Sourcery ✨ NVIDIA's Blackwell AI Chip

(3/11-3/15) Applied Intuition, InDrive, Together AI, Liquid Death, Unstructured, Adaptive ML, Axion Ray, FERMAT, Empathy; Wiz/Gem Security, SpringHealth/Bloom

It’s NVIDIA’s world, and we’re all living in it.

But before that.. want your deep tech company to give Anduril’s brand vibes? Well, talk to Ollie. Ollie helps design sick brands for deep tech companies at WEBOAF

And on a more personal note, Ollie recently interviewed me on his impressive podcast Brick by Brick, check it out if you’re curious about the beginnings of Sourcery & my journey in VC

Now on to some more ‘AI of the week:’ NVIDIA, Cognition, Groq SPV drama, & a majority of new startup fundings announced with AI in their description..

Musings

NVIDIA

Nvidia debuts next-generation Blackwell AI chip at GTC 2024 [Yahoo Finance]

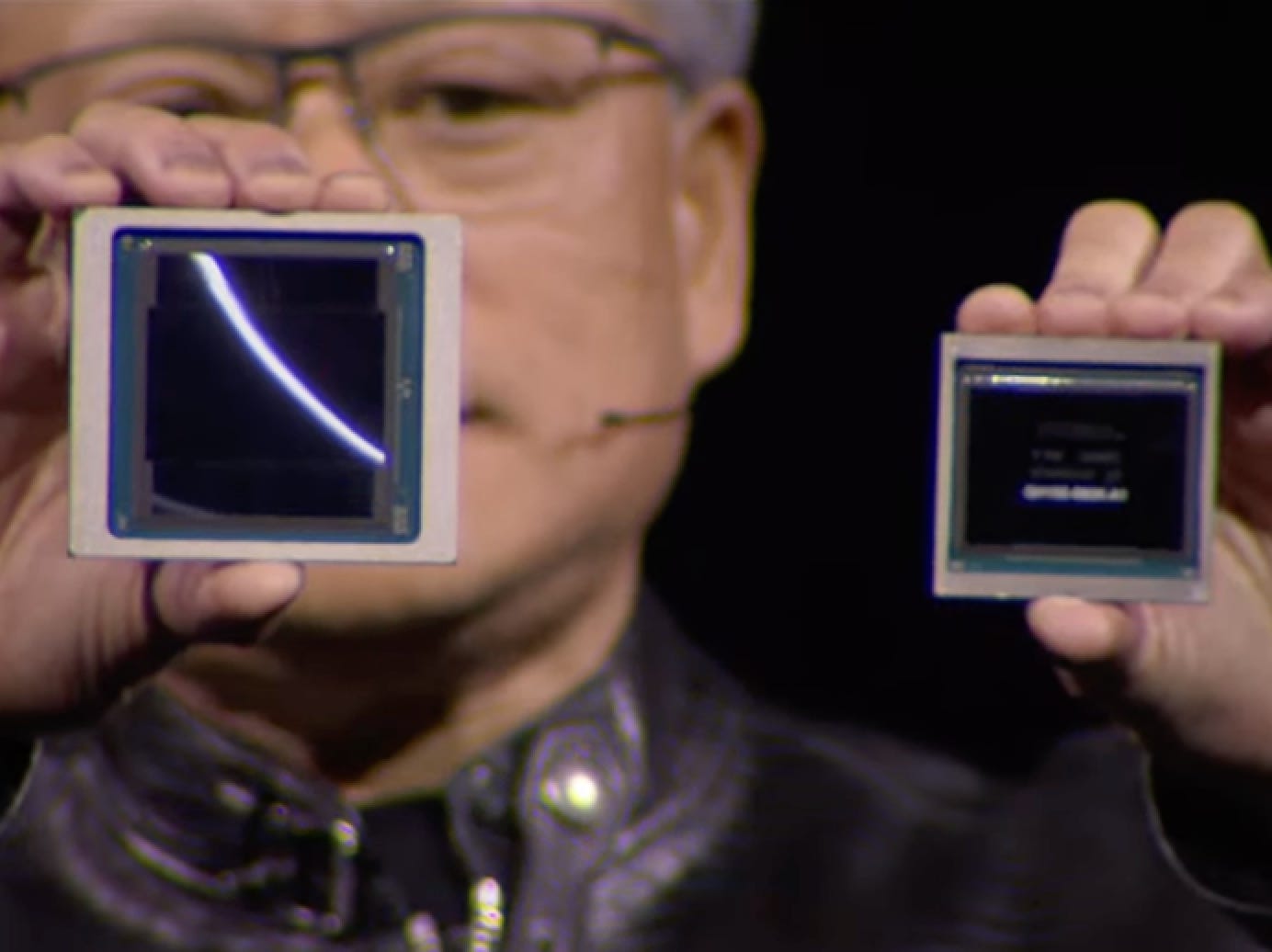

“Beyond the limits of physics”

The Blackwell is the successor to Nvidia’s already highly coveted H100 and H200 GPUs, and according to the company, it is the world’s most powerful chip..

Like its prior Hopper GPUs, the Blackwell GPU will be available as a standalone GPU, or two Blackwell GPUs can be combined and paired with Nvidia’s Grace central processing unit to create what it calls its GB200 Superchip.

That setup, the company says, will offer up to a 30x performance increase compared to the Nvidia H100 GPU for large language model inference workloads while using up to 25x less energy. That energy savings is an important part of the story.”

Nvidia's CEO unveils the next AI chip that tech companies will be scrambling for — meet 'Blackwell' [Business Insider]

The chip is packed with 208 billion transistors — 128 billion more than the Hopper.

With 3.4M views this clip of Jensen Huang went viral on X this past week for his message to Stanford graduate students on facing adversity and the importance of resilience

The All-In Podcast discusses more on the ‘vibe shift’ here

AI

Cognition released Devin, the first AI Software Engineer [CEO Scott Wu on X]

With 29.3M+ Views, 10.7K Reposts, 12.3K Quotes, 45K Likes, & 28.6K Bookmarks on X.. it’s clear a.) X has a VERY strong engineer audience, b.) Devin has ‘product market fit,’ c.) it’s going to need some help converting & maintaining all of the customer interest, d.) yes, they’re hiring

Devin will change the game, but remember: "Per task, 10-20 maxed out GPT4-32k calls /min, thats ~$2-$5/min, or $120-$300/hr depending on Input/Output token ratio." "took about 19mins for it to ask me for the API key from when I started." They crushed orchestration tho. [Deedy Das @ Menlo Ventures]

Chamath Palihapitiya fires two Social Capital partners over AI investment in Groq [Axios]

Understanding the Semiconductor Value Chain: Key Players & Dynamics [Quartr]

HardTech

Varda's Landing, Peter Thiel, & El Segundo: Delian Asparouhov of Founders Fund [Sourcery]

Miami Tech Week is coming up April 7-14th, list of events here

More

Don’t doubt: You’ve earned your seat. [Ultra Successful] Dr. Julie Gurner

“If you’ve made it to certain seats, chances are you do deserve to be there, but it doesn’t mean you’re done. These things don’t happen by chance.”

. . .

Last Week (3/11-3/15):

Relevant deals include the 60+ deals across stages below.

I've categorized the deals below into five categories, FinTech, Care, Enterprise & Consumer, HardTech, and Sustainability, and ordered from later-stage rounds to early-stage rounds.

Highlighted VC deals include

Applied Intuition, InDrive, Together AI, Liquid Death, Unstructured, Adaptive ML, Axion Ray, FERMAT, Empathy, CodaMetrix, Pi Health, Wiz, Vouch, Cache, OpenMeter, Big Sur AI, Key, Omni, Fluent Metal

Acquisitions & PE

Wiz/Gem Security, SpringHealth/Bloom

Funds

Ballistic Ventures

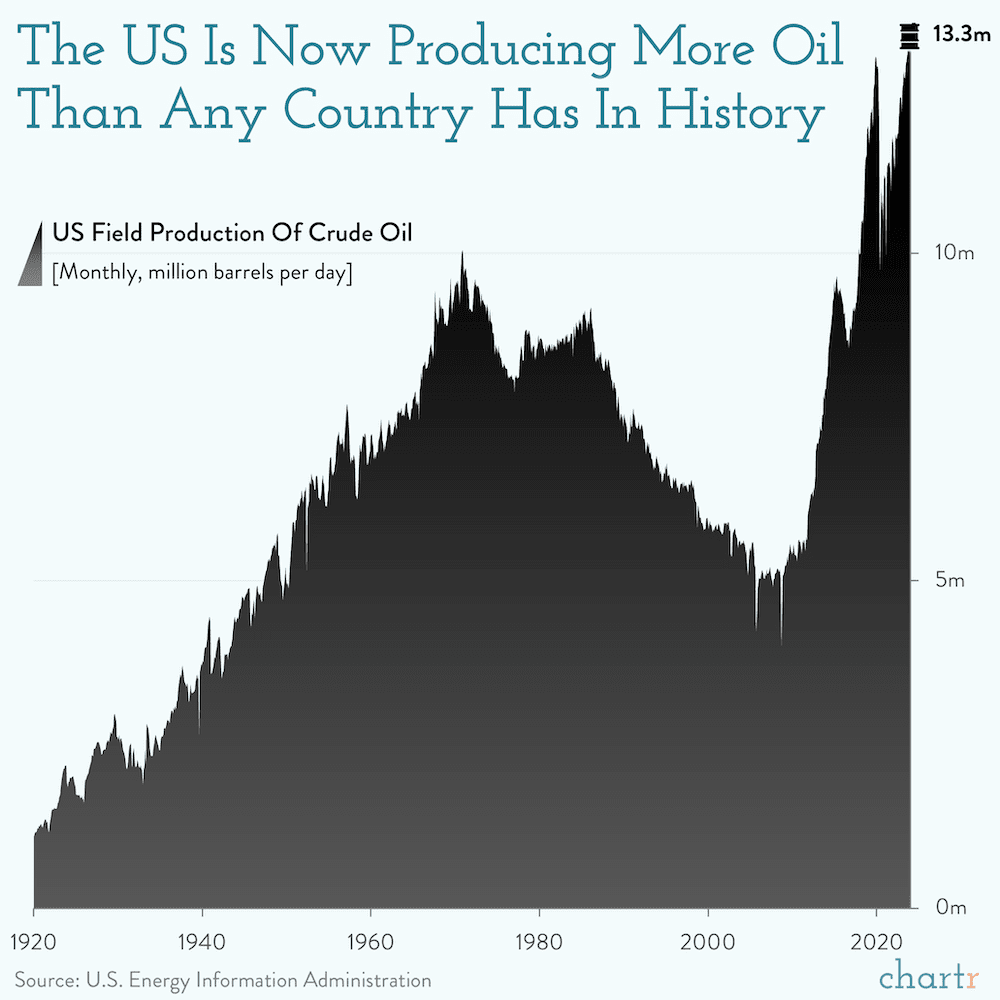

Final numbers on US Oil Production at an All Time High at the bottom.

Deals

Fintech:

- Vouch, San Francisco, CA business insurer, raised $25M in Series C-1 funding led by Ribbit Capital.

- Griffin, London, UK banking-as-a-service platform, raised $24M in funding led by MassMutual Ventures, NordicNinja, and Breega with participation from Notion Capital and EQT Ventures.

- Worth AI, Orlando, FL AI-powered financial underwriting platform, raised $12M in pre-seed funding from the Florida Opportunity Fund, Jim Douglas, and Asif Ramji.

- Cache, San Francisco, CA developer of their own cache exchange fund, raised $8.5M in seed funding from First Round Capital, Quiet Capital, and angel investors.

- Bluwhale, San Francisco, CA AI-powered platform designed to connect companies with Web3 wallet holders, raised $7M in seed funding led by SBI with participation from Cardano, Momentum6, Primal Capital, NxGen, Ghaf Capital Partners, Spyre Capital, and Baselayer Capital.

- Sonarverse, Irvine, CA crypto data infrastructure platform, raised $7M in seed funding led by BlockTower Capital with participation from United Overseas Bank, Aglaé Ventures, Third Prime Ventures, Ocular Funds, Aptos, FBG, and FJ Labs.

- Grupago, Mexico City, Mexico digital microcredit provider for small businesses, raised $4.3M in seed funding led by Deciens Capital with participation from Precursor Ventures, Clocktower Ventures, and Twine Ventures.

- OpenMeter, San Francisco, CA provider of usage-based billing management software, raised $3M from YC, Haystack, and Sunflower Capital.

. . .

Care:

- Zephyr AI, Tysons Corner, VA developer of AI algorithms for precision medicine processes, raised $111M in Series A funding from Revolution Growth, Eli Lilly & Company, Jeff Skoll, and EPIQ Capital Group.

- Empathy, New York, NY provider of grief, estate settlement, probate, and other services that operate through clients’ life insurance policies or employer bereavement leave, raised $47M in Series B funding led by Index Ventures with participation from General Catalyst, Entrée Capital, Latitude, Brewer Lane, and others.

- CodaMetrix, Boston, MA health care billing tech provider, raised $40M in Series B funding led by Transformation Capital with participation from insiders SignalFire and Frist Cressey Ventures.

- Pi Health, Cambridge, MA platform designed to streamline clinical trial processes for cancer therapies and treatments for other diseases, raised $30M in Series A funding led by AlleyCorp and Obvious Ventures with participation from Invus Capital.

- Nest Health, New Orleans, LA in-home and virtual care provider, raised $4M in a seed extension led by SpringTide with participation from Alumni Ventures, Ochsner Ventures, and others.

- Assort Health, San Francisco, CA developer of an AI bot for health care call centers, raised $3.5M in funding led by Quiet Capital with participation from Four Acres, Tau Ventures, and angel investors.

. . .

Enterprise & Consumer:

- Wiz, an Israeli cloud security firm, is in talks to raise around $800M at a valuation north of $10B, per the FT. Backers could include Thrive Capital, Lightspeed, G Squared, Sequoia Capital and Cyberstarts

- Luminary Cloud, San Mateo, CA real-time engineering simulation platform, raised $115M in funding from Sutter Hill Ventures.

- Together AI, San Francisco, CA developer of cloud infrastructure for developing generative AI models, raised $106M in funding led by Salesforce Ventures with participation from Coatue and existing investors Lux Capital, Kleiner Perkins, Emergence Capital, Prosperity7 Ventures, and NEA.

- Liquid Death, a canned water company, raised $67M at a $1.4B valuation led by SuRo Capital with participation from Live Nation, Science, and Gray's Creek Capital Partners.

- Unstructured, San Francisco, CA developer of technology designed to turn internal company data into formats compatible with large language models, raised $40M in Series B funding led by Menlo Ventures with participation from Databricks Ventures, and IBM Ventures.

- Nanonets, San Francisco, CA AI-powered workflow automation program, raised $29M in Series B funding led by Accel India with participation from Elevation Capital, Y Combinator, and others.

- Cayosoft, Columbus, OH provider of management and recovery solutions for Microsoft’s Active Directory service, raised $22.5M from Centana Growth Partners.

- Draftwise, New York, NY AI-powered contact and negotiation platform for lawyers, raised $20M in Series A funding led by Index Ventures with participation from Y Combinator and Earlybird Digital East Ventures.

- Adaptive ML, Paris, France developer of technology designed for enterprises to improve their generative AI models based on users’ interactions, raised $20M in seed funding from Index Ventures, ICONIQ Capital, Motier Ventures, Databricks Ventures, and others.

- Omni, San Francisco, CA business intelligence platform, raised $20M in new funding from Theory Ventures.

- Tavus, San Francisco, CA generative AI video research company, raised $18M in Series A funding led by Scale Venture Partners with participation from Sequoia Capital, Y Combinator, HubSpot, and others.

- Axion Ray, Brooklyn, NY AI observability command center, raised $17.5M in Series A funding led by Bessemer Venture Partners with participation from RTX Ventures, Amplo, and Inspired Capital.

- FERMAT, San Francisco, CA startup using AI and machine learning models to personalize e-commerce shopping without collecting personal data, raised $17M in Series A funding led by Bain Capital Ventures with participation from Greylock, QED Investors, and Courtside Ventures.

- Kaedim, San Francisco, CA AI-powered platform designed to produce digital 3D assets for game developers and interactive content creators, raised $15M in Series A funding led by A16Z GAMES with participation from Pioneer Fund.

- Pienso, Arlington, VA AI platform designed to turn text data into insights, raised $10M in funding led by Latimer Ventures with participation from Gideon Capital, SRI, Uncork, and Good Growth Capital.

- Prescient AI, Miami, FL AI-powered media measurement and optimization platform, raised $10M in Series A funding led by Headline and CEAS Investments with participation from Blumberg Capital and Focal VC.

- BREV/ΛN, Sunnyvale, CA platform for building AI agents with enterprise data, raised $9M in seed funding led by Felicis.

- DBOS, Cambridge, MA cloud-native operating system, raised $8.5M in seed funding led by Engine Ventures and Construct Capital with participation from Sinewave and GutBrain Ventures.

- Elixir, New York, NY modular network project, raised $8M in Series B funding led by Mysten Labs and Maelstrom with participation from Manifold, Arthur Hayes, Amber Group, GSR, Flowdesk, and others.

- RapidCanvas, Austin, TX AI platform designed for business leaders, raised $7.5M in seed funding led by Accel with participation from Valley Capital Partners.

- Big Sur AI, Mountain View, CA e-commerce AI platform, raised $6.9M in seed funding led by Lightspeed with participation from Capital F.

- Loop, San Francisco, CA automated delivery intelligence platform for food brands, raised $6M in seed funding led by Base10 Partners with participation from Afore Capital.

- Paylode, Miami, FL platform designed for companies to launch, manage, and monetize their own perk programs, raised $5.5M in seed funding from Susa Ventures, Vinyl Capital, Struck Capital, Day One Ventures, and others.

- Key, Palo Alto, CA professional networking platform, raised $4.3M in funding led by Felicis with participation from Liquid 2 Ventures, Alumni Ventures, Archangels Ventures, Cerigo Investments, Everywhere Ventures, and others.

- Codezero, Vancouver, Canada cloud development platform, raised $3.5M in seed funding from Ballistic Ventures.

- The New Club, San Francisco, CA professional network for senior-level women in engineering, raised $3.1M in funding led by Sierra Ventures and Afore Capital with participation from Operator Collective, Precursor Ventures, Dragonfly Capital, and others.

- Synch, New York, NY sales and sales operations platform, raised $3M in seed funding led by AltCap and Haystack with participation from Y Combinator, Ritual Capital, and others.

. . .

HardTech:

- Applied Intuition, Mountain View, CA vehicle software supplier for the automotive, trucking, construction, mining, agriculture, and other industries, raised $250M in Series E funding at a $6B valuation led by Bilal Zuberi at Lux Capital, Elad Gil, and Porsche Investments Management with participation from Andreessen Horowitz, and General Catalyst.

- InDrive, Mountain View, CA mobility and urban services platform, raised $150M from insider General Catalyst.

- Jukebox Health, New York, NY provider of clinical home modifications, raised funding from Home Depot Ventures.

- Efficient Computer, Pittsburgh, PA developer of computer processors, raised $16M in seed funding led by Eclipse Ventures.

- Glacier, San Francisco, CA developer of AI-powered robotics designed for recycling sorting, raised $7.7M in funding led by New Enterprise Associates and Amazon’s Climate Pledge Fund with participation from AlleyCorp, Overture Climate VC, and VSC Ventures.

- Furno, Mountain View, CA producer of carbon-neutral cement manufacturing technology, raised $6.5M in seed funding led by Energy Capital Ventures with participation from O'Shaughnessy Ventures, Cantos, and Neotribe.

- Fluent Metal, a Cambridge, MA developer of production-grade liquid metal printing, raised $3.2M in funding led by E15 with participation from Pillar VC and angel investors.

. . .

Sustainability:

- Sealed, New York, NY provider of residential energy efficiency software and solutions, raised $30M in funding led by Keyframe Capital with participation from Cyrus Capital, CityRock, Fifth Wall, and others.

Acquisitions & PE:

- Wiz, New York cloud security firm valued by VCs at $10.3B, agreed to buy Gem Security for $350M in cash. Gem is an Israeli cloud detection and response startup that raised $34M from GGV Capital, Team8, IBM Ventures and Silicon Valley CISO Investments.

- Spring Health, a behavioral health provider valued by VCs at $2.5B, acquired the therapy tools and digital content of Bloom, an New York-based cognitive behavioral therapy startup.

. . .

IPOs:

- Astera Labs, a Santa Clara, CA developer of semiconductor-based solutions for cloud and AI infrastructure, plans to raise up to $534M in an offering of 17.8M shares priced between $27 and $30. The company posted $116M in revenue for the year ending December 31, 2023. Sutter Hill Ventures and Fidelity Management and Research back the firm [SEC S-1]

- Reddit, San Francisco, CA social media platform, plans to raise up to $748M in an offering of 22 million shares priced between $31 and $34. The company posted $804M in revenue for the year ending December 31, 2024. Advance Magazine Publishers, Fidelity Investments, Quiet Capital and Tacit Capital, Sam Altman, Tencent, and Vy Capital back the company. [SEC S-1]

Funds:

- Ballistic Ventures, San Francisco, CA venture capital firm, raised $360M for its second fund focused on cybersecurity companies.

Final Numbers

America’s fossil fuel industry is booming. Indeed, no country in the history of our planet has pulled crude oil out of the ground at the pace of the United States over the last 6 years.

Data released by the US Energy Information Administration (EIA) on Monday reported that the US produced the equivalent of 12.9 million barrels of crude oil and condensate per day last year, 28% more than the world’s previous top producer, Russia, and 33% more than even the oil-rich Kingdom of Saudi Arabia. Production in December notched an even higher mark: 13.3 million barrels per day.

Reversing the flow

The modern petroleum industry can trace its roots — or wells — back to the 1850s when Edwin Drake dug a ~70 foot oil hole in Pennsylvania and started pumping up to 20 barrels a day of what would come to be known as black gold. But, despite getting a head start on much of the rest of the world, the US was a relatively small player in global oil for much of the 20th century.