Sourcery → Kendrick

(6/17-6/21) IPOs, Anduril, Archer, Coatue ☀️ Soot, Zepto, Waabi, Huntress, HeyGen, Daydream, Decagon, Constructor, Gynger, Talkiatry, Pomelo Care, CesiumAstro, Molten Industries

Musings

Macro

Coatue Conference Recap, Tesla & ISS Controversy [BG2 with Bill Gurley & Brad Gerstner]

This week they recap Coatue Conference, paper unicorn to IPO pipeline, IPO expectations, Elon’s pay package, Tesla's shareholder vote, ISS controversy, AI market trends, OpenAI IPO, Delaware court case, and more.

(35:55) SPECIAL GUEST: Coatue Founder Phillipe Laffont

This pod has overtaken All-In by a landslide for business & technology conversations

How Much Revenue Must a Company Generate to IPO? [Tomasz Tunguz]

🎧 New pod with Mark Suster of Upfront Ventures coming out this Friday on all things LA HardTech (Space, Defense, BioTech), Exit Opportunities (Are IPOs over?), as well as some thought-provoking summer book recommendations

AI

Stability AI Gets New CEO and a Bailout From Investor Group Led By Sean Parker [Information]

Hewlett Packard Enterprise and NVIDIA have announced NVIDIA AI Computing by HPE, a portfolio of AI solutions including HPE Private Cloud AI, which integrates NVIDIA AI computing and HPE's storage and cloud technologies to offer enterprises an efficient and flexible path for developing and deploying generative AI applications. [NVIDIA]

Meta has unveiled five new AI models, including multi-modal systems for text and image processing, next-gen language models, music generation, and AI speech detection, aimed at advancing AI technology and improving diversity in AI-generated content. [AI News]

Target is introducing a generative AI tool called "Store Companion chatbot" to assist employees with tasks and improve the shopping experience, addressing rising labor costs and low sales, by piloting the app in 400 stores before a nationwide rollout. [Axios]

Data

Databricks Has an Edge on Snowflake—but It May Not Be as Big as Investors Think [Information]

HardTech

Anduril Nears $12.5 Billion-Valuation Round Led by Founders Fund, Sands Capital [Information]

Astronauts stuck in space → NASA, Boeing knew Starliner capsule had leak before launch, astronauts stuck at ISS: reports [NY Post]

Archer Announces Planned San Francisco Air Mobility Network Connecting Five Locations Across the Bay Area [Archer] → Link to below Tweet

NASA's Voyager 1, the farthest human-made object in space at over 15 billion miles from Earth, has resumed normal science operations after a seven-month technical glitch, continuing its mission of collecting key scientific data since its launch in 1977. [Axios]

CarbonCapture Inc. has launched the first U.S. direct air capture system designed for mass production, aimed at removing significant amounts of CO2 from the atmosphere to combat climate change. [Carbon Capture Journal]

Joby Aviation has received FAA approval for its proprietary software, allowing users to summon air taxis via a mobile app, similar to hailing an Uber, marking a significant step towards making "flying taxis" a reality. [Axios]

More

Victory Lap: Inside Kendrick Lamar’s Historic ‘Pop Out’ Show in LA [Complex]

After winning the rap battle of the century against Drake, Kendrick hosts a star-studded historic Juneteenth show uniting LA. Yes, he really did play the Drake diss track ‘Not Like Us’ 5 times in a row to close it out.. Poetic Justice? PS.. loved ScHoolboy Q’s performances [Watch full set]

Inside Out 2 has just overtaken Dune 2 to become the biggest movie of 2024, with a whopping ~$286M domestic tally after a very strong Weekend 2

A severe heat wave is causing record-breaking temperatures across parts of the United States, stressing power grids and prompting health warnings as regions brace for the continued extreme heat. [Axios]

Are you a top AI founder or investor & want to connect with peers building the future of AI?

Apply here to attend Cerebral Valley New York—an invite-only event featuring speakers like Sridhar Ramaswamy CEO of Snowflake and Eric Glyman CEO of Ramp.

See ya there! 👋

Last Week (6/17-6/21):

Relevant deals include the 90+ deals across stages below.

I've categorized the deals below into eight categories, Fintech, Care, Enterprise / Consumer, HardTech, Sustainability, Acquisition/PE, IPO, and Fund Announcements, and ordered from later-stage rounds to early-stage rounds.

Highlighted VC Deals include:

Zepto, Waabi, Soot, Huntress, HeyGen, Daydream, Decagon, Constructor, Finaloop, Amplify Life Insurance, Gynger, Talkiatry, Pomelo Care, Entro Security, Veena Robotics, CesiumAstro, Molten Industries

Acquisitions & PE

SoundHound/Allset, Evercoast/Depthkit, Digits/Basis Finance

Funds

A*, Paradigm, The Engine Ventures, Refactor Capital

Final Numbers

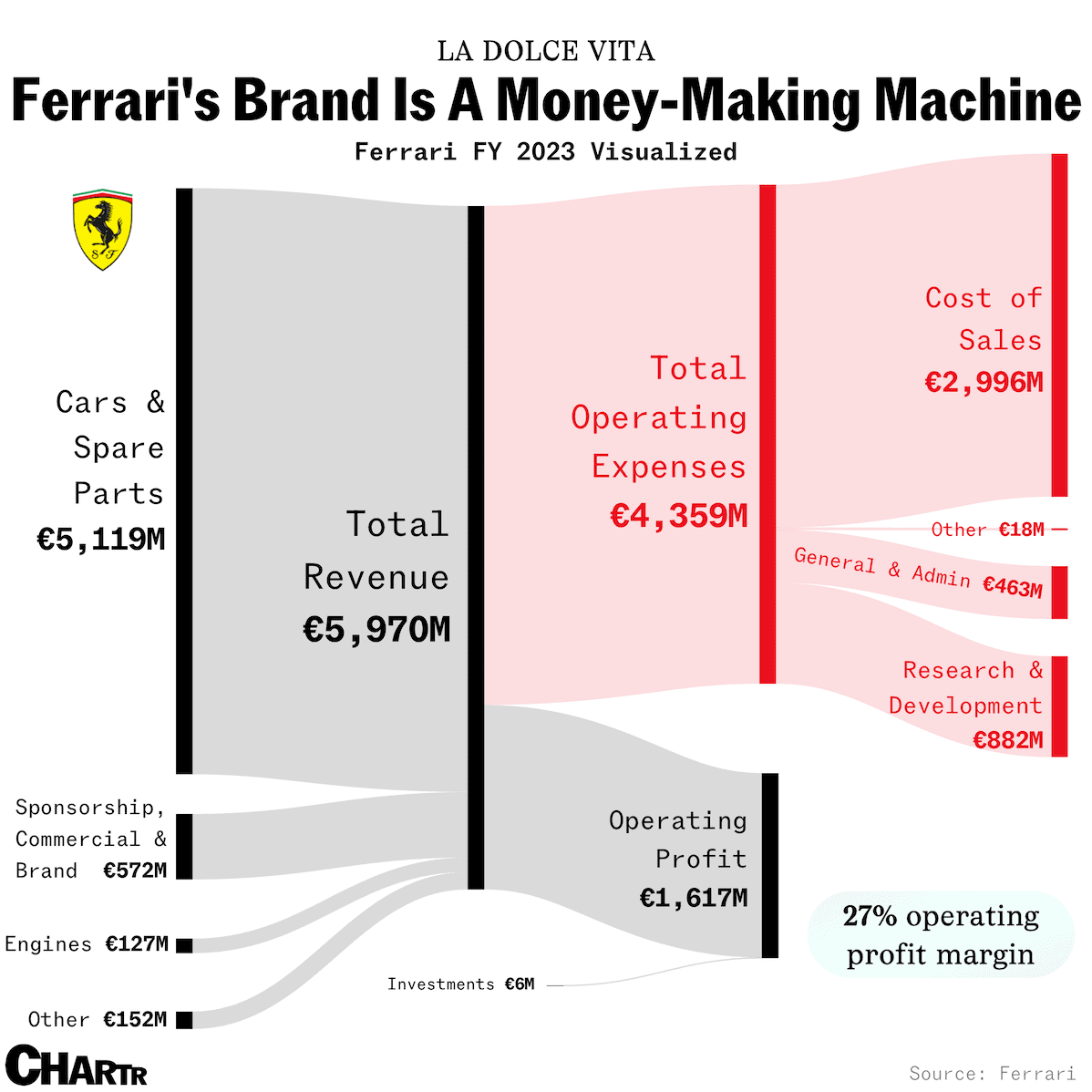

How Ferrari Makes Money, Uranium is on The Rise, Apple Services vs Product Margins

VC Deals

This roundup was customized & powered by Wonder. Start your free trial here.

Fintech:

- Clip, a Mexico City, Mexico- and Buenos Aires, Argentina-based digital payments and commerce enablement platform, secured $100M in funding, led by Morgan Stanley Tactical Value and an undisclosed West Coast mutual fund managers.

- Finbourne Technology, a London, UK-based investment management solutions fintech company and a cloud-native data management platform, completed a £55M ($70M) Series B funding round, led by Highland Europe and AXA Venture Partners (AVP).

- Finaloop, a Brooklyn, NY- and Tel Aviv, Israel-based automated bookkeeping and accounting platform, closed $35M in Series A funding, led by Lightspeed Venture Partners and joined by Vesey Ventures, Commerce Ventures, Accel, and Aleph.

- Amplify Life Insurance, a San Francisco, CA-based digital wealth-building platform focused on permanent life insurance, secured $20M in Series B funding, led by Crosslink Capital and Anthemis, with support from Moneta Ventures, Evolution Ventures, Greycroft, Munich Re Ventures, and Foxe Capital.

- Gynger, an NYC-based embedded financing platform for technology purchases, closed $20M in Series A funding, led by PayPal Ventures and joined by Gradient Ventures, Velvet Sea Ventures, BAG Ventures, and Deciens Capital.

- Renzo, the Liquid Restaking Protocol, raised $17M in funding, co-led by Galaxy Ventures and the Nova Fund – BH Digital).

- Cadana, an NYC-based global payroll technology company, completed a $7.4M funding round, led by Costanoa Ventures alongside Better Tomorrow Ventures and 500 Startups.

Care:

- Talkiatry, an NYC-based in-network psychiatric care provider, completed a $130M Series C funding round, led by Andreessen Horowitz (a16z) and joined by Perceptive Advisors.

- Pomelo Care, an NYC-based virtual medical practice that improves maternal and newborn health outcomes, closed $46M in Series B funding, led by First Round Capital and Andreessen Horowitz (a16z) Bio + Health, alongside Stripes, SV Angel, Operator Partners BoxGroup, Adam Boehler, and Puneet Singh.

- Humata Health, a Winter Park, FL-based company creating prior authorizations for payers and providers with AI and automation, closed $25M in funding, led by Blue Venture Fund and LRVHealth, alongside Optum Ventures, .406 Ventures, Highmark Ventures, and VentureforGood.

- Nomad Health, an NYC-based digital marketplace for healthcare jobs, secured $22M in funding, led by HealthQuest Capital, with participation from Adams Street, Icon Ventures, Polaris Partners, .406 Ventures, and RRE Ventures.

- Marigold Health, a Boston, MA-based tech-enabled peer recovery company, raised $11M in Series A funding, led by Rock Health and Innospark Ventures, alongside the Commonwealth Care Alliance (CCA), Wavemaker360, Stand Together Ventures Lab, Epsilon Health Investors, Koa Labs, VNS Health Plan, and KdT Ventures.

- MEandMine, a Palo Alto, CA-based startup built for classroom well-being, using AI-flagging to identify psychological risks in young children, secured $4.5M in funding, led by K5 Global.

Enterprise/Consumer:

- Zepto, an Indian grocery delivery company, raised $665M in Series F funding, co-led by Glade Brook, Nexus, and StepStone Group, with support from Avenir, Lightspeed, Avra, Goodwater, Lachy Groom, and Contrary.

- Waabi, a Toronto, Canada-based generative AI company, secured $200M in Series B funding, led by Uber and Khosla Ventures, with support from NVIDIA, Volvo Group Venture Capital, Porsche Automobil Holding SE, Scania Invest, Ingka Investments, HarbourVest Partners, G2 Venture Partners, BDC Capital’s Thrive Venture Fund, Export Development Canada, Radical Ventures, Incharge Capital, and others.

- Huntress, a Columbia, MD-based cybersecurity and service company, raised $150M in Series D funding, led by Kleiner Perkins, Meritech Capital, and Sapphire Ventures.

- HeyGen, a Los Angeles, CA-based AI video generation platform, closed $60M in Series A funding, led by Benchmark, alongside Thrive Capital, BOND, Conviction, Bond Capital, and others.

- Daydream, an NYC-based AI-powered shopping platform, secured $50M in seed funding, led by Forerunner Ventures and Index Ventures, with support from GV and True Ventures.

- Decagon, a San Francisco, CA-based enterprise-grade generative AI for customer support, secured $35M in Seed and Series A funding, co-led by a16z and Accel, with support from A*, Elad Gil, Aaron Levie (CEO, Box), Howie Liu (CEO, Airtable), Matt MacInnis (COO, Rippling), Aaref Hilaly (Partner, BCV), Mike Vernal (Ex-Sequoia), Frederic Kerrest (Cofounder, Okta), Jack Altman (CEO, Lattice), and Ed Hallen (Cofounder, Klaviyo).

- Tinybird, a Madrid, Spain- and NYC-based real-time data platform provider for data and engineering teams, completed a $30M Series B funding round, led by Balderton Capital, alongside CRV and Singular.

- Constructor, a San Francisco, CA-based AI ecommerce search and product discovery platform, raised $25M in Series B funding, led by Sapphire Ventures and joined by Silversmith Capital Partners.

- Entro Security, a Boston, MA-based non-human identity (NHI) and secrets management platform, raised $18M in Series A funding, led by Dell Technologies Capital, alongside Hyperwise Ventures, StageOne Ventures, Rakesh Loonkar, and Mickey Boodaei.

- SewerAI, a Walnut Creek, CA-based AI and cloud-driven sewer condition assessment company, raised $15M in Series B funding, led by Innovius Capital, and joined by Emerald VC, Epic Ventures, Suffolk Ventures, Bentley Systems, Burnt Island Ventures, Zachary Bookman (founder and CEO of OpenGov), and the CEOs of several AI and computer vision companies.

- Pomerium, a Los Angeles, CA-based access control platform, secured a $13.75M Series A funding round, led by Benchmark, with support from Bain Capital, Haystack, SNR, and Oleg Rogynskyy.

- Autify, a San Francisco, CA- and Tokyo, Japan-based AI platform for quality engineering, received $13M in Series B funding, led by Globis Capital Partners and LG Technology Ventures, alongside WiL (World Innovation Lab), Salesforce Ventures, Archetype Ventures, and Uncorrelated Ventures.

- Aidentified, a Boston, MA-based AI-powered prospecting platform for financial services companies, secured $12.5M in Series B funding led by FactSet.

- Daisy, a Costa Mesa, CA-based technology installation and services company for homes and offices, closed $11M in Series A funding, led by Goldcrest and Bungalow, with support from Bullish, Burst Capital, and angel investors.

- Tender, a Somerville, MA-based food technology startup, raised $11M in Series A funding, led by Rhapsody Venture Partners and joined by Lowercarbon Capital, Safar Partners, Claridge Partners, and Nor’easter Ventures.

- GPTZero, an NYC-based AI detector platform, secured $10M in Series A funding, led by Footwork and joined by Uncork Capital, Neo, Reach Capital, and Alt Capital.

- Hona, a Lehi, UT-based client engagement software provider for law firms, closed $9.5M in Series A funding, led by Costanoa Ventures and joined by Ludlow Ventures, Soma Capital, and Y Combinator.

- Substrate, an NYC-based AI infrastructure startup, raised $8M in Seed funding, led by Lightspeed Venture Partners and joined by South Park Commons, Craft Ventures, Guillermo Rauch (Vercel), Immad Akhund (Mercury), Will Gaybrick (Stripe), and others.

- Soot, an NYC-based visual interface for managing and organizing large datasets, allowing users to import and handle various file types, collaborate with AI, and create new content using AI tools, raised a $7.2M seed round led by Upfront Ventures. Strategic participation in the round included Michael Mente, Revolve co-founder and co-CEO, and former Beats executive Omar Johnson. Village Global, Spacecadet, and Compound provided pre-seed funding.

- Materia, an NYC-based comprehensive generative AI platform for public accounting firms, completed a $6.3M funding round, led by Spark Capital and joined by Haystack Ventures, Thomson Reuters Ventures, Exponential Founders Capital, and the Allen Institute for AI.

- Valuebase, an Austin, TX-based data-driven property valuations company, closed $6.3M in Seed funding, led by Narya Capital and joined by Sam Altman, Nat Friedman, Mythos Ventures, and Julian Weisser.

- Butterflies AI, a Bellevue, WA-based human-AI social media platform, closed $4.8M in Seed funding, led by Coatue alongside SV Angel and other angel investors.

- Trustwise, an Austin, TX-based generative AI application performance and risk management platform, completed a $4M seed financing round, led by Hitachi Ventures and joined by Firestreak Ventures and Grit Ventures.

- FairNow, a Mclean, VA-based AI governance software provider, completed a $3.5M Seed funding round, led by Somen Mondal and Shaun Ricci.

- Scoop Analytics, a San Francisco, CA-based business analytics tool provider, closed $3.5M in Seed funding, led by Ridge Ventures, with support from Engineering Capital and Industry Ventures.

- Hark, an NYC-based Voice of Customer (VoC) platform, secured $3.5M in seed funding, led by Oceans Ventures and joined by Converge VC, Atman Capital, Alumni Ventures, BDMI Fund, Tenzing Capital, and other angel investors.

- Showdme, an NYC-based innovative employee training and engagement software platform, raised $3M in funding from CIBC Innovation Banking.

- MeetRecord, an Austin, TX-based revenue automation platform for the service sector, closed $2.7M in Pre-Series A funding, led by SWC Global, with participation from All In Capital.

- Proofs, a San Francisco, CA-based AI agent API provider for accelerating the proof-of-concept phase in software sales, secured $2.6M in Pre-Seed funding, led by Earlybird Digital East Fund, and joined by RTP Global, Step Function Ventures, Expeditions Fund, and other angel investors.

- Vehya, a Detroit, MI-based mobile app provider for automating the installation, repair, and routine maintenance processes for home and small businesses, secured $2.1M in Seed funding, led by Community Reinvestment Fund, and USA (CRF), alongside other investors.

- Backstroke, an Indianapolis, IN-based generative AI messaging platform, closed $2M in Seed funding, led by High Alpha and Ground Game Ventures, joined by Allos Ventures.

- Megamod, a Raleigh, NC-based multiplayer gaming platform, secured $1.9M in funding, backed by Alexander Agapitov and his family fund Hand of Midas, Rubylight Fund, and other private investors.

- Gracia AI, a Wilmington, DE-based AI-powered ultra-photorealistic volumetric video company for immersive experiences and spatial computing, closed a $1.2M seed funding round, backed by The Venture Reality Fund, Triptyq Capital, LVL1 Group, and Future Fund.

- Submix.io, a San Francisco, CA-based audio technology company, secured $1M in Pre-Seed funding from Angel Invest Ventures, SCNE, Tiny Supercomputer Investment Company, and Vesna Capital.

- unitQ, a Burlingame, CA-based AI-powered customer feedback platform, secured an undisclosed investment from Zendesk Ventures.

HardTech:

- Vecna Robotics, a Waltham, MA-based flexible material handling automation solutions provider, completed a $100M Series C funding round, led by Tiger Global Management, Proficio Capital Partners, and IMPULSE.

- CesiumAstro Inc., an Austin, TX-based space communications technology provider, raised $65M in Series B+ funding, led by Trousdale Ventures, with support from the Development Bank of Japan Inc., Quanta Computer, Inc. (TWSE: 2382.TW), Kleiner Perkins, Lavrock Ventures, L3Harris Technologies (NYSE: LHX), InMotion Ventures, Matter Venture Partners, MESH Ventures, and Assembly Ventures.

- GrayMatter Robotics, a Los Angeles, CA-based autonomous robotic solutions company, raised $45M in Series B funding, led by Wellington Management and joined by NGP Capital, Euclidean Capital, Advance Venture Partners, SQN Venture Partners, 3M Ventures, B Capital, Bow Capital, Calibrate Ventures, OCA Ventures, and Swift Ventures.

- M2X Energy, a Rockledge, FL-based end-to-end developer of modular, transportable gas-to-liquids systems, closed $40M in Series B funding, led by Conifer Infrastructure Partners and joined by Breakthrough Energy Ventures, Eni Next, Add Ventures by SCG, and Autodesk Foundation.

- Kinetic, a Santa Ana, CA-based automotive infrastructure, maintenance, and servicing company for EVs and AVs, raised $21M in Series B funding, led by Menlo Ventures, with support from Lux Capital, Construct Capital, Haystack Ventures, Allstate Strategic Ventures, and Liberty Mutual Strategic Ventures.

- Maxterial, a Pleasanton, CA-based material science company, secured about $8M in Series A funding, led by Helios Climate Ventures, and joined by QEMETICA and Mott Corporation.

- Aikido Technologies, a San Francisco, CA-based floating wind technology startup, raised $4M in seed funding, led by Azolla Ventures, with support from Propeller Ventures, Sabanci Climate Ventures, Cisco Foundation, Anthropocene Ventures, and others.

Sustainability:

- Princeton NuEnergy (PNE), a Princeton, NJ-based lithium-ion battery direct recycling company, raised $30M in Series A funding, led by Samsung Venture Investment Corporation and Helium-3, with participation from Honda Motor Co. Ltd., LKQ Corporation, SCG Group, Traxys Group, and Wistron Corporation.

- Molten Industries, an Oakland, CA-based company that converts natural gas into clean graphite and hydrogen, secured $25M in Series A funding, led by Breakthrough Energy Ventures (BEV) and joined by Sozo Ventures, Mark Heising, Steelhead Capital, Union Square Ventures, 50 Years, J4 Ventures, Moai Capital, UVC Partners, Jane Woodward, and Peter Attia.

- Crux, an NYC-based sustainable finance technology company, raised $18.2M in Series A funding, led by Andreessen Horowitz, with participation from Clearway Energy Group, EDF Renewables, Intersect Power, Pattern Energy, Orsted, LS Power, and Hartree.

Acquisitions & PE:

- Honeywell (Nasdaq: HON) agreed to buy CAES Systems, a Colorado Springs maker of electronics for defense and aerospace, from Advent International for around $2B.

- Nextracker (NASDAQ: NXT), a Fremont, CA-based intelligent solar tracker and software solutions provider, acquired Ojjo, an energy company in the utility-scale ground-mount applications sector for solar power generation, for about $119M.

- SoundHound (Nasdaq: SOUN), a Santa Clara, CA-based voice artificial intelligence company, acquired Allset, a Los Angeles, CA-based online ordering platform that connects restaurants and local customers, for an undisclosed amount.

- Evercoast, an NYC-based end-to-end 3D spatial video software, acquired Depthkit, an NYC-based volumetric capture company, for an undisclosed amount.

- GrubMarket, a San Francisco, CA-based AI-powered food tech/eCommerce company, acquired Parsemony, an Alameda, CA-based ERP system for fresh produce distributors, wholesalers, repackers and food service suppliers, for an undisclosed amount.

- Digits, a San Francisco, CA-based automated bookkeeping platform for startups, acquired Basis Finance, a San Francisco, CA-based budgeting and forecasting platform, for an undisclosed amount.

Fund Announcements:

This roundup was customized & powered by Wonder. Start your free trial here.

- Hamilton Lane, a Conshohocken, PA-based alternative investment management and advisory firm raised $5.6B for its sixth secondary fund, the largest fund in the firm's history.

- Kinderhook Industries, an NYC-based private investment firm, closed its eighth fund at $2.74B, backed by domestic and international endowments, foundations, family offices, pensions, and other institutional capital bases.

- Charlesbank Capital Partners, a Boston, MA- and NYC-based private equity firm, closed its second fund focused on tech companies, with a total commitment of $1.3B.

- Paradigm, a San Francisco, CA-based crypto-asset investment firm raised $850M for its third fund.

- The Engine Ventures, a Cambridge, MA-based venture capital firm, raised $398M for their third fund focused on deep tech companies.

- A*, an early-stage VC firm, raised $315M for its second fund from Kevin Hartz (Eventbrite, Founders Fund), Bennett Siegel (Coatue), and Gautam Gupta (Opendoor/Uber).

- Refactor Capital, a Burlingame, CA-based venture capital firm, closed $50M for its fourth fund focused on startups in the bio, climate, and hard tech sectors.

Final Numbers

The charging horse

As arguably the most iconic luxury car company in the world, Ferrari’s foray into the world of electric supercars has been keenly anticipated. It’s also been highly secretive. But, some details did emerge this week from Reuters that Ferrari’s first electric effort will start at a hefty €500,000 ($535,000) — well above the company’s current average selling price of ~€350,000. The first Prancing Horse EV is expected in late 2025 and a second model is already in development.

For Ferrari, whose brand depends so greatly on the “noise factor” of its highly-romanticized cars, the move to quiet electric is potentially more risky than it is for other brands.

Unlike mass-market automakers, Ferrari's margins rival luxury titans like LVMH and Hermès, having posted a 27% operating profit margin last year. In contrast, VW and Mitsubishi hover around a 7% margin, Ford is close to 3%, and even rival Porsche only aims for 20%. At the rumored price tags, those margins seem likely to stay intact — the challenge will be in scaling production. Ferrari delivered only ~14,000 cars in 2023, but it has plans to ramp capacity up to as much as 20,000 a year to accommodate the new EV models.

While selling cars and parts is its main business, Ferrari also made $600M+ in sponsorship, commercial, and branding revenue last year bolstered by a strong Formula 1 performance.

Biting Back

Apple and the EU continue to go head-to-head.

Last week, the tech giant announced that it would withhold a number of features from European users — including Apple Intelligence and iPhone mirroring — because it claims the Digital Markets Act could create privacy or security risks. And, just this morning, Apple has been charged by the EU for failing to comply with that very same law, accusing the company of stifling competition on its App Store by preventing "app developers from freely steering consumers to alternative channels for offers and content."

If found non-compliant, Apple could face a fine of up to 10% of its global revenue, which, as our colleague Rani Molla points out, would be some $38 billion based on the company’s 2023 results.

The crux of the complaint is the App Store, which sits under “Services” — a wide division that spans advertising, subscriptions like Apple TV+ and iCloud, and virtually all other non-physical Apple products.

That division has become increasingly important for Apple’s bottom line (there are, after all, only so many people you can sell a $1,000+ iPhone to). In the last quarter, Services accounted for ~25% of Apple’s total revenue, but over 40% of its gross profit, notching an impressive gross margin of 75% — roughly double that of its Products division.

And it’s not just the EU that has put Apple’s Services cash cow in the spotlight: the US Justice Department also highlighted payments received by Apple for making Google the default search engine on Safari — which amounted to $20 billion in 2022 — as core evidence in its antitrust case against Google.

Gone Fission

After a decade of underinvestment, global superpowers such as China and India are doubling down on nuclear output. That appears to be setting off a chain reaction that’s boosted the price of uranium and incentivized major suppliers to join forces in a bid to meet soaring demand, as Australian uranium giant Paladin Energy announced today its acquisition of Canada’s Fission Uranium in a deal worth some $833M.

The combined company would position itself as a leader in the nuclear fuel space — an industry that, in remote parts of frozen Canada, Kazakhstan, and Australia, is booming. In fact, per Bloomberg, the soaring price of uranium (+233% in the last 5 years) has surpassed the increases seen for silver (+99%), gold (+75%), copper (+66%), and the all-important battery-powering lithium (+17%) in the same period.

As a vital component of the power-generating fission reactions harnessed by nuclear plants, the price of uranium gives some indication of the incremental demand for nuclear projects — and right now, it’s signaling a serious resurgence. The recent market reaction echoes the 2004 - 2007 period: a 3-year stretch when prices rose more than 650%. That previous bubble was in part due to the flooding of major mines restricting supply, but it was also generally a more “nuclear-optimistic” time, before the high-profile Fukushima disaster of 2011 tempered public appetite for nuclear energy.

Recently, though, prices have boomed as an atomic-gold-rush has spurred a surge in reactor infrastructure, driven by new projects in China and India. Indeed, Bloomberg reports that, globally, 61 new plants are currently under construction, 90+ are in planning, and an additional 300+ are being proposed.

Related chart: America’s nuclear output.