR.

- Gamma, a San Francisco, CA-based AI-powered presentation platform, received $12M in Series A funding, led by Accel, with support from Script Capital, South Park Commons, Lorimer Ventures, and Fellows Fund.

- Kudos, a Los Angeles, CA-based AI-powered smart wallet services and consumer reward and benefits company, completed a $10.2M Series A funding round, led by QED Investors, with support from Patron, The Points Guy founder Brian Kelly, Samsung Next, SV Angel, Precursor Ventures, The Mini Fund, Newtype Ventures, and the Four Cities Fund.

- Honey Homes, a Lafayette, CA-based membership service home upkeep and maintenance company, completed a $9.25M Series A-1 funding, led by Era Ventures, with support from Khosla Ventures and Pear VC.

- Artisan AI, a San Francisco, CA-based AI-powered enterprise employee and software startup, completed a $7.3M Seed funding round, led by Oliver Jung, alongside Sequoia Scout, Y Combinator, Soma Capital, BOND Capital, Anu Hariharan, Paul Daverda, Fellow’s Fund, and others.

- ChainML, a Silicon Valley-based AI and ML development and research lab, received $6.2M in seed extension funding, led by Hack VC alongside Foresight Ventures, Inception Capital, HTX Ventures, Figment Capital, Hypersphere Ventures, and Alumni Ventures.

- Monitaur, a Boston, MA-based model governance software company, received $6M in Series A funding, led by Cultivation Capital, alongside Rockmont Partners, Defy VC, Techstars, and Studio VC.

- Laws of Motion, a NYC-based AI sizing technology company for eCommerce brands and retailers, secured a $5M seed funding round from Corazon Capital, The Scout Program at Sequoia Capital, Leadout Capital, Eva Jeanbart-Lorenzotti, John Howard, Skims, and Frame, among other investors.

- Angel AI, a Nashville, TN-based provider of a parent-designed AI platform that provides an age-appropriate internet experience for children, closed a $4.75M Seed funding round, led by Cortical Ventures, with support from Village Global and other angel investors.

- Highperformr, a Wilmington, DE-based GenAI startup providing a Social AI platform, received $3.5M in Seed funding, led by Venture Highway, alongside Neon, DeVC, and other angel investors.

- Aerial, a Seattle, WA-based AI-empowered unstructured business data platform, secured $2M in Pre-Seed funding, led by Fuse, alongside Pack Ventures and Madrona Venture Group’s Pioneer Fund.

- c/side, a San Francisco, CA-based cybersecurity company, raised $1.7M in Pre-Seed funding, led by Scribble Ventures, with support from Roar Ventures, Kathy Korevec, Dan Scheinman, Jason Warner, Mike Taylor, Kevin Van Gundy, Zain Rizavi, Daniel Lopez, Dan Smith, and Nick Gianos.

HardTech:

- Bedrock Materials, a Chicago, IL-based battery technology startup from Stanford University, secured a $9M Seed funding, led by Trucks Venture Capital, Refactor Capital, and Version One Ventures, along with other investors, including Hanover Technology Investment Management, SpaceCadet Ventures, Brainstorm Capital, Evergreen Climate Innovations, Expansion VC, Climate Capital, Quest Venture Partners, Meliorate Partners, Valia Ventures, Ritual Capital, and other angel investors.

- Ndustrial, a Raleigh, NC-based AI-powered industrial energy intensity platform, secured $18.5M in Series B funding, led by ABB and GS Energy, alongside Clean Energy Ventures and ENGIE New Ventures.

- GoodShip, a Nashville, TN-based freight network orchestration and procurement platform, secured $8M Series A funding, led by Bessemer Venture Partners, with support from Ironspring Ventures, Chicago Ventures, FUSE VC, Cercano Management, 53 Stations, Andrew Silver, and Nichole Wischoff, among other angel investors.

- Lumo, a Napa County, CA-based connected irrigation company, received $7M in funding, led by Active Impact Investments and Fall Line Capital.

- Shaed, a Minneapolis, MN-based mobility platform provider, closed $5.7M in Seed funding, led by EnerTech Capital, alongside Powerhouse Ventures, Joe Pritchard, and other undisclosed corporate strategic investors.

- Firmus, a Miami, FL-based preconstruction AI design, review, and risk analysis company, secured an undisclosed amount in funding, led by Navitas Capital, with support from Heartland Ventures, PiLabs, and Unorthodox Ventures.

Sustainability:

- HIF Global, a Santiago, Chile-based eFuels company, completed a $164M funding round from Idemitsu Kosan, AME, EIG, Porsche, Baker Hughes, and Gemstone Investments.

- cylib, an Aachen, Germany-based sustainable end-to-end battery recycling company, secured a €55M Series A funding round, led by World Fund and Porsche Ventures, alongside Bosch Ventures, DeepTech & Climate Funds, NRW.Venture, Vsquared Ventures, Speedinvest, 10x Founders, and other angel investors.

- Orange Charger, a San Francisco, CA-based provider of EV charging solutions, raised $6.5M in seed funding, bringing the total funds raised to $8.8M, led by Munich Re Ventures and Climactic, alongside Baukunst, Lincoln Properties Ventures, Crow Holdings, and Space Cadet Ventures.

- Active Surfaces, a Woburn, MA-based flexible solar panel startup from MIT, received $5.6M in pre-seed funding, led by Safar Partners, alongside QVT, Lendlease, Type One Ventures, Umami Capital, Sabanci Climate Ventures, New Climate Ventures, SeaX Ventures, and others.

Acquisitions & PE:

- Squarespace (NYSE: SQSP), a NYC-based provider of a design-driven platform, is set to go private by Permira, the global private equity firm, in an all-cash transaction valued at approximately $6.9B.

- KPS Capital Partners acquired Innomotics, a Nuremberg, Germany-based supplier of electric motor and large-drive systems, from Siemens for €3.5 billion ($3.8 billion).

- Crescent Energy (NYSE: CRGY) is set to acquire SilverBow Resources (NYSE: SBOW), a Houston, TX-based oil and gas company, for $2.1B.

- Battery Ventures took TrueContext, an Ottawa, Canada-based field-service workflow company, private for approximately CAD$150M ($110.2M).

- Haveli Investments, a private equity firm based in Austin, TX, acquired ZeroFox, a Baltimore, MD-based external cybersecurity provider, taking it private for $1.14 per share in cash.

- Expanso, a Seattle, WA-based distributed data processing company, secured a strategic undisclosed amount of investment from Samsung Next.

- Mitra Future Technologies, Inc., a Mountain View, CA-based innovator of lithium-ion battery materials, received an undisclosed amount of investment from Alpha Wave Ventures, as part of a Series B funding round, joined by other investors, including General Motors, Zeon, InQTel, Techmet-Mercuria, and GS Futures

- Dessert Holdings, a portfolio company of Bain Capital, acquired Kenny’s Great Pies, a Smyrna, GA-based manufacturer of cream-based pies, from Kaho Partners, for an undisclosed amount.

- GitKraken, a Scottsdale, AZ-based developer tooling company, acquired CodeSee, a San Francisco, California-based code health innovator, for an undisclosed amount.

- G2Xchange, a Washington, DC-based software solutions company for government contractors, acquired GovAIQ, an AI technologies and deep learning company for the government contracting sector, for an undisclosed amount.

- EasyKnock, an NYC-based home equity solutions platform, acquired the assets of home equity investment firm, HomePace, based in Park City, UT, for an undisclosed amount.

- Accenture (NYSE: ACN) is set to acquire Openstream Holdings, a Tokyo, Japan-based holding company of Open Stream and Neutral, for an undisclosed amount.

- CallRevu, backed by Serent Capital, acquired TotalCX, a Houston, TX-based customer communications platform for automotive dealerships, for an undisclosed amount.

Fund Announcements:

- Norrsken VC, a Stockholm, Sweden-based VC firm, raised €320M ($346.3M) for its second fund focused on companies in the climate tech, energy, biotech AI, and health tech sectors.

- NewVale Capital, a Boulder, Colo.-based growth equity investment firm, raised $167M for their first fund focused on life science services companies.

Final Numbers

Data: Federal Reserve Bank of New York; Chart: CNBC

Americans owe $1.12 trillion on their credit cards, with the average balance per consumer at $6,218, an 8.5% increase year-over-year, as reported by the Federal Reserve Bank of New York and TransUnion. [CNBC]

Rising prices have contributed to higher credit card delinquency rates, with 8.9% of balances transitioning into delinquency and "serious delinquencies" reaching their highest level since 2010. [CNBC]

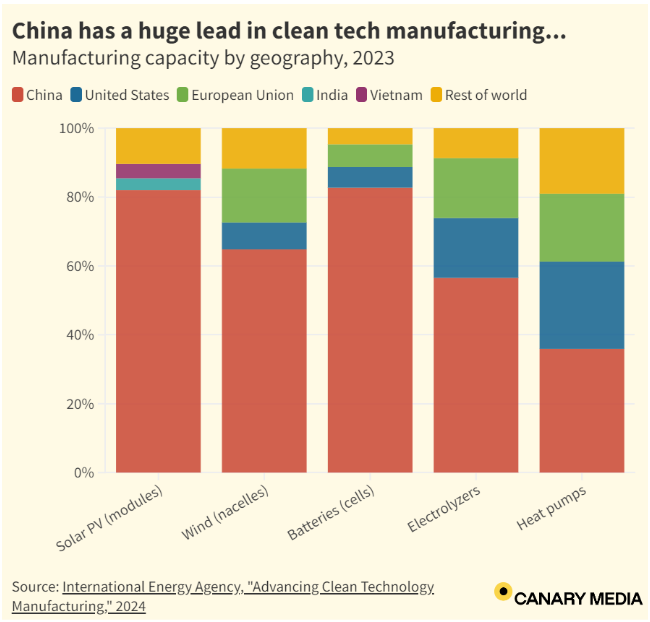

Data: International Energy Agency; Chart: Canary Media

China dominates the global clean energy technology manufacturing sector, producing the majority of solar panels, battery cells, wind nacelles, and electrolyzers. [Canary Media]

Despite a significant 70% increase in global clean technology manufacturing investment to $200 billion in 2023, China accounted for three-quarters of this investment, including over 80% of the output for solar modules and battery cells, about 65% of wind nacelles, and 56% of electrolyzers. [Canary Media]

New Research

A cocktail of rapamycin, acarbose, and phenylbutyrate prevents age-related cognitive decline in mice by targeting multiple aging pathways

Aging increases the risk of cognitive decline and impacts various biological processes in the brain. This study tested a combination of three drugs (rapamycin, acarbose, and phenylbutyrate) on middle-aged mice, showing that the cocktail improved their resistance to age-related cognitive decline. [PubMed NIH]

By analyzing RNA and molecular changes in the brain, the researchers found that the drug combination suppressed aging processes and increased autophagy more effectively than individual drugs, potentially implying that a multi-drug approach targeting various aging pathways might be more effective in treating age-related cognitive decline and brain aging. [PubMed NIH]

Amyloid β accelerates age-related proteome-wide protein insolubility

Aging leads to a loss of protein balance, causing insoluble protein aggregates, which are common in neurodegenerative diseases like Alzheimer's. This study found that amyloid beta (Aβ) increases protein insolubility similar to aging in C. elegans, indicating a core insoluble proteome (CIP) that may contribute to Alzheimer's and other chronic age-related diseases. [Springer]

The study suggests that targeting this protein insolubility, potentially with the metabolite Urolithin A, could be a new approach for treating dementia and other age-related conditions. This implies that addressing protein insolubility might help reduce the risk and impact of various age-related diseases. [Springer]